COIN Short-term analysis | Trading and expectationsNASDAQ:COIN

🎯 Price appears to have completed wave C of 2, a corrective pattern to the downside, filling the gap left in May 2024. Coin recovered above the daily pivot, but below the daily 200EMA so direction is ambigous.

📈 Daily RSI has printed bullish divergence from oversold, a strong bottoming signal.

👉 Analysis is invalidated below wave C, $220, keeping the downtrend alive.

Safe trading

Coin

The Robinhood vs. Coinbase War is raging. Is the Battle decided?While Robinhood has certainly been faster at launching traditional banking features, Brian Armstrong has explicitly confirmed a pivot for Coinbase to become a "financial super app" (or "everything app") to directly compete in that same space.

As of late 2025 and early 2026, Armstrong has shifted Coinbase’s narrative from being just a "crypto exchange" to becoming a "bank replacement"

The Coinbase "Everything App" Pivot

In his 2026 roadmap and recent interviews, Armstrong outlined a vision that looks very similar to what Robinhood is building, but powered by blockchain rails:

The "Everything Exchange": In December 2025, Coinbase officially launched tokenized stock trading and prediction markets (via Kalshi) within its main app. They also flagged plans for 24/7 perpetual futures on both crypto and stocks for 2026.

Primary Financial Account: Armstrong stated his goal is for Coinbase to be a "bank replacement" where users handle all spending, savings, and investing. This includes an aggressive push for the Coinbase Card and using stablecoins (USDC) for everyday payments.

On-Chain "Super App": Coinbase recently rebranded its wallet as an "everything app," integrating messaging, social networking, and "mini-apps" that run on its Base network. This model is more akin to China’s WeChat than a traditional US brokerage.

Robinhood currently feels like the "Amazon of Finance" because they already offer the full "Prime" experience (credit cards, 3% IRA matches, and gold subscriptions) using traditional rails.

Coinbase’s counter-argument is that traditional rails are "outdated". Armstrong's bet is that by building the same services on Base (their Layer 2 network), they can offer faster, cheaper, 24/7 global services that Robinhood’s traditional banking partners can't match—like instant 200-millisecond transaction "Flashblocks".

What do you think?

XRP Short-term analysis | Trading and expectationsCRYPTOCAP:XRP

🎯Price printed a bullish engulfing 3 white knight candle pattern, reclaiming the daily pivot and heading to test the daily 200EMA. Overcoming this will be very bullish. Wave 1 of 3 appears to be underway locally.

📈 Daily RSI has bearish divergence has been negated with yesterdays pump

👉 Analysis is invalidated below the swing low $1.8, keeping the downtrend alive.

Safe trading

SUI Short-term analysis | Trading and expectationsCRYPTOCAP:SUI

🎯Price printed a 3 white knight bullish engulfing pattern, reclaiming the daily pivot. Wave 3 of a new uptrend appears to be underway with a target of the daily 200EMA followed by $3.1

📈 Daily RSI bearish divergence has been negated

👉 Analysis is invalidated below $1.31, keeping the downtrend alive

Safe trading

SOL Short-term analysis | Trading and expectationsCRYPTOCAP:SOL

🎯Price caught a strong bid moving bullishly above the daily pivot but struggling at the High Volume Node resistance. Wave 1 of a new motif wave appears to be underway with an inital target of the daily 200EMA.

📈 Daily RSI has bearish divergence, price must get above $145 to negate this or face further downside.

👉 Analysis is invalidated below wave C, $110

Safe trading

ONDO Short-term analysis | Trading and expectationsLSE:ONDO

🎯Price printed a 3 white knight bullish engulfing pattern, jumping above the daily pivot and the descending resistance trend-line. Price must get above $0.5 to negate the bearish divergence that has emerged. Wave 1 of a new uptrend appears to be underway.

📈 Daily RSI tapped oversold with bullish divergence, where it caught a bid.

👉 Analysis is invalidated below the swing low, $0.35

Safe trading

HBAR Short-term analysis | Trading and expectationsCRYPTOCAP:HBAR

🎯Price caught a strong bid on bullish divergence, flipping the local structure bullish. However, bearish divergence has emerged at High Volume Node resistance. Price is above the daily pivot, which is bullish, but has a long way to go to reach the daily 200EMA.

📈 Price must get above $0.148 to negate the bearish divergence.

👉Analysis is invalidated below the swing low, keeping wave 2 alive.

Safe trading

DOGE Short-term analysis | Trading and expectationsCRYPTOCAP:DOGE

🎯 Price printed a bullish engulfing 3 white knight candle pattern. It is above the daily pivot, showing a bullish trend is emerging, but still below the daily 200EMA. Overcoming this will be very bullish. The Elliot wave count is tricky, so I will await more confirmation.

📈 Daily RSI has printed bullish divergence. The RSI shot up too hard and fast, which often results in a reversal, potentially testing the daily pivot as support.

👉 Analysis is invalidated below the swing low, keeping the downtrend alive

Safe trading

BNB Short-term analysis | Trading and expectationsCRYPTOCAP:BNB

🎯Price has closed above the daily 200EMA and daily pivot, suggesting a new bull trend has taken hold. If this is wave (3), we should expect a strong breakout in the coming days/weeks towards the all-time high. Wave 4 appears complete, with a textbook ABC correction ending at High Volume Node support.

📈 Daily RSI is currently showing bearish divergence across many altcoins, including BNB. A push above wave (1) will negate this divergence.

👉 Analysis is invalidated below wave (2), daily pivot and 200EMA.

Safe trading

AAVE Short-term analysis | Trading and expectationsCRYPTOCAP:AAVE

🎯 Price printed a bullish engulfing candle from daily RSI bullish divergence and High Volume Node support. It is currently testing the pivot. Overcoming this will add confidence to the bullish move, with a first target of the daily 200EMA and High Volume Node resistance at $220. Overcoming the daily 200EMA will add confluence to a major bottom being in.

📈 Wave (C) of triangle wave (D) appears to be underway. Daily RSI sits at the channel EQ and is crossed bullishly.

👉 Analysis is invalidated if we drop below $148, keeping wave (B) alive.

Safe trading

XRP Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:XRP

🎯 Wave 4 appears to have completed an expanded flat correction defined by the poke above the all-time high. Price found support at the weekly pivot, just above the weekly 200EMA and High Volume Node, keeping trend signals bullish. Wave 5 has a target of the R3 weekly pivot $5.7.

📈 Weekly RSI has printed bullish divergence.

👉 Analysis is invalidated if we fall below $1.5, keeping wave 4 alive.

Safe trading

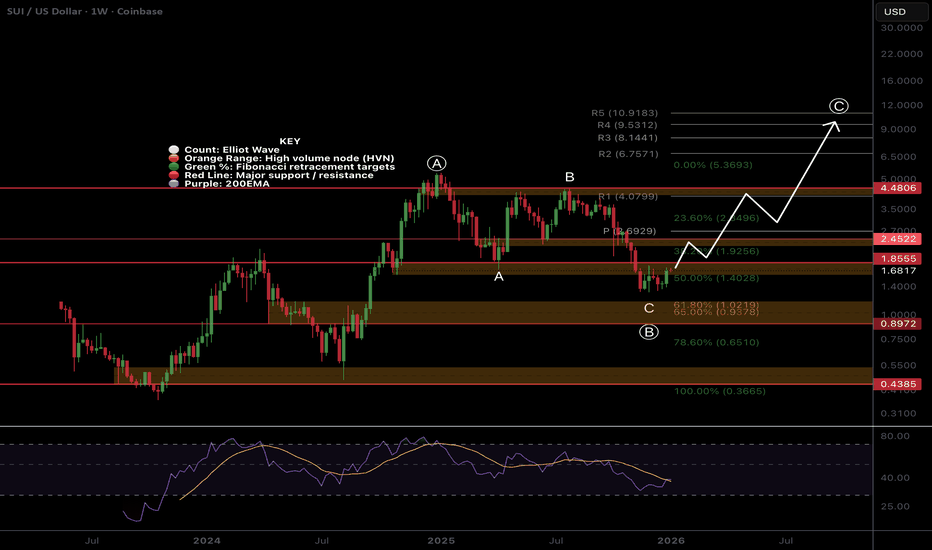

SUI Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:SUI

🎯 Price appears to have completed a shallow wave (B) correction at the S1 weekly pivot and 0.5 Fibonacci retracement. The chart is clean. Wave (C) has a terminal target os the R3 weekly pivot at $10.38 but could also over extend in the right conditions towards the R5, $15.

📈 Price is below the weekly pivot, and there is no 200EMA yet on this young asset. Weekly RSI is ticking bullish near oversold with no divergence.

👉 Analysis is invalidated below wave (B) at $1.3

Safe trading

SOL Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:SOL

🎯 Sol has been holding up significantly well with only a shallow retracement to the 0.382 for wave A of 4. A running flat correction appears complete at the Fibbonaci 0.236, weekly 200EMA and High Volume Node. Wave 5 has a target of the R3 weekly pivot at $462, but I expect this to overextend due to the shallow pullback to the R% pivot at $660.

📈 Price is above the weekly 200EMA, which is bullish, but below the pivot, which is bearish, giving the overall pattern ambiguity. Weekly RSI is bearish with room to fall, but doesn’t often reach oversold.

👉 Analysis is invalidated if price falls below wave A, $90

Safe trading

ONDO Macro analysis | The bigger picture | Long-term holdersLSE:ONDO

🎯 Wave 2 appears complete at the altCoin golden pocket, 0.786 Fibonacci retracement and High Volume Node support. Price is reacting well with a bullish engulfing candle. Wave 3 has an expected target in price discovery os the R£ weekly pivot $4.21, offering a 10x from here.

📈 Weekly RSI hit oversold threshold and ticked up bullishly.

👉 Analysis is invalidated below $0.35

Safe trading

ETH Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:ETH

🎯 Wave (IV) appears to have completed a multiyear running flat with weekly bullish divergence. A new motif wave is underway, completing its wave 1 of 5 with a poke above all time high on weekly bearish divergence. Wave 2 appears complete at the 0.5 Fibonacci retracement and High Volume Node support. Wave 3 has a target of the R4 weekly pivot at $7348. Wave 5 could extend towards $10,000.

📈 The retracement has been shallow compared to other alts. Weekly RSI is flipping bullish from below the EQ while price is about to challenge the weekly pivot. Price is above the weekly 200EMA, keeping the bullish trend in tact.

👉 Analysis is invalidated only if we get below$2634, keeping wave 2 alive.

Safe trading

HBAR Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:HBAR

🎯 Price has printed a textbook ABC for wave 2, now the weekly bullish divergence in the RSI. The bottom may be in with last week’s bullish engulfing candle at the Fibonacci golden pocket, the most likely termination for wave 2. Wave 3 has an expected target of the R3 weekly pivot $0.77.

📈 Price is below the weekly pivot, and there is still no 200EMA so there is still a chance for further downside with a target of the alt-coin golden pocket, 0.786 Fibonacci retracement, S1 pivot and High Volume Node support, $0.75.

👉 Bullish analysis is invalidated below $0.95, keeping wave 2 alive.

Safe trading

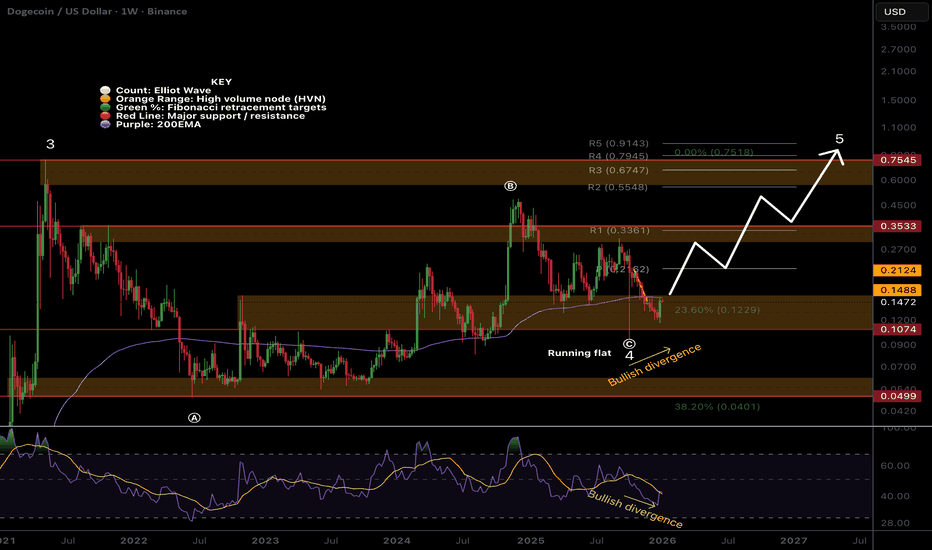

DOGE Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:DOGE

🎯 Uptrend remains intact from the multiyear wave 4 running flat bottom. We could still be in wave 4, as characterised by their long, complex ranges with shallow retracement 0.236 Fibs in this case. The initial upside resistance is the weekly pivot at $0.29, and macro wave 5 has a terminal target off a poke above all-time high at $0.76.

📈 Weekly RSI has printed bullish divergence as price tests the weekly 200EMA. Overcoming this is the first challenge and will add confluence to a bullish move.

👉 Analysis is invalidated below wave 4 and the S1 pivot, $0.0986

Safe trading

BNB Macro analysis | The bigger picture | Long-term holdersCRYPTOCAP:BNB

🎯 Price completed a macro wave 3 with bearish divergence on the RSI. Wave 4 is expected to end at the 0.382 Fibonacci $640, and can not extend below the 0.5 Fib, $506. Crypto assets can overextend in wave 5, which I believe we will see in 2026, with a terminal target of the R5 weekly pivot target, $2000, a psychological milestone where heaving selling may begin.

📈 Wave 4 is still underway, testing the previous all-time High Volume Node, 0.236 Fibonacci retracement, $760. Weekly RSI is at the EQ, where a bottom was found the previous two times and the price returned to an all-time high.

👉 Analysis is only invalidated if price falls below the 0.5 Fib, $506.

Safe trading

AAVE - Macro analysis | The bigger picture | Long-term holdersEURONEXT:AAVE

🎯 I am still looking at this multiyear triangle to break out to the upside with a terminal target of $670, the all-time High Volume Node resistance. Price is rangebound between $440 and $130 and appears to have completed triangle wave (C). Wave (D) is next, with a target of the upper boundary trend-line ~$340.

📈 Price is below the weekly 200EMA and pivot, reflecting the recent bearish trend, but finding support with bullish divergence in the RSI, suggesting a major bottom is forming. Wave (A) found terminal support at the golden pocket Fibonacci retracement.

👉 Analysis is invalidated below wave (A) or wave (B). This asset has been one of the best assets for trading signals in the last 3 years, sticking to the rules strictly.

Safe trading

NEAR - spot, long term.BINANCE:NEARUSDT.P

Throughout 2025, the coin remained within its range.

I consider exiting the range a deviation, and we will get the same deviation on the other side of the range.

Good luck with your trading! Use your risk management strategy.

The ideal entry point will be: $1.4 and $1.25.

The targets on the chart are a minimum of $3.2.

COIN Testing Key Support – Potential Long SetupNASDAQ:COIN (Coinbase) is currently testing a major support zone in the $235–$240 range, which has acted as a strong base in previous pullbacks. This level is attracting renewed interest as the broader crypto market shows signs of upward momentum, with BTC and ETH stabilizing and pushing higher. A bounce from this level could set up a strong risk/reward opportunity.

💡 Trade Idea

🔹 Entry: $235–$240 (support zone)

🔹 Take Profit Zones:

• TP1: $300–$335

• TP2: $375–$415

🔹 Stop Loss: Below $230 (to manage downside risk)

A break below $230 could invalidate this setup, but holding this level opens the door for a potential breakout if crypto strength continues. Watch volume and correlation with BTC closely in the coming sessions.

COIN Breakdown Setup Activated — Sellers in Control!🔥 COIN Bearish Heist 🕵️♂️ | Layered Sell Strategy in Play

📊 Asset Overview

COINBASE GLOBAL, INC. (COIN)

📍 NASDAQ Exchange

📈 Instrument Type: US Stock

⏱️ Trading Style: Swing Trade / Day Trade

COIN is currently showing structural weakness after failing to hold key consolidation levels. Price behavior suggests distribution, not accumulation.

🧠 Technical Analysis Breakdown (Detailed)

🔻 Market Structure

Price formed a symmetrical / contracting triangle

Breakout occurred to the downside, confirming bearish intent

Follow-through shows lower highs + weak rebounds

➡️ This indicates sellers are absorbing liquidity on every bounce.

📐 Moving Average Context

Price broke below clustered moving averages

MAs have shifted from support → resistance

Compression + expansion = volatility release

📉 When moving averages fail together, continuation risk increases.

📊 Momentum & Price Action

Bearish candles with long upper wicks

Failed recovery attempts = supply dominance

No strong bullish displacement after the breakdown

➡️ This favors sell-on-rally, not buy-the-dip behavior.

🎯 Trading Plan — Thief Style (Layering Strategy)

Instead of predicting the exact top, this plan uses multiple limit sell orders to build a position gradually as price reacts into resistance zones.

🕵️♂️ Entry Philosophy:

No single “perfect” entry

Scale in calmly

Let price come to you

🔴 Sell Limit Layer Zones (Example)

256.00

250.00

248.00

240.00

📌 These zones align with:

Prior structure resistance

MA rejection areas

Liquidity grab zones

➡️ You may add or reduce layers based on your execution model.

🛑 Risk Management (Expanded)

Reference Stop Loss:

265.00

This level represents:

Triangle invalidation

Failed bearish structure

Strong bullish reclaim zone

⚠️ Important Note to Thief OGs:

This stop is not mandatory.

You control:

Position sizing

Risk per layer

Partial exits or full invalidation

Trade responsibly and within your system.

🎯 Target Logic (Why 220.00?)

Target Zone: 🎯 220.00

This area is supported by:

Major historical demand

Oversold technical conditions

Correction completion zone

Possible bear trap resolution

💨 Execution Style:

Fast profit-taking

No greed

Exit when liquidity is offered

🚨 Escape quickly before volatility reverses.

🔗 Related Symbols to Watch (Correlation Insight)

Watching correlated assets improves timing and confidence:

BITSTAMP:BTCUSD 🟠

↳ Strong correlation with COIN direction and sentiment

BITSTAMP:ETHUSD 🔵

↳ Confirms crypto market risk appetite

IG:NASDAQ 📊

↳ Tech stocks weakness = pressure on COIN

NASDAQ:MSTR 🧠

↳ High-beta crypto equity, often moves first

📌 If BTC + NASDAQ show weakness, COIN downside probability increases.

🧠 Key Execution Rules

✅ Trade the structure, not emotions

✅ Layer entries, don’t chase

✅ Respect invalidation

✅ Take profits quickly at target

✅ Risk management > prediction

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

📢 Disclaimer:

This is a thief-style trading strategy just for fun.

Educational & entertainment purposes only — not financial advice.

#COIN #Coinbase #NASDAQ #BearishSetup #SwingTrade #DayTrade

#TechnicalAnalysis #LayeredEntry #RiskManagement

#PriceAction #MarketStructure #TradingView

BTCUSD SELL SETUPPOSSIBLE SELL SETUP BTCUSD

SL ABOVE SUPPLY ZONE

TP 1 BELOW DEMAND ZONE

TP 2 OPEN USE PROPER RISK MANAGEMENT

FOLLOW YOUR TRADING PLAN !!!!

SIMPLE BTCUSD TRADING PLAN

1️⃣ Timeframe

15m or 1H only

2️⃣ Indicators

200 EMA → trend

50 EMA → entry

RSI (14) → confirmation

3️⃣ BUY RULES

✅ Price above 200 EMA

✅ Pullback to 50 EMA

✅ RSI above 50

✅ Bullish candle

➡️ Then BUY

4️⃣ SELL RULES

✅ Price below 200 EMA

✅ Pullback to 50 EMA

✅ RSI below 50

✅ Bearish candle

➡️ Then SELL

5️⃣ Risk Rules

Risk 1% per trade

Always use Stop Loss

Target = 2× Stop Loss (1:2)

6️⃣ Management

At 1:1, move stop to breakeven

Do nothing else

7️⃣ Golden Rules

❌ No stop loss = no trade

❌ No emotions

❌ No overtrading

ONE LINE RULE

If all rules aren’t met → NO TRADE