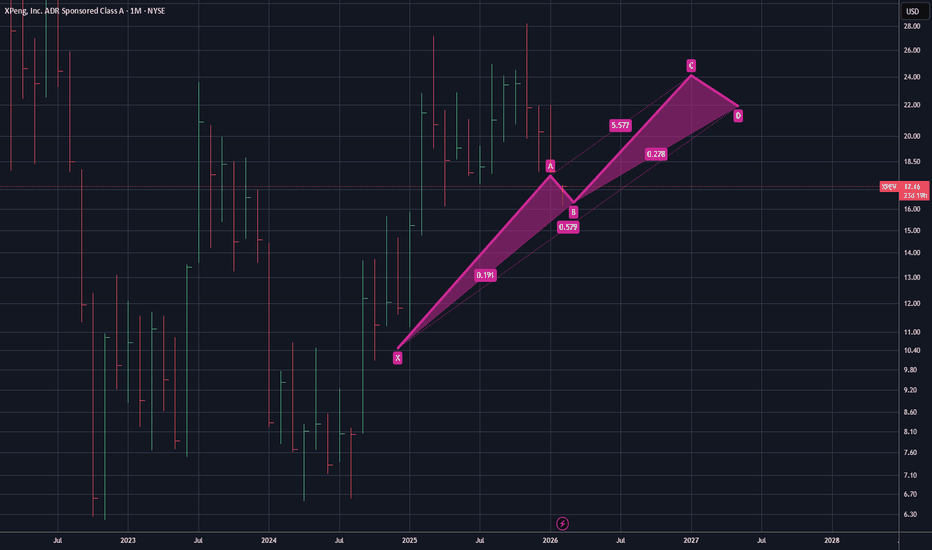

$XPEV - Next Leg Up? $24 Target by 2027XPEV's correlation seems to be bottoming out the bearish leg. I believe that with enough bullish support, the next wave up seems to be trending to $24 by the year 2027. If that is true, that sets up a decent step-in for a long. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Chartpatternstrading

Pattern Recognition: When Human Eyes Beat AI (And Vice Versa)

Humans are extremely good at:

Seeing context – earnings, news, macro backdrop

Interpreting imperfect structures – patterns that are "close enough"

Integrating non‑price information – sentiment, positioning, narrative

Your brain doesn't just see candles. It sees:

"This breakout is happening after a long base in a strong sector"

"This double top is forming into bad macro data"

That's powerful — but it's also where bias sneaks in.

The Machine's Pattern Edge

AI and algorithms are extremely good at:

Applying the same rules to every chart, every time

Scanning thousands of symbols and timeframes

Measuring pattern statistics across huge samples

Where we say "this looks like a flag", AI says:

Length: X bars

Pullback depth: Y%

Breakout follow‑through: average Z%

That objectivity is exactly what humans lose when they care about a trade.

When Humans Win, When AI Wins

Context‑Heavy Patterns (breakouts into news, sector flow, macro themes)

Human advantage: you can weigh "should this pattern even matter here?"

Simple, Repetitive Structures (candlestick patterns, basic ranges)

AI advantage: it will find and log them the same way at scale.

Fuzzy, Subjective Lines (trendlines, channels)

Best as collaboration: AI can test many definitions, you decide which make sense.

The future isn't about proving humans "better" or AI "better". It's about giving each the jobs they're built for.

A Practical Human + AI Workflow

Let AI Scan

Use screeners or pattern tools to surface potential flags, wedges, ranges, reversals.

Apply Human Context

Filter based on news, sector, macro, and your playbook.

Use AI Again for Confirmation

Check volume, volatility, and historical stats for similar patterns.

Execute Systematically

Turn your pattern rules into clear conditions; automate where possible.

In the AI Era, Know Your Role

Your edge as a human isn't out‑calculating the machine. It's:

Defining what "quality" patterns look like in your framework

Deciding which AI signals to care about and which to ignore

Bringing discipline and risk management to whatever patterns you trade

Let AI do the heavy lifting on scanning and counting. Save your limited attention for the handful of setups that truly deserve it.

Still Long for $UPRO, Short Trendline to BreakAMEX:UPRO has been heavily shortened recently but still has had a significant bull run. Right now, both with the MACD and the Multi-Factor Long Bias tool, a setup for continued bullish correlation is supported. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Apple - $265 Target, Shorts Catching Up, Losing the AI WarThe shorts seem to be catching up on the indicators with the bullish trendline breaking in support. Apple is also losing the AI wars, at least figuratively speaking (to some), and at the same time people are uncertain about earnings in 43 days. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Short Signal for $NFLX - $85 TargetNetflix is a company that has not just have had tons of controversy recently but are also in the middle of streaming wars in which people are unconfident if they can still maintain market share. After the expected Warner acquisition, the company would still be much lower on cash. Short signals are increasing and today the trendline has broken. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Meta - $450 Target - The Next Big Short?Even though Meta is holding up in the LLM race with Llama, Meta has had a massive failure (over $70B+) on the failed Metaverse project in which is their new namesake along with now the Australian social media ban for people 16 and younger, and people realizing the intensity of the data Meta collects on people. The stronghold Meta has on social media is coming to a pause, and at the same time questions are arising on whether or not they can differentiate themselves enough having a hard time tackling growth beyond Facebook's user stagnation point and advertising. That said, short volume is increasing, and the recent bull run could be due for a correction. The MACD trading indicators show two recent pushes over short volume, and at the same time, this seems to be the top of the bullish trendline. A retracement back to $450 making this a big short is possible. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$UPRO Continued Long $150 by 2027?The AMEX:UPRO index is looking quite healthy and seems to be continuing its positive run along with positive cumulative volume. Overall, with these current patterns $150 by EOY 2026 seems possible. As always, none of this is investment or financial advice. Please do your own due diligence and research.

GOLD ANALYSIS What’s Moving the Market Today? December 03, 2025OANDA:XAUUSD GOLD ANALYSIS What’s Moving the Market Today? (December 03, 2025)

Welcome back to Trade with DECRYPTERS, where we decode smart-money footprints into clean, actionable buy & sell zones.

Keep it simple. Trust the levels. Follow the plan.

📰 Market Overview

Gold continues its steady climb after reacting perfectly from Smart Money Buy Orders earlier this week. With price now rotating toward upper liquidity pockets, bulls remain firmly in control despite mild USD stabilization.

The U.S. Dollar Index has cooled after its post-election volatility, but ongoing geopolitical pressure and aggressive central-bank accumulation continue to support gold’s macro-bullish structure.

With key U.S. data (ADP, ISM Services, PCE) lined up this week and the FOMC approaching on December 9–10, markets are moving cautiously. Gold remains well-positioned inside a clean premium–discount rotation, respecting SMC structure consistently.

🔍 Key Fundamentals Driving Today’s Move

📈 88% probability of a December rate cut → lower yield competition boosts gold

💵 USD stabilizing but not strengthening → limits downside pressure

🌍 Global geopolitical tensions remain elevated → strong safe-haven premium

🏦 Central banks remain net buyers (634t YTD) → long-term structural demand

📊 Core PCE at 2.9% → keeps the Fed dovish-leaning but cautious

Gold’s strength continues to be driven by a clean mix of macro uncertainty, structural demand, and institutional order-flow behavior.

📆 Key Events to Watch

🔸 ADP Employment Data — Today at 01:15 UK Time

Weak ADP → bullish continuation toward sell zones

Strong ADP → liquidity sweep downward into buy areas

🔸 ISM Services PMI — Later Today

Contraction → strengthens rate-cut expectations

Expansion → stronger USD → intraday dip

🔸 PCE Inflation — December 5

The Fed’s preferred gauge

Soft PCE → pushes gold toward 4300+

Hot PCE → deeper retracement

🔸 FOMC Decision — December 9–10

Market expects 25 bp cut.

Hawkish → tests deeper discount zones

Dovish → breaks into new highs

🔸 Geopolitical Landscape

Any escalation = instant safe-haven spike

Calm USD strength = controlled pullback

🟩 GOLD TECHNICAL LEVELS

Gold continues to respect the rising structure, reacting precisely from discount zones and moving toward your institutional premium blocks. The impulsive bullish leg now positions price directly beneath the next major Smart Money Sell Area.

🟩 📌 SMART MONEY BUY ORDERS: 4147 – 4167

This is your primary institutional demand block, holding nearly $19 million in buy-side liquidity.

Expect:

✔️ First-tap reactions

✔️ Accumulation behavior

✔️ Discount long setups inside the broader bullish channel

A clean breakdown below 4147 opens liquidity toward 4108 → 4075.

🔺 📌 SMART MONEY SELL AREA: 4264 – 4284

This remains your high-probability distribution block, stacked with $29 million in sell-side orders.

Expect:

✔️ Manipulation wicks into premium

✔️ Stop-run behavior

✔️ Swing reversal setups

A break & hold above 4284 = continuation toward 4310 → 4325.

📌 Conclusion

Gold continues to rotate smoothly between institutional premium and discount zones, maintaining a strong bullish structure as long as 4147–4167 holds firm. With ADP data set to inject volatility, expect liquidity-driven movements rather than trend shifts. Stay patient, let the levels do the work, and execute only where smart money is active.

🙌 Support the Analysis

If this breakdown adds clarity to your trading, support with a like & comment it motivates deeper daily analysis.

Share your charts. Engage with the community.

Let’s grow together.

Best Regards,

M. MOIZ KHATTAK | Founder — TRADE WITH DECRYPTERS

$AMD Short Target - $200 - About to Break Support Trend?AMD Is about to break support and take a nose-dive. The next trendline, even with positive volume seems to be mostly sells. $200 as a short-term target before retracement seems reasonable. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$USDJPY Short Position - Target 152 YenUSDJPY seems to be breaking support for positive volume. If it breaks support, it might retrace back down to at least 152 yen. The bollinger bands and the last 24hr volume is telling. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Citigroup Short - $88 TargetThe support curve seems to be breaking again for Citigroup in similar pattern as it has had for nearly 14 years. If the curve doesn't allow for a continued uptrend, in which volume seems to be low, then it could end up retracing back down to $88. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$RDDT Long Setup - $280 Target During Q1 2026Reddit is one of those gifts that keep on giving since the IPO. Right now, support seems strong and it doesn't seem to be going away, at least from some current indicators. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$TSLA: $350 Target - $380 Short (Support Breaking)The support for Tesla seems to be breaking, and the oscillators are due for a negative downtrend along with the RSI close being too high. The analysts at the same time are neutral and this has been given a buy over a strong buy target with catalysts like lower earnings in some countries and a lack of competitive advantage over BYD for actual output of vehicles produced and sold. Management is also unsure of Musk who has a huge multitrillion dollar pay package incentive which will make the company even lower on cash. Therefore, the next target for a NASDAQ:TSLA short in my opinion, is $380 or less within Q1 of 2026. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$5+ Target for Butterfly NetworksButterfly Networks is one of those stocks that short sellers like to get their hands on, as with many microcap stocks as well. That said, the product seems well developed, they have a large IP portfolio and could potentially be due for a new support line soon. I think $5 before Q2 2026 could be feasible. As always, none of this is investment or financial advice. Please do your own due diligence and research.

All Red - $NNOX Long - But Nanox's Biggest Issue Right NowThe problem with Nanox, which is also likely why they recently had a stock sale, is likely the need of cash for further distribution. They are in the red and still have long ways to go. That said, when the market dips, Nanox seriously dips. Beyond just the recent France deal, a catalyst is needed to further push Nanox further. That said, I believe we could be long overdue for a bull run. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Gold Continued Support Feasible - Next Target for $4500? I believe if the oscillators play out, we can have another trendline support, even with aroon down, it could be quite minimal and a retracement for $4500 support per oz is possible. Gold as an asset and commodity seems to be getting scarcer and the demand for Gold including even in electronics is something I expect will increase. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$NVDA - $140 Target - Short Position - AI Bubble About to BurstIn my opinion, Nvidia does not have much to continue the next needed support for a pro-longed bull run, at least in terms of sentiment. The AI bubble has gone on for too long and the actual multiples of valuations in comparison to revenue and profit generations do not seem to have strong support when considering traditional investing strategies. Also, the next wave seems getting closer and closer to a red trend. Retracement potential is possible after hitting $140, but Nvidia needs to do far more benefit for the public good and have a differentiation that doesn't rely on trends such as crypto mining and the boost of LLMs. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$ETH, $4.7K+ Before End of 2027? Retracement Potential?Ethereum is one of those that I am neutral on but invested for long term holds. They have a monopoly on tokenization, yet at the same time, the whole purpose of Ethereum has changed dramatically.

The PoS transition when Ethereum Classic was the original Ethereum and Ethereum PoW is currently the "decentralized newer Ethereum" have left various technologist confused along with the removal of the Ropsten testnet. This has shown Ethereum to be much more centralized than promised and it is entering muddy waters in that sense.

Likewise, can Ethereum differentiate itself from Namecoin, Peercoin and these original PoS forks who got outpaced? Ethereum's technical transition also emphasizes the need for subnets, rollups and speed. Currently they are competing against Solana as well as other players including Z-Cash or minimal small players like Celo and Cardano. The technical differentiation needs to be expanded however in order to allow for scalability. Likewise, Ethereum is still prime in terms of PoS and name-brand but may not be prime in terms of technology.

That said, the long-term potential is still there and Ethereum has a hard to replace developer ecosystem. The patterns when considering fib retracement along with the past cipher and PnL setup showcase the potential of a $4.7K price point by October 2027. As always, none of this is investment or financial advice. Please do your own due diligence and research.

$BTC, $77.5K Target Before Retracement/Bull Run, LONG HoldBitcoin has the potential to drop as much as up to $77.5K as shown by the PnL and patterns setup. That said, holding and getting the dip or doing a short bet depends on your risk tolerance. As currently, I am very bullish on Bitcoin's long-term setup ignoring the in-between noise. As always, none of this is investment or financial advice. Please do your own due diligence and research.

Bitcoin - $250K Target by 2030 is Feasible - Why I'm Still LongSince I established this account on Tradingview in 2017, I have consistently shared positive sentiment regarding Bitcoin. Also, I have been monitoring crypto and blockchain technology since 2011. My optimism about Bitcoin's potential has been longstanding, particularly with the arrival of RSK, Bitcoin subnets, Ivy, the Lightning Network, and Bitcoin Oracles. Furthermore, Bitcoin has gained significant acceptance among institutional investors, as evidenced by the increasing prevalence of Bitcoin ETFs, Index Funds, and BTC being included in more retirement portfolios or mutual funds. Although I have maintained a bullish stance and invested in crypto for an extended period, the technology still faces considerable challenges in terms of scalability and achieving mass adoption. Additionally, I have previously suggested a new Proof of Work (PoW) mechanism for BTC mining; however, HashCash appears to be the preferred choice among Bitcoin Maximalists and the BTC Dev Team. A price of $250K by 2030 is a realistic possibility. As always, none of this is investment or financial advice. Please do your own due diligence and research.