Crypto

XAUUSD Fake Breakout at 4,520 - Price Tests Buyer Zone at 4,260Hello traders! Here’s my technical outlook on XAUUSD (4H) based on the current chart structure. Gold is trading within a broader ascending channel, confirming a dominant bullish structure despite the recent sharp pullback. After a strong impulsive rally, price respected the channel support and continued forming higher highs and higher lows, highlighting sustained buyer control throughout the trend. Currently, XAUUSD is trading below the broken channel support and has entered the Buyer Zone around 4,260, which aligns with a key Support Level and a prior breakout area. This zone represents an important reaction area where buyers may attempt to regain control. The projected path suggests a possible corrective bounce from this level, but overall price action remains vulnerable as long as it stays below the former resistance and channel structure. My scenario: as long as XAUUSD remains below the 4,520 Seller Zone and fails to reclaim the broken channel support, the bias favors further downside or consolidation. A clean hold above the Buyer Zone could trigger a short-term rebound toward the mid-channel area, while a decisive breakdown below 4,260 would open the door for a deeper corrective move. Please share this idea with your friends and click Boost 🚀

USD/CAD Chart – 3H Timeframe)...USD/CAD Chart – 3H Timeframe)

📈 Bullish Setup

Current Price: ~1.3710

Buy Zone: 1.3690 – 1.3720

🎯 Targets

Target 1: 1.3800 (first resistance / marked target)

Target 2: 1.3890 – 1.3900 (major resistance / upper target)

🛑 Stop Loss

SL: Below 1.3660 (recent swing low & cloud support)

🧠 Reason

Price is recovering from demand zone

Trendline break / retest

Bullish move toward previous resistance levels

Short (sell) targets

Scalping targets

Exact RR-based TP & SL

NZD/USD chart (2H timeframe)...NZD/USD chart (2H timeframe):

📈 Bullish Scenario

Current Price Area: ~0.5770

Buy Zone: 0.5750 – 0.5770

Target 1: 0.5810 (first resistance / marked target point)

Target 2: 0.5850 (next major resistance / upper target)

🛑 Stop Loss

SL: Below 0.5735 (recent low / demand zone)

🧠 Reason

Price bounced from a demand zone

Structure shows pullback after downtrend

Targets are aligned with previous resistance & cloud area

Short (sell) targets

Scalping targets

Exact RR-based TP & SL

GBP/USD (H1) –Chart pattern...GBP/USD (H1) –Chart pattern

Bias: Bearish

Sell zone: Around 1.3450 – 1.3480 (trendline / pullback area)

Target 1: 1.3380

Target 2: 1.3300

Stop Loss: Above 1.3520

Explanation:

Price has broken the ascending trendline and is rejecting the pullback. This suggests further downside toward the marked support levels.

Cardano Price Analysis: ADA Flashes Familiar Signals* ADA is again flashing a bullish divergence on the 3-day chart, a pattern that's preceded solid rallies several times in the past.

* However, the price of Cardano remains near stubborn levels of resistance that may hint that this movement could take some time and won't appear overnight.

* Whether ADA is building a solid base or needs more patience will come down to how price reacts around its most important support and reclaim zones.

When you step back and look at Cardano’s recent price action, one thing stands out. The market isn’t panicking; there’s no rush to sell, no sharp breakdown, and no sense that traders are trying to get out at any cost. Instead, ADA has settled into that uncomfortable middle ground where price just drifts.

For a while now, the ADA price has been hovering around the low-$0.30s. That kind of slow, sideways movement drains attention. Narratives cool off, and conviction fades simply because there’s no action to react to. It’s dull, and that’s often when markets start to matter.

What’s important is that ADA isn’t accelerating lower. Each dip into support tends to find buyers, while every bounce runs into resistance and fades. Sellers aren’t pushing aggressively, but buyers also aren’t ready to take control. The market is paused, not breaking.

This behavior isn’t new for Cardano. In past cycles, similar low-volatility stretches showed up late in consolidation phases. The ADA price went nowhere long enough for many traders to stop paying attention. Then, once positioning was light and expectations were low, structure shifted quickly.

On-chain data supports that view. ADA’s market cap has stayed within a relatively narrow range, and the recent drift hasn’t come with signs of panic. That points more toward digestion than fear.

What’s next for ADA?

What comes next will come down to structure, not sentiment. As long as price holds support in the low-to-mid $0.30s and continues to compress under resistance, the setup stays intact.

ADA isn’t making headlines right now, but this kind of quiet phase often matters more than it looks.

BNB/USDT | Sleeping for now! (READ THE CAPTION)As you can see in the Daily chart of BNBUSDT, after hitting a new ATH at $1375 in October, it has plummeted in price and is being traded now at $860.

It has reacted to the Bullish Rejection Block several times now, but it is still in a shallow run, taking its sweet time for the time being until it makes a real move.

Bullish targets are: 871, 884 and 897.

Bearish targets are: 846, 833 and 821.

$BTC 4h Time-based fractalsYou can interpret this fractal however you like, but structurally it still makes sense. We did get an extension at the highs, yet the current compression looks normal and not particularly concerning.

This type of pause often leads to a more controlled, slow grind higher. As long as price continues to hold the 88–87k area, a retest of the 97–100k zone remains reasonable before another breakdown.

Bitcoin Is Not Breaking Out Yet — This Is Classic Box Accumu....Hello everyone,

On the H1 timeframe, the key focus right now is not chasing an immediate breakout, but recognizing that Bitcoin is still consolidating inside a well-defined accumulation box. Despite several sharp intraday swings, price continues to respect clear boundaries, signaling balance rather than trend.

Structurally, BTC has been rotating between the 86,500 support zone and the 90,300–90,400 resistance zone. Multiple attempts to push higher have stalled below resistance, while every pullback into support has been absorbed quickly. This repeated back-and-forth price action is characteristic of box accumulation, where liquidity is being built before a directional expansion.

The recent impulsive rally toward the upper range was followed by an equally sharp rejection, but crucially, price did not break down. Instead, BTC stabilized above the mid-range and began forming higher short-term lows, suggesting that sellers are losing momentum near the bottom of the box while buyers remain active.

From a price action perspective, the market is printing overlapping candles and compressed swings, confirming that this is not a trending environment yet. The projected path on the chart reflects a typical accumulation outcome: continued rotation inside the box, potential liquidity sweeps, and only then a decisive move.

Key levels to watch:

Resistance zone: 90,300–90,400 — range high and breakout trigger.

Support zone: 86,500–86,800 — range low and structural defense.

Mid-range: ~88,500 — equilibrium area where noise dominates.

A clean breakout and acceptance above resistance would confirm bullish continuation and open the door for upside expansion. Conversely, a decisive breakdown below support would invalidate the accumulation structure and shift the bias lower. Until one of these conditions is met, Bitcoin remains range-bound and in preparation mode, not trending.

Wishing you all effective and disciplined trading.

Liquidity Builds Before the Real MoveOn the 1H timeframe, Bitcoin remains locked inside a clearly defined sideways range, bounded by a support zone around 86,700–87,000 and a resistance zone near 90,300–90,600. Price is currently trading around 88,500, which places it firmly in the middle of the range — a location that typically favors indecision rather than directional conviction.

From a market structure standpoint, Bitcoin has repeatedly failed to establish acceptance above the resistance zone. Each impulsive push into the 90K area has been met with swift rejection, signaling that sell-side liquidity remains active at the highs. These reactions confirm that the resistance is not yet weakened and continues to cap upside attempts.

On the lower boundary, the support zone has been respected multiple times, producing consistent rebounds. However, these reactions have become increasingly corrective rather than impulsive. This suggests absorption and balance, not aggressive accumulation. As long as price holds above this zone, downside continuation remains limited, but the lack of strong follow-through keeps the market range-bound.

The current price action shows compression and volatility contraction, a classic behavior ahead of expansion. Liquidity is being built on both sides of the range. A sustained break and acceptance above 90,600 would be required to confirm a bullish continuation scenario, while a clean loss of 86,700 support would expose lower liquidity pools and shift the bias decisively bearish.

From a broader macro perspective, Bitcoin remains sensitive to overall risk sentiment and liquidity conditions. With no clear macro catalyst or volume expansion visible at this stage, the market continues to favor range rotation rather than trend development.

In summary, Bitcoin is not trending it is consolidating. Until price decisively exits the 86,700–90,600 range, traders should prioritize reaction at key levels, patience, and disciplined risk management, rather than anticipating a breakout prematurely.

Bitcoin Builds a Base Below SupplyOn the 1H timeframe, Bitcoin is currently trading inside a well-defined range, capped by a clear resistance zone around 90,000–90,300 and supported by a key demand area near 87,700–88,000. Price has recently rebounded from the lower boundary of the range, indicating that buyers are still active at support, but the market has not yet transitioned into a trending environment.

From a structure perspective, the prior impulsive sell-off broke short-term bullish momentum and shifted BTC into a range-building phase. Since then, price action has been characterized by higher lows from support, but each upside attempt remains corrective and constrained beneath resistance. This behavior suggests balance and compression, not a confirmed breakout setup yet.

The 34 EMA and 89 EMA are beginning to flatten and converge, with price oscillating around them. This alignment typically reflects neutral momentum, reinforcing the idea that the market is waiting for new information or liquidity before committing to a directional move. As long as price remains below the resistance band, upside moves should be viewed as range rotations, not trend continuation.

The projected path toward resistance represents a mean-reversion move within the range, where liquidity is likely resting near the upper boundary. A clean breakout would require strong acceptance above 90,300, supported by increased volume and sustained closes above that level. Without those conditions, the probability of rejection and rotation back toward support remains elevated.

From a macro standpoint, Bitcoin is entering a period where expectations around monetary policy in the coming year are already partially priced in. This reduces the likelihood of an immediate, sentiment-driven breakout unless accompanied by a clear shift in liquidity conditions or risk appetite. As a result, the current structure favors patience and range awareness, rather than directional bias.

In summary, Bitcoin is constructively consolidating, but still structurally neutral. The market is preparing for expansion, yet direction remains unresolved. Until resistance is decisively reclaimed, Bitcoin should be treated as range-bound, with both upside and downside scenarios remaining technically valid.

BTC: The 15-Year Prophecy (Hosoda Time & The Diagonal)There is a ghost in the machine.

For the last few months, amidst the noise of breakouts and new highs, a specific signal has been flashing a warning that defies the rules of a standard Bull Market. It is a "glitch" in the data—a silence where there should be noise.

Most are ignoring it. Some are confused by it. Today, we are going to try solving it.

Below is the full evolution of the Bitcoin setup, from the Daily traps to the Macro truth, revealing why the "Silence" is actually the loudest signal we have ever seen.

Part 1: The Micro Trap (1D Chart)

Zooming into the daily timeframe, the structure of the decline is textbook. We are currently navigating Wave (4), but the context provided by the previous move is critical.

The "Extended" Wave 3: The drop we just witnessed wasn't a standard correction; it was an impulsive sell-off where Wave 3 was extended. when the third wave extends, it confirming strong momentum in the direction of the trend. The bears are in control.

Current Status (Wave 4): We seem to be in the middle of a Wave (4) relief rally, potentially unfolding as an ABC correction.

Sub-waves 'a' and 'b' appear complete, with 'b' potentially establishing a local higher low.

What's Next: We are likely waiting for Wave 'c' to expand upwards to potentially complete the structure.

The Potential Resistance ($99k): If this structure holds, Wave 'c' might push towards the resistance confluence around $99,323. This area could serve as a ceiling for this corrective phase.

The Downside Risk ($79k): Traders should remain cautious. If Wave (4) finds resistance near $99k, the Elliott Wave guidelines suggest a Wave (5) decline could follow. If that scenario plays out, the market might target the major support zone near $79,000.

Part 2: The Time Anomaly (1W Chart)

While the daily chart showed us the immediate price action, the Weekly chart reveals the true scale of the move. As discussed in previous updates, we are navigating a large-scale Irregular Flat Correction, and we are currently at the tail end of Wave (1) of the 5-wave impulse that makes up the larger C-Wave.

So, the entire impulsive structure we just analyzed on the Daily chart? That was just the first leg of this Weekly move.

☁️ The Ichimoku Signal: Testing "Senkou Span B" Price action has now entered the Ichimoku Cloud (Kumo), a critical zone of turbulence.

The Level: you can see candles trading inside the cloud. We have already tested the bottom support, specifically the Leading Span B (Senkou Span B).

The Forecast: Hitting this level signals that Wave (1) is either ending or has already ended. However, the market rarely makes it easy. I am expecting a potential "False Breakout" below the Cloud to trigger panic, followed by a sharp reclamation. That fake-out would likely mark the bottom of Wave (1) and start of Wave (2).

⏳ The Time Anomaly: Why so fast? There is a strange disconnect in the "Time" dimension of this cycle compared to history (see picture).

2021 Cycle: In the previous bull run, the correction for Wave 1 typically took 70 days to cool the RSI down to 37.

Current Cycle: We have smashed down to an RSI of 35.8 in just 42 days.

The Question: Why is the market correcting nearly twice as fast as before? This "Time Compression" indicates the cycle is moving faster and more violently than we are used to.

The "BBWP Mystery" Finally, look at the BBWP (Volatility) in the below picture. This presents a genuine anomaly. Throughout this cycle, we have seen contractions many times, yet the spectrum never reached the extreme 90% expansion levels. Now, at the very end of the cycle, we are seeing another massive BBWP Contractions.

Why is this happening? Is it just noise, or is this contraction actually telling us the truth?

Part 4: The Truth (6-Month Macro Chart)

Why is the market moving so fast? And what is the "BBWP Signal" we mentioned Before? Look at the 6-Month Logarithmic Chart below.

The Big Picture: Elliott Wave Supercycle on 6M Log Scale

On the logarithmic chart, Bitcoin appears to be wrapping up a massive impulse wave that started from its early days:

Wave (I): Peaked around 2013 (~$1,200 high).

Wave (II): Bottomed in 2015 (~$200 low).

Wave (III): Explosive rally to the 2021 all-time high (~$69,000).

Wave (IV): The 2022 bear market low (~$15,500).

Wave (V): Ongoing since late 2022, but here's the twist—it's unfolding as an ending diagonal (wedge pattern with overlapping subwaves: 1-2-3-4-5).

2.Applying Hosoda Time Theory (Ichimoku Time Theory indicate potential future market turning point).

The vertical lines in the chart are not Fibonacci; they are Hosoda Numbers (9, 13, 17, 21...),

9: Marked the 2023 Bull Run start.

13: Exactly Marked the Jan 2025 Top as end of wave 3, which matches the irregular flat analysis on Weekly chart which states that Cycle top was on Jan 2025.

17 (±1): Matches our projection for the next major pivot—the end of wave IV and the start of the final Wave V run on Jul-2026 or Jan-2027.

The "Mystery": The BBWP Anomaly

BBWP is contracting sharply now on weekly chart—at what feels like the end of the cycle, not the start. This flips the script on historical behavior. Why? I tie it back to the higher-degree Elliott count: The ending diagonal's converging nature naturally squeezes volatility, compressing Bollinger Bands as momentum fades. Instead of signaling a fresh bull, this late-cycle contraction could be foreshadowing a reversal—think trend exhaustion rather than accumulation.

A Possible Explanation: If the macro structure is indeed an Ending Diagonal, then this volatility crunch (BBWP contractions) and the market correcting nearly twice as fast as before makes perfect sense. We would be squeezing into the apex of a 15-year wedge. The market might be running out of "oxygen".

The Verdict: With the 6-Month structure potentially squeezing into a corrective Wave IV, the weight of evidence suggests that the path of least resistance is down. Until the market touches the lower boundary of this diagonal (or invalidates the structure), the only logical macro view is bearish.

How deep will the Bitcoin bear market retrace?We have already hit the 0.382 linear retrace level and the Bitcoin price is still bearishly consolidating.

So further downside is to be expected.

The question is how deep and do we have any confluent levels comparing the two fibonnaci's.

The answer is YES around the 50 thousand mark..

Which is an obvious key level to probe and ask questions of IMO

PENDLE – Weekly Structure Higher timeframe structure remains bearish

Price continues to trade below a key resistance after a clear rejection

Previous support has flipped into resistance

→ R/S flip is holding, keeping downside pressure intact

Recent downside move fully filled the lower wick

This indicates liquidity has been taken and short-term relief is possible

On the lower timeframe, a Market Structure Shift (MSS) has formed

→ This suggests a potential corrective move

As long as price remains below HTF resistance, any bounce should be treated as reactive

Bullish continuation only becomes valid after a reclaim and hold

Level-to-level market

Wait for confirmation, not anticipation

Do you expect a corrective bounce or continuation to new lows from here?

Should I break this down on the lower timeframe?

MrC

HARRYPOTTEROBAMASONIC10INU: Long term thoughts - bottom? On the weekly, I think it’s reasonable to start discussing a potential bottom forming here, but I want to be clear that this is still a developing process, not a confirmed reversal.

Price has gone through a prolonged markdown phase with multiple failed bounces, which is typical for meme assets after the hype cycle ends. What stands out now is that downside momentum has clearly slowed. Weekly ranges are compressing, volatility is contracting, and price is stabilizing around the 0.035–0.045 region, which has acted as a persistent floor.

Structurally, I’m no longer seeing meaningful lower lows. Instead, price is grinding sideways after a long dump. That kind of behavior is often how bottoms actually form, through time and compression, rather than a single sharp reversal candle. Selling pressure appears exhausted, and volume looks muted compared to prior breakdowns, which supports the idea that most weak hands are already out.

That said, this is not a confirmed bottom yet. Right now, I view this as a potential accumulation range rather than a trend change. For confirmation, I want to see a clear weekly higher low and eventually a reclaim of prior range resistance in the 0.07–0.09 area with expanding volume. Without that, this remains consolidation inside a broader downtrend.

If price loses this base decisively on a weekly close, then the basing thesis is invalidated and the downtrend simply continues.

From a probability standpoint, this is the zone where bottoms usually develop, but bottoms are processes, not events. Expect chop, false starts, and long periods of inactivity before any sustained upside. My bias has shifted from avoiding the chart to monitoring closely for accumulation and early reversal signals.

BTCUSDT: Bullish Push to 90750?BINANCE:BTCUSDT is eyeing a bullish rebound on the 4-hour chart , with price bouncing from an upward trendline near support, converging with a potential entry zone that could spark upside momentum if buyers hold against short-term dips. This setup suggests a recovery opportunity after recent pullback, targeting higher resistance levels with 1:2 risk-reward .🔥

Entry between 87870–87100 for a long position. Target at 90750 . Set a stop loss at 86420 , yielding a risk-reward ratio of 1:2 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging Bitcoin's resilience near the trendline.🌟

📝 Trade Setup

🎯 Entry (Long):

87,100 – 87,870

(Entry within this zone is valid with strict risk & capital management due to elevated volatility.)

🎯 Target:

• 90,750

❌ Stop Loss:

• 86,420

⚖️ Risk-to-Reward:

• ~ 1:2

⚠️ High-Risk Setup

💡 Your view?

Does BTC hold the ascending trendline and push toward 90,750, or does volatility drag price into a deeper correction first? 👇

#GOLD - RALLY STILL FAR FROM THE END Briefly — I expect Gold to keep growing in the next couple of years, we are far from the end of the rally. Three reasons why:

- Safe Haven. Gold (and other metals which was recently proved) still act as the main safe heaven for retail, institutionals, banks (including CBs) . The ongoing geopolitical tensions around the world make them allocating more funds to $XAU.

- Stocks. The stock market is extremely overheated (a quick look at the SP:SPX 1Y chart makes it obvious) . No significant correction since 2008, the 2022 pullback was only a bare minimum and clearly insufficient. RSI is now near critical overbought levels. Most likely we will see new highs on stocks in 2026 — but that will mark the cycle top. Add an AI bubble that is about to pop. The puzzle fits together. Rotation from stocks to metals has already begun.

- Crypto. The 10/10/25 crash was dramatic for crypto and its future. It pushed Bitcoin from "high risk" into "extreme risk" bracket. Altcoins are out of any measurement scale with some of them dumping -90% in one day. Crypto market needs huge reforms, one day I will cover that topic in a separate post. For now: Gold > Bitcoin. Sadly.

💰 Add up a weak TVC:DXY and you will clearly see that there are not many places where investors can allocate their money other than metals, primary $XAU.

My forecast: we will see TVC:XAU near $10,000 mark before 2029.

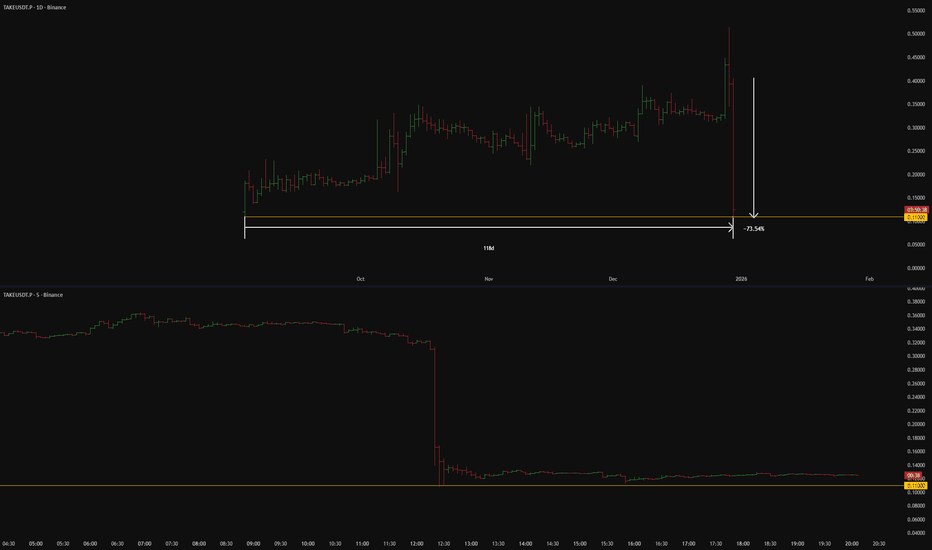

TAKEUSDT: short setup from daily support at 0.11000This case study highlights the critical significance of the asset's Listing Price level. At a minimum, it acts as a strong psychological barrier. At best, after 118 days of trading, we witnessed a pixel-perfect retest of this exact level — just look at how powerful the subsequent drop was.

I prioritize such setups because they heavily tilt the scales from a standard 50/50 toss-up to a solid statistical advantage in my favor. Several other confluence factors also strengthened this scenario, boosting the trade's profitability above the baseline. Clean charts like this are a rarity.

Relative to the 72% crash, the BINANCE:TAKEUSDT.P displays zero intent to correct, at least for now. The longer the accumulation continues above this support, the higher the likelihood of a breakdown. This market anomaly signals either a total vacuum of buyers or overwhelming selling pressure.

The scenario I expect:

Price void / low liquidity zone beyond level

Asset decoupled from the market (relative strength/weakness vs. BTC)

Momentum stall at the level

No reaction after a false break

Closing near the level

Closing near the bar's extreme

The chart displays negative factors:

Lack of consolidation

Was this analysis helpful? Leave your thoughts in the comments and follow to see more.

Bullish Channel Breakdown Signals Bearish ContinuationThis is a 3-hour XAUUSD (Gold vs US Dollar) chart from TradingView showing a clear trend transition:

Strong bullish trend earlier, guided by a rising ascending channel.

Price respected the upper and lower channel boundaries while making higher highs.

A sharp bearish breakdown occurred, with price decisively falling below the trend channel — signaling a potential trend reversal.

After the breakdown, price attempted a weak pullback but failed to reclaim the channel.

Two key downside targets are marked:

1st Target: ~4,255

2nd Target: ~4,170

The blue dynamic bands (volatility / Donchian-style channel) show expansion followed by contraction, supporting increased downside momentum.

The projected arrows suggest continued bearish pressure into early 2026 if support levels fail.

Overall, the chart highlights a shift from bullish structure to bearish continuation, with clearly defined downside objectives.

EURGBP – H1 Analysis ....EURGBP – H1 Analysis (based on my chart)

Market Structure

Clear descending trendline breakout ✔️

Price is now holding above the broken trendline (retest done).

Ichimoku cloud support forming → bullish reversal confirmed.

Momentum shifting from sell → buy.

📈 Buy Setup

Buy Zone: 0.8725 – 0.8750

🎯 Target Points

Target 1: 0.8780

Target 2: 0.8820 (main bullish target / My marked level)

❌ Invalidation

H1 close below 0.8705 → bullish setup fails.

📌 Trade Summary

Pair: EURGBP

Timeframe: H1

Bias: BUY (trendline breakout)

Targets: 0.8780 → 0.8820

📍 Around 0.8820, expect profit booking or short-term rejection, so partial profit is smart.

AUD/USD – 3H chart pattern...AUD/USD – 3H chart pattern

Bias: Bearish (Sell)

Price has broken below the rising channel and is moving under the cloud, so downside continuation is expected.

🎯 Sell Targets

Target 1: 0.6580 (first support / pullback target)

Target 2: 0.6460 (major support / final target)

🛑 Stop Loss

Stop Loss: Above 0.6700 (above channel & recent high)

📌 Summary

Trend: Bearish

Entry idea: Sell on pullback or breakdown

Targets: 0.6580 → 0.6460

SL: 0.6700

If my want, I can also give:

Exact entry price

CAKE/USDT – Post-Dump Consolidation and Key Levels to WatchCAKE is currently consolidating after a sharp 28% drop earlier in December, setting the stage for potential liquidity sweeps and reactive plays.

🔼 Upside Scenario

Stop Hunt Setup: Price is pushing toward stops above the Dec 29 high at $1.920. A sweep here may provide bulls a clean exit or set up a reversal.

Key Resistance: Watch the $1.9775 level – the top of the unfilled bearish daily gap from Dec 17, aligned with the 18-day EMA, creating technical confluence.

Extended Bull Case: If momentum continues and BTC stays strong, price may target the Dec 15 gap at $2.0843. This zone marks the next major upside liquidity area.

🔽 Downside Scenario / Support Zones

Immediate Support: Around $1.8665, particularly if Monday’s low holds above Saturday’s high, forming a bullish daily gap.

Rejection Zone: Multiple bearish rejections since Dec 20 reinforce this support area.

Deeper Pullback:

Equal lows at $1.7890 and $1.7670 could become bearish targets.

$1.7943 (Dec 18 rejection) may act as a reaction level for bulls.

Below $1.7670, next structural supports are weak until $1.7200 and $1.7000, which are psychological levels where bulls may step in.