SUIUSD; Heikin Ashi Trade Idea📈 Hey Traders!

Here’s a fresh outlook from my trading desk. If you’ve been following me for a while, you already know my approach:

🧩 I trade Supply & Demand zones using Heikin Ashi chart on the 4H timeframe.

🧠 I keep it mechanical and clean — no messy charts, no guessing games.

❌ No trendlines, no fixed sessions, no patterns, no indicator overload.

❌ No overanalyzing market structure or imbalances.

❌ No scalping, and no need to be glued to the screen.

✅ I trade exclusively with limit orders, so it’s more of a set-and-forget style.

✅ This means more freedom, less screen time, and a focus on quality setups.

✅ Just a simplified, structured plan and a calm mindset.

💬 Let’s Talk:

💡Do you trade supply & demand too ?

💡What’s your go-to timeframe ?

💡Ever tried Heikin Ashi ?

📩 Got questions about my strategy or setup? Drop them below — ask me anything, I’m here to share.

Let’s grow together and keep it simple. 👊

Cryptocurrency

XRPUSDTHello Traders! 👋

What are your thoughts on RIPPLE ?

On the XRP chart, we can see that after breaking the descending trendline and reaching a resistance level, the price has entered a corrective phase.

We expect this correction to continue down toward the support zone, which coincides with the ascending trendline. This area also represents a pullback to the previously broken bearish trendline.

Once the pullback is complete, we anticipate a bullish continuation toward higher targets.

Don’t forget to like and share your thoughts in the comments! ❤️

BITCOIN The vast importance of the Pivots. Is $180k possible?Bitcoin (BTCUSD) is most likely starting the new Bullish Leg of this Cycle, as stated on our recent analysis following the 1D MA50 (red trend-line) rebound.

Today we point out the critical role of Pivot trend-lines, which throughout the entirety of the current Bull Cycle, have provided a Support level and initiated massive rebounds.

Those Bullish Legs not only tend to be similar in strength (+60% to +92%) but the time between their starts is roughly the same (39 to 46 weeks).

Given also the fact that the 1W RSI has printed the same kind of consolidation it always forms when such a Bullish Leg started, we do expect a strong rally next, which if the +60% minimum rise holds, may very well be as close as $180000.

So do you think BTC can reach $180k before this Cycle is over or it's too high? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

119.15-119.70K to watch for Long tradeMorning folks,

So, Thu setup is done perfect. Jump precisely from K-support area of 118.30 that we discussed. But, BTC has reached just minor 1H target and now is moving down. Since overall upside impulse is not bad, we consider ~119.5K support area for bullish momentum trade for now...

Crypto Market Slows Down For A Pullback Within A Bullish TrendGood morning Crypto traders! Cryptocurrencies are coming slightly lower on the intraday basis due to stock market decline yesterday, but we still see them approaching support, so still be aware of a bounce and recovery at the end of the week or maybe next week because of an upcoming weekend. Crypto TOTAL market cap chart can be trading in wave »y« of a complex w-x-y correction in wave 4, unless it's a flat correction, but support is the same at 3.6T – 3.5T area, from where we may see a bullish continuation within wave 5.

DOGE Whales Are Back! $500M Buy Triggers Bullish BreakoutDogecoin CRYPTOCAP:DOGE is now again on the rise, thanks to a large increase in accumulation by whales. In the last week, addresses with 100 million to 1 billion DOGE boosted their holdings by 2 billion DOGE (roughly USD 500 million), indicating high confidence among major holders in the meme coin's long-term prospects.

Technical analysis on the monthly period shows that Dogecoin has the potential to maintain its bullish trend as long as the price stays above the lower trendline level around $0.15678. The movement's initial goal is classic resistance at $0.4688, with the possibility of further increases to the all-time high around $1.03 if strong momentum continues.

DOGE Can its 1st 1D Golden Cross in 9 months make it skyrocket?Dogecoin (DOGEUSD) just completed yesterday its first 1D Golden Cross formation in 9 months! The last one (November 05 2024), was right before the previous Bullish Leg of the 2-year Bullish Megaphone exploded.

As you can see on the chart, both previous Bullish Legs peaked on the 3.618 Fibonacci extension from their respective bottoms. Those were the pattern's Higher Highs.

If this is repeated, we can expect Doge to touch $1.1500 (as close to Fib 3.618 as possible), even by the end of this year.

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Declining 2-Year US Treasury Yields Could Fuel Bitcoin’s BullishThe follow chart is a comparison between Bitcoin CRYPTOCAP:BTC Daily Chart and the US 2 years Treasury Bonds TVC:US02Y .

The graphic shows the 2-year US Treasury yield declining from 3.7684% to 3.7308% on August 12, 2025, following a steep drop after CPI inflation in July stabilized at 2.7%. This underscores market expectations that the Federal Reserve will lower interest rates, driving up demand for bonds as a safe haven asset.

The potential on Short-Term Impact on the Bitcoin Market:

Positive: Falling rates and expectations for rate cuts weaken the US dollar, boosting capital flows into riskier assets such as Bitcoin. BTC may gain in the immediate term, testing the $130,000 resistance level, aided by new liquidity from stablecoins.

Risk: While falling yields can support Bitcoin’s bullish momentum, they may also signal recession fears. If investors interpret the decline as a warning of economic slowdown, BTC could face selling pressure—potentially dropping to $111,939. Volatility remains elevated, especially after the recent liquidation of leveraged long positions. Keep an eye on upcoming economic data for confirmation of market direction.

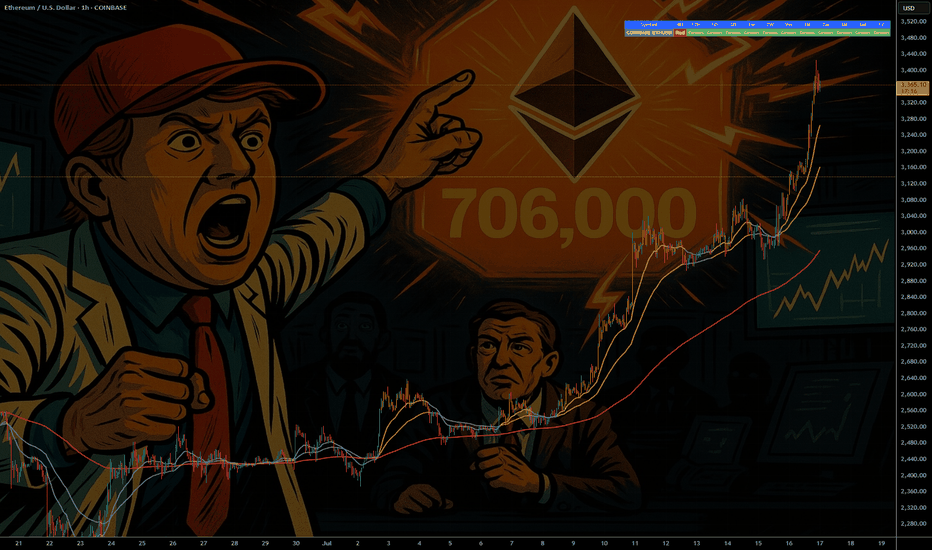

ETH - If You Know ...... You Know whats Coming

NYSE:BLK $BUIDL tokenized U.S.-Treasury fund launched on COINBASE:ETHUSD in Mar 2024—Wall Street is already settling real dollars on-chain.

NYSE:JPM JPMD stablecoin just went live on Base (an COINBASE:ETHUSD L2), piping wholesale payments from a $4 T balance-sheet straight through COINBASE:ETHUSD rails.

COINBASE:ETHUSD isn’t just riding the next crypto cycle—it’s becoming Wall Street’s settlement layer. From BlackRock’s on-chain Treasury fund to JPMorgan’s and soon Bank of America’s dollar tokens, a tidal wave of institutional stable-coin flows is lining up behind ETH. Fewer coins, more real-world volume—if you know, you know what’s coming.

NYSE:BAC CEO says they’ll issue a dollar-backed token the moment regulators nod—another tier-1 bank boarding the Ethereum train.

Stablecoin cap has blasted past $230 B , with 80 %+ of all on-chain transfers riding Ethereum (plus BSC) blocks.

Corporate settlements via stablecoins grew 25 % YoY in 2024 as multinationals replaced SWIFT with instant on-chain clearing.

Daily stablecoin throughput averages $7 B—each hop burning ETH and tightening supply.

BCG projects tokenized real-world assets to exceed $16 T by 2030 , with EVM chains as the default plumbing.

Over 500 M wallets already interact with stablecoins , a 30 % YoY surge led by emerging-market demand.

L2s like BINANCE:ARBUSDT & BINANCE:OPUSDT cut transaction fees 35 % yet still settle back to mainnet—meaning ETH captures the fee stream and the burn.

Bottom line: a tidal wave of bank-grade stablecoins + tokenized assets is lining up behind ETH; supply shrinks, demand soars—if you know, you know what’s coming.

quote] Marty Boots | 17-Year Trader — smash that , hit LIKE & SUBSCRIBE, and share your views in the comments below so we can make better trades & grow together!

CRAI/USDT is able to breakout as never before x10Our study shows that this small-cap coin can show interesting targets in the coming time, as data shows this, so we will follow it to see new confirmations.

All updates will be here on this page

The price is running now at around: $0,03947 as the chart shows.

BITCOIN Can it break above this 3-year Resistance and hit $200k?Bitcoin (BTCUSD) is extending its main 1W MA50 (blue trend-line) fueled rebound, which only recently confirmed the continuation with a short-term bounce on the 1D MA50. The short-term setting is transferred now back to the long-term and the next Resistance, which is the middle (0.5 Fibonacci level) of the macro Channel Up, that has been dominating BTC's price action since late 2017.

The 0.5 Fib has made its last rejection/ failed attempt to break on December 16 2024. It's been holding as a Resistance since May 02 2022. The last two Cycle Tops however haven't only been priced above the 0.5 Fib but above the 0.786 level too (obviously as close to the Channel Top as possible).

As a result, if BTC does break above the 0.5 level, a 'mere' test of the immediate upper Fib (the 0.618) could be translated by the end of the year (timing of Cycle Top) to a $200k test. That would also be a test of the Top of the 1st SD above (red Zone) of the Mayer Multiple Bands (MMBs), which is technically still within high tolerance levels.

So do you think we can get near $200k by the end of the year if the 0.5 Fib breaks? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Dash Can Be BottomingDash Can Be Bottoming, as we see it recovering out of a downward channel, which indicates for a bullish reversal by Elliott wave theory.

Cryptocurrency Dash with ticker DSHUSD is recovering from June lows out of the downtrend channel, which suggests that the impulsive decline from the 2024 highs is bottoming, as shown on the daily chart. Currently we can see it forming a bullish setup formation with waves A/1 and B/2 that can send the price higher within wave C or wave 3 of a five-wave bullish impulse. Wave C has room up to 26-30 area, but if if breaks above 31 bullish confirmation level, then we can start tracking wave 3 of a five-wave bullish impulse.

Dash is a cryptocurrency launched in 2014 that focuses on fast, low-cost payments and privacy. It uses a two-tier network with miners and “masternodes” to enable features like InstantSend (near-instant transactions) and PrivateSend (optional privacy). It started as a fork of Bitcoin.

BITCOIN Can $160k be the Top???Bitcoin (BTCUSD) closed last week on strong bullish fashion as it completed a formidable green 1W candle following a technical bounce on its 1D MA50 (red trend-line). This is a strong bullish signal as every time the (orange) Fibonacci Channel rebounded on its 1D MA50 after a 1W MA50 (blue trend-line) bounce, BTC extended the uptrend towards a new technical Higher High.

Based on the 1W LMACD, we could be roughly half-way (blue circle) through such a Bullish Leg. As you can see, those Bullish Legs have typically made rounded Tops (red Arcs), with the last two both breaking above the Fib Channel's 0.236 level. At the same time, on the horizontal Fib level, the sequence has applied significant importance to every .618 and .0 interval, with peaks on the 0.618, 1.0, 1.618, 2.0, 2.618. Now what's left realistically before the end of the Cycle at the end of the year are 3.0 and 3.618.

As a result, a rather modest potential Top projection is $160000, which is even conveniently placed just below the 0.236 Channel Fib from late October onwards.

Do you think that could be a potential Cycle Top candidate? Feel free to let us know in the comments section below!

-------------------------------------------------------------------------------

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

-------------------------------------------------------------------------------

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ADA/USDT | ADA Gains 18% – Bullish Momentum Ahead!By analyzing the Cardano chart on the 3-day timeframe, we can see that after correcting down to $0.69, the price saw renewed demand and has so far rallied over 18% to reach $0.80. Given the strength of this new bullish trend, I expect ADA to continue its upward move, with the next targets at $0.85, $0.93, and $1.00. Keep a close eye on this pair — this analysis will be updated!

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

118.5K and 120K For Long EntryMorning folks,

Not too much to say now. Most important thing - BTC was able to stay above vital 110-112K support. So the upside reversal that we traded last two weeks with minimal target around 116K was correct. Now BTC stands much higher, but in a moment when we started the trade - it was impossible to say.

Now we're watching two support areas of 120K and 118.5K for potential long entry. Nearest upside target is 127K

Take care.

TOSHI Breakout Watch – Testing Red Resistance Again!🚨 $TOSHI Breakout Watch – Testing Red Resistance Again! 🔴⏳

$TOSHI is testing the red resistance zone again.

📊 If breakout confirms, realistic targets in this bull market are the green line levels.

💡 If you have $TOSHI, don’t sell now — at this moment, there’s no sell signal. Best move is to hold and wait for a breakout.

BnB is on the wayBnb usdt Daily analysis

Time frame 4hours

Target 900$

Close Target is upperside of the band

We hear a lot of news about major crypto companies collaborating, as well as corporate acquisitions and filling the coffers with valuable cryptocurrencies.

But there is no volume in the market.

We are not seeing the growth that we expect to hear after all this good news.😒

What is the reason?

The answer is one word.

👉Strategic patience. 👈

Wait, this is the beginning. The rockets are refueling for a long, long launch.🚀🚀🚀

BITCOIN Bullflag and new all-time high ?!BULL FLAG and new all-time high 👀⏰

📇BTC daily-chart (BITSTAMP) and 💡everything important in the chart !

Bitcoin has broken out of its sideways consolidation and has recently successfully tested this channel (bull flag), thereby activating a potential bull flag.

The resulting targets (see example) are based on the low of approximately $98,240 and the sharp rise to the current all-time high of $123,236.

See the flags at the top with the corresponding price-targets 🏁 👀

💥Rising blue diagonal line for the previous support

💥From an indicator perspective, a possible bullish cross is imminent in the MACD-Indicator and bearish momentum may continue to decline ...

💥Finally, the bull flag (textbook) as an example of a chart pattern.

🔥Please also take a look at my last idea, as there are certain similarities based on this...

🎯 If you like this idea, please leave me a 🚀 and follow for updates 🔥⏰

Furthermore, any criticism is welcome as well as any suggestions etc. - You're also very welcome to share this idea.

I wish you a pleasant Sunday and a good start to the week & successful trading decisions 💪

M_a_d_d_e_n ✌

NOTE: The above information represents my idea and is not an investment/trading recommendation! Without any guarantee & exclusion of liability!