Dollar

CRITICAL JUNCTIONThe larger trend is down.

Shorter term trend is up.

There are 3 cases to be made here.

I currently don't see any reason for the green case, but perhaps the yellow. Gold and silver are signaling for the red case.

Strong Dollar Camp

- Scott Bessent's comments were helpful "strong dollar policy".

- Long Term Yields are rising. If they are relatively higher than their peers and confidence in the U.S. returns, it could be massively bullish.

Neutral Camp

Jerome Powell essentially walked away today, and said the rest is up to the next guy.... Did nothing to defend the dollar, or weaken it further. Stable Mable.

Weak Dollar Camp

- Trump weakens the dollar "who needs allies".

- Congress just wants to keep printing more to spend, they're only arguing about what to spend it on...

Nasdaq Retests January Highs + BSL – Rejection Here?Hello Fellow Traders,

We're looking at the Nasdaq (NQ or NDX) today.

The index has retested and taken out the January highs again — hitting major buy-side liquidity from earlier in the month.

Right now, the market is in a major consolidation phase and could stay range-bound through much of Q1. We're trading in premium territory relative to the broader dealing range — so a correction down to the discount area (below equilibrium) feels likely and healthy in this environment.

If we see clear rejection signs from the current area (e.g., strong wicks, failure to hold highs, or displacement lower), expect a potential waterfall move down to the highlighted discount PD Arrays.

Focus on reactions at those PD Arrays (like FVGs, NDOG/NWOG, Order Blocks, etc.) — not just price.

Example: If the top highlighted FVG breaks with displacement (strong move through it), it flips to an iFVG (inverted FVG). Any retracement back into that iFVG becomes a solid short signal.

Vice versa for lower arrays — bullish reactions there could confirm continuation or reversal.

Bias: Still overall bullish macro, but short-term correction to discount zones is expected to reload buyers. Watch for confirmation at those PD Arrays before acting — patience pays!

Keep risk tight, especially in choppy consolidation. What's your view on Nasdaq? Expecting rejection and drop, or breakout higher first? Drop your thoughts below!

#Nasdaq #NQ #NDX #TechnicalAnalysis #SMC #ICT #PDArrays #FVG #Forex #Indices

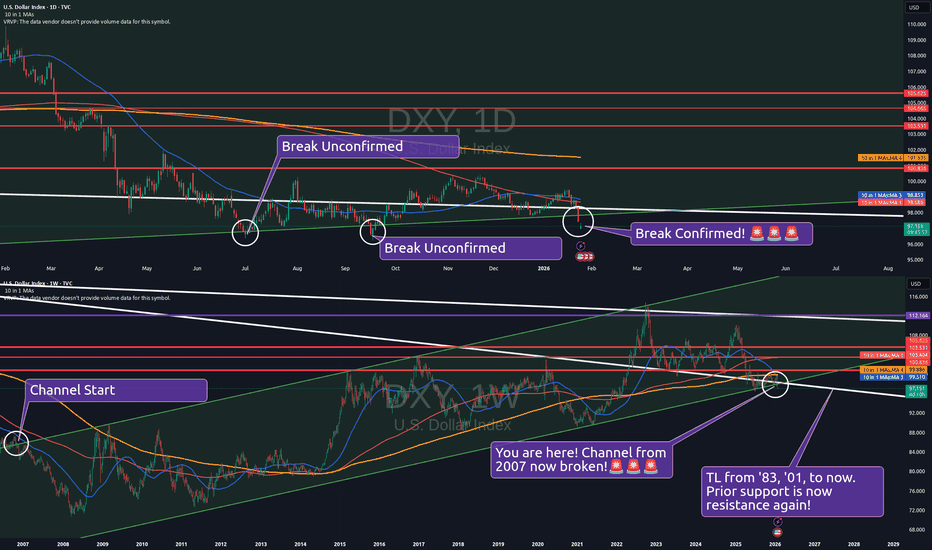

WARNING!!! 19 Year Dollar Channel is Now Broken!Trading Fam,

The title is NOT clickbait. If you’ve been following me for any length of time, you’ll know I have been warning you about this exact moment for some time. We’ve had many signs. Many clues. But the price of gold and silver rising exponentially was our crystal ball. And now, price movement on the U.S. dollar has confirmed to us that the dollar will continue its descent. For the first time in 19 years, the dollar has dropped from its ascending channel. The price of everything is about to increase. Be prepared.

Let’s take a look at our chart.

In the upper rectangle, you’ll see the U.S. dollar on the daily. We have existed inside this channel for 19 years. And for 8 months now, we’ve been consistently hammering away at the bottom of our channel, which has been acting as strong support. 19 years’ worth of strong support. Today, we finally confirmed a break below this support.

Two times in the past, once in July of last year and once in Sept., we did break the bottom of the channel. But we received no confirmation. We were looking for a lower low closing candle, but we never received that, and somehow we escaped back into our “safe” zone, the channel. Today, the break from our channel is looking like it will be confirmed. Yes, we do have to wait and see where our candle will close. But the reason I am confident this is our move is mainly because of that overhead trendline (white) coming all the way from 1983, drawn through a couple of tops in 2001, and extended through today. This will now act as major resistance. And it intersects almost precisely with the bottom of our 19-year channel!

This is not good. It means the price of everything is about to inflate even more than it already has. Any student of monetary history will know that all fiat currency always only ever ends in hyper-inflationary recession/depression. I’m not saying we are at that point yet. But maybe we are? Or is this time different? Whatever the case may be, we can’t cling to hopium to preserve our cash. We must take steps to hedge against this massive deterioration of our dollar that will continue to occur.

So, what do we do? Where do we go from here?

My suggestion is to concentrate on acquiring assets that the FED cannot print! This would include things like physical gold and silver. I have long been a proponent of the 4 “G’s” in investing/hedging strategy. Each “G” is symbolic of a larger class of commodities that will do well to keep one safe in both times of inflationary pressures as well as deflationary pressures. The 4 “G’s” are these:

Gold - anything categorized as precious metals

Ground - real estate providing tangible value and income potential

Guns - again, not literal. So, don’t let this scare you. But to keep the alliteration alive, guns stand for anything physical that can be used to protect your wealth. Usually, this comes in the form of something metal. Whether that be a safe, a tractor, or an iron tool that is hard to get, these tools can be used to protect your property, your precious metals, and anything else that is considered of value. Some may interpret this to be defensive type stocks.

Gas - energy related stocks and investments

How you acquire the above-listed and by what means is entirely up to you. But I don’t think you can go wrong. In the great depression, these categories saved people. In any sort of inflationary recession/depression, they are also most likely to do the same, and they will always hedge against a currency devaluation and an economy that can no longer be controlled.

✌️Stew

Weekly analysis 26th-30th January 2026In this video, we present a weekly market outlook for USD, EUR, and Ethereum (ETH) covering the period 26th–30th January 2026.

The analysis focuses on key technical levels, market structure, and momentum across major currency pairs and the crypto market. We break down recent price action, identify critical support and resistance zones, and discuss potential scenarios that may shape market movements during the week ahead.

Ethereum, USD, EUR, SPX500, FTSE100, CAC40, DAX40.

Dollar in 2026: Why USD Dilution May ContinueA year ago I mapped out a bearish DXY path over a one-year horizon, and the move played out with the index dropping roughly from 110 to 96. Now it’s time for a 2026 forecast. After revisiting both the technical structure and the fundamentals, my base case remains the same: a weaker TVC:DXY CAPITALCOM:DXY

Fundamentals: the Treasury problem is not “2035” — it’s 2026

There is an issue the market prefers not to discuss openly: in 2026 the U.S. must refinance a massive amount of debt, and it will do so in a world far removed from the zero-rate era. Much of that debt was accumulated when servicing costs were minimal. Rolling that same volume into materially higher yields means higher interest expense, more budget pressure, and a growing reliance on consistent demand at auctions.

From there, the policy menu has no easy options. Large spending cuts are politically difficult. Meaningful tax hikes are also difficult. Tightening liquidity hard enough to pressure markets is undesirable, especially in an election-driven environment. That is why the path of least resistance is continued USD dilution through softer financial conditions, expectation management, and allowing real debt burdens to erode over time. Add the political-economy layer: a push to bring production back home is structurally easier to support with a weaker USD.

Bottom line: 2026 looks like a year of continued pressure on the dollar, which is why my base case remains further USD depreciation.

Technicals: the key level is 100, and there are magnets below

Technically, the picture is consistent with the weak-dollar thesis. 100 remains the key area and psychological line where supply is concentrated. Above it sits a sell-side imbalance/FVG zone, while below there are still higher-timeframe imbalances that often act as magnets for price.

Wave logic (base case)

My base case is a double zigzag (dZ). Within that structure, I expect a final wave C to complete the current leg and transition into the final wave Y, effectively finishing the broader corrective pattern.

Targets: approximately 95.5 → 94 → 93, the (c)/(Y) area aligned with the 0.382/0.618 references on the mapping.

Alternative scenario: what would make me flip

The bullish alternative activates only on clear evidence. If price decisively reclaims 100 and holds above it for a sustained period, ideally confirmed on the daily and weekly, then a bullish continuation scenario opens up.

Until that happens, upside is an alternative, not the base case.

Summary

Priority: continued USD weakness and a test of the lower magnets at 95–93.

Invalidation: a sustained reclaim above 100 and acceptance there.

DXY (Dollar Index) 4H Outlook (Count 3)Here is a 4H update on the TVC:DXY index. I've been bearish for a while as you can see from my previous outlooks.

i think price in currently in a wave iii decline, i posted some chart images last night and the chart is playing out since then in line with the outlook.

previously posted weekly outlook shows the potential larger pattern at play.

If you like my analysis show your appreciation!!

20 Year Channel BreakThe dollar's sudden downward break this week indicates a lot more downside risk ahead for it. If Trump announces that he is nominating a major dove for Fed chair, this could get really ugly.

This is why Gold and Silver are going straight up right now.

Not good.

For now, 1st target is 96.

This is bullish for interest rates and bond yields.

This is bullish for inflation, oil, industrials, etc.

This is bearish for equities due to liquidity access tightening.

I don't know if Trump is trying to reset the monetary system, but if he doesn't stop, he just might do it. It is honestly wild. Something most people have been demanding for quite some time, but are we ready to implement what is next?

It is a matter of public security that the people are the owners of the next monetary system, and not the central banks or any bank.

DXY Breakout and Potential Retrace!Hey Traders, in today's trading session we are monitoring DXY for a selling opportunity around 99.100 zone, DXY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 99.100 support and resistance area.

Trade safe, Joe.

DXY is about to bounce off manthly support?DXY currently at the montly support level. Past 4 months DXY has created series of higher low, with strong liquidity grab off the support level market may bounce off the level as the price at order block which is a key level of support where in the past price rejected with strong break of structure.

As of Friday, market is highly likely to bounce off the level to retest the montly and weekly high.

USDOLLAR H4 | Bullish ReversalThe price is reacting off the pivot and could bounce off our buy entry level at 12.67, which is a swing low support.

Our stop loss is set at 12.64, there is a support level at 127.2% Fibonacci extension.

Our take profit is set at 12.71. a pullback resistance that aligns with the 38.2% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Gold at $5k? RSI divergence vs. breakout – which comes first?Gold is just $30 away from the historic $5,000 level, and silver is approaching $100 for the first time ever. But before you chase the breakout, we need to talk about the RSI divergence flashing on multiple timeframes and what it means for the next move.

In this video, we analyse the technical setup as gold approaches the most critical resistance level of this bull run. We explain why the "no safe haven" thesis—with the dollar collapsing on Greenland tensions and the yen crashing past 158 after the BOJ decision—is flooding capital into precious metals. But we also map out the warning signs that suggest $5K could trigger heavy profit-taking.

Key topics :

Measured move complete : The corrective leg projects to 4,930, which we just hit. Similarly, the Elliott Wave net distance (Waves 1-4) also targets the same level—two confluences at resistance.

Accelerated channel : Gold is trading in a parabolic, accelerated channel. As long as we hold 4,680 (61.8% Fib on daily) and 4,770 (61.8% Fib on 4H), the bias remains bullish.

RSI divergence : Weekly, daily, and 4-hour charts all show bearish divergence. Price is making new highs, but momentum is not confirming—classic topping behaviour.

The $5K test : Next upside targets are 5,012, 5,100, and 5,200. But $5K might be where sell orders are stacked. A failure here could trigger a sharp correction to 4,770-4,800.

Risky counter-trend Play : For the brave, a short at $5K with a stop at $5,050 and a target at $4,770 (61.8% support). But remember: "The trend is your friend."

Are you buying the dip or fading the $5K level? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Gold Pausing at Extremes – Waiting on Value or ConfirmationPrice stalled throughout yesterday’s session and failed to produce a clean breakdown until after the NY session. This hesitation coincided with the World Economic Summit, where uncertainty kept price compressed and choppy.

Once Trump spoke, Gold began to show signs of weakness, suggesting that macro-driven flows may finally be easing. With price having consolidated in the same area since Monday’s London session, I’m now watching to see if this pause resolves lower before continuation.

Key levels I’m monitoring:

Previous Daily Low: 4756.7

A clean break and acceptance below this level could open the door for a deeper retrace.

H4 Fair Value Gap: Located just above the Weekly Open

This remains my primary area of interest if price seeks value.

Previous Weekly Low: Resides inside the H4 FVG, adding confluence to the zone.

At current prices, conditions remain choppy and extended, offering poor risk-to-reward. I’m not interested in forcing trades in the middle of this range. I want to see either:

A decisive breakdown into value, or

Clear continuation strength above recent highs with acceptance.

Until then, patience is required.

USDOLLAR H4 | Bullish Bounce OffThe price has bounced off our buy entry level at 12.707, which is an overlap support that is slightly above the 78.6% Fibonacci retracement.

Our stop loss is set at 12.686, which is a pullback support.

Our take profit is set at 12.73, whichis a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (fxcm.com/uk), Stratos Europe Ltd (fxcm.com/eu):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (fxcm.com/en): Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited (fxcm.com/au):

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com/au

GBP/USD targets 1.35 after mixed UK jobs! Break or reversal?Today, we are doing a dive into GBP/USD following a mixed UK jobs report that has left traders scratching their heads. While unemployment has spiked to a 4-year high, sticky wage growth and new tariff threats from President Trump are keeping the pound bid. Is a breakout to 1.35 imminent, or is the labour market crack a warning sign?

We analyse the conflicting signals from the UK economy: unemployment rose to 5.1% in December (highest since 2021), yet wage growth held firm at 4.7%, keeping the BOE cautious on rate cuts. We overlay this with the "Greenland Tariff" threat weakening the US dollar and map out the technical path to 1.3568.

Key topics:

UK Jobs data: A breakdown of the December report—unemployment up to 5.1%, 43k job losses, yet sticky wages (4.7%) are preventing a dovish pivot from the BoE.

Trump tariff threat: How President Trump’s weekend threat to impose 10% tariffs on 8 EU nations (including the UK) over the Greenland dispute is pressuring the dollar and supporting cable.

Technical setup :

Bullish flag breakout: GBP/USD has reclaimed the 1.3400 handle and is holding above the 50% Fibonacci retracement.

Golden pocket: Currently testing the 1.3481 "golden pocket." A break here targets the 1.3568 cycle high.

Extension target: The 100% Fib extension points to 1.3500 as the immediate hurdle, with 1.3539 and 1.3562 above that.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Are you speculating on a 1.35 breakout or fading the weak labour data? Let us know in the comments!

EURUSD LONGS - BUYER BACK IN CONTROL?After the recent downtrend on the current pair it seems price has halted at support and buyers have resumed.

We can see the 1.16198 area is significant level where price attempted to break lower and failed with buyers entering.

On the daily time frame price is also now trading above the 100 day MA. On the 4 hour we can see a break and restest of the counter trendline signalling a potential big upside move

Expecting EURUSD to make a leg higher if the above holds - TP1 at 1.173 and TP2 at - 1.18150

Gold Breaks Balance, Now Waiting for ValueYesterday was a shortened session due to the MLK holiday, so I stayed flat. Price opened the week by breaking out of the range it had been consolidating in for most of last week, likely assisted by geopolitical headlines around potential tariffs involving Denmark/Greenland.

After the initial breakout, price spent the remainder of the session consolidating again, building value above the prior balance area.

Now that we are into a full trading day and inside the Asian Killzone, my bias remains bullish, but I am not interested in chasing price.

The breakout left behind a clean H4 Fair Value Gap, and I want to see price retrace into at least 50% of that imbalance before looking for long continuation. That 50% level aligns closely with:

The Previous Weekly High

The Previous Day’s Open (4627)

A controlled pullback into that area with acceptance would offer a much cleaner risk profile and confirm that higher prices are being defended. Until then, patience is key. Waiting for clarity inside the killzone rather than forcing entries.

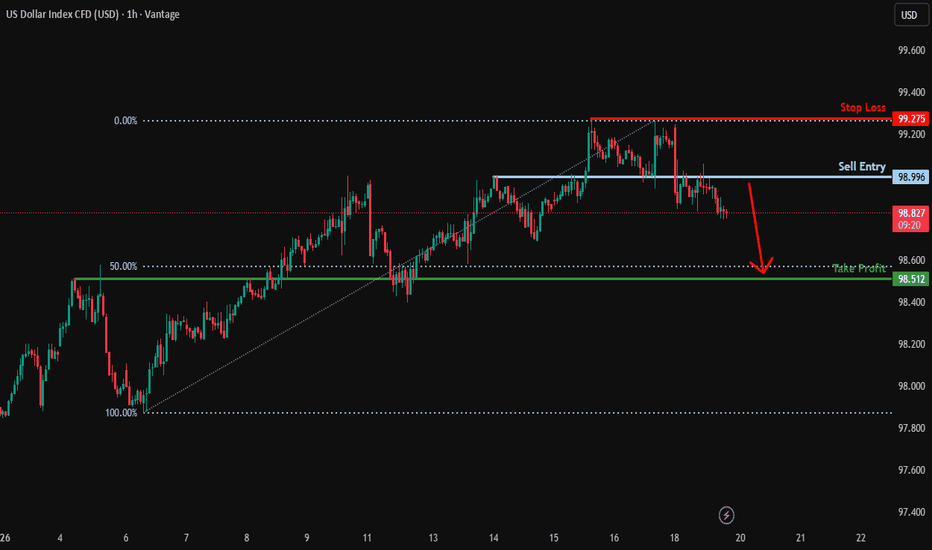

Bearish drop off?USDX has rejected off the resistance level, which is an overlap resistance, and could drop from this level to our take profit.

Entry: 98.96

Why we like it:

There is an overlap resistance level.

Stop loss: 99.27

Why we like it:

There is a multi-swing high resistance level.

Take profit: 98.51

Why we like it:

There is an overlap support that is slightly below the 50% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Early Market Close for MLK day. Wait for the better moveNot much to say. Not a move here. We are waiting for price to finish consolidation and break out of the area before we make any calls on direction. Looking for price to move bullish but need a pullback into entry. another full update during Asian session coming.