OKLO 1D: Transition phase after declineOn the daily chart OKLO has shifted from a prolonged downtrend into a basing phase. After a sequence of lower highs and lower lows, price broke out of a falling wedge and pulled back into a demand zone. Selling pressure failed to resume and recent lows remain intact.

From a structural perspective, price action reflects a complex base following the decline. The 80–90 area remains pivotal, aligning with the 200-day moving average and the 0.786 Fibonacci retracement. This confluence has already produced multiple reactions, reinforcing its relevance. Momentum indicators confirm stabilization rather than trend continuation, with MACD exiting negative territory while ADX remains subdued.

The primary structural reaction level sits near 115, marking the upper boundary of the current base. Acceptance above this area would open the door for structural expansion toward the 160 region. Failure to hold the 80–90 zone would invalidate the basing scenario and return price to a neutral structure.

From a fundamental standpoint the company remains early stage. EPS TTM stands at −9.68, with Q4 2025 EPS estimated at −0.17. Revenue remains absent, while cash flow stays negative, with operating cash flow at −62.2M and free cash flow at −68.5M. Liquidity remains strong, with cash per share at 6.13 and minimal debt, supported by recent capital inflows. Enterprise value is currently estimated at 13.8B.

At this stage the market is pricing structure and expectations rather than earnings. Price behavior within the base will define the next directional phase.

Price action leads before fundamentals follow.

Fibonacci

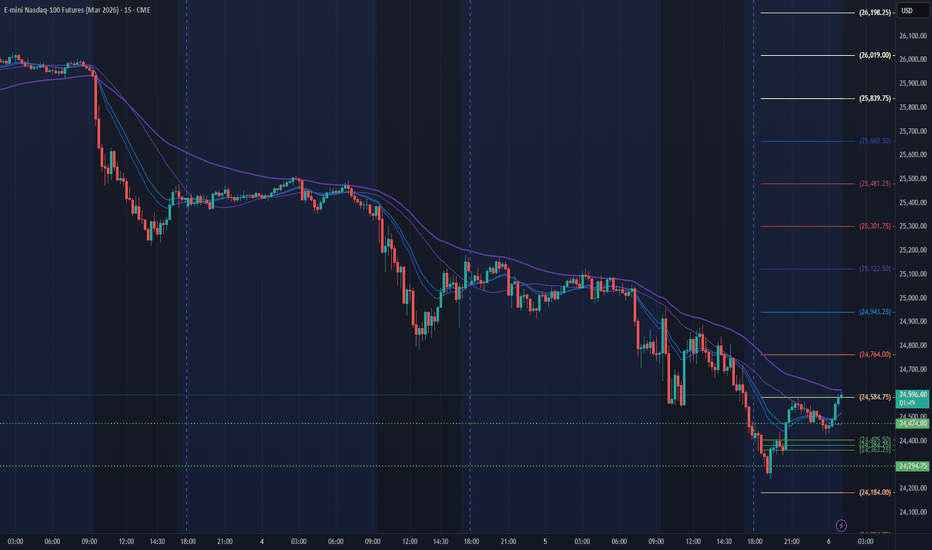

NQ Power Range Report with FIB Ext - 2/6/2026 SessionCME_MINI:NQH2026

- PR High: 24474.00

- PR Low: 24294.00

- NZ Spread: 402.5

Key scheduled economic events:

08:30 | Average Hourly Earnings

- Nonfarm Payrolls

- Unemployment Rate

Session Open Stats (As of 12:45 AM)

- Session Open ATR: 488.50

- Volume: 76K

- Open Int: 275K

- Trend Grade: Long

- From BA ATH: -7.7% (Rounded)

Key Levels (Rounded - Think of these as ranges)

- Long: 26521

- Mid: 25264

- Short: 23412

Keep in mind this is not speculation or a prediction. Only a report of the Power Range with Fib extensions for target hunting. Do your DD! You determine your risk tolerance. You are fully capable of making your own decisions.

BA: Back Adjusted

BuZ/BeZ: Bull Zone / Bear Zone

NZ: Neutral Zone

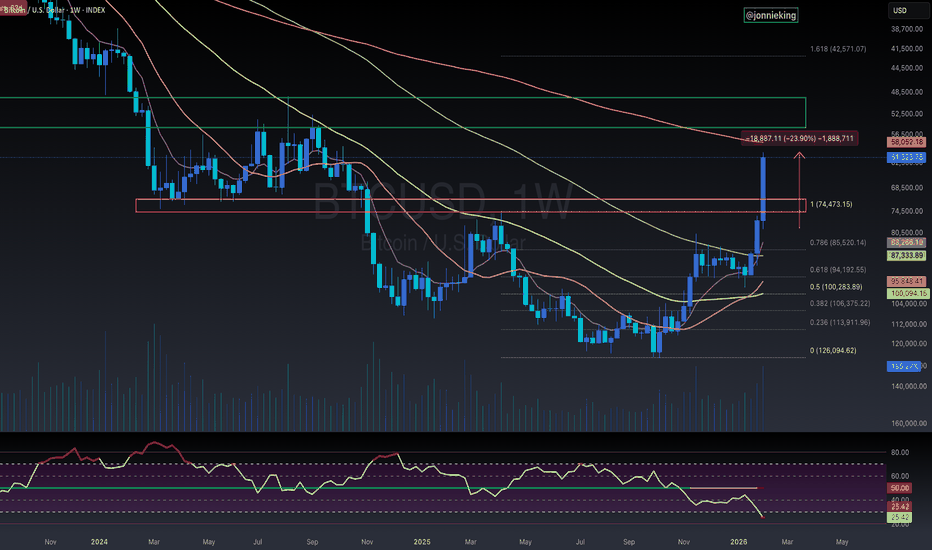

BTC REACHING A CRUCIAL PIVOT AREAForecasting BTC through market theory would suggest that the 61.8% pinball extension could be a major pivot area, and the start of a massive impulse wave to the upside. While we typically look for the 76.4% level to be the lowest lesser degree wave four pullback, the 61.8% level is still acceptable, and it is common that when the 76.4% is breached, the price will fall all the way to 61.8% level and find support to validate the count. That said, a breakdown and hold below the 61.8% extension level would invalidate portions of the forecast.

CRWV - Not too late for a long tradeCRWV setting up good for a long trade.

Formed a inverse H&S and popped to fill the gap above.

Don't jump in with whole size but scale in slowly with small size on dips between 90-100

Target 1 - 120

Target 2 - 140 - So much overhead supply at this level. It can struggle here I guess.

Bitcoin Long Term ViewBTC has retraced 50% from it's all time high and is currently in the 'Golden Pocket' zone. The golden pocket refers to a key Fibonacci retracement zone between the 61.8% and 50% levels, often indicating potential reversal points in trading.

Additionally, we are at the bottom of a regression channel which has historically acted as support. Using Fibonacci time extensions based on previous highs it looks plausible that a new high could be reached towards the end of the year or early next year.

We first need to see a reversal of the recent downtrend on the daily chart to confirm this reversal area.

SMC Hidden FVG + Rejection Block Road MapSell Trade is ready..

Sell trade is ready according to SMC. If price reaches this sell area then we'll look for rejection candle combine with clear Mss. Let's conquer this trade with precision. This XAUUSD analysis is built on structure, liquidity and smart money logic, not on guesswork.

🧠 Final Thought

If you understand liquidity, imbalance and structure, you stop chasing price —

you start letting price come to you.

👉 Do you agree with this bearish roadmap, or do you see a different liquidity draw?

Comment your view below — let’s read the market together.

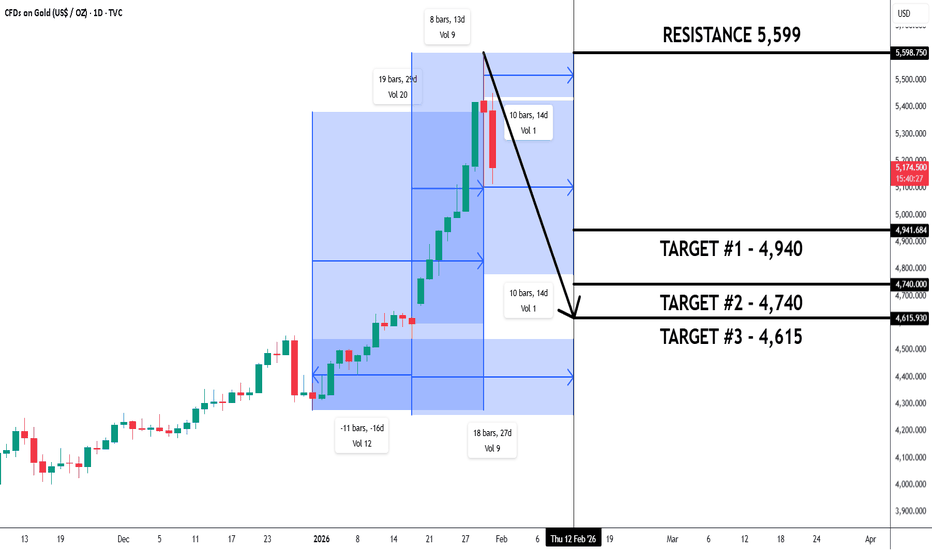

GOLD: BRACING FOR GRAVITY EFFECT AFTER AN EXTREME RALLYXAU/USD D1 - Gold remains bullish overall, but the current move is a correction after an extreme rally. Price may drop faster due to market gravity, with key downside zones at 4,940, 4,740, and 4,615 (Fibonacci cluster & gap area).

The vibrational date is around Feb 12, 2026. Focus is to wait and see the price action as we approach this date, especially around the highlighted levels.

AMD — Everything Looks BadSince October 2025, AMD stock has been correcting.

Waves A and B have formed, and it appears that Wave C has begun to develop.

The correction type is flat .

Wave C is forming as a five -wave impulse.

Key targets:

218 — local correction

200 — the most likely end of the impulse, located in the 50–60% range of the larger Wave 5

189

The potential move from the current level is 15–20%.

We assume that the stock may move lower after the initial targets are reached.

---

Subscribe and leave a comment.

You’ll get new ideas faster than anyone else.

---

Chumtrades xauusd friday trade planMarket Context

Gold is currently trading within a wide range, with the short-term structure still bearish. Price remains capped below the descending trendline, and each rebound weakens as it approaches resistance, indicating defensive, short-term capital flow with no clear signs of accumulation for a reversal yet.

Key Macro Factors

Markets remain under pressure from concerns about higher-for-longer interest rates, as monetary policy has not shifted toward easing. U.S. labor data volatility keeps gold highly sensitive to news, while rate-cut expectations for March–April remain low, offering insufficient support for a sustained bullish move. Geopolitical risks persist but currently act more as noise than a trend driver.

Market Expectations

Buyers are looking for short-term technical rebounds from demand zones, while sellers are waiting for pullbacks into resistance to continue distribution. Overall, the market appears to be positioning for a strong breakout, with elevated volatility risks heading into the weekend.

Intraday Trading Strategy

Bias remains SELL, trading in line with the prevailing structure. Look to sell on pullbacks into the 4,900–4,950 resistance area or near the descending trendline. BUY setups are strictly short-term reaction trades at support, with no intention to hold positions for long. Avoid chasing price during high-volatility moves.

Support zones: 4,825–4,836 | 4,800–4,814 | 4,750–4,766 | 4,640–4,700.

Resistance zones: 4,900–4,950 | 5,000 | a break above 5,100 would invalidate the bearish structure.

Friday Notes ⚠️

Fridays often carry the risk of sudden sell-offs, especially after 22:00 (VN time). On news-driven sessions, price can move fast and aggressively, increasing the risk of stop hunts. With wide volatility, tight risk management, smaller position sizing, and capital preservation should take priority over profit-seeking.

ASTRUSDT: Massive 12H Bullish Divergence at Key SupportDescription

The Setup: We are looking at the 12H chart for ASTER/USDT, and a high-probability reversal pattern is starting to take shape. While the price action has been making lower lows throughout this downtrend, the RSI (14) is clearly making higher lows. This classic Bullish Divergence suggests that the selling pressure is exhausting and a trend shift may be imminent.

Technical Highlights:

Timeframe: 12-Hour (High Conviction).

Price Action: Consolidating near a long-term horizontal support zone.

Indicators: RSI is showing a strong upward slope despite the price weakness. We are also seeing price beginning to hug the EMAs, looking for a breakout above the descending trendline.

Risk/Reward: With a tight stop just below the recent swing low, the R/R ratio is very attractive for a move back toward the 0.618 or 0.5 Fibonacci retracement levels.

Trading Plan:

Entry: Current levels or on a confirmed 12H candle close above the immediate EMA resistance.

Target: Primary target sits around the $0.91 level (as marked on the chart).

Stop Loss: Below the recent wick low at approximately $0.49.

Conclusion: Divergence on higher timeframes often precedes significant moves. Keep an eye on volume to confirm the breakout!

POTENTIAL BUY OPPORTUNITY ON BTCUSDBTCUSD dipped and found a low around the $60,333 level I anticipate buyers to step in as this level also shares confluence with the 61.8% fibo retracement level from the higher timeframe 3 months chart. Therefore, I’m longing BITSTAMP:BTCUSD from the current market price. Target is around the $80k level

UJ ShortM/W: Uptrend, hitting resistance level

D: Uptrend, respecting the lows

4H: Downtrend, price broke trend and retraced 61.8% on major FIB

1H: Uptrend, price is consolidating and resisting previous zone + BEARISH divergence on RSI.

CURRENTLY: I'm looking for price to go short to previous support/resistance zone

Exits

TP1 @ minor support/resistance

TP2 @ previous major resistance zone

ADOBE [ADBE] EWP TC FIB ANALYSIS MONTHLY TFADOBE (ADBE) – Monthly Elliott Wave Count

ADBE continues to trade inside its multi-decade bullish channel and is now approaching the lower boundary near $242, which we consider our primary Wave IV buy zone. From an Elliott Wave Principle perspective, the 2021 high completed Supercycle Wave III, with the current decline unfolding as Supercycle Wave IV (Cycle A–B–C). Wave C appears mature on higher timeframes: momentum is deeply reset on the monthly RSI, price action remains corrective (not impulsive), and we’re seeing classic late-stage Wave C behaviour near structural support.

Key confluence at $230–$250:

– lower secular channel support

– ~0.382 retrace of Supercycle III

– historical RSI cycle lows

> This strongly favours Wave IV termination in this region.

Invalidation:

A decisive monthly close below ~$200, followed by loss of channel support, would invalidate this count and open risk toward the 0.5–0.618 retracement zone (~$125–$160). Until then, $242 remains support, not hope.

NASDAQ confirmation:

The Nasdaq Composite remains in a corrective structure rather than an impulsive bear leg, supporting the interpretation that this is a broader Cycle/Supercycle Wave IV correction across tech — not the start of a secular bear market.

Assuming Wave IV completes near $242, projected Wave V targets align with the upper channel and Fib extensions in the $1,300–$1,350 region (≈ +456% from the Wave IV low), consistent with a final Supercycle Wave V advance.

Bottom line:

We’re positioned in the late stages of Wave IV, watching the $242 area as our buy zone. If this level holds, ADBE sets up for a multi-year Wave V move toward ~$1,346. Patience here matters.

Like and follow for more charts like this.

BCH/USDT 1D Chart🧭 Market Structure (HTF – Daily)

📉 Trend

Long-term: uptrend (orange trend line)

Medium-term: correction in an uptrend

Currently, the price has broken the local HH → HL structure and returned to important levels.

This is NOT a downtrend reversal yet, but a warning.

🧱 Key Levels (you've got this one figured out)

🟢 Resistance

564 USDT – mega-important (local S/R + trend intersection)

604 USDT

653 USDT – main HTF resistance

No D1 close above 564 → no confirmation of bullish strength.

🔴 Supports

506 USDT – currently being tested (local S/R)

460 USDT – very strong support (reactions + structure)

409 USDT – last line of defense, things get ugly below

📐 Trendlines

The blue bearish (HTF) has been rejected

The price has fallen below the crossover:

uptrend

MA (red)

👉 This is a classic corrective signal, not a panic signal.

📊 RSI & Stoch RSI

RSI (lower panel)

RSI ~ 40

Not oversold yet

No bullish divergence on D1

➡️ There is room for a further decline before a strong bounce occurs.

Stoch RSI

Often in extreme zones → nervous market

Currently not giving a clear long signal

🔮 Scenarios (most important)

🟡 Baseline scenario (most likely)

Consolidation / drop to:

460 USDT

There:

demand reaction

potential higher low

Only then an attempt to attack 564 → 604

👉 A healthy correction in the uptrend.

🔴 Negative scenario

Daily close < 460

Then:

quick move to 409

deeper accumulation possible

This would be a signal of medium-term weakness.

🟢 Bullish scenario (less likely NOW)

Quick return above:

506 → 540

Daily close > 564

Targets:

604

653

Without this, every raise is a pullback.

TOTAL3 (1W) — Elliott Wave White Scenario

TOTAL3 often produces overlap, messy structure, and wick traps. This idea is valid only if price respects the levels listed below and especially the 580B weekly rule.

Bigger Picture (Wave Structure)

We are dealing with Wave 5 of 5 on a higher degree.

Wave 3 (higher degree) topped on December 2, 2024 (weekly).

From that top, the market has been correcting in Wave 4 (higher degree) as an A–B–C structure:

Wave A completed down.

Wave B overshot and topped on October 6, 2024.

We are now in Wave C (sub-degree inside Wave 4). This is the final leg that should complete Wave 4 and set the stage for the higher-degree Wave 5.

Hard Levels (Use These Only)

Wave 4 retracement levels (higher degree):

0.382 = 684B

0.5 = 580B (this is the lifeline for the white scenario)

Wave C extension levels (sub-degree):

1:1 extension = 695B

1.236 extension = 611B

1.388 extension = 564B

1.68 extension = 495B (this is too low to accept; a wick is possible, but sustained break is not allowed)

Definition (Non-Negotiable)

A sustained break means a weekly close below the level.

A wick below a level does not count.

Wave 4 Completes and Wave 5 Begins

Core condition:

Price must hold above 580B on weekly closes.

Why 580B matters:

580B is the 0.5 retracement for Wave 4 on the higher degree. In this scenario, Wave 4 is either already finished or finishing, but it cannot be accepted below 580B on a weekly basis. If the market starts closing below 580B, you are no longer in a “Wave 4 completion into Wave 5” environment. The whole thesis collapses.

Where Wave C can finish:

If 580B holds on weekly closes, Wave C can complete in one of these ways:

Shallow completion around 695B (1:1 extension), meaning the correction ends early and the market attempts to turn up sooner.

Deeper completion into 611B (1.236) or 564B (1.388), meaning Wave C still needs more downside before it finishes, but it must do it without a weekly close below 580B.

Important note about 495B:

495B (1.68) is considered too low for acceptance in the white scenario. You can get a wick down there in a panic, but you should not see sustained trading and weekly acceptance below it. In other words: a spike is possible, but a real breakdown is not part of this scenario.

What “Wave 4 completion” should look like in real price action

Since TOTAL3 is messy, the confirmation has to be structural, not emotional. If Wave C is ending and Wave 4 is completing, you want to see:

Selling pressure start to weaken as price approaches the Wave C extension zones (695B first, then 611B/564B if it goes deeper).

A transition from falling swings to stabilization (loss of downside follow-through).

Then the market should be able to reclaim and hold above 684B (0.382). That reclaim is the key “this is not just a bounce” signal and it aligns with the idea that Wave 5 is starting to take control.

How to interpret 684B in this scenario:

684B is not just a random number. It is the 0.382 retracement of Wave 4 and acts like a gate. If price can reclaim 684B and hold it, it strongly supports the idea that Wave 4 is behind us and that the market is transitioning into Wave 5 (higher degree). If price cannot reclaim 684B and keeps rejecting, then any bounce is suspect and can still be part of a corrective mess.

Invalidation (Hard Rule)

Weekly close below 580B invalidates the white scenario.

Not a wick. Not an intraday break. A weekly close below 580B.

Summary

The whole thesis is simple:

We are in the final stages of Wave 4 (A–B–C) after the Wave 3 top on Dec 2, 2024. Wave B topped on Oct 6, 2024. Now Wave C is the last leg down. Wave C can finish shallow at 695B or push deeper to 611B or 564B, but the white scenario stays valid only if the market does not accept below 580B on a weekly close. If 580B holds, the next step is for price to eventually reclaim and hold above 684B, which is the confirmation zone that Wave 5 is beginning.

NZDCAD Will Fall From Major Support LevelHello Traders

In This Chart nzdcad HOURLY Forex Forecast By FOREX PLANET

today NZDCAD analysis 👆

🟢This Chart includes_ (NZDCAD market update)

🟢What is The Next Opportunity on NZDCAD Market

🟢how to Enter to the Valid Entry With Assurance Profit

This CHART is For Trader's that Want to Improve Their Technical Analysis Skills and Their Trading By Understanding How To Analyze The Market Using Multiple Timeframes and Understanding The Bigger Picture on the Charts

AVAX / USD [AVALANCHE] EWP TC FIB ANALYSIS WEEKLY TFAVAX remains inside a long-term descending channel, keeping the macro bias bearish. The 2024 rally topped near the 0.618 Fib + channel resistance, consistent with a Wave B in an ABC correction. Price has since broken support and appears to be unfolding Wave C, likely as a 5-wave impulse. Current structure suggests further downside toward the $6 region (possibly lower) before any meaningful macro bottom can form. Only a reclaim of $20 and a channel breakout would invalidate this bearish count. Until then, rallies remain corrective.

Like and follow for more charts like this.

Copper -- Bullish Perception - High Risk and Reward TradeCopper: Head and shoulder, right shoulder formation.

1. Right Shoulder in formation.

2. Head and shoulder formation at previous highs (all-time high).

3. Right shoulder trying to break n-1 highs and strong resistance - 6.174

Bullish scenario is price crosses value (Candle close) - 6.174

Entry price -- 6.05 to 6.17 (daily candle close)

Stop loss -- 5.6 (little high)

targets --

targets1 -6.4

targets2 -6.6

target3-7.09

target4-7.79