Gold Awaits PPI & GDP – Buy Dips, Sell Rallies🟡 XAU/USD – PPI & GDP Data to Define Range Expansion

🔍 Market Context

Gold remains range-bound between $4000–$4100, consolidating after last week’s liquidity sweep.

This week’s key U.S. data — Core PPI, Retail Sales, GDP, and Core PCE — will likely dictate the next major move.

Slight improvement in inflation and consumption data could strengthen the USD temporarily, but overall bias remains bullish mid-term as the Fed is expected to maintain a dovish stance into Q1.

📊 Technical Outlook (4H Chart)

Main Sell Zone (Super OB): 4170–4200 → potential reversal supply zone.

Fair Value Gap (FVG): 4130–4160 → short-term reaction zone if price retraces.

Sell Zone: 4090–4095 → short opportunity aligned with intraday bearish structure.

Buy Zone 1: 4024–4025 → minor demand, expecting internal liquidity sweep.

Buy Zone 2 (Main OB): 4003–4001 → strong order block with multiple rejections; key liquidity pool.

Structure: H4 BOS (Bullish) intact, suggesting a liquidity sweep before next expansion upward.

🎯 Trade Plan

1️⃣ SELL Setup – Short-term reaction from FVG

Entry: 4090–4095

Stop Loss: 4100

Take Profit 1: 4055

Take Profit 2: 4040

Take Profit 3: 4025

➡️ Reasoning: Price is likely to tap the lower edge of FVG and sweep local liquidity before a downside reaction toward internal range demand.

2️⃣ BUY Setup – First demand zone test

Entry: 4024–4025

Stop Loss: 4022

Take Profit 1: 4065

Take Profit 2: 4080

➡️ Reasoning: Expecting a short-term liquidity grab below the mid-range before bullish continuation.

3️⃣ BUY Setup – Main OB accumulation zone

Entry: 4003–4001

Stop Loss: 3998

Take Profit 1: 4045

Take Profit 2: 4075

Take Profit 3: 4090

➡️ Reasoning: Deep liquidity zone aligning with higher-timeframe OB. If macro data disappoints, this area can trigger the next impulsive leg to retest 4170+.

🧭 Overall Bias

→ Ranging bias before Core PCE

→ Buy dips – Sell rallies within 4000–4100 until a clear breakout post-GDP/PCE data.

→ Watch for false breakouts around FVG and maintain risk control before U.S. session releases.

Dailytrading

GOLD / XAUUSD – DAILY PLAN (Oct 17, 2025)🧭 MARKET CONTEXT

Main timeframe: M30 / H1

Current structure remains bullish, forming clear HH – HL sequences.

After a strong rally, price is now in a retracement phase toward a nearby demand zone aligned with the ascending trendline.

No sign of structure break yet (no BOS below the previous HL).

📈 PRIMARY SCENARIO (BUY SETUP)

➤ Entry Zone 1:

BUY GOLD 4280 – 4278

Stop Loss: 4275

Target 1: 4335

Target 2: 4350 (new HH)

Reason: This is a Bullish Order Block (OB) and BOS retest zone, aligned with the rising trendline.

Expecting a strong bullish reaction (rejection candle or engulfing bar) before triggering the buy limit.

➤ Entry Zone 2 (CP Setup – Confirmation Point)

BUY 4247 – 4245

Stop Loss: 4239

Target: 4300 / 4330 / 4350

Reason: This is the final demand zone near the main trendline, confluence of prior BOS + SSS (Structure Shift Support).

If price breaks below 4280 without reaction, patiently wait for confirmation around CP zone.

⚠️ ALTERNATIVE SCENARIO (STRUCTURE FAILURE)

If price closes below 4235 on M30, the bullish structure is invalidated.

→ The buy plan is canceled — wait for a pullback sell setup from 4280–4300 resistance.

If the buy stop loss is hit at 4239, monitor 4200 zone as the next H4 demand area.

GOLD TREND TODAY - Support and Resistance - Simple Analysis📈 Trend & Market Structure OANDA:XAUUSD

Gold is still in a clear uptrend, respecting higher highs and higher lows on H4.

Recent breakout structures (BOS) confirm bullish order flow, but price is approaching a liquidity zone near $3,800.

On the downside, unmitigated Fair Value Gaps (FVG) and Order Blocks (OB) remain potential buy zones if price retraces.

🔑 Key Levels

Resistance: 3800 – 3830

Support: 3765 – 3760 – 3755

Liquidity Buy Zone: 3715 – 3712

📌 Trade Ideas

🔴 SELL Setup (Countertrend / Scalping)

Entry: 3855 – 3858

Stop Loss: 3863

Take Profit:

TP1: 3850

TP2: 3840

TP3: 3820

TP4: 3800

Open TP: 3780

🟢 BUY Setup (Trend-following / SMC zones)

Entry: 3715 – 3712 (Liquidity + Strong OB)

Stop Loss: 3705

Take Profit:

TP1: 3725

TP2: 3735

TP3: 3755

TP4: 3775

Open TP: 3800

🎯 Strategy Note

Main bias: Look for buys on retracements in line with the uptrend.

Shorts at 3855 – 3858 are countertrend scalps only; use tight stops.

Apply scalping entries once price reacts at the defined S/R levels with confirmation (candlestick rejection, BOS, or volume shift).

Always use SL/TP for risk management.

⚡ Gold remains bullish overall; the plan favors buy opportunities from demand zones, while countertrend shorts should be quick and managed tightly.

GOLD DAILY PLAN 09/15: SMC & WYKOOF LOGIC🔎 Market Overview

Market Structure (SMC): Price is currently within a short-term descending channel but showing signs of Wyckoff accumulation around the 3620 – 3635 zone (Liquidity BUY). This is a key support area.

Wyckoff: After the supply test, price is likely to consolidate and then push upwards to sweep liquidity above (Liquidity SELL at 3688 – 3703).

Liquidity Zones:

Liquidity BUY: 3595 – 3592 (major demand area)

Liquidity SELL: 3688 – 3703 (profit-taking & potential reversal zone)

📌 Key Levels

Resistance: 3668 – 3688 – 3703

Support: 3634 – 3629 – 3622 – 3617

🟢 BUY Plan (Primary Setup)

Entry: 3595 – 3592

Stop Loss (SL): 3587 (below Liquidity BUY)

Take Profit (TP) targets:

TP1: 3615

TP2: 3625

TP3: 3635

TP4: 3645

Open TP: 3685 (extended Wyckoff target)

🔴 SELL Plan (Counter-trade)

Entry: 3698 – 3701 (Liquidity SELL zone)

Stop Loss (SL): 3706 (just above breakout trap)

Take Profit (TP) targets:

TP1: 3690

TP2: 3680

TP3: 3670

TP4: 3660

Open TP: 3650

⚡ Scalping Strategy

Only enter when confirmation signals occur at Order Blocks (OB) or Liquidity Zones.

Prioritise BUY trades at support and SELL trades at resistance.

Apply strict risk management: no more than 1–2% risk per trade.

✅ Conclusion:

Main directional bias for the day: BUY from 3595 – 3592, targeting the 3685 – 3700 region.

At Liquidity SELL 3688 – 3703, short-term SELL setups can be considered with targets back to 3660 – 3650.

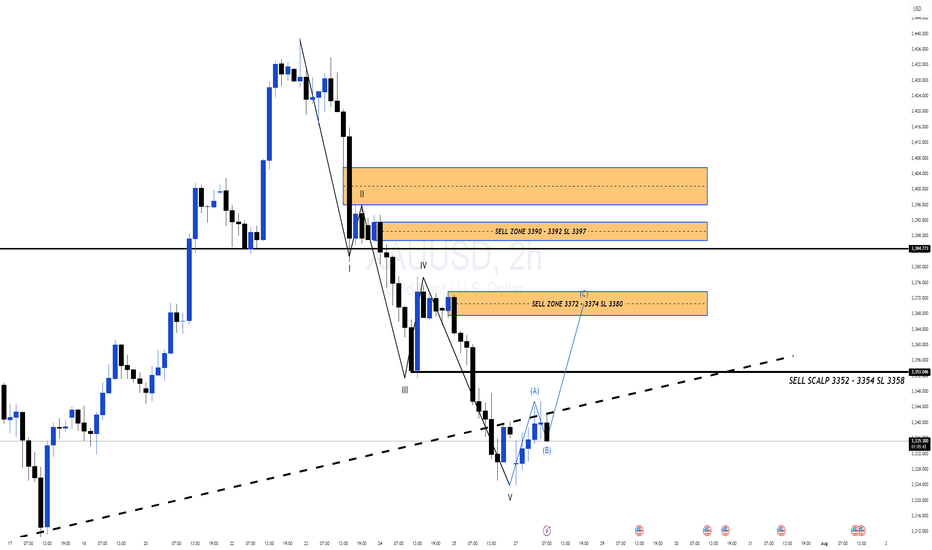

GOLD 29/08: Monthly Candle Closing. DON'T BUY FOMOGold is at a decisive point: will the market continue its bullish run, or is it setting up a deeper correction? Using Smart Money Concepts (SMC) and Elliott Wave Theory, we can map out clear scenarios without falling into FOMO traps.

🔎 Market Structure (SMC + Elliott)

Elliott Wave: The structure has completed waves III – IV – V, with wave V tapping into the higher trendline (D1). This suggests a potential exhaustion phase.

SMC:

Multiple BMS (Break of Market Structure) signals → liquidity manipulation by institutions.

EQH (Equal Highs) and EQL (Equal Lows) → liquidity pools ready to be swept.

Key Demand Zones identified:

3398 – 3396 (EQH + BMS support)

3372 – 3370 (deep liquidity sweep / EQL)

The D1 trendline remains the main dynamic resistance.

📌 Trading Plan

Scenario 1 – Short-term Sell (Counter-trend):

Sell Zone: 3319 – 3321

Stop Loss: 3327

Target: Demand Zone 3398 – 3396

Scenario 2 – Buy at Demand Zone 1 (Main Setup):

Buy Zone: 3398 – 3396

Stop Loss: 3390

Target: 3410 – 3415 (D1 trendline retest)

Scenario 3 – Buy at Demand Zone 2 (Deeper Sweep):

Buy Zone: 3372 – 3370

Stop Loss: 3365

Target: 3400 – 3410

✅ Best Risk-Reward setup, aligned with liquidity grab + Elliott retracement.

✅ Conclusion

The bigger picture still supports a bullish bias, but liquidity sweeps may occur before continuation.

Avoid chasing the market. Wait for confirmation at demand zones for optimal entries.

Main focus: Buy from 3398–3396 or 3372–3370, instead of entering impulsively at highs.

Gold SMC Playbook 25/08 – Liquidity Hunt at 3400 & 3325Market Context (SMC perspective)

Price is consolidating around 3367 after a strong impulsive push up and is currently reacting near minor resistance.

Clear ChoCH & BOS patterns confirm bullish intent on H1; however, liquidity pools remain below 3343 & 3325 (buy-side liquidity).

Imbalance zones identified: 3343–3341 and deeper 3325–3323 OB zone.

Key Levels

Resistance (Supply): 3372 – 3382 – 3389

Support (Demand): 3350 – 3342 – 3325

SMC Bias: Mixed – Play Both Long & Short Setups Around Liquidity

🔴 SELL Scenario (Short-term Liquidity Grab)

Entry: 3400 – 3403 (above local liquidity sweep)

Stop Loss: 3408

Targets:

TP1: 3390 (partial)

TP2: 3380

TP3: 3370

TP4: 3360 (open 3350 liquidity zone)

Rationale: Anticipate a sweep above 3400 into supply, then mitigation and sell-off.

🟢 BUY Scenario (Bullish Continuation from Demand OB)

Entry 1 (Scalp Buy): 3343 – 3341 (reactive zone) SL 3337

Entry 2 (Main OB): 3325 – 3323 (strong OB) SL 3319

Targets:

TP1: 3330

TP2: 3340

TP3: 3350

TP4: 3370 (open 3390 liquidity)

Rationale: Price may retrace to fill imbalance below 3340 and mitigate OB at 3325 before next bullish impulse.

Execution Plan (SMC flow):

Wait for liquidity sweep at highs or lows (above 3400 or below 3325) with confirmation.

Look for ChoCH & BOS on LTF (M5–M15) around OB for entry confirmation.

Trail SL to protect profits after TP1 hit; partial out and hold runner toward final liquidity target.

Gold (XAU/USD) Daily Trading Plan - 28th July 2025🔺 Technical Analysis

Gold opened the Asian session this week with a slight retracement, testing the 0.382 Fibonacci Retracement level before bouncing back strongly to last week's closing price around 3339. This move further solidifies the price action from a technical perspective.

Notably, gold has broken through a minor resistance on the M15 timeframe, invalidating the bearish structure and forming a full-bodied H1 candle. This sets the stage for a potential corrective uptrend to unfold.

On the Daily timeframe, the initial session's decline retested the bullish trendline and bounced back within the boundaries of the flag pattern. It's likely that this week, the price will continue towards the end of this pattern, providing a clearer confirmation of the medium-term trend.

🔺 Key Macroeconomic News

This week promises to be volatile with several crucial economic announcements, particularly as it marks both the end of the month and the start of a new one. Two key events that traders should pay close attention to are:

FOMC Interest Rate Decision: Always a focal point for the market, with significant impact on safe-haven assets like gold.

Non-Farm Payroll (NFP) Report: Vital US labour market data, capable of triggering substantial movements in both the USD and gold.

Therefore, be prepared for potential market shocks and exercise careful risk management.

📈 Trading Strategy & Considerations

Given the technical setup and upcoming macroeconomic events, consider the following:

Potential Corrective Uptrend: The invalidated bearish structure on M15 and the strong H1 candle suggest a short-term bullish bias for a corrective move.

Daily Flag Pattern: Monitor price action as it approaches the end of the flag pattern on the Daily timeframe for medium-term trend confirmation.

High Volatility Ahead: Exercise extreme caution around the FOMC and NFP announcements. These events can lead to significant and rapid price swings.

Risk Management: Prioritise strict risk management. Consider reducing position sizes or employing wider stop-losses during high-impact news events.

Disclaimer: This analysis is for informational purposes only and does not constitute financial advice. Trading involves significant risk, and you should only trade with capital you can afford to lose.

Remains Below 1.3700 Ahead of CPI Data from the US and CADUSD/CAD Remains Below 1.3700 Ahead of CPI Data from the US and Canada

USD/CAD continues to decline ahead of inflation data from both the US and Canada.

The US inflation rate is expected to rise to 2.7% year-over-year in June, up from 2.4% recorded in May.

Meanwhile, Canada’s CPI is forecasted to increase by 1.9% year-over-year in June, up from 1.7% in May.

USD/CAD is trading around 1.3690 during the European session on Tuesday, following two days of gains. The pair is declining as the US dollar (USD) continues to weaken ahead of the June CPI data from the US. The inflation figures will provide new insights into the Federal Reserve's (Fed) monetary outlook.

📉 Market Outlook for USD/CAD – Possible Drop on CPI Release

The USDCAD is still in a downtrend, and a sharp drop could occur with today’s CPI data release. Currently, there are two Buy Side Liquidity zones above and Sell Side Liquidity below, with the price balanced around the VPOC zone, which will soon decide the direction after the CPI announcement today.

Market liquidity still holds a FVG below, and with CPI data expected to favor USD, this could trigger a sharp drop towards this liquidity zone, possibly nearing CP OBS at 1.3600, followed by a potential rebound.

If price breaks CP zone, it may head toward a strong OB zone near 1.35xxx. Therefore, caution is advised when monitoring these OB zones.

🎯 Trading Strategy for Today

🟢 BUY ZONE: 1.36000

SL: 1.35500

TP: 1.36500 → 1.37000 → 1.37500 → ????

💬 What are your thoughts on USD/CAD ahead of the CPI data release? Do you expect a strong bounce or a continued decline? Share your views and join the conversation below!

👉 Follow for more updates and insights, and join the community to discuss real-time market moves!

EURAUD - Short Setup at Key ResistanceOANDA:EURAUD is approaching a significant resistance area that has before reversed bullish trends. The current upward move into this zone suggests potential selling opportunities if rejection signals appear, such as bearish engulfing candles or upper wicks.

I find that a move toward 1.65180 is likely.

A break above this resistance, however, could indicate a shift in market sentiment.

Just my take on support and resistance zones—not financial advice.

Always confirm your setups and trade with solid risk management.

XAUUSD CONFIRM 100 PIPS MOVE IS HERE🚨 Attention Traders! 🚨

🟡 Gold is in a no-trade zone! 🛑 Stay patient as we monitor key levels.

📊 Critical Zone: 2919 - 2945 (Support & Resistance)

🔻 Bearish Breakout? If the price drops below 2919, we’ll target:

🎯 TP1 = 2909

🔺 Bullish Breakout? A move above 2945 signals upward momentum:

🎯 TP1 = 2955

🔥 Stay sharp & trade wisely! 💰📈

DE30 Strengthens Within Ascending Channel, next at 652.00?DJ:DE30 remains within a well-defined ascending channel, with price recently rebounding from a key support level. This suggests a continuation of the uptrend, with the next target near 652.00, aligning with the upper boundary of the channel.

A short-term pullback could present a buying opportunity, particularly if bullish candlestick patterns like an engulfing or hammer formation emerge, confirming buyer strength. A decisive move above recent highs could reinforce momentum toward the expected target.

But if we get a break below the channel’s lower boundary, it would invalidate the bullish outlook and signal a potential shift in market direction.

CHFHUF At Key Support Zone, can it bounce to 437.900?FOREXCOM:CHFHUF is currently testing a major support area that has previously served as a strong base for bullish reversals. It could become a great potential buying opportunity if buyers confirm control.

I think an upward move toward 437.900 is very plausible. If the support fails to hold, however, further downside might happen.

Be sure to wait for clear confirmation of buyer strength before taking long positions.

Sensex Support and Resistance Levels for Better Trading DecisiI’ve created a chart highlighting the key support and resistance levels for Sensex, designed to help traders make informed decisions.

These levels provide critical insights for understanding potential price movements, enabling traders to identify ideal entry and exit points.

Use these levels to gain a clearer perspective on Sensex trends and optimize your trades with greater confidence.

Remember, these levels serve as guidance, so always combine them with your own analysis and risk management.

Bullish End of Year?This chart shows the price development of Alphabet (Google). Since reaching its high in July, the stock has been in a downward correction. However, it now appears that this correction may be ending. The price has formed a higher low, which could serve as the right shoulder in an inverse Head & Shoulders pattern.

Additionally, the SMAs are bullishly aligned once again. If the price breaks above the 38.2% Fibonacci level, I anticipate a bullish move toward the end of the year.

**JSWSTEEL HIGH VOLUME BREAKOUT**Disclaimer: I am Not SEBI Registered adviser, please take advise from your financial adviser before investing in any stocks. Idea here shared is for education purpose only.

22.09.2024 Swing trade

Buy- CPM

Target- 1023,1091,1160,+++

Stop Loss-910

#papertrade #learningonly #Swing trade

1.Breakout- All time high break out

2.Volume- all time high break with good volume

3. RSI-Bullish

4. Chart Pattern- moving forword with trend line.

News:- India's JSW Steel rises on Macquarie rating upgrade

India metal stocks up on demand revival hopes; Macquarie upgrades PT on five cos

Market bulls take restAfter a spectacular rally last week market bulls are taking a pause. Last two days look quite bearish on the daily chart but if we look at lower timeframes we won't see any signs of strong selling. Price is drifting down very slowly as a result of profit taking and low initiative from buyers.

The high level context is still very bullish: we're in an uptrend, market made new high, retracement <30%, there is an unfilled gap from last week.

There will be some volatility as new economic data released, but at this moment my bias is 100% bullish

Disclaimer

I don't give trading or investing advices, just sharing my thoughts

Weekly analysis of gold with my personal st based on the WMPUsing the data we get from the gold weekly chart and my special calculation program, we identify these waypoints as key gold points and based on that we can enter long and short positions. In this method, stoploss setting is based on your personal money management and is flexible, but the most logical stop is between 20 and 35 pips from the entry point on the drawing lines.

Every week we will recalculate and send you the lines and we hope to get between 200 and 500 pips of profit with this strategy.

Until further notice, this program will be run for free and after you believe in our method, the supplementary strategy along with the calculation program will be available for sale . and for those people who are not interested in calculation and training in the coming weeks of the channel, We will have a daily trading signal on gold.

CAD/JPY EXPECT BULL SOONFirst, if you found this helpful please like and leave a comment in the comment section for more discussion, and don't also forget to follow for more updates

Let us traders watch out for this pair this coming week. If the price brake to the upside that means I m on point and the price is facing WAVE C to complete the zigzag correction.

Goodluck

Gold bearish trend is ready againFrom my last analysis, we manage to catch the $55 Movement with risk reward 1:3. Now we will apply the same risk-reward ratio. Based on the Fibonacci & Ichimoku cloud we can clearly see the resistance level at $1660. Don't miss another golden opportunity. Share the idea with all your friends!