DOGE / USDT — Weekly AnalysisFirst time covering DOGE on the higher timeframe.

On the weekly chart price returned to a major historical level after filling the large downside wick — meaning long-term liquidity has been taken.

Structure overview

Major support: ~0.08 – 0.10

Weekly resistance: ~0.14

Major S/R flip: ~0.20

Market structure: macro range after long distribution

What this means

This area has historically been where accumulation starts, not where trends end.

However — holding the level is required first.

Right now price is sitting at decision support:

Hold → multi-week base possible

Lose → continuation into deeper range lows

Market logic

Higher timeframe levels react slower.

So expect consolidation first before any strong move.

Simple plan

Above 0.10 → basing phase

Reclaim 0.14 → bullish momentum returns

Reclaim 0.20 → trend shift on weekly

Lose 0.08 → bearish continuation

This is not a breakout zone — this is a positioning zone.

Do you think DOGE is entering accumulation or preparing another capitulation?

MrC

Crypto

EURUSD: Buyers Defend 1.1780 - Upside in Focus 1.1870Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a well-defined downward channel, where price consistently respected the descending resistance and support boundaries, forming a series of lower highs and lower lows. This structure confirmed sustained bearish control and orderly downside continuation. During this phase, several bearish pushes developed smoothly within the channel, highlighting strong seller dominance. After breaking the channel, EURUSD continued higher and successfully reclaimed the Support Zone around 1.1780, which acted as a key decision level. The breakout and subsequent hold above this zone confirmed a change from bearish structure into a bullish recovery phase. Price then accelerated toward the 1.1870 Resistance Zone, where supply became active again, resulting in consolidation and multiple breakout attempts.

Currently, price is trading above the rising trend line, while also forming a descending corrective structure beneath the triangle resistance line. Despite the pullback, the market continues to respect higher lows, suggesting that the recent decline is corrective rather than impulsively bearish. The ability of EURUSD to hold above the support zone keeps the bullish structure intact.

My Scenario & Strategy

My primary scenario favors a long continuation as long as EURUSD holds above the 1.1780 Support Zone and respects the rising trend line. The current consolidation appears to be a corrective pause within a broader bullish structure. A successful break and acceptance above the triangle resistance and the 1.1870 Resistance Zone would likely trigger renewed upside momentum. If buyers manage to reclaim and hold above resistance, the next bullish leg could extend higher, following the direction of the dominant trend.

However, a decisive breakdown below the support zone and trend line would weaken the bullish scenario and signal a potential deeper correction or range formation. For now, structure favors buyers, with pullbacks viewed as opportunities for continuation rather than trend reversal. EURUSD remains at a key technical decision area, and price reaction around support will be critical for the next move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

LINK / USDT — Daily Update (Follow-up)Price continued the downside after the previous update and tapped the lower liquidity zone.

The large wick has now been **fully filled**, meaning the market removed the imbalance and reached a reaction area.

Current situation

Local support: ~7.5 – 8.2

Reclaim level: ~12.2

Major S/R flip: ~18

Structure still bearish (lower highs & lower lows)

What this means

Right now this is a classic decision point:

After liquidity is taken, the market either bases → relief rally, or continues the macro downtrend.

Holding the current level could start a short-term recovery.

But without reclaiming 12.2, it remains only a bounce inside a bearish structure.

Simple plan

Hold 7.5–8.2 → relief move possible

Reclaim 12.2 → market strength returning

Fail to hold → continuation lower likely

So far this looks like a reaction, not a confirmed reversal.

Do you expect a bounce back into resistance or another sweep below support first?

MrC

RENDER / USDT — Daily UpdateAfter the strong impulse move up, price has now retraced and filled all imbalance (FVG) zones created during the rally.

This usually means the market finished correcting inefficient price action and is moving back into equilibrium.

Current situation

Major support: ~1.20 – 1.30

All bullish FVGs below price → filled

Momentum cooled down after distribution at highs

What this means

With imbalances cleared, the chart is no longer in a forced correction phase.

Now the level itself matters:

If support holds → accumulation range likely

If support breaks → continuation of the macro downtrend

Simple plan

Hold above 1.20 → base formation possible → recovery when market strength returns

Lose 1.20 → next liquidity sits lower → bearish continuation

First bullish confirmation → reclaim prior breakdown area (~1.60 zone)

Right now this is a reaction zone, not yet a reversal.

Do you expect buyers to defend this level or will liquidity below get taken first?

MrC

ENA / USDT — Daily Update (Follow-up)Price kept respecting the bearish structure after the previous update.

The rejection at the trendline confirmed sellers are still in control and the market moved back into the lower range.

Current situation

Local support: 0.095 – 0.115

Mid level to reclaim: 0.131

Key S/R flip: ~0.20

Still trading below descending trendline → bearish pressure remains

What this means

Holding below 0.131 keeps the chart weak → continuation range / grind down likely.

A reclaim of 0.131 opens room for a relief move into 0.20 S/R flip area.

Only above 0.20 the structure actually starts improving.

Simple plan

Below 0.131 → bearish / ranging

Reclaim 0.131 → bounce potential

Reclaim 0.20 → trend shift signal

Market now deciding between accumulation at lows or continuation.

MrC

#EURUSD , Time to Fly?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURUSD

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality setup at all but with a valid structure we can have it as QuickScalp

🚀 Trading Plan:

• Need Valid momentum Structure Close

• LTF ENTRY NEEDED ‼️

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

WLDUSDT.P:short setup from daily support at 0.3640SETUP SUMMARY

Regarding BINANCE:WLDUSDT.P : after a strong drop, the asset has been consolidating for 5 days. Typically, if an asset comes from above and enters consolidation, it will continue in the same direction — downwards.

This move is reinforced by the fact that BINANCE:BTCUSDT.P is dropping heavily today, dragging the entire market with it. BINANCE:WLDUSDT.P could indeed break the level today, even though it has already moved quite a lot relative to its average statistics.

We are currently seeing a pre-breakout base forming right at the level. If volatility decreases even further, it will be an ideal entry point, as it will allow for placing a tight stop loss.

PRO-THESIS FACTORS:

trend alignment

liquidity vacuum beyond level

market correlation

volatility contraction on approach

prolonged consolidation

lack of rejection after false break ADVERSE FACTORS:

high-volatility approach

no near-level base Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas.

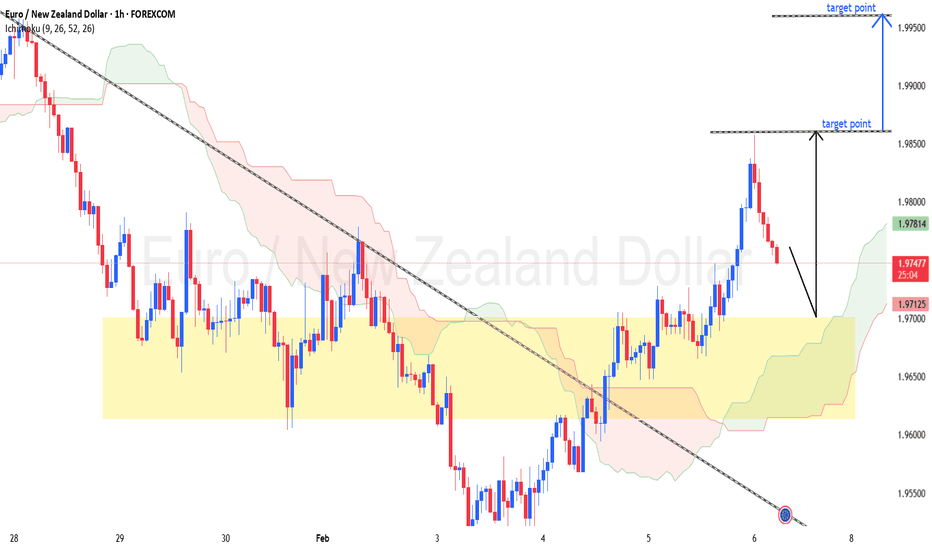

EURNZD – 1H Chart Targets...EURNZD – 1H Chart Targets 📊

Based on my chart (trendline break + strong bullish impulse + pullback zone):

🔍 Market Bias

Bullish continuation (buy on pullback)

📈 Buy Setup

Buy Zone:

1.9650 – 1.9700 (highlighted demand + cloud support)

Targets:

🎯 TP1: 1.9850

🎯 TP2: 1.9900

🎯 TP3 (Final): 1.9950 ✅ (marked target zone)

Stop Loss:

🛑 Below 1.9580

⚠️ Trade Notes

Previous downtrend already broken

Healthy pullback expected before next push up

Partial profit booking recommended at TP1 & TP2

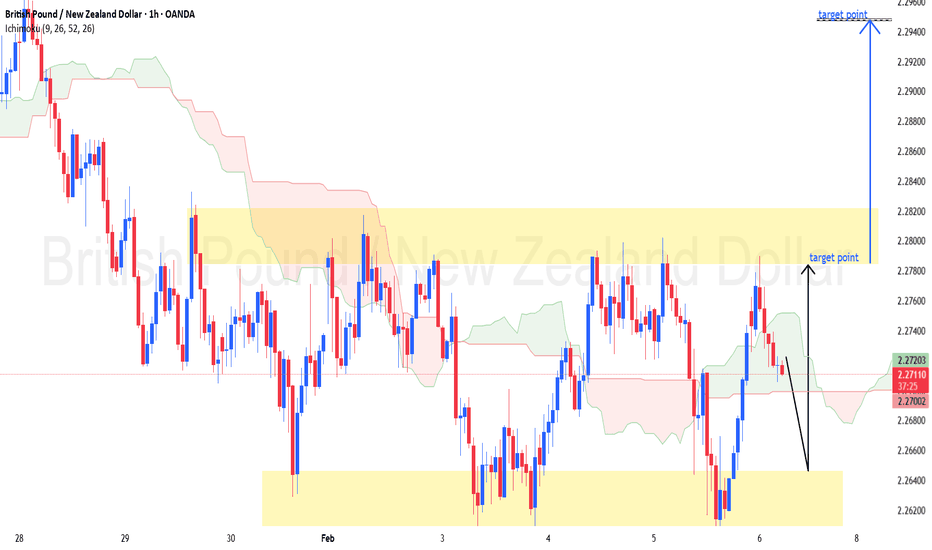

GBPNZD – 1H Chart Targets...GBPNZD – 1H Chart Targets 📊

Based on my chart (range market + demand reaction + Ichimoku in middle):

🔍 Market Bias

Short-term Bullish Pullback from demand

Overall structure still range / corrective

📈 Buy Setup

Buy Zone:

2.2620 – 2.2660 (lower demand zone)

Targets:

🎯 TP1: 2.2780

🎯 TP2: 2.2860

🎯 TP3 (Final): 2.2940 ✅ (upper resistance / marked target)

Stop Loss:

🛑 Below 2.2580

⚠️ Trade Notes

Expect reaction at 2.2780 (mid-range resistance)

Best to secure partial profits

Strong rejection from upper zone may give sell setup later

XAGUSD Rebound from Demand Zone.....Nice setup 👍 This XAGUSD (Silver) 2H chart shows a strong bearish move into support, followed by a reaction from the lower demand area. If you’re planning a **pullback / mean-reversion target**, here are the clean levels:

### 🎯 Upside Targets (from current bounce)

* **Primary Target (TP1): ~90.0 – 92.0**

👉 This matches your marked **range high / target point** and the underside of the Ichimoku cloud (strong resistance zone).

* **Extended Target (TP2, aggressive): ~95.0**

👉 Upper boundary of the previous range + cloud resistance. Only likely if momentum flips bullish and price reclaims the trendline.

### 🔄 Invalidation (keep it simple)

* If price **fails to hold above ~70–72**, the bounce is weak and downside continuation risk increases.

XAUUSD Bearish Bias Summary ....Based on the chart you shared (XAUUSD, 1H), price is trading below the descending trendline and under the Ichimoku cloud, with bearish structure after the CHoCH. The marked projection already aligns well with logical downside targets.

🎯 Downside Targets (Sell Bias)

1st Target (TP1): ~4,600

➜ Nearest horizontal support / previous demand zone.

2nd Target (TP2): ~4,400

➜ Major liquidity pool / lower support zone.

📉 Bearish Bias Summary (Short & Simple)

Price is respecting the descending channel and rejecting the cloud. As long as price stays below the trendline and cloud, continuation toward 4,600 → 4,400 remains likely.

If you want, I can also give you:

A clean title + caption for posting this chart

Or bullish invalidation levels (where this setup fails)

XAGUSD Bearish Continuation ......This is a 2-hour (H2) XAGUSD (Silver vs USD) chart showing a full market cycle: accumulation → bullish trend → breakdown → bearish continuation.

Key structure & concepts shown:

Range / Accumulation (Left side)

Price consolidates in a marked range, indicating accumulation and liquidity build-up.

Bullish Channel (Markup Phase)

Price breaks out and trends higher within a clean ascending channel, respecting dynamic support and resistance.

Trend Failure & Breakdown

Price loses the channel support and breaks below the prior range base (marked as Breakdown), signaling a bearish market structure shift.

Strong Impulsive Sell-Off

Large bearish candles show aggressive distribution and momentum to the downside.

Fair Value Gap (FVG) / Supply Zone Retest

Price retraces into the highlighted FVG / supply zone, where selling pressure is expected to step in again.

Bearish Continuation Target

A projected downside target is marked at prior demand/liquidity levels, suggesting continuation of the bearish leg after the pullback.

Gold H1: Distribution Phase After Break of StructureThis is a 1-hour (H1) XAUUSD (Gold vs USD) chart showing a clear market structure shift from accumulation to distribution, then into a strong bearish trend.

Key phases visible:

Range / Accumulation (Left side)

Price moves sideways inside a marked range, indicating consolidation and liquidity building.

Break of Structure (BoS)

Price breaks above the range high, signaling bullish intent and triggering a markup phase.

Trend Exhaustion & Reversal

After the strong bullish impulse, price forms a top and begins respecting a descending channel, showing a transition into bearish control.

Bearish Impulse (Markdown Phase)

Strong, consecutive bearish candles push price lower, confirming trend continuation to the downside.

Pullback into Rejection Zone

Price retraces into a marked supply / rejection zone (aligned with Ichimoku cloud resistance), suggesting institutional selling pressure.

Target Projection

A downside target is marked near prior lows / demand zone, implying a continuation short setup after rejection.

Bearish Descending Channel with Continuation Setup

This is a BTC/USD 1-hour chart showing a clear downtrend inside a descending channel. Price has been making lower highs and lower lows, respecting the channel boundaries. The Ichimoku Cloud is mostly above price, acting as dynamic resistance, which confirms bearish momentum. A BOS (Break of Structure) is marked, indicating continuation of the bearish move after a pullback into resistance. Price is currently trading near the lower half of the channel, suggesting selling pressure remains strong, with a projected downside target around the lower support zone (near 64k) if the trend continues.

GBPUSD – 4H Chart Targets... GBPUSD – 4H Chart Targets 📉

Based on the chart me shared (descending trendline + price below resistance):

Bias: Bearish (Sell on pullbacks)

Sell Zone:

1.3560 – 1.3600 (trendline / resistance area)

Targets:

🎯 TP1: 1.3500

🎯 TP2: 1.3420

🎯 TP3 (Final): 1.3350 ✅ (me marked target zone)

Stop Loss:

🛑 Above 1.3650 (trendline break & structure invalidation)

Notes:

Price is respecting the descending trendline

Bearish momentum remains strong

Ichimoku cloud resistance above price supports downside continuation

⚠️ Always manage risk properly and wait for confirmation on entry.

ETHUSD (2H) — clear picture...ETHUSD (2H) — clear picture

Here’s the clean breakdown based on what’s on my chart.

Market Structure

Strong bearish trend

Price is below Ichimoku cloud → trend still bearish

Descending trendline holding as resistance

No bullish structure break yet

Sell Targets 🎯

From current price area (~2190–2200):

TP1: 2,050 – 2,020

Minor support / first liquidity grab

TP2: 1,950 – 1,920

Strong horizontal support (my first marked target)

Final Target: 1,750 – 1,700 🔥

Major demand zone

Matches my second target point + full bearish continuation

Invalidation / SL

If 2H candle closes above 2,300–2,330

→ bearish setup weak

Safe SL: above 2,350

Bias

📉 Bearish continuation until ETH reclaims 2,350+ with structure break

This Isn’t a Reversal — It’s Only Phase Two. $BTC>65k Thank you for your attention! This is exactly what you've been hearing since September 2025. Next, we'll form the bottom, and reaccumulate until October.

A smart person told me to stop posting publicly. Make everything private, but I continue to publish my thoughts for you.

There are no entry points for positions here; my positions are elsewhere.

I accidentally made a private post yesterday

Right now, it’s still too early to talk about any meaningful reversal. We’re not in a recovery phase - we’re in phase two of the market cycle, and this phase tends to last longer than most expect. The structure is forming exactly as it should: slowly, unevenly, with pockets of stress that haven’t fully played out yet.

Bitcoin is dropping, but for me there’s nothing surprising in this move.

If you’ve been following my posts for a while, you know this scenario was not only possible

— it was highly probable. We’ve already reached the first target zones I highlighted earlier, and the market is now moving toward the deeper structural points that complete this segment of the cycle.

There are still shocks ahead, and the system hasn’t finished recalibrating.

This is not a trend market — this is a regime market. And regime markets demand patience, discipline, and the ability to read liquidity, not headlines.

2026: A Year of Market Regimes

2026 feels like a year defined by regimes, not direction.

This is a market that punishes overconfidence and rewards discipline: managing leverage, staying patient, and understanding liquidity matter more than any narrative.

Liquidity today behaves like a system of pipes. Sometimes the taps look wide open, yet the internal pressure shifts so fast that trends break long before the crowd can explain the move with headlines.

In these phases, Bitcoin behaves not like a “legend”, but like the most liquid proxy for risk:

under stress, it’s the first asset sold because reducing exposure through BTC is the easiest and fastest way.

This leads to a key insight:

Even during superficially “risk-on” news cycles, BTC can underperform when several forces align:

- rising demand for USD (dollar squeeze)

- carry trades unwinding

- capital rotating into leading sectors (metals, indices)

- portfolios cutting risk and closing leverage

Three Structural Scenarios for 2026

I avoid guessing levels; instead, I work with structural patterns. For 2026, I see three core possibilities:

1) Capitulation → Base Formation

A sharp washout, volatility climax, then a broad range and gradual base building.

2) Rallies Within a Larger Downtrend

Strong upside moves that turn into distribution.

The market gives hope — and takes it back on retests.

3) Macro Shock

An event in FX, rates, or liquidity triggers fast deleveraging.

Moves overshoot, correlations spike, and a violent mean reversion follows.

This is why my approach now is very simple:

fewer trades, higher quality.

I’m deliberately reducing the number of positions and focusing only on moments where structure provides a clear edge — because in years like this, capital is preserved not by activity, but by the right pauses.

About the Academy

In parallel, I’m updating my Academy in real time: weekly materials, market structure breakdowns, liquidity updates, USD dynamics, and risk indicators.

The access is open and free — anyone can stay aligned with the current regime without noise.

Current Market Structure

Looking at today’s structure, the market is forming precisely the segment I expected.

The key volume level ahead remains intact, and with high probability, price will break through it. Only after that expansion may we see the formation of the first real leg of the next cycle.

The conservative zones I mentioned earlier remain valid. More negative scenarios exist, yes — but the underlying logic does not change:

Accumulate gradually — on fear, liquidations, and liquidity distortions.

The main zone is very close, and that is where, in my view, the most interesting continuation setup will appear.

Best regards EXCAVO

ETH - V Reversal - Livermore Accumulation Cylinder to ATHLivermore accumulation cylinders are my bread and butter. ETH just posted it's final low into a 5+ year liquidation zone within a livermore accumulation cylinder

All of the on-chain liquidations are decimated, there are no more forced sellers.

Up only from 1739.

Below EMA, selling volume remains dominantHello everyone,

Looking at the current structure, the market is sending a fairly straightforward message: the primary trend remains bearish, and there are still no signs that the balance of control has shifted. The sequence of lower highs and lower lows is clearly intact, price is trading entirely below EMA 34 and EMA 89, and both moving averages are sloping downward. For me, that alone is enough to classify the market as bearish and to keep a defensive bias.

In this context, EMA 34 and EMA 89 are no longer acting as support but have turned into very “textbook” dynamic resistance levels. EMA 34 serves as short-term resistance, while EMA 89 caps price on a medium-term basis. What stands out is that nearly every rebound into these EMAs is quickly sold into, showing that sellers are firmly in control of price action. When EMA 34 stays below EMA 89 and the distance between them continues to widen, I consistently view upside moves as pullbacks within a downtrend, not as early reversal signals.

Volume further reinforces this view. Sharp declines are accompanied by a clear expansion in selling volume, reflecting active distribution and position unwinding. In contrast, recent rebounds have come with relatively weak volume, lacking meaningful follow-through from buyers. This is a very typical pattern of distribution within a downtrend, rather than accumulation ahead of a trend change.

From a price perspective, the area around EMA 34 is the nearest resistance, while EMA 89 represents a more attractive trend-aligned sell zone. On the downside, the most recent lows around 74k–75k are acting as temporary support. Only if price can print a clear H4 close back above EMA 89, supported by a convincing increase in buying volume, would I start to reassess the reversal narrative.

QNT Quant Cryptocurrency Buy AreaQNT Quant is not a bad project, but still not a buy for me!

In my opinion, QNT (Quant) crypto appears to address a significant challenge in the blockchain space by focusing on bridging disparate blockchains. The ability to create multi-chain applications or mApps using Quant seems promising, as it enables enhanced usability and communication between different blockchain networks. This is particularly crucial in the cryptocurrency landscape, where interoperability and seamless connectivity among various projects and platforms can greatly benefit the industry as a whole. By facilitating cross-blockchain communication, Quant has the potential to unlock new possibilities for developers and users, fostering innovation and efficiency within the decentralized ecosystem.

I have a large buy area in which I'm willing to average down if it`s the case: $41 - $71.

looking forward to read your opinion about it.

AXS Axie Infinity Triangle Formation BreakdownI don`t know if you have seen my preview AXS chart that had more than 500 Likes:

In its recent case against Binance, the SEC introduced 10 cryptocurrencies into the securities classification: BNB (BNB), Binance USD (BUSD), Solana (SOL), Cardano (ADA), Polygon (MATIC), Cosmos (ATOM), The Sandbox (SAND), Decentraland (MANA), Axie Infinity (AXS) and COTI (COTI).

The AXS (Axie Infinity) cryptocurrency recently experienced a breakdown of a triangle formation, signaling a potential bearish pattern. A triangle formation is a common technical chart pattern characterized by converging trendlines, indicating a period of consolidation before an anticipated breakout.

In the case of AXS, the breakdown of the triangle formation suggests a shift in market sentiment towards a bearish bias. This breakdown occurs when the price falls below the lower trendline of the triangle, indicating a potential continuation of the downtrend or a decline in price.

Traders and investors who closely monitor technical patterns may view the breakdown of the AXS triangle formation as a bearish signal, potentially prompting them to consider short positions or adjust their existing trading strategies accordingly.

Considering the above, my prite target for AXS Axie Infinity is $3.55, its strongest support.

Looking forward to read your opinion about it.

FLOKI Potential Correction Soon ! RSI at 99If you haven't read my article about meme coins:

Then the heightened RSI level of 99 for FLOKI signals a potential correction on the horizon.

Such an extremely high RSI often indicates overbought conditions, suggesting that the asset may be due for a pullback.

The price target, as per the Fibonacci retracement tool, is: $0.00000697

ORDERUSDT.P: short setup from daily support at 0.05800SETUP SUMMARY

Regarding BINANCE:ORDERUSDT.P , we have a very strong short setup. The asset is currently at its all-time lows. Consolidation above the level has been ongoing for slightly less than a week. Today, there was a strong attempt to push higher, which ended in nothing. We saw a level tap a few hours ago, followed by a close retest a few hours later, right into the level. We have a clear level from which a reliable short can be opened. Stop loss behind the breakdown bar, and in my opinion, we can comfortably expect a 5-10 to 1 risk-to-reward ratio.

PRO-THESIS FACTORS:

trend alignment

liquidity vacuum beyond level

market correlation

liquidity sweep (false move)

volatility contraction on approach

close retest

prolonged consolidation

precise level testing

price compression (Squeeze) ADVERSE FACTORS:

high-volatility approach Leave your thoughts on the setup in the comments. Follow this profile to monitor all upcoming ideas