$DXY bullish from 96-98, massive bull flagDespite everyone calling for the death of the dollar, I think the dollar is in the process of bottoming and then will head higher.

Macron called for the Euro to replace the dollar (which is laughable) and likely marks a bottom.

Either we bounce here, or I could see the possibility of one more spike low down to the ~96 support level, but should we see a reaction there, it sets up a massive move higher in the dollar.

As you can see on the chart, we've been correcting inside of a bull flag, if we can form a low around $96-98, we will reverse and head higher to break the flag to the upside. Upside targets on the chart.

I think the bull market in the dollar is just starting, don't let the news scare you out of accumulating dollars over other fiat currencies.

Dollar

USDCAD - DOLLAR STRENGTH TO COTINUEst]

We can see the pair has been in a strong upside trend since the start of January

Price has found support at 1.38640 which also is in confluence with the 100MA on the daily time frame, we can see support has held and buyers have potentially resumed in the market to continue this trades uptrend

TP 1: 1.4000

TP 2: 1.40939

Is The Price Of Silver Telling Us What The Dollar Is Going To DoTrading Fam,

I am sensing some events on the horizon, and the charts seem to confirm what I am feeling. I want to let you know what I am seeing. We’ll talk Silver, the dollar, S&P500, Bitcoin, and Ethereum in this video. Don’t shoot the messenger.

✌️Stew

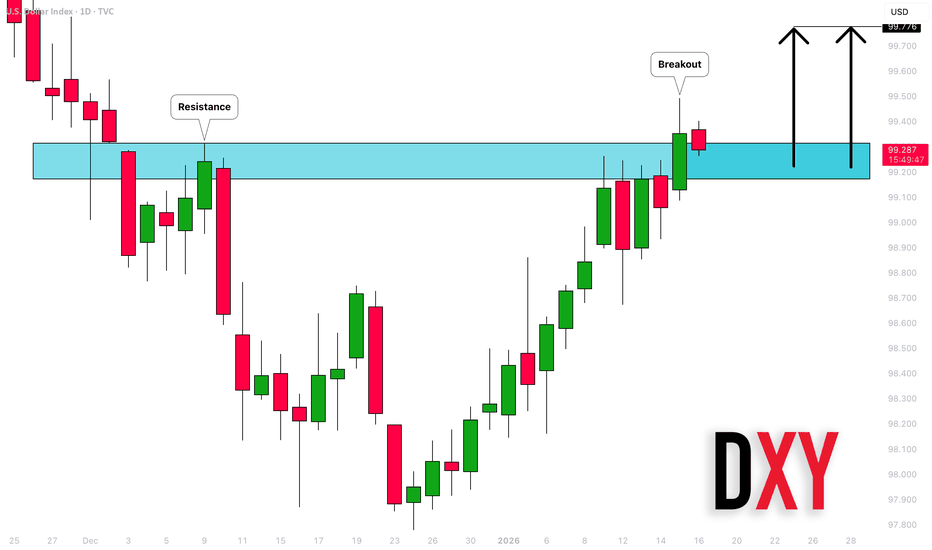

USD Index (DXY) Outlook: Bullish Structure HoldingThe Dollar Index is holding above the key 99.00-98.90 support zone and trading within a rising structure. Price has respected the ascending trendline and previous BOS-CHOCH levels showing buyers are still active. As long as DXY stays above 98.80 the bias remains bullish with upside targets around 99.85 and 100.20. A pullback toward 99.00-98.90 can be seen as a healthy retracement before continuation while a clear break below 98.50 would weaken the bullish outlook.

From a fundamental perspective the dollar is supported by expectations that the Federal Reserve will keep interest rates higher for longer as inflation remains sticky and the U.S. economy shows relative resilience compared to other major economies. Safe haven demand also favors USD amid global uncertainty and geopolitical risks. However any softer U.S. inflation or labor data could trigger short term pullbacks. Overall fundamentals currently align with the moderate bullish technical bias shown on the chart.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

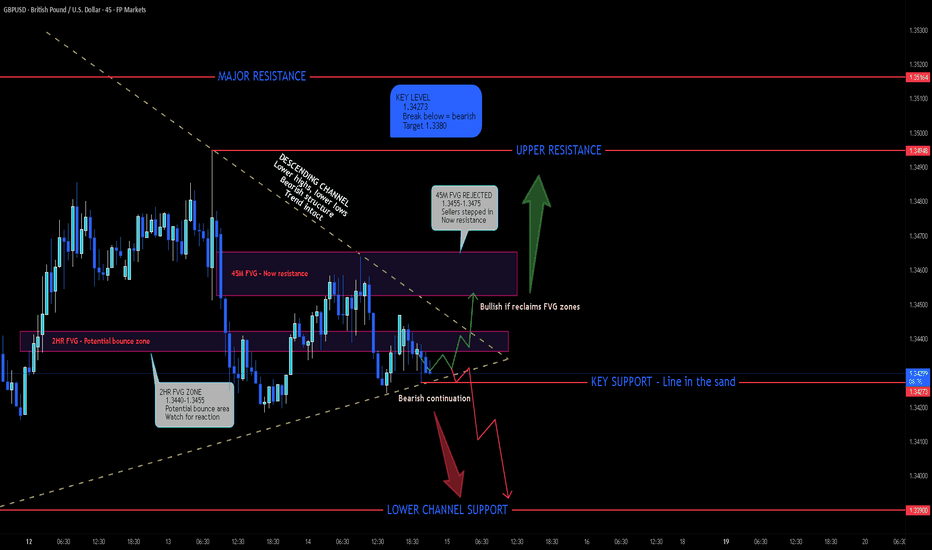

GBPUSD - Descending Channel with Stacked FVG Zones

Alright traders, let's talk GBPISD!

GBPUSD is showing some interesting price action right now. We've got a descending channel playing out on the 45-minute timeframe with two stacked FVG zones creating a decision area. Price just retested the 45M FVG and sellers stepped in - now it's acting as resistance.

Here's the key: 1.34273 is the line in the sand. Break below = bearish continuation. Hold above = potential bounce into the FVG zones.

The Structure

Price has been making lower highs and lower lows inside this descending channel. We saw a push up into the 45M FVG zone (1.3455-1.3475) but sellers rejected it hard. Now that zone has flipped from support to resistance.

Below that, we have the 2HR FVG zone (1.3440-1.3455) which could act as a retest area if we get a bounce. But if 1.34273 breaks, we're heading to the lower support at 1.3380.

Why This Setup Matters

Descending channel intact - trend is bearish until breakout

45M FVG rejected - sellers in control at that level

2HR FVG below - potential bounce zone if bulls step in

1.34273 is critical support - break = acceleration lower

BoE expected to cut rates - bearish for GBP

Dollar strength persisting despite Fed drama

Fundamental Picture

Mixed signals but leaning bearish for GBP:

UK GDP data due Thursday - expected to show 0.2% contraction

BoE's Taylor: "Interest rates should continue on a downward path"

UK inflation cooling faster than expected

Speculators cut bearish GBP positions by most in 5 months

Dollar holding near 1-month highs despite Powell drama

Fed expected to hold rates - supports USD

Japan yen drama pulling focus but USD still firm

Key Levels

Resistance:

1.3455-1.3475 - 45M FVG zone (now resistance)

1.3510 - Upper resistance

1.3575 - Major resistance / channel top

Support:

1.3440-1.3455 - 2HR FVG zone (potential bounce)

1.34273 - KEY SUPPORT (line in the sand)

1.3380 - Lower channel support

The Scenarios

Bearish (favored): Price stays below the 45M FVG zone, retests the 2HR FVG but fails to hold, breaks below 1.34273, and continues down the channel toward 1.3380. The descending channel structure supports this move, and weak UK data could accelerate it.

Bullish: Price bounces from the 2HR FVG zone, reclaims the 45M FVG (1.3455-1.3475), and breaks above the descending channel. Target would be 1.3510, then 1.3575. This needs strong UK GDP data or significant dollar weakness.

Chop scenario: Price oscillates between the FVG zones and 1.34273 support. Wait for a clear break before committing.

My Lean

I'm BEARISH here. The descending channel is intact, the 45M FVG got rejected, and the fundamentals favor USD strength (Fed holding, BoE cutting). The 1.34273 level is the trigger - break below that and we're targeting 1.3380.

If you're looking for shorts, wait for a retest of the 2HR FVG zone that fails, or a clean break below 1.34273.

What's your read on GBPUSD? Bulls or bears winning this one? 👇

Gold (XAU/USD): Tight Triangle + Equal Highs Before PPIHello Fellow Traders,

Gold (XAU/USD) is in a tight range since the London session today. Everyone is waiting for the US PPI news (Producer Price Index).

On the chart, we see a small triangle pattern forming. It has equal highs close to the Previous Day High.

My view: Price might do a quick fake breakout up to the ~4640 area to take out sellers (grab their stops), then drop back down to the marked hourly Fair Value Gap (FVG) around the 4600s.

That FVG zone should attract buyers again — expect a strong bounce from there to push higher for the rest of the day.

Overall, I'm still bullish on Gold (it's making new highs near ~$4,630–$4,640 today with strong safe-haven demand). But PPI can bring big moves, so stay careful.

Keep your risk small (tight stops).

Protect your money — don't risk too much!

Follow me for more trade ideas and updates.

Persistent yen weakness is lifting USDJPY

The yen continues to trade on a structurally weak footing as Japan’s persistently accommodative monetary stance contrasts with growing skepticism over further Fed rate cuts. Japan’s Katayama voiced concern over the one-sided depreciation of the yen, stressing that US Treasury Secretary Bessent expressed similar concerns following bilateral discussions.

Today’s US inflation data will have a direct impact on the dollar’s valuation and could drive heightened volatility in the yen.

USDJPY surged sharply, breaking above 159.00. Diverging bullish EMAs indicate a potential extension of the uptrend. If USDJPY closes above 159.00, the price may advance toward 159.50. Conversely, if USDJPY breaks below 159.00, the price could decline further toward 158.50.

Gold Trapped in Re-Accumulation Above Yearly HighGold exploded into the weekly open and tagged the Previous Yearly High and Monthly High, but instead of rejecting, price has been consolidating above that level for two full sessions now.

That’s not weakness — that’s re-accumulation.

We are currently sitting in a tight range between the Previous Daily Low (~4576) and the highs around 4630, with overlapping candles, compressed volume, and no real displacement. This is classic value building after a breakout, not a clean reversal.

There is a valid H4 FVG below around 4545–4525, but imbalances don’t get filled until the market finishes its business on the current side of the auction. Right now, liquidity is being built above the Yearly High.

Until we see:

• A break and acceptance below 4576 → shorts toward the H4 FVG

or

• A break and hold above 4630 → continuation to new highs

everything in between is chop.

I’m staying patient inside the killzones and waiting for escape velocity, not trying to predict direction inside a compression coil. The real move always comes after the range.

USDJPY eyes 160 as Japan politics crushes yen ahead of US CPI!USDJPY is currently breaking out towards the 160 psychological handle, with an inverse head-and-shoulders on the monthly chart seeing further long-term upside just hours before the US CPI comes out. The big trader question: Why is the yen collapsing even as the US dollar faces its own crisis?

We analyse the rare divergence driving this pair: Japan's political chaos, with snap election risks threatening aggressive "Sanaenomics", is overpowering US dollar weakness caused by the Powell investigation. We then zoom in to the daily chart to reveal a triangle pattern that suggests this rally could target 165 and even 175+ in the long term.

Key drivers

Japan political risk : Prime Minister Takaichi's potential snap election and fiscal expansion plans are terrifying investors, causing capital flight from the yen despite 10-year yields hitting 27-year highs.

US dollar crisis : The greenback is struggling due to the criminal inquiry into Fed Chair Powell, yet USDJPY rises because the yen is the weakest link.

CPI catalyst : Today's US inflation data is the immediate trigger. A hot print could confirm the breakout above 160, while a miss might create the perfect buy-the-dip scenario if Japanese investors continue to exit.

Technical breakdown

5-month rally : This is the 5th consecutive month of gains, accelerating toward the 160 level.

Double top break : We are breaking the January 2025 high at 158.90. Above this, we have clear air to the July 2024 cycle high at 161.90.

Long-term iH&S : A potential massive inverse head and shoulders suggests a measured move much higher.

Targets : 162.00 (cycle high), 165.66 (78.6% Fib), and 176.50 (major extension).

Are you buying the breakout to 162 or waiting for a CPI pullback? Let us know in the comments!

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

DXY = Global scenario for the US dollar index.TVC:DXY Global scenario for the US dollar index.

On the 3-month timeframe, it looks like a reversal to continue the upward trend after a correction down to $96.21.

• It seems we can expect growth in the dollar index roughly through 2032, with the main targets being $119.00, $126.00, and $142.00.

• The world is getting unsettled, and metals like gold, silver, platinum, and aluminum are rising with accelerating momentum.

Many investors and countries are scooping up physical metals because they know what could happen in the future, plus there's active construction of bunkers and more than 100 underground cities in the US.

Also, let's not forget that Warren Buffett's Berkshire Hathaway has accumulated historically massive cash reserves, reaching record levels, such as around $381 billion in late 2025.

It's hard to picture what the future holds, but I'm going off the chart here, and this idea gets invalidated if the dollar index drops below $96.00.

Entry: $99.00

Stop Loss: $96.00

Target 1: $119.00

Target 2: $126.00

Target 3: $142.00

Snapshot:

DXY H1 | Bullish Bounce OffThe price has bounced off our buy entry level at 98.35, which is a pullback support that aligns with the 50% Fibonacci retracement and the 78.6% Fibonacci projection.

Our stop loss is set at 98.14, which is a pullback support.

Our take profit is set at 98.85, which is a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

DXY 1Y Chart - Concerns AheadToday you can review the technical analysis idea on a 1Y linear scale chart for US Dollar Index (DXY).

The RSI being below the trend line seems concerning for the DXY however let's see how the global economy works out this year.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics #DXY

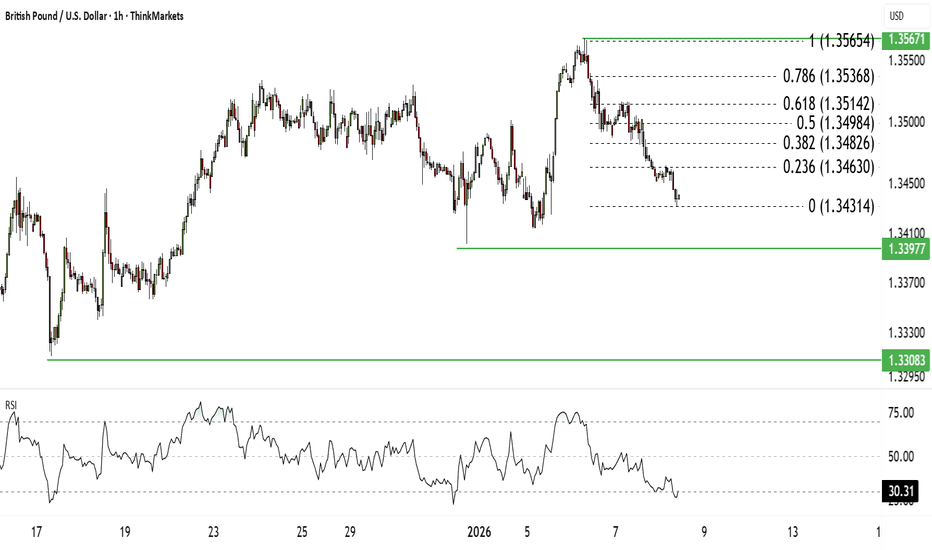

Cable eyes 1.34 on weak housing data.NFP to make or break bottomCable is pushing toward 1.34 with signs of a potential top forming, as clear divergence on the 4-hour RSI pushes prices lower. The big question: Will UK housing weakness and a divided Fed allow a break to 1.34 towards 1.33, or are we heading back to 1.35?

We analyse the impact of soft UK housing data, Halifax reported a 0.6% drop in December, against a backdrop of US dollar weakness and Fed uncertainty. With NFP looming tomorrow and President Trump potentially announcing a new dovish Fed Chair this month, volatility is guaranteed.

Key drivers

UK Housing softens : High mortgage rates are biting, with prices falling for the first time since June. Markets are split (47%) on an April BOE rate cut, capping Sterling's upside.

Fed & dollar : An 82% probability of a Fed pause in January is priced in, but markets still see cuts in 2026. A "U-shaped" dollar outlook favours GBPUSD upside early in the year.

NFP wildcard : Friday's jobs report could validate the Fed's "wait-and-see" stance or boost rate cut odds above 85%.

Technical levels

Bullish case : If 1.3400 holds as support (double bottom), we could bounce toward 1.3450 and eventually target 1.3500-1.3570 post-NFP.

Bearish case : A breakdown below 1.34 targets 1.3355 and the major support at 1.3300, especially if NFP comes in strong.

RSI check : The 1-hour RSI is oversold, suggesting a short-term bounce, but 4-hour divergence warns of medium-term weakness.

Are you betting on a breakout to 1.35 or fading the divergence? Share your plan in the comments and subscribe for our NFP coverage! Trade safe.

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

Gold at Decision Point — Consolidation or Weekly Reversal?Price made a high on Tuesday and spent Wednesday consolidating rather than rejecting. HTF structure remains bullish, but momentum has slowed and price is now compressing around value.

My weekly rule is that Tuesday’s high or low often sets direction — however, consolidation alone is not confirmation. For a higher-timeframe short bias, I want to see a clean break and close below yesterday’s low at 4433, followed by acceptance below that level.

Until then, any shorts are tactical and counter-trend, not conviction trades.

If 4433 fails and cannot be reclaimed, I’ll look for continuation lower.

If price holds value and re-accepts higher, this may resolve as continuation up.

Waiting for the market to show its hand. No anticipation — only confirmation.

Global FX Overview: Dollar steady as policy expectations remain Dollar (USD): Waiting for confirmation from labor data

The US dollar traded cautiously as traders refrained from making large directional bets ahead of a crucial batch of US labor market data, with December’s Nonfarm Payrolls report firmly in focus. Employment data plays a central role in shaping US monetary policy expectations, as labor market strength feeds directly into wage growth, inflation persistence, and ultimately interest rate decisions. With uncertainty around whether the US labor market is cooling meaningfully or remains tight, investors are opting to wait for clearer confirmation before adjusting rate expectations. As a result, the dollar has remained range-bound, reflecting a pause driven by event risk rather than a decisive shift in sentiment.

Asia (JPY): Yield differentials continue to favor the dollar

In Asia, the concept of yield differentials continues to explain why the dollar remains strong against the yen despite Japan’s recent rate increase. In foreign exchange markets, currencies are driven less by the absolute level of interest rates and more by the relative difference between two economies’ yields. While Japan has begun normalising policy and long-term Japanese government bond yields have reached multi-decade highs, the gap between Japanese and US interest rates remains wide. US short-term and real yields are still significantly higher, making dollar-denominated assets more attractive to global investors. This sustained yield advantage keeps capital flowing into the dollar, while the yen remains a preferred funding currency for carry trades. Until this differential narrows meaningfully, incremental tightening by the Bank of Japan is unlikely to produce sustained yen strength against the dollar.

Europe (EUR): Softer inflation dampens long-term tightening expectations

The euro weakened modestly after German inflation slowed more than expected, reducing confidence that future policy tightening will be required. As Germany is the euro area’s largest economy, weaker-than-expected inflation there carries significant weight for broader eurozone policy expectations. While markets still anticipate that interest rates set by the European Central Bank will remain unchanged through 2026, traders have slightly scaled back expectations for a potential rate hike in 2027. This reassessment reflects reduced concern that inflationary pressures will re-emerge as strongly as previously thought, making the euro marginally less attractive on a forward-looking yield basis.

Australia (AUD): Sticky inflation supports a ‘higher for longer’ stance

In Australia, November CPI data came in softer than expected, signalling some easing in inflationary pressure. However, inflation remains above the Reserve Bank of Australia’s 2% to 3% target range and is not declining quickly enough to justify a shift toward rate cuts. While inflation is no longer accelerating, it has proven sticky, indicating that underlying price pressures remain persistent rather than resolved. This dynamic places the RBA in a “higher for longer” policy position, where rates are likely to remain restrictive for an extended period. As a result, expectations for near-term easing have been pushed back, helping to underpin the Australian dollar despite softer headline inflation data.

Key takeaway for readers

Across regions, currency movements continue to be driven less by individual data points and more by how those data shape relative interest rate expectations. Whether it is US labor market resilience, persistent yield differentials favoring the dollar, softer European inflation dampening future tightening, or sticky Australian inflation delaying rate cuts, foreign exchange markets remain firmly anchored to the outlook for monetary policy rather than short-term noise.

Gold (MGC) — HTF Bullish, Waiting on Acceptance for ContinuationHTF structure remains bullish with price printing higher highs and higher lows.

Yesterday produced a slow, rotational push higher, suggesting digestion rather than clean expansion.

Today’s session opened by testing yesterday’s high, followed by an immediate pullback into the 50% equilibrium of yesterday’s range. This area is now acting as a key decision zone.

For continuation, I want to see:

Displacement away from the 50% level

Reclaim and acceptance above yesterday’s high (not just a tag)

Clean follow-through without immediate rotation back into prior range

If price fails to reclaim and starts accepting below equilibrium, I’ll remain patient and wait for deeper value before considering continuation setups.

Bias stays bullish — execution depends on confirmation, not assumption.

Plan > Patience > Execution

XAUUSD Strong Bull Trend, Watching for Continuation vs Shallow

Timeframes: 4H / 1H (Daily context)

Date: January 6, 2026

Bias: Bullish continuation with intraday consolidation risk

📌 Market Overview

Gold (XAUUSD) remains within a dominant bullish structure, supported by persistent safe-haven demand and strong technical momentum. After an exceptional rally throughout 2025, price is consolidating above the $4,400 region, suggesting acceptance at higher value rather than distribution.

Current price action reflects digestion before the next directional expansion.

📈 Trend & Market Structure

Daily trend: Strong bullish (higher highs / higher lows)

4H structure: Ascending channel remains intact

Recent pullback: Shallow and corrective, followed by a fast reclaim above $4,400

A previously observed 4H bear flag failed, increasing continuation probability

➡️ As long as price holds above the recent higher low, bullish structure remains valid.

📊 Technical Indicators

RSI (14):

Holding around 64–65

Bullish momentum, no bearish divergence

RSI above 55 supports trend continuation

MACD:

Daily MACD remains positive (no bearish cross)

4H MACD has turned upward again after consolidation

Momentum pause, not reversal

Moving Averages:

Price well above 50-day and 200-day MAs

Bullish MA alignment confirms trend strength

20-day MA acting as dynamic intraday support

Bollinger Bands:

Price trading near the upper band

Bands beginning to expand again → volatility expansion likely

No mean-reversion signal yet

Volume / VWAP:

High-volume acceptance around $4,395–$4,405

Price holding above VWAP = buyers in control

Thin volume above $4,440 increases breakout potential

🔑 Key Levels to Watch

Resistance

$4,441 — Immediate resistance / breakout confirmation

$4,475–$4,500 — Next upside expansion zone

Support

$4,403 — Intraday pivot / value area

$4,373 — Key short-term support (recent higher low)

$4,313 — Major structural support (bullish invalidation below)

🧠 Trade Scenarios

Scenario 1 — Bullish Continuation (Preferred)

Bias: Buy strength

Confirmation: Sustained break and hold above $4,441

Expectation: Continuation toward $4,475–$4,500

Rationale: Failed bearish pattern + bullish momentum + strong structure

Scenario 2 — Shallow Pullback (Counter-Trend / Neutral)

Failure near $4,440 combined with loss of $4,395

Retracement toward $4,373 possible

Still corrective unless $4,313 breaks

📌 Technical Conclusion

No topping or distribution signals present

Momentum indicators support continuation

Consolidation above former resistance is constructive

Bias remains bullish while price holds above $4,373

Dollar Off to Weak Start After Worst Year Since 2017. Now What?The US dollar rang in 2026 without much enthusiasm. No fireworks. No flex. Just a quiet shuffle out of the gate that felt eerily familiar to anyone who shoved cash in FX markets last year.

After logging its worst annual performance since 2017, the greenback has started the new year on the back foot — and traders are wondering whether this is merely a breather or the beginning of something more structural.

If currencies had personalities, the dollar currently looks like it stayed up too late in 2025 and is still reaching for its first coffee. After all, the US currency was the worst performer of all major currency indices last year, according to the currency index performance table .

💵 The Euro Holds the Line at $1.17

Front and center in the dollar’s early-2026 wobble is the euro, which has done a solid job containing the greenback’s attempts to regain swagger. The FX:EURUSD briefly dipped toward $1.1670, only to bounce smartly after running into two major moving averages — the kind of technical speed bump that gets traders’ attention.

The result? The euro stabilized near $1.17, flat on the year and comfortably above levels that once seemed ambitious.

📉 A Brutal Year in the Rearview Mirror

Let’s rewind.

In 2025, the dollar index TVC:DXY fell roughly 10% against a basket of major currencies, its steepest drop in nearly a decade. The early damage came fast and loud, triggered by President Donald Trump’s aggressive tariff campaign back in April, which rattled global markets and reignited concerns about US growth and trade stability.

At one point, the dollar was lower by 15%, before clawing back some ground. But the recovery never quite stuck.

What really kept the pressure on was the Federal Reserve’s pivot back to rate cuts in September, which undermined one of the dollar’s most reliable supports: yield advantage.

🏦 Rate Cuts Change the FX Equation

Currencies love interest rate differentials. They’re boring, mathematical, and extremely powerful.

As the Fed moved toward easing — and signaled more to come — that differential began to shrink. The market is now pricing in two to three quarter-point cuts by the end of 2026, a meaningful shift for a currency that spent years riding the “higher for longer” narrative.

Across the water, the picture looks different. ECB President Christine Lagarde recently reminded markets that “all options should remain on the table,” even as the central bank held rates steady and raised growth and inflation forecasts.

TLDR: Europe isn’t in a rush (or under pressure) to cut.

📈 Why Europe (and the UK) Are Benefiting

The euro was the biggest gainer among major currencies in 2025, rising nearly 14% to levels last seen in 2021. Wall Street banks now expect it to climb further — toward $1.20 by the end of 2026.

Sterling isn’t far behind. Analysts see the FX:GBPUSD rising from around $1.33 to $1.36, helped by relatively sticky inflation and fewer expectations for aggressive easing from the Bank of England.

👔 Politics Enter the FX Chat

Another wildcard looms over 2026: the next Fed chair.

Markets are keenly aware that President Trump’s eventual pick to succeed Jay Powell could influence the dollar’s trajectory. If investors believe the next chair will be more receptive to White House pressure for deeper rate cuts, the greenback could face additional headwinds.

Powell’s term ends in May, FYI.

🤖 Dollar Bulls Still Have a Case

What about the bull case? Dollar bulls’ argument rests on one powerful theme: AI-driven growth. The US economy continues to benefit from massive investment in artificial intelligence, data centers, and advanced manufacturing — sectors where America remains the global leader.

If that growth keeps the US economy outperforming Europe, the Fed may find it harder to cut aggressively, putting a floor under the dollar. In other words, the greenback’s obituary may be a bit premature.

🧭 So What Now?

Anyway, the dollar enters 2026 without its usual moat — pressured by rate expectations, policy divergence, and lingering doubts about its haven status, especially in the wake of gold OANDA:XAUUSD shattering records .

That doesn’t mean a straight-line decline. FX markets rarely move that neatly. But it does suggest that rallies may be sold rather than chased, and that traders are increasingly comfortable exploring alternatives.

Off to you : Where do you see the dollar heading next? Ready to buy high and sell low, or what? Share your views in the comments!

GBPUSD – H4 Supply & Demand | Bearish TrendGBPUSD has reacted into H4 supply and delivered a bearish Break of Structure, confirming a shift in market structure.

Price has swept internal sell-side liquidity but failed to reclaim bullish structure, suggesting continuation rather than reversal.

Bias: Bearish

Idea: Sell rallies into H4 or refined lower-timeframe supply

Targets: Liquidity lows below

Invalidation: Strong reclaim above H4 supply

As long as price remains below supply, the **path of least resistance remains to the downside**.