Bitcoin at Key Support as Trendline Reclaim Comes Into FocusBTC is currently reacting from a major support zone after a sharp corrective move from the previous highs. Price has moved back into a historically important demand area, where buyers have stepped in before. This zone aligns with higher time frame structure support and acts as a key level for market stability.

The most important factor to watch now is the long term ascending trendline. A successful reclaim and hold above this trendline would signal that bullish structure is being restored and could open the path for a continuation toward the upper resistance range shown on the chart.

If price fails to hold above the current support and loses momentum, a deeper retracement toward the lower demand zone remains possible. This area still sits within the maximum corrective range without breaking the broader market structure.

Bitcoin is approaching a critical decision point where volatility is expected to increase. The next move will likely define the medium term trend direction.

Crypto

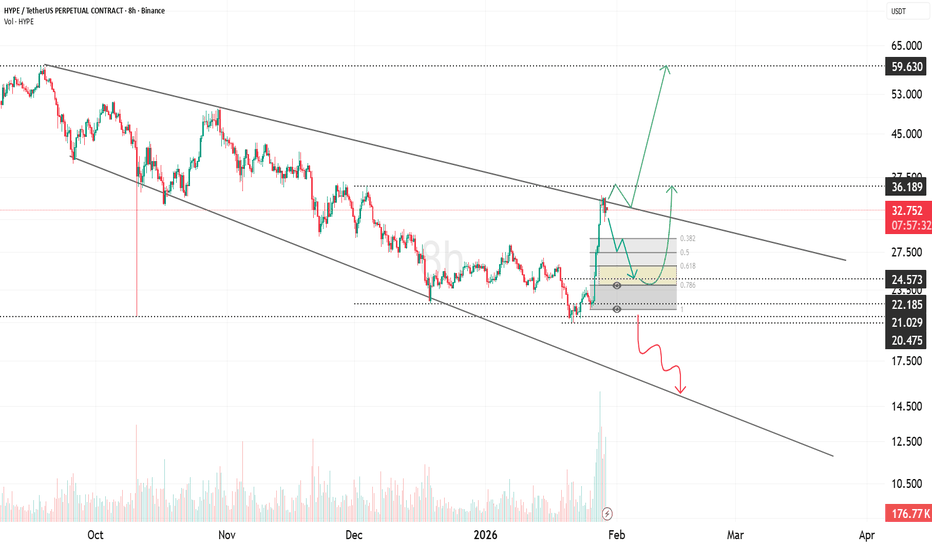

HYPE Testing Broadening Wedge ResistanceHYPE is forming a broadening wedge pattern, where price action is expanding with higher volatility over time. After reacting from the lower boundary of the structure, price has moved back toward the upper trendline, which is acting as a key resistance zone.

This area is important because broadening wedges often signal increasing market participation and volatility before a larger directional move. A sustained breakout above the upper wedge resistance could confirm bullish continuation and open the path toward higher supply zones marked on the chart.

If price fails to break this resistance and gets rejected, a pullback toward the lower boundary of the broadening wedge remains possible. The market is approaching a decision point, and a strong move is likely once this range resolves.

Prop Firms vs Real Accounts: The Structural Trade-Off Most TradeMost comparisons between prop firms and real accounts focus on capital size, profit splits, or challenge difficulty. What is discussed far less is how each environment reshapes the way traders think, decide, and execute. The difference is structural, and it has a direct impact on performance.

Prop firm accounts are rule-bound by design. Daily drawdown limits, maximum loss thresholds, and evaluation deadlines create a narrow operating window. These constraints reward control and consistency, but they also introduce pressure. Every trade is filtered through the question of survival. Traders become highly sensitive to short-term equity fluctuations because a single mistake can end the account.

This changes behavior in subtle ways. Traders hesitate to hold through normal drawdowns, cut winners early to protect equity, or avoid valid setups late in the day to reduce risk exposure. None of these actions are irrational. They are logical responses to the environment. The issue arises when traders confuse rule compliance with optimal execution.

Real accounts remove these external constraints. There is no forced stop at a daily loss and no expiration date. Drawdowns are uncomfortable but recoverable. This freedom allows for longer holding periods, broader trade selection, and more flexibility in execution. At the same time, it demands a higher level of internal discipline. Without rules enforced externally, risk management becomes entirely self-regulated.

Many traders perform well in one environment and struggle in the other because the skill sets are different. Prop firms reward precision, restraint, and consistency under pressure. Real accounts reward patience, emotional regulation, and long-term thinking. Success in one does not automatically translate to success in the other.

The mistake is treating prop accounts as practice for real trading without acknowledging the incentives involved. The rules shape behavior, expectations, and even strategy selection. Traders who understand this stop blaming themselves for feeling constrained or overly cautious.

Neither model is superior. Each serves a different purpose. Clarity comes from aligning your approach with the structure you are trading under, rather than forcing one mindset into the wrong environment.

$USDT & $USDC vs. $ETH - Warning a Funeral could occur. 💀 💀 💀

Watch the Stablecoin/ETH Market Cap ratio carefully.

A spike here isn't always 'Dry Powder' waiting to buy.

The Trap: If ETH breaks the $2,400 support level, we could see a 'Liquidation Spiral' that sends the ratio to all-time highs.

This isn't new money coming in—it's ETH value vanishing.

Safe Haven: Cash is King until ETH reclaims its 200-day SMA at $3,400."

#ETH #Ethereum #Stablecoins #MarketCrash #LiquidityTrap #CryptoAnalysis @thecryptosniper #HVF

what does AI say:

📉 The Doomsday Ratio: (USDT + USDC) / ETH

In a crash, this ratio spikes vertically. But unlike a "healthy" spike (where new money enters), this is a "Deleveraging Spike."

1. The ETH Collapse (The Denominator Shrinks)

Revenue Compression: Layer 2s are so efficient now that they are starving the Mainnet of fees. Without a high "burn" rate, ETH is becoming slightly inflationary again, losing its "Ultra Sound Money" appeal.

The ETF "Exodus": If institutional investors see ETH as a "leveraged claim on ecosystem activity" that isn't growing, they may rotate back to Gold or Bitcoin. A sustained outflow from spot ETFs could trigger a -40% re-rating.

The Liquidation Spiral: Since many "loopers" use ETH as collateral to borrow stablecoins, a price drop below $2,400 could trigger a cascade of liquidations on Aave/Compound, forcing more ETH onto the market and crushing its market cap.

2. The TradFi Standoff (The Numerator Stagnates)

The "Trust Gap": If the ratio increases simply because ETH is dying, TradFi institutions won't "buy the dip" with new USDC. They will wait for more regulatory "Supervision" rather than just "Legislation".

The Yield Trap: If stablecoins like USDT/USDC don't offer higher yields than risk-free US Treasuries (currently highly competitive in 2026), there is no incentive for a corporate treasurer to move cash onto the blockchain.

ZEC 1W update: approaching the $300 inflectionZcash is now rotating back toward the $300 level, and this is a very important area from a higher-timeframe perspective.

Context first:

ZEC went from a long period of compression into a vertical expansion, followed by a sharp rejection and distribution. What we’re seeing now is not random downside – it’s a mean reversion back toward the first major support formed after the breakout.

Why $300 matters:

• It’s the prior breakout / acceptance zone

• It acted as support on the first pullback

• It’s where buyers previously stepped in aggressively

• Losing it would signal failed acceptance; holding it keeps structure intact

As price approaches this level again, there are two clean scenarios:

Bullish / constructive

If ZEC holds ~$300 with weekly closes and reduced sell pressure, this becomes a higher-timeframe higher low. That would favor:

• Base building

• Volatility compression

• Potential re-expansion toward $380–450 later

Bearish / invalidation

If $300 loses with acceptance below, the move starts to look more like a blow-off top rather than a trend shift, opening the door to deeper mean reversion.

Right now, this is a decision zone, not a panic zone. Strong trends retest their breakout levels. Weak ones lose them. ZEC is approaching the line where that distinction gets made.

Patience here matters more than prediction.

TRX Compressing Near Breakout ZoneTRON is trading inside a tightening structure where price is compressing between a rising support trendline and a descending resistance. This kind of price action often appears before an expansion move, as volatility continues to contract and both buyers and sellers are forced closer together.

The rising lower trendline shows that buyers are stepping in at higher levels, while the descending upper trendline continues to cap upside attempts. This compression suggests that momentum is building beneath the surface. A daily close above the upper resistance would confirm a bullish breakout and open the path toward the next major resistance zone higher on the chart.

If price fails to break above resistance and instead loses the rising support, the structure would weaken and could lead to a deeper pullback toward the lower demand area. For now, TRX remains in a decision zone where a strong directional move is becoming more likely.

XAGUSD Bullish Breakout: Trend Continuation Toward 124.00This is a 30-minute XAGUSD (Silver vs USD) chart showing a bullish breakout within a well-defined uptrend.

Overall trend: Price is moving inside a rising channel, respecting an ascending trendline that has acted as dynamic support.

Ichimoku Cloud:

Price is above the cloud, confirming bullish market structure.

The cloud is rising and expanding, signaling strong underlying momentum and trend stability.

Key resistance & breakout:

A horizontal resistance zone capped price multiple times.

Silver has now broken and held above this level, confirming a bullish breakout.

Price action: Post-breakout consolidation shows higher lows, indicating acceptance above resistance rather than a false break.

Support confluence: The breakout level aligns closely with the rising trendline and the top of the Ichimoku cloud, strengthening the bullish bias.

Target projection: An upside target is marked near 124.00, consistent with trend continuation and prior structure extension.

Overall, the chart favors trend continuation to the upside, as long as price remains above the breakout zone and ascending trendline.

“XAUUSD Bullish Continuation: Strong UptrendThis is a 30-minute XAUUSD (Gold vs USD) chart showing a strong bullish continuation.

Overall trend: Clear uptrend supported by a rising diagonal trendline. Price has respected this trend multiple times.

Momentum: A sharp impulsive rally followed by a healthy consolidation near the highs, suggesting buyers are still in control.

Ichimoku Cloud:

Price is trading well above the cloud, confirming bullish market structure.

The cloud itself is thick and rising, indicating strong trend support and reduced downside risk.

Support zone: A highlighted demand area around the mid-5,200s acted as a base before the explosive move higher.

Current price action: Price is consolidating around 5,533, forming higher lows — a classic bullish pause rather than reversal.

Target projection: An upside target is marked near 5,722, aligning with prior resistance / extension of the trend.

Overall, this looks like a bullish continuation setup, favoring further upside as long as price remains above the cloud and trendline.

ETH/USDT | Going back up? (READ THE CAPTION)By examining the 2H chart of ETHUSDT, we can see that after reaching 3400 2 weeks ago, it experienced a drop from there all the way to 2787, reaching the Bullish OB and bouncing back up to 2933 and now is being traded at 2908.

I expect ETHUSDT to retest the FVG outlined above, and then going over the Consequent Encroachment of the FVG.

For now, the targets are: 2957, 3000, 3037 and 3074.

BTC/USDT | Next targets (READ THE CAPTION)After reaching 97,924 around 2 weeks ago, BTCUSDT has been dropping gradually, reaching as low as 86,074 and is now being traded at 88,200 after failing to go through the IFVG. I expect BTCUSDT to retest the IFVG.

Current targets for BTCUSDT: 88,250, 89,000, 89750 and 90,500.

EURUSD: Corrective Pullback After Strong Bullish ImpulseHello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD has been trading within a well-defined upward channel, which reflects a strong bullish structure over the higher timeframe. Price has consistently respected the channel boundaries, forming higher highs and higher lows, confirming that buyers remain in control of the broader trend. Each impulsive leg higher has been followed by corrective pullbacks that stayed contained within the channel, signaling healthy trend behavior rather than trend exhaustion. Recently, the market delivered a strong bullish impulse, breaking above the previous consolidation and pushing decisively higher. This impulsive move confirmed bullish momentum and attracted aggressive buying interest. After the breakout, price reached a key resistance zone around 1.1900, where sellers stepped in and caused a fake breakout above resistance. This failure to hold above the highs signals weakening bullish pressure at premium levels.

Currently, EURUSD started to correct lower, pulling back from resistance while still remaining inside the overall upward channel. Importantly, this decline currently appears corrective rather than impulsive, suggesting profit-taking and short-term seller activity instead of a full trend reversal. The former resistance area around 1.1800 has flipped into a Support Zone, which is now acting as the first key downside target and decision area. As long as price remains above the lower boundary of the channel, the broader bullish structure stays intact. However, the inability to sustain acceptance above resistance increases the probability of a deeper pullback toward support before the next directional move.

My Scenario & Strategy

My primary scenario is a short-term bearish correction within the broader bullish trend. As long as EURUSD trades below the resistance zone near 1.1900 and shows rejection from the upper channel boundary, I expect sellers to maintain control in the short term. The first target for this corrective move is the Support Zone around 1.1800, where buyers previously stepped in aggressively. If price reaches this support area and shows bullish reaction or consolidation, a continuation to the upside would remain the preferred higher-timeframe scenario. A clean bounce from support would confirm that the move lower was only a correction within the uptrend.

However, if EURUSD breaks below the support zone and shows acceptance beneath it, this would signal a deeper correction toward the lower boundary of the ascending channel. Only a decisive breakdown of the channel structure would invalidate the bullish bias and shift the market into a more bearish environment. For now, the setup favors a controlled pullback after a strong impulse, with short-term downside potential toward support while the overall trend structure remains bullish.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

BTCUSDT Review January 29 2026Short-term price movement ideas.

As expected in the previous analysis, price received confirmation from the daily area of interest. The 4H BtS is now acting as the main area of interest to work with.

If we get a test of the 4H zone along with confirmation on the 1H timeframe, we can then consider opening a short position targeting a new low.

Be flexible, adapt to the market, and the results will come quickly. Good luck to everyone.

Bitcoin Descending Channel Signals Further Downside To $86,100Hello traders! Here’s my technical outlook on BTCUSD (4H) based on the current chart structure. BTCUSDT initially traded inside a well-defined range, reflecting a prolonged period of balance between buyers and sellers. This consolidation phase ended with a clean upside breakout, signaling a shift in market control toward buyers. After the breakout, price entered a structured ascending channel, confirming a bullish phase with higher highs and higher lows. During this advance, Bitcoin respected the rising support line and showed strong impulsive moves, highlighting sustained buyer strength. As price approached the upper boundary of the ascending channel, multiple fake breakouts appeared near the resistance line, indicating growing exhaustion at the highs. Eventually, BTC failed to maintain acceptance above the channel resistance and experienced a breakdown below the channel, confirming a loss of bullish momentum and a structural shift. Following this breakdown, price moved lower and formed a descending channel, signaling short-term bearish control. Attempts to recover were capped by the descending resistance line, and several breakout attempts above this line were rejected, reinforcing seller dominance. A key Resistance / Seller Zone around 89,000 acted as a strong supply area, where previous support flipped into resistance after the breakdown. Currently, BTCUSDT is trading within the descending channel and moving toward a clearly defined Buyer Zone / Support area around 86,100, which aligns with a broader horizontal support and a rising long-term support line. This confluence strengthens the level and makes it a critical reaction zone. The recent price action suggests continuation to the downside rather than accumulation, with bearish momentum still in control. My scenario: as long as BTCUSDT remains below the 89,000 Resistance / Seller Zone and continues to respect the descending channel structure, the bearish bias remains valid. I expect sellers to push price toward the 86,100 Support / Buyer Zone (TP1). A strong reaction or temporary bounce may occur there, but a clean breakdown and acceptance below this support would open the door for further downside continuation. A confirmed breakout and acceptance back above 89,000 would invalidate the short scenario and suggest a shift toward consolidation or recovery. For now, market structure clearly favors sellers, with downside continuation as the primary scenario. Please share this idea with your friends and click Boost 🚀

SKRUSDT: short setup from daily support at 0.021556BINANCE:SKRUSDT.P has been in a perpetual downtrend since the very first day of its listing.

A local stop occurred at the 0.021556 level. The price hovered above it for 2 days, and today, on the third day, the level has been broken. There is no impulsive move following the breakdown yet, indicating a lack of panic. However, a new, very local ("raw") level has formed immediately below at 0.020333.

Important: It is mandatory to wait for the 4H candle close before making any decisions. The setup looks "raw" until confirmed by the close.

Key Observations:

Record Consolidation. Usually, consolidations on this asset are short-lived. The current one has lasted for four days, which is a record for this coin.

Buyer Weakness. While we don't see a downward impulse yet, we also see zero strength from buyers to reclaim the level, despite an attempt.

Bearish Signals. A solid pre-breakout base is forming: a gradual, calm approach to the level combined with low volatility. All point to a Short.

BTC 1W Update: Leaning bullishBitcoin continues to lean bullish from a higher-timeframe perspective, even after all the recent volatility.

What the weekly is telling us:

• Price held trend support and respected the rising structure

• BTC is consolidating above the mid-range, not below it

• Repeated acceptance around this zone shows buyers defending value

• Momentum is compressing, which often precedes expansion

The key difference now versus earlier selloffs is where price is stabilizing. Instead of rolling over, BTC is building a base while holding higher lows. That’s constructive behavior, especially within a broader range.

As long as:

• Trend support holds

• Price remains accepted above the mid-range

The bias stays upward, with the range highs back in play. This doesn’t mean straight up – chop and fakeouts are part of the process – but structurally, BTC is acting like a market preparing for continuation, not failure.

Let price do the work. Bullish lean, patient execution.

BTC: The Chart Designed to Wreck You (102k Incoming?)This current correction is extremely deceptive. I have re-labeled this chart more than 8 times, and this is arguably one of the trickiest price actions I’ve seen in my trading experience.

I am sharing this strictly for educational purposes only.

Honestly, trading a complex correction like this is reckless. I see people calling "longs" just because the correction is technically an uptrend or because of some EMA signal— Trading the direction of a correction drastically lowers your win rate compared to trading the main trend. This price action is designed to liquidate reckless and inexperienced people—you won't see it coming.

The structure might be shaping up as a Expanding Triangle to complete a W-X-Y correction.

* **W:** Zigzag

* **X:**

* **Y:** Expanding Triangle (Current)

Unlike standard triangles that contract, this structure shows increasing volatility. In these specific "Expanding" setups, the final Wave E often exhibits a blow-off top expanding significantly in price.

Potential Target:

If the "blow-off" play out, we could see a thrust toward **98,000 – 102,000**

Critical Levels & Invalidation:

- Watch **87,777**. If this level breaks, assume Wave D is extending.

* **Invalidation:** If **84,398** is broken, then this entire triangle idea is invalid.

* **C-5 Confirmation:** If the **80,604** is lost, it confirms C-5 is underway.

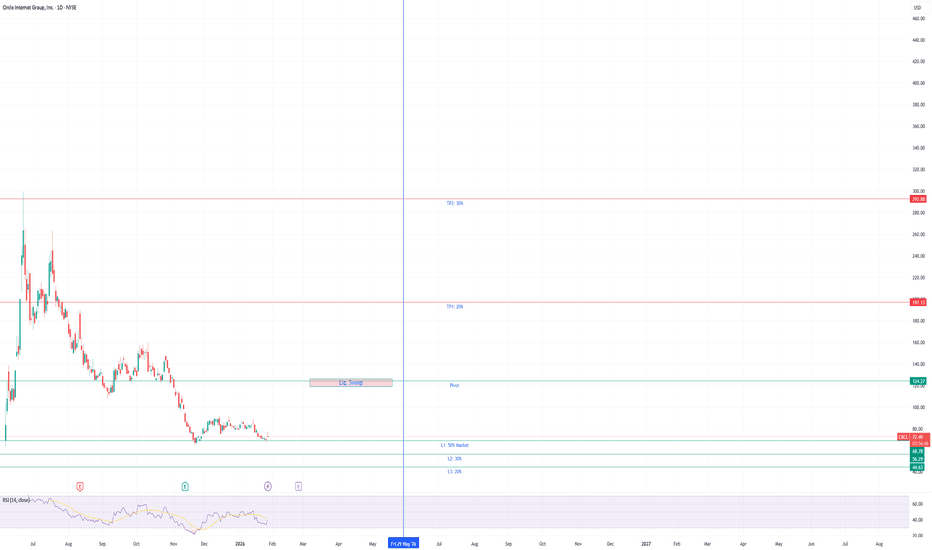

[LOI] - CRCL - CRCL

Key points :

Regulatory Clarity Boosts Stablecoin Legitimacy : Recent U.S. laws like the GENIUS Act and the proposed Digital Asset Market Clarity Act suggest a more supportive environment for stablecoins, potentially driving mainstream adoption while acknowledging debates over interest-bearing features.

USDC's Market Dominance and Growth : As the second-largest stablecoin with circulation around $73.7 billion, USDC benefits from high transaction volumes and integrations, positioning Circle for revenue expansion amid global digital asset trends.

Absence of U.S. CBDC Creates Opportunities : With U.S. retail CBDC efforts halted, private stablecoins like USDC could fill payment gaps, especially in cross-border and instant payments, though this relies on evolving interoperability with Fed systems.

Potential Fed Leadership Shift [ /b]: The upcoming change in Fed Chair in May 2026 may introduce pro-innovation policies, enhancing crypto-friendly guidance, but outcomes depend on the nominee's stance.

Undervalued at Current Market Cap : At approximately $16.5 billion, CRCL appears undervalued given projections for significant upside. Asset backed issuance at $73.7 billion makes a 3x gap which could be bridged quickly upon greater regulatory clarify + Pro-innovation FED

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

Sir. Galahad - QUANT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by.

LINK Break & Retest SetupWe're closely watching Chainlink (LINK) as it approaches the critical $12.00 resistance zone. This level has capped price action multiple times, and a confirmed breakout with a successful retest could signal the start of a fresh bullish leg.

📈 Trade Plan

We'll be entering a long spot position on the break and retest of $12.00. Patience is key—confirmation is everything in this kind of setup.

🎯 Targets:

• TP1: $13.00 – $14.50

• TP2: $16.00 – $17.00

🔻 Stop Loss: Just below $11.35

This setup aligns with classic breakout-retest price action and will be monitored closely over the coming sessions.

Trading Weekends Is a Dead-Man ZoneWeekend trading in crypto looks active on the surface, but the structure underneath is fragile. Liquidity thins, participation drops, and price becomes easier to move with relatively small orders. What appears to be opportunity is often noise amplified by absence of depth. This is why weekends quietly drain accounts rather than build them.

Institutional participation is minimal during weekends.

Many large players reduce exposure or remain inactive, which removes the stabilizing force that normally absorbs volatility and validates structure. Without that participation, levels lose reliability. Breakouts occur without follow-through. Reversals happen without warning. The market is not directional; it is reactive.

Spreads widen and order books thin. This increases slippage and distorts risk. Stops that would survive during active sessions are easily tagged. Entries that look precise on the chart fill poorly in reality. Execution quality degrades, even if the setup appears valid in hindsight.

Another issue is narrative vacuum. During the week, price responds to macro flows, funding dynamics, and session-based participation. On weekends, these drivers are largely absent. Price often rotates aimlessly or runs obvious liquidity pools without establishing commitment. Traders mistake movement for intent and become the liquidity that others exit against.

Psychology also shifts. Weekends invite boredom trading.

Without a structured routine, traders lower standards, widen assumptions, and take setups they would normally ignore. Losses feel smaller individually, but they accumulate through frequency and poor sequencing.

There are exceptions. High-impact events or structural carryover from a strong weekly close can create opportunity. These situations are rare and require reduced size and stricter confirmation. For most traders, restraint is the edge.

The market will still be there on Monday with clearer structure, deeper liquidity, and better execution conditions. Survival in trading is not about participation at all times. It is about choosing when conditions justify risk. Weekends rarely do.

BTCUSD | Rejection Seeing a lot of people online talking about their BTC long positions.

Here I am to share you my short bias idea. With the big red weekly candle from last week, I am looking for a rejection from the upper zone. ($91.000)

If this one breaks I would be out of short ideas. I would like one of those big red candles on one of the higher time frames. The one that makes the bull shiver.

Let me know what you are thinking!

Do your own due diligence, this is not investment advise!

Why Traders Freeze Even With a Profitable StrategyOne of the most misunderstood challenges in trading is freezing under uncertainty. Many traders assume the problem comes from missing skills, weak discipline, or an incomplete strategy. In practice, freezing rarely originates from technical shortcomings. It emerges from how the human nervous system reacts when outcomes are uncertain.

Most traders who freeze are prepared. They have a defined system, tested rules, and a clear execution plan. The difficulty arises at the moment where a decision must be made without knowing the result. Preparedness and uncertainty tolerance are separate skills. One can exist without the other. Many traders know exactly what to do, yet struggle to act because the outcome cannot be guaranteed.

Freezing follows a predictable pattern. A trader builds a system, tests it, and recognizes valid setups in real time. When execution becomes necessary, hesitation appears. The hand pauses, the mind begins negotiating, and small delays feel justified. Waiting for more confirmation appears rational, but often reflects discomfort with uncertainty rather than patience. The trade moves without execution, followed by frustration rooted in inaction rather than loss.

Over time, freezing erodes execution consistency. Valid setups are skipped, entries become late, and price is chased instead of anticipated. Statistical performance becomes unreliable because execution no longer matches the system. Confidence weakens, not because the method fails, but because the trader fails to apply it consistently. This often leads to misplaced blame on market conditions, strategy selection, or external factors, while the underlying issue remains unresolved.

Under uncertainty, logic loses influence. Even when traders understand probabilities, risk distribution, and long-term expectancy, the nervous system responds as if uncertainty represents personal threat. Stress responses override analytical thinking. Decision-making shifts from structured execution to self-protection. This biological response persists unless explicitly trained for.

Habitual freezing changes behavior. Missed trades generate frustration, which leads to forced entries and impulsive decisions. The trader oscillates between inactivity and overreaction. Rules remain written but lose authority during live execution. Discipline appears intact externally, while internal decision-making is driven by fear and relief rather than process.

Progress begins when confidence is no longer treated as a prerequisite for action. Confidence develops after consistent execution, not before it. Trading becomes more manageable when framed as participation rather than control. Outcomes remain uncertain, but execution remains consistent. Each decision becomes a simple question of alignment with rules, independent of emotional state.

Practical improvement comes from shifting focus toward probabilities, cultivating curiosity instead of judgment, and building tolerance through repetition. Emotional stability develops through exposure, not motivation. Each executed trade reinforces functional behavior under uncertainty.

Markets continuously test a trader’s relationship with uncertainty. Progress depends on the ability to execute despite incomplete information. Some traders wait for certainty that never arrives. Others act according to plan and accept uncertainty as part of the process. Trading rewards consistency under uncertainty. Functioning within it is the skill that separates stalled progress from long-term development.

ETHUSD 2H Demand Reaction & Potential Mean ReversionThis is a 2-hour ETH/USD chart (Coinbase) showing a clear market structure shift from bullish to bearish, followed by consolidation at demand.

Key observations:

Upper Range & Supply Zone (~3,320–3,400):

Price previously traded within a defined range near supply, showing multiple rejections at the highs. This area acted as strong resistance.

Break of Structure (BOS) → Distribution:

After pushing into supply, ETH failed to hold higher highs, indicating distribution before the sell-off.

CHoCH & Breakdown (~3,080):

A Change of Character (CHoCH) occurred as price broke below prior support, confirming bearish control. This level flipped from support to resistance.Strong Impulsive Sell-Off:

Following the breakdown, price dropped aggressively, showing imbalance and momentum to the downside.

Demand Zone (~2,880–2,920):

Price reacted sharply at demand, forming long wicks and halting the decline—suggesting buy-side interest.

Lower Range Consolidation (~2,920–3,040):

ETH is currently ranging at the lows, indicating pause/accumulation after the impulsive move.

Projected Targets:

2nd Target: Return to prior structure near ~3,080

1st Target: Range midpoint / prior resistance near ~3,280

These imply a potential mean reversion or corrective move if demand holds

The chart tells a classic story:

Distribution at supply → structure break → sell-off into demand → consolidation, with upside targets mapped if the demand zone continues to defend.

If you want, I can also: