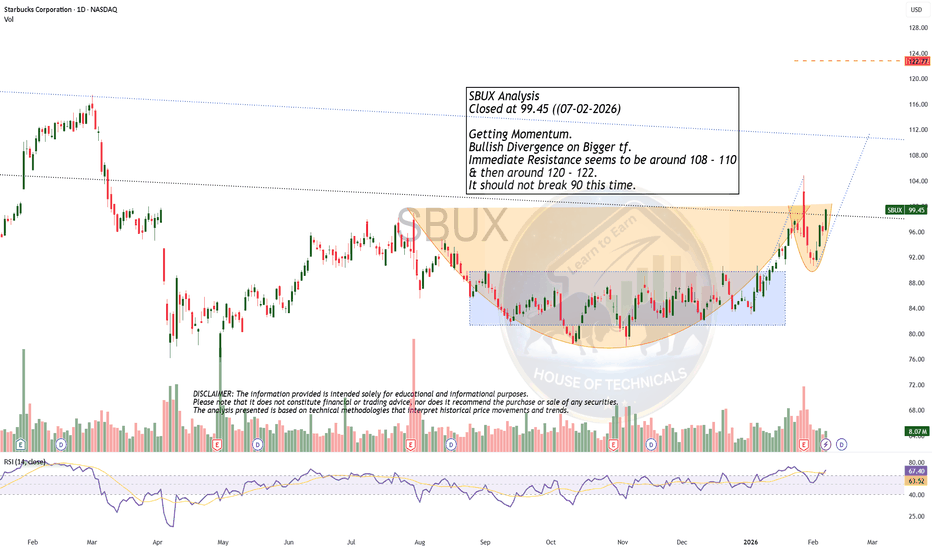

Coffee_analysis

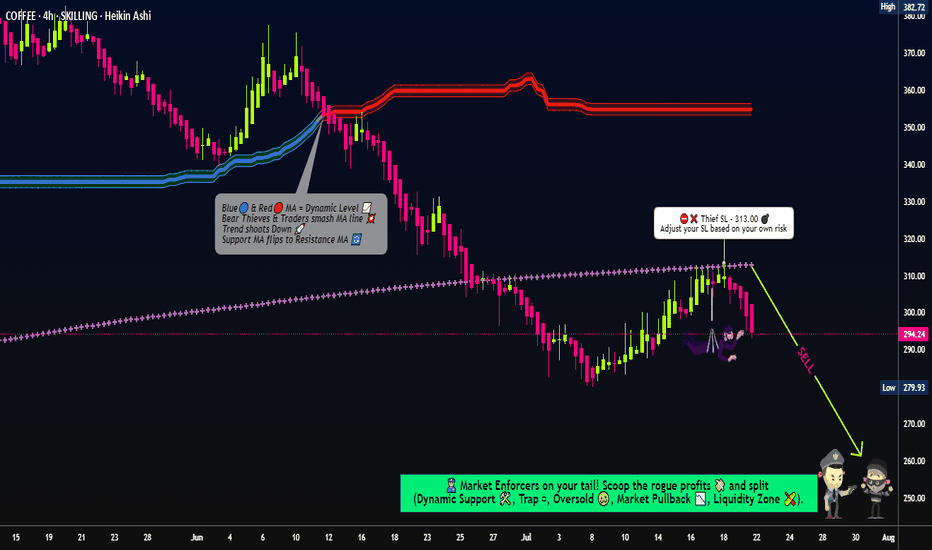

COFFEE | HMA Support Holds | Bullish Breakout Imminent🎯 COFFEE CFD: The Double-Bottom Espresso Shot Setup ☕💰

📊 Market Overview

Asset: COFFEE (Commodities CFD)

Strategy Type: Swing/Day Trade - Cash Flow Management

Bias: 🟢 BULLISH

Timeframe: 2h

🔍 The Setup - Why This Brew is About to Percolate

Alright coffee addicts and chart nerds, let's break down this caffeinated opportunity! ☕⚡

Technical Confirmation:

🎯 Hull Moving Average (HMA) is acting as our dynamic support level

📍 Double Bottom Formation confirmed after price retested the HMA support TWICE

🔥 Buyers stepped in aggressively at the dynamic support zone, confirming bullish momentum

📈 The trend reversal is LOCKED IN - bulls are taking control

This isn't your average coffee break setup - we've got a textbook double-bottom pattern forming right on our dynamic HMA support. Price knocked twice, buyers answered both times. You know what that means? It's go time! 🚀

💎 Entry Strategy - The "Thief" Layered Approach

Primary Entry Signal:

✅ Breakout Confirmation: Wait for price to breach and CLOSE above @385 resistance zone

⚠️ IMPORTANT: Set your price alerts at 385 on your trading platform so you don't miss this breakout! TradingView, MT4, MT5 - whatever you use, SET THAT ALARM! ⏰

🎯 Layered Entry Zones (Scaling In):

This is the "Thief OG" method - you can choose ANY of these levels post-breakout:

Layer 1: 360

Layer 2: 365

Layer 3: 370

Layer 4: 375

Layer 5: 380

Pro Tip: You don't have to enter all at once! Scale in as price confirms momentum. Buy the dip, catch the rip! 🎢

🛑 Risk Management

Stop Loss: @350

Risk-Reward Ratio: Approximately 1:2 (Solid setup! 💪)

📢 Disclaimer Note:

Dear Ladies & Gentlemen (Thief OG's) - This SL is MY personal level. YOU control YOUR money, YOUR risk. Adjust according to your account size and risk tolerance. Trade smart, not hard! 🧠💰

🎯 Profit Targets - Know When to Take Your Coffee to Go

Target Zone: @420 🎯

Why 420?

Strong historical resistance level

Overbought conditions likely

Potential bull trap zone - don't get greedy!

💡 Strategy: Scale OUT just like you scaled IN. Take profits along the way. Lock in gains before the market locks YOU out! 🔒💵

📢 Disclaimer Note:

Dear Ladies & Gentlemen (Thief OG's) - This TP is MY personal target. YOU control YOUR profits. If you're in the green, secure your bag at your own discretion. Nobody ever went broke taking profits! 💰✨

📈 Correlated Pairs to Watch

Keep an eye on these related markets - they move together like coffee and cream ☕🥛

PEPPERSTONE:SUGAR (SB1!) - Commodity correlation

ASX:BRL (Brazilian Real) - Brazil = #1 coffee producer, currency strength matters

PEPPERSTONE:COCOA (CC1!) - Soft commodities sector correlation

DXY (US Dollar Index) - Inverse relationship; weaker dollar = stronger commodities

Key Point: If sugar and cocoa are rallying, coffee usually follows the party! Also, watch weather reports from Brazil - drought conditions = bullish coffee prices. ☀️🌧️

⚡ Key Takeaways

✅ Double-bottom pattern confirmed on HMA dynamic support

✅ Bullish momentum building

✅ Wait for 385 breakout confirmation

✅ Layer entries between 360-380

✅ Manage risk with SL @350

✅ Secure profits near 420 resistance

✅ Watch correlated pairs for confirmation

🎭 The "Thief Style" Philosophy

This is the Thief OG strategy - we steal opportunities from the market like a caffeinated ninja!

This analysis is for educational and entertainment purposes. We're here to learn, laugh, and hopefully make some money along the way!

Remember: The market doesn't care about your feelings. Stick to YOUR plan, manage YOUR risk, and protect YOUR capital. This is a game of probabilities, not certainties!

✨ If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!

#Coffee #CommoditiesTrading #CFDTrading #SwingTrading #DayTrading #TechnicalAnalysis #DoubleBottom #HullMovingAverage #HMA #Breakout #BullishSetup #TradingStrategy #PriceAction #SupportAndResistance #RiskManagement #ThiefStyle #CoffeeMarket #CommodityTrading #TradingIdeas #ChartAnalysis #ForexCorrelation #SoftCommodities

Analysis Techniques – Arabica Coffee Futures (Dec 2025)Analysis Techniques – Arabica Coffee Futures (Dec 2025)

Date: October 23, 2025 | Timeframe: D1 | Contract Code: ICEUS KCZ25

1. Trend Overview and Price Structure

December 2025 Arabica coffee futures continued to rally strongly, up +2.18% to 423.95 cents/lb, marking the sixth consecutive session of gains and returning to the highest level since early May 2025.

The current technical setup shows clear bullish momentum following a two-week consolidation between 380–400 cents.

If momentum persists, prices could advance toward the strategic resistance zone at 450 cents/lb, corresponding to the March 2025 swing high.

Short-term trend: Strongly bullish – continuing wave (3) within a broader recovery cycle.

2. Key Technical Price Levels

Resistance: 424 – 450 – 480

Support: 388 – 351 – 316

3. Detailed Technical Analysis

(1) Short-Term Trend:

Price has broken above the 400–410 resistance zone and is now aiming for the 450 target area.

A clear horizontal accumulation breakout pattern has formed, signaling that buyers are fully in control of the market.

(2) Trading Volume:

Volume has expanded alongside rising prices over the past week, confirming renewed speculative and commercial participation.

Managed money funds are likely rebuilding net-long positions after September’s liquidation phase.

(3) Wave Structure:

According to Elliott Wave Theory, Arabica is in wave (3) of a bullish sequence that began from the 316.50 low in July 2025.

Wave (1): 316 → 388

Wave (2): correction to 351

Wave (3): currently targeting 450–455, the 161.8% Fibonacci extension.

(4) Confirmation Signals:

Price broke above the accumulation range with long-bodied bullish candles, showing no signs of distribution.

Short-term EMAs (12–36) are expanding upward, confirming strong momentum.

Breakout volume exceeded the 20-session average, validating the move.

4. Strategic View – VNC

According to Bloomberg Intelligence, Arabica’s sharp rally through October has been driven by three fundamental catalysts:

1. Short-Term Supply Tightness in Brazil:

September exports fell nearly 11% year-on-year, as dry weather slowed harvest progress.

ICE-certified stocks dropped sharply, reaching the lowest level in 18 months.

2. Renewed Speculative Flows:

Commodity funds have rotated back into soft commodities (coffee, cocoa, sugar) as the energy complex corrected.

The Arabica-to-Robusta net-long ratio has risen to 1.4x, its highest since April.

3. Stable Consumption Demand:

Roasters in Europe and the U.S. have increased stockpiling ahead of the winter season.

The slightly weaker Brazilian real (5.52 BRL/USD) has discouraged farmer selling, tightening near-term supply.

VNC expects bullish momentum to persist in the short term, with 450 cents/lb as a medium-term target. However, profit-taking or a rebound in the real could trigger corrective pullbacks near 460–470 cents/lb.

5. Suggested Technical Strategies

Primary Long Scenario (Trend-Following):

Entry: 415 – 420

TP1: 450

TP2: 465

SL: 404

Probability: 75%

Risk/Reward Ratio: ~1:2.8

Alternative Short Scenario (Rejection at 450 Resistance):

Entry: 448 – 452

TP: 388

SL: 460

Probability: 25%

Risk/Reward Ratio: ~1:3

6. Corporate Hedging Strategies

For Arabica Exporters (Brazil, Colombia):

Increase forward price fixation around 440–450 cents/lb, as prices approach strong resistance.

Utilize options collars to protect profit margins in case of a near-term correction.

For Importers and Roasters (EU, U.S., Vietnam):

Consider early hedging in the 400–420 zone to lock in costs before a potential breakout above 450.

If prices reach 450–460, consider unwinding older hedges to maintain a neutral exposure.

For Commercial Traders:

Maintain medium-term long positions, targeting 450–455 for partial profit-taking.

A confirmed breakout above this zone could open the path toward 480–500 cents/lb.

Analysis Techniques – Robusta Coffee Futures (Nov 2025)Analysis Techniques – Robusta Coffee Futures (Nov 2025)

Date: October 23, 2025 | Timeframe: D1 | Contract Code: ICEEU XRX25

1. Trend Overview and Price Structure

November 2025 Robusta coffee futures surged +2.70% to USD 4,750/ton, marking a clear breakout from a descending triangle accumulation pattern that had persisted since September.

This session confirms a technical breakout, lifting prices above the key 4,700 resistance zone and opening the path toward a medium-term upside target of 5,300–5,560 USD/ton.

The short-term trend has shifted decisively from consolidation to bullish continuation, supported by a stable higher-lows structure established since August 2025.

2. Key Technical Price Levels

Resistance: 4,986 – 5,300 – 5,561

Support: 4,303 – 4,050 – 3,696

3. Detailed Technical Analysis

(1) Short-Term Trend:

After consolidating between 4,300–4,500, Robusta broke above its descending trendline, confirming a bullish reversal.

The measured move projection, based on the triangle’s height (~USD 930), suggests a potential advance toward 5,550 USD/ton, equivalent to a 20% price increase.

(2) Trading Volume:

Volume expanded sharply during the breakout sessions, signaling renewed participation from both speculative and commercial traders after a prolonged Q3 correction.

(3) Wave Structure:

According to Elliott Wave Theory, prices are progressing within wave (3) of a bullish cycle, targeting 5,300–5,560 USD, where a confluence exists between the April swing high and the 161.8% Fibonacci extension zone.

A breakout above 5,560 would confirm further upside potential toward 5,800–6,000 USD in Q4 2025.

(4) Confirmation Signals:

Breakout above the descending trendline from June.

Strong bullish candles closing above the entire short-term resistance range.

Momentum and volume confirm active buying pressure (bullish momentum).

4. Strategic View – Bloomberg Intelligence

According to VNC, Robusta’s sharp recovery in the second half of October is driven by a combination of three key factors:

1. Tight Supply from Vietnam and Indonesia:

ICE Europe reported Robusta inventories falling to their lowest level since 2016.

Vietnam’s September exports dropped over 20% year-on-year, as farmers delayed sales in anticipation of higher prices.

2. Steady Demand from Europe and the U.S.:

European roasters have increased stockpiling ahead of the year-end consumption season.

The strengthening euro against the dollar has improved purchasing power for European buyers.

3. Spillover from the Arabica Market:

Arabica prices have rallied above 410 cents/lb, creating a positive contagion effect across the broader coffee complex.

The Arabica/Robusta price ratio (A/R spread) has normalized around 1.35x, allowing further upside in Robusta without triggering substitution pressures.

VNC notes that the 4,300–4,500 zone now serves as a solid price base, with 5,300–5,560 as an achievable target for November—provided the Brazilian real remains stable and speculative inflows continue.

5. Suggested Technical Strategies

Primary Long Scenario (Trend-Following):

Entry: 4,650 – 4,720

TP1: 5,300

TP2: 5,560

SL: 4,460

Probability: 75%

Risk/Reward Ratio: ~1:3

Alternative Short Scenario (Rejection at High Resistance):

Entry: 5,550 – 5,600

TP: 4,950

SL: 5,720

Probability: 25%

Risk/Reward Ratio: ~1:2

6. Corporate Hedging Strategies

For Coffee Exporters:

Increase forward sales coverage in the 4,750–5,000 zone as global prices have strongly recovered and the domestic basis has narrowed.

Consider partial hedging for December–January delivery contracts to protect profit margins.

For Importers (Roasters & FMCG Companies):

Consider partial hedging on dips near 4,400–4,500, focusing on Q1 2026 deliveries, to secure supply amid continued market volatility.

For Commercial Investors:

Maintain medium-term long positions targeting 5,300–5,560.

A confirmed break above 5,560 could justify expanding long exposure toward 5,800–6,000 USD.

#Coffee – Triangle Formation#Coffee (D1) – Triangle Formation & Potential Wave 5 Extension

Current price: $386.4

Coffee futures are developing a triangle continuation pattern, signaling possible breakout toward the next impulsive wave — likely wave 5 within the broader bullish sequence.

🧩 Technical Context

• The market completed a clean 1–2–3–4 wave sequence since the August low (~$330).

• Current structure consolidates inside a symmetrical triangle, typical before a wave 5 breakout.

• The pattern is forming above key supports, confirming mid-term bullish bias.

📈 Wave 5 Projection

• Potential breakout direction: upward continuation

• Stop-loss: below wave 4 low (~$355)

• Fibonacci-based upside projections:

– 0.786 Fib → $416

– 1.0 Fib → $432

– 1.2 Fib → $448

– 1.618 Fib → $480

– 2.0 Fib → $508

– 2.618 Fib → $556

Expected wave 5 may extend toward $480–$500 if breakout confirms with volume.

🧭 Summary

• D1 structure indicates triangle consolidation in a bullish trend.

• Breakout above $390 would confirm the start of wave 5.

• Stop remains below the wave 4 low (~$355) to protect against false breaks.

• Momentum and volume confirmation are key for trend continuation.

Analysis techniques – Arabica Coffee Futures (Dec 2025)Analysis techniques – Arabica Coffee Futures (Dec 2025)

Date: Oct 06, 2025 | Timeframe: D1 | Contract Code: KCZ25

1. Trend Overview and Price Structure

December Arabica coffee rose +2.28% to 388.35 cents/lb, breaking above the 384–385 consolidation zone and confirming a short-term recovery.

The medium-term structure remains bullish from the 272.05 low, with a key support area around 350. Sustaining this zone may lead prices toward 420 cents/lb, the highest resistance since May 2025.

2. Key Technical Levels

Resistance: 384.6 – 420 – 450

Support: 350 – 316.5 – 272

3. Detailed Technical Analysis

(1) Short-term Trend:

Momentum strengthened as prices reclaimed the 384–385 area. Holding above 380 reinforces the near-term uptrend.

(2) Volume:

Volume expansion during the latest rally reflects renewed speculative buying.

(3) Wave Structure:

Arabica appears to be in wave 3 of a medium-term recovery cycle, targeting 420 – 450. A confirmed breakout above 420 could extend the move into wave 5 toward 450.

(4) Confirmation Signals:

A daily close above 388–390 would confirm bullish continuation, while a drop below 350 would weaken the broader structure.

4. VNC View

Short Term: Supported by low ICE certified stocks and a stronger BRL reducing farmer selling.

Medium Term: Brazilian 2025/26 crop remains strong, but rising logistics costs and recovering consumption in the US/EU support price stability.

Risk Factors: Currency volatility (BRL/USD) and prolonged La Niña weather conditions in South America may distort supply-demand balance.

5. Suggested Technical Strategies

Preferred Long Setup:

Entry: 384 – 388

TP: 420 – 450

SL: 350

Probability: 65%

Counter-trend Short Setup:

Entry: 418 – 420

TP: 370 – 350

SL: 425

Probability: 35%

6. Corporate Hedging Guidance

Roasters / Importers: Lock in purchases around 380 – 390 to hedge against potential rally toward 420.

Exporters: Delay sales once above 400 and use forward hedges to capture upside if the uptrend extends.

Analysis techniques – Robusta Coffee Futures (Nov 2025)Analysis techniques – Robusta Coffee Futures (Nov 2025)

Date: Oct 06, 2025 | Timeframe: D1 | Contract Code: LRCX25

1. Trend Overview and Price Structure

November Robusta coffee surged to USD 4,528/ton (+4.65%), extending its rebound from the 4,020 – 4,305 support zone.

The price pattern is shaping a falling wedge, a potential reversal setup if the upper boundary near 4,600 – 4,650 breaks.

Medium term, the market is transitioning from a downtrend into a consolidation-recovery phase, targeting 4,926 – 5,646 once resistance breaks.

2. Key Technical Levels

Resistance: 4,650 – 4,926 – 5,646

Support: 4,305 – 4,020 – 3,628

3. Detailed Technical Analysis

(1) Short-term Trend:

The current rally is a corrective move after September’s decline. Holding above 4,305 shows renewed buying strength, supported by a breakout through the descending trendline.

(2) Volume:

Volume expansion during Oct 4–5 sessions indicates active technical buying and bullish participation.

(3) Wave Structure:

Price appears to be forming a wave 3 recovery leg. If the move extends, theoretical targets lie around 4,926 – 5,646.

(4) Confirmation Signals:

A daily close above 4,650 confirms wedge breakout; a break below 4,305 would risk a pullback toward 4,020.

4. Bloomberg Intelligence Strategic View

Short Term: Technical rebound supported by tight ICE inventories and speculative buying in Robusta.

Medium Term: Heavy rains in Vietnam’s Central Highlands and Brazil’s Minas Gerais may improve 2025/26 output, yet Indonesia’s weak supply continues to underpin prices.

Key Risk: A stronger USD or weaker BRL could trigger producer hedging and limit upside momentum.

5. Suggested Technical Strategies

Preferred Long Setup:

Entry: 4,450 – 4,520

TP: 4,926 – 5,646

SL: 4,305

Probability: 65%

Counter-trend Short Setup:

Entry: 4,900 – 4,950

TP: 4,305 – 4,020

SL: 5,000

Probability: 40%

6. Corporate Hedging Guidance

Exporters: Consider forward sales around 4,900 – 5,000 to secure short-term profits.

Roasters/importers: Hedge near 4,400 – 4,500 to mitigate upside exposure in case of a breakout above 4,926.

Analysis techniques – Robusta Coffee Futures (Nov 2025)Date: 30/09/2025 | Timeframe: H1 | Contract Code: LRCX25

1. Trend Overview and Price Structure

The Robusta market is weakening after failing to hold the 4,200 USD/ton support. The overall bias is bearish as prices trade below long-term averages, forming a distribution pattern on the H1 chart.

2. Key Technical Levels

Resistance: 4,305 – 4,500 – 4,926

Support: 4,020 – 3,628 – 3,145

3. Detailed Technical Analysis

Short-term trend: Breakdown below 4,150 suggests continuation of the downtrend.

Volume: Increasing volumes during sell-offs confirm selling pressure dominance.

Wave structure: Currently in the second impulse wave down, targeting 3,600–3,650.

Confirmation signals: Bearish crossovers among moving averages reinforce downside momentum.

4. VNC Intelligence Strategic View

Short-term bearish momentum dominates as the market fails to reclaim 4,305 resistance. Mid-term fundamentals remain weak, with steady supply from Vietnam and Brazil adding to pressure.

5. Suggested Technical Strategies

Short setup (trend-following):

Entry: 4,150–4,200

TP: 3,630

SL: 4,310

Probability: High

Counter-trend Long setup:

Entry: 4,000–4,020

TP: 4,300

SL: 3,880

Probability: Low – tactical rebound trade only.

6. Corporate Hedging Guidance

Importers may consider hedging short-term positions to benefit from the downtrend. Exporters should avoid premature short sales, maintaining flexible forward contracts in case of a rebound near 4,000.

Coffee Heist: Are You Ready for the Bullish Layup?🚨☕ "COFFEE" Heist Plan – Swing/Day Robbery 🚨

🌟 Hola! Ola! Bonjour! Hallo! Marhaba! 🌟

Dear Robbers & Money Makers 🤑💰💸✈️

Based on 🔥 Thief Trading Style Analysis 🔥 here’s our master heist plan to rob the "COFFEE" Commodities CFD Market.

🎯 Plan: Bullish Robbery

Entry 📥: Any price level – Thief always sneaks in at any vault door.

👉 But remember: Thief Strategy = LAYERED ENTRY ⚡

Multiple Buy-Limit Layers:

(390.00) 🏦

(380.00) 💎

(370.00) 🎭

(360.00) 🔑

(Add more layers based on your own robbery plan)

Stop Loss 🛑:

This is Thief SL @ 340.00 ⚔️

Dear Ladies & Gentlemen (Thief OG’s) – Adjust your SL based on your personal robbery strategy & risk appetite.

Target 🎯:

⚠️ Police barricade spotted @ 440.00 🚔

So escape early with the loot @ 430.00 💸 before getting caught!

🏴☠️ Thief Notes:

Our heist is in the bullish zone 🚀

Layer in carefully, don’t rush 💎

Always manage risk – the cops (market makers) are watching 👮♂️

Use alerts, trailing SL & risk management to protect your stolen bags 💰

💥 If you’re riding with the Thief crew – Hit Boost 🚀 & Share Love ❤️ – that fuels our robbery strength!

We rob, we trade, we escape – That’s the Thief Way! 🏆🐱👤

#ThiefTrader #CoffeeHeist #CommoditiesCFD #SwingTrade #DayTrade #LayerStrategy #BuyTheDip #TradingPlan #ForexRobbers #MarketHeist

The Coffee Vault is Open! Time to Rob the Bulls’ Treasure!☕💰 COFFEE MARKET HEIST – Bullish Loot Run! 💰☕

🌟 Hola, Bonjour, Hallo, Marhaba, Money Makers & Legendary Robbers! 🌟

Today’s target? "COFFEE" Commodities CFD Market – and we’re going in BULLISH 🚀📈

📌 Plan – Moving Average Breakout Entry

💎 Entry Point: The vault door is open – any price level is fair game!

💡 Thief’s Layer Strategy: Stack those buy limits like gold bars –

(345.00) ➡ (340.00) ➡ (330.00) ➡ (320.00) ☑️

(Feel free to increase the layers if your pockets are deep enough 🤑)

🛑 Stop Loss – Thief’s Escape Hatch

This is my Thief SL @300.00 🔒

👑 OG Robbers: Adjust your SL to match your strategy & risk appetite.

Remember, the cops are always closer than you think 🚔💨

🎯 Target – Police Barricade Ahead

🏆 Loot Goal: 410.00

💥 Hit it, bag the profit, and vanish before the sirens get loud!

📢 Thief Trader Pro Tips

Scalpers: Only rob from the Long side 🏴☠️

Swing Traders: Ride the heist wave with patience 🌊

Always trail your SL to protect the loot 💼

⚠️ Market Alert: Big news drops = high volatility.

🚫 Avoid fresh entries during news blasts.

✅ Manage positions like a true market outlaw.

💖 Boost this plan if you want the robbery crew to stay strong & profitable!

Let’s drink the profits ☕, not the losses.

🏆🚀 Thief Trader – Turning Charts into Loot Since Day One! 🏆🚀

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot. Thief (I"AM) using multiple limit orders (DCA / layering strategy style method of entries).

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high level of candle wick on the 4H timeframe (~313.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 260.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

Coffee Trade Analysis - Fx Dollars - {11/07/2025}Educational Analysis says that Coffee (Commodity) may give trend Trading opportunities from this range, according to my technical analysis.

Broker - NA

So, my analysis is based on a top-down approach from weekly to trend range to internal trend range.

So my analysis comprises of two structures: 1) Break of structure on weekly range and 2) Trading Range to fill the remaining fair value gap

Let's see what this Commodity brings to the table for us in the future.

Please check the comment section to see how this turned out.

DISCLAIMER:-

This is not an entry signal. THIS IS FOR EDUCATIONAL PURPOSES ONLY.

I HAVE NO CONCERNS WITH YOUR PROFIT OR LOSS,

Happy Trading, Fx Dollars.

COFFEE - My Commodity of ChoiceI've laid out a plan I'm looking at on one of my favorite commodities - COFFEE ☕😍

What makes it so hard is the predictability of the weather - nearly impossible for the future. However, it is odd to see that the price still bonces at key support and resistance zones, almost like any "stock". Which tells me regular market trading still applies despite the odd weather event.

The reason Coffee has fallen so hard over the past few months is supply - due to extremely favorable weather conditions, coffee supply is more than demand. Resulting, as market dynamics goes, in a drop of price.

It's unfortunate though that my favorite pack of beans at the supermarket has not gone down - weird how that works 🙄 I like a medium roast, Columbia single origin.

It's dropped -33% already, but I can clearly see the market structure entering bearish phase after the bullish phase, peak (the new high) and now likely a multi-month bearish season. The question is just where the price can bottom for such a well loved commodity.

I looked at past cycles, not too long ago we dropped roughly 44% during the bearish cycle, taking 2-3 years to move into accumulation before another impulse wave up. That places a target for entry exactly in the highlighted zone around $250ish.

But I wouldn't get too greedy on my favorite commodity, buying orders can't be too low either. This would likely have to be a multiyear hold. Pepperstone sells coffee on cash contract but I usually do futures. Pity that I didn't get in sooner, bullish cycles is also at least a 2 year journey. I'll sell when the weather is bad 😅

Next up? Chocolate for sure...

“COFFEE CFD Smash-and-Grab: Thieves’ Swing Trade Blueprint!"🚨☕ The Great "COFFEE" Market Heist 🚨💰

🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔️Dear Money Makers & Robbers, 🤑💸✈️

Get ready for the ultimate COFFEE Commodities CFD Market Heist! Based on our 🔥Thief Trading Style combining technical and fundamental analysis, here’s our master plan to snatch profits from the market vault.

💥 The Master Plan:

📉 Entry:

“The vault is wide open! Swipe the bearish loot at any price—our heist is on!”

💸 Use sell limit orders on the 15- or 30-minute timeframe, at the nearest swing high or low levels to lock in the perfect robbery spot.

🛑 Stop Loss:

📌 Set your Thief SL at the nearest or swing high/low on the 4H timeframe (~380.00) to keep your loot safe.

📌 Adjust SL based on your trade risk, lot size, and multiple entry plan—don’t let the cops catch you!

🎯 Target:

Aim for 315.00 or escape before the target—take the loot and run!

👀 Scalpers’ Tip:

Only scalp on the Short Side! If you’ve got deep pockets, jump in big; otherwise, join swing traders to ride the heist. Use trailing SL to protect your loot.

💣 Market Vibes:

The “COFFEE” CFD market is trapped in bearish territory, fueled by:

🔎 Risky levels

🔎 Oversold zones

🔎 Consolidation

🔎 Trend reversal

🔎 Traps near levels where bullish robbers get strong.

📰🗞️ The Big Picture:

Check out the Fundamentals, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, and Future Trend Targets to stay one step ahead! 👉👉👉🔗 (Check our bi0 for liinks!)

⚠️ Trading Alert:

News releases can rock the market vault!

🚨 Avoid new trades during big news

🚨 Use trailing SL to lock profits and guard your loot.

💥 Hit the Boost Button!

Supporting our Robbery Plan helps us all steal money with ease! 💰💵 Boost our robbery team’s strength, and trade with the Thief Trading Style to cash in every day. 💪🏆🤝🚀🎉

Stay tuned for our next heist plan—until then, keep those profits safe and stay sharp! 🤑🐱👤🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

Dear Money Makers & Robbers, 🤑 💰💸✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes long entry. Our aim is the high-risk Red Zone. Risky level, overbought market, consolidation, trend reversal, trap at the level where traders and bearish robbers are stronger. 🏆💸"Take profit and treat yourself, traders. You deserve it!💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bullish loot at any price - the heist is on!

however I advise to Place buy limit orders within a 15 or 30 minute timeframe most recent or swing, low or high level. I Highly recommended you to put alert in your chart.

Stop Loss 🛑:

Thief SL placed at the Nearest / Swing low level Using the 4H timeframe (370) Day/Swing trade basis.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 470 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Long side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

💰💵💸"COFFEE" Commodities CFD Market Heist Plan (Swing / Day) is currently experiencing a bullishness,., driven by several key factors. .☝☝☝

📰🗞️Get & Read the Fundamental, Macro Economics, COT Report, Sentimental Outlook, Intermarket Analysis, Seasonality, Future trend targets & Overall outlook score..., go ahead to check 👉👉👉🔗🔗🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan (Swing / Day)🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish robbers are stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The vault is wide open! Swipe the Bearish loot at any price - the heist is on!

however I advise to Place sell limit orders within a 15 or 30 minute timeframe most nearest or swing, low or high level.

Stop Loss 🛑:

📌Thief SL placed at the nearest/swing High or Low level Using the 3H timeframe (400.00) Day/Swing trade basis.

📌SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

Target 🎯: 335.00 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

☕"COFFEE" Commodities CFD Market Heist Plan (Swing / Day Trade) is currently experiencing a bearishness,., driven by several key factors.👇

📰🗞️Get & Read the Fundamental, Macro, COT Report, Quantitative Analysis, Sentimental Outlook, Intermarket Analysis, Future trend targets.. go ahead to check 👉👉👉🔗

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

"COFFEE" Commodities CFD Market Bearish Heist Plan🌟Hi! Hola! Ola! Bonjour! Hallo! Marhaba!🌟

⚔Dear Money Makers & Thieves, 🤑 💰✈️

Based on 🔥Thief Trading style technical and fundamental analysis🔥, here is our master plan to heist the "COFFEE" Commodities CFD Market. Please adhere to the strategy I've outlined in the chart, which emphasizes short entry. Our aim is the high-risk Green Zone. Risky level, oversold market, consolidation, trend reversal, trap at the level where traders and bullish thieves are getting stronger. 🏆💸Book Profits Be wealthy and safe trade.💪🏆🎉

Entry 📈 : "The heist is on! Wait for the breakout (370) then make your move - Bearish profits await!" however I advise placing Sell Stop Orders below the breakout MA or Place Sell limit orders within a 15 or 30 minute timeframe. Entry from the most recent or Swing high or low level should be in retest.

📌I strongly advise you to set an alert on your chart so you can see when the breakout entry occurs.

Stop Loss 🛑: Thief SL placed at (400) swing Trade Basis Using the 4H period, the recent / swing high or low level.

SL is based on your risk of the trade, lot size and how many multiple orders you have to take.

🏴☠️Target 🎯: 340 (or) Escape Before the Target

🧲Scalpers, take note 👀 : only scalp on the Short side. If you have a lot of money, you can go straight away; if not, you can join swing traders and carry out the robbery plan. Use trailing SL to safeguard your money 💰.

"COFFEE" Commodities CFD Market is currently experiencing a Neutral trend (higher chance to 🐻🐼Bearishness)., driven by several key factors.

📰🗞️Read the Fundamental, Macro Economics, COT Report, Seasonal Factors, Intermarket Analysis, Sentimental Outlook, Future trend predict.

Before start the heist plan read it.👉👉👉

📌Keep in mind that these factors can change rapidly, and it's essential to stay up-to-date with market developments and adjust your analysis accordingly.

⚠️Trading Alert : News Releases and Position Management 📰 🗞️ 🚫🚏

As a reminder, news releases can have a significant impact on market prices and volatility. To minimize potential losses and protect your running positions,

we recommend the following:

Avoid taking new trades during news releases

Use trailing stop-loss orders to protect your running positions and lock in profits

💖Supporting our robbery plan 💥Hit the Boost Button💥 will enable us to effortlessly make and steal money 💰💵. Boost the strength of our robbery team. Every day in this market make money with ease by using the Thief Trading Style.🏆💪🤝❤️🎉🚀

I'll see you soon with another heist plan, so stay tuned 🤑🐱👤🤗🤩

The Coffee Code: A Short Opportunity Hidden in Plain SightThere is a difference between seeing the market and truly understanding it. Most traders react. The enlightened anticipate.

This week, the COT strategy has illuminated a setup so clear, yet so overlooked, that only those who understand the deeper language of the markets will act. Coffeewhispers a warning, and few are listening.

The Codes Have Been Revealed:

🔻 Code 1: Commercials' COT Index – The real insiders, the ones who move markets, are at a bearish extreme. The last time we saw this setup? A major reversal followed.

🔻 Code 2: Positioning Extremes – Large specs are at an all-time high in longs. When the herd rushes in, exits become crowded.

🔻 Code 3: Advisor Sentiment – The so-called “experts” are euphoric. When advisors scream bullishness while commercials quietly stack shorts, it’s a sign. A big one.

🔻 Code 4: Valuation – Coffee is severely overvalued relative to Gold, Treasuries, and the Dollar. The weight of reality will soon press down.

🔻 Code 5: ADX Over 60 – A high ADX signals a trend’s climax. The moment it rolls over is the key to this code triggering the move.

🔻 Code 6: Seasonality – Mid-February to March? Historically, a time of decline. The cycle repeats for those who see it.

🔻 Code 7: Cycles Colliding – Multi-timeframe cyclical pressure is now aligned against coffee.

The rarest and most powerful force in motion.

Additional indicators confirm it. Distribution. Divergences. Ultimate Oscillator. Williams ProGo. %R sell zones. Every signal is flashing red.

And yet, most will hesitate. Most will ignore the signs. They will wait until it's too late.

The question is not whether the opportunity exists. It’s whether you can see it.

If you understand what’s written here, you already know what comes next.

If you don’t... then perhaps it’s time we talked.

Disclaimer

The information provided in this content is for educational and informational purposes only and should not be construed as financial advice, investment recommendations, or an offer to buy or sell any securities or financial instruments.

Trading financial markets involves significant risk, including the potential loss of capital. Past performance is not indicative of future results. You are solely responsible for your trading decisions and should conduct your own research or consult with a licensed financial advisor before making any financial decisions.

The creator of this content assumes no liability for any losses or damages resulting from reliance on the information provided. By engaging with this content, you acknowledge and accept these risks.

Acknowledgment

The strategies and concepts taught in this class draw significant inspiration from the works and teachings of Larry Williams, a pioneer in trading and market analysis. His groundbreaking research and methodologies have shaped the foundation of modern trading education.

While this class incorporates Larry Williams’ principles, the content has been adapted and presented to reflect my own understanding and application of these ideas. Full credit is given to Larry Williams for his original contributions to the field of trading.

COFFEE - UniverseMetta - Signal#COFFEE - UniverseMetta - Signal

D1 - Formation of potential 3rd wave.

H4 - Securing behind the channel line + possible retest of the level, through the 3rd wave. You can try to enter from these levels or wait for the breakout of the 1st wave. Stop behind the maximum of the 1st wave.

Entry: 328.66 - *320.11

TP: 307.55 - 293.16 - 279.62 - 257.96

Stop: 344.60

Arabica Coffee Futures. The Canary in the Coal MineWith nearly 60 percent up path performance in 2024, Arabica coffee futures rose above $3.00 a pound, the highest mark since May 2011, as traders assess potential problems with next year’s crop in top producer - Brazil.

Despite recent rains, soil moisture levels remain low, leading to limited fruit development and excessive leaf growth, local traders said.

U.S. and European coffee lovers are getting ready to tighten their belts as natural disasters have hit the world’s two largest coffee-producing countries, causing commodity prices to more than double in the past five years.

Droughts in Brazil, the world’s largest coffee producer, and severe typhoons in Vietnam, the second-largest producer, have severely disrupted the global coffee supply chain, driving up production costs that are increasingly being passed on to consumers.

In addition, there are reports that Brazilian coffee farmers are holding back shipments of coffee to the market in hopes of higher prices, leading to further shortages, tighter supplies of coffee on the spot market, and higher prices.

Coffee is literally the “Canary in the coal mine,” signaling climate change, the ecological crisis, and its impact on agriculture.

The idiom originated within the Industrial Revolution in England (back to late XVIII century), when coal miners, lacking modern gas-monitoring equipment, would take canaries (birds) into the coal mine with them. And when dangerous gases like carbon monoxide (which is odorless) accumulated in excess in the mine, they stopped the birds chirping and killed the canaries before killing the miners, thus providing a warning to leave the tunnels immediately.

As some of the world’s largest coffee-consuming regions, coffee lovers in the United States and Europe will find the price hikes particularly hard to stomach.

According to German consumer data company Statista, Europeans consume about 3.2 million tons of coffee a year, accounting for nearly 33 percent of the world’s total coffee consumption, while Americans drink 400 million cups of coffee daily (which equates to 146 billion cups of coffee consumed in the United States each year, or nearly four cups a day for every American adult).

In fact, coffee is more than just a morning ritual in the United States; it has become a cultural and business driver.

But understanding the depth of America’s love affair with coffee may be as complex as the drink itself, and of course, more complex than the current coffee prices.

Natural disasters have taken a heavy toll.

Brazil, which accounts for about 40% of the world’s coffee production, is battling one of its worst droughts in decades. Dry conditions have severely impacted Arabica-growing regions, reducing yields.

The 2023–24 crop cycle is already seeing a sharp drop in production, with some estimates suggesting output could fall by as much as a fifth (20%).

The impact is being felt most acutely in Minas Gerais, Brazil’s largest coffee-producing state and home to high-quality Arabica, which has seen months of lower-than-normal rainfall.

Brazil’s farmers are battling the country’s worst drought in seven decades and above-average temperatures.

While Brazil dominates the Arabica market, Vietnam is the world’s leading producer of the cheaper Robusta beans used in instant coffee. Earlier this fall, Typhoon Yagi devastated the country’s main coffee-growing regions in the Central Highlands, killing at least 60 people and injuring hundreds more.

Thousands of hectares of coffee plantations were estimated to have been damaged, leading to significant losses in both the current crop and future production potential, as the damaged trees will take years to recover.

A perfect storm of environmental concerns has driven prices to all-time highs, above US$3.00 per pound of coffee beans.

The combined impact of drought in Brazil and the typhoon in Vietnam has sent global coffee prices soaring. The International Coffee Organization (ICO), an intergovernmental body made up of coffee-exporting and -importing countries, reported that prices rose nearly 20% in the third quarter of 2024, reaching their highest level in nearly a decade.

The ongoing effects of climate change make a quick return to stability difficult. The sector remains vulnerable to extreme weather conditions, which could further disrupt future harvests. In addition, growing global demand, particularly in emerging markets such as Asia, could continue to put upward pressure on prices, further slowing recovery efforts.

As the world’s two largest coffee producers struggle to recover from the crisis, the outlook for the global coffee market remains uncertain.

Climate change is reducing the area of land suitable for growing coffee crops, and extreme weather events are becoming more frequent, creating a range of challenges for the sector and coffee drinkers in the US and Europe.

In technical terms, the main 12-month graph of coffee prices indicates another buyers attempt to storm the round, 250-cent mark.

Since the price is near to consolidate by the end of the year above this round number, it can contribute to a further rally and multiple price growth in the foreseeable future.

The Enigma of Robusta: Why is Coffee's Unsung Hero So Valuable?Robusta coffee, a resilient and versatile bean, has played a pivotal role in the global coffee market. Despite its often overlooked status, Robusta has experienced a significant surge in value in recent years. This article explores the factors driving the rising prices of Robusta coffee, including increased demand, supply chain disruptions, and climate change. By understanding the challenges and opportunities facing Robusta, we can better appreciate its enduring significance in the global coffee industry.

Introduction

The global coffee market has witnessed a steady rise in demand, leading to a corresponding increase in prices for both Arabica and Robusta beans. While Arabica often takes center stage, Robusta, a less celebrated but equally essential bean, has also experienced a notable appreciation in value. This article delves into the reasons behind Robusta's ascent, examining the factors that have contributed to its growing prominence.

Factors Driving Robusta Coffee Prices

Several key factors have converged to push Robusta coffee prices upward:

Increased Demand: The global appetite for coffee has expanded significantly, particularly in emerging markets. This rising demand, coupled with a limited supply, has created upward pressure on prices.

Supply Chain Disruptions: Weather-related challenges, geopolitical tensions, and logistical constraints have disrupted supply chains, leading to shortages and higher costs.

Climate Change: Climate change has exacerbated weather-related events, such as droughts and floods, impacting coffee production and driving up prices.

Shifting Cultivation Patterns: Some farmers have shifted their focus to more profitable crops, reducing the overall supply of Robusta coffee.

The Enduring Value of Robusta

Despite the challenges it faces, Robusta Coffee continues to hold significant value. Its resilience, versatility, and unique flavor profile make it a sought-after commodity. As a cornerstone of the global coffee market, Robusta plays a crucial role in meeting consumer demand and supporting the livelihoods of millions of farmers.

Conclusion

The rising prices of Robusta coffee can be attributed to a combination of factors, including increased demand, supply chain disruptions, and climate change. While the future of coffee production faces challenges, Robusta's enduring value and adaptability position it as a resilient force in the global coffee market. By understanding the factors driving price increases and exploring innovative solutions, we can ensure the continued sustainability and enjoyment of this beloved beverage.