SANTOS Compressing Inside Rising StructureSANTOS is currently trading inside a rising structure, forming higher lows while pushing into a well-defined resistance zone around 2.45–2.55. Price compression near this area suggests a decision phase is underway.

A clean breakout and acceptance above resistance would confirm bullish continuation and open the path toward the 3.60+ region. However, failure to hold the rising support could trigger a deeper pullback, with downside risk toward the 1.80–1.70 zone and potentially lower if structure breaks.

This level decides continuation vs rejection. Patience is key here.

Crypto

Estimated Stock Market Peak 2026"It's time to call 'bullshit' on the market."

The newswire has been busy lately, don't get distracted by; something feels off.

More than four years have passed since my last major stock market top analysis.

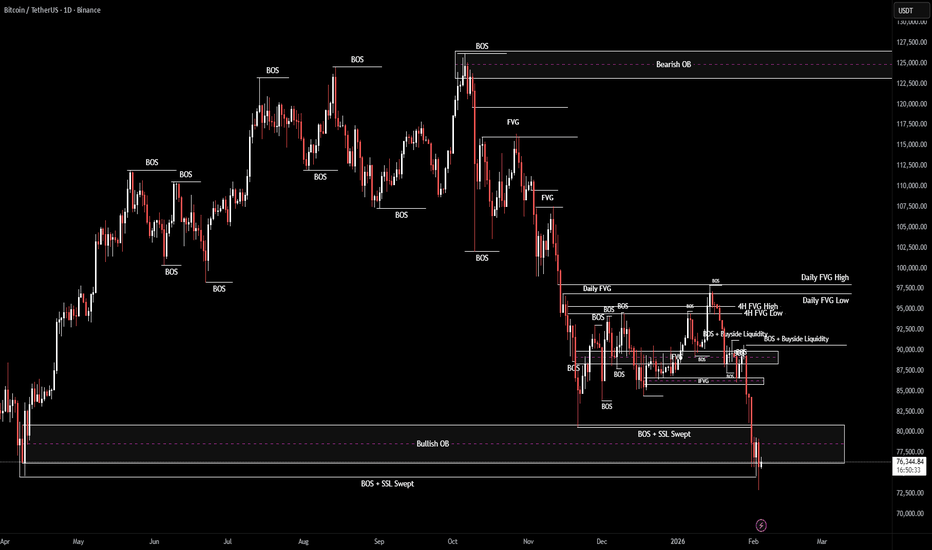

Why Bitcoin? Because it is one of the most cyclical assets, based on liquidity flows at the extreme end of the risk curve, leading the global market peak.

This was the first market cycle with high interest rates and without economic stimulus. Therefore, neither an expansion of the business cycle nor a comparable investment interest from retail, which ultimately led to a peak of apathy rather than euphoria. A typical sign of a later cycle environment, in times of economic uncertainty and risk aversion, with an absence of market breadth, in which only major caps temporarily lead and all other stocks and indicators lag behind. Without an expansion of the broader markets, the entire system risks collapse as soon as the blue chips lose momentum. Zombie companies survived on 0% interest rates, but now the bill is coming due. They have to refinance billions this year at significantly higher rates and will most likely not survive. Warren Buffett, on the other hand, is sitting on a historically high cash reserve of over $380b and doesn't want to "buy the dip", but rather first ride out the delayed effects of rapid interest rate hikes and market downturns on companies whose AI expenditures aren't based on actionable revenues.

Contrary to popular belief, rate cuts into a recession are not bullish.

The Fed could begin larger cuts once they realize the economy is falling off a cliff.

Markets will then respond by falling through the news narrative of an escalating potential war or energy crisis blackout bankrun leading to surging inflation and fears of a global recession.

Only when we hit rock bottom will the Fed have a reason to intervene and aggressively stabilize the market through QE and stimulus checks.

Meanwhile, the commodity supercycle is underway, countering the cryptocurrency market, which is based on tech and big risk-on sentiment speculation. Rising precious metals are a worrying warning signal for the economy, indicating the market being concerned about the stability of the system, predicting what lies ahead of us. A rotation is unlikely to occur immediately; instead, a deep retracement will likely have to take place first. Some of the weakness by stocks may become more pronounced whenever Gold gets a correction.

You will see the US stock markets similarly plunge, but then soar like an eagle as they become the last bastion of capitalism, as frightened money from all over the place, including sovereign bond markets, pours into equities one last time as exit liquidity like never before. It will be interesting to see how ByteDance, SpaceX, OpenAI, Anthropic, Databricks, Stripe, Canva, Revolut, Klarna and Kraken time their IPOs to coincide with the market peak.

The last crypto market capitulation in June 2022 was triggered by the disappearance of Luna(+UST), 3AC, BlockFi, Celsius and the short-term depegging of USDT, which are maximum fear events. This was followed by a five-month time-based capitulation and the absolute market bottom depression caused by the FTX insolvency.

Assumption of next market capitulation bottom:

Corporate Subprime Bitcoin Crisis of 2026

"The system works – but does it justify this valuation?"

Bitcoin was an asset, but it was treated like equity. The highest-probability risk is institutional treasury capitulation under debt and cash flow pressure.

2024–2025: Bitcoin was used as a balance sheet asset (leverage, convertible bonds, project financing). Many models only work when prices rise, and not in MSTR Ponzi schemes.

In 2026, refinancing becomes more expensive, cash flows are insufficient, covenants are triggered, and creditors demand de-risking. The accompanying stock market correction will certainly contribute to this.

= Everyone who needed to own Bitcoin has to sell. High volume and volatility, thin order book illiquidity, negative altcoin funding rates, large arbitrage, and unfavorable front page newspaper and magazines coverage of fear, uncertainty and doubt sentiment.

However, the maximum psychological effect only occurs when something unexpected happens and what is perceived as "safe" breaks down, resulting in existential consequences for private investors.

1. At least another ~1% USDTUSD decline due to altcoin capitulation selling, if not eventually, at a cycle bottom, the controlled Tether implosion restructuring to USDC (Circle)

2. A reputable, top-10, retail-loving coin (-90% Solana, Tron) loses significance/trust

3. Quantum anxiety, privacy wallet/custody layer shock due to wallet bug, smart contract freeze, multi-chain bridge problem, recovery failure

= At the end of the day, as always: Bitcoin hasn't failed – but everything around it.

Assuming the market continues to move at its current velocity relative to historical corrective structures, it seems logical that the loud and frightening crash as well as the associated surprise narrative, will occur during the Blood Moon sometime in February-March.

We will see which global fear narrative emerges while observing the bottoming process through technical indicators and on-chain data. Depending on the strength of the Q1 correction, possibly 5+ months later a bottom in August-October. You should start buying BTC as soon as the price drops below $48.5k, with a target range of around $39k. If the price retraces further, things might be different this time. I will provide you with a new update then. No financial advice.

This isn't about calling a precise top. It's about asymmetry and risk management. Don't be fooled into thinking the markets are doing well beneath the surface.

"Patience is bitter, but its fruit is sweet."

Thank you for reading.

Noteworthy to watch:

- 2029 Shmita year

- 2026 median housing market peak, 18-year real estate cycle recession

- 2026 George Tritch (Benner) cycle – time to sell

- 2026 Chinese Year of the Horse

- 2026 bearish stock market U.S. midterm election years

- 2026 longest ISM PMI<50 & Copper/Gold ratio contraction

- 2026 largest inverted yield curve & Gold/US02Y ratio above 200WMA

- U.S. initial jobless claims above 260k =recession

- JNK divergences overlaying SPX

- Energy rotation Oil and Gas, inflation rising

- DXY rising

- DOWJONES reaction at 34.5k-36k

- TOTAL3ES excluding Btc, Eth and Stablecoins, reaction at $270b

- ETH expanding flat bottom zone at $900

Potential Total Market Cap BottomA potential bottom for the Total Market Cap over the coming months may be around ~$1.48T.

Currently, the market stands near $2.47T, which implies there could still be a reduction of ~$1T in total market value.

This is not investment advice.

Just sharing a personal view and interpretation of the current market environment.

EURJPY – 2H chart pattern...EURJPY – 2H chart pattern.

Nice structure on this one. Here’s the clean target map based on what’s visible.

What I’m seeing

Strong impulsive bullish move just completed

Price tapped into upper supply / resistance zone (yellow)

Ichimoku: price extended far above the cloud → pullback is healthy/expected

My marked arrows suggest a corrective move down, not full trend reversal (yet)

Sell / Pullback Targets 🎯

From current area 184.7 – 185.0:

TP1: 183.80 – 183.65

Previous structure + cloud top

Matches my first marked target

TP2: 182.60 – 182.40 🔥

Strong demand zone

Prior consolidation + liquidity pool

My second target point aligns perfectly

Invalidation / SL

If 2H closes above 185.50

→ pullback idea weak

Safe SL: above 185.80

Bias

📉 Short-term bearish correction

📈 Overall trend still bullish → watch for buys again near 182.5

Bitcoin still aiming for $78k - Institutional ContinuationH1 Long Signal: Institutional Continuation After Liquidity Sweep

Market Context & Setup

Price on the H1 timeframe is currently trading at 75,305.93, and short-term structure remains decisively bullish. The market has printed a clean Bullish Break of Structure (BOS), followed by a higher low (CHoCH) and a strong bullish candle that swept downside liquidity before reversing. This sequence signals active institutional participation rather than a retail-driven bounce.

The trade plan is an intraday long, executed either at market or on a shallow retest into the identified order block, sized according to H1 volatility and predefined risk rules.

Smart Money Concepts (SMC)

The SMC module on H1 confirms bullish control. Price cleared the prior swing high near 74,200, triggering a Change of Character, and then retraced into an institutional order block around 74,800–75,000 before resuming higher. This validates continuation rather than distribution.

Based on SMC structure:

Entry: 75,305.93

Stop Loss: 74,552.87 (below the swept low and order block boundary)

Risk: 753.06 points

Using BOS/CHoCH-based projections:

TP1 (1.5R): 76,435.52

TP2 (2.5R): 77,188.58

TP3 (4.0R): 78,318.17

SMC structure takes precedence for invalidation and stop placement. In this case, all confirmations align with the SMC read.

Liquidity Intelligence

Liquidity Intelligence flagged a clean sweep of equal lows near 74,200, followed by absorption and a bullish volume spike of ~1.8× the H1 average. This behavior is characteristic of stop-hunts followed by institutional accumulation.

Because liquidity conditions passed:

Entry is favored now or on a very shallow retest

A lack of sweep or absorption would have invalidated the setup

Order Block Detection

Order Block Detection identifies a bullish H1 order block at 74,800–75,000, which remains unmitigated. Price is currently trading just above this zone, confirming it as active institutional demand.

This order block:

Justifies entering at market or on OB acceptance

Dictates stop placement just below the zone

Allows for scaling in if price dips and holds the OB

A full mitigation (engulfment) of the order block invalidates the trade.

Fair Value Gap (FVG)

A bullish H1 Fair Value Gap sits higher between ~76,300 and 76,500, aligning precisely with TP1 at 76,435.52. This unfilled imbalance represents a natural liquidity target where partial profit-taking is expected.

Because the FVG confirmation passed, TP1 is treated as the primary exit / partial take-profit zone.

Momentum & Trend Filters

RSI (H1):

RSI is hovering around 58, indicating bullish momentum without overbought conditions. This supports further upside toward TP1 and TP2 before reversal risk increases.

Moving Averages (H1):

Price is above both the 50 EMA (~74,200) and 200 EMA (~72,400), with the 50 EMA above the 200 EMA. This bullish EMA alignment confirms that longs are favored on the hourly timeframe.

MACD (H1):

MACD shows a positive histogram with the MACD line above the signal line, aligning with the BOS candle. Momentum supports continuation rather than mean reversion.

Support, Resistance & Volume

Key Support: 74,800–75,000 (order block), then ~74,200 (swept low)

Resistance: 76,300–76,500 (FVG / TP1), 77,100–77,300 (TP2 zone)

Volume (H1):

The breakout candle printed ~1.8× average H1 volume, exceeding the strategy’s confirmation threshold (>1.5×). Elevated volume during the sweep-and-reversal sequence confirms institutional participation and increases the probability of a sustained move toward higher targets.

News & Event Risk

No specific macro, crypto, or on-chain events were provided for the current session. This setup is therefore based purely on price action and liquidity structure. Traders should remain alert to unexpected high-impact headlines or exchange announcements, as these can rapidly invalidate intraday structures.

Trade Plan Summary (H1)

Direction: LONG

Entry: 75,305.93 (market or on shallow OB retest)

Stop Loss: 74,552.87

TP1 (Partial Exit): 76,435.52

TP2: 77,188.58

TP3: 78,318.17

Execution Notes:

Size the position so the SL distance (~753 points, ~1% of price) matches your risk rules

Take partial profits at TP1 and move stop to breakeven

Exit immediately if:

The order block is fully mitigated, or

Liquidity Intelligence no longer shows absorption

Final Assessment

This is an A-quality H1 long setup, with alignment across SMC structure, liquidity sweep and absorption, order block demand, FVG targets, volume confirmation, and momentum indicators. Risk is tightly defined beneath institutional support, and profits are staged at logical liquidity and structure levels to maximize reward while controlling downside.

XAUUSD (2H) chart:..XAUUSD (2H) chart:

What I see

Clear breakout above the descending trendline

Price is holding above the demand / yellow zone

Ichimoku cloud ahead is thin → easier upside continuation

Momentum looks corrective → turning bullish

Targets (step-by-step)

TP1: 5,120 – 5,150 (nearest resistance / reaction high)

TP2: 5,280 – 5,320 (previous structure resistance)

Final target: 5,480 – 5,550 🎯

(Matches my drawn target point + measured move)

Invalidation / Safety

If price closes back below 4,980 – 5,000 on 2H → bullish setup weak

Conservative SL: below 4,950

Bias

📈 Bullish continuation as long as price stays above the breakout zone

BTCUSDT: Reacts to Key Support - Corrective Bounce To $82,200Hello everyone, here is my breakdown of the current BTCUSDT setup.

Market Analysis

BTCUSDT was previously trading within a well-defined upward channel, where price respected both the rising support and resistance boundaries, printing higher highs and higher lows. This structure clearly confirmed bullish control and healthy trend continuation. However, as price approached the upper region of the channel, bullish momentum began to weaken. After several failed attempts to sustain higher prices, BTC broke below the channel support, signaling the first sign of structural weakness.

Currently, price is stabilizing above the Support Zone and attempting to recover toward the 82,200 Resistance Zone, which now acts as a critical level. This area aligns with previous support turned resistance and represents a key decision point for the market. The overall structure suggests that the current move is a corrective rebound within a broader bearish impulse rather than a full trend reversal at this stage.

My Scenario & Strategy

My primary scenario favors a corrective long setup as long as BTCUSDT holds above the 77,800–78,200 Support Zone and continues to reject lower prices. A sustained hold above this demand area could allow price to recover toward the 82,200 Resistance Zone as a first upside target (TP1). This move would represent a technical retracement after the sharp sell-off.

However, strong rejection from the 82,200 resistance would likely confirm that sellers remain in control, potentially leading to another bearish continuation. A decisive breakdown and acceptance below the Support Zone would invalidate the long scenario and open the door for further downside expansion. For now, BTC is at a key reaction area, and confirmation from price behavior near resistance will be crucial.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

BTCUSDT Bearish Structure Holds - Short From ResistanceHello traders! Here’s my technical outlook on BTCUSDT (2H) based on the current chart structure. Bitcoin initially traded within a clearly defined range, where price moved sideways for an extended period, indicating market equilibrium and accumulation before the next directional move. This ranging phase eventually resolved to the upside, leading to a strong impulsive rally and a short-term bullish continuation. However, after reaching the local top, price turned around and transitioned into a well-structured descending channel, confirming a shift in short-term market control from buyers to sellers. Following the breakdown, Bitcoin dropped sharply into the Seller Zone, where price briefly reacted before continuing lower. The sell-off eventually extended into the major Buyer Zone around 75,700, which aligns with a key horizontal support area and prior demand. Price briefly pierced this level, forming a fake breakout, but quickly recovered back above support — a strong indication that sellers failed to gain acceptance below demand. Currently, BTC is stabilizing above the Buyer Zone and attempting a short-term recovery. This price behavior suggests a corrective rebound rather than a confirmed trend reversal at this stage. Structurally, as long as price holds above the Buyer Zone, a recovery move toward the 78,700–79,400 Resistance / Seller Zone (TP1) remains possible. This area also aligns with a descending resistance line, making it a key level to watch for potential rejection. Rejection from the Resistance / Seller Zone favors continuation to the downside. A move back toward the 75,700 support is the first target, followed by potential extension toward lower demand levels if selling pressure accelerates. Acceptance below the Buyer Zone would confirm bearish continuation and open the door for deeper downside. The bearish scenario remains valid as long as price stays below resistance and fails to reclaim the broken structure. Only a strong breakout and acceptance above the Seller Zone would invalidate the short setup. Until then, BTC remains in a corrective bounce within a broader bearish structure. Please share this idea with your friends and click Boost 🚀

EURUSD Bulls Take Control - 1.1940 as Next TestHello traders! Here’s my technical outlook on EURUSD (3H) based on the current chart structure. EURUSD previously traded within a well-defined ascending channel, where price consistently respected both the rising support line and the channel resistance, confirming steady bullish control and healthy trend conditions. During this phase, the market printed higher highs and higher lows, showing strong buyer dominance. However, after reaching the upper boundary of the channel, bullish momentum began to weaken, and price transitioned into a corrective phase. This correction unfolded gradually, signaling profit-taking rather than an immediate trend reversal. Following the pullback, EURUSD formed a rising triangle structure supported by a clear ascending support line. Price then broke impulsively to the upside, signaling a structural shift and renewed buying interest. This breakout pushed price above the Buyer Zone around 1.1860, confirming acceptance above previous resistance turned support. The bullish impulse extended into the Seller / Resistance Zone near 1.1940, where price is currently reacting. At this level, sellers have started to show interest again, and price is consolidating below the resistance, indicating hesitation and potential short-term exhaustion after the strong rally. Structurally, the Buyer Zone around 1.1840–1.1860 now acts as a key support area. As long as price holds above this zone and respects the rising triangle support line, the broader bullish structure remains intact. A sustained hold above support favors a continuation move toward the 1.1940 Resistance Level, which stands as the primary upside target (TP1). This level also represents a critical decision zone where either continuation or rejection is likely to occur. My scenario: holding above the Buyer Zone keeps the bullish continuation scenario valid, with a potential retest of the 1.1940 Resistance Level. A clean breakout and acceptance above this resistance would open the door for further upside expansion. However, a strong rejection from resistance followed by a breakdown below the Buyer Zone would invalidate the bullish bias and signal a deeper corrective move. For now, EURUSD is trading at a key structural area, with buyers attempting to defend support and push price higher. Please share this idea with your friends and click Boost 🚀

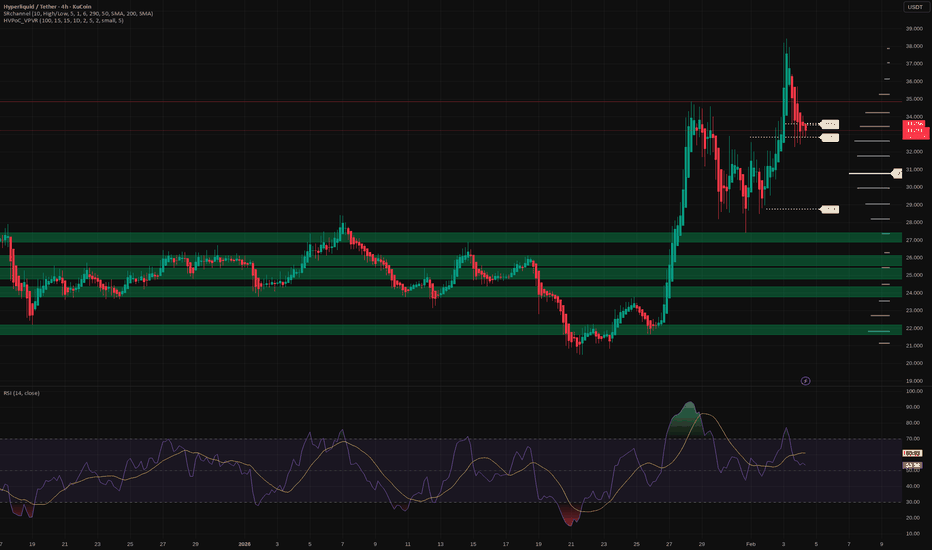

Hyperliquid: bull flag in play? key levels to watch aheadHyperliquid. Who’s riding this new perp beast or just watching from the sidelines? According to market chatter, the recent token launch plus growing derivatives volume keeps Hyperliquid in the spotlight, and today’s headlines about rising on-chain activity only added fuel to the narrative.

On the 4H chart we’ve got a classic post-pump chill phase: sharp vertical move, then a sideways pullback between roughly 31 and 35 that looks like a bull flag. Volume on the run-up was heavy and is now fading while RSI cooled from overbought back to the 50–60 zone - a healthy reset instead of a trend break. I’m leaning long, expecting liquidity grabs toward 32-31 and then a push through 34 with eyes on 36-38.

My plan: ✅ base case is that 31 holds as key support and price grinds higher toward 36 first, 38 if momentum returns. ⚠️ If we start closing 4H candles below 31 and especially under 29.7, I’ll treat it as a local top and look for deeper buys down in the lower green zones. I might be wrong, but I’d rather wait for the dip than FOMO into the last green candle at the highs.

VANA Testing Upper Boundary of Descending ChannelVANA is currently trading near the upper boundary of a long-term descending channel, making this a key decision area. Price has respected this structure for a long time, and the current move represents a clear resistance test, not support.

If price manages to break and hold above the upper trendline, it would indicate a potential trend shift and open room for a stronger upside move. However, a rejection from this level would likely keep price moving lower within the channel.

RSI is hovering near oversold territory, suggesting downside momentum may be slowing, but confirmation still depends on how price reacts at this resistance.

This is a wait-and-react zone.

BNB/USDT | Alive! (READ THE CAPTION)As you can see, BNBUSDT swept away the liquidity below 730 level and then moved back up to 783 before dropping back in the Bullish OB zone and now it's being traded at 755.

I would like to see BNB leave the Bullish OB zone soon to make an upwards move.

For now, the targets are: 760, 769, 778 and 787.

SOL/USDT | Liquidity sweep first (READ THE CAPTION)As you can see in the Daily chart of SOLUSDT, it has gone below $100 and the Bullish OB zone and it's being traded at 97.05 right now. I expect it to sweep the liquidity below the 95.27 level before starting a bullish movement.

I prefer to wait for now and not trade on SOLUSDT.

ETHUSD Downtrend Channel – Reversal Setup Toward Key ResistanceThis 1H ETHUSD chart shows Ethereum trading within a well-defined descending channel, confirming a strong bearish trend from late January into early February. Price remains below the Ichimoku cloud, keeping overall bias bearish, but a clear bounce from the highlighted demand/rejection zone has formed a short-term base. The marked BOS (break of structure) hints at early bullish intent after the sell-off. If momentum holds, price could attempt a corrective move toward the 2,450–2,500 resistance zone, which aligns with the upper channel and cloud resistance, before any larger trend continuation.

XAGUSD Trend Shift – CHoCH Signals Potential Bullish RecoveryThis 1H XAGUSD chart shows silver transitioning from a prior uptrend into a sharp bearish move, followed by signs of stabilization and early bullish reversal. The Change of Character (CHoCH) marks the shift in market structure after the sell-off. Price has rebounded from a highlighted demand zone and is attempting to reclaim the Ichimoku cloud, suggesting improving momentum. If buyers maintain control, the projected upside target sits near the 100–102 zone, aligning with previous structure and cloud resistance.

XAUUSD Bullish Reversal – BOS Targets Higher Leve.....This 1H XAUUSD chart shows a clear shift from a prior downtrend into a bullish reversal after a Change of Character (CHoCH). Price forms higher highs and higher lows within an ascending channel, signaling growing bullish momentum. Gold is trading above the Ichimoku cloud, suggesting trend support, with the highlighted demand zone acting as a strong base for the move. The projected upside targets point toward the 5,300 area as the first target and around 5,600 as the second target, aligning with the rising channel resistance.

BTC/USDT | Back on track? (READ THE CAPTION)Good morning folks, Amirali here.

By examining the daily chart of BTCUSDT we can see that it went as low as 72,945 last night, sweeping the sellside liquidity there and then it went back up and it is now being traded at 76,500.

Currently, Bitcoin is in the Bullish OB range, and I expect it to retest this zone and go for the Mean Threshold and the high of the Bullish OB.

Targets for BTC: 77000, 77500, 78000, 78500 and 79000.

Why BTC is Heading to $43k!Looking at the weekly chart, the picture for Bitcoin is becoming increasingly bearish. We have a clearly defined Head and Shoulders pattern, and the recent price action suggests we are at a critical tipping point.

Technical Outlook: The "Right Shoulder" has just been completed right around the 2025 Open level.

My primary scenario involves a short-term corrective bounce towards the zone between the 2026 Open (~$88,000) and 2025 Open (~$94,000) to flip previous support into resistance.

Following this, I expect a continuation of the downtrend with a primary target at the 2024 Open level (the ~$42k - $45k area), representing a potential -44% move from current levels.

Fundamental Headwinds:

Institutional Exit: Over the last 3 months, we've witnessed a massive $6.18 billion outflow from BTC ETFs.

BlackRock Signal: Notably, even BlackRock's client base has shown a significant shift toward selling, which often precedes a deeper market correction.

The MicroStrategy Risk: With their average purchase price hovering around $76,052, the current market price puts them near a break-even point. If BTC sustains a move below $70k, the pressure on their balance sheet becomes a real "black swan" threat.

The 2nd Year Presidential Cycle: We are currently in the second year of Trump's presidency. Historically, the 2nd year of any US presidency over the last 50 years has been the weakest for high-risk assets.

This is typically the year when economic "skeletons in the closet" appear. I don't expect a sustainable bull run until 2027 (the 3rd year), when administrations historically pump the markets to ensure favorable re-election conditions.

Conclusion: The technical breakdown combined with institutional outflows and unfavorable cyclical timing points to a long-term correction. Watch the 2024 Open level as the ultimate magnet.

Resistance Zone: $88,000 - $94,000

Target: $43,000 (2024 Open)

Not financial advice. Trade at your own risk!

BTCUSD Key Daily SupportBTCUSD is testing a major daily support zone around 75,000–78,000. Holding above this area could lead to a technical bounce, while a daily close below 75,000 may trigger further downside toward the 63,000–65,000 region. This is a key decision level and confirmation is needed.

Bitcoin Bounce Here!?If you find this information helpful or inspiring, please consider a boost and a follow. Any questions or comments are always welcome.

Bitcoin has just printed a swift selloff that swept 74,420, a level that immediately stands out as a potential swing pivot failure. This move also allows for two potential completed Elliott Wave interpretations, both of which suggest the possibility of a change in direction. That said, it is still too early to declare a confirmed trend change.

From a structural perspective, the decline shows characteristics that allow for a completed larger degree Zigzag, as well as a completed Wave 3 of a lesser degree. Both interpretations point toward the possibility of a directional shift, even if that shift initially presents itself as only a weak or corrective bounce.

The key word here is possibility, not certainty.

So far, we have seen a fast move down followed by a sharp reaction. On its own, that is not enough. What matters next is how price behaves internally. For confirmation, the market needs to retrace the swift move up in a corrective manner and hold a Higher Low, ideally within our TDU AOI. Without that structure, any upside remains vulnerable to being just another countertrend reaction.

If that Higher Low does form, the focus then shifts to whether price can challenge and break the most recent Lower High. A successful break would support the idea of at least a C wave advance for a Wave 4 within a larger impulse. If the Zigzag variant has completed, there is also the potential for further upside.

What strengthens this area is the confluence across multiple counts. Both the corrective and impulsive interpretations currently lean toward the same near term directional outcome, even if their longer term implications differ. This alignment increases interest, but it does not replace confirmation. Additional confluence is also present through the swing failure pattern and surrounding support resistance.

For now, this remains a tracking environment. The approach here is conservative by design. Let the market show its hand through structure, not assumptions. Until internal confirmation appears, patience remains the edge.

Trade Safe!

Trade Clarity!

Morpher long-term: Bearish Full Analysis!

CRYPTO:MPHMUSD

💡Hello Traders!💡

🏹This analysis is for all those traders who don't know what to trade. Or are confused like several others for hearing people say trade this; trade that but don't explain to you why and normally have a dangerous risk for your investment. I only trade after research and until I'm confident that the risk is minimum.

📉🎯Market Structure

Recently, Morpher has devalued like crazy. Once worth more than $0.02 per MPH now it is worth around $0.0072 and will continue to go down. I have been trading for more than a year this crypto and understand this crypto. It no longer is the crypto that kept its investor motivated and are lacking communication with investors and updates.

🐻💰Bear Market Is Obvious

The picture of the trend is now very clear. Because it leads to a sell-of which takes it to the point it it now. The only way this crypto can go up is if there is a crypto rally. Otherwise this is now a dead crypto; which makes it an ideal crypto to short.

NOTE : ⚠ Every trader should do their own research to be able to trade with confidence. This information has worked for me and wanted to share. That´s why I love TradingView theme "LOOK FIRST / THEN LEAP".

👍Thanks for your attention!👊

👇Feel free to comment below!👇

Crypto Winter 2026: BTC 75% Correction PT 30 000 USDInvestment Memo: Anticipating a 2026 Bitcoin Crypto Winter

By ProjectSyndicate

________________________________________

1. Executive Summary

❄️ Summary view: This memo treats 2026 as the high-probability crypto winter year for Bitcoin following the 2024 halving, with a working top around 123,000 USD and an expected cycle low near 30,000 USD, implying roughly a 75–76% drawdown from the peak. This is fully consistent with historical Bitcoin bear markets, which have typically seen 75–85% corrections from all-time highs.

❄️ Contrarian hook: While mainstream narratives still focus on ETFs, institutional adoption, and “crypto as macro asset,” the explosion of leverage (Aster DEX up to 1001x), CZ-backed perps, and BNB-chain meme-coin mania are treated here as late-cycle excess—classic topping signals rather than sustainable foundations.

________________________________________

2. Thesis & Target Range

📊 Cycle top assumption: cycle high of ~123,000 USD per BTC. That is well within the band implied by recent ATH prints ~125–126k in mid-2025 and aligns with a typical “blow-off” overshoot above the prior psychological milestone at 100k.

📊 Cycle low assumption: 30,000 USD downside target represents a drawdown of ~75.6% from 123,000 USD—slightly shallower than the 2018 crash (~84%) and broadly in line with the 2021–22 bear (~77% from 69k to ~15–16k). That keeps this winter brutal but not apocalyptic, consistent with a maturing asset still capable of deep mean reversion.

🧮 Math check on prior winters

• 2017–18: 19k → 3k ≈ 84% drawdown

• 2021–22: 69k → 16k ≈ 77% drawdown

• 2025–26 (your base case): 123k → 30k ≈ 76% drawdown

This places scenario squarely inside the historical corridor of 75–85% post-peak corrections.

________________________________________

3. Historical Pattern: Why Large Drawdowns Are the Base Case

📉 Structural volatility: Bitcoin’s entire price history is punctuated by massive post-parabolic drawdowns—early cycles saw 86–93% collapses, later ones 75–80%. Each halving-to-peak run has ended in a violent crash once marginal buyers are exhausted and leverage saturates.

📉 Time dimension: Historically, the “winter” phase has lasted 9–18 months from peak to capitulation and then a long grinding accumulation. The 2017 peak to 2018–19 bottom spanned roughly a year; the 2021 peak to 2022–23 nadir similarly took about a year, with a further period of sideways chop.

📉 Drawdown normalization: Traditional asset allocators increasingly frame Bitcoin as an alternative macro asset, but the statistical reality is unchanged: drawdowns of 70%+ are not outliers—they are typical. An assumption of only shallow corrections is the non-consensus view; a 75% winter is actually the boringly normal scenario from a historical distribution standpoint.

________________________________________

4. Where We Are in the Current Cycle

⏳ Post-halving positioning: The fourth Bitcoin halving occurred in April 2024, cutting block rewards to 3.125 BTC and effectively tightening supply. Historically, the major blow-off tops occur 12–18 months after halving, as reduced supply + narrative momentum pulls in late-stage retail and leverage.

⏳ Evidence of late-cycle behavior: By mid-2025, Bitcoin had already pushed to new ATHs above 100k and then into the ~120–126k region, with growing signs of ETF saturation, institutional FOMO, and leverage-driven upside. From a purely cyclical lens, we are more likely in the “euphoria / distribution” band than in early bull territory.

________________________________________

5. Aster DEX & Meme-Coin Mania as Contrarian Top Signals

🚨 Aster DEX as the “Hyperliquid of BNB Chain”: Aster DEX, emerging from APX Finance and Astherus and explicitly leveraging Binance’s network, is marketed as a high-performance perp DEX with MEV-resistant trading and leverage up to 1001x, backed by CZ/affiliate ventures. From a contrarian perspective, this is textbook late-cycle: maximum leverage offered to the broadest possible audience at or near cycle highs.

🚨 BNB meme-coin carnival: Simultaneously, BNB-chain meme coins and speculative listings (Maxi Doge, PEPENODE, various new BNB meme projects) are being pushed as high-beta “next 100x” plays. Historically, similar episodes—2017 ICOs, 2021 dog-coin and NFT mania—have coincided with or slightly lagged Bitcoin’s macro top rather than signal early-cycle value.

🎭 Narrative pattern recognition: In prior cycles, the market’s center of gravity shifted from Bitcoin to highly speculative edges (ICOs, NFTs, obscure DeFi, meme coins) at the very end of the bull. Late-cycle liquidity rotates into lottery tickets while BTC quietly transitions from “must own” to “source of funds.” The current Aster + BNB meme complex rhymes strongly with that historical script.

________________________________________

6. Why a 75% Drawdown to 30,000 USD is Plausible

🧊 From 123k to 30k mechanically: A move from 123k to 30k doesn’t require structural failure; it merely requires a reversion to historical drawdown. That kind of move can be achieved by:

• ETF inflows slowing or turning to mild outflows

• Derivatives funding turning negative as carry trades unwind

• A moderate macro risk-off (equities correction, higher real yields)

🧊 Maturing, not invincible: As adoption broadens—spot ETFs, institutional mandates, integration into macro portfolios—Bitcoin’s upside may gradually compress, but liquidity cycles and leverage cycles haven’t vanished. Even if each cycle’s drawdown edges slightly lower from ~85% to ~77%, there’s no reason to assume sub-50% drawdowns are the new regime. A respectable winter at 30k is almost conservative relative to earlier -80%+ events.

________________________________________

7. Why the Floor Might Hold Above Prior Lows

🛡️ On-chain + macro floor logic: Without pinning to proprietary on-chain models, two simple supports for a 30k floor are:

• Institutional cost basis: A growing chunk of supply is held via ETFs and treasuries accumulated in the 40–70k band. Many of these players may defend positions with hedging or incremental buying in the high-20k / low-30k region rather than panic-sell at -70–80%.

• Realized price ratcheting higher: Across cycles, Bitcoin’s long-term realized price average on-chain cost basis tends to step up structurally. Past winters have bottomed not far below that long-term average; as the realized base rises, so does the likely bear-market floor.

🛡️ Regime shift vs. previous cycles: In 2018 and 2022, Bitcoin was still climbing the wall of institutional skepticism. By the mid-2020s, you have:

• Spot ETFs

• Corporate treasuries

• Sovereign/FI experimentation

These players typically do not capitulate to zero; they reduce risk, but they also accumulate in stress. That supports the idea of a shallower floor (30k) instead of a full 85–90% purge.

________________________________________

8. Timing the 2026 Winter

🧭 Halving + 18-month lag template: Using the standard halving cycle template, major tops often occur 12–18 months post-halving, and winters then dominate the following year. With the fourth halving in April 2024, a 2025 ATH and a 2026 winter are exactly what the simple cycle model would project.

🧭 Scenario sketch

• 2025: Distribution at elevated levels (80–120k+), persistent Bitcoin as digital gold narrative, alt & meme blow-off, over-issuance of high-leverage products (Aster, other perps).

• 2026: Liquidity withdrawal + ETF fatigue + regulatory flare-ups → a stair-step decline through 80k, 60k, 45k, culminating in capitulation wicks into the 30–35k zone before a multi-month bottoming process.

________________________________________

9. Market Structure Stress Points in a Winter Scenario

🧱 Leverage cascade risk: Perp DEXs offering hundreds to 1000x leverage attract the most price-insensitive flow at the worst time. When BTC breaks key levels (e.g., 80k → 60k → 50k), auto-deleveraging and forced liquidations can accelerate downside far beyond spot selling. Aster-style platforms, while innovative, mechanically create risk of cascading liquidations in a volatility spike.

🧱 Alt & meme vaporization: BNB meme coins and other speculative assets that rode the late-cycle pump will likely see 90–99% drawdowns, as in previous winters where smaller alts dramatically underperformed BTC. In your framework, BTC at 30k is actually the “high-quality survivor” outcome; the majority of late-cycle tokens may never reclaim their peaks.

🧱 Mining and infrastructure: With halved rewards and a much lower BTC price, marginal miners will be forced offline, just as in prior winters. That tends to deepen the short-term pain but ultimately improves the cost curve (strong miners consolidate, inefficient ones exit), laying groundwork for the next cycle.

________________________________________