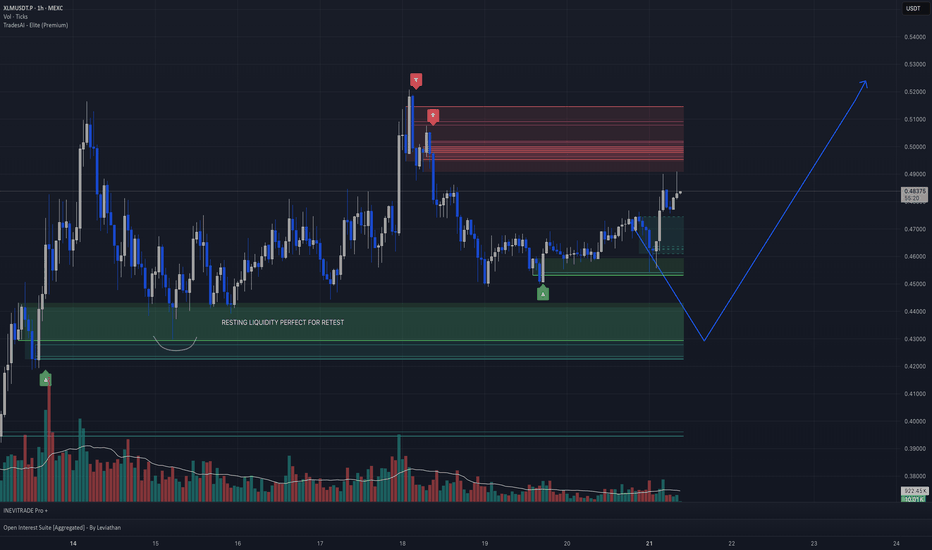

XLM/USDT 1-hour chart analysisHey everyone! Thrilled to present my first TradingView idea! Check out this XLM/USDT 1-hour chart from MEXC. I’ve identified a key “resting liquidity” zone at 0.4100–0.4200, where I expect a retest soon. The price surged from 0.4000 to 0.5200, hit resistance, and is now consolidating around 0.47388. This green zone was a consolidation area before the breakout, and with high volume at the peak dropping during the pullback, it’s a prime dip zone. If it holds, we could see a move back to 0.5200!

Contains IO script

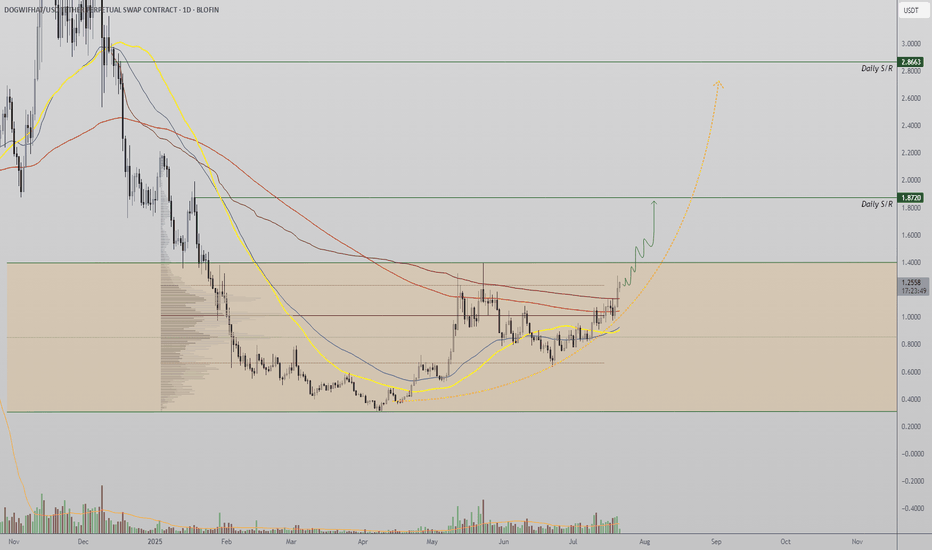

WIF Eyes Bullish Expansion as Range High NearsWIF (W-I-F) is gearing up for a potential parabolic move as it presses against key range high resistance. A confirmed breakout from this level, supported by rising volume, could trigger a bullish expansion first toward the $1.60 mark, with a secondary target of $2.60 in play.

Technically, the asset has reclaimed its 200-day moving average — a strong bullish signal that often precedes trend continuation. However, the current volume profile remains below average. For this breakout to be considered valid and sustainable, it must be accompanied by a noticeable surge in volume.

As long as price breaks above the range high with strong volume support, WIF remains poised for significant upside in the coming weeks and months. The overall structure suggests bullish continuation — but volume confirmation will be the key trigger to watch.

$ELMO – Meme Coin Watchlist Alert VIE:ELMO – Meme Coin Watchlist Alert

(Not the dev / not financial advice – just sharing what I’m seeing)

Elmo has been popping up everywhere lately after going viral on X. Not gonna lie, I think this could be one of the next meme plays to keep an eye on. 🔥

A few reasons I’m watching it:

Total Supply: 294.85M — much lower than typical meme coins that flood the market with trillions. Scarcity matters when hype builds.

If it ever hit $1, that would be a ~$295M market cap — not impossible in meme territory.

Community sentiment is bullish, and it’s gaining holders fast.

Some recent attention due to the alleged X account drama, where Elmo's profile posted wild conspiracy content — added a weird but viral twist to the narrative.

⚠️ I'm not holding a huge bag — just risked a small position to see where this goes. It’s a meme coin, so it’s high risk/high reward. Could do nothing, could moon.

🔎 Just giving a heads up — do your own research if it interests you. I’ll be tracking it for a while.

DYOR

NotFinancialAdvice

Nas Long to clear HH liquidity before correctionHTF Context – Monthly / Weekly / Daily

• Big Beautiful Bill (Trump Tax + Spending Bill)

o Passed July 4th, acting as a stimulus.

o Markets historically rally on fiscal stimulus expectations (tax cuts + spending packages).

o This fuels bullish sentiment short-term, but long-term raises debt, inflation risk, and rate hike concerns.

• Seasonality

o July is typically strong for equities, especially tech, with mid-July often marking local tops before August pullbacks.

• Monthly structure

o Strong bullish monthly candles.

o Next major fib retracements if rejected: 38.2% ~20,398, 50% ~19,625, 61.8% ~18,852.

• Weekly / Daily structure

o HH-HL sequence continues.

o Price in premium zone, approaching major supply block 23,200–23,300.

o Daily BOS not broken downwards yet.

________________________________________

Key Levels

• Major supply / liquidity magnet: 23,200–23,300 (sell-side OB in futures, uncollected liquidity above HH)

• Recent swing high: 22,900

• Daily pivot: 22,470

• Intraday demand zone: 22,450–22,350 (4H wedge base + VWAP)

• Weekly support shelf: 22,100–22,200 (if lost, major trend shift bearish)

________________________________________

My View – Most Likely Path

1. Price is likely to sweep the liquidity above recent highs into the 23,200–23,300 supply zone.

o Why? Market rarely leaves liquidity uncollected. This move traps breakout buyers and hits stops above HHs.

o Big Beautiful Bill fuels the final squeeze higher as algorithms price in fiscal stimulus.

2. After liquidity sweep above 23,200–23,300:

o Expect strong rejection from that zone.

o Institutions offload positions into trapped retail longs.

o Price pulls back towards daily and weekly support zones for reaccumulation.

3. Alternate scenario (less likely)

o Immediate sell-off from current levels without sweeping HH.

o Weak move; would still expect a revisit higher later to clear liquidity before a proper downtrend.

________________________________________

Trade Setups – Intraday & Swing

Intraday Long (Most Likely)

• Bias: Bullish continuation

• Entry Zone: 22,450–22,350 (4H demand + VWAP)

• Trigger: 5m/15m BOS up

• Stop: Below 22,300.

• Targets: First at 22,615, next at 22,845, final at 23,200–23,300.

________________________________________

Intraday Short (Countertrend / Liquidity Sweep Reversal)

• Bias: Short from supply after liquidity grab

• Entry Zone: 23,200–23,300

• Trigger: Sweep of HH with rejection wick or bearish engulfing candle

• Stop: Above 23,350 (structure invalidation).

• Targets: First at 22,845, then 22,600, extend to 22,450 if momentum accelerates.

________________________________________

Swing Long (Continuation)

• Bias: Bullish trend intact

• Entry: After retest of daily pivot (22,470) or 4H demand (22,350–22,450) with 4H CHoCH + BOS up.

• Stop: Below 22,200 (weekly support break invalidates).

• Targets: 22,845 then 23,200–23,300. Blue sky if above.

________________________________________

Swing Short (Only if structure breaks)

• Trigger: Daily close below 22,200

• Bias: Bearish trend shift

• Targets: 21,800 first, then 21,000 major fib cluster and weekly MA.

________________________________________

Summary – My Final Opinion

Price is in a strong uptrend fuelled by fiscal stimulus, rate cuts and tarrif hopes . I think it will sweep the liquidity above 23,200–23,300 before any deeper pullback or trend reversal. Any rejection from that supply zone will be the cue to short for a structural retracement. Until then, I’ll keep buying dips aligned with the HTF bullish structure.

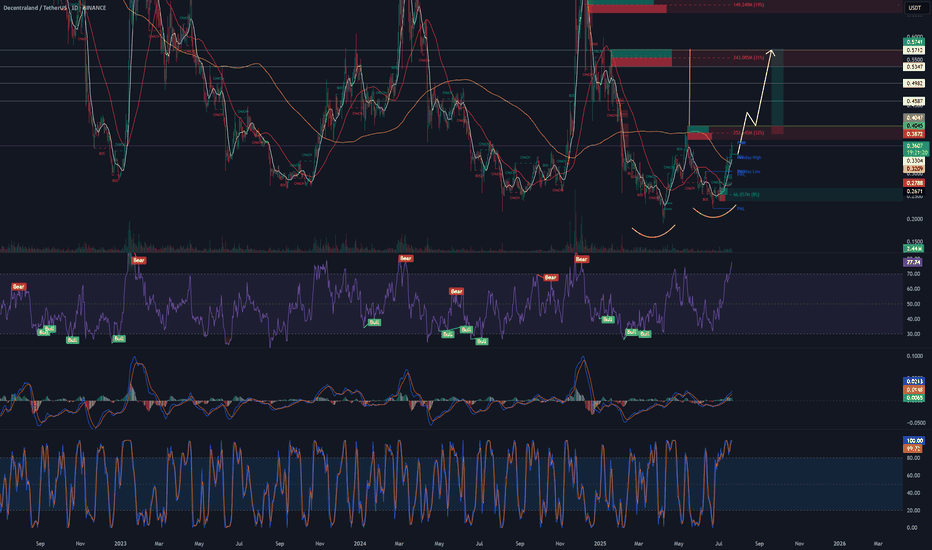

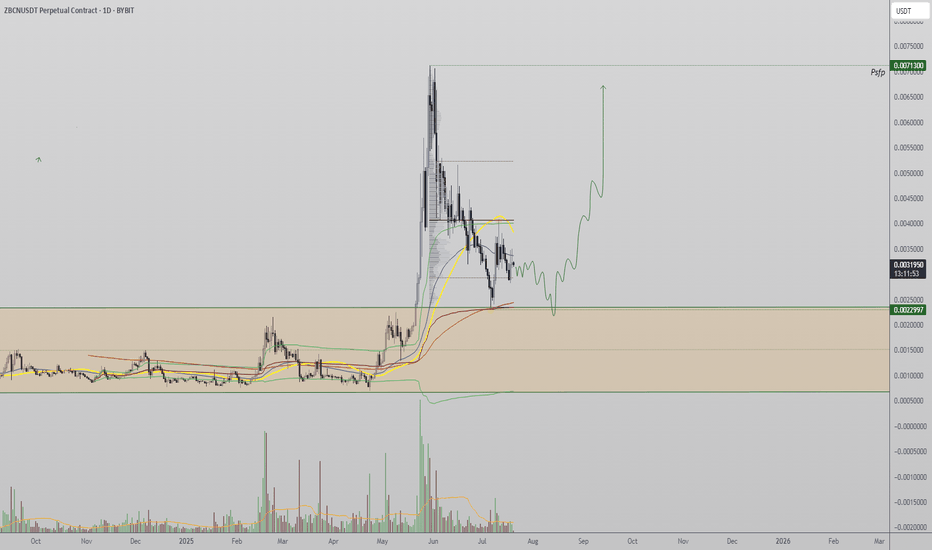

Zebec Retests Range High as Point of Control Caps BreakoukZBCN is trading above its long-term accumulation range, but faces key resistance at the point of control. A volume-backed reclaim could trigger a breakout toward new all-time highs.

Zebec (ZBCN) has pushed above its multi-month accumulation range and is now attempting to solidify a bullish retest of the range high. While this is typically a positive signal for continuation, ZBCN is facing immediate resistance from the point of control (POC) — the region of highest traded volume within the current structure. Until price breaks and reclaims this level, a full bullish breakout remains on hold.

Key Technical Points:

-Trading above long-term accumulation range – Breakout confirmed, but must hold to remain valid

- Point of control acting as resistance – Volume-heavy region currently capping upward momentum

-Retest of range high is critical – Needed to avoid swing failure and confirm bullish structure

From a technical standpoint, the range high — which served as resistance during the accumulation phase — now needs to be flipped into support. A successful retest and reclaim of this level will confirm it as a new demand zone. This would provide the structural foundation for a stronger move upward, especially if it is followed by a breakout through the point of control.

However, if ZBCN fails to reclaim the POC and volume continues to decline, there is a risk of a swing failure pattern (SFP) forming at the range high. This could lead to a temporary breakdown before another attempt to move higher. A sweep of the recent swing low may occur as part of this rotation, but if the market structure holds and buyers return, this could also serve as a bottoming formation and setup for renewed upside momentum.

The broader outlook remains bullish, provided price can stay above the previous accumulation range. But the next key step in the trend progression is a decisive break and hold above the POC with strong volume. If this occurs, it would unlock the potential for a move to new all-time highs, as there is little historical resistance above the current zone.

ZBCN needs to confirm its bullish structure by reclaiming the point of control with volume support. If it can successfully retest the range high and avoid a swing failure, the stage is set for continuation toward price discovery. Until then, short-term volatility around the range high and swing low levels is expected.

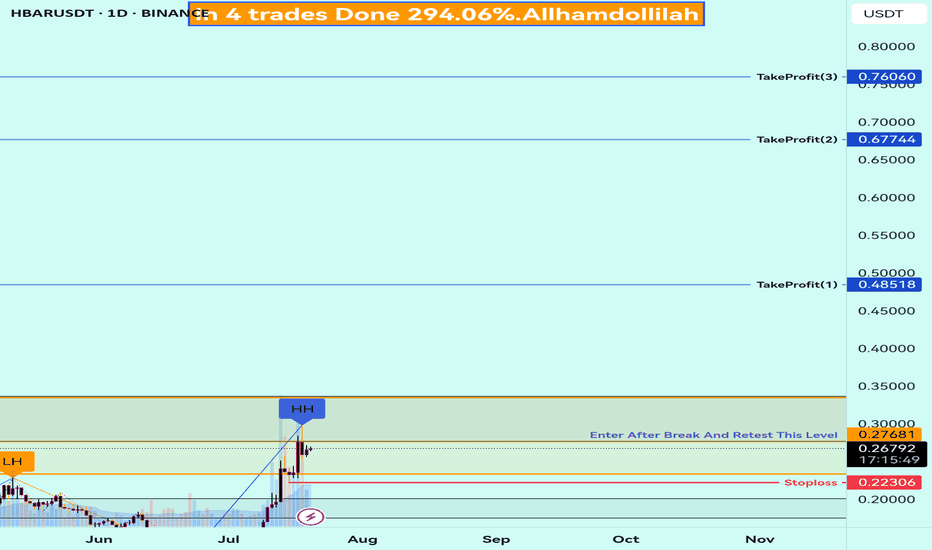

Buy Trade Strategy for HBAR: Backing Enterprise-Grade DLT AdoptiDescription:

This trading idea is centered on HBAR, the native token of Hedera Hashgraph, a next-generation distributed ledger technology (DLT) designed for speed, security, and scalability. Unlike traditional blockchains, HBAR uses a unique hashgraph consensus mechanism, making it exceptionally efficient and suitable for enterprise adoption. Major companies, including Google, IBM, and Boeing, are part of Hedera's Governing Council, which enhances its credibility and long-term sustainability. HBAR is used to power decentralized applications, pay for network services, and secure the network through staking.

As interest in scalable and environmentally friendly DLTs grows, HBAR is well-positioned to benefit from broader institutional and developer adoption. Nevertheless, the crypto market remains highly volatile and is influenced by a variety of external factors such as regulations, market sentiment, and global economic trends. Investing in HBAR requires a balanced risk management approach.

Disclaimer:

This trading idea is provided for educational purposes only and does not constitute financial advice. Cryptocurrencies, including HBAR, involve substantial risks and may result in the loss of your entire investment. Always conduct independent research, consider your financial situation, and seek professional advice before making any investment decisions. Past performance is not indicative of future results.

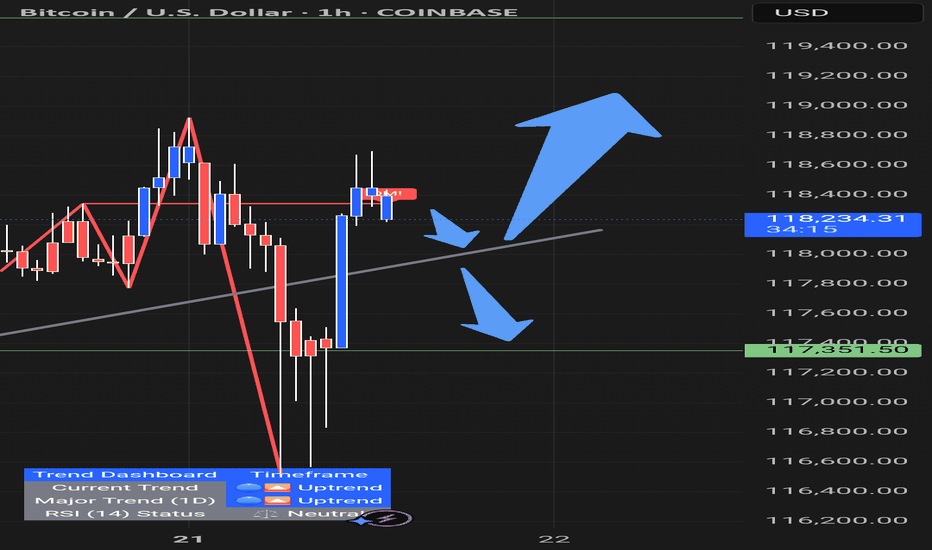

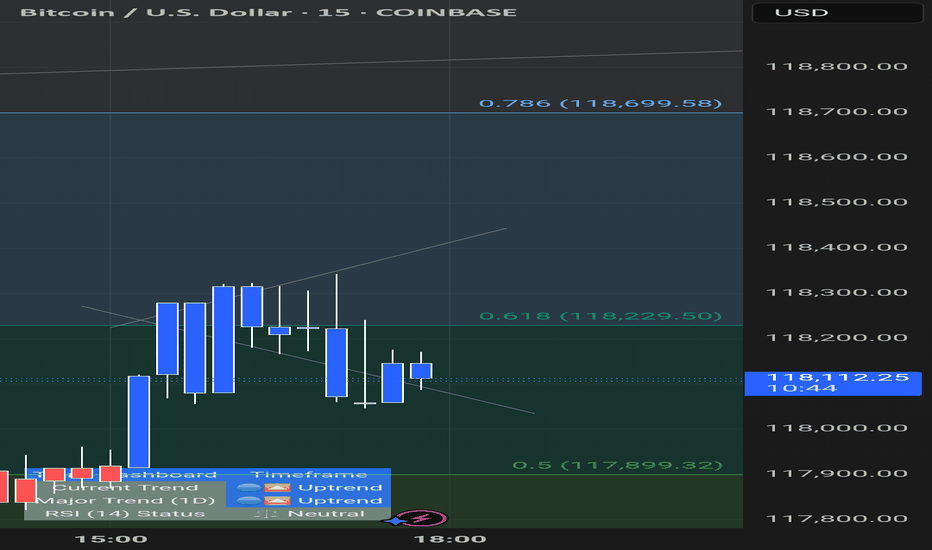

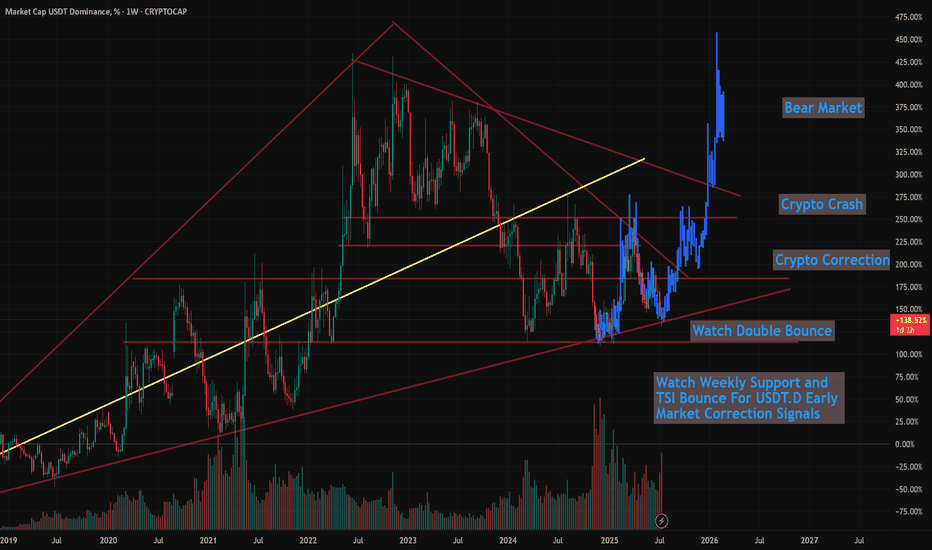

USDT.D Showing Troubling Signs of a Market Top SoonIn this video, I revist the USDT.D study I've talked about a few times before showing that when Tether Dominance comes down to this multi-year trendline support (since 2018), that's typically the beginning of a correction.

It's inversely related for obvious reasons. Money flowing out of Bitcoin and crypto flows into stablecoins (Like Tether), so when one is up and peaking, the other is down and correcting.

This video shows the relationship between both, and how we are likely setting up for a near term correction in the coming weeks.

My best guess is we continue to rally hard into early to mid-August, potentially getting close to $150k, followed by a 20-25% correction into September.

The BIG question is...

Will that mark the top, or will get a 2nd (and maybe 3rd) pump to $200k - $245k as my other models have been showing.

Let me know what you think!

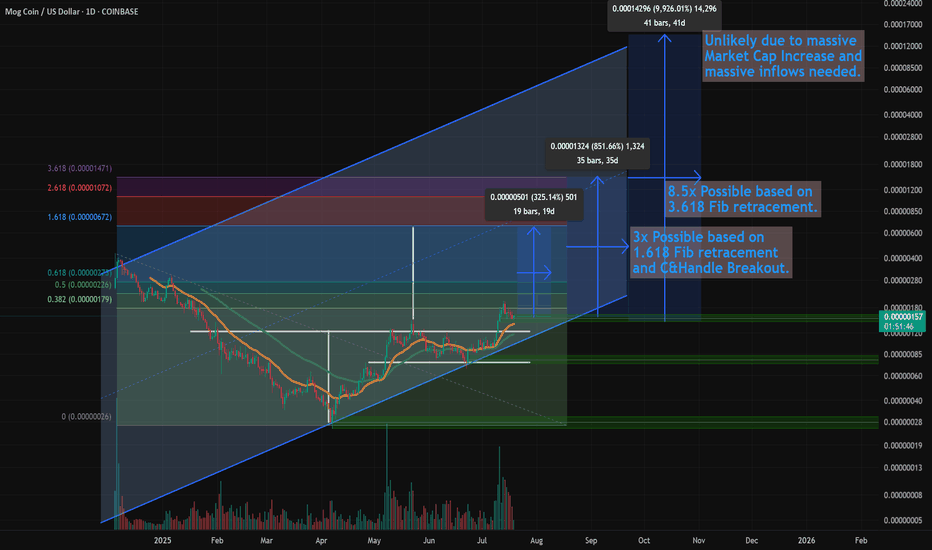

$MOG Setting Up For Cup & Handle Breakout - 10x - 100x TargetsAs I stated in the video, I don't normally cover Meme coins, but this is a great looking chart for MOG and thought I'd do a quick study on this with some potential price targets...

And how I'm using AI to get a better handle on the likelihood of my TA targets.

In short -- 10X here is possible this bull run (8.5x more likely based on the Fib)

But 100X is very unlikely, even though the top of the parallel trend channel shows it's potential.

No surprise there, but watch how using AI can give clarity on this and these decisions.

Let me know what you think...