BTCUSDTHello Traders! 👋

What are your thoughts on BITCOIN?

Following its recent sell-off, Bitcoin entered a corrective phase and managed to rally up to the $98,000 area, where it faced strong selling pressure and got rejected. After this rejection, price broke below its ascending trendline and is now trading beneath it, signaling a weakening bullish structure.

Key Resistance Zone:

The $92,000 – $93,000 area acts as a major resistance and is currently capping price action. As long as Bitcoin remains below this zone, the bearish scenario remains favored.

Key Support Zone:

The $84,000 level stands as an important support. A clear break and daily close below this area could open the door for a deeper decline toward the $75,000 zone.

Expected Scenario:

Price is likely to consolidate and complete a pullback toward the broken structure before continuing lower. If the support zone fails, increased selling pressure could push Bitcoin toward the lower target levels.

What’s your take? Will the $84k support hold, or are we heading straight to $75k? Drop your thoughts in the comments below!

Don’t forget to like and share your thoughts in the comments! ❤️

Crypto

BTCUSDT Fake Breakdown Sparks Bounce from DemandHello traders! Here’s my technical outlook on BTCUSDT (1H) based on the current chart structure. Bitcoin initially traded within a clearly defined range, where price moved sideways, indicating temporary balance and accumulation before the next directional move. This range eventually resolved to the upside, triggering a strong bullish impulse that pushed price sharply higher. However, this breakout failed to sustain, and BTC quickly turned around from the highs, signaling exhaustion of buyers and the start of a corrective phase. After the rejection, price transitioned into a well-defined descending channel, where it consistently respected the falling resistance line and internal support, forming a sequence of lower highs and lower lows. This structure clearly confirmed short-term bearish control. Currently, BTC is holding above the reclaimed support and stabilizing after the fake breakdown, indicating acceptance above the Buyer Zone. This behavior often precedes a corrective recovery rather than an immediate trend reversal. From a structural perspective, the area around 84,700 acts as the next Resistance / Seller Zone, which aligns with previous support turned resistance and represents a logical upside target. My scenario: as long as BTCUSDT holds above the Buyer Zone around 82,000 and continues to respect this reclaimed support, a corrective move toward the 84,700 resistance area (TP1) remains likely. This would represent a healthy pullback recovery within a broader bearish structure. However, a strong rejection from resistance could resume downside pressure, while a decisive breakdown back below the Buyer Zone would invalidate the recovery scenario and signal continuation of the downtrend. For now, price is at a key reaction zone, with buyers attempting to confirm the fake breakout and extend the rebound. Please share this idea with your friends and click Boost 🚀

SOL/USDT | Slowly going back up (READ THE CAPTION)By examining the daily chart of SOLUSDT we can see that after dropping as low as 112.14 and touching the high of the Bullish OB, it bounced back up and its currently being at 116.00.

Considering that Solana has swept the liquidity pool, I expect it to slowly move higher.

Targets for Solana: 116.50, 117.00, 117.50, 118.00, 119.00 and 120.

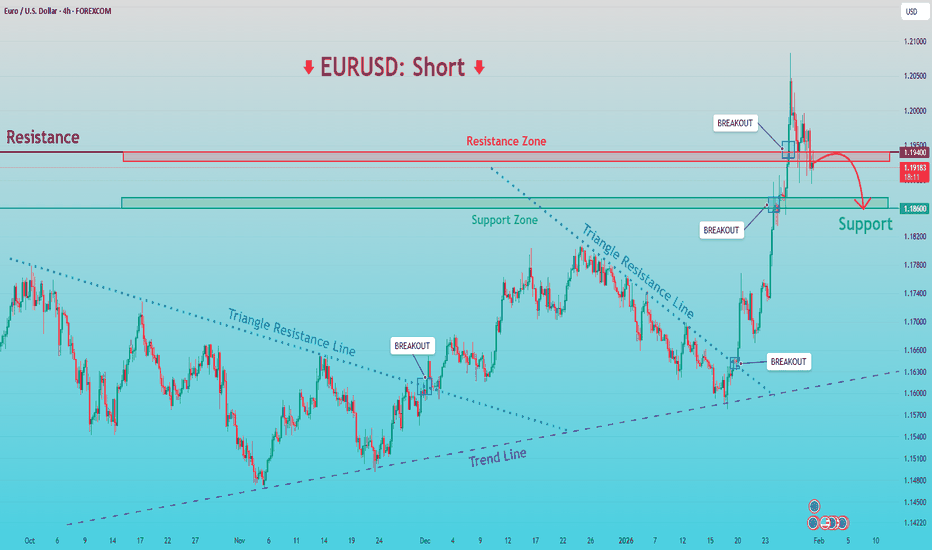

EURUSD: Rally Stalls at Resistance - Correction To 1.1860Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD has recently transitioned from a prolonged consolidation into a strong impulsive bullish move. After respecting a rising trend line and repeatedly breaking above the descending triangle resistance, price showed increasing bullish momentum, confirming a structural shift to the upside. This breakout led to a sharp rally, pushing EURUSD into the higher price area and directly into a clearly defined Resistance Zone around 1.1940–1.1950. At this resistance, price behavior has changed noticeably. After the initial breakout above the zone, EURUSD failed to sustain acceptance at higher levels and printed signs of exhaustion, including a false breakout and rejection wicks. This suggests that buyers may be losing control near this key resistance, while sellers are beginning to step in.

Currently, price action shows hesitation and consolidation below the resistance, indicating a potential distribution phase rather than continued impulsive strength. Below the current price, the Support Zone around 1.1860 stands out as a critical area. This zone previously acted as resistance and was later flipped into support during the bullish breakout, making it a key level for short-term structure. A pullback toward this support would align with a healthy corrective move within the broader context. Overall, while the higher-timeframe trend recently turned bullish, the market is now reacting at a major resistance level, and the structure suggests that the current move may be corrective rather than a continuation breakout.

My Scenario & Strategy

My primary scenario favors a short setup as long as EURUSD remains below or shows clear rejection from the 1.1940–1.1950 Resistance Zone. A confirmed rejection from this area could trigger a corrective move back toward the 1.1860 Support Zone, where buyers may attempt to re-enter. If selling pressure accelerates, a deeper pullback toward the rising trend line could follow.

However, if price achieves a clean breakout and strong acceptance above 1.1950, this would invalidate the short bias and open the door for further bullish continuation. For now, EURUSD is at a key decision point, and patience is required to see whether sellers can defend resistance or buyers regain control above it.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

TON/USDT | Going through the Bullish OB! (READ THE CAPTION)In the 4H chart of TONUSDT we can see that after a primary reaction to the Bullish Breaker, it went further down, playing with the Bullish OB for a short while and then go even lower, reaching 1.410. It is currently being traded at 1.420.

I expect TON to retest the bullish OB, the targets for it and if it goes through the Bullish OB are: 1.440, 1.455, 1.470 and 1.485.

If it fails: 1.410, 1.395, 1.380 and 1.365.

DOGE/USDT | Doge goes lower! (READ THE CAPTION)After October 10th, DogeUSDT has been just going lower and lower and lower! As you can see, it reacted to the Bullish OB several times, but returned to it each time like a magnet. It is currently being traded at 0.11160, and I don't see any indication of a bullish run for the time being.

Targets for DogeUSDT: 0.11050, 0.10900, 0.10750 and 0.10600.

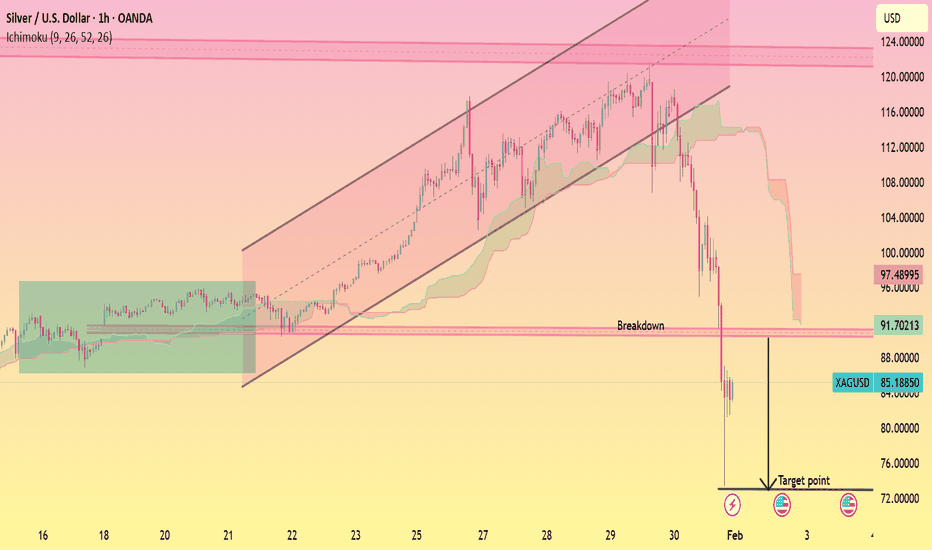

XAGUSD Channel Breakdown

This is a 1-hour XAGUSD (Silver/USD) chart. Price was moving in a clear ascending channel with Ichimoku support, then broke down below the channel and key support zone. After the breakdown, strong bearish momentum appeared, indicating a trend reversal from bullish to bearish, with downside continuation toward the marked lower target area.

EURUSD Short: Fake Breakout at Supply, Pullback to 1.1850Hello traders! Here’s a clear technical breakdown of EURUSD (4H) based on the current chart structure. EURUSD initially traded within a well-defined ascending channel, confirming a strong bullish environment with consistent higher highs and higher lows. This phase reflected clear buyer control and healthy trend continuation. After reaching the upper boundary of the ascending channel, price lost momentum and transitioned into a descending corrective channel, signaling a temporary pullback rather than a full trend reversal. The corrective move remained orderly, with price respecting the descending structure and gradually compressing toward the lower boundary. At the lower edge of the descending channel, EURUSD formed a clear pivot point, where seller pressure weakened and buyers stepped back in aggressively. This led to a bullish breakout from the descending channel, confirming the end of the corrective phase. Following the breakout, price accelerated sharply higher, impulsively breaking above the key Demand Zone around 1.1850, which previously acted as resistance. This clean structure flip confirmed strong buyer commitment and renewed bullish momentum.

Currently, price then surged directly into the higher-timeframe Supply Zone around 1.2000–1.2050, where a fake breakout occurred. The rejection from this area suggests that sellers are active at the highs and that the market may be temporarily overextended after the strong impulse. Such behavior often leads to a corrective retracement rather than immediate continuation.

My primary scenario is a corrective pullback from the supply zone toward the 1.1850 Demand Zone (TP1). This level represents former resistance turned support and is a key area where buyers previously entered aggressively. As long as EURUSD holds above this demand zone, the broader bullish structure remains intact, and any pullback should be viewed as corrective within an overall uptrend. A strong bullish reaction and stabilization from the demand area could open the door for another attempt higher toward the supply zone and potentially new highs. However, a decisive breakdown and acceptance below the 1.1850 demand zone would weaken the bullish bias and increase the probability of a deeper correction. For now, the market favors buyers, with the current move best interpreted as a pullback after a strong impulsive rally. Manage your risk!

SOL Breakdown in Bearish ChannelThis 2-hour SOL/USD chart with Ichimoku Cloud shows a sustained downtrend inside a descending channel. After topping near the upper resistance, price rolled over, lost cloud support, and formed a bearish consolidation before breaking lower. SOL continues to trade below key resistance around 128–130, with the cloud acting as overhead pressure. The projected downside target sits near 104, signaling bearish continuation unless price reclaims the channel and cloud.

ETH Breaks Support, Bearish Continuation

This is a 1-hour ETH/USD chart with Ichimoku Cloud. Price first moved sideways in a defined range, then rallied into a clear resistance zone near the top. After rejection, ETH broke down below key support and the Ichimoku cloud, confirming a bearish shift. Price is now trending lower with weak momentum, and the chart projects a downside target around 2,550, suggesting continuation of the bearish move unless price reclaims the broken level.

BTCUSDT: Reacts to Key Support - Corrective Bounce To $82,200Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT was previously trading within a well-defined upward channel, where price respected both the rising support and resistance boundaries, printing higher highs and higher lows. This structure clearly confirmed bullish control and healthy trend continuation. However, as price approached the upper region of the channel, bullish momentum began to weaken. After several failed attempts to sustain higher prices, BTC broke below the channel support, signaling the first sign of structural weakness.

Currently, price is stabilizing above the Support Zone and attempting to recover toward the 82,200 Resistance Zone, which now acts as a critical level. This area aligns with previous support turned resistance and represents a key decision point for the market. The overall structure suggests that the current move is a corrective rebound within a broader bearish impulse rather than a full trend reversal at this stage.

My Scenario & Strategy

My primary scenario favors a corrective long setup as long as BTCUSDT holds above the 77,800–78,200 Support Zone and continues to reject lower prices. A sustained hold above this demand area could allow price to recover toward the 82,200 Resistance Zone as a first upside target (TP1). This move would represent a technical retracement after the sharp sell-off.

However, strong rejection from the 82,200 resistance would likely confirm that sellers remain in control, potentially leading to another bearish continuation. A decisive breakdown and acceptance below the Support Zone would invalidate the long scenario and open the door for further downside expansion. For now, BTC is at a key reaction area, and confirmation from price behavior near resistance will be crucial.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

Bitcoin Breakdown From Range, Targeting Lower SupportThis is a 2-hour BTC/USD chart showing a clear **downtrend within a descending channel**. Price previously **ranged sideways** (marked “Range”), then **broke down sharply**, losing range support. The **Ichimoku cloud is bearish**, acting as resistance above price. After the breakdown, price formed a **bearish Fair Value Gap (FVG)** overhead and is consolidating below it. The chart highlights a **projected downside move toward the ~72,000 area**, aligning with the lower channel support as the target zone.

Crypto May Be In Trouble!Trading Fam,

I feel dirty for posting these recent titles. They are not intended to be clickbait. I swear. I am only relaying to you what I am seeing in the charts. I never really gain popularity by becoming bearish on crypto anyways. Degens still heart the moonboys. I am not one.

Now, to put it simply, Bitcoin has a 15 percent chance to negate the very ominous H&S pattern I am seeing in the charts. Should it take that 15 percent path, what I am about to say becomes null and void.

If Bitcoin follows the highest probability path here and this H&S pattern plays out (85 percent chance), then you can see the target I have drawn to the downside ...somewhere between 40-50k is my rough estimate. Ouch! This represents up to a 50 percent drop from current price.

Surprisingly, altcoins appear to be able to fair better. The target I have drawn for the Total3 chart represents a 25-30 percent loss.

Both Bitcoin and Altcoins are on strong support right now. If broken, the targets down become valid.

Total3 shows that price remains in a descending channel. Should Bitcoin's H&S pattern trigger, I would expect alts to follow. They would then descend to the bottom of this channel which intersects with that green support area.

You will also note that I have an "October 2023 Support" trendline drawn on both charts. Both of these trendlines have been broken to the downside, giving further indication of more bearish price action to come.

Be SAFU!

✌️Stew

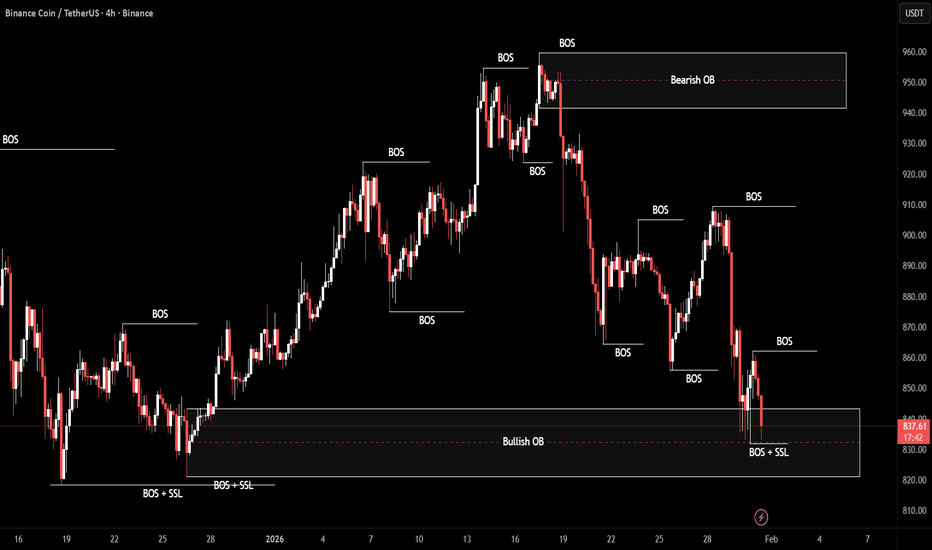

BNB/USDT | Liquidity Sweep First! (READ THE CAPTION) By examining the 4H chart of BNBUSDT, we can see that after hitting 959.50 2 weeks ago, it has been gradually dropping in price, going as low as 831.85, hitting the Mean Threshold of the Bullish OB, an initial reaction and going up before dropping again to the Bullish OB zone, currently being traded at 837.50.

What I would like to see is BNB going below the 818.40 level, sweeping all the Sellside liquidity there and then make an upwards move.

Targets for now: 831.50, 824.50 and 817.00

$BMNR: The $161 Ghost Top – Will the Great price void be filled?💀📉 💀📉

We need to talk about #BMNR.

Tom Lee’s vision of an 'Ethereum Treasury' is a grand experiment, but for retail investors, it’s becoming a house of mirrors.

The Trap: Thousands of retail accounts are trapped at the $100+ entry levels. With the current price at $25, the psychological damage is already done.

The Gap: Look at the monthly chart. There is a massive, unfilled gap from $12.38 down to the $4.57 zone.

The Reality: $4 billion of unrealised losses on just $79.3M in revenue is not a business; it's a high-stakes bet with YOUR capital. $200M stake on youtuber is a massive gamble. Completely unrelated to bringing Tradfi on chain.

Warning: If we lose the $24.33 support, the next unfulfilled targets will likely be met.

With $16.70 a high conviction probability imho.

#BMNR #TomLee #Ethereum #StockMarketCrash #RetailTrap #DilutionWarning

📉 3 Red Flags

1. The "Split-Adjusted" Illusion & High-Price Trap

The stock reached an all-time high of $161 earlier in the year but is currently trading around $25.10.

The Danger: Retail investors who "bought the top" are now sitting on 84% losses.

The Gap: There is a significant technical gap back toward the $3.20 - $5.00 range (the 52-week low). If the market loses faith in the "Ethereum Treasury" narrative, the stock could gravity-pull toward its DCF (Discounted Cash Flow) fair value of just $0.18.

2. The "Alchemy of 5%" vs. Extreme Dilution

Tom Lee’s strategy, "The Alchemy of 5%," aims to control 5% of the total ETH supply.

The Dilution: To fund this, Lee recently asked shareholders to approve a 100x increase in authorised shares—from 500 million to 50 billion.

The Warning: While Lee claims this keeps the share price "reasonable," it effectively ensures that current retail holders will be massively diluted unless ETH prices go parabolic immediately.

3. The Financial "Flippening"

The company’s latest financials (Q1 2026) showed a staggering $5.2 billion net loss, flipping from a profit just one quarter prior.

Fragile Model: Despite having $14 billion in assets, the revenue from staking.

Is only revenue if sold for Dollars.

He made himself a Eth whale --- where dumping is part of the business model.

The Risk: This creates a situation where the stock trades purely on the sentiment of ETH, but with the overhead of a massive corporate cash-burn.

ETHUSD (3H chart pattern ).ETHUSD (3H chart pattern ).

structure-based take.

What the chart shows

Strong impulsive drop → then a bearish descending channel (flag)

Price is below the Ichimoku cloud → bearish bias

Me’ve marked a breakdown attempt near the lower channel

This looks like a bear flag continuation, not a reversal

🎯 Downside Targets

🎯 Target 1 (near-term)

≈ 2,880 – 2,850

Recent reaction lows

First liquidity/support zone

Good partial profit area

🎯 Target 2 (main target)

≈ 2,700 – 2,680

Measured move of the flag (pole → breakdown)

Strong horizontal support

Matches my marked “target point” area

🎯 Target 3 (extension, if momentum is strong)

≈ 2,600

Previous demand zone

Psychological level

❌ Invalidation

If price breaks and holds above ~3,000–3,020

Or cleanly reclaims the channel + cloud → bearish setup fails

Summary

TP1: 2,880–2,850

TP2: 2,700–2,680

TP3: 2,600 (optional extension)

If my want, I can:

Tighten this into a scalp vs swing plan

Help with stop-loss placement

Or flip it and give bullish targets if it breaks up 📈

ENSOUSDT.P: long setup from daily resistance at 1.6399BINANCE:ENSOUSDT.P is in a bullish trend. After a strong rally, it consolidated for a few days. Now, a solid pre-breakout base is forming right under the 1.6399 resistance, which acts as the upper boundary of the trading channel.

I have mixed feelings about the Daily timeframe because the asset has already extended significantly today. However, on the 4H timeframe, we see clear price compression towards the level with decreasing volatility. On the 5m chart, the price tested the level multiple times without a deep rejection or correction, which would be the normal reaction here.

The logic: When we don't see the expected reaction (a pullback), that catches my attention. If an asset rallies hard and still has the strength to hold highs and consolidate right under resistance, it signals a strong buyer.

Conditions: Volatility must not increase before the breakout. The entry must strictly follow the system rules. Given the overextended Daily chart (which is the primary one), I will be extremely cautious with this trade, or might skip it entirely if the setup isn't perfect.

ALGO Approaching Decision Zone Near TrendlineAlgorand has been trading under a long term descending trendline and is now compressing near a critical support zone. Price action shows the formation of a potential inverse head and shoulders structure while still respecting the broader downtrend.

The neckline area aligns closely with the descending trendline, making this zone extremely important. A successful breakout above this trendline would invalidate the bearish structure and open the path for a stronger upside continuation toward higher resistance levels.

However, if price fails to break the neckline and loses the local support, a downside move toward the lower liquidity zone is possible to complete the wick fill. This would keep the broader bearish trend intact.

Momentum is tightening and volatility is likely to expand soon. The next move from this area should define the short to mid term direction.

BTCUSD Institutional Levels: Sell Premium 97 500–102 000🔱 BTCUSD WEEKLY SNAPSHOT — EXECUTIVE SUMMARY

✨ Bitcoin positioned in a late-cycle distribution structure with elevated bull trap risk

🔴 Primary sell-side liquidity magnet reclaimed at 97 500 confirms seller interest

🔄 Current price action shows upside probes without sustained acceptance

🧱 Institutional sell zones stacked above market

• 100 000 psychological magnet

• 102 000 technical overshoot and bull trap extension

🟡 Reaction resistance zone at 97 500

📉 Bearish-to-neutral bias remains valid below 102 000

🎯 Downside liquidity objectives

• First buy-side liquidity pocket at 85 000

• Major accumulation and max pain zone at 80 000

⬇️ Market structure shows expansion up without follow-through followed by fast rejection risk

⏳ Expect upside attempts to be sold into rather than accepted

⚠️ Invalidation requires sustained acceptance and consolidation above 102 000

🎯 Strategy Sell strength into premium zones Buy only after liquidity sweep into discounts

🏦 Larger accumulation favored only after buy-side liquidity is cleared below 85 000 to 80 000

🧠 BTC MARKET LOGIC — INSTITUTIONAL READ

• Sellers active at psychological and technical round numbers

• Upside extensions used to distribute inventory

• 97 500 acts as a pivot between distribution and acceleration

• Acceptance above 100 000 required to flip bias

• Failure near highs increases probability of fast drawdown into liquidity pools

• Downside targets represent value zones not momentum trades

🗳️ BTC WEEKLY SCENARIOS — WHAT’S YOUR PLAY?

Which path do you expect for BTC next?

🅰️ Rejection at 97 500 to 100 000 → breakdown toward 85 000

Classic distribution into sell-side liquidity

🅱️ Spike into 100 000 to 102 000 → sharp rejection → fast drop to 80 000

Textbook bull trap and liquidity sweep

🅲 Range below 97 500 → compression → expansion lower into 85 000

Slow build before acceleration

🅳 Your level Drop ONE BTC price you are watching most this week 👇

BTCUSD (3H, chart pattern)...BTCUSD (3H, chart pattern).

clean bearish structure 👍

Here’s the straightforward target map based on what’s on my chart.

🎯 Targets (bearish continuation)

TP1: 87,900 – 88,000

→ Nearest liquidity + minor structure (price already reacting here)

TP2: 85,500 – 85,800

→ Equal lows + demand sweep zone (my marked “target point” area)

TP3 (extended): 83,800 – 84,200

→ Channel projection + higher-timeframe imbalance

🧠 Why these targets

Overall lower highs + lower lows

Price is below the descending trendline

Consolidation under resistance = bearish continuation

Ichimoku cloud above price → bearish bias stays valid

❌ Invalidation

Clean 3H close above 90,200 – 90,500

Break and hold above the descending trendline

🧭 Trade bias

Best plays: sell rallies

Avoid longing until trendline + structure break

If my want, tell me:

Entry price my eyeing

Scalp or swing.

Trend Weakening, Market Shifts Into Defensive ModeHello everyone,

On the D1 timeframe, Bitcoin is no longer maintaining its previous bullish structure. Price has fallen below both EMA 34 and EMA 89, while the two moving averages have started to slope downward and repeatedly act as rejection zones whenever price attempts to rebound. When EMAs transition from support into resistance, it often signals a shift in short-term control — sellers no longer need aggressive pressure; they simply wait for pullbacks to re-establish dominance.

The decline toward the 81,500 USD area carries the characteristics of an active distribution phase rather than ordinary volatility. Large daily candle bodies reflect decisive position unwinding, typically accompanied by leverage liquidations and a rapid shift in market sentiment from optimism to caution. Moves like this rarely conclude with a single touch of the low; they usually leave an after-effect in the form of weak and short-lived recoveries.

At the current stage, the 80,000 – 81,500 zone acts as a nearby psychological support where technical reactions may appear due to accumulated liquidity. Below that, the 76,000 – 78,000 region stands out as a notable former demand area should 80k be clearly broken. On the upside, the 89,000 – 93,000 band — where EMA 34 and EMA 89 converge — remains the key zone to evaluate the strength of any rebound. As long as price cannot establish acceptance above this area, short-term advances are more likely to be technical recoveries rather than structural reversals.

From a broader flow perspective, the environment does not yet favor an early breakout scenario. Heightened volatility across risk assets has reduced overall market leverage, while the absence of a strong catalyst limits the return of fresh capital into crypto. When liquidity fails to expand, markets typically choose between two familiar paths: sideways consolidation to absorb supply, or a deeper correction to rediscover a more attractive equilibrium.

Wishing you all productive trading sessions, and what’s your view?

GOLD DROPPING BADLYXAUUSD is showing a strong impulsive bullish structure on the higher timeframe followed by a sharp rejection candle, signaling a corrective phase after an overextended rally rather than a confirmed trend reversal, with price pulling back into a key Fibonacci retracement and previous breakout demand zone where resistance flipped to support, a classic breakout and retest scenario watched by smart money and trend traders. The broader market context still favors gold strength as safe haven demand, inflation hedge positioning, central bank gold accumulation, and ongoing macro uncertainty continue to underpin the long term bullish narrative, while short term volatility is being driven by US dollar flows, bond yield expectations, and high impact economic releases that temporarily fuel profit taking after parabolic moves. Technically this is a healthy pullback within an overall uptrend, with liquidity being rebalanced and momentum resetting from overbought conditions, and as long as price holds above the major demand block and structural higher low zone, dip buying, trend continuation, bullish order flow, and breakout retest setups remain the dominant strategy for positioning toward higher resistance levels once the correction completes.