THE FOUR HORSEMEN OF FINANCE -BTC/SP500/GOLD/COPPERTHE FOUR HORSEMEN OF FINANCE

BTC/SP500/GOLD/COPPER

"THE GREAT SHOWDOWN IN THE FINANCIAL ARENA: WHO WINS?" ⚔️

There are 4 assets on the table: GOLD | COPPER | SPX | BITCOIN

Our technical data screams that history's largest "Great Rotation" has begun. Leave your emotions aside. Let the data speak.

ROUND 1 & 2: THE "BUBBLE" vs THE "OPPORTUNITY"

Traditional markets are saturated. Bitcoin is historically cheap against them.

BTC vs S&P 500: RSI is at 26 (Technical Bankruptcy). Similar to 2015/2019 bottoms.

BTC vs GOLD: RSI is at an ALL TIME LOW (29).

2w chart BTC vs S&P 500

1w chart BTC vs S&P 500

1w BTC vs GOLD

1M BTC vs GOLD

Verdict: Wall Street and Gold are exhausted. Smart money is rotating into the only oversold asset: Bitcoin.

ROUND 3: THE ECONOMIC REALITY

Is Bitcoin expensive against the economy? NO.

BTC/COPPER: Technically oversold against industrial demand.

COPPER/GOLD RATIO: Deep in the danger zone (RSI 22). When this ratio rises from the dead, Bitcoin goes parabolic.

Meaning: We are at the exact pivot point where risk appetite wakes up.

THE VERDICT & THE TRAP

Those in stocks feel "Safe." Those in Bitcoin feel "Tired." This is the trap. The market transfers wealth from the impatient to the patient.

The Scoreboard:

S&P 500: Overvalued ❌

Gold: Saturated ⚠️

Bitcoin: OVERSOLD AGAINST EVERYTHING. ✅

Strategy: Follow the value, not the price. The "Great Rotation" flows to the scarcest asset—because this is exactly what happened in every previous cycle bottom. History is repeating itself.

PSYCHOLOGICAL TRAP

Those currently in stocks or gold feel "Safe." Those holding Bitcoin feel "Tired and Jaded." This is exactly what the market is: A transfer of wealth from the impatient to the patient.

The "Oversold" zones on the charts are "Pain" zones. But the biggest profits are always born from this pain.

STRATEGY

I am not a soothsayer; I am an analyst. The data tells me this: Global liquidity will exit swollen traditional markets (SPX, Gold) and flow into the asset with the highest "Value/Price" mismatch.

That asset, having bottomed out in all ratios, is Bitcoin. This is not investment advice; it is an "Asset Survival" guide.

"The crowd follows price; Professionals follow value." Value is currently at the bottom, while Price has not yet left the station.

Are you ready?

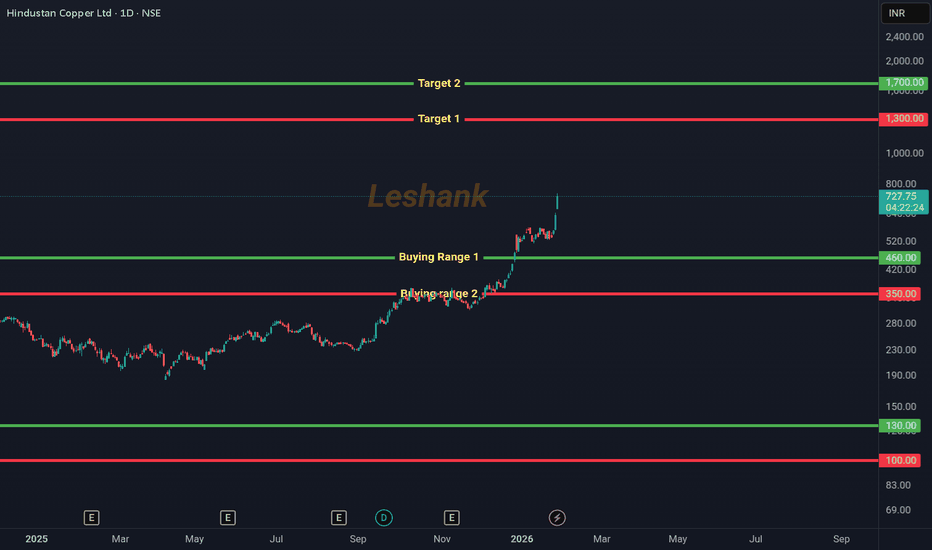

Copper

#XCUUSD COPPER - Price Is In A Clear UptrendCopper is in a clear uptrend (bullish structure).

Price broke above old resistance (green zone = support now) also a previous ATHs, pulled back into it, and is holding higher lows inside an ascending channel.

That support area is a buy-the-dip (long) zone, with upside targets toward ~7.00 if the trend continues. Which is a round number and a strong psychological level that has been acting like a magnet for the price.

Copper: Following Gold and SilverAs the weekly chart indicates, we foresee a pronounced sell-off as part of the green wave , but not before finishing its current run to conclude the magenta wave (Y) and therefore the overreaching green wave around the $7.00 mark.

The then following and before mentioned wave should bring copper down into our green long target zone between $4.56 and $4.06.

Falling towards key support?COPPER is falling towards the support level, which acts as a pullback support aligned with the 38.2% Fibonacci retracement, and could bounce from this level to our take profit.

Entry: 5.8119

Why we like it:

There is a pullback support level that aligns with the 38.2% Fibonacci retracement.

Stop loss: 5.7173

Why we like it:

There is a pullback support level that is slightly above the 78.6% Fibonacci retracement.

Take profit: 5.9634

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

LUN (Canada) - Copper Giant Resetting After A Solid RunLundin Mining has been a powerhouse lately, up roughly 270% since the lows in 2025. Based in Vancouver, this diversified miner produces copper, zinc, gold, and nickel from operations across the globe.

Fundamentally, on Jan 21st 2026 the company just released strong 2025 results, beating their original copper guidance with a record Q4 at their Caserones mine. However, the recent 13% drop seems to be a reaction to their 2026 outlook. While overall production is stable, they flagged lower mining rates at Candelaria for the first half of the year as they bring a mining contract in-house. The market likely used this "softer" start to 2026 as an excuse to take profits after such a massive run. The long-term story remains intact, with production expected to ramp back up in 2027.

Technically, the pullback has been orderly. The stock dropped to the 20-day SMA which has been providing support throughout the run and which is often where institutional support often steps in during strong trends like this one. The RSI has reset from overbought territory but is turning back up, and the price action inside the highlighted circle shows buyers are starting to absorb the selling pressure. Yesterday (Jan 24, 2026) Haywood Securities also raised their price target to $42 from $32 which shows confidence is still there.

Might be worth a watch if it can hold these levels.

..................................................

PLEASE NOTE: Nothing I post is trading advice. All investing involves risk, and past performance doesn’t predict future results. Trends can and do end. For 2026 , my goal is to try and post one new asset each day. Something outside the usual gold, silver, BTC, or big tech names. I like to find stocks worldwide showing steady trends with some good gains, a recent pullback, and signs of renewed strength. I don’t necessarily hold positions in these. They are simply companies I find interesting at the time of posting. I’ll often revisit them within a week to see how they went and share any updates. If you enjoy these posts, please BOOST and FOLLOW ME to discover more under-the-radar stocks and businesses from around the world. ..................................................

Copper – Targets for the Year: 15,760 > 16,600 – 16,800 > 14,800Good day, friends. Today we will try to analyze the current situation in the copper market for this year and identify key targets for the year. Let's start with the news that had the biggest impact:

🔴 Codelco — El Teniente: Tunnel Collapse (July 2025) A tragedy at the world's largest underground copper mine, caused by seismic activity triggered by mining operations. Current Situation:

Partial resumption — 8 underground sectors deemed safe are operational, running at ~75% capacity

Production Losses in 2025: 48,000 tonnes of copper

❌ Exact recovery date not announced. Forecast — no earlier than late 2026.

Codelco — A Chilean state-owned company and the world's largest copper producer. Operates legendary deposits: • El Teniente — the world's largest underground copper mine • Chuquicamata — one of the largest open-pit mines • Radomiro Tomic — high-grade ore Codelco faces challenges: aging assets, declining copper ore grades, and the need for large-scale investments in modernization.

🔴 Freeport-McMoRan — Grasberg: Landslide and Force Majeure (September 2025) A serious incident at one of the world's largest copper mines Force majeure declared on deliveries

Recovery Plan: • Big Gossan and Deep MLZ mines (unaffected) restarted in Q4 2025 • Main mine Grasberg Block Cave — phased restart from Q2 2026 Phase 1 - Q2 2026 - Beginning of phased restart of Grasberg Block Cave Phase 2 - H2 2026 - Reaching 85% capacity Full Recovery - 2027 - 100% capacity

Freeport-McMoRan (FCX) An American company with the world's most profitable copper mine — Grasberg in Indonesia. Key facts:

• Grasberg is also one of the largest gold deposits (gold bulls send their regards) • Largest copper producer in the USA (Morenci mine in Arizona) • Actively developing underground mining at Grasberg

🔴 DR Congo — Copper Mine Collapse (November 2025) This is not a major corporate mine, but the incident highlights the risks of mining in the region. • African Copper Belt — DR Congo and Zambia are attracting major investments

✅ Kamoa-Kakula — Smelter Launch (November 2025) This is the biggest event in the industry. Estimated Smelter Capacity - 500,000 tonnes/year (direct-to-blister) Product - Copper anodes (first melt completed) Production in 2025: 388,838 tonnes of copper in concentrate Forecast for 2026: Sales 20,000 tonnes above production (inventory realization)

p.s. There is no incentive to sell inventory now; better to wait for price growth and sell in Q2 2026 for higher margins.

Ivanhoe Mines and Zijin Mining launched their own 500,000 tonnes/year smelter directly on-site in DR Congo. This allows production of high-purity copper anodes instead of exporting concentrates, significantly increasing margins.

🟡 Escondida and Zaldivar — Strike (January 2026) The world's largest copper mine is experiencing disruptions. Protesters are blocking access roads to the mines. Blockades affect access to Escondida (BHP) and Zaldivar in the La Negra industrial sector, Chile.

📈 Factors Supporting DEMAND

China — Massive investments in renewable energy Target by 2035 - 3,600 GW of solar and wind capacity (new commitment) State Grid Investments - 89 billion USD planned for 2025 — a record level Each GW of solar capacity requires ~2,500-5,000 tonnes of copper . Grid expansion and energy storage require even more. This creates sustainable long-term demand.

USA — Tariff Policy (Section 232) November 1, 2025 - 25% tariff imposed on imports of medium and heavy trucks and parts November 14, 2025 - Framework agreement announced with Switzerland and Liechtenstein (rate reduction) November-December 2025

Impact on copper Tariff uncertainty stimulated frontloading by American importers, temporarily boosting demand.

Electric Vehicles — Continued Growth In 2025, over 18.5 million electric vehicles were sold globally, accounting for ~25% of new sales. Each EV contains 80-100 kg of copper (4 times more than ICE vehicles).

Summary November 2025 became a turning point for the copper market: The combination of factors — China's massive investments in renewable energy, US tariff policy, and multiple disruptions at the world's largest mines — created a powerful bullish impulse that supported prices above 13,000 USD/tonne. Particularly significant is that the three largest producers (El Teniente, Grasberg, Escondida) simultaneously faced problems, which is a rare coincidence that amplified the supply deficit.

Now for the technical analysis. In this forecast, we use Fibonacci extension zones for price and time, projecting onto the industry information and expected events we've gathered. The overall trend is bullish. I assume that the current uncertainty with strikes will last up to 2 months, and we will observe sideways movement for some time while buyers accumulate positions and replenish inventories for subsequent resale, amid growing demand and increasing deficit due to accidents at major facilities.

Next — growing demand (including the new Kamoa-Kakula smelter) will push the price toward 15,760 – 15,800 (which we should reach by May).

Then — relative price stabilization in the range of 15,780 – 16,600 Likely price breakout ~ 16,800

After which , amid news of the restart of Grasberg Block Cave and other damaged mines, as well as news of increased copper production in DR Congo , buyers will take profits , leading to a phased price correction .

As copper production in DR Congo continues to grow:

2025 - ~3,210 thousand tonnes | +0.3%

2026 (forecast) - ~3,404 thousand tonnes | +6%

First correction target: ~ 14,800

Second target: ~ 13 200

What do you think?

With Respect to Everyone, Your #SinnSeed

Macroeconomic Indicator: Gold-Copper SpreadMacroeconomic Indicator: Gold-to-Copper Spread

The Gold-to-Copper Spread (Gold-to-Copper Ratio) is the ratio between the price of gold and the price of copper, expressed by the formula:

Gold–Copper Ratio = Price of Gold / Price of Copper

This indicator shows how much the price of gold exceeds or lags behind the price of copper at a given point in time. It is often used to analyze market sentiment, assess economic stability, and identify investor preferences.

Gold

Gold is traditionally considered a safe-haven asset. Its price generally rises during periods of economic and financial uncertainty, when investors seek to preserve capital and reduce risk.

Additionally, gold may receive support in the following conditions:

weakening of the US dollar

rising inflation expectations

declining real interest rates

increasing geopolitical risks

growing demand from central banks

Copper

Copper is often called “the doctor of the economy” due to its high sensitivity to industrial production and economic growth. The price of copper typically rises during phases of economic expansion, when demand for commodities and risk assets increases.

The spread reflects only the relationship between the two assets and does not account for other factors such as exchange rates, geopolitics, or changes in monetary policy.

Copper may also rise under the following conditions:

supply deficits (strikes, logistical disruptions, declining production)

structural growth in demand (electric vehicles, energy transition, data centers)

monetary stimulus and growth in global liquidity

weakening of the US dollar

speculative phases in commodity markets

stimulus measures from China

Rising Gold/Copper Ratio

Typically signals:

increase in risk-off sentiment

deterioration in economic expectations

growing demand for safe-haven assets

expectations of recession or slowdown

intensification of geopolitical risks

decline in real interest rates

This is usually accompanied by weakness in equity markets, cyclical sectors, and industrial commodities.

Falling Gold/Copper Ratio

Typically indicates:

strengthening of risk-on sentiment

improving expectations for economic growth

growth in industrial activity

capital inflows into risk assets

the beginning or middle of an economic expansion

It often correlates with rising equity indices, industrial metals (in a “healthy” risk-on regime, copper should rise not alone but together with aluminum, nickel, and zinc), oil, industrial ETFs (XLI), equity indices, PMI, macro data, and bond yields.

The Spread Cannot Be Analyzed in Isolation

Key indicators without which this indicator should not be interpreted:

Real rates

DXY (US dollar)

S&P 500, Russell 2000, Industrial ETF (XLI), oil (WTI, Brent), aluminum, zinc, nickel, CRB Index / GSCI

China: real demand or illusion — declining or growing

Geopolitics

All these metrics can be found on TradingView. It is recommended to create a separate watchlist and monitor them there.

The Spread Is Falling

This means copper is stronger than gold. The base hypothesis is that the market is shifting into risk-on mode. We then verify this using other indicators.

1. Real Rates

Real rates are rising - gold is under pressure, the spread falls for a “healthy” reason.

This confirms that the market truly expects economic growth.

Real rates are falling, but the spread is still falling - copper is rising too aggressively.

This is not a macro growth signal, but rather a sign of copper supply deficit or speculative acceleration.

Conclusion:

If the spread falls while real yields are rising, this is a strong, clean risk-on signal.

If it falls while real yields are declining, distortions are already present.

2. DXY (US Dollar)

DXY is falling - supportive for commodities, copper’s strength looks logical.

This confirms a risk-on environment.

DXY is rising, but the spread is still falling - copper is rising despite currency pressure.

This is often a sign of a local copper deficit or an artificial squeeze.

Conclusion:

A falling spread with a weak dollar is a normal macro scenario.

A falling spread with a strong dollar is a reason to be cautious.

3. What Should Happen in Other Markets

If the decline in the spread reflects true risk-on, typically:

S&P 500 is rising

Russell 2000 is rising faster than S&P (increased risk appetite)

Industrial ETF (XLI) is in an uptrend

Oil (WTI, Brent) is strengthening

Aluminum, zinc, and nickel are rising together with copper

CRB / GSCI commodity indices are moving higher

Key point:

Copper should not rise alone. If you see copper rising, equities flat, oil weak, metals not confirming then this is almost always mean that not macro growth, but a local copper story (supply shock, squeeze, speculation).

4. China: Real Demand or Illusion

Copper is almost impossible to interpret without China.

China PMI rising + credit impulse rising + yuan strengthening

copper growth is fundamentally confirmed

a falling spread = healthy risk-on

China PMI falling + weak economy, but copper rising

this is not macro demand

it is either a supply deficit or speculative flows

Conclusion:

If China does not confirm copper’s move, the decline in the spread loses its macro meaning.

The Spread Is Rising

This means gold is stronger than copper. The base hypothesis is that the market is moving into defense (risk-off). But confirmation is still required.

1. Real Rates

Real rates are falling - gold rising is logical.

If equities and commodities weaken at the same time, this is true risk-off.

Real rates are rising, but gold is still rising - the driver is not monetary.

This is usually geopolitics or fear of systemic risks.

Conclusion:

Rising spread with falling real yields = classic macro risk-off.

Rising spread with rising real yields = the market is genuinely afraid.

2. DXY (US Dollar)

DXY is rising - pressure on commodities, support for gold - the rising spread looks logical.

DXY is falling, but the spread is still rising - gold is rising too strongly.

This is most often a sign of fear, geopolitics, or systemic hedging.

Conclusion:

Rising spread with a strong dollar = standard risk-off.

Rising spread with a weak dollar = a warning signal.

3. What Should Happen in Other Markets

If the rise in the spread reflects true risk-off, typically:

S&P 500 weakens or moves into correction

Russell 2000 falls faster than S&P

XLI (industrial sector) is under pressure

Oil weakens

Industrial metals fall

CRB / GSCI move lower

If instead gold is rising, equities are rising, oil is holding, commodities are not falling, then this is not classic risk-off. It means gold is rising for its own reasons (rates, geopolitics, hedging).

4. China (PMI)

Chinese data weakening + copper falling

the rise in the spread is fundamentally confirmed

the market truly expects a slowdown

Chinese data strong, but copper still weak

the issue is not demand, but other markets

the spread signal is distorted

Geopolitics in the Interpretation of the Gold/Copper Ratio and Markets

Geopolitics is a factor that breaks the normal macro logic of markets.

It is not directly linked to the economic cycle, but it sharply changes capital behavior.

If macro indicators reflect “slow” processes (rates, growth, inflation),

then geopolitics represents shock events that trigger fear, defensive positioning, risk aversion, increased demand for liquidity

That is why it is always considered separately from macroeconomics.

How Geopolitics Affects the Gold/Copper Spread

In most cases, geopolitics, strengthens demand for gold, weakly supports copper, therefore pushes the spread higher

But the key point is:

this is not because the economy is deteriorating,

but because investors are hedging against event risk.

That is why a geopolitically driven rise in the spread often is not confirmed by falling equities, is not accompanied by worsening PMI, does not coincide with changes in interest rates

Enjoy!

COPPER Time to turn bearish long-term?It's been more than 4 months (September 03 2025, see chart below) since we had a look at Copper (HG1!), giving a strong buy signal right at the bottom of the 4.5-year Rising Wedge, which went straight to our 6.000 Target:

By doing so, the price hit the top of this pattern and for practically the last 3 weeks, it's been trading sideways, getting rejected twice on that Higher Highs trend-line, unable to close a 1W candle above.

As a result, we treat this as a Sell Signal, given also the fact that the 1W RSI is getting rejected just below the 70.00 (overbought) Resistance, where we got the last 2 Sell Signals on the July 21 2025 and March 24 2025 Highs.

All Bearish Legs on this Rising Wedge have pulled back to at least their respective 0.618 Fibonacci retracement levels, making contact with the 1W MA100 (green trend-line). As a result, our Target is at 5.000, marginally above the 0.618 Fib level.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Gold, Silver, Copper Futures Positionings ComparedUsing the latest weekly Commitment of Traders (COT) data, I look at how futures traders are positioned in gold, silver and copper. Together, they tell three very different stories — one that looks undervalued, another that appears overextended, and a third that makes me nervous.

MS.

XAUUSD: closing the gap🛠 Technical Analysis: On the H4 chart, Gold (XAUUSD) printed a sharp impulse and a visible gap, and price is now hovering around the gap area near 4,660—a zone that often invites mean-reversion. While the broader structure still shows a prior bullish trend, the current setup favors a corrective sell if the gap area is rejected and momentum rolls over. The first bearish confirmation would be weakness back below the local pivot and a slide toward the SMA50 region, with the main objective at the next major support. The projected downside target is the marked support at 4,352.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell near the gap area (approx. 4,600 – 4,640)

🎯 Take Profit: 4,352.24

🔴 Stop Loss: 4,778.56

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Supreme Court tariff decision risk: What to track this week With a potential decision due this week, Treasury Secretary Scott Bessent said it is “very unlikely” the Supreme Court will overturn President Donald Trump’s power to impose tariffs, warning that the Court “does not want to create chaos.”

Assets to watch ahead of the decision

US dollar index

Moves with trade expectations and inflation risk.

US Treasury yields

Particularly the 2 year and 10 year, as uncertainty feeds into growth and inflation assumptions.

US equities

S&P500 and NASDAQ100 for broad risk sentiment, especially trade-exposed sectors.

Chinese equities and yuan

Directly tied to tariff headlines and trade risk.

Commodities

Copper for growth signals, oil for broader risk tone.

Gold

Often the first hedge if uncertainty rises.

Copper reach new highAs we enter 2026, the copper market is undergoing a structural transformation driven by a collision of geopolitical trade shifts and the accelerating green energy transition. The historic price peaks seen in late 2025 were a direct result of "inventory migration," where massive amounts of physical metal moved into the U.S. to preempt 2027 tariffs. This has left global LME stocks dangerously depleted while demand from renewable energy and EV sectors continues to grow at a projected 7–10% annually.

Beyond traditional green tech, the rapid expansion of AI-driven data centers has emerged as a critical new pillar of consumption. These high-intensity sectors are placing unprecedented pressure on a supply chain already burdened by a decade-long exploration drought and declining ore grades in major producing regions, such as Chile. With a projected deficit of nearly 600,000 tonnes for 2026, the market is facing a chronic shortage that cannot be quickly resolved.

The primary challenge for the coming years is the significant lead time required for new production. It takes nearly 15 years to bring a new mine online, meaning the current supply gap is essentially locked in for the foreseeable future. Consequently, we anticipate a sustained era of elevated pricing, where the strategic focus for industrial consumers will shift from managing price volatility to securing physical supply in an increasingly scarce global market.

Technical view:

XCUUSD briefly tested the previous record high and pulled back, trending upward with the expanding EMAs and strong momentum. Prices are traded between EMAs, indicating that they may consolidate in the short term.

If XCUUSD breaches the last swing high, the price can reach the Fibonacci 227.2% at 6.4370.

By Van Ha Trinh - Financial Market Strategist at Exness

XAUUSD: corrective setup🛠 Technical Analysis: On the H4 chart, Gold is showing a potential corrective setup after the recent swing high area. Price is hovering near the 4,560–4,580 zone, and a confirmed breakdown would signal that sellers are taking control. The SMA cluster (50/100) remains below price, but the downside scenario targets the next key demand area around 4,351, where structure support aligns with the broader trend support. If bearish momentum accelerates, the next major support zone near 3,900 becomes the medium-term objective.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed breakout of 4,560

🎯 Take Profit: 4,351.15 (main target), extended target near 3,900

🔴 Stop Loss: Approx. 4,688.57

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Copper Map: Price Could Hit $8 Then $10 On Projected Deficit Huge impulse is underway on Copper Futures quarterly chart

The metal price was under pressure since Great Financial Crisis

as you can see it was in huge Triangular consolidation from 2008 till 2020

The metal rose from the ashes in 2020 breaking out of Triangle

It hit the record high $5 mark in 2022 as I labeled it as wave 1 in projected

5 wave sequence

Wave 2 was textbook perfect as it retraced the first wave by 61.8% exactly (Fibonacci ratio)

Wave 3 has been confirmed since the price overcame the peak of wave 1 beyond $5

It can hit 1.618x of wave 1 from the bottom of wave 2 at $8.1

Waves 4 and 5 are not calculated as we should wait to see how wave 3 unfolds

This map aligns with the projection of deficit of Copper by 2030

XAGUSD: $70 support breakdown setup🛠 Technical Analysis: On the 4-hour chart, silver (XAGUSD) is reversing from its recent peak and attempting to advance toward a key support zone near 70.0. The SMA50 is currently acting as support. The chart suggests a more reliable selling opportunity will only arise after a confirmed break below 70.0, which would signal a continuation of the bearish trend. In this case, the next bearish magnet would be the noted support at 64.515 (near the SMA200).

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed breakdown below 70.0 (approx. 69.887 – 70.00)

🎯 Take Profit: 64.515

🔴 Stop Loss: 75.276

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

Venezuela: The "Blue Gold" Heist (It’s Not Just Oil)If you rode the Western Digital ( NASDAQ:WDC ) trade with me, you saw what happens when the market realizes AI needs Space. We caught the bottom on WDC because the infrastructure trade was obvious. (See related idea: The Vault of the AI Era)

But the "Supercycle" doesn't stop at Storage. It goes deeper. From Bytes (Software) ➡️ to Atoms (Raw Materials).

1. The "Blue Gold" Thesis 🇺🇸🇻🇪 Everyone is debating the oil politics of the US & Venezuela. They are missing the Tech Angle. Venezuela sits on the Orinoco Mining Arc, home to massive reserves of Coltan ("Blue Gold") and Rare Earths.

The Reality Check: You cannot build an NVDA GPU, a WDC hard drive, or a TSLA robot without these minerals. Coltan is the "blood" of the electronics industry.

The Pivot: The US "Reconstruction" effort isn't just charity. It is a strategic move to secure the physical supply chain of the AI era. They are breaking the monopoly on critical tech inputs.

2. The "Hard Asset" Rotation 🔄 Smart Money is rotating from "Overvalued Tech" to "Undervalued Resources."

Silver ( NASDAQ:XAG ): The ultimate "Hybrid." It wins twice—once on inflation (Venezuela spending), and again on the massive industrial demand for the AI grid. (See my "Curse Broken" analysis)

Gold ( TVC:XAU ): The Liquidity Sponge. If they print money to rebuild, Gold goes up. Simple math.

3. The Chart: The REMX Breakout 📉 I marked up the Weekly Chart of the Rare Earth ETF ( AMEX:REMX ) because the geometry is too clean to ignore.

The Wedge: We just broke out of a multi-year Falling Wedge (Blue Channel). In my experience, this is the "Terminator" of bear markets.

The Floor: We are bouncing perfectly off the Green Support Zone ($50-$60). The "Peak Fear" is in.

The Trade: While Tech is at All-Time Highs, the inputs for Tech are at multi-year lows. That is the opportunity.

REMX 1D:

👇 The "Physical AI" Watchlist: We are playing the Supply Chain, not the noise.

The Brains: NASDAQ:NVDA (Compute)

The Vault: NASDAQ:WDC (Storage Infrastructure)

The Atoms: AMEX:REMX , NYSE:MP (Rare Earths)

The Hedge: TVC:SILVER , TVC:GOLD , $

The Question: We all own the Chips ( NASDAQ:NVDA ). But be honest—do you own a single ounce of what the chips are actually made of?

Disclaimer: Just sharing my read on the macro supply chain. Not financial advice.

XAUUSD: short-term opportunities🛠 Technical Analysis: On the H4 chart, Gold (XAUUSD) remains in a broader uptrend, but the latest swing shows a rejection from the rising resistance line, followed by a sharp pullback and consolidation. Price is now rotating back toward the key horizontal support zone around 4,350–4,365, where another test could trigger a bearish continuation move. The SMA50 and SMA100 are acting as dynamic “decision” levels, while the SMA200 aligns closely with the first downside objective. A confirmed breakdown below the 4,350 area opens the path toward 4,246.67, with the marked medium-term support area near 3,900 as an extended target.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed breakdown 4,350–4,365 support zone (approx. 4,365.78)

🎯 Take Profit: 4,246.67 (the first target), medium-term extension toward the support area near 3,900

🔴 Stop Loss: 4,484.90

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

COPPER - The Metal No One Is Talking About… YetCopper just did something important, it broke above its previous all-time high. That alone puts it back on the radar from a macro perspective.

Structurally, the trend is clearly bullish. Price is respecting the rising trendline, and what we are seeing now is a normal post-breakout reaction, not weakness.

The plan from here is simple: 👇

i will be watching the intersection of the rising trendline and the prior structure zone. That confluence is where risk becomes defined and where trend-following longs make the most sense.

As long as price holds above structure and respects the trendline, the bullish thesis remains intact.

📊 Always follow your trading plan regarding entry, risk management, and trade management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

Vedanta - My Stock Pick for 2026Starting the year at ATH. Coming out of 15 year period of consolidation.

Look for dips till 530 to enter.

Target: 765 / 1200

Support: 530 / 495 / 360

Below 495 exit temporarily and buyback on reversal above 530.

Disclaimer: I have entered the trade around 606. Looking for dips to build on position.

XAUUSD: bullish exhaustion🛠 Technical Analysis: On the 4-hour (H4) timeframe, Gold (XAUUSD) has encountered significant selling pressure after testing the major psychological and technical resistance zone between 4,520 and 4,550. While the pair previously maintained a "Global bullish signal" throughout December, the current price action indicates a structural shift.

The price has decisively broken below the steep diagonal resistance line that guided the recent impulse move higher. Currently, Gold is trading at 4,370, struggling to hold above its immediate support level. Further price pressure on support will lead to a breakout, a scenario that should be expected after the New Year holidays.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on breakdown of current support (approx. 4,336.58)

🎯 Take Profit: 4224.40 (Support)

🔴 Stop Loss: 4,411.82

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

COPPER IS PRIMED AND READYSo this decade precious metals have finally shown volatility. Gold and Silver have been a highlight especially with the past Administration boasting EV, GREEN-NEW DEAL, and now with AI; Precious metals are showing that people as of right now prefer a physical safe haven asset rather than “code” like cryptocurrency. Even now with the Trump administration, space exploration and the ongoing need and increasing demand for more precious metals is obviously making these assets worth looking at BUT one metal that stands out the most but no one is talking about, is COPPER (CU)!

COPPER is by far primed and ready to show what its really made of. Often overlooked, with pennies being disclosed as being “worthless,” it takes more to produce 1 penny than what its actual value is, with only 2-4% of modern day pennies being made of Copper (CU) and 96%+ being zinc and other over supplied metals. Why?

By 2026 the US Government will stop printing pennies, and any 1 cents transactions will now be rounded to the nearest Nickel.

Gold and Silver showed similar chart patterns, and experienced almost the same innovations that lead to its increase demand thus leading to price being bullish as well. One thing that leads me to believe COPPER IS VERY UNDERVALUED is the FACT that silver mining and gold mining can be done by basically any individual with an increased appetite to fund a business venture of 1mil+, and in this day and age thats more common than you think. But copper mining takes at least 10times more money, and it takes at least 15 years to get a Copper Mine up and ready before you start to dig your first ore. With that being said, and the fact that most copper mines if not all of them up to unow, are starting to show depletion…. its TIME.

Technical analysis is easy here, basic trend and resistance/support and price action on the monthly outlook. This asset will be like when your daddy or great granddaddy bought gold cheap!