Crypto

BOME Reclaim Attempt After Descending Channel BreakBOME spent an extended period trading inside a well-defined descending channel following a sharp sell-off. Price has now broken above the lower channel boundary and is attempting to reclaim structure, signaling a potential shift from pure continuation to a recovery phase.

Currently, price is holding above the recent local support zone around zero point zero zero zero six three. As long as this level is defended, upside continuation toward the mid and upper channel resistance becomes possible, with the next major resistance sitting near zero point zero zero zero eight one.

If price fails to hold this reclaimed area and slips back below the recent support, the move would be classified as a failed reclaim, and continuation toward lower demand zones remains likely.

This setup is driven by descending channel dynamics, support reclaim behavior, and post-break stabilization. Confirmation above reclaimed structure is required before stronger continuation.

TON/USDT | Weak momentum (READ THE CAPTION)In the 4H chart of TONUSDT we can see that after it hit the Bullish Breaker, it went up and it is now being traded at 1.635. However, the bullish momentum is still weak and we are yet to see a strong move from TON.

Current bullish targets: 1.693, 1.761 and 1.830.

HYPE – At a Crossroads After a Small Weekly GainHYPE wrapped up the week in green with a modest +2% gain, but the broader picture remains cautious. Price action is still capped by the $26 resistance, a key level that needs to be broken for any real bullish momentum to emerge. Until then, upside moves may continue to stall.

🔻 Downtrend Still Dominates

Since late September, HYPE has been in a strong downtrend, losing over 60% of its value. That said, the asset found strong support at $22, which triggered a recent bounce. This support zone now serves as a critical level to hold if bulls hope to defend against further losses.

⚠️ Outlook: Weak Until Key Levels Break

Despite the bounce, the downtrend structure is still intact. Bulls need to reclaim $26, and ideally make a strong push above $30, to suggest a trend reversal and spark broader interest. Until that happens, rallies may remain short-lived and corrective in nature.

🕵️♂️ Keep an eye on price action around $26–$30 for confirmation of any shift in trend.

XAUUSD (Gold) – H1 Analysis...XAUUSD (Gold) – H1 Analysis (based on My latest chart)

Market Structure

Overall bullish structure is broken (strong impulsive sell).

Price is now below the main ascending trendline → trend shift.

Current move is a pullback into resistance + Ichimoku cloud.

Marked red arrows show sell rejection zone (good supply).

Bias: SELL on pullback

📉 Sell Setup (Preferred)

Sell Zone: 4,360 – 4,400

(price is already reacting from this zone)

🎯 Target Points

Target 1: 4,300

Target 2: 4,240

Target 3 (extended): 4,180

❌ Invalidation

H1 close above 4,430 → sell idea invalid.

📌 Trade Summary

Pair: XAUUSD

Timeframe: H1

Bias: SELL

Targets: 4,300 → 4,240 → 4,180

📍 If price breaks below 4,300, expect strong bearish continuation.

🔄 Alternate Buy Scenario (Only if confirmed)

Buy only above: 4,430

Buy Targets: 4,480 → 4,520

Binance Coin (BNB) Rejected at $900 – Bearish Momentum Building?Binance Coin (BNB) made a strong attempt to break through the $900 resistance, but the move was quickly rejected. This sharp pullback highlights heavy seller presence at this level, which has turned into a firm psychological barrier. Currently, the price is consolidating around $870, reflecting indecision among bulls and bears.

With momentum tilting in favor of the bears, there’s growing risk of further downside. If selling pressure intensifies, BNB could test key support levels at $800 and $690. These zones may attract buyers again, especially if the broader crypto market stabilizes or rebounds.

🔍 Watch for a reaction near $800 — a clean bounce could signal a reversal, but a breakdown may open the door to a steeper correction. Until BNB clears $900 with strong volume, upside looks limited in the short term.

📉 Stay cautious and keep an eye on key levels!

XAUUSD (Gold) – 2H Chart pattern...XAUUSD (Gold) – 2H Chart pattern

(trendline break + rejection from resistance):

Bias: Bearish / Sell on pullback

Targets:

🎯 Target 1: 4200

🎯 Target 2: 4040

Invalidation / SL:

❌ Above: 4415–4430 (recent resistance zone)

Reasoning (simple):

Price broke below the rising trendline

Rejection from resistance (red arrows)

Momentum shows continuation to downside supports

Exact entry zone

Scalp vs swing setup

Risk–reward calculation

BTC 1D Update: The pump is starting... Looking good so far Bitcoin is starting to look constructive again on the daily. After the sharp selloff from the highs, price has spent time basing and stabilizing rather than continuing lower. The recent price action is showing tighter ranges, reduced downside momentum, and a gradual shift from impulsive selling to consolidation.

The $72k–73k region remains the major higher timeframe support and has held convincingly so far. Since bouncing from that area, BTC has been forming a short-term range with higher lows, suggesting sellers are losing control. This kind of behavior typically precedes expansion rather than continuation lower.

The $88k–90k zone is acting as the current pivot. Holding above this area keeps the short-term structure neutral to bullish. A clean reclaim and hold above $92k–95k would be an early signal that the market is ready to push back toward the $100k region and eventually challenge the prior range highs near $108k.

What stands out is the broader market context. We’re starting to see strength and momentum return across parts of the crypto market, with selective alts beginning to catch bids. That usually happens when Bitcoin stops trending down and transitions into accumulation or early expansion.

As long as BTC continues to hold above the mid-range and avoids another impulsive breakdown, I view this as a constructive reset rather than a topping structure. The bias shifts toward patience and looking for continuation setups, with invalidation on a loss of the recent range lows.

Overall, Bitcoin is starting to look better structurally, and the return of upside momentum across crypto supports the idea that this consolidation may resolve higher rather than lower.

BTCUSDT Long: Demand Support Intact, Next Test at $89,000Hello traders! Here’s a clear technical breakdown of BTCUSDT (4H) based on the current chart structure. After a strong bearish impulse, Bitcoin was trading inside a well-defined descending channel, reflecting sustained seller control. This bearish phase ended with a clear breakdown and a sharp reaction from a key pivot low, where buyers stepped in aggressively, marking an important structural shift. From this pivot point, BTC transitioned into a consolidation phase, forming a broad range, which signals balance between buyers and sellers after the impulsive move. Price respected both the upper and lower boundaries of this range multiple times, confirming it as a valid accumulation zone. Eventually, Bitcoin broke below the range briefly, but this move was quickly absorbed by buyers near the Demand Zone around 86,800, leading to a strong recovery and reclaim of structure.

Currently, BTCUSDT is trading above the rising Demand Line, having confirmed a breakout and subsequent retest. Price is gradually moving higher toward the Supply Zone near 89,000, where multiple tests and rejections have already occurred. This area represents a key resistance, with sellers actively defending it, as shown by repeated reactions and failed continuation attempts.

My scenario: as long as BTCUSDT holds above the 86,800 Demand Zone and respects the rising demand line, the bias remains bullish and corrective pullbacks are likely to attract buyers. A clean breakout and acceptance above the 89,000 Supply Zone would confirm bullish continuation and open the door for further upside. However, failure to hold demand and a breakdown below the demand line would invalidate the bullish scenario and shift focus back toward range lows. For now, price is compressing between demand and supply, and a decisive move is likely ahead. Manage your risk!

EURUSD Long: Demand at 1.1720 Sets Up a Push Toward 1.1770Hello traders! Here’s a clear technical breakdown of EURUSD (2H) based on the current chart structure. After forming a solid pivot low, EURUSD transitioned into a bullish trend, supported by a rising trend line that guided price action higher. Following this move, the market entered a consolidation range, signaling temporary balance before the next expansion phase. Price later broke out of the range to the upside, confirming renewed buyer strength. However, upon reaching the upper Supply Zone near 1.1770–1.1780, EURUSD experienced a fake breakout, followed by rejection and increased selling pressure. This rejection highlighted active sellers defending supply. Despite this, buyers managed to push price higher again, leading to another breakout attempt above supply, though momentum remained limited.

Currently, EURUSD is pulling back from the supply area and is trading near the Demand Zone around 1.1720, which aligns with the rising demand line and prior breakout structure. This zone represents a key decision area, where buyers may attempt to defend the bullish structure.

My scenario: as long as EURUSD holds above the 1.1720 Demand Zone, the broader bullish structure remains intact, and the pullback can be considered corrective. A strong reaction from demand could lead to another test of the 1.1770 Supply Zone. However, a decisive breakdown below demand would signal a loss of bullish control and open the door for a deeper corrective move. For now, price is at a critical level, with demand acting as the key area to watch. Manage your risk!

Bitcoin 1MONTH vs Bitcoin 1WEEK vs Bitcoin 1DAY from 2023Here's a comparison that no one seems to see or be talking about. We could be on the precipice of the next major rally if Bitcoin's 1MONTH and 1DAY charts tell us what we could see next on the 1WEEK chart. This is the BULLISH scenario that would defy the 4 year cycle.

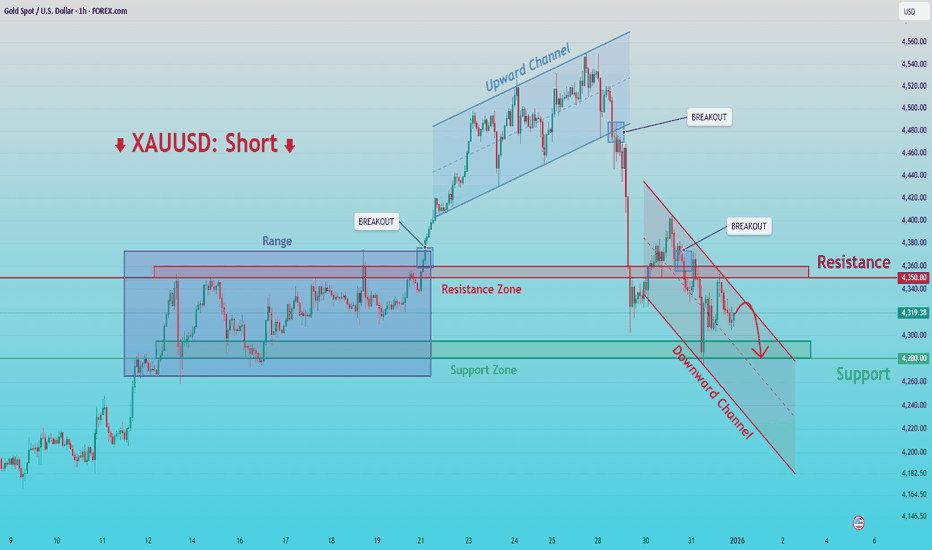

XAUUSD: Rejection at 4,350 Resistance Signals Further DownsideHello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

XAUUSD previously traded within a well-defined upward channel, confirming a strong bullish structure during that phase. Price then broke down from the channel, signaling a loss of bullish momentum and a shift in market control. After the breakdown, Gold attempted to recover but was capped by a clearly defined Resistance Zone around 4,350, which previously acted as a key level during the range phase.

Currently, price formed a lower high and transitioned into a downward channel, confirming bearish continuation. Multiple breakout attempts above descending resistance were rejected, reinforcing seller dominance. The market is now trading below the former resistance, with structure favoring further downside pressure. Below current price, a Support Zone near 4,280 is visible, acting as the next key area where buyers may attempt to slow the decline.

My Scenario & Strategy

My primary scenario: as long as XAUUSD remains below the 4,350 Resistance Zone and continues to respect the downward channel, the bearish bias remains valid. Any pullbacks into resistance that show rejection can be viewed as short opportunities, with downside continuation toward the 4,280 Support Zone as the primary target.

However, a clean break and acceptance above resistance would invalidate the short scenario and suggest a potential shift back toward consolidation or recovery. Until then, structure favors sellers, with momentum aligned to the downside.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

BTCUSDT: Range Compression Signals Potential Break Above $90,100Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT is trading within a broader consolidation after a strong bearish impulse earlier in the chart. Following the sell-off, price found a key support base around the 87,300 Support Zone, from which buyers stepped in and stabilized the market. Since then, Bitcoin has been moving inside a series of well-defined ranges, indicating compression and balance between buyers and sellers. Structurally, price is capped by a descending triangle resistance line, while at the same time respecting a rising trend line from below. This creates a tightening structure, suggesting a potential directional move ahead.

Currently, BTC is consolidating above the support zone and just below the 90,100 Resistance Zone, which has repeatedly rejected price in recent attempts. The latest pullbacks remain shallow and corrective, showing that sellers are struggling to push price back below support.

My Scenario & Strategy

My primary scenario as long as BTCUSDT holds above the 87,300 Support Zone, the structure remains constructive and biased toward a bullish resolution. A sustained hold above support could allow price to build momentum for another push toward the 90,100 Resistance Zone. A clean breakout and acceptance above this resistance would confirm bullish continuation and open the door for further upside.

However, a decisive breakdown below the support zone would invalidate the bullish scenario and shift focus toward lower levels. For now, BTC remains compressed between support and resistance, with buyers defending structure and pressure building for a potential breakout.

That's the setup I'm tracking. Thank you for your attention, and always manage your risk.

EURNZD (H4) – Chart pattern...EURNZD (H4) – Chart pattern:

🔻 Bias: Bearish (Sell)

Price is rejecting a strong supply / resistance zone near 2.0400 – 2.0450, and the structure shows a likely move down.

🎯 Targets

TP1: 2.0250 (first support / cloud level)

TP2: 2.0180 (previous demand)

Final Target: 2.0100 – 2.0120 ✅ (matches my marked “target point”)

🛑 Stop Loss

SL: Above 2.0480

📌 Logic

Rejection from resistance

Price back inside / below Ichimoku cloud

Lower high formed → continuation to downside

Exact entry price

Risk–reward setup

Scalp vs swing targets.

ETH/USDT | No energy for now! (READ THE CAPTION)By analysing the 4H chart of ETHUSDT, we can see that after hitting the Consequent Encroachment of the FVG, it dropped in price and has failed 2 times to go through the FVG and is now being traded at $2984.

Just like the other major crypto currencies, ETH has been consolidating in the same zone for a while, with no clear indication of any move for the time being.

Bullish targets for ETH: 3001, 3020 and 3057.

Bearish targets: 2947, 2910 and 2873.

BTCUSDT | Current targets! (READ THE CAPTION)As you can see in the 2H chart of BTCUSDT, it has been going up and down between the IFVG and the Demand Zone, no clear view of how and when it'll make a move.

In a prior analysis, I had mentioned that the bullish target were 88400, 89000 and 90400. BTC reached the first 2 targets but failed to go for the 3rd one.

For the time being, these are the bullish targets for BTC: 88,225, 88700, 89200 and 89700.

Bearish targets: 87,700, 87,250, 86,700 and 86,250.

LTC/USDT | Up or down? (READ THE CAPTION)By examining the 2H chart of LTCUSDT, we can see that after sweeping initial SellSide Liquidity, it started an upwards move, currently being traded at 77.55.

There are relative equal lows below the current zone LTCUSDT is being traded, I expect it to eventually drop there and sweep the liquidity there and then start another upwards move.

Current bullish targets for LTCUSDT: 78, 79.3 and 80.50.

Bearish Targets: 76.60, 75.40 and 74.30.

XAUUSD Fake Breakout at 4,520 - Price Tests Buyer Zone at 4,260Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold is trading within a broader ascending channel, confirming a dominant bullish structure despite the recent sharp pullback. After a strong impulsive rally, price respected the channel support and continued forming higher highs and higher lows, highlighting sustained buyer control throughout the trend. Currently, XAUUSD is trading below the broken channel support and has entered the Buyer Zone around 4,260, which aligns with a key Support Level and a prior breakout area. This zone represents an important reaction area where buyers may attempt to regain control. The projected path suggests a possible corrective bounce from this level, but overall price action remains vulnerable as long as it stays below the former resistance and channel structure. My scenario: as long as XAUUSD remains below the 4,520 Seller Zone and fails to reclaim the broken channel support, the bias favors further downside or consolidation. A clean hold above the Buyer Zone could trigger a short-term rebound toward the mid-channel area, while a decisive breakdown below 4,260 would open the door for a deeper corrective move. Please share this idea with your friends and click Boost 🚀

USD/CAD Chart – 3H Timeframe)...USD/CAD Chart – 3H Timeframe)

📈 Bullish Setup

Current Price: ~1.3710

Buy Zone: 1.3690 – 1.3720

🎯 Targets

Target 1: 1.3800 (first resistance / marked target)

Target 2: 1.3890 – 1.3900 (major resistance / upper target)

🛑 Stop Loss

SL: Below 1.3660 (recent swing low & cloud support)

🧠 Reason

Price is recovering from demand zone

Trendline break / retest

Bullish move toward previous resistance levels

Short (sell) targets

Scalping targets

Exact RR-based TP & SL

NZD/USD chart (2H timeframe)...NZD/USD chart (2H timeframe):

📈 Bullish Scenario

Current Price Area: ~0.5770

Buy Zone: 0.5750 – 0.5770

Target 1: 0.5810 (first resistance / marked target point)

Target 2: 0.5850 (next major resistance / upper target)

🛑 Stop Loss

SL: Below 0.5735 (recent low / demand zone)

🧠 Reason

Price bounced from a demand zone

Structure shows pullback after downtrend

Targets are aligned with previous resistance & cloud area

Short (sell) targets

Scalping targets

Exact RR-based TP & SL

GBP/USD (H1) –Chart pattern...GBP/USD (H1) –Chart pattern

Bias: Bearish

Sell zone: Around 1.3450 – 1.3480 (trendline / pullback area)

Target 1: 1.3380

Target 2: 1.3300

Stop Loss: Above 1.3520

Explanation:

Price has broken the ascending trendline and is rejecting the pullback. This suggests further downside toward the marked support levels.

Cardano Price Analysis: ADA Flashes Familiar Signals* ADA is again flashing a bullish divergence on the 3-day chart, a pattern that's preceded solid rallies several times in the past.

* However, the price of Cardano remains near stubborn levels of resistance that may hint that this movement could take some time and won't appear overnight.

* Whether ADA is building a solid base or needs more patience will come down to how price reacts around its most important support and reclaim zones.

When you step back and look at Cardano’s recent price action, one thing stands out. The market isn’t panicking; there’s no rush to sell, no sharp breakdown, and no sense that traders are trying to get out at any cost. Instead, ADA has settled into that uncomfortable middle ground where price just drifts.

For a while now, the ADA price has been hovering around the low-$0.30s. That kind of slow, sideways movement drains attention. Narratives cool off, and conviction fades simply because there’s no action to react to. It’s dull, and that’s often when markets start to matter.

What’s important is that ADA isn’t accelerating lower. Each dip into support tends to find buyers, while every bounce runs into resistance and fades. Sellers aren’t pushing aggressively, but buyers also aren’t ready to take control. The market is paused, not breaking.

This behavior isn’t new for Cardano. In past cycles, similar low-volatility stretches showed up late in consolidation phases. The ADA price went nowhere long enough for many traders to stop paying attention. Then, once positioning was light and expectations were low, structure shifted quickly.

On-chain data supports that view. ADA’s market cap has stayed within a relatively narrow range, and the recent drift hasn’t come with signs of panic. That points more toward digestion than fear.

What’s next for ADA?

What comes next will come down to structure, not sentiment. As long as price holds support in the low-to-mid $0.30s and continues to compress under resistance, the setup stays intact.

ADA isn’t making headlines right now, but this kind of quiet phase often matters more than it looks.