GBPJPY reaching the best level for long-term buying.The GBPJPY pair has been trading within a 10-month Channel Up since the April 09 2025 market bottom. In the past 2 weeks it is on a technical Bearish Leg as following a +8.60% Bullish Leg, it topped and the correction broke below the 1D MA50 (blue trend-line) yesterday.

This has always been an early Buy Signal, with the last two breaks even touching and rebounding exactly on the 1D MA100 (green trend-line). In fact this 8.60% Bullish Leg into correction resembles the one that led to the August 04 2025 Higher Low just above the 1D MA100. The 1D RSI sequences among those two fractals are identical and with the RSI about to enter its Support Zone, we are about to get the strongest Buy Signal.

Our Target is at least the 1.786 Fib extension (like October 08 2025) at 220.000.

---

** Please LIKE 👍, FOLLOW ✅, SHARE 🙌 and COMMENT ✍ if you enjoy this idea! Also share your ideas and charts in the comments section below! This is best way to keep it relevant, support us, keep the content here free and allow the idea to reach as many people as possible. **

---

💸💸💸💸💸💸

👇 👇 👇 👇 👇 👇

Forex

EURCHF Readies An Inverse Head and ShouldersOANDA:EURCHF has exhibited strong indications of a Bullish Reversal possible with the formation of an Inverse Head and Shoulders!

Price has made it back to the "Neckline" or Resistance @.9138, that has been holding price down and helping form the pattern which is not completed!

If price is successful in making a Breakout of the Neckline, this will generate Long Opportunities to take from the Neckline up to the next Resistance level!

XAUUSD: Liquidity Grab Below Support, Expansion Ahead To $5,110Hello everyone, here is my breakdown of the current XAUUSD setup.

Market Analysis

Gold has been trading within a well-defined bullish environment, previously respecting a clean ascending channel, where price consistently formed higher highs and higher lows. This structure reflected strong buyer dominance and healthy trend continuation rather than impulsive exhaustion. During this phase, XAUUSD also went through a consolidation range, signaling accumulation before the next impulsive move. The breakout from the range triggered a strong bullish impulse, pushing price aggressively toward the 5,110 Resistance Zone, where sellers became active. This area acted as a major supply zone, leading to a sharp rejection and a deep corrective move. Price dropped impulsively, breaking below the rising channel and testing lower liquidity, which marked a short-term shift in market structure.

Currently, XAUUSD is stabilizing above the reclaimed support zone, with multiple breakout attempts confirming acceptance above demand. This price behavior indicates that buyers are gradually regaining control, while sellers are unable to push price back below key support.

My Scenario & Strategy

My primary scenario favors a bullish continuation, as long as XAUUSD holds above the 4,970 Support Zone and continues to respect the rising triangle support line. The recent reclaim and consolidation above support suggest that the prior drop was a fake breakdown, not the start of a sustained bearish trend. From a structural perspective, pullbacks toward the support zone are considered corrective, offering potential continuation opportunities rather than reversal signals. The next key upside objective lies at the 5,110 Resistance / Supply Zone (TP1), which aligns with previous supply and remains the main barrier for further upside. A clean breakout and acceptance above the 5,110 resistance would confirm bullish continuation and open the door for a renewed expansion toward higher levels.

However, a decisive breakdown and acceptance below the support zone and triangle support line would invalidate the bullish scenario and signal a return of bearish pressure. For now, structure favors buyers, with Gold holding above key demand and building strength for the next directional move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

XAUUSD Range Accumulation → Potential Upside BreakGold (XAUUSD) is currently trading inside a structured accumulation range on the 1H timeframe. Price has been respecting a strong support base around the 4,980–5,020 zone while forming higher lows, indicating steady buying interest and controlled consolidation.

The chart highlights repeated bounce patterns from support, suggesting institutional demand and liquidity collection before a potential continuation move. Price is now testing the upper range near 5,100–5,150, where resistance has previously rejected bullish attempts.

A sustained hold above the range support keeps the bullish structure intact, while a clean break and hold above the upper resistance area could open room toward higher target zones near 5,145 and 5,188. As long as price remains inside this structure, expect consolidation with breakout potential.

This analysis is for educational and informational purposes only and reflects technical structure, not financial advice. Always manage risk and confirm with your own strategy before making trading decisions.

CADJPY - Range High Pressure!CADJPY is currently hovering right at the upper bound of its range, a level that has repeatedly acted as a ceiling for price.

Each time price reached this area in the past, upside momentum faded and sellers stepped in.

As long as this resistance zone holds, the focus stays on short setups, looking for a rotation back toward the middle or lower end of the range.

For the bears to fully take over, we need confirmation.

That confirmation comes with a break below the last low marked in red. A clean break there would signal that sellers are gaining control and that downside continuation becomes more likely.

Will this range reject price once again… or is a breakout brewing? 👀

⚠️ Disclaimer: This is not financial advice. Always do your own research and manage risk properly.

📚 Stick to your trading plan regarding entries, risk, and management.

Good luck! 🍀

All Strategies Are Good; If Managed Properly!

~Richard Nasr

GOLD 11/02 – H2 ROUTE MAP | COMPRESSION ABOVE 5000Gold is tightly compressed above the 5000 mark after a recovery sequence from the 44xx bottom.

USD weakens but the price has yet to break 5100 to confirm an upward structure.

When the market is trapped in a narrow range, a sudden move often comes without warning.

MACRO CONTEXT

No official negotiations between the US and Iran this week → geopolitical risks remain simmering.

US economic data disappoints → USD continues to weaken in the short term.

However, capital flow has not strongly returned to gold → the upward force still lacks long-term commitment.

➡️ Gold has macro support, but lacks a significant catalyst to break out of the equilibrium zone.

TECHNICAL STRUCTURE H2

After the early month CHoCH decline, the price formed a 44xx bottom and recovered.

Currently, the price is accumulating within the 5000 – 5100 range.

The short-term FVG below is continuously maintained → indicating support exists.

But above, there remains a supply zone not fully absorbed.

➡️ This is a compression state before a breakout, not a clear trend.

ROUTE MAP – PRICE ZONES TO WATCH

🔴 UPPER ZONE

5090 – 5145

Nearest peak

Fib extension mark

H2 technical resistance

➡️ If it holds above 5145 → opens up a rally towards 5250.

🟢 LOWER ZONE

4980 – 5000

H2 FVG

Current equilibrium zone

4860 – 4900

Fib 0.618

Important H2 demand

4680 – 4700

Deep Fib 0.382

Zone to reactivate the downward structure if broken

HOW LUCASGRAY IS MONITORING NOW

The price is trapped between 5000 and 5100.

When the market accumulates for many consecutive sessions in a narrow range, there is a high probability of a strong liquidity move this week.

We:

Do not predict the direction.

Wait for acceptance above 5100 or loss of 5000.

Clearly separate scalp within the range and swing according to breakout.

Current bias: NEUTRAL – waiting for a break of 5000 or 5100 to confirm direction.

— LucasGrayTrading

GOLD Today NFPHi, I’m Maicol, an Italian trader.

I study Gold since 2019.

I need your support.

Leave a like and follow me.

It’s a small thing for you, but important for my work.

Please read the description to understand the trading plan.

Don’t focus only on the chart. Thanks.

Live today at 14:00 CET (Rome time).

🌞 GOOD MORNING EVERYONE 🌞

Yesterday Gold closed the daily candle bearish, but it is still holding above our key level.

For now, I remain bullish until we see a daily close below 5000.

A confirmed daily repositioning below that level would change the bias.

What to watch today?

NFP at 14:30.

After NFP, monitor:

Yesterday’s daily lows

The dynamic liquidity zone

A potential trap around the gap / the area marked with the spheres

The initial price reaction will be crucial.

If price pushes immediately and aggressively toward the 5100 daily imbalance, it may become difficult to look for longs from the marked levels.

If instead price drops first, takes liquidity, and then reacts, we could have a more valid setup — always keeping today’s data in mind.

We’ll go through everything live at 14:00.

With the chart in front of us, it will be much clearer.

See you later and have a great Wednesday.

🔍 Reminder 🔍

I avoid trading during the Asian and London sessions.

I focus on the 14:30 news and the New York open at 15:30.

🔔 Turn on notifications so you don’t miss anything.

📬 If you have any questions, message me. I’ll reply.

🔍 NEXT APPOINTMENTS 🔍

As usual, we’ll be live at 14:00 to follow the market in real time.

In the meantime, have a good day.

-GOOD TRADING

-MANAGE RISK

-BE PATIENT

GBP/USD | what's ahead? (READ THE CAPTION)Good morning folks, Amirali here.

As you can see, after yesterday's fall, GBPUSD went well below the Jan 26th NWOG and Feb 5th NDOG. However, it made an upwards move after the initial drop and is now being traded at 1.3670, just above the Jan 26th NWOG High.

Now, if the price holds above 1.3670 in the next 2 hours, I can see it go for the Feb 2nd NWOG and for 1.37000.

For the time being, the targets are: 1.3680, 1.3690 and 1.3700.

If it fails to hold above this level, the targets will be: 1.3670, 1.3663, 1.3656 and 1.3650.

Bitcoin Rejected at Resistance — Is 63K the Next Magnet?Bitcoin is currently trading inside a short-term bearish structure after failing to reclaim the 68.5K resistance zone. Price attempted a minor recovery but was rejected cleanly from the lower boundary of the previous range, confirming that former support is now acting as resistance.

1️⃣ Market Structure

- Clear lower highs forming on the right side of the chart.

- EMA cluster is sloping downward short-term momentum favors sellers.

- Price is trading below both dynamic resistance levels.

The inability to hold above 68.5K signals weak bullish follow-through. This suggests the market is in a distribution-to-markdown transition rather than accumulation.

2️⃣ Key Levels

Resistance Zone: ~68,000 – 68,500

This level is now a supply flip. Any bounce into this area is likely to face selling pressure unless strong momentum reclaims it.

Support Zone: ~63,000 – 63,500

This is the next high-liquidity demand area. If bearish pressure continues, this zone becomes the primary downside magnet.

The projected path suggests:

Minor relief bounce

Followed by continuation lower toward support

3️⃣ Invalidation Scenario

Bearish bias weakens if:

Price closes decisively above 68.5K

EMAs flatten and reclaim structure

Higher high forms on H1

Until that happens, rallies remain corrective within a developing downtrend.

Trader’s Mindset

Bitcoin is not breaking down impulsively yet but it is failing to reclaim resistance.

That is often how markdown begins.

👉 Trade the structure. Respect the resistance flip.

63K is the liquidity pool that matters next.

GBPJPY Is Bullish! Buy!

Please, check our technical outlook for GBPJPY.

Time Frame: 4h

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 209.949.

Considering the today's price action, probabilities will be high to see a movement to 212.016.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

Potential 600Pips on EURAUDWait for price to rally into the 1.7780 – 1.7805 region.

Confirmation:

A structural shift, confirmed by a break and close below 1.7690.

Possible Entries

Entry 1

Sell Limit @ 1.7885

Stop Loss @ 1.7838

Entry 2

Sell Limit @ 1.7870

Stop Loss: Refined on entry

Target Levels

T1: 1.7484

T2: 1.7330

T3: 1.7180

This move can be anticipated to develop between 19:00 UTC, 17th December 2025 and 02:00 UTC, 26th January 2026.

This setup offers a projected risk-to-reward of approximately 1:11 when executed from refined entries.

Trade Safe.

Patience is the Way!

Ieios

CHFJPY: Bullish Push to 203?FX:CHFJPY is eyeing a bullish continuation on the 4-hour chart , with price forming higher highs and higher lows within an upward channel, converging with a potential entry zone that could fuel upside momentum if buyers defend amid recent volatility. This setup indicates a rally opportunity post-pullback, targeting higher levels with approximately 1:2.5 risk-reward .🔥

Entry between 200.600–201.000 for a long position. Target at 203.000 . Set a stop loss at a daily close below 200.250 , yielding a risk-reward ratio of approximately 1:2.5 . Monitor for confirmation via a bullish candle close above entry with increasing volume, capitalizing on the pair's upward bias in the channel.🌟

Fundamentally , CHFJPY is trading around 201 in early February 2026, with key events this week potentially influencing direction. For the Swiss Franc, Wednesday February 4 at 3:30 AM UTC brings the SVME Purchasing Managers Index (Feb), where a reading above 50 could strengthen CHF amid manufacturing recovery. For the Japanese Yen, Tuesday February 3 at 3:35 AM UTC features the 10-Year JGB Auction , with higher yields potentially weakening JPY if demand softens. Overall, positive CHF data versus JPY auction outcomes could favor upside in CHFJPY. 💡

📝 Trade Setup

🎯 Entry (Long):

200.600 – 201.000

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 203.000

❌ Stop Loss:

• Daily close below 200.250

⚖️ Risk-to-Reward:

• ~ 1:2.5

💡 Your take?

Do you see CHFJPY extending toward 203.00, or does price need more consolidation before the next impulse? 👇

GBPUSD: Bearish Drop to 1.334?FX:GBPUSD is eyeing a bearish reversal on the 4-hour chart , with price testing resistance after recent highs in an upward trendline from June 2025, converging with a potential entry zone that could spark downside momentum if sellers defend amid volatility. This setup suggests a pullback opportunity post-rally, targeting lower support levels with more than 1:2 risk-reward .🔥

Entry between 1.3566–1.3586 for a short position. Target at 1.3341 . Set a stop loss at a close above 1.3664 , yielding a risk-reward ratio of more than 1:2 . Monitor for confirmation via a bearish candle close below entry with rising volume, leveraging the pair's dynamics near resistance.🌟

Fundamentally , GBPUSD is trading around 1.357 in early February 2026, with key events this week. For the US Dollar, Nonfarm Payrolls (Jan, forecast 50K) on February 6 at 1:30 PM UTC, the week's highlight—weak data could favor GBP upside. 💡

📝 Trade Setup

🎯 Entry (Short):

1.3566 – 1.3586

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 1.3341

❌ Stop Loss:

• Close above 1.3664

⚖️ Risk-to-Reward:

• > 1:2

💡 Your view?

Is this the start of a healthy pullback toward 1.3340, or will GBP bulls push through resistance and extend the rally? 👇

GBP/CHF LONG FROM SUPPORT

Hello, Friends!

Previous week’s red candle means that for us the GBP/CHF pair is in the downtrend. And the current movement leg was also down but the support line will be hit soon and lower BB band proximity will signal an oversold condition so we will go for a counter-trend long trade with the target being at 1.056.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/CHF BEARS WILL DOMINATE THE MARKET|SHORT

EUR/CHF SIGNAL

Trade Direction: short

Entry Level: 0.913

Target Level: 0.910

Stop Loss: 0.914

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Silver Is Compressing at Range High — Breakout Loading?Silver Is Compressing at Range High — Breakout Loading?

Silver on H1 is clearly trading inside a well-defined sideway range, with price now pressing into the upper resistance zone (~83.8 – 84.2).

📊 Structure Overview

- After the aggressive sell-off, price formed a base near the 78.5 support zone.

- Strong impulsive recovery created a shift in short-term structure (higher lows).

- Now price is rotating inside a rectangular range.

- EMAs are flattening and slightly turning up → momentum is stabilizing, not expanding yet.

- Current candles are testing the range high multiple times → compression effect.

Repeated tests of resistance without deep rejection often signal liquidity build-up, not weakness.

🧠 Scenario Planning

Bullish Case

Clean H1 close above 84.2

Followed by shallow pullback holding above breakout level

→ Expansion toward 84.6+ (marked target).

Bearish Case

Strong rejection wick or bearish engulfing at resistance

→ Rotation back toward mid-range (81.5)

→ Deeper move into support 78.5 if momentum accelerates.

🎯 Trading Logic

Inside a range:

Buy discount (support).

Sell premium (resistance).

Or wait for confirmed breakout with acceptance.

Right now price sits at premium.

No breakout confirmation yet → patience > prediction.

Silver is not trending.

It is compressing and compression precedes expansion.

Trade what you see, not what you hope.

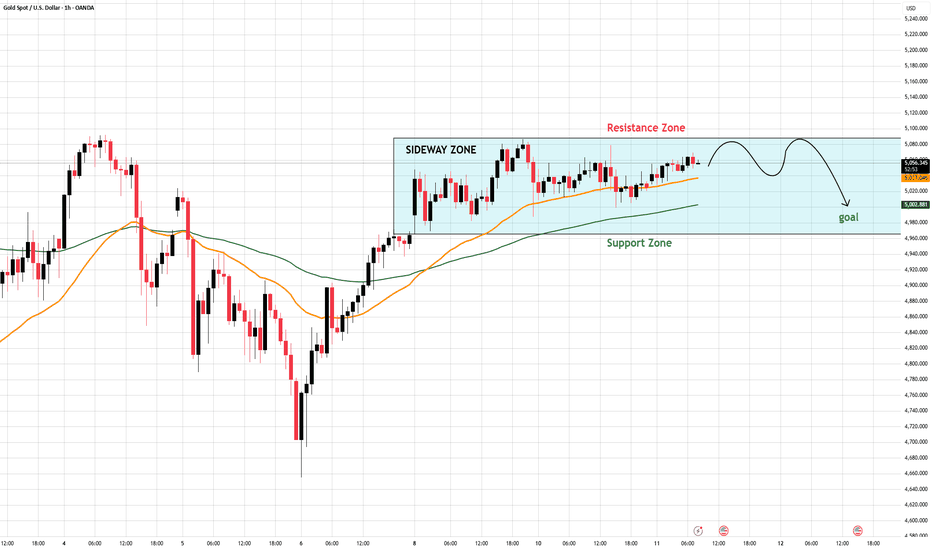

Gold Is Compressing at Range High — Breakout or Bull Trap?On the H1 chart, Gold is clearly trading inside a defined sideway range, with price now hovering near the upper boundary (Resistance Zone ~5,080 area).

📊 Market Structure

- After the sharp recovery from the previous sell-off, price transitioned into range equilibrium.

- The EMA cluster (short & mid-term) is flattening and slightly rising → indicating balance, not expansion.

- Higher lows inside the range show mild internal bullish pressure.

- However, price is still capped below clear resistance → no confirmed breakout yet.

🧠 What This Means

This is classic range compression near resistance.

Two scenarios:

Bullish Case

Clean H1 close above resistance

Followed by acceptance + shallow pullback → Expansion toward new highs.

Bearish Case

Rejection wicks + bearish engulfing near resistance → Rotation back to mid-range or even support zone (~4,980–5,000).

🎯 Trading Logic

In a sideway market:

Buy near support.

Sell near resistance.

Or wait for confirmed breakout with structure shift.

Right now, price is at premium inside the range → risk-reward favors patience over chasing longs.

Short conclusion:

Gold is not trending,it is deciding.

The breakout must prove itself.

⚠️ Disclaimer

This analysis is for educational purposes only and not financial advice. Markets involve risk and conditions can change at any time. Always manage risk properly and trade what you see, not what you hope.

EUR-JPY Swing Long! Buy!

Hello,Traders!

EURJPY sharp selloff taps higher timeframe demand. Liquidity sweep below equal lows hints at accumulation, with bullish reaction suggesting a retest and continuation from demand soon. Time Frame 12H.

Buy!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

EURGBP (1H CHART PATTERN)...EURGBP 1H chart 👀

I see a clear Head & Shoulders pattern:

Left Shoulder ✔

Head ✔

Right Shoulder forming ✔

Rising neckline (slightly upward sloping)

Bias: Bearish if neckline breaks.

🎯 Downside Targets (Measured Move)

📍 Neckline Area

Around 0.8690 – 0.8700

A confirmed break + close below this level activates the pattern.

🎯 Target 1 (conservative)

≈ 0.8660

First horizontal support

Short-term liquidity area

🎯 Target 2 (full measured move)

≈ 0.8615 – 0.8620

Height from Head → Neckline projected down

Matches my marked lower target

❌ Invalidation

Strong break and hold above 0.8730 – 0.8740

If right shoulder turns into higher high structure

Clean Summary

Activate below: 0.8690

TP1: 0.8660

TP2: 0.8620

(XAGUSD) 2H chart...(XAGUSD) 2H chart 👀

What I see

Strong prior downtrend → now recovery

Descending trendline already broken

Price reclaiming short-term support zone (~80–81)

Attempting to push back into / above Ichimoku cloud

Bullish structure forming (higher lows)

Bias: Short-term bullish continuation unless it falls back below 80.

🎯 Upside Targets

🎯 Target 1 (near resistance)

≈ 92.00 – 93.00

Prior resistance zone

Matches my first marked “target point”

Logical take-profit for partial exit

🎯 Target 2 (major resistance)

≈ 100.00 – 102.50

Strong psychological + structural level

Top of previous breakdown area

Matches my second marked target

🎯 Extension Target (if momentum strong)

≈ 107 – 110

Previous supply area

Cloud top / higher timeframe resistance

❌ Invalidation

Clean break and hold below 79.50 – 80.00

Loss of support zone (red demand area)

Clean Summary

TP1: 92–93

TP2: 100–102.5

TP3: 107+ (extension)

AUD/USD Surge: Navigating the Aussie’s Three-Year HighThe AUD/USD pair recently shattered market expectations by climbing past the 0.7100 threshold. This rally marks a definitive three-year peak for the Australian Dollar. Domestic monetary strength and shifting global dynamics drive this impressive performance. Investors now prioritize the Australian Dollar as a premier "risk-on" asset.

The Monetary Pivot: RBA Takes the Lead

Hawkish commentary from the Reserve Bank of Australia (RBA) ignited the latest surge. The RBA maintains a restrictive stance to combat persistent inflation. Unlike its global peers, the RBA resists premature interest rate cuts. This policy divergence creates a significant yield advantage for the Aussie Dollar.

Geostrategic Leverage and Critical Minerals

Australia occupies a vital position in the modern global supply chain. Its geostrategy focuses on providing critical minerals to Western allies. Nations prioritize Australian lithium and rare earths to decouple from volatile markets. These strategic partnerships ensure consistent capital inflows and bolster the currency's value.

Industrial Innovation and Business Excellence

Australian mining giants lead the world in automation and high-tech integration. Companies deploy autonomous fleets to maximize efficiency and safety. These innovations lower operational costs and increase export volumes. Such robust business models attract significant foreign direct investment into the Australian economy.

Leadership and Corporate Culture

Australian corporate leaders embrace agile management and transparency. They foster cultures that prioritize sustainable growth and technological adoption. This leadership style builds immense investor confidence in Australian equities. Strong corporate governance provides a stable foundation for currency appreciation during volatile periods.

Technological Sovereignty and Cybersecurity

Australia invests heavily in quantum computing and biotechnology. Rising patent filings in green hydrogen technology showcase a diversifying economy. Simultaneously, the government enforces world-class cybersecurity frameworks to protect financial infrastructure. This digital resilience encourages institutional traders to maintain long-term positions in AUD.

Macro Outlook: Risk Appetite and Data

The current market environment reflects a rampant appetite for risk. Global traders are moving away from the safe-haven US Dollar. Upcoming US Non-Farm Payroll data will likely dictate the next short-term move. However, the structural strength of the Australian economy suggests a continued bullish trajectory for AUD/USD.