XAUUSD – Short Idea (15-Minute Chart)Market Structure:

Price is trading within a rising channel, showing short-term bullish structure. However, the move is corrective in nature as price approaches higher-timeframe resistance (PDH) while remaining in a premium area of the range.

Key Technical Confluences:

Price reacting near the upper boundary of the rising channel

PDH acting as overhead resistance

Bullish candles losing momentum near highs

Potential for a pullback after premium re-pricing

Bias:

🔴 Bearish reaction favored from channel resistance

Execution Framework:

Short opportunities become valid on clear rejection from channel resistance

Invalidation if price shows strong acceptance above PDH

Downside potential toward channel midline and prior intraday structure

Risk Management:

Wait for confirmation before execution

Keep risk defined and position size controlled

Market conditions can shift quickly

Conclusion:

As long as price remains below PDH and respects the rising channel resistance, short-side pullbacks remain technically justified within the current structure.

⚠️ This analysis is for educational purposes only and does not constitute financial advice.

Forex

Bearish reversal off pullback resistance?Fiber (EUR/USD) is rising towards the pivot, which is a pullback resistance and could reverse to the 1st support, which is a pullback support that aligns with the 50% Fibonacci retracement.

Pivot: 1.1941

1st Support: 1.1837

1st Resistance: 1.2039

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party.

EURUSD Equal Highs Formed Before Bearish ContinuationQuick Summary

EURUSD formed Equal Highs after the recent strong rally and the Price is now likely targeting a demand zone before continuing lower

The overall move remains corrective within a broader bearish reaction from the monthly timeframe

Target remains 1.17665

Short entries require a clear CHOCH or strong rejection confirmation

Full Analysis

Following the strong bullish expansion, EURUSD has now formed Equal Highs (EQH), creating a clear liquidity pool above price.

This structure suggests that the recent rally may have primarily aimed at engineering liquidity rather than initiating a sustainable bullish trend.

The pair is now expected to target a nearby demand zone as part of a corrective retracement before resuming its broader bearish continuation.

The downside objective remains 1.17665, aligning with the current bearish order flow and the strong reaction previously initiated from the monthly timeframe.

Despite the recent upside movement, bearish pressure remains dominant.

However, entering short positions directly from this area carries risk.

A confirmed Change of Character (CHOCH) on lower timeframes or a strong rejection signal (such as a clear bearish engulfing candle or displacement move) is required to validate the entry

XAGUSD Bearish Continuation After Pullback

The 2H Silver (XAGUSD) chart shows a clear bearish structure following a strong sell-off and break of structure (BOS). Price attempted a pullback into a marked supply/resistance zone and aligned with a descending trendline, but selling pressure resumed. The market is now consolidating below the trendline, suggesting continuation to the downside. The projected target lies near the lower demand zone around the mid-60s, indicating sellers remain in control unless price reclaims the supply area.

GBPUSD Bullish Recovery Toward Key Resistance

The 1H GBPUSD chart shows a sharp bearish move within a descending channel, followed by a strong bullish reversal from the lower demand zone. Price has broken out of the channel and formed higher highs and higher lows, signaling a short-term trend shift to the upside. The recent pullback found support, and buyers are pushing price higher toward the marked first target near the previous resistance area around 1.3740–1.3760. As long as price holds above the demand zone, bullish momentum remains favored.

Silver Is Compressing Below Supply — Breakout or RejectionSilver has staged a strong recovery from the support area, forming a sequence of higher lows along the rising trendline. This confirms that buyers are active and defending pullbacks, keeping the short-term structure constructive.

However, price is now compressing directly beneath a well-defined supply zone, where previous upside attempts were capped. The recent candles show overlapping ranges and reduced momentum, suggesting absorption and indecision, not a clean breakout yet. This is typical behavior when the market is deciding between continuation and rejection.

As long as price holds above the rising trendline and the support area, the bullish structure remains intact. A confirmed breakout and acceptance above the supply zone would open the door toward the higher supply premium area (goal). Failure to break, on the other hand, could trigger a pullback toward trendline support before the next attempt.

Bullish continuation: Clean break + hold above supply → expansion toward the marked goal.

Corrective pullback: Rejection at supply → retrace toward trendline / support area, structure remains bullish if higher lows hold.

Mindset: Let price prove the breakout. Compression at supply is a decision point, not a signal by itself.

Silver Under Pressure – Sellers Are in ControlXAGUSD is currently clearly leaning toward a short-term BEARISH trend, as both recent news and the technical structure fail to support a sustainable bullish move.

From a news perspective , silver is facing pressure from profit-taking after the previous strong rebound , while the U.S. dollar and U.S. Treasury yields are showing signs of stabilization. This has made short-term capital more cautious toward metals like silver , which are highly sensitive to USD fluctuations. When safe-haven demand is not strong enough, rallies in XAGUSD are more likely to be viewed as selling opportunities.

On the H4 timeframe, the bearish structure remains firmly intact . Price is still below the Ichimoku cloud and moving within a descending trend channel, confirming that sellers continue to control the market. Recent rebounds have only produced lower highs, highlighting weak buying pressure and a lack of follow-through.

The 86.0–86.4 zone is acting as a key resistance area , where the descending trendline and the Ichimoku cloud converge. Repeated rejection from this zone would further reinforce the bearish scenario . If XAGUSD fails to break and hold above this resistance, the probability strongly favors a renewed move lower, with an initial target near 70.0, followed by a deeper extension toward 69.9, as highlighted on the chart.

In summary, XAGUSD is currently in a technical rebound within a larger downtrend. The most sensible approach at this stage is to prioritize SELL setups on rallies, patiently waiting for price-action confirmation, rather than attempting to catch a bottom while the dominant trend remains unfavorable for buyers.

EU Bulls Raise A FlagFX:EURUSD has fallen into a Consolidation after quite an impressive rally and what we could be seeing is a popular Continuation pattern, the Bull Flag!

With a Bull Flag, we should expect price to deliver a Bullish Breakout of the Falling Resistance of the Channel, accompanied with a Retest of that Breakout.

Once a valid Breakout and successful Retest is made, this pattern should generate Long Opportunities.

AUD-JPY Bullish Continuation! Buy!

Hello,Traders!

AUDJPY strong uptrend holds as price respects demand after liquidity sweep. Bullish BOS and impulsive structure suggest continuation toward buy-side liquidity above recent highs. Time Frame 4H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

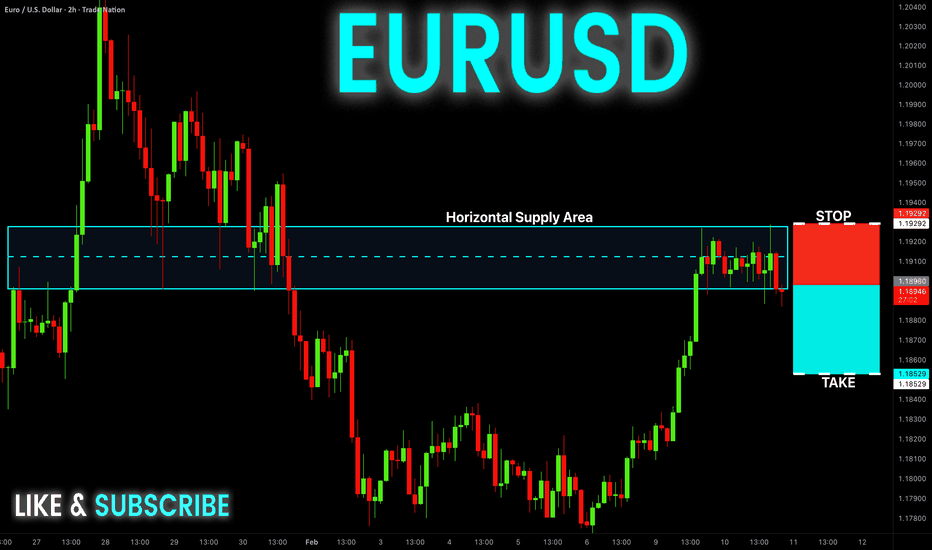

EURUSD FREE SIGNAL|SHORT|

✅EURUSD double top forms inside premium, followed by bearish displacement and MSS. Failed continuation signals mitigation lower, with sell-side liquidity resting below the range.

—————————

Entry: 1.1905

Stop Loss: 1.1929

Take Profit: 1.1870

Time Frame: 2H

—————————

SHORT🔥

✅Like and subscribe to never miss a new idea!✅

GBP-CAD Bearish Breakout! Sell!

Hello,Traders!

GBPCAD breaks below a key supply base with strong displacement. Bearish BOS confirms distribution, exposing sell-side liquidity toward lower imbalance zones. Time Frame 4H.

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EUR-USD Free Signal! Sell!

Hello,Traders!

EURUSD sweeps buy-side liquidity into a major supply zone. Strong bearish reaction and BOS confirm smart money distribution, opening room toward sell-side liquidity.

--------------------

Stop Loss: 1.1992

Take Profit: 1.1853

Entry: 1.1898

Time Frame: 2H

--------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

TheGrove | EURUSD buy | Idea Trading AnalysisEURUSD broke through multiple Support level and is now holding above the trendline and key level zone. The current pullback toward the marked support cluster suggests a potential continuation of the bullish move, provided price holds this structure.

EUR/USD is trading within a rising channel, with price holding above the ascending support line after a clear bullish and is moving on Resistance LEVEL.

Hello Traders, here is the full analysis.

GOOD LUCK! Great BUY opportunity EURUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

TheGrove | GBPUSD buy | Idea Trading AnalysisGBP/USD is trading within a rising channel, with price holding above the ascending line after a clear bullish and is moving on Resistance level.

We expect a decline in the channel after testing the current level.

We expect a decline in the channel after testing the current level

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great BUY opportunity GBPUSD

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad ⚜️

TheGrove | CADJPY Sell | Idea Trading AnalysisYou can expect a reaction in the direction of selling from the specified Resistance area

CADJPY moving higher as it tests the strong resistance level..

We expect a bearish move from the confluence zone.

Hello Traders, here is the full analysis.

I think we can soon see more fall from this range! GOOD LUCK! Great SELL opportunity CADJPY

I still did my best and this is the most likely count for me at the moment.

-------------------

Traders, if you liked this idea or if you have your own opinion about it, write in the comments. I will be glad 🤝

EURUSD 8-month Channel Up on a Bearish Leg.The EURUSD pair has been trading within a Channel Up since June and following the January 27 2026 Higher High rejection on an overbought 1D RSI, it started its latest Bearish Leg.

Yesterday's rise resembles the Lower High that both previous Bearish Legs had (orange circles) before they resumed the downtrend to the bottom of the Channel Up and the 0.786 Fibonacci retracement level.

As a result, our short-term Target is 1.16850, which will make a 1D MA200 (orange trend-line) test as well. If the 1D RSI hits its Support Zone earlier, book the profit regardless.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

GBPCAD: Bullish Continuation is Highly Probable! Here is Why:

It is essential that we apply multitimeframe technical analysis and there is no better example of why that is the case than the current GBPCAD chart which, if analyzed properly, clearly points in the upward direction.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

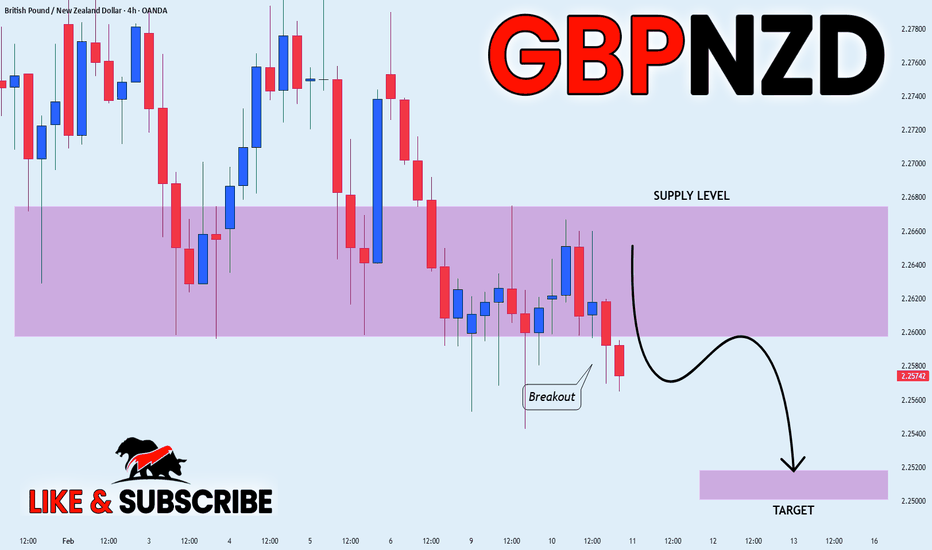

GBPNZD: Bullish Continuation & Long Trade

GBPNZD

- Classic bullish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Long GBPNZD

Entry - 2.2589

Sl - 2.2572

Tp - 2.2619

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD Trading Opportunity! BUY!

My dear subscribers,

GBPUSD looks like it will make a good move, and here are the details:

The market is trading on 1.3653 pivot level.

Bias - Bullish

My Stop Loss - 1.3639

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.3678

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

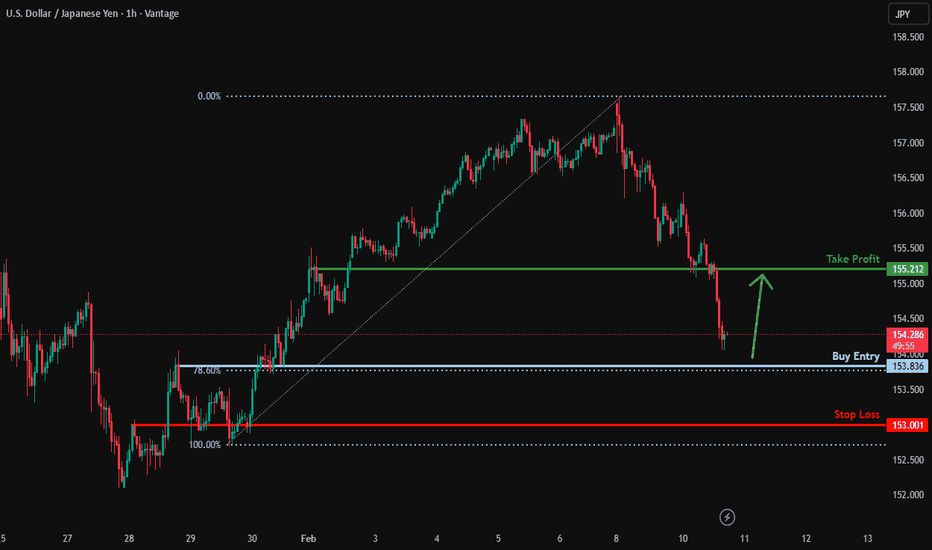

Potential bullish reversal?USD/JPY is falling towards the support level, which is an overlap support that aligns with the 78.6% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 153.83

Why we like it:

There is an overlap support that aligns with the 78.6% Fibonacci retracement.

Stop loss: 153.

Why we like it:

There is an overlap support level.

Take profit: 155.21

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.