BTCUSDT False Break of Resistance – Possible Short ScenarioHello traders! Here’s my technical outlook based on the current BTCUSDT (1H) chart structure. Price previously traded inside a broad descending channel, where sellers remained in control and the market printed a clear sequence of lower highs and lower lows. During this phase, multiple breakdown attempts were followed by weak pullbacks, confirming bearish pressure. The decline eventually slowed as price reached the highlighted Buyer Zone, which coincides with a strong horizontal support area and the lower boundary of the channel. At this demand zone, selling pressure was absorbed and price sharply reversed, producing a strong impulsive breakout above the channel resistance. This breakout signaled a shift in market structure from bearish to bullish. Following the breakout, BTC rallied aggressively into the upper Seller Zone, where price briefly pushed above resistance but failed to sustain acceptance, resulting in a fake breakout and a corrective pullback. Currently, BTC is trading below the descending resistance line while struggling to reclaim the 68,800 resistance area. The price action shows weakening bullish momentum, with lower highs forming and buyers failing to push price back into the premium zone. This suggests that the recent upside move was corrective and that sellers are gradually regaining control. My primary bearish scenario activates on a clear rejection from the descending resistance line or a breakdown below the 66,800 support zone. Acceptance below this level would confirm bearish continuation and open the path for a move toward the lower demand area. Please share this idea with your friends and click Boost 🚀

Chart Patterns

XAUUSD Long: Ascending Channel Holds - 5,260 as Next TargetHello traders! Here’s my technical outlook on XAUUSD (2H) based on the current market structure. Gold initially moved within a clearly defined descending structure, guided by a strong supply trend line that consistently capped upside attempts and maintained bearish pressure. This phase was characterized by lower highs and impulsive selloffs, confirming seller control. The decline eventually reached a major pivot point where price reacted from a rising demand trend line, signaling the first meaningful shift in momentum. From that pivot, gold produced a structural breakout above the descending supply line, marking the transition from bearish control into early-stage recovery.Following the breakout, price entered a horizontal range, reflecting temporary equilibrium between buyers and sellers. Inside this range, multiple reactions formed without strong continuation, highlighting a balance phase rather than immediate expansion.

Currently, XAUUSD is consolidating above the 5,160 demand zone, which now acts as short-term structural support. This level aligns with prior breakout structure and the lower portion of the ascending channel, reinforcing its technical importance. Overhead, the 5,260 supply zone represents the next major resistance area and aligns with the upper boundary of the channel, creating a clear objective for bullish continuation.

My primary scenario favors further upside as long as price holds above the 5,160 demand area and remains within the ascending channel structure. A sustained move toward 5,260 appears likely, where a reaction or short-term pullback could occur. A clean breakout and acceptance above 5,260 would open the path for continued expansion higher within the channel. However, a strong rejection from supply followed by a breakdown below 5,160 and channel support would signal weakening bullish momentum and increase the probability of a deeper corrective move. For now, structure and momentum favor buyers while price remains supported inside the ascending channel. Manage your risk!

EURUSD: Holding Support Sets Up a Move Toward 1.1860 ResistanceHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD previously moved within a well-defined upward channel, showing strong bullish momentum and a clear sequence of higher highs and higher lows. Multiple breakout confirmations along the channel highlighted sustained buying interest and healthy trend continuation. This bullish phase eventually stalled near the 1.1860 resistance area, where price faced strong supply and failed to maintain acceptance above the range high. After this rejection, the market transitioned into a range and distribution phase, followed by a breakdown that led price into a descending channel. Within this bearish structure, sellers maintained control, pressing the market lower with consistent lower highs. Despite this, downside momentum gradually weakened as price approached the highlighted support zone around 1.1790, an area with previous demand and strong historical reactions.

Currently, price reacted positively from this support zone and broke above the descending channel structure, supported by a rising triangle support line. This breakout suggests that bearish pressure is losing strength and that buyers are starting to regain control, at least in the short to medium term.

My Scenario & Strategy

As long as EURUSD holds above the 1.1790 support zone, the structure favors a bullish continuation. The current consolidation above support indicates accumulation rather than distribution. If buyers maintain acceptance above this level, the next logical upside target is the 1.1860 resistance area, which aligns with the previous range high and supply zone. A clean breakout and consolidation above 1.1860 would confirm renewed bullish momentum and open the path for further upside expansion toward higher liquidity zones. This level may initially act as a reaction zone, so partial profit-taking is reasonable there.

However, if price fails to hold above the 1.1790 support and breaks back below the triangle support line, the bullish scenario would be invalidated. In that case, EURUSD could revisit lower demand areas and resume a broader corrective move. For now, the market structure favors long setups from support, with clear invalidation below key demand. As always, wait for confirmation and manage risk properly.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD - US-Iran Talk - Hope for Positive Outcome (27.02.2026)📊 Description✅ Setup OANDA:XAUUSD

Gold (XAUUSD – M30) is currently trading inside a major resistance zone after an impulsive bullish rally.

Market structure shows:

✔ Price reacting multiple times from higher resistance supply

✔ Rising trendline losing momentum

✔ Consolidation near highs → potential distribution phase

✔ Fundamental pressure from improving US-Iran diplomatic talks

Reduced geopolitical fear often weakens safe-haven assets like Gold.

🧱 Support & Resistance

🔺 Resistance Zone: 5200 – 5245

🔻 1st Support: 5071

🔻 2nd Support: 5021

These areas represent key liquidity reaction zones.

⚠️ Disclaimer

This analysis is for educational purposes only and not financial advice.

Always follow proper risk management and trade according to your own strategy.

#XAUUSD #GoldAnalysis #ForexTrading #PriceAction #SupportAndResistance #SmartMoney #IntradayTrading #TradingView #GoldTrading

If you find this analysis useful: 👍 Like the idea

💬 Comment your view — Gold Bullish or Bearish?

⭐ Follow for daily high-probability setups

Charts Don’t Lie — Traders Don’t Quit. 📈

AUD/NZD: More Growth is ComingThe 📈AUDNZD pair had been consolidating within an ascending triangle pattern.

The price action demonstrated a series of higher lows and consistent highs.

The resistance level of this triangle was breached yesterday.

Given the current strong bullish market trend, it is anticipated that the market is likely to continue its upward trajectory.

The subsequent target is set at 1.1911.

DOGE Distribution Warning: Is a Sharp Flush Coming?Yello Paradisers! Are you seeing what smart money is quietly doing on #DOGE right now, or are you about to get caught in the next possible sharp downside move? At first glance, this looks like “just another healthy pullback.” That’s exactly how retail traders get trapped. But when we read the structure properly and remove emotions from the equation, the chart is telling a very different story. Right now, this is not a place for emotional trading. This is a place for discipline.

💎#DOGE has clearly respected the descending resistance trend-line and failed to break above it. That rejection is not random. It confirms ongoing structural weakness. As long as price holds momentum within the supply zone/Order block + FVG zone 1H, probability favours continuation to the downside. The immediate minor support sits around 8985. If bearish pressure continues, that level becomes the first magnet.

💎From Volume Spread Analysis perspective, the sequence is even more revealing. We saw a buying climax followed by a climactic action bar. This combination typically shows distribution. In simple terms, institutions use these aggressive spikes to offload positions into retail enthusiasm. When the crowd feels confident, smart money distributes quietly.

💎#DOGE has now swept the upper trigger line of buying climax. This is a key weakness confirmation. When a buying climax upper trigger line swept, it shows that demand is not strong enough to absorb supply. If bearish momentum continues, the next major possible target sits around 8030, which could be tested sooner than many expect.

💎If #DOGE manages to break above the key resistance at 10875 with a strong momentum candle, this whole bearish probability would be invalidated, and we could instead see a bullish continuation. As always, we let price confirm our bias.

Discipline is key, Paradisers! The charts may look volatile, but this is where professionals thrive and amateurs panic. Don’t let emotions guide your trades. Wait for clear confirmation and manage risk like a pro. Strive for consistency, not quick profits. Treat the market as a businessman, not as a gambler.

MyCryptoParadise

iFeel the success🌴

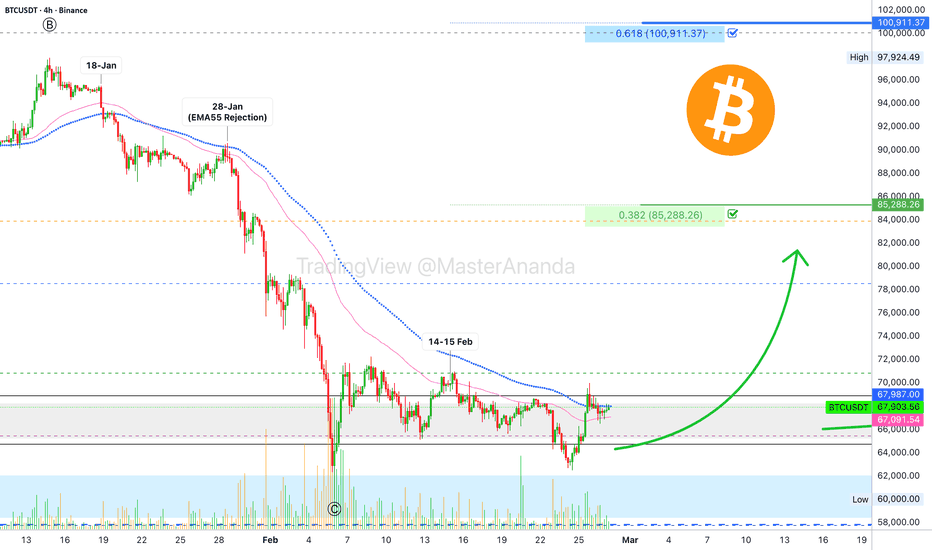

Bitcoin 4H Moving Averages EMA55 & EMA89 —$85,000 Becomes ActiveAll long-term support levels have been recovered (some are still in process but this is a done deal). I don't think there is need to mention them again. We are winning.

We've been bullish since 6-February and the recent higher low, $62,500, validates a higher high comes next.

Many traders, analysts and market participants are stuck between $70,000, $72,000 and $74,000. They are hoping, waiting and preparing for doom. They are looking to buy Bitcoin at $50,000, $40,000 and so on.

What is the problem with this? Bitcoin is going up.

Forget any price tag below $75,000. While I can appreciate and understand that there is a resistance level here, this isn't the main target short-term. Bitcoin is already aiming at $85,000. $85,000 has been activated thanks to buyers being ready and present. The signal below corroborates what I've been saying.

The strong crash, a rejection and lower prices happened around EMA55 & EMA89 (see 28-Jan. on the chart). In reverse, Bitcoin will move back up to test these resistance levels once more.

The fact that prices bounced at $60,000, not reaching lower, is what makes unavoidable a challenge of higher-resistance next.

There was no support zone at $60,000. The main support was $57,772. Bitcoin recovered before reaching this level. Sellers didn't have the strength required to push prices lower. There was no test of long-term support.

Since support was missed, the market needs to test resistance to see if it holds. Only if the last major resistance holds will Bitcoin move back to test the same support once more. Not $57,772 but the $60,000 - $62,500 price range.

Now, a lower low is not set in stone or guaranteed. If resistance is confirmed, then Bitcoin goes back down to see what the market will say around 60K.

It can happen that buyers show up with force even before 60K. For example, the recent drop, buyers were present above $62,000.

If prices rise up with force, then you can say good bye to any long-term move below the last major low.

Anything can happen, but the market tends to produce strong variations between cycles.

The fact that 2022 produced a lower low, November vs June, doesn't mean that 2026 will be the same. Market conditions are different now. There is more demand for Bitcoin and less supply. The correction was already pretty strong, but we are open to see anything happen. It all depends on how this relief rally goes.

If Bitcoin manages to move above $90,000 in March or April, reaching 100K, you can say good-bye to your 40K.

If Bitcoin fails to move beyond $80,000 or $85,000, then the worst is yet to come. You know what I mean?

Regardless of the long-term, right now, Bitcoin is going up.

The bear market is over, lower low or higher low.

The bear market bottom is already in.

Thanks a lot for your continued support.

My statement above can be corroborated by going through the altcoins, an exercise we did just weeks ago.

When in doubt, look around.

The best is yet to come.

We are bullish now.

We are going up!

Namaste.

BTCUSDT: The Selling Pressure is DominatingBased on the H4 chart, BTCUSDT is currently moving within a downward channel, with strong resistance around 68,770 USDT. Price has failed to break through this level in recent sessions, indicating that selling pressure is taking control. This could cause BTCUSDT to continue declining towards the support level of 64,800 USDT, where price has previously reacted.

In terms of news, BTCUSDT is facing pressure from a lack of upward momentum and a weakening market sentiment. While there is inflow from ETFs, there is no clear signal to push the price up, and the USD continues to dominate the market. If the support cannot hold, BTC may continue to drop to the 64,000 USDT region.

In summary, BTCUSDT is likely to decrease slightly in the next 24 hours. The 68,770 USDT resistance will be the key level, and if it is not broken, the price may head towards lower support levels.

Gold Analysis - Can Buyers Push the Price to $5,400?Gold is currently being traded in a clear ascending channel, with prices continuously respecting both the upper and lower boundaries of the channel. The recent upward momentum indicates that buyers are in control of the market, suggesting the possibility of further price increases.

Recently, gold prices have broken through an important resistance level and may return to test this area. If this level holds as support, gold prices could continue to rise, potentially reaching 5,400, which is near the upper boundary of the channel.

As long as the price remains above this support level, the prospect of a price increase will remain intact. Maintaining this support level will further strengthen the upward trend and provide opportunities for gold to keep moving higher. However, if the price fails to hold at this support level, the price increase scenario could be invalidated, opening the door for a deeper correction towards the lower boundary of the channel.

Remember, in every trade, risk management is crucial. Don’t forget to validate technical signals and use stop-loss and take-profit to protect your account!

Wishing you success in your trading and always maintaining a stable mindset!

Hellena | EUR/USD (4H): LONG to 1.19523 area (Wave 3). Colleagues, the price has almost reached the target in the previous idea, but I think it would be appropriate to update the idea a little and add a couple of details.

In particular, waves “1” and “2” of the lower order are already clearly visible. I believe that wave “2” has practically completed its corrective development, and I expect to see the development of wave “3” of the middle and lower order soon. This is a fairly strong bullish signal, and I will be watching it closely.

The target remains the same - the resistance area of 1.19523.

Manage your capital correctly and competently! Only enter trades based on reliable patterns!

WTI Oil Pulls Back from Its 2026 HighWTI Oil Pulls Back from Its 2026 High

As the XTI/USD chart shows, the price of a barrel:

→ set fresh 2026 highs above $67 earlier this week;

→ but yesterday posted a sharp reversal lower (as indicated by the blue arrow).

The spike in volatility was driven by conflicting reports from Geneva, where talks between the United States and Iran were taking place:

→ some sources suggested negotiations had reached an impasse, as Washington insists on a complete halt to uranium enrichment;

→ meanwhile, according to Omani mediators, progress has been made and another round of talks is scheduled for next week.

Technical Analysis of the XTI/USD Chart

When analysing the oil price chart on the morning of 19 February, we suggested that:

→ the market could soon set a new high for the year (which materialised, with a series of highs formed between 19 and 23 February);

→ the 65.20 level would act as support (confirmed on 23 February).

Today’s chart indicates growing bearish pressure, reflected in the following:

→ WTI struggled to hold above its yearly highs, forming signs of potential bull traps;

→ yesterday’s candle (marked with a red arrow) shows a pronounced upper wick.

At the same time, bulls clearly defended the former resistance level at $63.73. The lower boundary of the ascending trajectory that has defined WTI price movements in 2026 also supports the bullish case.

It is worth noting that an OPEC+ meeting is scheduled for the weekend. According to media reports, analysts expect an increase in output from April, which could heighten concerns about oversupply — particularly after US crude inventories rose on Wednesday. As a result, Monday’s trading may open with elevated volatility.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

Setupsfx_| XAUUSD(GOLD): 3000+ Pips Intraday Trading Setup! Dear Traders,

Gold has been accumulating since the last few days with a strong bullish volume emerging in the market. As the price has accumulated, we expect a strong distribution to take place in the next week. The potential move is worth approximately 3200 pips in total. A reasonable swing target for swing traders is identified. For a safe entry, a breakout is considered necessary before entering a buy position.

Team Setupsfx

WHY & HOW WE BUY DIPS IN GOLD (XAUUSD)Hey Everyone,

We always talk about buying dips on all our posts, so wanted to share an educational post on how and why.

Gold is a trend-respecting asset, with a longer term Bullish structure overall. Therefore it doesn’t move in straight lines, it moves in waves.

In an uptrend:

Price makes higher highs

Price makes higher lows

Pullbacks happen into key support zones

Institutions accumulate at discounts

Instead of chasing breakouts, we let price come back to value.

The dip = discount inside a bullish structure.

What We Look For Before Buying a Dip

Buying blindly is gambling. Buying at structure is trading.

Here’s our checklist:

1- Clear Market Structure

Is Gold making higher highs & higher lows?

If yes → Bias remains bullish.

2- Strong Support Confluence

On your chart, mark:

Previous breakout zones

Demand zones

Trendline support

4H / Daily support levels

And MAs

The more confluence, the higher the probability.

3 - Rejection Confirmation

We don’t buy falling knives.

We wait for:

Strong wicks rejecting support

Break of minor structure on lower timeframe

Confirmation reduces risk and EMA5 confirmations.

Why This Strategy Works in Gold Specifically

Gold reacts strongly to:

Inflation expectations

USD weakness

Risk-off sentiment

Central bank demand

Institutions accumulate gold on pullbacks, not at random highs.

That’s why dips into strong support often create explosive moves.

Psychology Behind Dip Buying

Most retail traders:

Panic sell at support

Buy after breakout

Enter emotionally

Professionals:

Buy fear

Sell euphoria

Execute at levels

Trading is positioning , not reacting.

What To Do With The Chart I’ll Share

When I post the chart:

Identify the marked support

Ask yourself:

Is structure still bullish?

Do we have confluence?

Is there rejection?

Plan entry, stop, and target BEFORE entering.

No plan = No trade.

We’ll wrap up the week with this post and be back on Sunday with our multi-timeframe charts, trade ideas, and detailed plans for the week ahead.

Have a great weekend.

Mr Gold

USD/CAD - Channel breakout (26.02.2026)📊 Description ✅ Setup OANDA:USDCAD

USDCAD (M30) shows a clear structure shift after failing to sustain inside the rising channel.

Key observations:

✔ Price rejected from major Resistance Zone

✔ Ascending structure losing strength

✔ Breakdown below trendline support

✔ Lower highs forming → bearish pressure increasing

Market sentiment currently favors sellers unless price reclaims resistance.

🧱 Support & Resistance

🔺 Resistance Zone: 1.3690 – 1.3705

🔻 1st Support: 1.3638

🔻 2nd Support: 1.3622

These zones represent liquidity reaction areas.

⚠️ Disclaimer

This analysis is for educational purposes only and does not constitute financial advice.

Always apply proper risk management and trade based on your own strategy.

#USDCAD #ForexTrading #PriceAction #TrendlineBreak #SupportAndResistance #IntradayTrading #ForexAnalysis #TradingView #SmartMoneyConcepts

If you find this analysis helpful: 👍 Like the idea

💬 Comment your bias (Buy or Sell?)

⭐ Follow for more high-probability setups

Charts Don’t Lie — Traders Don’t Quit. 📈

XAU/USD | Gold Breaks Out Again – FVG Fill Before Next ExpansionBy analyzing the #Gold chart on the 2-hour timeframe, we can see that since yesterday price was ranging around the $5185 level without following a clear directional trend. However, today following new headlines and rising tension expectations, Gold experienced an aggressive impulsive move.

Within minutes, price surged from around $5185 to $5240 and is currently trading near the $5227 level. This expansion confirms that buyers are still in control when geopolitical risk increases.

During this move, a clear FVG was created between $5190 and $5207. Based on structure and liquidity behavior, I expect this imbalance to be filled in the near term before continuation. A pullback toward that zone could provide a healthier base for the next bullish leg.

If momentum resumes after the FVG fill, the next upside targets to monitor are $5245, followed by $5255, then $5275, and ultimately the $5300 level in case of sustained bullish pressure.

Volatility remains elevated and reactions around imbalance zones will be key. This chart will continue to be updated step by step as price reacts to key levels.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

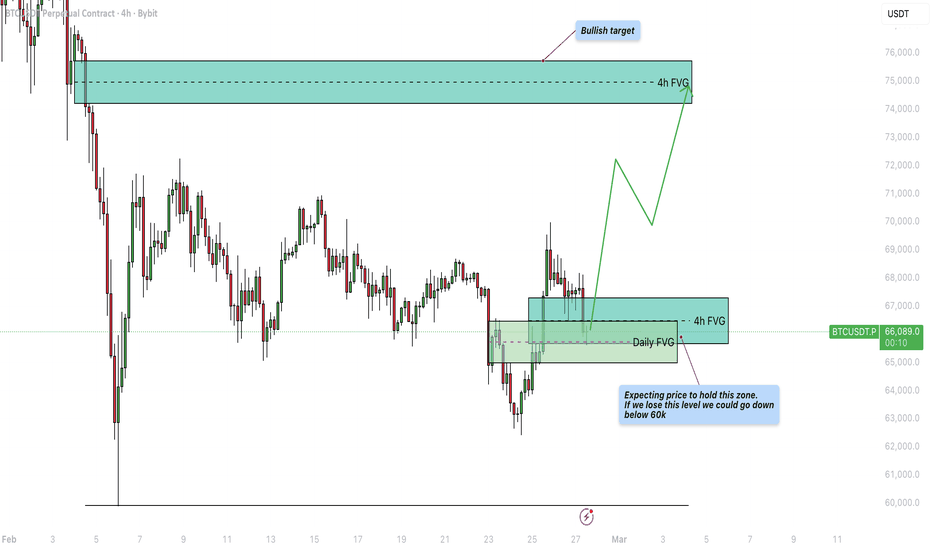

Bitcoin - Most important level to hold for the bulls!Bitcoin is currently trading around $66,100 after bouncing from the recent lows near $63,000. The market structure shows a recovery into a key higher-timeframe imbalance zone, where price is now attempting to stabilize. This area is technically significant because it combines both a Daily and a 4h fair value gap. The reaction here will likely determine whether this move develops into a larger recovery or rolls over into another leg down.

Daily FVG

The Daily FVG sits slightly below current price and represents a higher timeframe imbalance that has not been fully resolved. Higher-timeframe gaps tend to carry more weight, as they reflect stronger institutional order flow. Price has now moved back into this Daily FVG and is attempting to hold above it. As long as daily candles continue to close within or above this zone, it suggests that buyers are defending the area. Losing this Daily imbalance, however, would signal weakness and increase the probability of a deeper decline.

4H FVG

Inside the broader Daily zone lies a 4h FVG that aligns closely with current price action. This confluence creates a strong technical support cluster. The 4h imbalance is more sensitive to short-term movements and is currently acting as immediate support. If price respects this level with higher lows and continued acceptance above it, the structure supports a bullish bounce scenario. A clean breakdown below both the 4H and Daily FVG would invalidate the short-term recovery and shift momentum back to the downside.

Target Area

If this support cluster holds, the next logical upside target is the large 4h bearish FVG around the $74,000–$76,000 region. This higher imbalance remains unfilled and acts as a magnet for price in a recovery scenario. A sustained move above $68,000 would strengthen the probability of continuation toward that upper target zone. That area represents the next major resistance and the primary objective if bullish momentum builds.

Final Thoughts

Bitcoin is sitting at a critical support confluence formed by the Daily and 4h FVG. As long as price holds this level, a larger bounce toward the $74K–$76K imbalance remains possible. However, if this zone fails and sellers regain control, the downside opens significantly, with a move below $60,000 becoming a realistic scenario. The current level is therefore pivotal for determining the next major directional move.

-------------------------------

Thanks for your support.

- Make sure to follow me so you don't miss out on the next analysis!

- Drop a like and leave a comment!

GBP/USD | Pound Bounces From Demand – Bullish Continuation ...By analyzing the #GBPUSD chart on the 4-hour timeframe, we can see that price is currently trading around the $1.34750 level. After reaching the key $1.344 demand zone last night, strong buying pressure stepped in and prevented further downside.

The reaction from this demand level confirms that buyers are actively defending this structure. As long as price continues to hold above the $1.344 region, the bullish continuation scenario remains valid and momentum is expected to gradually build.

If this strength continues, the next upside targets to watch are $1.35100, followed by $1.35230, then $1.35500, and finally the $1.35800 level in case of sustained bullish expansion.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

Australian Stock Index ASX 200 Reaches Record HighAustralian Stock Index ASX 200 Reaches Record High

As the chart of the ASX 200 index shows, today’s candle has moved above the 9,210 level, marking a fresh all-time high. Since the start of the year, the benchmark of Australian equities has gained more than 5.6%, supported by:

→ A strong earnings season. A significant number of companies not only exceeded analysts’ expectations but also upgraded their profit forecasts for the 2026 financial year.

→ Economic resilience. The unemployment rate remains low despite the Reserve Bank of Australia maintaining a firm policy stance.

→ Elevated prices for gold, uranium and copper, along with signs of a recovery in China’s economy, which have provided support to the mining sector.

Technical Analysis of the ASX 200 Chart

Price action continues to unfold within an ascending channel (highlighted in blue) that has been in place since autumn 2025. Within this structure:

→ The median line acted as support on 24 February, signalling underlying strength.

→ The upper boundary has repeatedly served as resistance during 2026.

It is worth noting that:

→ The psychological 9,100 level had previously capped gains within the channel.

→ The index has now climbed above 9,200 near the upper boundary of the blue channel.

→ The RSI indicator is approaching overbought territory.

Given these factors, it is reasonable to assume that some long-position holders may look to take profits, potentially leading to a pause in bullish momentum. As a result, the following scenario cannot be ruled out:

→ Failure to secure a sustained move above 9,200;

→ The development of a corrective pullback in the ASX 200 (Australia 200 on FXOpen).

In such a case, support may emerge near the lower orange trend line, which reflects the upward trajectory seen during the second half of the month.

This article represents the opinion of the Companies operating under the FXOpen brand only. It is not to be construed as an offer, solicitation, or recommendation with respect to products and services provided by the Companies operating under the FXOpen brand, nor is it to be considered financial advice.

XAUUSD: Triangle Pressure Rising - Downside Move Brewing To 5110Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD has recently been trading inside a well-defined upward channel, reflecting a period of steady bullish recovery after the earlier consolidation phase. Within this structure, price respected dynamic support and resistance while forming a sequence of higher highs and higher lows, signaling consistent buying interest as the market advanced toward the upper boundary. The bullish expansion eventually slowed near the resistance zone around the 5200 region, where sellers began to absorb momentum and limit further upside. Multiple rejections from this level, combined with the formation of a descending triangle resistance line, indicate that supply remains active in this area and that bullish momentum is gradually weakening.

Currently, price is consolidating just below resistance after a failed breakout attempt. The inability to hold above the resistance band suggests that buyers are losing strength, while the compression beneath the triangle resistance reflects building pressure that often precedes a directional move. If this structure resolves to the downside, the next key area lies near the horizontal support zone around 5110, which previously acted as a demand region and may once again attract buyers.

My Scenario & Strategy

My scenario: as long as XAUUSD remains capped below the 5200 resistance zone and continues respecting the descending triangle resistance, the probability favors a bearish pullback toward the 5110 support region. This level aligns with prior reaction lows, a liquidity cluster, and the lower boundary of the current consolidation range, making it a logical downside target. A confirmed rejection from resistance followed by bearish continuation would signal that sellers are regaining short-term control and that the market may transition into a deeper corrective phase.

However, if price breaks and holds above the 5200 resistance area with strong bullish momentum, this would invalidate the bearish scenario and suggest renewed upside continuation toward higher liquidity zones. Until such confirmation appears, the current structure favors a cautious bearish outlook from resistance.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

GOLD: Safe-Haven Demand Lifts Gold Toward Higher LevelsGOLD: Safe-Haven Demand Lifts Gold Toward Higher Levels

GOLD is well positioned to rise further at this moment.

The Geopolitical situation is very bad and the probably the market may anticipate that the deal between the U.S and Iran will not be reached despite that Iran is working a lot on that part.

🔴Notably, the two American negotiators, Steve Witkoff and Jared Kushner, remained silent about the current status of negotiations. The White House declined to comment.

🔴President Trump is considering ordering the U.S. military to carry out targeted strikes in Iran. In making the case for an attack, his administration has made some false or unproven claims.

All the news is favoring gold price to grow even more.

Only any strange manipulation can push it down again.

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️

USD/CAD Positioning & Structure Hint at the Next MoveUSDCAD is currently trading inside a key higher-timeframe demand zone after a strong bearish displacement from the 1.41 area.

At this stage, I’m not looking for predictions but for reaction at critical levels.

From a positioning perspective, COT data shows non-commercial traders increasing CAD long exposure, suggesting underlying CAD strength building in the background.

At the same time, retail sentiment remains majority long USDCAD, which historically acts as a contrarian signal.

Seasonality also aligns with this view, as late February into spring tends to favor CAD appreciation, adding confluence to a potential downside continuation.

Technically, price is consolidating within an imbalance/demand structure around the mid-1.36 area. This type of price action often represents accumulation before expansion, meaning the next move will likely come from liquidity interaction rather than immediate continuation.

Key Levels I’m Watching

1.3718 → short-term bias pivot

1.3880 – 1.3920 → major supply / sell-the-rally zone

1.3545 → demand support & breakdown trigger

1.3476 → downside liquidity target

My Current Plan

I remain in a sell-the-rally environment unless price achieves daily acceptance above 1.392.

Preferred scenario:

Price stabilizes inside demand

Corrective rally toward supply

Rejection → continuation lower

Invalidation occurs only if price sustains acceptance above the supply zone, signaling a structural shift.

For now, I focus on process, positioning, and reaction, not prediction.

TheGrove | USDJPY buy | Idea Trading AnalysisUSD/JPY is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance level.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity USDJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

Bitcoin Turns Technically Bullish — Will the Flag Hold?Bitcoin Turns Technically Bullish — Will the Flag Hold?

From a technical perspective, BTC is showing the formation of a clear and strong 4-hour bullish flag pattern.

The price just confirmed the bullish move and is showing increasing bullish momentum.

The market has been volatile recently and has transformed from bearish to bullish and vice versa many times.

It remains to be seen whether the price will respect this pattern.

It is impossible to know whether this pattern will further transform into something different or whether it will work as well as it is showing.

Currently, BTC is showing only a bullish pattern.

Targets:

72K ; 75K and 78.7K

You may find more details in the chart.

Thank you and good luck! 🍀

❤️ If this analysis helps your trading day, please support it with a like or comment ❤️