ES (SPX, SPY) Analysis, Key-Zones, Setup for Thu (Feb 12)Wednesday's NFP session delivered exactly the volatility we expected - a 80-point intraday range from 6,931 to 7,011 as the market digested both the headline jobs number and the critical benchmark revisions. The initial spike to session highs quickly faded as traders processed the mixed implications of the data, and we've since settled into consolidation around the 6,960-6,970 zone heading into the close. The battle between bulls and bears remains undecided, with neither side able to establish clear control.

News & Sentiment Analysis:

The NFP release dominated Wednesday's session, with the employment report showing the labor market entering 2026 on relatively steady footing. Hiring remained concentrated in healthcare and construction, while job losses in federal government payrolls and financial activities highlighted continued unevenness beneath the surface. The unemployment rate held near recent levels at 4.4%, reinforcing the narrative that conditions are stabilizing rather than re-accelerating. The big story was the benchmark revisions showing 2025 job growth was weaker than previously reported - a significant data point that will shape Fed thinking going forward.

Market reaction to the jobs data was notably counterintuitive at first glance. The dollar, bond yields, and the S&P 500 all moved higher initially, while gold weakened - the opposite of what you'd expect from stronger employment data that reduces the urgency for rate cuts. But institutional analysis interprets this as the market embracing a "soft landing" narrative: growth remains resilient, labor conditions aren't deteriorating sharply, and risk appetite can stay supported even as policy easing gets pushed further out. Equities benefited from confidence in the expansion while gold softened as crisis hedging demand faded.

Fed's Hammack delivered hawkish commentary throughout the session, stating that "the Fed should stay on hold right now" and that the "current Fed funds rate is right around neutral." She emphasized that rates aren't putting much restraint on the economy and the Fed doesn't need to fine-tune policy. She also noted that US government debt is on an unsustainable path that must be dealt with - a nod to fiscal concerns that could influence longer-term rate thinking. Gold and metal price rises were flagged as potentially inflation-related.

On the geopolitical front, reports emerged that Trump and Xi are expected to extend the trade truce in an upcoming summit, per South China Morning Post - a constructive development for risk sentiment. Meanwhile, the Pentagon is preparing to deploy a second aircraft carrier to the Middle East as Trump raises pressure on Iran over nuclear deal negotiations, adding a layer of geopolitical uncertainty that could emerge as a factor if tensions escalate.

Interest rate futures pricing post-NFP shows 99.4% probability of no change at the January Fed meeting, 94% at March, and the first real coin-flip comes in June with 49.1% chance of a cut. By December 2026, markets are pricing approximately 52 basis points of total cuts - roughly two 25bp reductions. This is a notable pullback from earlier expectations and aligns with the Fed's hawkish messaging.

Trump's energy agenda made headlines with coal power generation expected to be up 25-30% this year, and the administration directing Department of Energy funds to coal plants in West Virginia and Ohio. He also took aim at "crazy China-made windmills," signaling continued policy divergence on energy.

On the earnings front, MCD and CSCO reported after hours Wednesday. Looking ahead to Thursday, earnings include DHI (D.R. Horton) before the open and AMAT (Applied Materials), PANW (Palo Alto Networks) after the bell - key names for housing sentiment and tech/AI infrastructure spending.

Japanese PPI came in at 2.3% YoY versus 2.4% prior, with MoM at 0.2% versus 0.1% - modest but showing continued price pressures in the world's third-largest economy. UK GDP data releases Thursday at 02:00 ET with a heavy slate including GDP Estimate, Manufacturing Production, Industrial Production, and Business Investment figures.

Technical Structure:

• Daily oscillator readings still elevated in the 60s but unwinding from overbought - room to push either direction

• 4H structure shows the rejection from PWH (7,025) holding, with price building lower highs since Monday's 7,011 spike

• 1H shows consolidation with oscillator in neutral 40-50 zone - neither overbought nor oversold

• Price currently trading around Y-POC (6,965) and VWAP (6,965) - classic equilibrium positioning

• Key structural levels: Higher low at 6,931 (Wednesday low), lower high at 7,011 (Wednesday high) - compression triangle forming

• Premium zone remains above 6,980, discount zone below 6,950

Forecast:

• Overnight: Range-bound consolidation expected between 6,950-6,975 as globex digests the NFP aftermath

• Morning Session: Potential continuation of Wednesday's late-day trend; watch for institutional flows around UK GDP release impact

• Afternoon: Likely choppy as market positions ahead of Thursday's earnings (AMAT, PANW after hours)

• Daily Close: Bias slightly bearish given failed breakout attempts and hawkish Fed tone; expect close near 6,955-6,970

• Expected Range: 6,930 to 6,990 (60pt range as volatility compresses post-NFP)

• Most Likely Path: Drift lower to test 6,950 support, potential bounce there, but staying below 6,980 resistance

Thursday Events:

• 02:00 ET: UK GDP Estimate MoM (0.1% exp vs 0.3% prev)

• 02:00 ET: UK GDP YoY Prelim (1.2% exp vs 1.3% prev)

• 02:00 ET: UK Manufacturing Production MoM (-0.1% exp vs 2.1% prev)

• 02:00 ET: UK Industrial Production MoM (0% exp vs 1.1% prev)

• Pre-Market: DHI earnings (D.R. Horton) - housing sector bellwether

• 08:30 ET: Initial Jobless Claims (watch for any surprise after NFP)

• 13:30 ET: BoC Meeting Minutes release

• 16:00 ET: Trump Speech scheduled

• After Hours: AMAT earnings - semiconductor equipment, AI capex indicator

• After Hours: PANW earnings - cybersecurity, enterprise spending indicator

Resistance:

• 7010-7015 - Wednesday High / PDH zone - major resistance, rejected sharply on NFP spike

• 6985-6990 - ONH / Wednesday PM resistance - bulls need to reclaim for bullish continuation

• 6975-6980 - Y-VAH / Prior equilibrium - first hurdle on any bounce attempt

• 6968-6972 - VWAP / Y-POC cluster - current pivot zone, defines intraday bias

Support:

• 6955-6960 - NYPM.L / Current consolidation low - first support test

• 6950-6953 - Y-VAL / ONL cluster - key structural level, break triggers acceleration

• 6930-6935 - Wednesday Low / NYAM.L - major support, bulls' last stand

• 6900-6910 - 4H equilibrium / Fib 1.272 extension - deeper correction target

• 6875-6880 - PWL proximity - major support if breakdown occurs

How I'm seeing it:

• Leaning slightly bearish below 6,975 given the repeated rejections at higher levels and hawkish Fed tone

• If price holds above 6,950 = range-bound choppy action between 6,950-6,985

• If price breaks below 6,930 (Wednesday low) = bearish acceleration toward 6,900 4H equilibrium

• If price reclaims 6,985 = potential squeeze to retest 7,010

• Watch initial jobless claims at 08:30 - could provide directional catalyst if surprising

• AMAT/PANW earnings could set tone for Friday's tech trade

• Primary Setup: Short from 6,975-6,980, stop 7,000, targeting 6,935 (Wednesday low retest)

The post-NFP environment typically sees follow-through in the initial direction, but Wednesday's reversal from highs suggests the bulls couldn't hold their gains. The fact that we're trading near Y-POC and VWAP after such a volatile day tells me the market is seeking equilibrium before the next move. Thursday is more about earnings reactions and positioning than major data, so expect a lower-volatility session unless we get a surprise in jobless claims or geopolitical headlines. Patience is key - let the market show its hand before committing to a directional bias.

Good Luck !!!

Es1

S&P500 is it about to crash due to a Global Liquidity peak??S&P500 (SPX) has been rising non-stop within its 3-year Bull Cycle following the October 2022 market bottom of the 2022 Inflation Crisis Bear Cycle. Such Bear Cycles are systemic and take place periodically on the long-term scale. Since the 2009 bottom of the U.S. Housing Crisis, those Bear Cycles have bottomed at or very close to the 1W MA200 (orange trend-line).

The index hasn't made contact with its 1W MA200 since that October 2022 bottom. Even the Tariff War correction exactly one year ago didn't touch it. This is a sign that the overheated/ bought stocks may be reaching their peak.

What may have reached its peak (or is entering its peak zone) is the M2 Global Liquidity Index (black trend-line), the global money supply circulating the financial system. As you can see based on the Sine Waves tool, the Global Liquidity tends to peak around every 4 years roughly. The next Sine Wave absolute peak is on the week of February 23 2026 (2 weeks from now).

In the past 12 years, the Global Liquidity has peaked both a little earlier or later, so that's a Peak Zone we have entered. What this technically suggest for the stock market is that the S&P500 has very high chances of entering a Bear Cycle that should bottom at or very close to its 1W MA200. And based on the latter's trajectory, that could be around 5500.

Are you willing to hold your stocks based on that?

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

ES (SPX, SPY) Analysis, Key-Zones, Setup for Tue (Feb 10)Continuation of Weekly Analysis | Pre-Wednesday Data Bomb

---

OVERALL BIAS: BEARISH INTO WEDNESDAY (UNCHANGED)

Monday validated the volatility thesis but not the directional conviction. The 76-point intraday range (6,924 to 7,000) showed both sides getting tested. Wednesday's NFP + CPI simultaneous release remains THE event. Light positioning today.

---

1. WHAT ACTUALLY HAPPENED MONDAY

Monday's Session Data (Verified)

- Open: 6,935.50 - Gap DOWN 51 pts from Friday close (6,986)

- High: 7,000.50 - Tested Y-VAH / R2 Psychological Level

- Low: 6,924.25 - Tested S2 Friday Close Area

- Close: ~6,980 - Near Y-POC (6,986)

- Range: 76.25 pts - High volatility pre-data

Weekly Levels vs. Monday Reality

- R2 (7,000): TESTED and REJECTED

- R3 (6,970-6,964): TESTED - passed through both ways

- S1 (6,935-6,942): HELD - opened here

- S2 (6,920-6,932): HELD - low at 6,924.25

---

2. TODAY'S SENTIMENT AND FLOWS

SPX Greek Hedging (Volland Data)

- Delta Hedging: $17.4B - Dealers hedging SPX price moves

- Vega Hedging: $51.4M - Hedging against volatility changes

$17.4B daily delta hedging creates mechanical flow that amplifies moves.

China Data Tonight (20:30 ET)

- CPI YoY: 0.4% exp vs 0.8% prior

- PPI YoY: -1.5% exp vs -1.9% prior

---

3. TUESDAY ECONOMIC CALENDAR

08:30 ET - RETAIL SALES MoM | Exp: 0.4% | Prior: 0.6% | HIGH IMPACT

12:00 - Fed's Hammack Speaks

13:00 - Fed's Logan Speaks

16:00 - Trump on Fox Business - WILD CARD

---

4. KEY LEVELS - Tuesday Feb 10

RESISTANCE

R1: 7,040-7,043 - PWH / ATH Zone

R2: 7,000-7,005 - Psychological (REJECTED Monday)

R3: 6,983-6,986 - Monday High / Y-POC

R4: 6,970-6,975 - Strong High Zone

SUPPORT

S1: 6,964-6,970 - Entry Zone

S2: 6,948-6,952 - Offer Wall

S3: 6,935-6,942 - Monday Open (HELD)

S4: 6,920-6,925 - Monday Low (HELD)

CRITICAL: 6,980 - Y-POC / Monday Close

---

5. BOTTOM LINE

Monday proved the market is coiled but not committed. A 76-point range that ended flat = everyone waiting for Wednesday.

Tuesday Strategy: Trade the range, respect the edges, preserve capital.

Good Luck !!!

Day 103 — +$1,286 Profit: Preparing for a Wild WeekEnded the day +$1,286 trading S&P 500 Futures. Apologies for the lack of posts recently—I've been incredibly busy, but I'm making an effort to get these journals out, even if I have to shift to a weekly format. The market has been playing out exactly according to our weekly analysis, which is huge validation for the strategy. We are seeing range expansion everywhere, which tells me this coming week is going to be wild. Big ranges mean big opportunities if you stick to the major levels.

Day 103— Trading Only S&P 500 Futures

Daily P/L: +1286

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: *STOCK FUTURES RISE IN SUNDAY NIGHT TRADE, VIX FALLS AS INVESTORS BRACE FOR BUSY WEEK

📈Key Levels for Tomorrow:

Above 6890 Bullish Level

Below 6870 = Bearish Level

ES (SPX, SPY) Weekly Analysis, Key-Zones, Setup for Week of Feb Friday looked impressive on the surface - ES rallied 134 points from Thursday's 6,798 low to close at 6,952. But look under the hood and it tells a different story. NVDA ripped +7.87% and mechanically dragged the index higher while three of the biggest AI capex spenders (AMZN -5.55%, GOOGL -2.53%, META -1.31%) all closed RED. That's not broad buying - that's a squeeze.

The positioning tells the story: 437K spec shorts on ES facing 927K fund manager longs. When NVDA popped, shorts got torched. Price is now sitting in the premium zone near 6,960 with momentum fading into the weekend. The 50-DMA at 6,881 remains unreclaimed resistance, and we're overextended above equilibrium.

The Big Event - Wednesday Feb 11:

NFP + CPI release simultaneously at 08:30 ET. This is unprecedented and creates massive binary risk. Expect subdued, coiled action Sunday through Tuesday as traders position for the data bomb.

Scenario Matrix:

• Strong NFP + Cool CPI (Goldilocks): Target 7,000+ as shorts get squeezed

• Weak NFP + Hot CPI (Stagflation): Target 6,800-6,850, 100-DMA at 6,797 becomes the line

• Mixed data: Choppy, directionless - wait for clarity

Resistance:

• 7040-7043 – PWH / ATH Zone

• 7000 – Psychological Level

• 6964-6970 – Strong High - Rejection Zone

• 6948-6952 – Offer Wall - Heavy Sell Orders

Support:

• 6935-6942 – Equilibrium - First Support

• 6920-6932 – Friday Close Area

• 6881 – 50-DMA - Key MA

• 6797-6800 – 100-DMA = THE LINE

How I'm seeing it:

• Bearish bias into Wednesday's data release

• If gap up to 6,970-7,000 fails: short entries with stops above 7,010

• Light positioning through Tuesday - don't commit size ahead of Wednesday

• A++ setups only at clear range edges with 3:1+ risk-reward

Friday's squeeze doesn't change the bigger picture - labor market deterioration, AI spending ROI questions, Iran risk, none of that got fixed by one green day. The asymmetry favors the bearish side given positioning, but let the data speak on Wednesday.

Good Luck !!!

ES (SPX, SPY) Analysis, Key-Zones, Setup for Fri (Feb 6)Yesterday was rough for tech with Nasdaq dropping over 1.3% after GOOGL's capex guidance spooked the market. MSFT down nearly 5% didn't help either. But overnight we got some relief - Amazon announcing $200B in AI infrastructure spending gave futures a decent lift. VIX pulled back from the 21+ levels which is helping stabilize things a bit.

ES bounced off the 6820 area and pushed back up toward the prior range. We're currently sitting around the 6850-6860 zone which is right at VWAP and the prior day's equilibrium. The bounce looks corrective so far rather than impulsive.

Forecast:

- Overnight: Choppy consolidation with slight upward drift

- Morning Session: Expecting a push into 6865-6875 resistance zone

- Afternoon: Likely fade if rejection at resistance holds

- Daily Close: Targeting below 6850 if short setup triggers

- Expected Range: 6825 to 6890

- Most Likely Path: Grind up into 6865-6875, find sellers, mean revert back toward 6840-6825

Friday Events:

- Pre-market: Watching for continuation of tech bounce

- Morning: Jobs data aftermath still influencing sentiment

- VIX: Currently around 20 - elevated but cooling

- After the bell: Light earnings calendar

Resistance:

- 6960-7005 – Major resistance, 7005 is the RTH High from earlier this week

- 6900-6920 – Upper resistance zone, would need strong momentum to reach

- 6880-6890 – Secondary resistance, this is where the short thesis gets invalidated

- 6865-6875 – Primary zone of interest, entry zone for mean reversion short

Support:

- 6845-6840 – First support and T1 target for shorts

- 6825-6835 – T2 target zone, prior support area

- 6800-6820 – Major support and T3, this is the key level bulls need to hold

- 6760-6780 – Deep support, only in play if 6800 breaks

Critical Level:

- 6850 – VWAP and equilibrium pivot, the line in the sand for intraday bias

Strategic Bias - Mean Reversion Short:

The setup here is a mean reversion short looking for a fade off the 6865-6875 resistance zone. Here's the thinking:

- Structure: The 1H chart shows a lower high pattern forming. Yesterday's selloff created a clear supply zone in the 6865-6890 area. The overnight bounce looks like a retracement into that supply rather than a trend reversal.

- Context: Despite the bounce, the broader picture still shows weakness. Tech got hit hard and one Amazon headline doesn't fix the GOOGL/MSFT damage. Buyers need to prove themselves above 6880 for me to flip bullish.

- The Play: Looking for price to push into 6865-6875 and show rejection (wicks, failed breakout, momentum divergence). If we get that, the trade is short targeting VWAP at 6850 first, then 6840, with a runner toward 6825.

- Risk: Stop above 6881. If price closes above that level with momentum, the lower high thesis is dead and shorts need to step aside.

- Invalidation: A strong push through 6890 with follow-through would shift bias to neutral/bullish and open up a run toward 6920+.

How I'm seeing it:

- Bearish bias below 6880, looking for mean reversion short at 6865-6875

- First target is VWAP at 6850, then 6840, extended target 6825

- If 6881 breaks with conviction, step aside - bulls taking control

- Below 6800 would confirm broader weakness and open 6760-6780

The overnight bounce gave us a setup. Now it's about waiting for price to reach the zone and show its hand. No need to chase - let the trade come to us.

Good Luck !!!

S&P Futures Trading Day 102 — +$740 Profit: Bearish Signals CallEnded the day +$740.27 trading S&P 500 Futures. Today felt surprisingly easy thanks to multiple bearish signals this morning that gave me the heads-up on the pullback. That said, I didn’t expect the drop to be that hard—the market is starting to behave a bit irrationally these days. I managed to maintain a 100% success rate on my trades, sniping 5 points at the 6900 support and running from the screens before the volatility could take anything back.

Day 102— Trading Only S&P 500 Futures

Daily P/L: +740.27

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: STOCKS END LOWER, VIX JUMPS AS TECH SHARES TUMBLE

📈Key Levels for Tomorrow:

Above 6982= Bullish Level

Below 6980 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:30 AM Market flipped bearish on VX Algo X3! :check~2:

VXAlgo ES X7 Sell signal :check~2:

S&P 500 Overbought Warning Signal :check~2:

9:50 AM VXAlgo ES X1 Oversold signal :check~2:

10:32 AM VXAlgo ES X1 Oversold signal :check~2:

10:49 AM VXAlgo ES X1 Oversold signal :check~2:

12:50 PM VXAlgo ES X1 Oversold signal :check~2:

1:08 PM XAlgo NQ X3 Buy Signal

1:10 PM VXAlgo ES X1 Oversold signal

1:40 PM VXAlgo ES X1 Oversold signal

S&P500 Channel Down pulling back to the 1D MA100.The S&P500 index (SPX) has been trading within a 2-month Channel Up and despite yesterday's strong recovery on a 1D MA50 (blue trend-line) rebound, the price is correcting equally aggressively today.

That is technically part of the pattern's new Bearish Leg. With the previous two Legs hitting their respective 0.786 Fibonacci retracement levels, we expect the current one not to diverge and target 6835. That would be just above the 1D MA100 (green trend-line), which is technically the Support that distinguishes the long-term bullish trend from the bearish.

Notice also that last week's Top coincided with the 1D RSI getting rejected on its 4-month Lower Highs trend-line. A strong long-term Bearish Divergence indeed.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Day 101 — Blowing 5 Accounts: The "Storm" That Never CameEnded the day -$1,264.56 per account... a grim start to February. After an 8-day win streak last month, I had this nagging feeling that a "storm" was coming to hit my accounts, and today that self-fulfilling prophecy came true. I took what I thought was a high-probability trade at the 97 MOB, but the market didn't care—it broke right through and kept running. Between Friday and today, I’ve lost about 5 accounts. While the payouts year-to-date are still solid, the real cost here is the time lost building those accounts. Now, the grind to regrow the farm begins.

Day 101— Trading Only S&P 500 Futures

Daily P/L: -$1264.56

Sleep: 5 hours

Well-Being: Good

🔔News Highlights: *DOW NOTCHES BEST DAY IN NEARLY TWO WEEKS AS FEBRUARY BEGINS ON A STRONG NOTE

📈Key Levels for Tomorrow:

Above 6985= Bullish Level

Below 6980 = Bearish Level

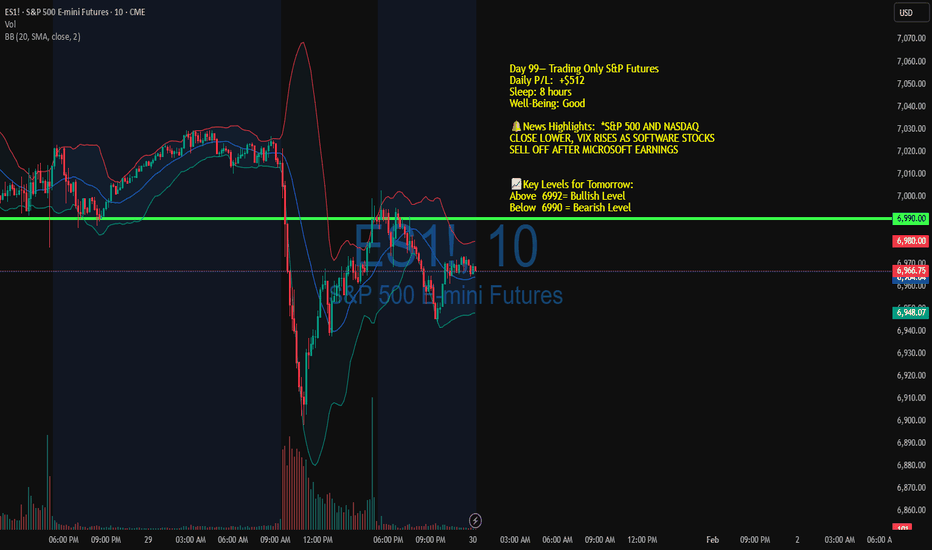

S&P Futures Trading Day 99 — Trading the 6990 Breakdown to 97MOBEnded the day +$512 trading S&P Futures. Today was a very "easy" day where the market moved exactly as anticipated, but it ended with a bittersweet realization. I caught the bearish flip as we lost the 6990 level and was ready to ride the drop down to the 97-minute MOB area. However, I completely forgot I had a hard daily profit limit set on my account. Just as the trade was working, I got kicked out at +$500, missing out on what could have easily been a $750–$1,000 day. It stings to leave money on the table, but the analysis was spot on.

Day 99— Trading Only S&P Futures

Daily P/L: +$512

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *S&P 500 AND NASDAQ CLOSE LOWER, VIX RISES AS SOFTWARE STOCKS SELL OFF AFTER MICROSOFT EARNINGS

📈Key Levels for Tomorrow:

Above 6992= Bullish Level

Below 6990 = Bearish Level

ES (SPX, SPY) Analysis, Key-Zones, Setup for Fri (Jan 30)AAPL crushed it today - iPhone revenue up 23%, China sales up 38% - and the market just sold it. Couldn't hold the pop. Tim Cook mentioned chip shortages and being in "supply chase mode" which spooked some folks. Meanwhile MSFT got hammered, down 10% after hours on cloud growth slowdown and AI spending concerns. That's a big deal - roughly 15-20 points of drag on ES at the open.

ES broke down during Asia, flushed from 6,980 through 6,968 all the way to 6,943 before catching a bid. Bounced back to 6,967-6,970 where we're now seeing a Lower High form on the 15-min. Structure is bearish - lower highs, lower lows confirmed. The 4H equilibrium at 6,930-6,920 is the magnet below.

Forecast:

• Overnight: Down to flat, leaning bearish

• Morning Session: Expecting downside pressure

• Afternoon: Likely choppy and two-sided

• Daily Close: Leaning toward a red close

• Expected Range: 6,900 to 6,990

• Most Likely Path: Test and reject 6,970-6,980 early, roll over and break 6,950, test the 6,930 equilibrium, bounce attempt fails, fade into close near 6,920-6,940

Friday Events:

• 6:15 AM: CVX (EPS 1.38 exp, Rev 44.1B)

• 6:30 AM: XOM (EPS 1.69 exp, Rev 81.3B)

• 6:30 AM: VZ (EPS 1.06 exp, Rev 36.1B)

• 7:00 AM: AXP (EPS 3.56 exp, Rev 18.9B) - good read on consumer spending

• 10:00 AM: Core Trend Inflation data

• After the bell: AMZN, GOOGL, INTC

Resistance:

• 7,022 – Thursday's High

• 7,010-7,012 – Prior Equilibrium Zone

• 6,993-6,995 – Critical Level / PDH Area

• 6,980-6,982 – VWAP / Demand Turned Resistance

• 6,968-6,970 – Lower High Formation

Support:

• 6,955-6,950 – Tested Support Zone

• 6,943-6,945 – Overnight Low

• 6,930-6,920 – 4H Equilibrium (Major Target)

• 6,900 – Psychological Level

• 6,875 – Prior Week Low

How I'm seeing it:

• Leaning bearish below 7,000

• A push back to 6,970-6,980 that can't reclaim sets up a fade toward 6,950, 6,940, then 6,930

• The bounce from 6,943 looks like a selling opportunity, not a trend change

• Above 6,995 and held - bearish view weakens

• Below 6,943 opens the door to 6,930-6,920

The market couldn't rally on perfect AAPL numbers. MSFT down 10% will probably overshadow META's +9%.

Good Luck !!!

ES (SPX, SPY) Analysis, Key-Zones, Setup for Thur (Jan 29)FOMC is behind us. Powell kept rates at 3.50-3.75% with a dovish lean. Two dissents favoring a cut from Waller and Miran which tells you something about where the Fed might be heading. They upgraded growth to "solid pace" and said labor is "stabilizing" so the soft landing story is still alive.

Earnings after hours were solid. Microsoft beat EPS by 31%, Azure still growing at 38%. Meta crushed guidance. Tesla had 20% gross margins which surprised a lot of people, plus Optimus 3 coming in three months. IBM did well too.

But even with those beats, ES sold off about 21 points after the close. Interesting part though, CVD flipped positive during the drop. Looks like buyers were quietly absorbing on the way down. Something to keep in mind tonight.

Tomorrow morning GDP drops at 8:30 AM. Atlanta Fed GDPNow has it at 5.4% while street consensus is around 2.5-3%. If it comes in hot, could get choppy as people start pricing out cuts.

Resistance:

- 7010-7012: Need to get back above here first

- 7022: Today's high

- 7032-7044: Bigger resistance zone

- 7057-7060: Weekly extension

Support:

- 6990-6993: Where we're hanging out now

- 6975-6980: Minor demand

- 6920-6930: 4H equilibrium, bigger support

- 6875: PWL

How I'm seeing it:

- Neutral to slightly bullish overnight

- Watching 6990 for any absorption

- Above 7010 and 7022-7035 comes into play

- Below 6975 and bulls lose control

With CVD positive and earnings strong, feels like bears have some work to do here. But a hot GDP or weak Apple numbers Thursday evening could flip things around pretty quick.

Good Luck !!!

S&P Futures Trading Day 98 — Dodging the Tradovate Outage & TradEnded the day +$439.30 trading S&P Futures. I can't stress enough how much difference a full 8 hours of sleep makes; I saw the market incredibly clearly today. I started early and locked in about $300 during the pre-market session, then wisely sat on the sidelines when Tradovate started having server outages. I didn't let the tech issues tilt me—instead, I waited it out and came back for Power Hour (2–3 PM), netting another $150 to close the day strong.

Day 98— Trading Only S&P Futures

Daily P/L: +$439.30

Sleep: 8 hours

Well-Being: Good

🔔News Highlights: *STOCKS CLOSE LITTLE CHANGED, VIX RISES AFTER FED RATE DECISION

📈Key Levels for Tomorrow:

Above 6992= Bullish Level

Below 6990 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

— 9:35 AM ES1! Phase Change: Bullish :check~2:

— 9:35 AM MES Market Structure flipped bullish on VX Algo X3!

— 10:15 AM ES1! Phase Change: Bearish :check~2:

— 10:20 AM VXAlgo NQ X1DP Sell Signal :check~2:

— 10:30 AM MES Market Structure flipped bearish on VX Algo X3! :check~2:

— 1:00 PM VXAlgo ES X3DP Sell Signal :check~2:

— 1:40 PM VXAlgo NQ X1DP Sell Signal :check~2:

— 2:00 PM S&P 500 Market Structure flipped bearish on VX Algo X7 timeframe :check~2:

ES (SPX, SPY) Analysis, Key-Zones, Setups for Wed (Jan 28)

ES pulled back to 7,019 after Globex ripped to 7,039 overnight. We're consolidating below the overnight high ahead of FOMC at 2 PM and Mag 7 earnings after the close. The path of least resistance is higher but binary events cap conviction.

OVERNIGHT RECAP

Globex pushed to 7,039 - highest level of the rally - then reversed into London. It was liquidity sweep above Tuesday's high followed by profit-taking. Asia was bid, Europe faded. Currently holding Y-VAH area around 7,017-7,020.

Key overnight levels:

Overnight High: 7,039

London Open High: 7,039

Asia Session High: 7,027.75

GLOBAL DRIVERS

Bullish factors dominating the tape:

China approved 400K NVIDIA H200 chips for Alibaba, Bytedance, and Tencent. This is a massive AI tailwind and removes a key overhang on the semiconductor complex.

SoftBank announced plans to invest an additional $30 billion in OpenAI, reinforcing the AI investment narrative heading into Mag 7 earnings.

ASML surged 6% in Amsterdam after Q4 bookings crushed expectations. Semiconductor strength continues.

Gold hit a record high above $5,200 per ounce on dollar weakness and safe haven flows.

Asian tech index reached all-time highs. South Korea's market has now surpassed Germany in total value, gaining $1.7 trillion since the AI rally began.

Dollar weakness continues with DXY near 4-year lows around 95.60. Trump's dovish stance on the dollar ("the loss is good for US businesses") supports risk assets.

Kremlin indicated openness to Trump contact, signaling potential geopolitical de-escalation.

Caution factors:

ECB's Villeroy called the dollar drop "a sign of US unpredictability."

South Korea warned they cannot rule out US mentioning tariffs again due to investment disagreements.

Mortgage applications fell 8.5% with rates rising to 6.24%.

Daily oscillator at 110 - extreme overbought. Extended 5 sessions straight.

FOMC PREVIEW - 2:00 PM ET

The Federal Reserve is currently expected to maintain interest rates in the range of 3.50% to 3.75%, with a probability of 97.2%. However, the real focus will be on Powell's tone rather than the decision itself.

Dovish signals to watch for include the statement highlighting a cooling labor market, greater confidence in ongoing disinflation, indications that rate cuts may be likely in 2026, and less emphasis on upside inflation risks.

On the other hand, hawkish signals to look out for might emphasize inflation uncertainty, Powell stressing the need for "greater confidence" before considering any cuts, pushback against near-term easing expectations, and an overall emphasis on patience and caution.

I expect the Fed will make an in-line decision to hold rates and use data-dependent language. Powell is likely to avoid providing a timeline for cuts and will emphasize flexibility. We may see an initial spike in reaction to the decision, followed by a fade as the focus shifts to corporate earnings.

MAG 7 EARNINGS - AFTER CLOSE

Microsoft, Meta, and Tesla are all scheduled to report earnings tonight after 4 PM. This is significant because having three major companies report on the same night can cause the ES to move by more than 50 points in Globex.

For Microsoft, strong growth in Azure and acceleration in AI revenue are essential. Meta needs to show strength in ad revenue without raising concerns about AI spending. Tesla has the weakest setup, facing issues with margin compression and competition concerns.

Additionally, Apple will report after the close on Thursday.

FOMC EXECUTION

Reduce position size by 50% before 2 PM announcement.

Wait 5-10 minutes for initial reaction to settle. The first move is often a fake.

Trade the second move:

If dovish spike to 7,045+ then buy the pullback to 7,030-7,035.

If hawkish flush to 7,000 then short retest of breakdown or buy 6,988 support.

If chop then wait for earnings to resolve direction.

BOTTOM LINE

Day 6 of the rally: Overnight, the market pushed to new highs at 7,039 before reversing. This situation could indicate either a bull flag, suggesting a continuation to 7,050 and above, or a liquidity sweep that signals a mean reversion back to 7,000.

The Federal Open Market Committee (FOMC) meeting will determine the outcome. If Powell takes a dovish stance, we may see a squeeze higher; if he adopts a hawkish tone, we could experience a drop. However, tonight's earnings reports from Microsoft, Meta, and Tesla are the larger wildcards in this scenario.

Consider buying dips in the range of 7,005 to 7,008 with defined risk. Additionally, look to fade spikes between 7,035 and 7,039 if rejection is confirmed. It's advisable to be flat before the earnings announcements at 4 PM.

Trade what you see. Good luck !!!

S&P500 & NASDAQ: Trading Above The +FVG! Look For Longs!Welcome back to the Weekly Forex Forecast for the week of Jan. 27-30th.

In this video, we will analyze the following FX market: S&P500 and NASDAQ

Both indices have been trading sideways. Both made an inefficient bearish move last week that

took a week to recover from. Both have been struggling to get move higher through a bearish FVG.

That changed Monday. The Monday candle closed above the -FVG, indicating bullish order flow.

Look to take advantage tomorrow! Price is heading towards buy side liquidity, and there will be opportunities to take valid long setups over the next 24 hrs.

Enjoy!

May profits be upon you.

Leave any questions or comments in the comment section.

I appreciate any feedback from my viewers!

Like and/or subscribe if you want more accurate analysis.

Thank you so much!

Disclaimer:

I do not provide personal investment advice and I am not a qualified licensed investment advisor.

All information found here, including any ideas, opinions, views, predictions, forecasts, commentaries, suggestions, expressed or implied herein, are for informational, entertainment or educational purposes only and should not be construed as personal investment advice. While the information provided is believed to be accurate, it may include errors or inaccuracies.

I will not and cannot be held liable for any actions you take as a result of anything you read here.

Conduct your own due diligence, or consult a licensed financial advisor or broker before making any and all investment decisions. Any investments, trades, speculations, or decisions made on the basis of any information found on this channel, expressed or implied herein, are committed at your own risk, financial or otherwise.

Day 97 — Grinding Back Profit in Short Squeeze ModeEnded the day +$204.85 trading S&P Futures. Operating on just 3 hours of sleep, the morning started rough with some losses due to a false signal as the market entered short squeeze mode. It was a grind, but I managed to claw my way back to profitability by the close. The MES market feels incredibly difficult right now—signals are mixed, and the relentless squeezing makes me hesitant that a sudden unload is coming. My plan moving forward is to size down to reduce risk while leaving just enough room to catch the downside if the rug finally gets pulled.

Day 97— Trading Only S&P Futures

Daily P/L: +$204.85

Sleep: 3 hours

Well-Being: Good

🔔News Highlights: *S&P 500 ENDS AT A NEW RECORD HIGH AS TECH SHARES RALLY AHEAD OF MEGACAP EARNINGS, FED MEETING

📈Key Levels for Tomorrow:

Above 6955= Bullish Level

Below 6950 = Bearish Level

📊Reviewing signals for today (9:30am – 2pm EST):

9:40 AM VXAlgo NQ X1DP Sell Signal,

9:50 AM ES1! Phase Change: Neutral :check~2:

9:50 AM MES Market Structure flipped bullish on VX Algo X3! :check~2:

10:00 AM Market flipped bullish on VX Algo X3! :check~2:

10:30 AM VXAlgo ES X1 Overbought/toppy Signal

11:30 AM VXAlgo ES X1 Overbought/toppy Signal :check~2:

11:50 AM VXAlgo ES X1 Overbought/toppy Signal :check~2:

12:20 PM ES1! Phase Change: Bearish :check~2:

12:30 PM VXAlgo NQ X1DP Buy Signal :check~2:

12:54 PM MES Market Structure flipped bearish on VX Algo X3!

1:16 PM VXAlgo ES X1 Oversold signal

1:30 PM Market flipped bearish on VX Algo X3!

ES (SPX, SPY) Analysis, Key Zones, Levels for Tue, (Jan 27)

BIAS: CAUTIOUSLY BULLISH — Breakout Watch

ES is testing 6,995-6,998 in premarket after rallying from the 6,970 area overnight. We're now less than 0.5% from all-time highs. Asia hit new records, Europe is bid, and risk appetite is at five-year highs according to Goldman Sachs. The path of least resistance is higher - but FOMC Wednesday and Mag 7 earnings create headline risk.

The dip buyers got their fill overnight. Now it's breakout or rejection at 7,000.

OVERNIGHT RECAP

Asia/Europe session was bullish across the board. MSCI Asia regional index hit a new all-time high. South Korean chipmakers rallied despite the tariff headlines. Stoxx 600 pushed higher led by a 21% surge in Puma. US futures followed with S&P +0.3% and Nasdaq +0.7%.

The yen gave back some gains, falling 0.2% as intervention fears cooled slightly. Gold and silver held near record highs. Dollar remained weak near 2022 lows.

Key overnight developments that shifted sentiment:

South Korea's Blue House clarified that the US letter they received was NOT directly related to Trump's tariff announcement. This de-escalates the immediate tension.

Canada's PM Carney said he had a "good conversation with President Trump." Another de-escalation signal.

Japan's Finance Minister Katayama confirmed they will "take action in line with the US-Japan FX agreement" and "closely coordinate with US authorities as needed." The intervention threat remains but is now expected rather than surprising.

BACKGROUND: IRAN TENSIONS

Trump told Axios on Monday that the US has "a big armada next to Iran" as the USS Abraham Lincoln carrier strike group entered the region. This is ongoing posturing, not a new headline — markets have already digested it. Watch for any escalation but this is not driving price action today.

WHAT'S DRIVING THE RALLY

Goldman Sachs strategists note that investor appetite for risk is at its greatest level in five years. Economic confidence is overcoming geopolitical concern.

Micron surged 5% in premarket after announcing plans to expand memory chip production. This is bullish for the semiconductor complex and supports the AI infrastructure narrative heading into Mag 7 earnings.

The three-year bull market continues to find buyers on every dip. Investors are looking to earnings this week to validate the AI-driven rally.

SCHEDULED CATALYSTS

Tuesday 10:00 AM: Consumer Confidence

Wednesday 2:00 PM: FOMC Decision (97% hold expected)

Wednesday 2:30 PM: Powell Press Conference

Wednesday After Close: Microsoft, Meta, Tesla earnings

Thursday 8:30 AM: Q4 GDP Advance (Atlanta Fed tracking 5.4%)

Thursday After Close: Apple earnings

Friday 8:30 AM: Core PCE (Fed's preferred inflation gauge)

The FOMC is fully priced for a hold at 3.50-3.75%. The market will trade Powell's tone. Hawkish = pullback. Dovish = breakout fuel.

Mag 7 earnings Wednesday night are the main event. These can swing ES 50+ points. Microsoft and Meta expectations are high. Any disappointment could trigger a sharp reversal from 7,000.

SUPPORT AND RESISTANCE ZONES

RESISTANCE

R2: 7,015 to 7,025

Extension target if 7,000 breaks cleanly. This is where profit-taking kicks in on breakout longs.

R1: 6,997 to 7,005

Current battle zone. Overnight high 6,998.75 and psychological 7,000. Must break and hold above 7,005 to confirm breakout.

SUPPORT

S1: 6,985 to 6,990

Overnight support and VWAP area. First level to buy if we pull back. Expect bids here.

S2: 6,970 to 6,978

Prior value area and overnight rally base. Strong support. If this holds on a pullback, bullish structure intact.

S3: 6,952

Monday's low. Losing this invalidates bullish structure and opens gap fill to 6,920-6,940.

PRIMARY SETUP: BREAKOUT LONG

We're at the door. The overnight session was bullish, de-escalation headlines are hitting, and risk appetite is at five-year highs. The setup favors a breakout above 7,000.

Trigger: Clean break and hold above 7,000 for 5+ minutes

Entry: 7,002 to 7,005 on the retest. Do NOT chase the initial spike. Wait for price to break above 7,000, pull back, and hold it as support.

Stop: 6,993

Target 1: 7,015 to 7,020 (take partials, move stop to breakeven)

Target 2: 7,035 to 7,040 (trail remainder)

Risk: 10-12 points

Reward: 15-35 points

R:R: 1.5:1 to 3:1

If the breakout fails and we reject back below 6,995, do NOT take this setup. Wait for price to pull back to S1 (6,985-6,990) or S2 (6,970-6,978) and reassess for a dip buy.

RISK FACTORS

Government Shutdown — 77% probability by Friday. Senate Democrats blocking DHS funding after Minneapolis shootings. Partial shutdown likely but markets typically shrug off short shutdowns.

Minneapolis Unrest — Two citizens killed by federal agents this month. Protests ongoing. Driving the shutdown standoff and adding political uncertainty.

Trump Tariffs - South Korea 25% threat de-escalated slightly with Blue House clarification. Canada conversation "good" per PM Carney. Still watch for headline risk.

Iran - USS Abraham Lincoln now in region. Tensions ongoing but not escalating today. Background noise unless new headlines hit.

Overbought Technicals - Daily oscillator at 110 (extreme). We're extended and due for mean reversion eventually, but momentum can stay overbought longer than expected in trending markets.

RISK MANAGEMENT

Reduce position size by 50% this week

No overnight holds through Wednesday earnings

Take quick profits at resistance

Use breakeven stops once in profit

Be ready to flip direction on headline surprises

The market can move 30-50 points on a single headline. Capital preservation first.

BOTTOM LINE

Bulls are in control. We rallied overnight, de-escalation headlines are hitting, and risk appetite is at multi-year highs. The setup favors a breakout above 7,000.

But this is FOMC week with Mag 7 earnings Wednesday night and a government shutdown Friday. The breakout needs to happen with conviction or we risk a "buy the rumor, sell the news" reversal.

Key question: Can ES break and hold 7,000 before FOMC? If yes, the path opens to 7,020-7,040. If no, expect consolidation between 6,978-7,000 until Wednesday's catalysts resolve.

Trade what you see, not what you think. Good luck !!!

S&P500 short-term Channel Up targeting 7040.The S&P500 index (SPX) has been trading within a highly symmetrical Channel Up and following last week's Higher Low on its bottom, marginally above the 1D MA100 (red trend-line), we are seeing the new Bullish Leg unfolding.

The previous one, which also bottomed on the 0.786 Fibonacci retracement level rose my a little over +4.00%, similar to the Bullish Leg before. With the 4H RSI entering a slow down phase just below its 70.00 overbought level, we expect the price rise to get more neutral as well. Regardless of the pace, we expect the index to reach 7040 at least before pulling back towards the bottom of the Channel Up.

Note that only a 1W closing below the 1D MA100 can be technically considered as a trend switch to bearish long-term.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

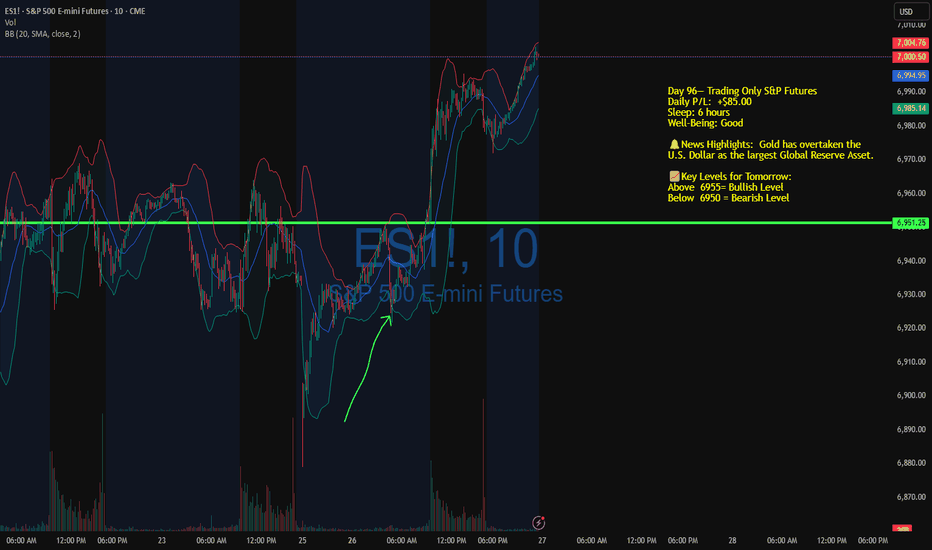

Day 96 — Surviving the Bull Trend: "The Old Me" Would Have LostDay 96— Trading Only S&P Futures

Daily P/L: +$85.00

Sleep: 6 hours

Well-Being: Good

🔔News Highlights: Gold has overtaken the U.S. Dollar as the largest Global Reserve Asset.

📈Key Levels for Tomorrow:

Above 6955= Bullish Level

Below 6950 = Bearish Level

Ended the day +$85.00 trading S&P Futures. I started the session in the red after an overnight short at the 1-minute MOB didn't work out. The market was looking extremely bullish, and honestly, I struggled to find a clean setup this morning. Instead of forcing it, I decided to trust Bia's analysis to short the 6986 area. It worked, and I even added a second short assuming we hit the top of the daily range. I’m just glad I survived and ended green lol, the "old me" would have fought this trend all day and turned a difficult session into a disaster.

📊Reviewing signals for today (9:30am – 2pm EST):

— 9:10 AM VXAlgo NQ X1DP Buy Signal :check~2:

— 10:00 AM S&P 500 Market Structure flipped bullish on VX Algo X7 time frame :check~2:

— 12:05 PM ES1! Phase Change: Bullish :check~2:

— 12:20 PM VXAlgo NQ X1DP Buy Signal :check~2:

— 1:35 PM ES1! Phase Change: Bullish