TSLA Short targetsI get my stock levels, and sometimes tickers, from my dowsing work with a pendulum and scales I've made.

I have that TSLA is at a swing high and should head down to the $417 area where it may bounce, and I've had numbers come as lower targets at $398, 399 & 400.

Today I was guided to get the date of a price revisit (which I find fairly reliable as guidance). The date came as 11/17. That was a large range day, but it's an area to watch and there's some meat on the bones even at the top end of the range, $424.

The low of that day was $398, so that's neat it aligns with numbers I've gotten. There is a little bullish energy still in TSLA, but the main thing is it'll keep going down.

Dowsing

Dividend stock UHTWhen I let my dowsing choose a stock, every now and then they are something pretty boring, so this is one of those. It pays a 7% dividend from what I saw, and I get that it could have a little pullback soon for an entry long.

I get that it will get up to $45 and likely just consolidate. I got the message about chop & consolidation a lot, which is great! So, not expecting a lot, but if you're looking to park some money, the energy reads well for it & you can research it from here.

Super bullish MSTR to $235Obviously, this is getting liftoff today. My dowsing work is super bullish calling for 19% up from here. That makes the target around $235.

There is a message about a "look above & fail", so a slight retracement may occur, but this is a shorter term trade from what I get.

I'll be watching next Monday as it's saying that's the exit date. I get 2 of the most bullish options when I ask about this, and they are not typically just for the day only and I could imagine a lot of people jumping on board.

How low do we go? NVDAI get my information on where stocks might be headed based on my dowsing- as-in, with a pendulum. A super interesting thing occurred, which is that I did a reading on NVDA back on Feb. 25, 2024, which suggested a future date to be aware of in 20 months from then.

I just put the date in my my phone calendar for Oct. 24th 2025 with a couple alerts so I can pay attention. When I saw NVDA made these highs and pulled right back, I was super intrigued as it was in my date window. It's now head and shouldersy looking, and as such, I did draw a couple symmetry lines (are annotated as gray dashes) for reference.

(Love than my target is right above the second symmetry.)

I have been getting lower levels on NVDA, but I'm getting tired of some of these multiple numbers I get, so I just asked what advice there is and it said to get a date.

When I get a date, it often means a price revisit, or could be a pattern repeats from the past.. In this case, it's suggesting a price revisit to where NVDA traded on 11/14/2024. Then, I asked how many percent down from the ath at $212 & it gives me 31%.

My joy came when I drew the price lines out for the date, and lo and behold they overlay the 31% down price (146.41)!

I attempted to find out when this may hit, and I get Feb. 20th or 26th zone.

Let's boogie!

CRS support areasMy dowsing chose this on 11/25th as part of a bunch of picks I did back then over a couple days, but especially wanted me to pay extra attention to it on Friday. I started putting levels on my chart to share this idea, but got super frustrated because it wasn't clear enough.

I was confident in $290, but suggestions lower were all over and even down to $234.

The main way I get information is with my pendulum & scales I've created over the years.

I get numbers for prices, percentages, points and dates that point to prices.

Sometimes Too many times, these numbers are mixed around, so I might think it's giving me one, thing, but later find out it's something else.

So, I try multiple readings to try to narrow things down. I do love when I get dates because that's usually pretty clear & these dates are suggesting a price revisit. When I can get an alignment of a target within (or near) the prices of a particular date, I get the warm and fuzzies LOL.

The main idea is you can short into support, but this is a very strong stock, and I believe, pointing to an entry for longer term investing.

It does have a head and shoulders, and is already down over 3% this morning after a reversal Friday.

My work, however, is not technical, but it's nice when you can see obvious alignment with my dowsing signals & gives me more conviction. That's all for now.

TSLA trade of the weekThis idea is something new where I'm asking my HIGHLY EXPERIMENTAL dowsing work for a "best bang for your buck" trade at the beginning of the week. Last week was pretty good saying to short SPY on Wed., so I'm going to journal these and see if it can be consistent.

If this aligns with YOUR work, great.

The idea is TSLA has a spike up towards the upper gap around $326-28. My levels on TSLA often are overshot, but anyway. Then watch for it to head towards the lower gap in the $310-307 zone and possibly down to $302.

My work is INCONSISTENT. There's more going into this than just looking at an indicator. This is energy, intention, intuition and God knows what else and it's more for myself than you. But, if you're interested, I'm happy to answer questions and share as I hope it inspires your own sense of what is possible beyond just the physical world.

TLT long into Sept. 26th?I had TLT on my calendar (from the very EXPERIMENTAL dowsing work that I do) for yesterday and today from readings I did on 5/22 & 5/18.

Being that it was looking like a swing low in this date window, I checked this morning, & from the very experimental work that I do, I get that it's heading to around $100. I had a prior post suggesting a larger bottom in place, and this appears to have been accurate.

The date for exit (VERY EXPERIMENTAL & for journaling purposes) I get is Sept. 26th.

*** NOTE ***

I post things here as a method of journaling ideas. If it aligns with YOUR OWN WORK, great. I'm pretty sure everyone has their good and bad streaks no matter what method they use.

So, I had a rough patch after finding out my incredibly special companion kitty was dying. Did I know att this would affect my work? No! I tried to stay "normal" ( for me ;) ). Did I learn something? Of course, & in the future I will allow myself more downtime to come back to balance.

No one really knows what's going on in my life, but I guess this work is probably more subject than other methods to emotional or energetic disruptions. I always clear my energy, but in certain circumstances it may be better to just chill. I'm learning as I go. If you have any advice on making this work better, please lmk.

News sends SMCI down?I do dowsing for my information on stocks, & it came to my attention that SMCI may have some news around 9 am tomorrow that sends it down over 13% (taken from the Fri close).

It suggested just a daytrade - for reference last Thursday dowsing also said there was a short daytrade in TSLA & you probably know it was down 18+%.

Since I blew off the TSLA guidance, I don't want to miss this one! The idea is to short into the $35-36 area and buy it there.

I may be off on the timing. This morning I asked how many hours till this occurs & it was 20 or 20.4 from around 8:30 a.m. There is also something the 11th. Maybe that is when it really turns back upward?? Of course, it could be nothing too, but I'll check in on Wed.

It will be a "scene of the crime" trade at the target area, so this could be really nice catching both sides IF IT'S CORRECT. My work can be spot on at times & miss entirely others, but I did pull an oracle card from a website that has tons & tons of cards it "randomly" chooses from. I asked about this idea and it gave the YES card - your intuition is correct. We'll see.

Watching for pullback in METAMETA hit a target area I had on my dowsing work for the upside. Actually, it busted it by $10, but I get that it'll pullback to around the $610 area. There may be some kind of news. I'm unsure if it's specific to META, or the entire market. This would be happening soon. Like, tomorrow. BUT, I've been very wrong before... so if it triggers short, I'd expect it to be a decent move down (over 5%). We'll see.

Swing high on QQQ?My dowsing work is suggesting today is likely a swing high in indexes and there will be a few days down from around here. The level I expect on QQQ is just under 500. I've had some numbers as far as into the 80s as well, but not expecting that this go around.

I posted my roadmap for SPY as an idea for what to expect this week, and this is playing out so far. Today would be the "look above and fail", but we need to get the fail part! If it starts, then I think the target lower is valid.

I also will mention I get the number 6. That could be price or percent. If percent it's down to 495, which makes sense. In terms of price the last swing low was at 506.... idk we'll see.

SPY dowsing roadmap for this weekI've been posting the weekly readings my dowsing has given for SPY's potential price movement the past couple months and it's really interesting.

I go week by week, but am starting to include each day of the week looking forward. I left on the chart the prior notations from those ideas I've posted & you can reference what I had versus what actually occurred.

This week is quite negative. I've had the number around $562-62 coming up for a while, & beyond that, around the $542-48 area as I recall. I don't really get any positive gain over last week's close.

We'll see what happens.

SPY volatility this weekI'm posting the rest of the readings I did for each week this month on SPY. This week I'm expecting a drop into Wed. I get all my info from dowsing, btw.

I noticed all last week it kept suggesting to sell rallies, which makes me thing we're going to pull back. The weekly (done at the beginning of the month) did suggest over 5% down this week. But my dowsing now says to watch for a bounce Wed. with a look below & fail. Move up to some extent Wed. & reverse down Thursday (implies gap up or some up). Then Friday up. Short term watching the $575 area for the bounce or resumption of trend.

Next week's reading of down more is a bit of a head scratcher, so that's why I think things could just be really volatile.

Low on QQQ I'm looking for is 498.

GLD where to?My dowsing work suggested a high around $288 on GLD, which obviously worked out (see prior idea). There's often a decent reversal opportunity once levels are hit. This one was golden... Wah-wah.

I'm trying not to over ask on things because with my work, I think it opens the door for misleading information or confusion on my part.

Simply put, the guidance was to get a date from the past, which was Jan. 10th. Look to revisit that price, which happens to correlate with the area of the 200 sma. When I asked what price from the H/L of that day, I get $249.

I drew a line to show the reference candle from January.

I ask what date this may occur by & get May 15th, but another date came of July 26th. There's some big stuff I think happening in indexes too in June/July. Dates are often reversals, but can be nothing. You just never know, but odds are more often they are something.

GDXJ short to $44Using my dowsing readings on GDXJ as confirmation was helpful for the long GLD idea, so why not use it for the move down idea? Only this time, I'll post what I get :)

As I mentioned, I'm a dowser & all my ideas and levels come from that. There's not much to this idea other than it shouldn't go much above 54. I do have a bit higher on GLD, and then a significant correction, which on GDXJ gives me a target of $44.

Levels hit well before, so hopefully, we can get lucky again.

SPX potentials for resistance & lowsI do dowsing & that's where I get my information from. I am expecting a move up tomorrow and then a high Wed./Thurs. with a reversal back down.

I've had levels around the 5450 area even since September, as well as dates suggesting a return to prices even lower from around November/December 2023, which if you recall, was the start of this big run up. I'm only showing the more near term idea, because that's what seems more clear.

The areas at the top are likely resistance in the near term. I'm not sure on timing for lows, but suspect something big in June/July.

I have some potentially important dates including this Thursday, as well as April 18th, 23rd, June 2nd and twice I get July 14th as well.

Intuition stock: NOW shortI navigate markets by using my dowsing skills, and sometimes, intuitive hits. I actually have to sit still & ask for the intuitive stocks, however, & I don't often do it - even though I've had some remarkable results.

I did take a shot this morning though & heard or received, "NOW". Unsure if it was a suggestion to be more in the moment, I cleared my mind again & still got NOW & repeatedly the number 38. I pretty much left it at that, but took a look at the chart anyway, then went on with my day. It wasn't until I decided this afternoon to ask dowsing if there's anything to it that I got really intrigued...

I asked for the most important things to know about it, and got the "crash" option, followed by, "it's a big high". So I take another look at the chart to see what the hod might have been, & then I was blown away to see it is $1037.94. That's as good as 38 to me, & this is why I'm making this idea to journal what happens because it was very clear and repeating the number 38 in my mind this morning.

I used dowsing to try for the low. I think it's about 5.7% down this week. That'll be around 976-78. And the bigger low is around $947. I asked what date that low may hit by and got a date of June 16th, but I wouldn't put too much weight in that. I can't wait to see what happens with this one. We'll see!

USO long tgt $81I do dowsing & had a date to watch for on Monday 5/5 in USO from a reading I did on 3/25 & it even suggested a swing low! Yay! I don't always get the correct info going into these dates, so I'm hoping this will get more consistent.

Anyway, there may be a spike down in USO in the near future. If so, it's a buying opportunity as my work suggests this is a longer term low that's in place. I get a target of $81, but it also did give me 84, but that's the prior high & suspect. That's why I asked a second time & got 81.

When I ask what date we may hit this target by, I get the date of July 17th, so watch what happens there.

That's all for now!

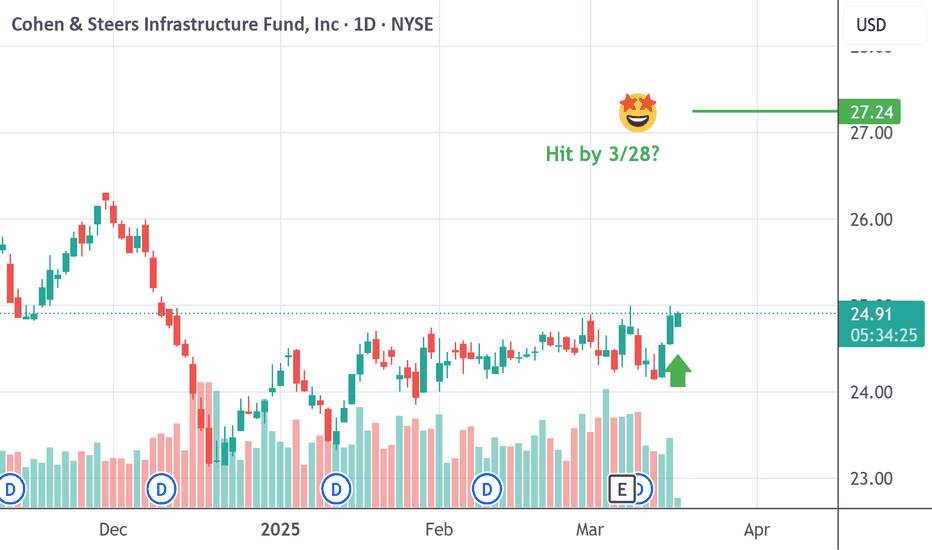

UTF up from here to 27.23ishMy dowsing suggested I ask for a stock from a screener I use. This list has many thousands of tickers & it's always interesting what I get.

This was neat because I asked what price I'm looking for BEFORE looking at the stock & the pendulum went to $26-27. So when I found it trading under $25 if felt like some validation.

There was a mention of a spike down & reversal up. Idk if that means this morning it already happened, or is yet to, but I'm pretty confident we hit the target, which is $27.23.

It shouldn't go under $24 & I asked what date we meet the target by and got March 28th.

There's no options on this fyi. We'll see how it shakes out!

Pendulum pick MTRN to $83Last night my dowsing told me to get a pendulum pick from the stock scanner. I do this from my ipad & all levels & info is from dowsing.

Anyway, I'll mention the first thing it gave me was a stock TDEC. I'm only noting this for journaling purposes. It's a weird "buffer" etf for emerging markets. Not interested, but may imply something bigger picture.

The second stock, which I changed settings on the screener to "optionable", is this MTRN. I know nothing about this stock, & I kind of like it that way so I'm not biased.

First things I get that it was going down, but will make a reversal up with the number 83. I was happy to see a number relatively close to where it's actually trading, but is down hard this today & I'm looking at 72 for a buy area. I did get the number 69, but that also could be the % down for today... and it's the prior low. Down 7% should be around $72, so watch this for a reversal and the target is 83. That also would fill a gap on the daily.

On a SPY idea I did pull a tarot card to see what it offered & it was totally relevant. This one was also really positive for just sitting back, relaxing & letting the money come. 4 of swords & 10 of pentacles if you're into it.

That's all.

Bearish energy TSLA earningsEarnings are kinda hard to read, but I totally nailed TSLA last time, so practicing here again with my dowsing.

It's all really bearish. I've already had a number around $188 come up for it, and that comes along with 185. Seems my levels get blown out by about 20 pts on TSLA, but watch out in these zones.

I suspect down 8%, but dowsing says down 17%. Advice is new 52 week low.

That's it. We'll see.

Pendulum pick for KR - short tgt 44I have many tens of thousands of dollars worth of home renovations to do, so why not ask my dowsing/spirit team to help find me a stock that can help PAY for these expenses and then some?

I'm a dowser, btw, so all my ideas & levels come from this form of information gathering. So woo woo ;)

The pick is from all of NYSE, so it's a lot. I'll admit, when I've done this in the past I've seen stocks have way better moves faster & I'm like, "why didn't you give me THAT one?!"

Regardless, I'm not going to disrespect the guidance, but just try to be more pointed in my intention. I did ask for this one to be a quick move, but I don't think it will be.

I do, however, have good confidence the target will hit. I did not look at the chart before I finished the reading & had a target. It's a way to see how accurate the level & info might be, so I was definitely happy the chart & levels look reasonable. It's literally at a multi year high & the dowsing said it's at a swing high.

Out the gate on this reading, it was saying swing trade short, & soon. It might get up to 69.

Anyway, when I ask about the 44 level (tgt), twice I get that the "target is reached". I tried to get the amount of time this takes & got the months around May/June as an exit, but it could easily be a few months. It's a 36% drop from 69 if it reaches there.

I drew the trendlines just to see how it behaves there. Maybe that'll help as a confirmation/trigger to short since it has been relatively strong.

That's it. Hopefully, this can pay some bills!!

SPY short targets for this weekI expect this area to offer at least a bounce. There may be something like that on Thursday.

This is based on my dowsing work. I also left my prior idea, which was done at the beginning of the month to see how things shake out with projecting week by week with my work.

Obviously, the standout dates were very relevant. I don't get that there are any new dates to add.

Intuitively, I will say I heard the word, "floor". So where we land may be support for a bit?

We'll see. I'm still very new at intuitively hearing/receiving messages & things.