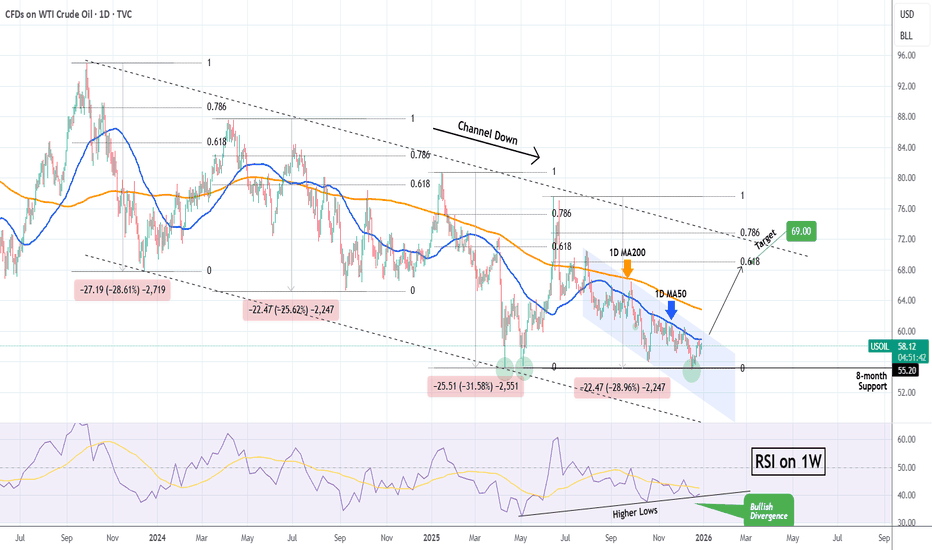

WTI OIL closing its first green month after 5 straight red.One month ago (December 30 2025, see chart below), we gave a strong long-term buy signal on WTI Oil (USOIL), as it hit its 8-month Support on a 1W RSI Bullish Divergence:

The price reacted very positively and is about to close its first green 1M candle after 5 straight red. This is why we bring you this time the same chart but on the 1M time-frame. At the same time pay close attention to the 1M MA200 (orange trend-line), which delivered the last strong rejection for the market, which last time closed a month above it exactly a year ago (Jan 2025).

This is why we stay firm on our $69.00 Target, which isn't only on the 0.618 Fibonacci retracement level (where all 3 previous Bullish Legs of the 2-year Channel Down retraced) but also below the long-term Resistance posed by the 1M MA200.

As a side-note, to get an idea of how bearish the market is on the long-term (and why a sell at the top of the Channel Down is later suggested), Oil hasn't closed a month above its 1M MA50 (blue trend-line) since July 2024.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Crude Oil Futures WTI (CL1!)

WTI OIL initiating a +10% rally.WTI Oil (USOIL) has been trading within a 1-month Channel Up, whose last Bullish Leg hit and got rejected exactly on the 1D MA200 (red trend-line). The resulting correction/ Bearish Leg found Support on the 4H MA50 (blue trend-line) and given that the 4H MA200 (orange trend-line) was kept intact, we expect that to initiate the new Bullish Leg.

The 1D RSI being above its MA (yellow trend-line) supports further upside and given that the previous Bullish Leg rose by +11.85%, we expect a similar development for the current one, targeting $65.50.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

US OIL: Bullish Break Out Potential?In this Weekly Market Forecast, we will analyze the US OIL for the week of Jan. 19-24th.

US Crude Oil has been sideways for over 3 years. Accumulating. April '25 there was a significant

sweep of sell side liquidity, followed by an impulsive move to the high of the consolidation. Manipulation. A correction to the previous move followed to the .705 fib (Optimal Trade Entry).

If we get a significant move higher from current levels, this could be the start of the 3rd phase of price action.... distribution.

AMD ..... is what I am looking for.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

US OIL: Bullish Break Out Potential?US Crude Oil has been sideways for over 3 years. Accumulating. April '25 there was a significant sweep of sell side liquidity, followed by an impulsive move to the high of the consolidation. Manipulation. A correction to the previous move followed to the .705 fib (Optimal Trade Entry).

If we get a significant move higher from current levels, this could be the start of the 3rd phase of price action.... distribution.

AMD ..... is what I am looking for.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

WTI OIL Relief pull-back expected on the short-term.WTI Crude Oil (USOIL) is trading within a short-term Channel Up on the 1H time-frame, being supported by the 1H MA50 (blue trend-line).

With the price approaching the 1D MA200 (red trend-line) and the 1H RSI hitting its Lower Highs trend-line, it is possible to see a technical pull-back in the form of a Bearish Leg for this Channel Up.

All Bearish Legs within this pattern declined by around the same level, with the lowest being -1.81%. Assuming a max extension on the 1D MA200, we can calculate a minimum -1.81% decline, targeting $61.20.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI OIL This is what separates a drop to $49 from a rally to $68WTI Crude Oil (USOIL) remains within its 2-year Channel Down since the September 25 2023 High, as well within a 'smaller' one (blue) since late July 2025.

What separates right now the market from a continuation of the latter's Channel Down downtrend and a rebound towards the long ones 1W MA100 (green trend-line), is the 8-month Support level of 55.20.

As you can see, this has recently held (week of December 15 2025) for the 3rd time since April 2025. However the 1D MA50 (red trend-line) keeps rejecting any 1W candle, maintaining the bearish trend of the (blue) Channel Down.

If it breaks and the market closes 2 straight 1W candles above it (1D MA50), then we expect a 2-3 month rally to test the 1W MA100 and the 0.618 Fibonacci level (like all previous Bullish Legs within the 2-year Channel Down did) at $68.00.

If on the other hand the market closes a 1W candle below the 8-month Support (55.20), we expect the continuation of the bearish trend until the 1W RSI touches its long-term Support Zone again. An early estimated Target on his is $49.00 but best to take profit when the 1W RSI this the Support Zone regardless of the price, as it has marked the last two major market bottoms (Lower Lows).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Crude to $75 Profit TargetYou all know I'm a 100% Chart driven trader.

But of course I also have my fundamental thoughts.

Here is my layman’s fundamental thesis:

I do not believe that Venezuelan oil will flood global markets, just because they grabed Maduro. On the contrary, the opposite is more likely. Venezuela’s production is dominated by heavy and extra-heavy crude, which is costly to extract and difficult to refine. As a result, an oversupplied market is unlikely from this point of view.

But with a U.S. military invasion of Iran could be very likely to drive oil prices higher, potentially sharply so. The effect would stem from supply risk, transportation chokepoints, and market psychology I think. Even if physical supply disruptions were initially limited. My experience is, that short-term crazy price moves are often driven by psychological factors.

So, in short:

1. Risk to the Strait of Hormuz (Primary Factor)

2. Potential loss or Threat of Iranian Oil Supply

3. Spillover Risk to Other Producers

4. Speculation and Financial Market Reaction

5. OPEC and Strategic Reserves Probably Very Limited

Sure, the magnitude would depend on duration, scope, and whether shipping through Hormuz remains uninterrupted, but upward price pressure would be immediate.

Timing is always the most difficult part. That’s why I would look at a trade with a horizon of at least three months, or longer (likely using ITM LEAP options).

The chart needs to confirm my thesis.

First, I want to see a break of the descending pressure line (red).

Next, the CIB line must be broken.

Finally, a sign of stabilization above the CIB line would serve as my entry signal.

That’s it. My stalker hat is on.

WTI OIL Strong case for a 2-month rally.WTI Oil (USOIL) has been trading within a Channel Down since the September 28 2023 High. Since then, it as had four Bearish Legs (including the current one), which declined on a range of -25.62% to -31.58%. All subsequent rebounds (Bullish Legs) that followed, hit at least their 0.681 Fibonacci retracement levels.

Given that the price rebounded 2 weeks ago on the 8-month Support (55.20) and the 1W RSI has been on Higher Lows (i.e. Bullish Divergence) since May, we may see a new Bullish Leg emerging now.

The one condition that will confirm that will be the price breaking above the blue Channel Down. If that takes place, we will turn bullish for the next two months, targeting $69.00 (Fib 0.618).

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CRUDE OIL (CL) PREDICTIONCRUDE OIL (CL) PREDICTION

📊 Market Sentiment

Crude oil prices had been trending lower following signs of de-escalation in the Israel–Palestine conflict, easing tensions with Iran, and emerging peace signals from the Russia–Ukraine front.

However, recent statements from Trump and the possibility of a U.S. military action against Venezuela have shifted sentiment back to the upside.

Venezuela holds approximately 18% of the world’s proven oil reserves and ranks as the 12th largest oil producer globally. Any potential conflict involving the U.S. could significantly disrupt supply expectations, acting as a strong bullish catalyst for oil prices.

📈 Technical Analysis

CL swept monthly liquidity around the $55 level and has since shifted into a bullish structure on the daily timeframe.

In my view, this move indicates that price has gathered sufficient energy for either continuation higher or a controlled retracement before the next bullish leg.

📌 Prediction – Game Plan

I entered a long position at 56.24$.

🎯 TP1: 57.70$

I will take partial profits here and move the remaining position to breakeven.

🎯 TP2: 58.90$

🛑 Stop Loss: Daily close below 55.40$

💬 For deeper sentiment and strategy insights, subscribe to my Substack free access available.

This analysis is for educational purposes only and does not constitute financial advice. Always conduct your own research before trading or investing.

WTI OIL on its 1D MA50 again. Sell signal.Last week (December 17, see chart below) we gave a strong Buy Signal on WTI Crude Oil (USOIL) after it hit and rebounded on the 8-month Support.

The resulting rally easily hit our $58.50 Target and today the price tests the 1D MA50 (blue trend-line) for the first time since the previous Lower High of the 5-month Channel Down. This is an automatic technical Sell Signal as at the same time the 1D RSI is reversing near its 4-month Resistance Zone.

Our short-term Target is again the $55.20 Support.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI OIL Time to buy the 8-month Support.Last week (December 9, see chart below), we gave a strong Sell Signal on WTI Oil (USOIL) as the 1-month Channel Down topped and started its new Bearish Leg, which eventually hit our $56.20 Target:

This time we move back to the 1D time-frame as the longer term dynamics are coming into place again. The key development now is that the price hit yesterday the 55.20 8-month Support (holding since April 09 2025) and today bounced.

This rebound has high probabilities of being a sustainable one, especially since the 1D RSI also bounced from inside its own Support Zone.

Based on the 6-month Channel Down, the immediate Resistance level, thus our short-term Target is the 1D MA50 (blue trend-line). We estimate that the price can make contact with it at $58.50.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Will this be the final Defense from BUYERS to LIFT Crude ?NYMEX:CL1!

Becoming Profitable in the Auction, is a choice only chosen by the 'PROFITABLE'...

As of December 14, 2025, the (front-month) WTI crude oil futures contract (CL1) has declined by approximately 18% to 20% this year (year-to-date). Now currently we have a Daily Demand zone that ranges from $57.00-$55.00 p/b, will this be the final defense from buyers to lift the offer higher here in the auction or will sellers over power and tank the auction lower? There has been gr8 talks in the Energy Markets that Crude OIL is expected to go into a strong BULL MARKET PHASE starting 2026, what are your thoughts? Lmk in the comments...

Continued Success,

TreyHighPwr

#BHM500K

WTI OIL 1.5 month Channel Down started new Bearish Leg.WTI Oil (USOIL) has been trading within a 1.5-month Channel Down (since the October 4 High), that priced last Friday its latest Lower High, this time above the 1D MA50 (red trend-line).

That initiated the new Bearish Leg (also confirmed by the 4H RSI rejection at the top of its range). All 4 previous Bearish Legs bottomed just when the hit the -0.236 Fibonacci extension.

Based on that, we are expecting WTI to make a new Lower Low at 56.200.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

WTI OIL targeting at least $56.00 on the short-term.WTI Oil (USOIL) continues to expand its 4-month Channel Down and has repeatedly been rejected on its 1D MA50 (blue trend-line) in the past 40 days.

As mentioned before, this is similar to September's price action, which eventually tested the previous Support before breaking it and move to a new Lower Low on the 1.5 Fibonacci extension.

As a result, we are still expecting to see $56.00 on the short-term.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

CL1! — Bullish Above 58 with Target at 62.22Crude oil maintains a constructive bullish structure as long as price holds above the 58.00 key support zone. This level remains the foundation of the current upward bias.

The next meaningful obstacle for buyers sits at the 60.69 resistance, which aligns with a major Fibonacci cluster and has shown strong rejection in previous attempts. A clean breakout and sustained close above 60.69 would confirm renewed bullish momentum.

Above that resistance, the path opens toward 61.71 followed by the main upside target at 62.22, which represents the completion of the current Fibonacci expansion.

As long as price trades above 58, the bullish scenario remains valid. A failure at 60.69 may trigger a temporary pullback, but the broader structure favors continuation toward 62.22 once the level is cleared.

WTI OIL Short-term relief rebound before a Lower Low?WTI Oil (USOIL) has been trading within a 1-month Channel Down and has just completed its strongest Bearish Leg (-5.91%). All previous three Bearish Legs eventually bottomed and rebounded into the new Bullish Legs towards the Sell Zone consisting of the 4H MA200 (orange trend-line) - 1D MA50 (red trend-line) range to form a new Lower High.

In 2 out of those 3 cases, it even exceeded the 0.618 Fibonacci retracement level. As a result, we expect a short-term rise now to subsequently be sold towards the -0.236 Fibonacci extension. Our medium-term Target remains 56.500.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Light crude oil On oil, I like two levels for trade, one is short from the approximate price of 66.3, where a deviation above the high could be created, and the close fibo level of 0.5 adds to the confluence, and the daily level on the long, I would like a drop at least below the value low around the price level of 57.46, where the daily level is also nearby