COLLECT/USDT – 2H Chart Update & Long Trade SetupCOLLECT/USDT – 2H Chart Update & Long Trade Setup

COLLECT is trading inside a symmetrical triangle, showing compression and a potential breakout.

Trade Long

Entry Zone: 0.078 – 0.080

Stop Loss: 0.0755

Targets:

TP1: 0.085

TP2: 0.092

TP3: 0.098 – 0.100

Price holding higher lows

Support from the ascending trendline

MA acting as dynamic support

Triangle breakout favors upside if volume expands

⚠️ Invalidation:

A 2H close below 0.0755 will negate the bullish setup.

Manage risk properly & wait for confirmation.

Cryptosanders

ETH/USDT – 4H Chart Update. ETH/USDT – 4H Chart Update

ETH is showing strength from the lower trendline and continuing its short-term recovery within the descending structure.

Trend: Still inside a descending channel

Current Move: Higher lows forming → bullish momentum building

Immediate Support: 3,000 – 3,050

Resistance: 3,250 – 3,350 (trendline + supply)

A sustained breakout above 3,300–3,350 can shift momentum toward 3,500+.

Rejection near resistance may cause a pullback toward the 3K support zone.

Bias: Short-term bullish, overall trend neutral until breakout confirmation.

Trade with confirmation and proper risk management.

BTCUSDT – 4H Chart Update. BTCUSDT – 4H Chart Update

BTC is showing strength after holding the $84.6K–$85.8K demand zone multiple times (strong buy interest visible).

Price is now moving higher with short-term bullish momentum.

🔹 Support: 85.8K / 84.6K

🔹 Resistance: 93.5K–94K zone

🔹 Bias: Bullish above support, pullbacks are buy-on-dips

As long as BTC holds above the marked support, upside continuation remains likely.

Risk management is key ⚠️

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Structure: Price is compressing inside a descending wedge, trading near the lower trendline → selling pressure is weakening.

Price reclaimed the short-term 21MA and is testing the 100 MA area — a key decision zone.

Support: 2,900 – 2,880

Resistance: 3,080 – 3,120

Breakout Zone: 3,250 – 3,350+

Sideways grind near support + compression = energy building.

Wait for a clear 4H close above the descending trendline for continuation.

This is a confirmation zone, not a blind entry area.

DYOR | NFA

BNBUSDT – 4H Chart Update. BNBUSDT – 4H Chart Update.

Price is moving inside a descending channel, but holding the rising demand zone.

Short-term MA curling up; price trying to reclaim the 100 MA.

Support: 820 – 800 (major demand)

Immediate Support: 840 – 830

Resistance: 880 – 900 (trendline zone)

Breakout Zone: 920 – 1,000+

Higher low formed from demand + compression = potential base building.

A clean 4H close above 880–900 can open room for upside expansion.

⚠️ Wait for confirmation, avoid chasing.

DYOR | NFA

XRPUSDT – 4H Chart UpdateXRPUSDT – 4H Chart Update

XRP remains within a descending channel, but the price is pressing against the upper trendline, indicating compression near resistance.

Price just tested the 100 MA; momentum is trying to shift short-term.

Support: 1.88 – 1.85

Major Support: 1.78 – 1.75

Resistance: 1.95 – 2.00

Breakout Zone: 2.10 → 2.40+

Lower selling pressure and a tight range near the trendline create a decision zone.

A 4H close above $2.00 can trigger a fast upside move. Rejection keeps range-bound action.

⚠️ Wait for confirmation, no blind entries.

DYOR | NFA

BTCUSDT – Chart Update. BTCUSDT – Chart Update

Price compressing inside an ascending triangle

Higher lows holding → bullish structure intact

Key resistance: 89.5K–90K

Break & hold above = momentum move toward 92K–95K

Support: 87K–86K zone

👉 Patience here. Expansion coming after the breakout.

Not financial advice

DOGEUSDT – 4H Chart UpdateDOGEUSDT – 4H Chart Update

Still bearish, but momentum is weakening

The price is holding a strong demand zone (0.120 – 0.115) after a prolonged downtrend.

Descending trendline is being tested

Volatility compression near support → decision zone

Repeated rejections from lower levels show selling pressure exhaustion

Support: 0.120 – 0.115 (critical)

Invalidation: Below 0.112

Resistance: 0.135 – 0.150

Breakout zone: 0.160+ → opens room toward 0.20

⚠️ Extreme fear environment = patience > prediction

DYOR | NFA

ADAUSDT – Daily Chart. ADAUSDT – Daily Chart.

Macro downtrend intact (descending channel)

The price is sitting at a major HTF demand level after a prolonged sell-off.

Selling momentum is exhausting near channel support

Price is compressing → base formation possible

This zone often leads to sideways accumulation before expansion

Support: 0.35 – 0.32 (critical demand zone)

Invalidation: Below 0.30

First Resistance: 0.48 – 0.52

Major Supply: 0.70 – 0.82 (previous value area)

In Extreme Fear, strong coins usually move sideways at support to absorb sell pressure before trend reversal.

No blind longs. Wait for structure shift + volume confirmation.

DYOR | NFA

MAGICUSDT – Long Trade Setup (4H)MAGICUSDT – Long Trade Setup (4H)

Price compressing inside a falling wedge

Breakout above resistance with MA support → bullish bias

Entry: ~0.097–0.098 zone

Targets: 0.102 ➝ 0.106+ (projection shown)

Stop-loss: below 0.0925 (wedge invalidation)

Falling wedge + higher lows = upside continuation.

Trade with confirmation & proper risk management.

DYOR | NFA

USDT.D – 1D Chart UpdateUSDT.D – 1D Chart Update

Structure forming a rising wedge

Rejection near 6.6% resistance

Momentum weakening below trendline

Breakdown scenario: drop toward 4.4%–4.2% zone (marked)

👉 Falling USDT dominance = bullish for BTC & Altcoins

Wait for confirmation. Not financial advice.

USDT Dominance – Chart Update and Analysis. USDT Dominance – Chart Update and Analysis (Weekly)

Current Level: ~6.32%

Structure: Rising Wedge / Long-Term Compression

USDT dominance is trading within a contracting wedge.

The price is approaching the upper trendline resistance (Zone 3).

Previous tops (1 → 2 → 3) show lower highs → upward momentum is weakening.

Rejection near the upper trendline would be bullish for BTC and Altcoins.

Clean breakout + hold above resistance = temporary risk-off / market pullback.

Resistance: 6.4% – 6.7%

Support: 4.8% – 5.0%

Rejection from resistance → relief for Altcoins.

Invalidation: Strong weekly close above the wedge → caution on long positions.

⚠️ Use USDT dominance in conjunction with the BTC chart + TOTAL market cap for confirmation.

This is not financial advice | Manage your risk.

BTCUSDT – 4H | Chart Update. BTCUSDT – 4H | Chart Update.

BTC is compressing inside a symmetrical triangle (lower highs + higher lows). This is a classic volatility squeeze before expansion.

Strong buyer reaction seen multiple times near 85.8k – 84.6k (green circles)

Rising trendline support is still respected.

93.5k – 94k remains a heavy rejection area

Price needs a clean breakout to unlock upside

Price is trying to reclaim short-term MA

Sustained hold above trendline + MA = bullish confirmation

Above 89–90k → breakout attempt toward 93k+

Below 85.8k → deeper pullback toward 82.2k

This is a decision zone. Structure favors upside only after confirmation.

Small update • Big move loading

DYOR | NFA

BTC Dominance (BTC.D) – Weekly Chart BTC Dominance (BTC.D) – Weekly Chart | Full Details (with 25MA and 100 MA)

BTC.D is trading within a long-term descending channel. After a strong recovery from the 2022 lows, the dominance is now stalling near the mid-range resistance (~59–60%).

25 MA: Tracks short-term momentum

BTC.D is hovering around/slightly below the 25 MA.

100 MA: The price is still above the 100 MA, meaning the overall BTC dominance trend has not yet broken down.

A break below the 100 MA would signal a significant shift towards altcoin strength.

This is a decision zone.

BTC dominance is not yet bearish, but the strength of the uptrend is weakening.

Keep a close eye on the MA — they will guide the next move.

DYOR | NFA

SOLUSDT – 4H Chart Analysis. SOLUSDT – 4H Chart Analysis.

SOL is trading inside a descending wedge/compression zone

Price is hugging the lower trendline, indicating that selling pressure is losing strength

Volatility has contracted, hinting at a decision move soon

Support:-

120 – 118 → Immediate support

112 – 110 → Major demand/breakdown level

108 → Last HTF support if panic expands

Resistance:-

126 – 128 → First resistance

132 – 135 → Trendline resistance

140+ → Breakout continuation zone

During Extreme Fear, assets often move sideways near support to absorb sell pressure before direction expansion.

This is a wait-for-confirmation zone, not a blind entry area.

DYOR | NFA

ETHUSDT – 4H Chart UpdateETHUSDT – 4H Chart Update

ETH is compressing near the lower trendline of a rising channel, showing loss of momentum but no breakdown yet.

Price holding ~2,900 support

Trading below short-term MA → consolidation phase

Structure suggests base building rather than distribution

Support: 2,900 – 2,850

Strong Support: 2,700 – 2,750

Major Support: 2,500

Resistance: 3,000 – 3,050

Supply: 3,300 – 3,400

If 3,050 breaks: momentum can expand toward 3,300+

If 2,850 fails, the price may revisit 2,700

Extreme Fear + channel support often hints at quiet accumulation.

DYOR | NFA

BTCUSDT –Chart Analysis (4H)BTCUSDT –Chart Analysis (4H)

BTC is coiling inside a tightening range — lower highs vs higher lows. This type of compression usually leads to a sharp directional move.

Price is respecting the rising base around 85k

Every dip into the green zones shows buyer absorption

Sellers are active below 89k, keeping pressure from above

Support: 85,800 – 84,600

Major Support: 82,200

Resistance: 88,800 – 89,500

Supply Zone: 93,500 – 94,000

When price holds support during Extreme Fear, it often means weak hands are exiting while stronger players accumulate quietly.

DYOR | NFA

BTC/USDT – 4H Chart Update. BTC/USDT – 4H Chart Update.

Price swept liquidity near 84.5K and bounced → classic fake breakdown.

Still moving inside a descending channel.

84.5K = key support (holding keeps bounce valid).

82.2K = invalidation level if support fails.

Resistance: 88K → 92K–94K supply zone.

Neutral to slightly bullish as long as 84.5K holds.

Reclaim above 88K = upside continuation possible.

Below 84.5K = deeper pullback risk.

Not financial advice. Manage risk.

FET/USDT – Long Trade Setup (Daily)FET/USDT – Long Trade Setup (Daily)

Price forming a base after a strong downtrend

Falling wedge/compression near support

Price below cloud, but selling pressure weakening

Long Plan

Entry Zone: 0.19 – 0.205

Stop Loss: 0.1840

Targets:

T1: 0.26

T2: 0.32

T3: 0.37+

DYOR | NFA

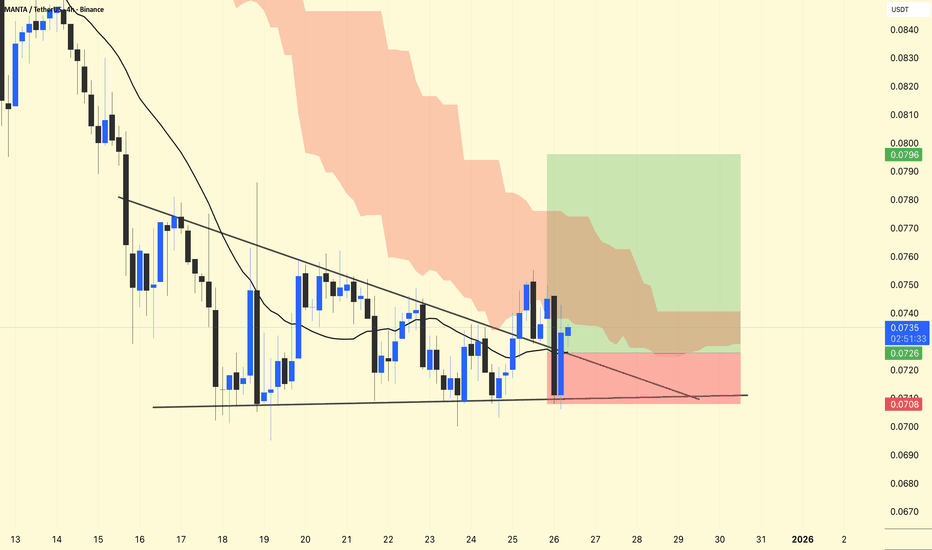

MANTA/USDT – Long Trade Setup (4H)MANTA/USDT – Long Trade Setup (4H)

Structure: Descending wedge/trendline compression

Ichimoku: Price pushing back into the cloud → momentum stabilizing

MA acting as dynamic support

Long Idea

Entry Zone: 0.0725 – 0.0730

Stop Loss: 0.070

Targets:

T1: 0.0760

T2: 0.0790 – 0.0800

DYOR | NFA

BTCUSDT – 4HChart AnalysisBTCUSDT – 4HChart Analysis

Structure: Price is still following a descending channel

Ichimoku: Price is hovering around the cloud → Range and uncertainty

Strong Demand Zone: 84,600 (Multiple reactions → Buyers active)

Dynamic Resistance: Falling trendline near 88,800 – 89,300

Lower Highs → Sellers are capping rallies

Bullish Relief: Sustaining above 84,600 + Breaking 89K → Move towards 91K – 92K

Bearish Continuation: Loss of 84,600 → Next target 82,200

Consolidation phase within a downtrend. Be patient — only trade on breakouts or support confirmations.

⚠️ No FOMO. Risk management first.

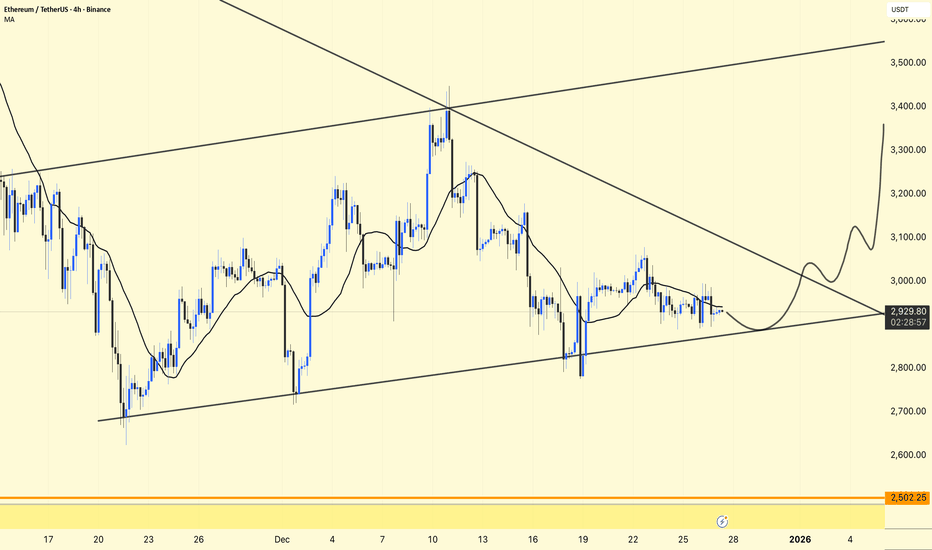

ETHUSDT – 4H Chart Update. ETHUSDT – 4H Chart Update.

Lower highs, descending trendline still active

ETH rejected from the trendline near 3,350–3,400

Price below cloud → bearish / consolidation phase

Holding around 2,930

Immediate Support: 2,880 – 2,900

Major Support: 2,700 – 2,750

Resistance: 3,050 – 3,120

Major Resistance: 3,350 – 3,400

Above 3,120 → short-term bullish relief toward 3,300+

Below 2,880 → risk of move toward 2,750

Until the breakout, range & patience are best

⚠️ Trend is still weak — trade only with confirmation & strict risk management.

BTCUSDT – 4H Chart Update. BTCUSDT – 4H Chart Update.

Price is still inside a descending channel

Strong sell-off again from trendline + Ichimoku cloud Current Price: ~87,200

Strong Support: 84,600

Next Support: 82,200 if 84.6k breaks

Resistance: 88,800 – 89,500

Major Supply: 93,500 – 94,000

Hold above 84,600 → range bounce possible

Break below 84,600 → bearish continuation risk

Trend flips bullish only above descending trendline + cloud

⚠️ Market still corrective. Wait for confirmation — no FOMO.