Dollar Index Dumps as De-dollarization Goes "Cranked to Eleven"This is a top you know what we use on stage.

But it's very very special because if you can see.

The numbers all go..

To Eleven, look like across the board.

Eleven. Eleven. Most Eleven.

Amps go up to Ten exactly.

It's one louder, isn't it . It's not Ten.

That's extra push over the cliff. This car is to Eleven.

Dollarindex

BTC Ready To CRACK!This chart is pretty much self-explanatory as per BKC rules.

Wave 1 thrusts down

Wave 2 counter trend rising wedge with 3 waves and hook

Wave 3 down is about to begin.

Clear price action is way below the Death Cross.

I’ll say it again: the JPY carry trade is breaking, and it’s hitting crypto.

By crypto-bro expert logic, a weaker dollar should mean crypto goes up. That’s not what’s happening, is it?

Why? Because they don’t understand how the monetary system actually works.

They looked smart while the trend did the work for them. Now the trend is gone—and reality is doing the explaining.

Men are now taking the boys' money like candy without even a mask on in the light of day!

BTC is now at stage 4 where the experts try to motivate fools.

4️⃣ Deep Decline (-30%) — Moral Pressure Phase

“Buy when there’s blood in the streets”

“This is how generational wealth is made”

“The smart money is buying”

“Be greedy when others are fearful”

“This is once-in-a-decade”

📌 Translation: We need new buyers to absorb forced selling.

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

DXY Cracking!With all this nonsense coming from Trump it is only a matter of time before the $ index collapses along with the stock market and the economy.

This is not political, I call it as I see it, without stubility and the rule of law, investment capital grows wings and flies away.

XOM executive said best when he denied Trump to go into Venezuela due to volitile political system. No different here in the US.

This mini wave up in the DXY is already cracking.

The situation is becoming more and more serious with Trump's insistance in destroying America from within. Not a single American has net benefited from any of his actions after 1 year in office. In fact its just getting worse and worse.

As I have been saying GTFO and STFO.

Being a hero is the world's shortest-lived job.

This is not POLITICAL! This is COUNTING!

#FAFO

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

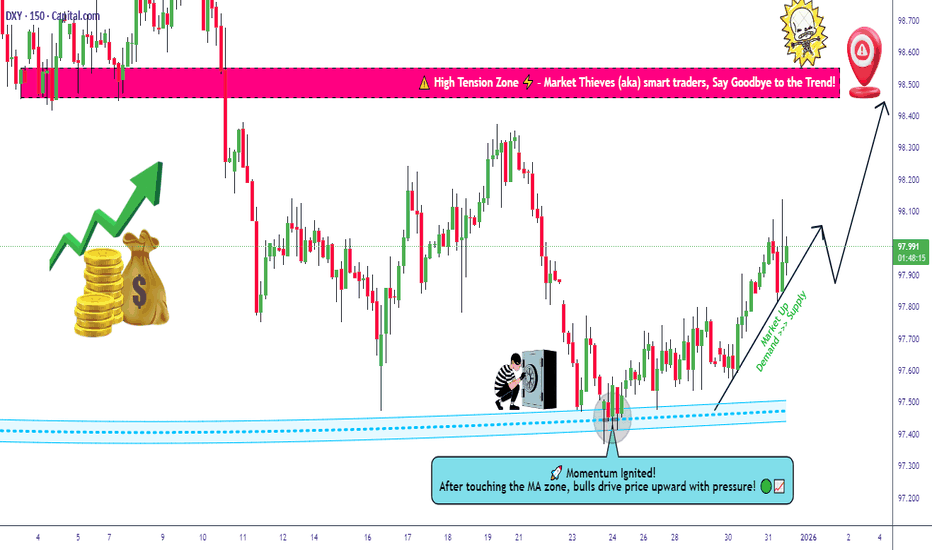

DXY Breakout and Potential Retrace!Hey Traders, in today's trading session we are monitoring DXY for a selling opportunity around 99.100 zone, DXY was trading in an uptrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 99.100 support and resistance area.

Trade safe, Joe.

DXY is about to bounce off manthly support?DXY currently at the montly support level. Past 4 months DXY has created series of higher low, with strong liquidity grab off the support level market may bounce off the level as the price at order block which is a key level of support where in the past price rejected with strong break of structure.

As of Friday, market is highly likely to bounce off the level to retest the montly and weekly high.

USD Index (DXY) Outlook: Bullish Structure HoldingThe Dollar Index is holding above the key 99.00-98.90 support zone and trading within a rising structure. Price has respected the ascending trendline and previous BOS-CHOCH levels showing buyers are still active. As long as DXY stays above 98.80 the bias remains bullish with upside targets around 99.85 and 100.20. A pullback toward 99.00-98.90 can be seen as a healthy retracement before continuation while a clear break below 98.50 would weaken the bullish outlook.

From a fundamental perspective the dollar is supported by expectations that the Federal Reserve will keep interest rates higher for longer as inflation remains sticky and the U.S. economy shows relative resilience compared to other major economies. Safe haven demand also favors USD amid global uncertainty and geopolitical risks. However any softer U.S. inflation or labor data could trigger short term pullbacks. Overall fundamentals currently align with the moderate bullish technical bias shown on the chart.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!

Dollar At Resistance As you know, yesterday we got the US inflation data, which did not change and remained at 2.7% on a yearly basis, exactly as expected. The real moves came later, after Trump said that Powell is again too late with cutting rates and that markets should move higher on good news rather than falling. He clearly wants to give the impression that it is the Fed’s fault when markets react negatively to positive data.

Another important topic is Greenland, which remains under the spotlight. Trump has repeated several times that the US must own Greenland and even suggested that the US does not rule out using force to take control. This is one of the reasons why we are seeing a pretty strong recovery in energy prices, and there could be even more upside ahead. But despite this uncertainty around potential military actions, stocks are still holding up relatively well for now.

But my eyes are all on the USD. ...it seems to be this correction still appears to be in play since the end of December, but at resistance. It could be a seven swing move rather than a simple ABC rally, but it is still a counter trend movement. Notice that the dollar is now back at the very important 99.30 level, which can be potentially interesting reversal area going into 2nd half of this week. A drop out of the corrective channel and a break below 98.67 could be the first trigger for bears to push the dollar lower.

GH

GBPUSD – Weekly Cycle ContextGBPUSD continues to follow its long-term cyclical rhythm. The market remains bullish while the rising trendline holds, with price advancing away from the last cycle low.

That said, within the cycle framework, price is still expected to be pulled toward the next cycle bottom. A decisive break of the trendline would signal a shift in control and better align price with the declining phase of the cycle.

Until then, bullish structure remains intact - patience is key.

Watching for:

• Trendline break

• Momentum rollover

• Cycle timing alignment

Educational only, not financial advice.

DXY Daily: Bullish Bias Building Ahead of CPI Hello Traders!

After a long weekend, we're back and focusing on the US Dollar Index (DXY) on the Daily timeframe.

Key observations:

Price has already reached the discount area (50% Fibonacci retracement) relative to the current dealing range — a classic zone where buyers often step in.

The equilibrium area was respected perfectly, followed by a clean retracement higher.

We now see relative equal highs forming, with buy-side liquidity pooled around 100.4. This level could act as a magnet if momentum builds.

Technical indicators are leaning bullish on DXY at the moment. However, today brings a major catalyst: the US CPI release. We’re positioned for upside potential, but the news will ultimately dictate the next directional move.

Waiting for the CPI print to confirm direction. Until then, the technical setup favors bulls.

What’s your take? Bullish continuation post-CPI, or expecting a reversal? Drop your thoughts below!

#DXY #USD #CPI #Forex #TechnicalAnalysis #Fibonacci #DollarIndex

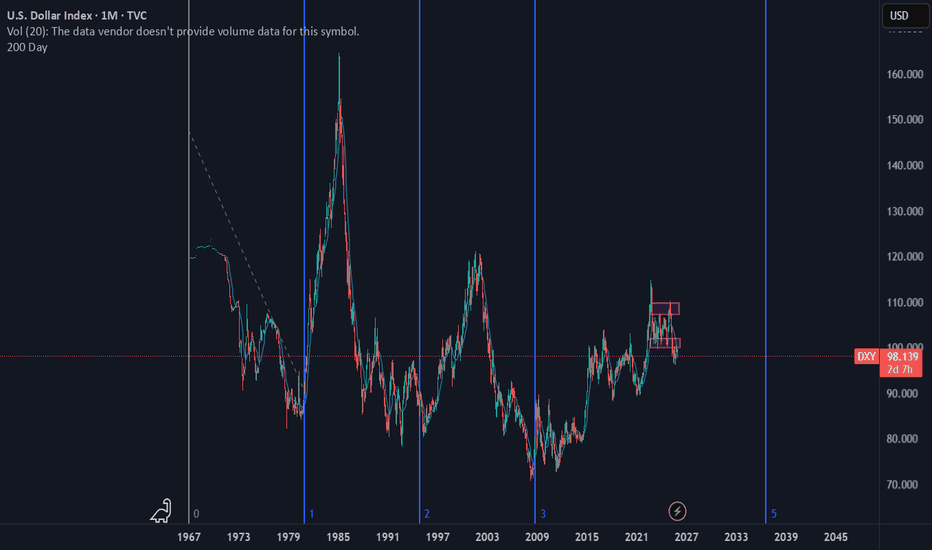

DXY = Global scenario for the US dollar index.TVC:DXY Global scenario for the US dollar index.

On the 3-month timeframe, it looks like a reversal to continue the upward trend after a correction down to $96.21.

• It seems we can expect growth in the dollar index roughly through 2032, with the main targets being $119.00, $126.00, and $142.00.

• The world is getting unsettled, and metals like gold, silver, platinum, and aluminum are rising with accelerating momentum.

Many investors and countries are scooping up physical metals because they know what could happen in the future, plus there's active construction of bunkers and more than 100 underground cities in the US.

Also, let's not forget that Warren Buffett's Berkshire Hathaway has accumulated historically massive cash reserves, reaching record levels, such as around $381 billion in late 2025.

It's hard to picture what the future holds, but I'm going off the chart here, and this idea gets invalidated if the dollar index drops below $96.00.

Entry: $99.00

Stop Loss: $96.00

Target 1: $119.00

Target 2: $126.00

Target 3: $142.00

Snapshot:

DXY 1Y Chart - Concerns AheadToday you can review the technical analysis idea on a 1Y linear scale chart for US Dollar Index (DXY).

The RSI being below the trend line seems concerning for the DXY however let's see how the global economy works out this year.

If you enjoy my ideas, feel free to like it and drop in a comment. I love reading your comments below.

Disclosure: This is just my opinion and not any type of financial advice. I enjoy charting and discussing technical analysis. Don't trade based on my advice. Do your own research! #millionaireeconomics #DXY

US Dollar Index Outlook | Trend Strength vs Key Resistance💰 DXY (US DOLLAR INDEX) - SWING TRADE OPPORTUNITY 📊

Bullish Momentum Play with WEIGHTED MA Breakout Confirmation

🎯 MARKET CONTEXT

Current Price: 98.53 | Trend: Consolidation Zone (97.00 - 100.00 Range)

Status: Preparing for breakout above Monday highs at 98.85 🚀

After the worst annual performance since 2017 (-9.3% in 2025), the DXY is regaining momentum in early 2026. Bulls are establishing strong demand at critical support levels with both 50-hour and 200-hour moving averages acting as backstops. The technical setup suggests a potential run toward the 99.30-99.50 resistance zone on breakout confirmation.

📈 TECHNICAL SETUP - LAYERING STRATEGY (Thief Entry Method)

Entry Strategy: Multiple Limit Order Layers 🎰

Using the Smart Layering Technique for optimal risk-adjusted positioning:

Layer 1 Entry @ 98.40 💰 Support Zone Entry (33% Position Size)

This is your first buy trigger at the lower support consolidation zone. Activate your first limit buy here to catch early momentum before the main move. This layer catches sellers panicking at support levels. Strong psychological anchor for building position.

Layer 2 Entry @ 98.50 📊 HULL MA Pull-Back Zone (33% Position Size)

Your second layer activates at the HULL moving average pullback confirmation point. This is where momentum traders get shaken out—perfect opportunity to add. Average your cost higher while securing better entry confirmation. This level shows institutional interest.

Layer 3 Entry @ 98.60 🚀 Accumulation Zone (34% Position Size)

Your final layer triggers at the upper consolidation band where accumulation is strongest. By this point, you've built 100% of your position with an average cost significantly lower than a single market order. This creates psychological momentum as you're "buying strength" into the breakout zone.

Pro Tip: You can adjust layer spacing based on volatility. Wider layers = patience for perfect fills. Tighter layers = aggressive accumulation for faster positioning. This method reduces average entry cost while managing drawdowns effectively. Smart traders stack positions like this instead of FOMO market buying. 🎯

Stop Loss (SL): 98.20 🛑

Hard stop at the 4-hour support consolidation level. This represents a breach of the lower Rectangle boundary.

⚠️ Disclaimer: This is MY suggested SL. You maintain complete control over your risk management. Scale your position size accordingly to your personal risk tolerance. Only risk what you can afford to lose completely. This is NOT financial advice—trade at your own risk.

Target Zone (TP): 99.30 - 99.50 🎊

Primary Resistance Level where overbought conditions + trapped short sellers create a natural profit-taking zone. This level aligns with Monday's highs (98.85) and extends toward the 99.30 psychological level.

⚠️ Disclaimer: This is my projected resistance zone based on technical analysis. Market conditions change rapidly. Take partial profits at 99.30 and trail your stop on remaining position. You decide your exit strategy—this is guidance, not a guarantee.

🔗 RELATED PAIRS TO WATCH (Correlation Analysis)

1️⃣ EUR/USD (FX: FX:EURUSD ) 📉

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.1716 | Watch: 1.3520-1.3560 range

Key Driver: Euro manufacturing weakness (Dec: 9-month low) supports USD strength

Action: If DXY breaks 99.30, expect EUR/USD to test 1.15 support levels

2️⃣ GBP/USD (FX: FX:GBPUSD ) 💷

Correlation: NEGATIVE (inverse to DXY)

Current Level: ~1.3445 | 2026 Forecast: 1.36-1.40 range expected

Key Driver: BOE cutting rates more gradually than Fed = GBP resilience likely

Action: Sterling strength could limit DXY upside; watch for BOE communications

3️⃣ USD/JPY (FX: FX:USDJPY ) 🇯🇵

Correlation: POSITIVE (moves WITH DXY)

Current Level: ~156.65 | 10-Month Low: 157.89 (Nov 2025)

Key Driver: BOJ Intervention Risk + Rate Hike Expectations

Action: BOJ still holds limited rate hike probability until July—JPY weakness supports USD strength

4️⃣ DXY vs USD/CAD (FX: OANDA:USDCAD ) 🇨🇦

Correlation: MIXED (commodity-sensitive)

Watch Level: Canadian economic data + BoC policy divergence

Key Driver: CAD weakness when risk-off sentiment dominates

Action: Oil prices + BoC dovish stance = support for USD/CAD upside

📰 FUNDAMENTAL & MACRO DRIVERS (Live as of Jan 8, 2026)

🚨 SHORT-TERM CATALYSTS (This Week/Next Week)

✅ US Employment Data (Jobs Report - Jan 10)

Latest: -105K jobs (WORSE than +64K expected)

Impact: Signals economic weakness BUT triggers "safety trade" into USD

Watch: If jobs continue weak → confirms Fed rate cuts → longer-term DXY weakness

Action: Initial dip likely, then reversal higher on safe-haven demand

✅ Fed Rate Cut Expectations - CRITICAL

Market Pricing: 2 x 25bp cuts in 2026 (vs Fed's 1 cut projection)

Fed Communication Risk: Multiple Fed officials saying more dovish stance needed

Richmond Fed President Barkin: Monetary policy requires "finely tuned judgments"

Impact: Rate cut expectations = DXY headwind long-term, but near-term bounces likely

✅ ISM Manufacturing PMI (Already Released)

Dec Data: Sharpest contraction since 2024 | Services PMI also revised lower

Impact: Economic slowdown narrative = negative for USD long-term

But: Safe-haven demand provides near-term support

✅ Geopolitical Risk - Venezuela Situation

Recent: US military action in Venezuela sparked brief safe-haven rally

Current: Concerns eased; initially pushed DXY to 98.80, faded back to 98.50

Watch: Any escalation = temporary USD strength; normalization = weakness

📊 MID-TERM DRIVERS (Next 1-3 Months)

🔴 Federal Reserve Independence Concerns

Timeline: Fed Chair selection happening THIS MONTH (Trump announcement)

Market Fear: New Chair (May 2026) may prioritize rate cuts over inflation control

DXY Impact: Significant structural selling pressure if dovish chair appointed

Watch: Trump's nominee announcement = potential volatility catalyst

🔴 US Inflation Data (CPI Reports)

Status: Core inflation sticky; any surprise UP = DXY support

Risk: If inflation surprises DOWN = accelerates rate cut timeline = DXY weakness

Watch: Jan 15 & Feb 12 CPI releases

💚 US Fiscal Policy Uncertainty

Wildcard: Trade policy, tariffs, government spending debates

Scenario 1: Tariffs trigger inflation → Fed stays hawkish → DXY stronger

Scenario 2: Fiscal stimulus accelerates early 2026 → inflation risk → mixed effects

🌍 INTERNATIONAL FACTORS

🇪🇺 Eurozone Economic Weakness

Factory Activity: 9-month low in December

Support: Lower inflation readings in Germany/France (good news for ECB)

DXY Impact: Euro weakness = relative USD strength support ✅

🇯🇵 Bank of Japan (BOJ) Policy

Current: BOJ raised rates 2x in 2025 but YEN still underperformed

Forward View: Markets pricing <50% chance of BOJ hike until July 2026

DXY Impact: Yen weakness = carry trade pressure = mild USD strength

💡 2026 DXY SCENARIO ANALYSIS

BASE CASE: "V-Shaped" Year

H1 2026: DXY expected to decline toward 94.00 as Fed cuts rates

H2 2026: Rebound above 99.00 as fiscal stimulus drives inflation + yields higher

Current Position (98.53): Setting up for H1 weakness, but near-term bounces likely

BULL CASE (Our Setup) 🚀

Thesis: Consolidation breaks above 99.30 → tests 100.00

Catalyst: Labor data weakness + geopolitical safety bid extension

Resistance: 99.30-99.50, then 100.00 psychological level

Risk: Only viable if jobs report doesn't accelerate rate cut expectations

BEAR CASE 📉

Thesis: Fed cuts rates aggressively → DXY collapses toward 94.00

Catalyst: New dovish Fed Chair + prolonged economic weakness

Support: 97.50-97.00 rectangle lows become prime targets

Timeline: Likely unfolding H1 2026

⚡ KEY TAKEAWAYS FOR TRADERS

1️⃣ Entry: Use the 3-layer method at 98.40 / 98.50 / 98.60—cost-averages your fills

2️⃣ Risk: Hard stop at 98.20; size accordingly to your account

3️⃣ Reward: Target 99.30-99.50 for near-term swing (100-150 pips potential)

4️⃣ Watch: Jobs report (Jan 10) = weekly game-changer | Fed chair news (late Jan) = structural pivot

5️⃣ Correlations: Monitor EUR/USD, GBP/USD, USD/JPY for confirmation of DXY momentum

⚠️ TRADING DISCLAIMER

🚨 This is NOT financial advice. I am NOT a licensed financial advisor or analyst. This setup represents my personal technical + macro analysis framework. Markets are unpredictable. All trades carry RISK OF TOTAL LOSS. You are responsible for:

✅ Your own position sizing

✅ Your own stop loss placement

✅ Your own profit target selection

✅ Conducting independent research before entry

Trade responsibly. Risk what you can afford to lose completely. Accept losses gracefully. Consistency beats perfection. 🎯

Last Updated: January 8, 2026

DXY Real-Time Price: 98.57 | 52-Week Range: 96.22 - 110.18

Good luck, traders! May your entries be clean and your exits cleaner. 💼📈

Dollar Off to Weak Start After Worst Year Since 2017. Now What?The US dollar rang in 2026 without much enthusiasm. No fireworks. No flex. Just a quiet shuffle out of the gate that felt eerily familiar to anyone who shoved cash in FX markets last year.

After logging its worst annual performance since 2017, the greenback has started the new year on the back foot — and traders are wondering whether this is merely a breather or the beginning of something more structural.

If currencies had personalities, the dollar currently looks like it stayed up too late in 2025 and is still reaching for its first coffee. After all, the US currency was the worst performer of all major currency indices last year, according to the currency index performance table .

💵 The Euro Holds the Line at $1.17

Front and center in the dollar’s early-2026 wobble is the euro, which has done a solid job containing the greenback’s attempts to regain swagger. The FX:EURUSD briefly dipped toward $1.1670, only to bounce smartly after running into two major moving averages — the kind of technical speed bump that gets traders’ attention.

The result? The euro stabilized near $1.17, flat on the year and comfortably above levels that once seemed ambitious.

📉 A Brutal Year in the Rearview Mirror

Let’s rewind.

In 2025, the dollar index TVC:DXY fell roughly 10% against a basket of major currencies, its steepest drop in nearly a decade. The early damage came fast and loud, triggered by President Donald Trump’s aggressive tariff campaign back in April, which rattled global markets and reignited concerns about US growth and trade stability.

At one point, the dollar was lower by 15%, before clawing back some ground. But the recovery never quite stuck.

What really kept the pressure on was the Federal Reserve’s pivot back to rate cuts in September, which undermined one of the dollar’s most reliable supports: yield advantage.

🏦 Rate Cuts Change the FX Equation

Currencies love interest rate differentials. They’re boring, mathematical, and extremely powerful.

As the Fed moved toward easing — and signaled more to come — that differential began to shrink. The market is now pricing in two to three quarter-point cuts by the end of 2026, a meaningful shift for a currency that spent years riding the “higher for longer” narrative.

Across the water, the picture looks different. ECB President Christine Lagarde recently reminded markets that “all options should remain on the table,” even as the central bank held rates steady and raised growth and inflation forecasts.

TLDR: Europe isn’t in a rush (or under pressure) to cut.

📈 Why Europe (and the UK) Are Benefiting

The euro was the biggest gainer among major currencies in 2025, rising nearly 14% to levels last seen in 2021. Wall Street banks now expect it to climb further — toward $1.20 by the end of 2026.

Sterling isn’t far behind. Analysts see the FX:GBPUSD rising from around $1.33 to $1.36, helped by relatively sticky inflation and fewer expectations for aggressive easing from the Bank of England.

👔 Politics Enter the FX Chat

Another wildcard looms over 2026: the next Fed chair.

Markets are keenly aware that President Trump’s eventual pick to succeed Jay Powell could influence the dollar’s trajectory. If investors believe the next chair will be more receptive to White House pressure for deeper rate cuts, the greenback could face additional headwinds.

Powell’s term ends in May, FYI.

🤖 Dollar Bulls Still Have a Case

What about the bull case? Dollar bulls’ argument rests on one powerful theme: AI-driven growth. The US economy continues to benefit from massive investment in artificial intelligence, data centers, and advanced manufacturing — sectors where America remains the global leader.

If that growth keeps the US economy outperforming Europe, the Fed may find it harder to cut aggressively, putting a floor under the dollar. In other words, the greenback’s obituary may be a bit premature.

🧭 So What Now?

Anyway, the dollar enters 2026 without its usual moat — pressured by rate expectations, policy divergence, and lingering doubts about its haven status, especially in the wake of gold OANDA:XAUUSD shattering records .

That doesn’t mean a straight-line decline. FX markets rarely move that neatly. But it does suggest that rallies may be sold rather than chased, and that traders are increasingly comfortable exploring alternatives.

Off to you : Where do you see the dollar heading next? Ready to buy high and sell low, or what? Share your views in the comments!

Bullish Dollar98.50 resistance overhead.

If DXY pushes above that it will signal a potential bulltrend restarting. We are on huge multi-decade support. Been forming a scooping bottoming formation since the summer, with RSI positive divergences building.

Wall Street consensus says the yellow path will happen.

The USD will be weak in Q1 and Q2 2026 and then rebound in the last half of the year.

- Are they wrong?

- I think they are, and the green path is in play catching people off guard.

DXY analysis for the weekMy outlook for DXY is for price to continue dropping after the recent mitigation of a supply zone, which has already supported the bullish move we’ve seen on EU. I’m expecting further downside from here.

If price does push higher, there is a clean supply zone above that I’ll be watching closely, as I believe it could present another strong opportunity for the dollar to roll over and continue lower.

Confluences for This Bias:

• Price has recently mitigated a strong supply zone

• Overall structure remains bearish

• Liquidity resting below that price may look to target

• Price is within a valid dealing range

P.S. If price breaks above the current high, I wouldn’t be surprised to see a short-term bullish push before any further downside.

DXY preparing a 2-month rally.The U.S. Dollar index (DXY) has been consolidating within a 6-month Rectangle pattern following the very bearish first half of 2025. As this consolidation Rectangle evolved, the price managed to break above all of its MA Resistance levels in succession: 1D MA50 (blue trend-line), 1D MA100 (green trend-line) and a little more than a month ago, the 1D MA200 (orange trend-line).

This slow process hints towards the formation of a long-term Support base, in preparation for a 2026 Bull Cycle. The first steps of such a process is establishing the conditions for shorter term rallies. And what this chart shows us is that, every time the index made a 1D MACD Bullish Cross, just like the one it completed today, it started an uptrend.

This time, we also have a Double Bottom on the 1D RSI, which also made Higher Highs, being a Bullish Divergence against the price's Lower Highs.

As a result, it may be time for the 6-month Rectangle to break upwards and the first technical Targe is the 0.382 Fibonacci retracement level at 101.550.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Dollar Index Respects Trend Support — Buyers in Control💵 DXY DOLLAR INDEX | Swing Trade Setup 📊

Strategic Bullish Recovery with Multi-Layer Entry Strategy

📈 CURRENT MARKET STATUS

Current Price: 98.02 - 98.36 USD 📍 | Bias: BULLISH SWING TRADE 🟢 | Timeframe: 4H-Daily Swing Trade ⏰ | Market Condition: Pullback to Support Zone 💪

🎯 TECHNICAL SETUP

Plan: Bullish breakout from triangular moving average pullback with strong support confirmation from the 97.50-97.90 demand zone. 📉➡️📈

📍 MULTI-LAYER ENTRY STRATEGY (Thief Strategy)

Using Limit Order Layering - Scale-In Approach for Risk Management

Utilize multiple buy limit orders to reduce entry risk and maximize fill probability:

🔵 Layer 1 @ 97.60 📍 - 30% Position Size - Initial Entry at Strong Support ✅

🔵 Layer 2 @ 97.70 📍 - 30% Position Size - Secondary Level Confirmation ✅

🔵 Layer 3 @ 97.80 📍 - 25% Position Size - Tertiary Entry Momentum Build 📈

🔵 Layer 4 @ 97.90 📍 - 15% Position Size - Final Layer Aggressive Entry 🚀

✅ Pro Tip: Adjust layer prices based on your risk tolerance and account size. Scalable entry reduces overall trade risk and improves entry quality significantly. 💡

🛑 STOP LOSS

🔴 Hard SL @ 97.50 📍 - Below demand zone for protection 🛡️

📊 Risk: -50 pips maximum per trade 📉

⚠️ NOTE: Stop loss placement is your personal risk decision. Dear Ladies & Gentleman (Thief OG's) - Manage your own risk parameters accordingly. This is YOUR choice, YOUR responsibility, YOUR profit or loss. 🎯

🎁 PROFIT TARGETS

🟢 Target 1 (Easy Win) @ 98.30 📍 - +50 pips 💰 - Take 25% profit and lock in gains immediately ✅

🟢 Target 2 (Main Target) @ 98.60 📍 - +80 pips 💵 - Take 40% profit at moving average resistance zone 📊

🟢 Target 3 (Extended) @ 98.80 📍 - +100 pips 🤑 - Trailing stop on remaining 35% position for momentum capture 🚀

🟢 Target 4 (Aggressive) @ 99.00+ 📍 - +130+ pips 🎊 - Let your winners run with intelligent trailing stops for maximum profit 📈

⚠️ NOTE: High voltage electric gate acts as STRONG RESISTANCE + overbought zone detected at 98.50-98.70. This is a potential market TRAP zone - please take profits responsibly and don't get greedy. Final TP is YOUR personal choice based on YOUR strategy and risk appetite. 🎲

💡 TECHNICAL ANALYSIS BREAKDOWN

Bullish Confluence Factors ✅:

✅ Strong support from 97.50-97.90 demand zone (Historical reaction area proven) 📍

✅ Triangular moving average confirmation (Key technical indicator) 📊

✅ Pullback from overbought conditions (Healthy correction setup) 🔄

✅ Potential base formation pattern (Accumulation zone visible) 🏗️

⚡ 52-week range: 96.22 - 110.18 (Plenty of room for upside movement) 📈

Risk Factors to Monitor ⚠️:

⚠️ Overbought signals at 98.50-98.70 (Strong resistance overhead) 🚧

⚠️ Market trap potential (Price rejection very possible) 🪤

⚠️ Thin year-end trading volumes (Additional volatility risk) 📉

🌍 RELATED PAIRS TO WATCH (Dollar Correlation Analysis)

HIGH NEGATIVE CORRELATION 🔴 (Inverse to DXY - If DXY up, these go down):

🔗 EUR/USD - Correlation: -0.95 ⚡ (STRONGEST HEDGE PAIR) - EUR is 57.6% of DXY weight, watch for BrexitNews & ECB statements 📢

🔗 Gold (XAUUSD) - Correlation: -0.90 ⚡ (Safe-haven inverse) - Precious metals rise when USD weakens, strong economic indicator 💛

🔗 Crude Oil (XTIUSD) - Correlation: -0.75 ⚡ (Commodity proxy) - Weaker dollar = higher oil prices, OPEC decisions matter 🛢️

🔗 Silver (XAGUSD) - Correlation: -0.88 ⚡ (Precious metals) - Follows gold closely but with more volatility, watch industrial demand 🏭

🔗 Bitcoin (BTCUSD) - Correlation: -0.65 ⚡ (Crypto hedge) - Dollar weakness = crypto strength, watch Fed policy closely 🪙

OTHER MAJOR PAIRS 📊 (Direct constituents of DXY Index):

🔗 USD/JPY - DXY Weight: 13.6% 📊 - Currently 156.44 - Watch BOJ (Bank of Japan) statements + Yen carry trades 🇯🇵

🔗 GBP/USD - DXY Weight: 11.9% 📊 - Brexit dynamics remain + BoE policy movements important 🇬🇧

🔗 USD/CAD - DXY Weight: 9.1% 📊 - Oil-sensitive pair, commodity correlations + BoC rate decisions 🇨🇦

🔗 USD/SEK - DXY Weight: 4.2% 📊 - Nordic economy barometer + Riksbank policy 🇸🇪

🔗 USD/CHF - DXY Weight: 3.6% 📊 - Safe-haven currency pair, SNB decisions matter 🇨🇭

📰 FUNDAMENTAL FACTORS & ECONOMIC DRIVERS

🔴 HIGH IMPACT CATALYSTS (Coming Up)

📌 FOMC Minutes Release ⏰ - CRITICAL for USD direction 🚨 - Expected guidance on 2026 rate cuts (2 cuts currently priced in by markets) 📉 - Dovish bias would support DXY weakness, hawkish would support strength 📊

📌 Fed Chair Announcement (Early January 2026) - Trump administration to announce Powell's successor 👔 - Market uncertainty = potential big USD volatility swings 💥 - Could change entire policy expectations for 2026 🎯

📌 US Non-Farm Payroll (NFP) (First Friday of Each Month) 👥 - Strong employment data = Bullish for USD 📈 - Weak employment data = Bearish for USD 📉 - Previous trend showing mixed signals, watch closely 🔍

📌 US CPI Release (Mid-month Inflation Data) 📊 - Inflation currently at 2.7% (Dec 18, 2025 data) 📍 - Below Fed target of 3%, supports rate-cut narrative 🎯 - This weakens USD support structure 📉

📌 US Pending Home Sales 🏠 - Already jumped +3.3% in November = Bullish economic indicator ✅ - Consumer strength supports USD flows 💪

🟠 MACRO HEADWINDS PRESSURING DXY (Current Environment)

💨 2025 Dollar Decline - Already down -9.6% year-to-date (worst year since 2017!) 📉 - This is a major structural weakness signal for USD

💨 Trump Tariff Uncertainty - Aggressive tariff policies creating significant dollar weakness 📉 - Protectionism narrative reduces USD safe-haven demand 🚫

💨 Fed Independence Concerns - Political pressure on Federal Reserve reduces hawkish USD support 📢 - Powell successor uncertainty adds volatility 🎲

💨 Rate Differential Narrowing - Other central banks holding rates higher relative to US expectations 📊 - Makes USD less attractive on yield basis 💰

💨 Fiscal Deficit Concerns - US government spending pressures mounting 🏛️ - Structural USD weakness risk for 2026 ⚠️

🟢 BULLISH DXY FACTORS (Supporting Our Trade)

💪 Stronger GDP - Q3 GDP data came in strong, showing economic resilience 📈 - Manufacturing sector showing signs of recovery 🏭

💪 Labor Market Resilience - Despite recent volatility, employment remains relatively stable 👥 - Fewer major job losses than expected 📊

💪 Safe-Haven Demand - Geopolitical tensions support USD flows into safe assets 🛡️ - Middle East conflicts, Russia-Ukraine ongoing ⚠️

💪 Real Yield Attractiveness - US 10Y Treasury yield at 4.13% is attractive vs. peer nations 💰 - Investors seeking better returns flowing to USD 📈

💪 Month-End Flows - Potential technical bounces from dollar repositioning happening now 📊 - Year-end rebalancing creates support zones 🎯

📊 HISTORICAL CONTEXT & KEY LEVELS

🔵 96.22 - 52-week LOW (October 2025) - Major support zone 📍

🔵 97.50-97.90 - DEMAND ZONE (Our current trade setup area) ✅ - Strong historical reaction level 📊

🔵 98.30-98.70 - RESISTANCE ZONE (Strong overbought area with trap potential) 🚧 - Take profits here, don't be greedy 💡

🔵 99.00 - Psychological round number resistance 📍 - Major price target for aggressive traders 🎯

🔵 110.18 - 52-week HIGH (February 2025 event-driven spike) - Distant target for extended bull 🚀

🎲 RISK MANAGEMENT CHECKLIST (Must Do)

✅ Only risk 1-2% of your account per single trade 💰 - Never go all-in, always protect capital 🛡️

✅ Use stop loss without ANY exceptions 🛑 - No emotional decisions, pre-set your exit 📍

✅ Scale into positions with limit orders 📊 - Don't chase market price, let price come to you 🎯

✅ Monitor FOMC announcements closely 📢 - Set alerts for important economic releases 🔔

✅ Watch geopolitical news (Fed, Trump statements) 📰 - Breaking news can reverse markets instantly ⚡

✅ Take profits at resistance levels 💹 - Lock in gains, don't let winners turn into losers 📈

✅ Don't add to losing positions 🚫 - Patience is key, better opportunities always come 🎯

✅ Keep detailed records of all entries/exits 📝 - Track your performance and improve continuously 📊

⚡ TRADE PLAN SUMMARY

🎯 Setup: Swing trade LONG on DXY from demand zone 97.50-97.90 📍

🎯 Entry Method: 4-layer limit order strategy (Scale-in approach recommended) 📊

🎯 Stop Loss: Hard stop at 97.50 (No exceptions, no moving it) 🛑

🎯 Profit Targets: 98.30 (T1) → 98.60 (T2) → 98.80 (T3) → 99.00+ (T4) 🎁

🎯 Risk/Reward Ratio: Approximately 1:1.6 to 1:2.6 depending on which layer you enter 💹

🎯 Timeframe: 4H-Daily swing trade (3-7 trading days typical duration) ⏰

🎯 Conviction Level: MEDIUM-HIGH (Technical confluence + demand zone + economic setup) 📈

🟢 PROBABILITY EDGE SUMMARY

This setup combines multiple confluence factors for higher probability:

📊 Technical Setup - EMA pullback + demand zone confirmation

🏗️ Structural Setup - Triangular pattern + base formation

😊 Sentiment Setup - Oversold conditions creating bounce opportunity

📈 Fundamental Setup - Rate expectations + economic data supporting

Estimated Win Rate: 55-60% (Based on confluence factors, not guaranteed) 📈

Risk/Reward Ratio: Minimum 1:2.0 target recommendation 💰

Best Trading Sessions: New York + London overlap (9am-12pm EST) ⏰

💬 FINAL THOUGHTS FOR TRADERS

Dear Ladies & Gentleman (Thief OG's) 🎩 - This is a carefully crafted setup based on real market data and technical confluence. However, markets are always unpredictable. Your discipline in following your trading plan matters MORE than being right 100% of the time.

Trade responsibly. Manage your risk. Take your profits. Protect your capital. 💪

The best traders aren't the ones who win every trade - they're the ones who survive and profit over time through disciplined risk management and emotional control. 🎯

Good luck traders! May your profits flow like the currency you're trading! 📈💰

Remember: Your broker, your rules. Your strategy, your risk. Adjust all levels to match YOUR trading plan perfectly. ✅

DXY - Descending Wedge at 98.13 | -9.58% YTD

Executive Summary

The US Dollar Index (DXY) is trading at 98.130 on December 29, 2025, consolidating within a descending wedge pattern on the 2H timeframe. The Dollar is on track for its worst year since 2017 with -9.58% YTD losses, pressured by Fed rate cut expectations, dovish Fed Chair concerns, and Trump's tariff policies. However, a potential bullish reversal pattern is forming at the bottom of the wedge, with an ascending channel developing. FOMC minutes due Tuesday could be the catalyst for the next directional move.

BIAS: NEUTRAL - Watching for Breakout Direction

The Dollar is at a critical inflection point. The descending wedge suggests potential bullish reversal, but fundamental headwinds remain strong. Wait for confirmation before committing to a direction.

Current Market Context - December 29, 2025

DXY is consolidating near yearly lows:

Current Price: 98.130 (+0.08% on the day)

Day's Range: 97.915 - 98.177

52-Week Range: 96.218 - 110.176

52-Week High: 110.176

52-Week Low: 96.218

Technical Rating: SELL

Performance Metrics - MIXED:

1 Week: -0.54%

1 Month: -1.45%

3 Months: +0.22%

6 Months: +1.54%

YTD: -9.58%

1 Year: -9.21%

The Dollar is having its worst year since 2017, down nearly 10% YTD. Short-term metrics are mixed, but the longer-term trend is clearly bearish.

THE BEAR CASE - Dollar Weakness Continues

1. Fed Rate Cut Expectations

The Dollar continues to see underlying weakness as markets price in further rate cuts:

FOMC expected to cut rates by ~50 bp in 2026

Markets pricing 19% chance of -25 bp cut at January 27-28 meeting

Two rate cuts expected in 2026

Fed officials split on path forward - majority forecast single additional cut

Lower rates = weaker Dollar

2. Dovish Fed Chair Concerns

President Trump to announce new Fed Chair in early 2026

Kevin Hassett (National Economic Council Director) most likely choice

Hassett seen as most dovish candidate by markets

Trump wants next Fed chairman to lower rates

Dovish Fed Chair = bearish for Dollar

3. Fed Liquidity Injection

Fed began purchasing $40 billion/month in T-bills mid-December

Announced December 10 - $40 billion/month liquidity injection

Increased liquidity pressures Dollar lower

Quantitative easing-like effects

4. Interest Rate Differentials

FOMC expected to cut rates ~50 bp in 2026

BOJ expected to raise rates +25 bp in 2026

ECB expected to leave rates unchanged in 2026

Narrowing rate differentials = Dollar weakness

Yen strengthening on BOJ rate hike expectations

5. Trump Tariff Policies

Aggressive tariff policies pressuring Dollar

Threats to Fed independence

Trade tensions creating uncertainty

Dollar down nearly 10% YTD partly due to tariff concerns

6. Technical Rating: SELL

TradingView technicals gauge pointing toward "Sell"

Descending wedge pattern (bearish continuation possible)

Below major moving averages

Momentum indicators bearish

THE BULL CASE - Potential Reversal Forming

1. Descending Wedge Pattern (Bullish Reversal)

Descending wedge is typically a bullish reversal pattern

Price compressing at bottom of wedge

Ascending channel forming within wedge

Potential breakout to upside

Pattern suggests exhaustion of selling pressure

2. US Economic Data Still Solid

Q3 GDP came in at +4.3% - stronger than expected

Nov pending home sales rose +3.3% m/m (vs +0.9% expected)

Jobless claims unexpectedly fell

US businesses see employment growth at 4.32%

Revenue growth expectations at 3.83%

Strong data could limit Dollar weakness

3. Safe-Haven Demand

Stock market weakness boosting liquidity demand for Dollar

Geopolitical tensions (Venezuela blockade, ISIS strikes in Nigeria)

Ukraine-Russia peace deal uncertainty

Risk-off events could boost Dollar

4. Oversold Conditions

Dollar down -9.58% YTD - oversold

Mean reversion possible

Near 52-week low (96.218)

Potential for bounce

5. "US Exceptionalism" Positioning

BNY's Bob Savage: Rise above 98.15 could trigger momentum buying

"US exceptionalism positioning" could resurge

Dollar bulls waiting for catalyst

6. FOMC Minutes Catalyst

Fed minutes due Tuesday (December 30)

Could provide signals on rate cut timing

Hawkish surprise could boost Dollar

Key catalyst for next move

Technical Structure Analysis

Price Action Overview - 2 Hour Timeframe

The chart shows a complex structure with potential reversal forming:

Descending Wedge Pattern (Primary):

Clear descending wedge established from highs

Upper trendline: Falling resistance (connecting lower highs)

Lower trendline: Falling support (connecting lower lows)

Wedge narrowing - compression before breakout

Typically bullish reversal pattern

Price near apex of wedge

Ascending Channel (Secondary - Forming at Bottom):

Small ascending channel forming within wedge

Higher lows being established

Potential early reversal signal

Watch for breakout above wedge resistance

Key Zones Identified:

Upper resistance zone: ~99.25 (major resistance)

Secondary resistance: ~98.80

Current consolidation: 97.90-98.20

Support zone: ~97.85-98.00

Major support: ~97.25

52-Week Low: 96.218

Key Support and Resistance Levels

Resistance Levels:

98.177 - Day's high / immediate resistance

98.15 - BNY trigger level for momentum buying

98.80 - Secondary resistance zone

99.00 - Psychological resistance

99.25 - Major resistance zone

100.00 - MAJOR PSYCHOLOGICAL RESISTANCE

110.176 - 52-WEEK HIGH

Support Levels:

97.959 - Recent low

97.915 - Day's low / immediate support

97.85-98.00 - Support zone

97.50 - Secondary support

97.25 - Major support

96.50 - Deep support

96.218 - 52-WEEK LOW (critical)

Pattern Analysis

Descending Wedge Characteristics:

Pattern duration: Several weeks

Wedge narrowing toward apex

Volume typically decreases in wedge

Breakout direction: Usually bullish (70% of cases)

Target: Measured move = wedge height at breakout

Current position: Near bottom of wedge

Ascending Channel (Within Wedge):

Small ascending channel forming

Higher lows: Bullish sign

Could be early reversal signal

Watch for breakout above 98.80

Moving Average Analysis

Price trading below major moving averages

MAs sloping downward - bearish alignment

Short-term MAs below long-term MAs

Death cross patterns on longer timeframes

MAs providing dynamic resistance on rallies

SCENARIO ANALYSIS

BULLISH SCENARIO - Descending Wedge Breakout

Trigger Conditions:

2H close above 98.80 (wedge resistance)

Break above 99.00 psychological level

Volume confirmation on breakout

FOMC minutes hawkish surprise

Risk-off sentiment boosting Dollar

Price Targets if Bullish:

Target 1: 99.25 - Major resistance zone

Target 2: 100.00 - Psychological level

Target 3: 101.00-102.00 - Measured move target

Extended: 103.00+ (trend reversal)

Bullish Catalysts:

Descending wedge = bullish reversal pattern (70% breakout up)

Ascending channel forming at bottom

US economic data still solid (GDP +4.3%)

Oversold conditions (-9.58% YTD)

Safe-haven demand potential

FOMC minutes could be hawkish

"US exceptionalism" positioning could return

Mean reversion from extreme weakness

BEARISH SCENARIO - Wedge Breakdown / Continuation

Trigger Conditions:

Break below 97.25 major support

Close below 97.00

FOMC minutes dovish

Fed signals more aggressive rate cuts

Dovish Fed Chair announcement

Price Targets if Bearish:

Target 1: 97.25 - Major support

Target 2: 96.50 - Deep support

Target 3: 96.218 - 52-week low

Extended: 95.00-96.00 (new lows)

Bearish Catalysts:

-9.58% YTD - Worst year since 2017

Technical rating: SELL

Fed rate cuts expected (~50 bp in 2026)

Dovish Fed Chair concerns (Hassett)

Fed liquidity injection ($40B/month)

Interest rate differentials narrowing

Trump tariff policy uncertainty

Below major moving averages

NEUTRAL SCENARIO - Consolidation in Range

Most likely short-term outcome:

Price consolidates between 97.50-98.80

Thin holiday trading continues

Wait for FOMC minutes Tuesday

Wait for Fed Chair announcement

Wedge pattern continues to compress

Breakout direction unclear until catalyst

MY ASSESSMENT - NEUTRAL with Slight Bullish Bias

The evidence is mixed, but the technical pattern suggests potential reversal:

Bullish Factors:

Descending wedge = typically bullish reversal

Ascending channel forming at bottom

Oversold conditions (-9.58% YTD)

US economic data solid

Safe-haven demand potential

Near 52-week low (mean reversion)

Bearish Factors:

Technical rating: SELL

Fed rate cuts expected

Dovish Fed Chair concerns

Fed liquidity injection

Interest rate differentials narrowing

Below major moving averages

Worst year since 2017

My Stance: NEUTRAL - Wait for Confirmation

The descending wedge pattern suggests potential bullish reversal, but fundamental headwinds are strong. The Dollar could go either way from here. Wait for FOMC minutes and a clear breakout before committing.

Strategy:

Wait for breakout confirmation

Long above 98.80 with targets 99.25, 100.00

Short below 97.25 with targets 96.50, 96.218

Respect the wedge pattern

FOMC minutes Tuesday = key catalyst

Trade Framework

Scenario 1: Bullish Breakout Trade Above 98.80

Entry Conditions:

2H close above 98.80

Volume confirmation

Break above descending wedge resistance

Trade Parameters:

Entry: 98.85-99.00 on confirmed breakout

Stop Loss: 98.00 below recent support

Target 1: 99.25 (Risk-Reward ~1:0.5)

Target 2: 100.00 (Risk-Reward ~1:1.2)

Target 3: 101.00-102.00 (Measured move)

Scenario 2: Bearish Breakdown Trade Below 97.25

Entry Conditions:

2H close below 97.25

Volume confirmation

Break below major support

Trade Parameters:

Entry: 97.20-97.00 on confirmed breakdown

Stop Loss: 97.80 above recent resistance

Target 1: 96.50 (Risk-Reward ~1:1)

Target 2: 96.218 (52-week low)

Target 3: 95.50-96.00 (Extended)

Scenario 3: Range Trade (Neutral)

Entry Conditions:

Price bounces at 97.50-97.85 support

Bullish rejection candle

No breakout yet

Trade Parameters:

Entry: 97.50-97.85 at support

Stop Loss: 97.00 below major support

Target 1: 98.50 (Risk-Reward ~1:1)

Target 2: 98.80 (Wedge resistance)

Risk Management Guidelines

Position sizing: 1-2% max risk per trade

Wait for breakout confirmation

Thin holiday volumes = wider stops

FOMC minutes Tuesday = key catalyst

Don't anticipate breakout direction

Scale out at targets

Move stop to breakeven after first target

Watch for Fed Chair announcement

Invalidation Levels

Bullish thesis invalidated if:

Price closes below 96.218 (52-week low)

Descending wedge breaks down

Fed signals aggressive rate cuts

Dovish Fed Chair confirmed

Bearish thesis invalidated if:

Price closes above 99.25 (major resistance)

Descending wedge breaks up with volume

Fed signals no more rate cuts

Risk-off surge boosts Dollar

Key Events to Watch

FOMC Minutes - Tuesday, December 30

Fed Chair Announcement - Early 2026

Year-End Positioning - Through January 1

BOJ Policy Signals - January 23 meeting

ECB Policy - February 5 meeting

Conclusion

The US Dollar Index is at a critical inflection point, trading at 98.130 within a descending wedge pattern. The Dollar is on track for its worst year since 2017 with -9.58% YTD losses, but a potential bullish reversal pattern is forming.

The Numbers:

Current Price: 98.130

YTD Performance: -9.58%

1-Year Performance: -9.21%

52-Week High: 110.176

52-Week Low: 96.218

Technical Rating: SELL

Key Levels:

99.25 - Major resistance

98.80 - Wedge resistance / breakout level

98.13 - Current price

97.85-98.00 - Support zone

97.25 - Major support

96.218 - 52-WEEK LOW

The Setup:

Descending wedge pattern with ascending channel forming at bottom. Fundamentals are bearish (Fed rate cuts, dovish Fed Chair concerns), but technicals suggest potential reversal. FOMC minutes Tuesday could be the catalyst.

Strategy:

NEUTRAL stance - wait for confirmation

Long above 98.80, target 99.25, 100.00

Short below 97.25, target 96.50, 96.218

FOMC minutes Tuesday = key catalyst

Respect the pattern

The Dollar is at a crossroads. The descending wedge suggests potential bullish reversal, but fundamental headwinds remain strong. Wait for the breakout.

DXY Breakdown After Major Top – Wave v in ProgressThe DXY chart shows that the U.S. Dollar has completed a larger corrective structure and is now moving inside a new impulsive bearish phase. After forming a major top near the 110 area, the index started a clear five-wave decline, indicating strong downside momentum. The recent sideways movement looks like a corrective pause (wave iv / Y) rather than a trend reversal. As long as the price stays below the key resistance zone around 100–101, the overall structure remains bearish. This suggests the dollar is preparing for the final wave lower (wave v / 3), which could push the index toward deeper support levels. Overall, the Elliott Wave structure favours continued weakness in the U.S. Dollar in the coming months.

Stay tuned!

@Money_Dictators

Thank you :)

U.S. Dollar Index (DXY) – Daily / Long-Term OutlookThe U.S. Dollar Index is currently trading at a major long-term demand zone, holding above the key support around 96.25–98.20. This area has historically acted as a strong reaction zone, and price is showing signs of base formation after an extended corrective phase.

Structurally, DXY previously completed a strong impulsive rally toward the 114.87 resistance (real algo level) before entering a prolonged distribution and decline. The recent selloff appears corrective rather than trend-ending, as price has now begun to respect an ascending trendline, suggesting early signs of bullish re-accumulation.

The projected path highlights a potential higher-low structure, followed by a gradual bullish expansion. A sustained move above the psychological 100–102 zone would confirm momentum shift, opening the door for a retest of the 110 SMT resistance, and ultimately a push back toward the 114.87 major high.

As long as price holds above the 96.25 support and continues to print higher lows, the long-term bullish bias remains valid. A clean break below this support would invalidate the bullish scenario and signal further downside risk.

DXY Bullish Continuation Inside Ascending ChannelThe U.S. Dollar Index is trading within a clear ascending channel showing a sustained bullish structure after forming a strong low near 97.87. Price respected the lower trendline and printed multiple CHoCH and BOS signals confirming a shift from bearish to bullish momentum. Currently DXY is consolidating around 98.62–98.65 holding above the key 0.382–0.5 Fibonacci retracement zone which acts as a strong demand area.

The recent pullback looks corrective targeting liquidity before continuation. As long as price holds above 98.20–98.30 the bias remains bullish with upside targets toward the weak high near 99.00–99.20 aligned with the -0.382 and -0.618 Fibonacci levels. A clean breakout above this zone could accelerate further upside while a breakdown below channel support would weaken the bullish outlook.

Note

Please risk management in trading is a Key so use your money accordingly. If you like the idea then please like and boost. Thank you and Good Luck!