Chart Patterns

ETHUSD – RANGE TO BREAKOUT STRUCTURE | BUYERS IN CONTROLPrice spent significant time in a well-defined range trade, building liquidity above a strong demand zone area. After multiple consolidations, the market transitioned into UTA (Upthrust Action) and successfully broke out of the range, confirming bullish intent. The former buyer zone acted as a base, while the breakout level is now turning into a seller zone flip, supporting continuation. As long as price holds above the breakout structure, the path remains open toward the strong supply zone, which stands as the next upside target.

XPL first signs of life. Time to execute a strategy. PLASMA is showing a clear shift in structure after an extended downtrend. Price has broken out of the descending channel and is now pushing higher into a key reaction area.

The highlighted structure zone below price is acting as a base. As long as this area holds, pullbacks are being absorbed and buyers remain in control. A strong reaction here supports continuation, while acceptance back below it would likely lead to consolidation.

Momentum is expanding rather than fading, suggesting this move has follow-through behind it. This level matters,hold structure and continuation stays on the table; lose it and PLASMA likely chops before the next direction is set.

Watching how price behaves around this zone.

BTCUSD Intraday View: Upside Bias While Above SupportBitcoin is showing strength on the intraday chart. Price is holding above the 88210 support, which keeps the short-term direction positive.

The market has been moving higher step by step, showing buyers are active. As long as price stays above the key support area, upside continuation is possible.

Key Levels to Watch

Support / Pivot: 88210

Lower Supports: 86930 → 86160

Resistance Levels: 91020 → 91790 → 92560

Market Expectation While price remains above 88210, the path of least resistance is upward toward 91020 and 91790. Any pullback into support may be corrective, not a trend change.

Invalidation A strong break and hold below 88210 would weaken the bullish intraday view and may lead to a deeper pullback.

This is a simple price-action observation for educational purposes only, not financial advice.

BITSTAMP:BTCUSD IG:BITCOIN CRYPTOCAP:BTC $Crypto $Cryptocurrency

Single-Family Home Prices Priced in Gold (1971–2026)📊 Single-Family Home Prices Priced in Gold (1971–2026)

This chart shows the price of a U.S. single-family home measured in ounces of gold, not dollars, going back to the early 1970s.

Why this matters:

Tight Credit is not good for markets! Bad JUJU!

Gold acts as a long-term monetary benchmark. Pricing homes in gold strips out currency effects and helps reveal real cycles, not nominal noise. It gives us insight into how the market is looking at credit going forward.

🔎 What the chart shows (facts)

Home prices in gold move in long, multi-decade cycles

Peaks tend to occur during periods of:

easy credit

suppressed interest rates

strong belief in “housing always goes up”

Troughs tend to follow:

monetary tightening

credit contraction

stress resets in the financial system

Historically, these cycles are not random and not short-term.

Bottom line

This chart is about relative value, monetary regimes, and long-term structure.

For new traders:

Learn to separate nominal prices from real purchasing power, "VALUE" and you’ll start seeing markets more clearly.

Structure first. Emotion later.

The home didn't change

The Currency did.

I strongly encourage traders and investors to understand the operational mechanics of the monetary system. There is a meaningful distinction between money and currency, and this chart highlights that difference clearly.

Understanding that distinction changes how you interpret cycles, value, and risk.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

XAUUSD Intraday View: Downside Still StrongGold is under selling pressure right now. Price is trading below 4370, which is an important level. As long as gold stays below this area, sellers remain in control.

The market tried to move up but failed, and price turned down again. This shows weakness. The RSI is also very low, which confirms strong selling momentum.

Levels to watch:

Resistance: 4370 → 4405 → 4440

Support: 4274 → 4245 → 4205

Expectation:

If price stays below 4370, gold can continue moving down toward 4274 and 4245.

Only a strong move back above 4370 would reduce the downside pressure.

This is a simple price-action view for learning purposes only, not financial advice.

CRYPTOCAP:FOREX NYSE:SMC TVC:GOLD

XAU/USD 30-MINUTES LONG POSITION CHART TRADE PLANXAU/USD (Gold) 30-minute chart based

Market Structure

Overall structure before the drop was bullish (higher highs & higher lows).

Price moved up into a strong resistance / supply zone (yellow box at the top).

That zone caused a rejection → sellers stepped in aggressively.

📉 Resistance Reaction (Top Yellow Zone)

The circled high shows liquidity grab / fake breakout.

After tapping resistance, price formed strong bearish candles.

This confirms the zone as valid supply.

Bias changes from bullish → short-term bearish / corrective.

Sharp Sell-Off

The big red move down indicates:

Stop-loss hunting of buyers

Break of short-term bullish structure

Price dropped into a demand / support zone (bottom yellow box).

Current Area (ENTRY Zone)

Price is now reacting from demand and forming a small bounce.

This is a pullback / retracement, not a trend reversal yet.

Entry marked is a speculative buy expecting a corrective move upward.

Target

Target is set near 4,374 – 4,380

This aligns with:

Previous support turned resistance

Mid-range of the prior move

Logical TP for a counter-trend buy

Stop Loss

Stop below 4,301

AI chart analysisYou’re asking for the **bigger picture** — and this 1D (daily) chart of **ETH/USD** as of **Jan 3, 2026**, shows a *massive* shift in momentum.

Let’s break it down **at a glance**, no math, just what the chart is *screaming* right now.

---

## 📈 ETH/USD – 1D Chart Snapshot (Jan 3, 2026)

- **Price**: $3,115.0 (+3.82%)

- **Trend**: **Bullish reversal confirmed** after months of downtrend.

- **Candles**: Green, higher highs, higher lows → uptrend in progress.

- **Volume**: Strong recent volume → institutional or whale buying likely.

---

## ☁️ Ichimoku Cloud – Bigger Picture Read

> 🔍 Remember: Cloud = trend filter + support/resistance

### 1. **Price vs. Cloud**

- **Price is ABOVE the cloud** → **Bullish trend confirmed**.

- Cloud is **green/turning up** → support zone forming.

- This is a **major shift** from the bearish setup we saw in Dec 2025.

> ✅ **Implication**: Trend has flipped. Bulls are now in control on the daily timeframe.

---

### 2. **Conversion Line (Tenkan-sen)** – White line

- Sloping **up sharply** → short-term momentum is strong.

- Acting as **dynamic support** — price bouncing off it.

---

### 3. **Base Line (Kijun-sen)** – Yellow/orange line

- Price is **above Kijun** → medium-term trend is now bullish.

- Tenkan > Kijun → bullish alignment confirmed.

---

### 4. **Lagging Span (Chikou Span)** – The trailing green line

- Chikou is now **above past price candles** → confirms bulls are in control.

- No more “trailing below” — that bearish signal is gone.

---

### 5. **Future Cloud (Projected Kumo)**

- Cloud ahead is **green and rising** → suggests continued support and upward momentum.

---

## 📉 RSI & MACD (Bottom Panel)

- **Stoch RSI**: Rising, not overbought yet → room to run.

- **MACD**: Bullish crossover, histogram expanding → momentum accelerating.

> 💥 **Confluence**: All indicators aligning — bullish across the board.

---

## 🧭 What’s Happening Now? (At a Glance)

> 🐂 **ETH is breaking out of its consolidation range** — and it’s doing it with conviction.

- Yesterday’s long wick ($3,200) was a rejection.

- Today, price **closed above that wick high** → **resistance turned into support**.

- That’s a classic **bullish breakout confirmation**.

---

## 🎯 Key Levels to Watch (Next 2 Weeks)

| Level | Significance |

|--------------|----------------------------------------|

| **$3,200** | **Former resistance → now support** |

| **$3,150** | Minor support / pullback zone |

| **$3,050** | Critical support — break = bearish |

| **$3,300** | Next major resistance / target |

| **$3,500** | Psychological milestone / next goal |

---

## ✅ Trading Takeaway (Quick & Dirty)

> 🚀 **The market has flipped. Bulls are in charge.**

➡️ **Strategy**:

- **Buy on dips** near $3,150–$3,100 with stop below $3,050.

- **Target $3,300–$3,500** if volume holds.

- **Watch for rejection at $3,300** — could retest or consolidate.

---

## 💬 Final Thought

> “It was trying… and now it’s succeeding.”

That long wick wasn’t the end — it was the **setup**.

Now ETH is breaking out, confirming the trend reversal.

This is how markets work — **rejection → consolidation → breakout**.

If you missed the entry, don’t chase. Wait for a pullback — the trend is your friend.

---

*Disclaimer: Not financial advice. Crypto moves fast. Use stop-losses. This is analysis, not prediction.*

SPY LongAscending triangle pattern in Uptrend, which is a strong bullish continuation pattern.

Trendline touch.

Long entry 681

Stop 677 (when trendline break)

Target 725 (top line of uptrend wedge)

Risk management is much more important than a good entry point.

I am not a PRO trader.

In my trading plan, the Max Risk of each short term trade should be less than 1% of an account.

BTC - Ascending Triangle | Liquidity Sweep Before Breakout?

Executive Summary

Bitcoin is trading at $90,529 on the first trading day of 2026, testing the upper resistance of an ascending triangle on the 4H timeframe. Price has rallied +2% today as dip buyers stepped in aggressively. The structure suggests a short-term pullback to sweep liquidity below $88K before breaking the ascending pattern and bursting higher.

BIAS: BULLISH - Short-Term Dip, Then Breakout

Current Market Data

Current: $90,529 (+1.98%)

Day's Range: $88,309 - $90,927

October Peak: $126,000

Key Support: $86,000-$88,000

Fear & Greed Index: 36 (Fear → improving)

What's Driving the Rally

"January Effect" - Tax-loss selling ended, capital redeploying

Whale accumulation visible on-chain

Open interest up 2% to $130B - leveraged bulls entering

$217.82M in shorts liquidated in 24 hours

Meme coins rallying (PEPE +32%) - risk-on returning

Fed rate cuts expected by March

Key News Context

Bitcoin's four-year cycle officially broken - first red post-halving year

ETF effect pulled liquidity forward into 2024

BlackRock deposited 1,134 BTC ($101.4M) to Binance - bearish signal

But whales reducing exchange deposits - bullish signal

Zero Bitcoin obituaries in 2025 - first time since Satoshi era

Technical Structure - 4H

Ascending Triangle Pattern:

Rising support trendline (yellow dashed) - higher lows

Horizontal resistance at $90,000-$90,500 (pink zone)

Price compressing toward apex

Typically bullish breakout pattern (70%+)

Key Levels:

Resistance:

$90,000 - $90,500 - Horizontal resistance (pink zone)

$93,000 - $93,200 - Upper target zone

$100,000 - Psychological level

Support:

$88,000 - CME gap zone ($87,800-$88,000)

$86,000 - $86,500 - Major support zone (pink)

$84,000 - $84,500 - Deep support / liquidity pool

Liquidity Analysis

Heavy liquidation clusters below $88,000

More intense bands near $86,000 and $84,500

CME gap at $87,800-$88,000 - likely to be filled

Thin resistance between $91,000-$94,000 if breakout occurs

SCENARIO ANALYSIS

PRIMARY: Liquidity Sweep Then Breakout

Short-term dip to $86,000-$88,000 to sweep liquidity

Fill CME gap at $87,800-$88,000

Bounce off ascending trendline support

Break above $90,500 resistance

Target $93,000-$94,000, then $100,000

BULLISH: Direct Breakout

Trigger: 4H close above $90,500 with volume

Targets: $93,000 → $94,000 → $100,000

BEARISH: Triangle Breakdown

Trigger: Break below $86,000 and ascending trendline

Targets: $84,500 → $83,000 → $80,000

My Assessment

Ascending triangle at resistance with liquidity pools below. Expect short-term dip to sweep $86K-$88K liquidity, fill CME gap, then break ascending pattern and burst higher. Risk-on sentiment returning, whale accumulation, and January Effect support bullish thesis.

Strategy:

Wait for dip to $86,000-$88,000 zone

Long on bounce with stop below $84,500

Target $93,000-$94,000, then $100,000

Or long on confirmed breakout above $90,500

Drop your comments below on what you think is the NEXT MOVE!

Bitcoin: Testing Descending Trendline – Potential Correction📝 Idea Description

Overview: Bitcoin is currently trading under a significant descending trendline on the 12-hour timeframe. The chart illustrates a clear pattern of lower highs, with price action respecting the "Sell-point" and "Buy-point" zones identified through recent price history.

Technical Key Points:

Descending Resistance: The primary black trendline continues to act as a ceiling. Unless we see a high-volume breakout above this line, the bearish structure remains intact.

Key Resistance Levels: Immediate resistance is sitting at $94,645, with the major psychological and technical peak at $126,199.

Projected Path: As indicated by the red projection line, I am anticipating a rejection from the current trendline intersection, potentially leading to a corrective wave down toward the $71,300 – $75,000 support cluster.

Major Support: The horizontal level at $71,333 serves as a critical "target zone" for a potential retracement before any long-term trend reversal can be confirmed.

Conclusion: Patience is key here. I am looking for either a successful retest of the lower support levels or a definitive daily close above the descending trendline to flip my bias to bullish.

XAUUSD– Bearish SetupPrice is pulling back into a high timeframe zone, where previous selling pressure was clearly established.

This area acts as a key decision zone, and the current reaction suggests that sellers are beginning to regain control.

Technical Notes:

Pullback into high timeframe resistance / supply

Bearish reaction confirms rejection from the zone

Market structure remains bearish

No strong bullish continuation after the pullback

Trade Perspective:

Bias: Bearish

Invalidation: Strong close above the high timeframe zone

Target: Previous liquidity / demand area below

Risk–reward is favorable if price respects the zone

This setup highlights the importance of waiting for price to come to value, then reacting based on confirmation — not anticipation.

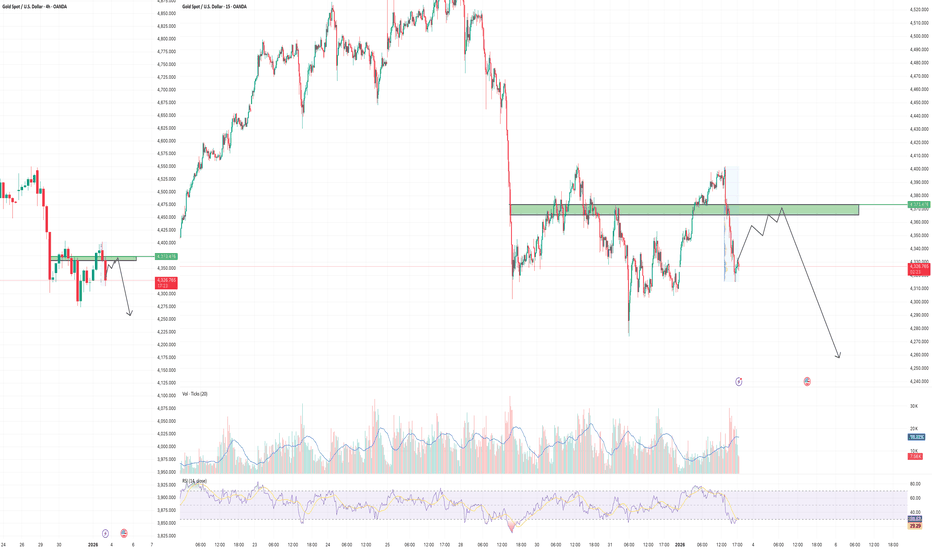

SHORT XAUUSD📉 XAUUSD SHORT SETUP – M15 Chart Summary

✅ 1. Market Context

Timeframe: M15 (15-minute chart), with higher-timeframe (H4) confirmation.

Key Resistance Zone: 4370–4380 – strong supply area with prior multiple rejections.

Market Structure (MS): Bullish structure broken → shifted to bearish.

⚠️ 2. SFP (Swing Failure Pattern) / Trap Setup

Price spiked above previous highs into the resistance zone → then dumped sharply.

Classic liquidity grab (trap long positions) – confirming a bearish reversal.

The drawn arrow path suggests a pullback into the trap zone, then a continuation to the downside.

📊 3. Volume & RSI Analysis

Volume Spike: Huge volume during the breakout, then rejection → confirms trap.

RSI: Divergence – price made a higher high, but RSI failed to follow → bearish signal.

🎯 Trade Plan

Element Details

Entry Zone Around 4365–4375 (during pullback into trap zone)

Stop Loss (SL) Above the trap high – around 4385

Take Profit (TP1) 4300 – nearest support

Take Profit (TP2) 4250–4260 – deeper support zone

Risk:Reward: Potential 3R–4R setup if held to TP2.