Chart Patterns

Gold and Silver Breakout After Jobs ShockFriday’s US jobs report acted as a macro trigger

Not noise

A regime signal

Payrolls printed well below expectations

Labor momentum is cooling faster than policy expected

Markets reacted immediately

✓ Gold pushed into the $4,490 zone

✓ Silver surged toward $79

✓ Weekly momentum confirmed across both metals

Why This Matters

Weak employment data accelerates the path toward rate cuts

That shifts the balance

✓ Real yields fall

✓ Dollar pressure increases

✓ Non yielding assets gain relative strength

This environment historically favors precious metals

Why This Move Has Follow Through

✓ The rate hiking cycle is already over

✓ Inflation has stabilized enough to allow easing

✓ Geopolitical risk remains elevated

✓ Central bank gold accumulation continues

This is structural demand meeting cyclical tailwinds

Silver Is Leading

Silver out performance signals risk appetite within the metals complex

✓ Dual demand from industry and capital flows

✓ Elevated gold silver ratio compressing

✓ Smaller market size amplifies momentum

Historically silver leads during expansionary phases of metals bull cycles

Technical Structure

Gold

✓ Holding breakout above recent consolidation

✓ Prior resistance now acting as support

Silver

✓ Clean expansion from multi week base

✓ Strong acceptance above breakout zone

This is trend continuation behavior not exhaustion

Positioning Insight

Pullbacks into prior breakout zones remain constructive

Invalidation only occurs on sustained acceptance back below support

RB Trading

Educational content only

Risk management required

DOGE / USDT — LongDOGE / USDT — Long

— Higher-timeframe convergence has not played out yet. Hourly convergences are present, along with a level retest and a test of the daily MA50.

— Entry: $0.13972 (market buy)

— Stop: $0.135 — 3.44%

— Target: $0.155

— Risk per trade: 1% of total deposit

— Position size: 30% of total deposit

— RR: 1:3.15

MS Pullback Finds Demand as Bullish Trend Remains IntactMS is currently in a pullback phase, where the formation of a bullish candlestick pattern signals emerging demand. The stock continues to structure higher highs and higher lows, while the 20-, 50-day EMAs are aligned to the upside, with price trading above them. This alignment reinforces the presence of strong bullish momentum despite the near-term consolidation.

Morgan Stanley operates as a globa NYSE:MS l financial services firm, providing investment banking, wealth management, and investment management services to corporations, governments, institutions, and individuals. Its operations are organized across Institutional Securities, Wealth Management, and Investment Management segments.

Fundamentally, MS is a wide economic moat company with a market capitalization of approximately $296.1 billion. The firm has delivered consistent growth in both revenue and EPS over the past four quarters. Profitability has remained stable, with ROE above 13%, ROIC above 3%, and net margins exceeding 5% over the last five quarters. The balance sheet is solid, supported by a current ratio above 1x and a debt-to-equity ratio of about 3.9x, reflecting the capital-intensive nature of large financial institutions while remaining within manageable levels.

[SHORT] ZECUSDT - Continuation Trend?Hello traders!

Will ZEC continue to offer opportunities in a downtrend?

If price revisits the Golden Zone and forms a Bearish Engulfing, it could be a valid setup.

Make sure the candle closes within the Golden Zone before entering a SHORT position.

Targets are already set — and be sure to manage your Stop Loss properly.

Happy hunting! 🎯📉

XGN (NASDAQ): Deep Pullback in Tech-Enabled DiagnosticsExagen Inc. has been on a wild ride, and while it had a strong rally last year, the current reality is a significant pullback . From the November highs of around $12.00, we’ve seen a steep 50% correction down to the $6.30 level. For a momentum trader, the trend is broken, but for a value hunter, this deep retracement might be offering a discount on a growing business, if it can find a floor and looking at the price actions and indicators this might be a good chance this is it.

Fundamentally, the story is evolving beyond just standard lab tests. Exagen is increasingly integrating Advanced Machine Learning and Generative AI into their research pipeline to discover new autoimmune biomarkers and streamline clinical trials. That tech-forward approach is backing their solid 37.9% revenue growth , suggesting the business is expanding even if the share price has taken a beating.

Technically, this is a "wait and see" setup. Price is currently still well below both its 50-day and 200-day SMAs, confirming the downtrend is still in control. However, the RSI has cooled dramatically to 39 , sitting in deep oversold territory. The selling volume looks to be thinning out, but I’d need to see price reclaim the $6.65 level to confirm the bleeding has stopped before trying to catch this knife.

After all this downside, its still up 100% for the year and if it turns there is plenty of upside for it to run to.

Could be worth a watch.

============================

ABOUT ME: Global TradingView Moderator (English) and full-time trader. I focus on top-performing stocks worldwide , trading momentum and clean trend continuations after pullbacks. I use a trailing stop customised for each stock to manage risk, lock in gains, and exit when the trend ends. Nothing I post is trading advice. I simply like to highlight interesting companies from around the world that may be worth a closer look. Please give this idea a BOOST if you found it interesting, and FOLLOW ME to discover more standout stocks and businesses from global markets.

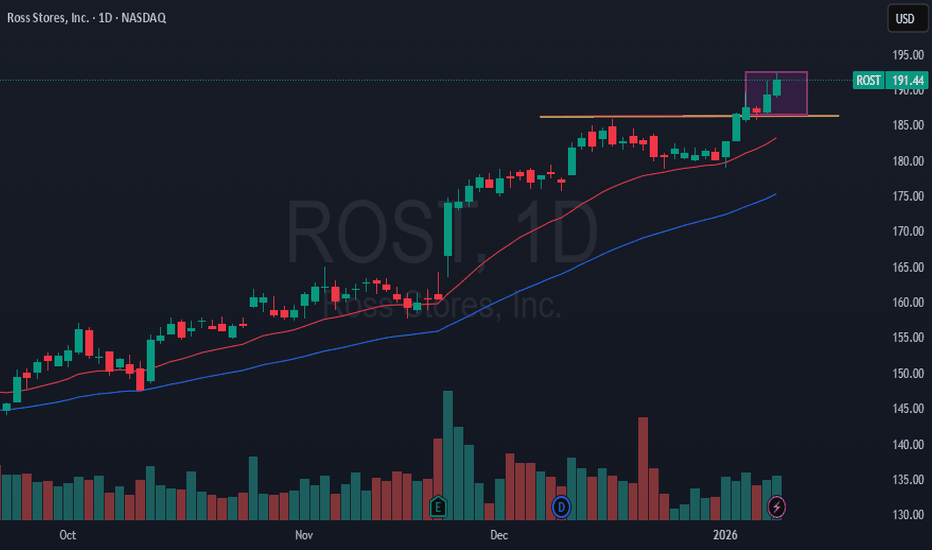

ROST Breaks Higher as Strong Uptrend and Volume Confirm StrengthROST is in a strong ascending trend, supported by increasing volume, signaling rising institutional interest. The stock continues to print higher highs and higher lows, while holding firmly above key moving averages, reinforcing the prevailing uptrend. Price is currently in a breakout phase, trading approximately 3% above the breakout level, which suggests momentum remains intact, though short-term consolidation is possible.

Ross Stores, Inc. operates off-price retail apparel and home accessories stores, offering branded and designer apparel, footwear, accessories, and home fashions through its Ross Dress for Less and dd’s DISCOUNTS banners. Fundamentally, ROST is a wide economic moat company, having delivered three consecutive quarters of revenue growth and two quarters of earnings growth over the last three quarters.

Profitability remains solid, with ROE above 37%, ROIC above 21%, and net margins exceeding 9% over the past five quarters. The balance sheet is also robust, supported by healthy liquidity with a current ratio of 1.5x and prudent leverage reflected in a debt-to-equity ratio of approximately 0.9x, positioning the company well for continued growth. NASDAQ:ROST

AAPL Tests Key Demand Zone After Head-and-Shoulders BreakdownAAPL has completed a head-and-shoulders breakdown and continues to trade below its key moving averages, signaling the emergence of a short-term downtrend. However, the stock is beginning to find demand in the $257–$259 zone, which may act as an important support area. For the prior uptrend to be re-established, price will need to attract sustained buying pressure and reclaim the 50-day moving average. Long-term investors may view this zone as a potential accumulation area, while traders may prefer to wait for clear signs of trend reversal and higher highs.

Fundamentally, AAPL remains a wide economic moat company with consistent revenue and EPS growth over at least the past four quarters. Profitability is strong, highlighted by ROE above 130%, ROIC above 60%, and net margins of approximately 25% over the past five quarters. The balance sheet is solid, supported by adequate liquidity with a quick ratio of 0.86x and a debt-to-equity ratio of about 1.5x, reflecting Apple’s capacity to sustain growth while managing leverage effectively.

Gold (XAU/USD) 4H Chart Observation – January 10, 2026

Current price around 4,509 with a modest gain of +0.29% on the session, showing continued strength in the broader uptrend. Market Observation The chart displays multiple Fair Value Gaps (FVGs): a key bearish/mitigation FVG in the upper zone around 4,620–4,640, acting as potential resistance/overhead supply, and a larger unfilled bullish FVG lower down near 4,380–4,400, which could serve as deeper support if a pullback develops.

Price has recently swept liquidity below prior lows before recovering sharply, now pushing upward with a clean bullish displacement arrow indicating momentum toward the upper FVG area.

Horizontal structure lines highlight consolidation zones around 4,500 (recent pivot/support) and 4,480 (prior swing area), with the overall trend remaining bullish above these levels.

Entry Zone (for study): Around the 4,500 level or minor pullbacks into the recent green candle bodies for potential continuation plays. Hypothetical Target Levels (for analysis): Upside toward 4,540–4,560 (next resistance cluster) or extension into the upper FVG at 4,620+ if momentum sustains. Risk Zone / Invalid Level (example): A clean break and close below 4,480–4,490 would invalidate the current bullish recovery and suggest deeper retracement toward lower FVGs. Gold maintains a strong bullish structure in the medium term, supported by elevated safe-haven demand, but watch for potential exhaustion near overhead FVGs and resistance clusters as momentum has been strong but not unlimited. This is an educational observation, not a trading call.

BTC short term (4H) bearish Jan 10 BTC/USD 4H Binance chart (Jan 2026):

Price ~$90,529, flat (-0.03%).

SuperTrend bearish (sell), price below it.

EMA 15 crossed below 50 (bearish).

SAR buy signal.

Stoch RSI 71 (nearing overbought).

MACD bearish, histogram negative and widening.

Overall: short-term bearish momentum, consolidation near $90k support/resistance zone.

XAUUSD Update New all-time high in January ?After touching the support area at 4270, gold has resumed its upward movement and is currently approaching its previous all-time high, at 4550.

Looking at the current price action, we can see that the price is attempting to break through the previous all-time high.

Currently, key levels are at 4450 and 4480.

We'll see if the price breaks the all-time high next week.

Have a blessing week ahead !

AARTIPHARM CMP 761Price is forming a bullish symmetric triangle after a strong selloff.

Lower trendline shows higher lows (₹670 → ₹705 → ₹730 → ₹745)

Upper trendline shows lower highs (₹800 → ₹780 → ₹770)

This indicates rising demand + falling supply, which creates strong price compression.

Price is now trading near the apex.

A daily close above ₹775–780 with volume will confirm a breakout.

Triangle height ≈ ₹130

Measured move projects ₹840–900 on breakout.

Risk-Reward

Entry ~ ₹780

SL ~ ₹745

Risk ~ ₹35

Reward to ₹860 = ₹80

Reward to ₹900 = ₹120

Watching for expansion from this structure..Do your research before you invest.

ETERNAL is compressing under a major supply zone.ETERNAL (Zomato) Daily Chart

Validating this strictly against my breakout framework:

Flat resistance: ₹286–288

Touched 4+ times → strong supply zone

Rising trendline:

₹272 → ₹276 → ₹280 → ₹282 → higher lows

Buyers stepping in earlier each time

Price is compressing into resistance.

Apex not reached yet. Pressure building.

This is a textbook ascending triangle.

No breakout yet.

Today’s high was ₹292 but close is still below resistance.

Real confirmation happens only on a daily close above ₹291 with volume.

Triangle height ≈ ₹16

Breakout projection → ₹304+

Watching this for a clean expansion move.

#ETERNAL #Zomato #NSE #TechnicalAnalysis #Breakout

This is for educational purpose. Do your research before you invest.

$SSV looks set for another move !!TSXV:SSV looks set for another move 🚀

Price is pulling back into a major support zone around $3.80–$3.90, which previously acted as resistance and now lines up with Fib 0.5, strong horizontal demand, and prior consolidation.

This dip could offer a solid buy-the-dip opportunity if support holds.

A clean bounce from this area opens the door for a push back toward $4.70+, and potentially new highs if momentum returns.

Patience here, support reaction is key 👀

#SSV

Long GOLD (GC, GLD, etc)I am planning to go to a long GOLD position again. Maybe needs some consolidation, but the eventual target will be 4800-5000 around mid-end 2026. I will choose otm GLD leap calls.

There is an alternative scenario that the price will drop to ~3850 first to form a wedge pattern. If so, I will double down on my leap calls.

SOL - Descending Wedge at FVG Support | Inverse H&S Forming?

Hey TradingView community! 👋

Solana is setting up for something big. Let me break down what I'm seeing on the 45-minute chart.

The Setup

SOLUSD is trading at $135.69 inside a descending wedge pattern, currently sitting right on two stacked FVG zones around $135-138. This is a classic compression pattern - price is coiling tighter and tighter before an explosive move.

The key question: breakout or breakdown?

Why I'm Watching This Closely

Descending wedge is typically a BULLISH reversal pattern

Price sitting on FVG support zones - buyers should defend here

Potential inverse Head & Shoulders forming on higher timeframes

Whale just placed $8.09M buy order between $133.88-$135 - smart money loading

Morgan Stanley filed for Solana ETF - institutional adoption incoming

$1.30M net outflows from exchanges = accumulation happening

The News is Bullish

Major institutional moves this week:

Morgan Stanley filed for Solana Trust ETF - could reach 19M+ clients

Whale deposited $8.09M with buy orders at $133-135 range

Forward Industry holding nearly $1B in SOL - institutional liquidity growing

JPMorgan expanding JPM Coin to Canton Network - Wall Street going all-in on crypto

Bank of America cleared to recommend Bitcoin ETFs - crypto normalization

Analysts say inverse H&S pattern forming - breakout target $168-171

Key Levels I'm Watching

Resistance:

$140 - Immediate resistance / wedge upper boundary

$145-146 - MAJOR resistance (tested 6+ times since November)

$152 - Breakout confirmation level

$168-171 - Bullish target if pattern confirms

Support:

$135-138 - FVG zones (current test)

$133 - Whale buy zone / critical support

$128-130 - Lower FVG / November lows

$122 - Lower wedge support

My Game Plan

Bullish scenario: If SOL holds the $133-135 FVG zone and breaks above $145-146 with volume, we could see a rapid move to $152, then $168-171. The descending wedge is a bullish pattern, and the whale accumulation at these levels is a strong signal. Morgan Stanley ETF filing adds fuel to the fire.

Bearish scenario: If we lose $133 support, next stop is $128-130 (lower FVG). Break below $122 would invalidate the bullish structure and open the door to retest November lows around $120.

The Bottom Line

I'm bullish on this setup. Descending wedges typically break UP, whales are loading at current levels, and the institutional news flow is incredible (Morgan Stanley ETF!). The $145-146 level is the key - it's been rejected 6+ times. A clean break above that = liftoff.

Watch the FVG zones for support. If $133-135 holds, this could be the bottom before the next leg up.

What do you think? Is SOL ready to break out? Drop your thoughts below! 👇

Breaking news this weekend! Gold analysis for Monday.The fundamentals for gold remain bullish in the long term. The geopolitical situation between the US and Venezuela escalated significantly over the weekend. Buying by major central banks, stockpiling by miners, and further easing by the Federal Reserve will all drive the upward momentum. In short, gold's dip is for a better jump later.

On the one hand, the significant gains accumulated earlier may prompt some traders to take profits or rebalance their investment portfolios; on the other hand, the CME Group, one of the world's largest commodity trading platforms, has increased margin requirements for gold, silver, and other metal futures.

This means that traders need to pay more margin when establishing positions. While this measure is intended to prevent potential default risks during contract delivery, it will also, to some extent, curb speculative buying in the market. In addition, geopolitical risks have always been a major driver of price increases for traditional safe-haven assets like gold. During periods of increased market uncertainty, gold, with its excellent store-of-value properties, often becomes a "safe haven" for capital.

I believe the two key drivers of gold's performance in 2025 are: a highly tense geopolitical and geoeconomic environment, and a weaker dollar coupled with marginally lower interest rates.

The future price of gold will depend more on the interaction of these two macroeconomic trends.

The current gold price reflects, to some extent, the market's expectations of the macroeconomic consensus. However, in reality, the economy rarely follows the "consensus script," meaning that gold prices may still deviate significantly in the future – if a mild US economic downturn prompts the Federal Reserve to further cut interest rates and the dollar continues to weaken, gold will be supported; if the economic and policy environment improves significantly, the risk premium on gold may be reversed, with a potential retracement of 5% to 20%. Some also caution that the "rate of increase is unsustainable" after gold prices doubled in two years. Commerzbank expects gold prices to rise to around $4,400 in 2026; some independent analysts, while bullish on gold's continued rise, also believe that it's not a bad thing for the market to start discussing a "bubble"—a bubble doesn't mean an immediate burst, but rather a reminder to investors that volatility will increase. Overall, the strong surge in gold prices in 2025 is changing its asset characteristics: gold is no longer just a single safe-haven asset, but is becoming an important "strategic allocation asset" for global capital to hedge against geopolitical risks, policy uncertainties, and fluctuations in the dollar system.

Retail investor sentiment is extremely optimistic, and Wall Street investment banks generally maintain a bullish outlook. The core logic lies in the continued high intensity of central bank gold purchases, the expectation of declining real interest rates that has not been completely reversed, and the persistence of macroeconomic uncertainties. Although the gold price trend in 2026 is unlikely to replicate the "accelerated linear trend" of 2025, under the support of multiple forces, the "probability of reaching new highs" is still widely considered greater. Market expectations for gold to reach $5,000 are gradually evolving from a minority view to a broader consensus.

Gold price trend analysis for next Monday:

This week, the market was affected by the diversion of funds due to the surge in Chinese concept stocks and concerns about tightening global liquidity, causing gold prices to fall again after touching the 4402 level. Although the weekly chart barely held the key moving average support, and the daily chart showed resilience in resisting a second test of the 4270 level, the overall upward momentum was severely insufficient. Currently, the market is in a wide-range oscillating pattern with "resistance above and support below," waiting for new volume signals to break the balance.

From the 4-hour chart, gold prices fluctuated lower again on Friday. Although the decline was limited, if it effectively breaks below the key support of 4300, it may open up further downside potential. Currently, the short-term moving average group has turned downwards, forming resistance, and the MACD indicator is also running below the 0 axis, indicating increased bearish momentum. If the price weakens first, attention should be paid to the support strength in the 4305-4300 area. A technical rebound may occur on the first touch. This week, the price tested 4300 twice and rebounded to 4400 twice, which is a structural adjustment after a sharp decline. On Friday, I emphasized that this wave of gold prices had formed a head and shoulders bottom pattern at the bottom. Once it stabilizes above 4400, the bulls will surge again, targeting 4500 and 4550, and in the overall trend, we shouldn't try to predict the top. However, if it doesn't stabilize above 4400, it will be considered low-level consolidation after a significant drop.

Therefore, the outlook for next week is likely to be similar. Currently, the closing price is around 4330. Will next week's opening follow the opposite trend of this week's opening? Given the safe-haven news over the weekend, I believe there's a high probability of a direct upward movement. In summary, for short-term trading next Monday, I recommend focusing on long positions, with short positions as a secondary strategy. The key resistance level to watch in the short term is 4400-4405, and the key support level is 4270-4300. Everyone should keep up with the pace.

Ethereum Stuck Below Trendline — Bearish Pressure Price is continuing to respect the descending trendline and trading below the EMA, confirming a sustained bearish market structure. Recent bullish attempts have failed near the trendline, showing clear seller defense and lack of upside follow-through.

As long as price remains capped below 3,140–3,160, any bounce is likely corrective and vulnerable to renewed selling pressure.

A bearish continuation below 3,100 keeps downside targets active toward 3,050 → 3,000, with a deeper liquidity objective near 2,970–2,960. Only a decisive breakout and close above the descending trendline would invalidate the bearish scenario and signal a potential trend shift.

Ethereum Breaks Trendline — Bears Take Control Below Key SupportPrice has confirmed a bearish break of the rising structure, failing to hold above the EMA and respecting the descending trendline as new resistance. Recent pullbacks into the trendline are being sold, signaling strong seller control.

As long as price remains below 3,150–3,170, any bounce is likely corrective rather than a reversal. A brief push toward the trendline may occur but is expected to attract fresh selling pressure.

Sustained weakness below 3,100 exposes downside liquidity toward 3,060, with a deeper target near 3,000–2,980. Only a decisive breakout and close above 3,240 would invalidate the bearish scenario and signal a shift back to bullish momentum.