USDCAD — Clean Breakdown Setup Toward 1.35000USDCAD presents a very interesting opportunity this week. It looks like one of those setups where, after a clear break of support, we can enter on the pullback.

In my view, this is not a situation that requires multiple confirmations — the breakdown itself could be sufficient reason to enter a short position.

The potential target for this move could be around 1.35000.

Personally, I’ll be closely monitoring this pair at the start of the week.

#Pouyanfa🔥

Chart Patterns

Chart Analysis – Bullish Reversal Toward Resistance

The 1-hour chart of Gold vs US Dollar (XAU/USD) shows a strong bullish recovery after a sharp sell-off. Price has reclaimed a key demand zone and is now pushing toward a major resistance level.

🟢 1. Demand Zone Holding (Bullish Structure Intact)

Price sharply dropped into the 4,880–4,920 support area

Strong rejection from the lows (highlighted reaction zone)

Higher low formed after the bounce

Momentum shifted bullish with consecutive higher highs and higher lows

This confirms buyers stepped in aggressively at discount levels.

🔴 2. Stop Loss Zone

The marked 4,930–4,950 region acts as invalidation.

A break below this zone would:

Disrupt bullish structure

Indicate potential continuation downside

Suggest failed breakout attempt

As long as price remains above this level, bullish bias remains valid.

🟩 3. Current Resistance Zone

Price is now testing 5,020–5,060 supply area

This zone previously acted as consolidation and breakdown area

Reclaiming and holding above it turns it into support

A clean breakout and close above 5,060 increases probability of continuation.

🎯 4. Upside Target

If breakout confirms:

Next major resistance: 5,120–5,150

Strong momentum could extend toward the psychological 5,200 region

📊 Technical Structure Summary

Level Type Price Zone Meaning

Major Support 4,880–4,920 Strong demand reaction

Invalidation 4,930–4,950 Stop loss area

Breakout Level 5,020–5,060 Key resistance flip

Target Zone 5,120–5,150+ Upside objective

📌 Bias: Bullish Above 4,950

Holding above support → continuation likely

Break and close above 5,060 → acceleration expected

Failure below 4,930 → bearish pressure returns

If you'd like, I can also provide:

A short trading plan version

Risk-to-reward breakdown

Intraday scalp vs swing perspective

Or convert this into a caption for social media 🚀

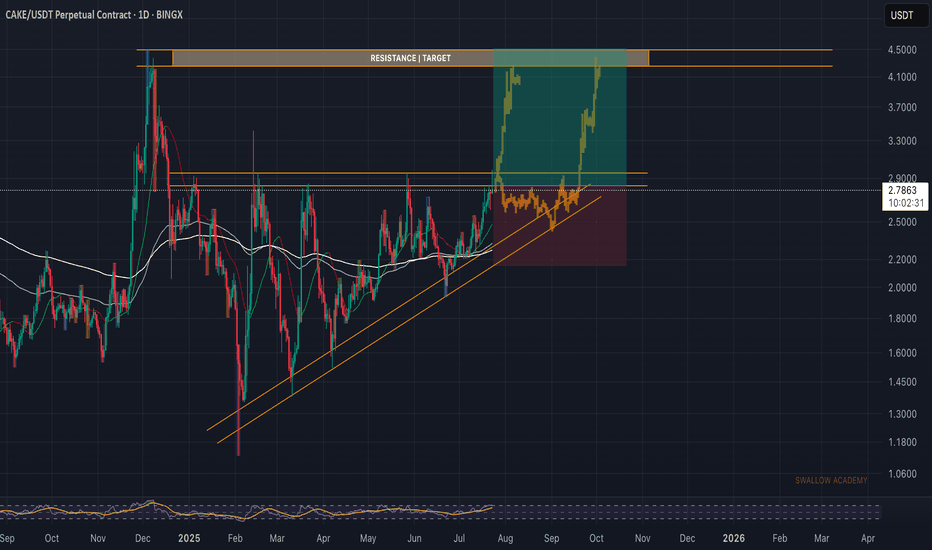

Pancake Swap (CAKE): Looking For Breakout | Bullish TrianglePancake looks good for long here, where we are at the last pressure point in that triangle pattern, which is hinting to an upcoming volatile breakout (or even breakdown, who knows).

Either way, based on the overall market status currently, we are looking more for the bullish breakout here, which would then need to be confirmed with a proper retest on smaller timeframes, which then again would give us a good opportunity for a long position!

Swallow Academy

WHR ready to runGreat chart for using Momentum Wave oscillator.

WHR is ready to run. It just needs to break that yellow down-slopping trend line. As soon as it does...off to the races.

Here is an interesting summary for each of the "buy" signals and the results. It is on the weekly chart. You can see the green vertical lines. It is when the momentum oscillator goes below -60.

As of now, we have hit the yellow trend line again. But the big support line was hit (white line), so we are probably consolidating to gain strength to break the yellow resistance line. Look for a median move average of 35% from when the signal was given. Could be more depending on the overall S&P market, tariffs, etc. Remember that the average move is 88.5%

Entry: If not already in, look for a small pull back on the 1 hour chart for a good entry.

Metric Result

Total signals: 13

Wins: 12

Losses: 1

Win rate: 92.3%

Average move: 88.5%

Median move: 35%

11/1/74, 100%

2/1/78, 14%

4/2/79, 11%

4/1/80, 235%

12/3/90, 90%

11/1/20, 99%

4/1/09, 212%

1/3/12, 327%

11/1/18, 35%

11/1/22, 18%

1/2/24, -30% (negative)

7/1/24, 14%

1/2/26, 25% (current and end results pending)

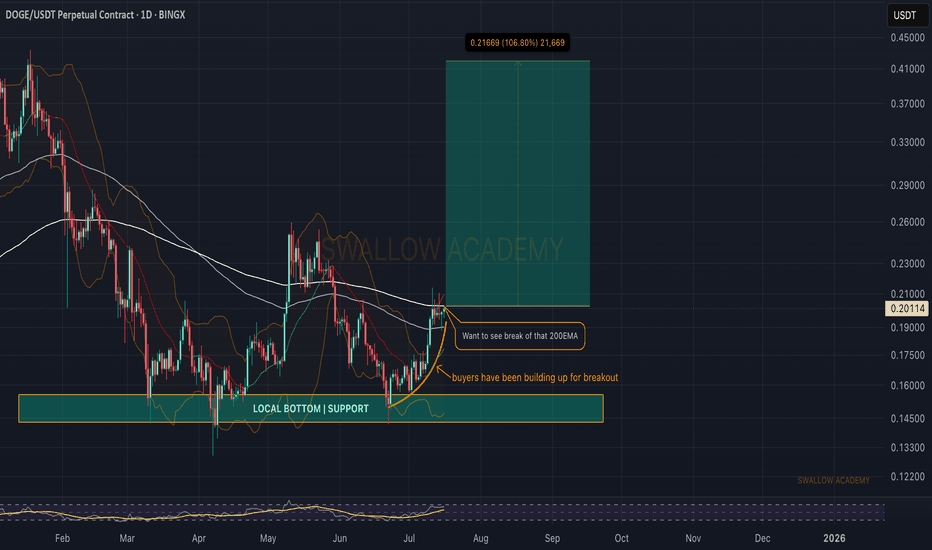

Dogecoin (DOGE): About To Breakout and Start Strong Bullish MoveDogecoin has been on our radars for quite some time, and we had a nice bounce since last time (from the local bottom).

Now we are approaching the breakout point (200 EMA) area, where upon seeing the break we should start a strong upward movement.

Swallow Academy

Shiba Inu (SHIB): Looking For Breakout | Do Not Miss It...Do not miss the breakout that we might see about to happen. We are looking for a breakout on SHIB coin where once we get that breakout from the zone of accumulation (sideways channel), we are going to look for further movement to upper target zones from there!

Swallow Academy

SPY On The Rise! BUY!

My dear subscribers,

SPY looks like it will make a good move, and here are the details:

The market is trading on 681.65 pivot level.

Bias - Bullish

My Stop Loss - 678.64

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 687.62

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

#DYDX/USDT Breakout from Falling Wedge |#DYDX

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.1027, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.0160

First Target: 0.1100

Second Target: 0.1150

Third Target: 0.1198

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.

US30 BEARS WILL DOMINATE THE MARKET|SHORT

US30 SIGNAL

Trade Direction: short

Entry Level: 49,449.0

Target Level: 48,076.7

Stop Loss: 50,359.3

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

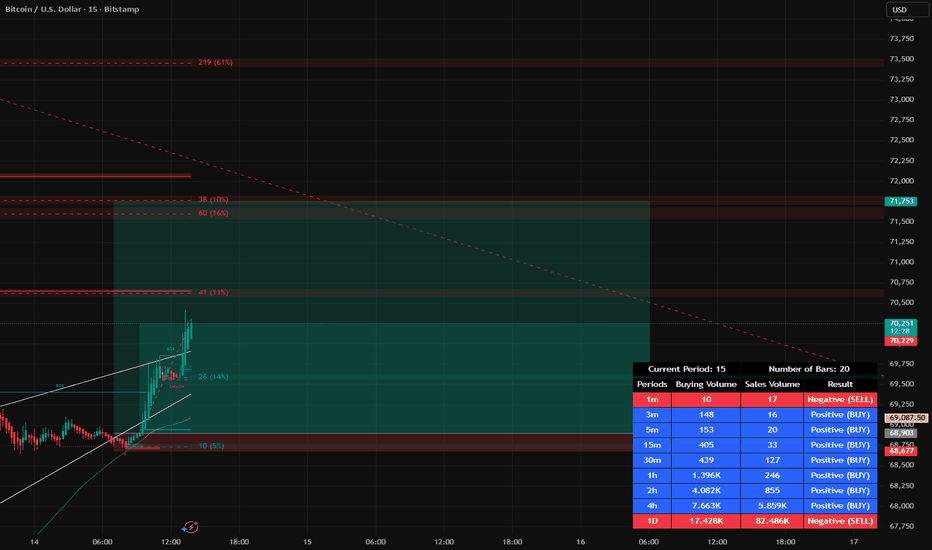

BTC Liquidity Building Before a Key Breakout

Most indicators are starting to turn positive, especially liquidity behavior, which suggests accumulation around the current zone.

The bounce from this area is technically strong, but the real trigger remains clear:

A sustained move above 75K opens the path toward:

🎯 $80,000

🎯 $85,000

From a time perspective, February 18 is an important cyclical date and could act as a catalyst for a decisive move — either acceleration or rejection.

For now:

Structure is attempting to shift.

Liquidity is improving.

Momentum is stabilizing.

The next few sessions will be critical.

📅 I’ll update the chart and may go live depending on how price reacts around the 75K level.

Let’s see how the market responds.

#Bitcoin #BTC #Crypto #Gann #PriceAction #Liquidity #TradingView

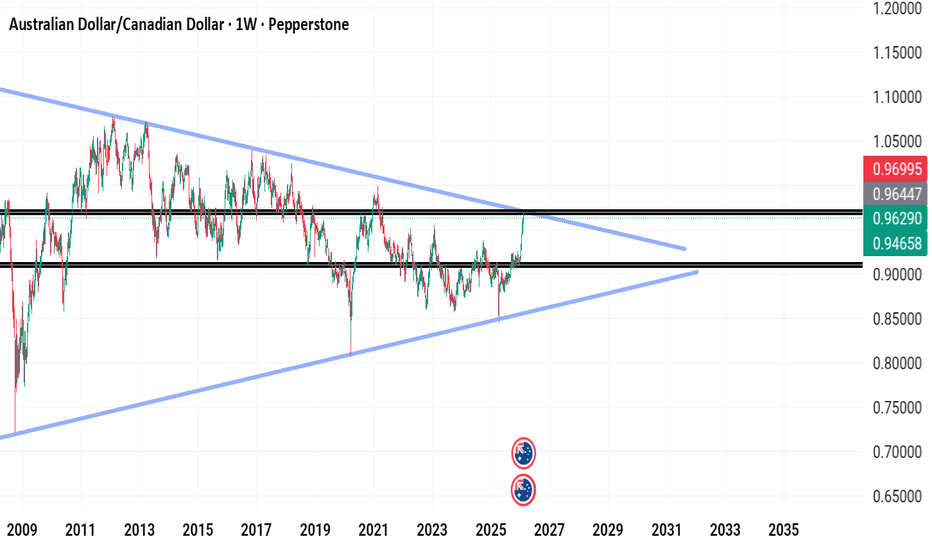

AUDCAD1. Price is reacting to a weekly timeframe down trend line.

2. Price is also reacting to a weekly supply level.

3. In the H4 timeframe, there is bearish engulfing candle already closed signaling price may come down.

4. Early sellers could enter the trade or wait for retest of the supply level.

Dow Jones (US30) sits within an Expanding Wedge formation; suppoThe rally was sold, and the dip was bought, resulting in US30 posting an indecisive doji-style candle on Friday.

From a technical perspective, we hold within a large Expanding Wedge pattern. This formation has an eventual bias to break to the downside. The measured move target is 47,452.

Trendline resistance is currently located at 50,980

Trendline support is located at 48,681. Bespoke support is located at 48,600

Conclusion: There's no clear bias from current levels. The preferred stance would be to buy into a dip close to the 48,600 support level for a corrective move higher

EURUSD | FRGNT DAILY FORECAST | Q1 | W7 | D16 | Y26📅 Q1 | W7 | D16 | Y26

📊 EURUSD | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

FX:EURUSD

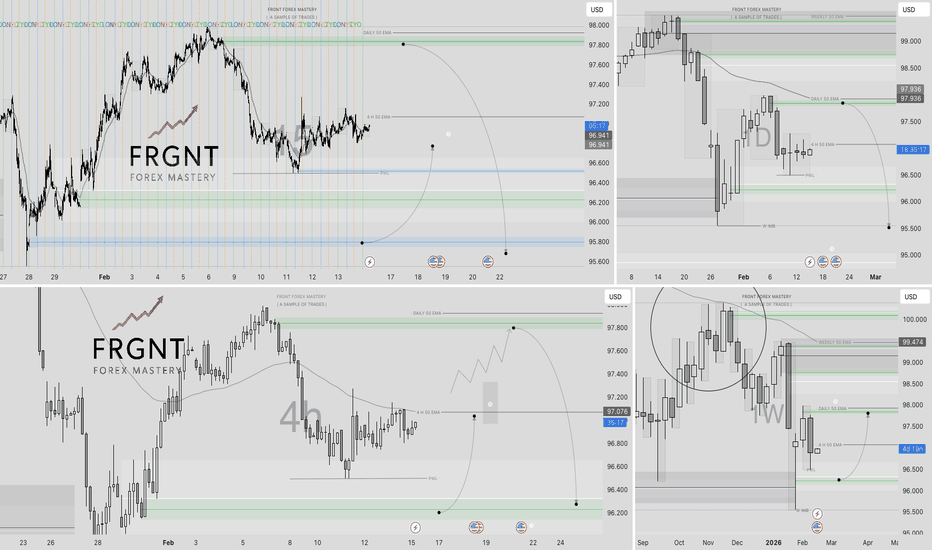

DXY | FRGNT DAILY FORECAST | Q1 | W7 | D16 | Y26📅 Q1 | W7 | D16 | Y26

📊 DXY | FRGNT DAILY FORECAST |

🔍 Analysis Approach

I’m applying a developed version of Smart Money Concepts, with a structured focus on:

• Identifying Key Points of Interest (POIs) on Higher Time Frames (HTFs) 🕰️

• Using those POIs to define a clear and controlled trading range 📐

• Refining those zones on Lower Time Frames (LTFs) 🔎

• Waiting for a Break of Structure (BoS) as confirmation ✅

This process keeps me precise, disciplined, and aligned with market narrative, rather than reacting emotionally or chasing price.

💡 My Motto

“Capital management, discipline, and consistency in your trading edge.”

A positive risk-to-reward ratio, combined with a high-probability execution model, is the backbone of any sustainable trading plan 📈🔐

⚠️ On Losses

Losses are part of the mathematical reality of trading 🎲

They don’t define you — they are necessary, expected, and managed.

We acknowledge them, learn, and move forward 📊➡️

🙏 I appreciate you taking the time to review my Daily Forecast.

Further context and supporting material can be found in the Links section.

Stay sharp 🧠

Stay consistent 🎯

Protect your capital 🔐

— FRGNT 🚀📈

TVC:DXY

ID – 1H Descending Channel With Short Term AccumulationOn the 1H timeframe, ID is clearly trading inside a well defined descending channel, respecting lower highs and lower lows. The macro intraday trend remains bearish as long as price stays inside that channel.

🔍 Current Structure

Recently, price formed a short term ascending mini range / rising structure near the lower half of the channel. This suggests local accumulation after a strong sell off.

We are currently sitting around the 0.0515 – 0.0530 area, which is acting as an intraday pivot zone.

📌 Key Levels

• 0.0515 → Local support / flip Level

• 0.0445 – 0.0460 → Major channel support & liquidity area

• 0.0652 → Resistance Level

• 0.0926 → Higher timeframe major resistance

🧠 Possible Scenarios

🟢 Bullish Case

If price holds above 0.0515 and breaks the descending channel resistance, we can expect continuation toward 0.065 first, and potentially expansion toward 0.09 zone.

🔴 Bearish Case

If the current structure fails and 0.051 breaks with momentum, market could sweep liquidity around 0.0445 before any meaningful bounce.

For now, short term structure is improving, but confirmation only comes with a clean channel breakout.

APPLE: Free Trading Signal

APPLE

- Classic bullish formation

- Our team expects growth

SUGGESTED TRADE:

Swing Trade

Buy APPLE

Entry Level - 255.79

Sl - 251.80

Tp - 264.27

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

#WLD/USDT Pump Anticipated#WLD

The price is moving within a descending channel on the hourly timeframe. It has reached the lower boundary and is heading towards a breakout, with a retest of the upper boundary expected.

The Relative Strength Index (RSI) is showing a downward trend, approaching the lower boundary, and an upward bounce is anticipated.

There is a key support zone in green at 0.4000, and the price has bounced from this level several times and is expected to bounce again.

The indicator is showing a trend towards consolidation above the 100-period moving average, which we are approaching, supporting the upward move.

Entry Price: 0.4088

First Target: 0.4180

Second Target: 0.4314

Third Target: 0.4497

Stop Loss: Below the green support zone.

Don't forget one simple thing: Money Management.

For any questions, please leave a comment.

Thank you.