BTCUSDT – Key Supply & Demand Zones | 4H Market StructureBitcoin is currently reacting near a previously respected demand zone after a strong impulse move. Price is consolidating below a higher-timeframe resistance while holding above structural support.

This idea highlights key zones of interest, potential reactions, and areas where volatility may increase.

No predictions — price action confirmation is required.

Key Levels:

Resistance zone (HTF)

Demand zone (range base)

Support zone (invalidation area)

Notes:

This is a technical perspective, not financial advice. Always manage risk.

Chart Patterns

GBPCHF Massive Short! SELL!

My dear friends,

My technical analysis for GBPCHFis below:

The market is trading on 1.0741 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0731

Recommended Stop Loss - 1.0747

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY Technical Analysis! BUY!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 90.143

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 90.455

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTC 1Hr Analysis BTCUSDT – 1H Technical Analysis

🧱 Market Structure

Clear Double Bottom formed around 89,300 – 89,600

Strong bullish impulse after the pattern

Price failed to hold above resistance and is now ranging

Recent structure shows HL → LH → indicating consolidation, not reversal yet

👉 Bias: Nutral → Slightly Bullish (range-bound)

🟢 Bullish Scenario

Strong 1H close above 91,900

Targets:

92,600

93,200

Structure flips bullish again

🔴 Bearish Scenario

1H close below 89,500

Targets:

88,700

87,900

Double bottom invalidated

BTCUSD (4H) – Bearish Structure After Distribution, ConsolidatioMarket Structure:

The chart shows a clear bearish shift after the January impulsive rally.

A BOS (Break of Structure) to the upside occurred first, followed by distribution and then a CHoCH (Change of Character) to the downside, confirming loss of bullish control.

Price is now making lower highs and lower lows, respecting a descending trendline, which reinforces bearish bias.

Key Levels & Zones:

Supply / Resistance:

~93,500–94,500 (previous highs & rejection zone)

~92,000–92,500 (mitigated area / prior structure)

Current Price: ~90,574, trading below key structure and trendline.

Demand / Support:

~87,800–88,500 (FVG / demand zone)

Below that, next liquidity rests near ~85,500.

Fair Value Gaps (FVG):

The lower FVG remains unfilled, acting as a bearish magnet if downside continuation occurs.

Upper FVGs have mostly been mitigated, reducing bullish fuel.

Bias & Scenarios:

Primary Bias: Bearish continuation while price remains below ~92,000.

Bearish Scenario:

Consolidation → breakdown → move toward 88,500 FVG, possibly extending to 85,500.

Invalidation / Bullish Shift:

Strong reclaim and close above 92,500–93,000, breaking the descending trendline, could open continuation toward 94,500+.

Trading Insight (ICT / SMC perspective):

Favor sell-on-rallies into premium zones and trendline resistance.

Wait for lower-timeframe CHoCH confirmation for entries.

Avoid longs unless structure flips decisively.

Quantum Leap: $QTUM Continuation Pattern has triggered.The Defiance Quantum ETF (QTUM) is showing a classic bullish continuation pattern after a spectacular 2025. Following a sharp rally, the price has been consolidating in a tight range near its 52-week high of $117.12.

The Technical Setup: We are seeing a clear consolidation phase—likely a cup and handle / or continuation inverse head and shoulders Both have the same price objective—just above the 50-day moving average ($114.36).

This 'pause' in the trend is healthy and suggests that the previous uptrend is ready to resume.

FUNDAMENTAL DRIVER:

2026 is being labeled a potential 'inflection year' for the industry.

IBM is targeting quantum advantage by the end of this year with its 120-qubit Nighthawk processor, while IonQ aims for systems up to 256 qubits.

Diversified Exposure: Unlike betting on a single stock, QTUM holds 84 different companies, spreading risk across hardware, software, and machine learning leaders like Microsoft, Alphabet, and NVIDIA.

Massive Market Growth: Analysts estimate the quantum computing market could grow from $0.8 billion in 2025 to over $1 billion in 2026, with some projections suggesting a nearly $2 trillion value creation potential by 2035.

Sustained Inflows: The ETF has seen net AUM growth of over $2.39 billion in the last year, proving that institutional capital is rotating heavily into this sector.

What's your take? Is the quantum sector ready for another parabolic move?

GBP/JPY Approaching a Critical Breakdown Zone

For GBP/JPY, the bearish outlook is conditional — it will only be valid if a specific trigger occurs. Recently, the pair has been moving within a rising sub‑channel after an extended bullish run. This type of structure often signals exhaustion of the prevailing uptrend, especially when price begins to struggle near the upper boundary.

If the lower boundary of this ascending channel is broken to the downside, it would provide a strong sell signal. More precisely, the key level to watch is 210 A confirmed break below this level would indicate a potential shift in market structure and open the door for a bearish move.

However, if price does not break below 210.04, then there is no valid bearish setup and no trade. The outlook becomes bearish only upon a clean downside break.

If the 210.04 level is broken and price stabilizes below 212.64, the bearish targets become:

• First target: 207.45

• Second target: 203.30

This analysis remains valid exclusively if the 210.04 support level is broken to the downside. Without that break, the pair remains directionless with no bearish expectation.

---

ETH the bull case, as opposed to my recent bearish perspectivesSo I've been sharing some ideas about CRYPTOCAP:BTC and stable coins over the last few days. I suggest you check those out to understand why I'm also sharing this bull case for $ETH.

You can find my BTC analyses here:

About Ethereum Bull case:

I'm not sharing bearish distribution plays only to be blindsided by potential bullish PA. There's definitely something to say for the overal price buildup in this current area. The way the price has been going up and down at first, but is now slowly coiling up as if we are creating a mini-parabolic move.

So on this chart I've pointed out what type of PA I'd like to see in order to expect a more bullish outcome from this current Low Timeframe area. I specifically say Low Timeframe because I want you to understand that this also means the expected outcome is short term. When looking at daily timeframes, you cannot expect an outcome where the new trend lasts months. You'll need the weekly or monthly timeframe for long term views.

Anyway back to the topic: if ETH can reclaim the top of the range and you need an entry: that might be it. If price can sustain above 3.2K, I think there's a good chance we will visit at least 3.8K next.

From a Wyckoff perspective that scenario means we've just witnessed a SOS-phase and are about to see a 1.618 extension next.

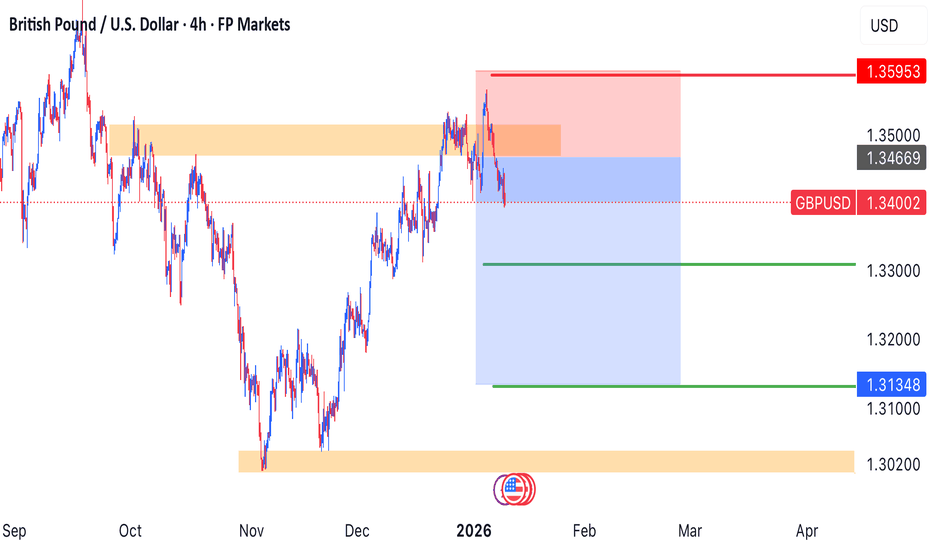

GBP/USD Faces Strong Rejection

, GBP/USD has been reacting to a key resistance level that price rejected multiple times. Eventually, the pair attempted a false breakout above this zone, but quickly closed back below it — a classic fake‑out that reinforces the strength of this resistance area.

Based on this behavior, the outlook for GBP/USD remains bearish as long as price continues to trade below the 1.357 level. Staying under this zone keeps the downside scenario valid, with expectations for the decline to extend toward the first target at 1.330, followed by the second target at 1.31180.

USDCAD | Strategic SELL Opportunity🔻💼 USDCAD | Strategic SELL Opportunity (Multi-Target Setup)

Overview:

USDCAD is displaying bearish continuation behavior, with price reacting near a well-defined supply area, favoring further downside movement.

Sell Zone (Focus Area):

🔴 1.3920 – 1.3915

This zone acts as a strong resistance area where selling pressure is expected to dominate.

Downside Objectives:

🎯 1.3900 – First reaction target

🎯 1.3880 – Momentum extension

🎯 1.3860 – Structure continuation

🎯 1.3840 – Deeper downside move

🚀 1.3820 – Possible stretch target if selling accelerates

Why This Setup Works:

✔ Price reacting from a clear supply zone

✔ Bearish market structure remains intact

✔ Momentum aligns with downside continuation

Trade Management Insight:

Step-by-step profit booking helps secure gains while keeping exposure for extended moves. Capital protection remains the priority.

Execution Guidance:

Wait for price rejection or confirmation within the sell zone before execution. Avoid chasing price.

Final Note:

As long as price respects the resistance area, downside continuation toward lower targets remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you believe in clean levels, disciplined execution, and professional risk control rather than noisy signals, feel free to connect. I work with traders who value clarity, patience, and long-term consistency.

🔒 Trade with structure. Manage risk. Stay consistent.

Gold Maintains a Dominant Bullish Structure on the 4H Chart

On the 4‑hour timeframe, gold continues to trade above a well‑defined ascending trendline. Recently, price bounced cleanly from this level, reinforcing the strength of the ongoing bullish structure. Even during the sharp correction, gold failed to break the previous swing low, confirming that the overall uptrend remains fully intact with no signs of reversal.

A clear bull‑flag pattern also formed, followed by a decisive breakout and continuation to the upside — another strong indication that buyers remain firmly in control. As of now, gold maintains a powerful bullish trajectory, and from a medium‑term perspective, price is still targeting the4694 zone as long as it continues to trade above this key support region.

-

Nifty Under Pressure-FII Exodus,Trump Insanity & Rupee Weakness1. Since May 2025, USDINR gained ~8.7%, while Nifty gained 8.0% (as the Indian rupee is devaluing, market won't get out of this correction)

2. FII outflows hit record in 2025; DII's inflows hold base but mutual fund AUM growth slowed to 18% (Refer to the Out data in the given image.)

3. Trump Factor

4. Short Buildup at 26000

5. Threat of Inflation

What can reverse this...?

1. FTA news

2. Tax relief by the government in the budget.

3. Monetary Easing by Fed & RBI (It will reverse the USD price to some extent)

4. Earning Surge post Q1 of 2026.

Sectors where you should find the opportunity to invest...

1. Metals

2. Banking

EURGBP | Strategic BUY Opportunity (Multi-Target Setup)💼📈 EURGBP | Strategic BUY Opportunity (Multi-Target Setup)

Overview:

EURGBP is positioning for a bullish continuation, supported by stable price behavior and sustained buying interest near a key demand area.

Buy Zone (Focus Area):

🟢 0.8680 – 0.8675

This zone continues to attract buyers, offering a favorable location for long positioning.

Upside Objectives:

🎯 0.8700 – Initial reaction

🎯 0.8720 – Momentum extension

🎯 0.8730 – Structure expansion

🚀 0.8750 – Possible stretch if momentum accelerates

Why This Setup Works:

✔ Clear trend alignment

✔ Strong price acceptance above demand

✔ Controlled momentum with room to expand

Trade Management Insight:

Step-by-step profit booking allows capital protection while keeping exposure for higher targets.

Execution Guidance:

Wait for price confirmation inside the buy zone. Precision matters more than frequency.

Final Note:

As long as price respects the demand area, upside continuation remains the higher-probability scenario.

⸻

✨ Special Note for Serious Traders

If you value clean structure, disciplined risk management, and consistent execution over hype, feel free to connect. I work closely with focused traders who prefer quality over quantity.

🔒 Professional mindset. Controlled risk. Long-term consistency.

XAUUSD Forming Bullish TrendXAUUSD is maintaining a powerful bullish trend that’s extended for months, and the latest price action shows clear continuation behavior after reclaiming an important intermediate demand zone. The way gold has rallied out of that zone — turning former resistance into support and holding above it — tells us that buyers are firmly in control and absorbing selling pressure. This kind of base building at demand after a strong impulse is exactly what continuation setups look like, with room to push toward psychological and structural higher levels.

The chart shows strong structural support around the highlighted zone, which acted as resistance earlier in the year and then flipped to support on the break. Price tested that area and rebounded cleanly, suggesting that institutions are defending that level and that liquidity below is being respected. Higher lows and sustained bullish order flow indicate that the broader trend still favors upside continuation rather than a deeper correction.

From a fundamentals perspective, gold’s macro drivers remain supportive for a sustained rally. Safe-haven demand is still elevated amid ongoing geopolitical and economic uncertainties, and expectations around slower tightening or future rate cuts from major central banks have reduced real yields. This environment makes a non-yielding asset like gold more attractive, reinforcing the bullish narrative.

Overall, the current structure on XAUUSD reflects trend continuation rather than reversal. Buyers are stepping in at strong support and the emerging pattern exhibits low-risk continuation characteristics. As long as price remains above the demand zone and maintains bullish momentum, the path of least resistance is higher, offering a profitable setup for continuation toward new multi-month highs.

NEWTUSDT Forming Falling WedgeNEWTUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 60% to 70% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching NEWTUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in NEWTUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

Sell Xauusd only if!!!looking at Gold, the daily seems to be all encompassed in a single day's sell off,

now price is at a critical moment, a sell off will happen if price refuse to break higher with a full 4h body candle close above the recent high. i anticipate a liquidity sweep followed by a sharp sell off to last weeks low. trade wisely and wait for confirmations.

sell stop: 4477

stop loss: 4485

take profit: 4280

SAHARAUSDT Forming Bullish MomentumSAHARAUSDT is forming a clear bullish momentum pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 140% to 150% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching SAHARAUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in SAHARAUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

One of the Two Trades This WeekAnother week documented

Trades taken: 02

SL: 01 TP: 01 RR: 1:5

I already shared the trade that reached its target.

This one reached the stop.

I’m showing this because both sides matter.

A system is not proven by its winners alone —

it’s proven by how losses fit into the process.

This setup met the same conditions as the winning one.

The idea was valid.

The risk was defined.

The outcome was simply different.

That’s how probability plays out over time.

Dr Copper Back in PlayCopper is back in charge. Prices have pushed into record territory. The market is signalling what the fundamentals have been hinting at for years. This is not a one-quarter story. It is a decade story.

Demand is structural. AI data centres, grid upgrades, EVs, renewables and defence all pull on the same wire. Fuels can be substituted. Copper cannot be replaced at scale without cost, complexity and efficiency losses.

Supply is the constraint. New mines take a long time. Permitting is slow. Politics is messy. Grades are falling. Capital discipline remains the default after years of disappointing returns. Even when projects are approved, execution risk is high and downtime is common. Scrap helps, but it cannot close the gap if demand keeps compounding.

Technical levels look bullish above the mid US$4/lb range.

The bullish case rests on that asymmetry. Demand can surprise to the upside quickly, while supply responds slowly. Pullbacks will happen, but they are more likely to be opportunities than warnings. Copper is the metal of electrification, and an increasingly electric world makes copper exposure less a trade and more a position.

The forecasts provided herein are intended for informational purposes only and should not be construed as guarantees of future performance. This is an example only to enhance a consumer's understanding of the strategy being described above and is not to be taken as Blueberry Markets providing personal advice.

CGPTUSDT UPDATECGPT

UPDATE

CGPT Technical Setup

Pattern: Falling Wedge Pattern

Current Price: $0.0355 USDT

Target Price: $0.10000 USDT

Target % Gain: 181.69%

Technical Analysis: CGPT is breaking out of a falling wedge pattern on the 1D chart, indicating strong bullish potential. Price has recently attempted to break above the descending resistance trendline with increasing volume, suggesting buyers are stepping in. A confirmed breakout above the wedge could validate continuation toward the projected upside target near $0.10000, aligning with the measured move from the pattern.

Time Frame: 1D

Risk Management Tip: Always use proper risk management.

SUIUSDT TECHNICAL ANALYSIS!! BULLRUNNING IS COMING???Hello guys,today i will provide my idea about the SUI.

In my opinion obviously the price making a falling wedge pattern that leads to a big bullish bias if it breaks.But for the moment is inside the channel that allow as to trade safer because according the trendlines that we follow in the 1D timeframe the next days the price will reach 3.30.The technical tools that it helps us is the RSI:3O that made a break out,the 50ema that the price closed above and the elliot wave pattern that possibly the price will make.

This is my opinion and not a finanical advice!

EURUSD – Daily Outlook (Weekend Prep)

1️⃣ Higher Timeframe Location

EURUSD expanded cleanly from discount into premium, completing its upside objective.

That ERL has been delivered.

2️⃣ Premium Failure = Shift in Intent

Inside premium, price:

• Failed to hold highs

• Left inefficient price action

• Started distributing

This tells us buy-side is no longer the draw.

3️⃣ Liquidity Narrative

The next clear objective sits below:

➡️ IRL Sellside Liquidity

4️⃣ Fair Value Gaps (Key Zones)

We have:

• An iFVG above (likely ignored if bearish continuation holds)

• A lower FVG acting as a short-term retracement zone

Expectation:

➡️ Retrace into FVG

➡️ Reject

➡️ Continue lower

5️⃣ Weekly Expectation

➡️ Mitigation into FVG

➡️ Continuation to IRL sellside

➡️ Patience required no chasing entries

📌 Bias: Bearish below premium

📌 Focus: Location > confirmation

📌 Rule: HTF narrative first, LTF execution second

ERL / IRL framework keeps you aligned.

Let the market do the work.

— DAT | Dr Algo Tradin