Candlestick Analysis

NQ Power Range Report with FIB Ext - 12/19/2025 SessionCME_MINI:NQH2026

- PR High: 25257.50

- PR Low: 25209.75

- NZ Spread: 106.75

Key scheduled economic events:

08:30 | Core PCE Price Index (MoM|YoY)

10:00 | Existing Home Sales

Session Open Stats (As of 12:55 AM)

- Session Open ATR: 430.77

- Volume: 35K

- Open Int: 271K

- Trend Grade: Long

- From BA ATH: -4.1% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 24008

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

BITCOIN (BTCUSD): Bullish Outlook Explained

There is a high probability that Bitcoin will rise more,

following a formation of a bullish imbalance candle and change of character.

I think that the price will reach at least 88000 level soon.

❤️Please, support my work with like, thank you!❤️

I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

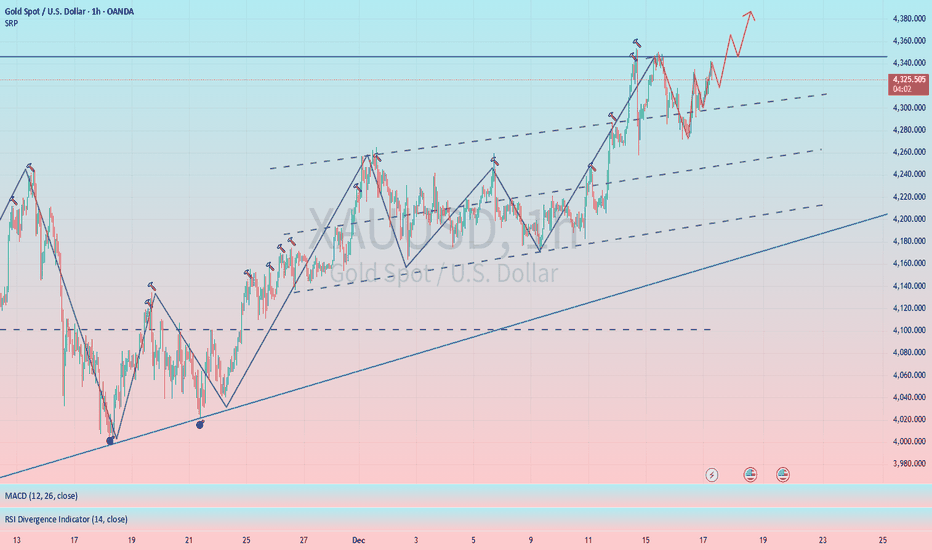

Continue to be bullish, 4380 is definitely not the high point#XAUUSD OANDA:XAUUSD TVC:GOLD

Yesterday, the gold market released a positive signal: after hitting a high, gold prices did not fall back quickly, but instead showed signs of continuing to rise and break through. This makes me even more convinced that real pressure doesn't offer repeated opportunities, repeated testing is often for the sake of a final breakthrough. Currently, we only need to wait for a valid breakout of the 4345-4355 range. Once this level is firmly established, the upside potential will be fully unlocked.

Currently, gold prices are hovering around 4333, providing room for both bulls and bears to battle. However, in my opinion, I still tend to be bullish. Firstly, although the area above 4345-4355 represents short-term resistance, repeated tests indicate that the resistance is limited and will eventually be broken. Secondly, the upward structure we have been optimistic about remains intact, and no reversal signals have been seen. Meanwhile, Tuesday's data has already increased expectations of an interest rate cut, and if tonight's CPI data is moderate, it will further strengthen that expectation.

Therefore, today's trading strategy remains focused on buying at lower levels, Short-term support is seen at 4325-4320, while key support remains at 4300-4290. Holding this level will lead to a full-scale counterattack by the bulls. In short, the market tends to be relatively calm before the release of big data, it's best to observe more and act less, only participating at key points

CADCHF LONG Market structure long on HTFs DW

Entry at Both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection At AOi

Daily EMA retest

Previous Daily Structure Point

Around Psychological Level 0.57500

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

NZDCAD SHORTMarket structure bearish on HTFs

Entry at Both Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Retest

Daily EMA retest

Around Psychological Level 0.80000

Touching EMA H4

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 105%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

EURCAD SHORTMarket structure bearish on HTFs DW

Entry at Weekly and Daily AOi

Weekly Rejection at AOi

Previous Weekly Structure Point

Daily Rejection at AOi

Previous Daily Structure Point

Daily EMA retest

Around Psychological Level 1.62000

H4 Candlestick rejection

TP: WHO KNOWS!

Entry 100%

REMEMBER : Trading is a Game Of Probability

: Manage Your Risk

: Be Patient

: Every Moment Is Unique

: Rinse, Wash, Repeat!

: Christ is King.

Bullish Daily Bias After Previous Day Low Being RaidPrice swept yesterday’s low and it's reclaiming it with a potential bullish close, indicating sell-side liquidity absorption. I am therefore targeting long opportunities, anticipating bullish close today and a continuation expansion move tomorrow.

Note: this is quite risky as I usually wait for candle close to confirm the sweep.

Selena | BTCUSD | 1H – Liquidity Sweep Into DemandBITSTAMP:BTCUSD

After rejection from the top rejected zone (~102k–103k), BTC sold off aggressively. The decline stabilized near the 81k–83k strong buy zone, where multiple reactions confirm demand. The recent downside spike appears engineered to grab sell-side liquidity before continuation higher. However, price is still below key descending resistance, meaning confirmation is required.

Key Scenarios

✅ Bullish Case 🚀 (Only if structure holds)

Condition: Price holds above 85,000–87,000 demand zone

🎯 Target 1: 91,000

🎯 Target 2: 95,000

🎯 Target 3: 99,000

❌ Bearish Case 📉 (Invalidation)

If price breaks and closes below 81,000

🎯 Downside Target 1: 78,000

🎯 Downside Target 2: 74,500

Current Levels to Watch

Resistance 🔴: 91,500 – 94,000 – 99,000

Support 🟢: 87,000 – 83,000 – 81,000

⚠️ Disclaimer: This analysis is for educational and informational purposes only. It is not financial advice. Please conduct your own research before trading.

Gold – Could it be on Course to Post New Record Highs?Gold may have taken a back seat to Silver in the last two weeks, but it still sits within touching distance of its all-time high of 4381 registered back in late October, currently trading around 4335 at time of writing (0630 GMT).

Looking forward, with liquidity declining due to the upcoming festive holiday period, traders may be trying to assess whether the release of today’s US inflation data (CPI) and real time updates on escalating geo-political tensions between the US and Venezuela, may provide enough of a catalyst to push Gold prices to even higher levels or could result in disappointment and a dip back down to lower levels.

Today’s US CPI release at 1330 GMT, could be an important volatility driver given some Fed policymakers have flagged that consumer prices trending above the US central bank’s 2% target are a potential reason for halting further rate cuts in the first half of 2026. Lower interest rates as a rule benefit precious metals which are non-interest-bearing assets. Therefore, a higher-than-expected CPI number could weigh on Gold prices, while a lower reading could see attempts to push towards new highs.

The developing geo-political situation in Venezuela, where President Trump has ordered a blockade of sanctioned oil tankers going in and out of the country could also be relevant to where Gold moves next as it is traditionally seen as a safe haven asset in times of crisis. Amid a buildup of US military forces in the region any escalation could see Gold prices spike, while any signs of a resolution could lead to a pullback into the weekend.

Gold Technical Update: Could it be on Course to Post New All-Time Highs?

After a period of choppy sideways activity, Gold is showing some potential for a further phase of price strength. However, resistance at the October 20th all‑time high of 4381 continues to cap the current advance, with upside momentum slowing as that level becomes closer.

As such, it could be important to monitor how this resistance at 4381 is defended on a closing basis as it could help gauge the directional themes for Gold moving forward.

Potential Resistance Levels:

An old all‑time high can often serve as an important focal point for traders. In Gold’s case, the 4381 October 20th peak previously proved strong enough not only to cap the advance but also to help initiate a sell‑off down to the 3887 October 28th low, as reflected on the chart above.

If current price activity is to evolve into a further phase of strength, closes above the 4381 resistance may now be required. Successful breaks could then shift the focus to higher resistance levels, such as the 38.2% Fibonacci extension at 4572, or even the 61.8% extension at 4689.

Potential Support Levels:

Of course, the 4381 level does currently remain intact, and it’s possible this level could cap prices again and trigger fresh weakness. Should renewed selling pressure materialise over the remainder of the week, with the resistance level at 4381 still intact on a closing basis, the focus for traders might then shift to support provided by the rising Bollinger mid‑average, currently at 4220.

If seen, closing breaks below this potential 4220 support could open scope for further price declines towards 4172, which is the 38.2% Fibonacci retracement support.

A failure to hold this 4172 level may then open the path for moves toward 4060, which is the deeper 61.8% retracement.

The material provided here has not been prepared accordance with legal requirements designed to promote the independence of investment research and as such is considered to be a marketing communication. Whilst it is not subject to any prohibition on dealing ahead of the dissemination of investment research, we will not seek to take any advantage before providing it to our clients.

Pepperstone doesn’t represent that the material provided here is accurate, current or complete, and therefore shouldn’t be relied upon as such. The information, whether from a third party or not, isn’t to be considered as a recommendation; or an offer to buy or sell; or the solicitation of an offer to buy or sell any security, financial product or instrument; or to participate in any particular trading strategy. It does not take into account readers’ financial situation or investment objectives. We advise any readers of this content to seek their own advice. Without the approval of Pepperstone, reproduction or redistribution of this information isn’t permitted.

FireHoseReel | BNB Daily Analysis #23🔥 Welcome To FireHoseReel !

Let’s dive into Binance Coin (BNB) analysis.

👀 BNB 4H Overview

BNB has broken its newly formed support, activating our pre-breakout trigger with a strong 4-hour candle. Price is now moving toward the bottom of the range.

📊 Volume Analysis

After breaking the multi-timeframe support highlighted in the previous analysis, BNB’s volume increased significantly. If selling pressure continues, price could extend its move toward the range low.

✍️ BNB Trading Scenarios

🟢 Long Scenario:

A break above $876, accompanied by rising buying volume, strong momentum, and a fakeout of the current zone, could offer a long opportunity. This setup is high risk, so if taking a long, a maximum risk of 0.25% is recommended.

🔴 Short Scenario:

Waiting for BNB to form a new structure and identify fresh trigger zones would be the more logical approach for short positions. We remain patient until clearer short setups appear.

🧠 Protect your capital first. No setup is worth blowing your account. If risk isn’t controlled, profit means nothing. Trade with rules, not emotions.

USD/JPY(20251218)Today's AnalysisMarket News:

Ben Waller, one of the final candidates for the next Federal Reserve Chair and current Governor, said on Wednesday that the current job market is "very weak" and job growth is "not optimistic," therefore the Fed still has room to cut interest rates. He supports further rate cuts to restore the central bank's interest rate setting to a neutral level, while stating that policymakers do not need to rush into doing so.

Speaking at the Yale University CEO Summit, Waller noted that the Fed's current interest rate is 50 to 100 basis points higher than the neutral rate, but he emphasized that "aggressive action is not needed" and that rate cuts can continue "at a moderate pace."

Waller stated that "the job market indicates the Fed should continue cutting rates," while also assuring that "we are not seeing a cliff-like drop in the job market."

Technical Analysis:

Today's Buy/Sell Threshold:

155.30

Support and Resistance:

156.52

156.06

155.77

154.83

154.54

154.08

Trading Strategy:

If the price breaks above 155.77, consider buying, with a first target price of 156.06.

If the price breaks below 155.30, consider selling, with a first target price of 154.83.

AUD/JPY eyes 102.40 as BOJ loomsThe bearish correction in AUD/JPY has stalled above the key 102.40 level, coinciding with the swing high set in November 2024. While the pair bounced on Wednesday after an exploratory probe beneath the level, it remains close enough to use for protection depending on how near-term price action evolves.

With the message from the oscillators more neutral than bullish, with RSI (14) approaching 50 while MACD has crossed the signal line from above and is pushing lower, price action should take precedence when assessing whether to go long or short.

If AUD/JPY can hold 102.40 into the European session, consider initiating longs with a stop beneath the level for protection, targeting a retest of resistance above 104 and the December swing high.

But if the pair reverses back beneath 102.40 into the European open and holds there, the setup could be flipped, with shorts established on the break and a stop above for protection, targeting 101.50 initially.

Friday’s Bank of Japan interest rate decision looms as a major volatility catalyst, so ensure risk management is top of mind when assessing setups. I suspect the bank will deliver a dovish hike, lifting overnight rates by 25 basis points while talking down the urgency for more imminently. Such an outcome would normally lend itself to upside, given the pair has seen strong relationships with risk appetite and rate differentials between Australia and Japan over recent weeks.

Good luck!

DS

Failed Breakout - Gap FillIntel has been in a steep downtrend since 2021 with big moves up this year. Buyers failed to breakout of the downtrend and 52 week high early this December. It may be time for Intel to cool off and fill the gap. A close above the trendline and failed breakout level would invalidate this idea.

EURJPY bearish expectations from here

OANDA:EURJPY we can see BEARISH ENGULFING candle, after bearish engulfing looks like coming descending triangle. We are have constant bullish trend here long period and here after todays events expecting to see point of revers.

SUP zone: 182.500

RES zone: 180.300, 178.900

Buy on dips as the ascending triangle pattern remains intact#XAUUSD TVC:GOLD OANDA:XAUUSD

Despite yesterday's data releases, the overall long-term trend remains unchanged. Gold prices are currently standing above the daily MA5 and MA10 again, indicating a short-term market bias towards upward movement. Therefore, our trading strategy will continue to focus on buying on dips. While bullish, we will avoid chasing rallies. The 4345-4355 level remains a key short-term resistance level. Short-term support levels to watch are 4320-4305. If gold prices pull back to these levels during the European session, consider going long on gold