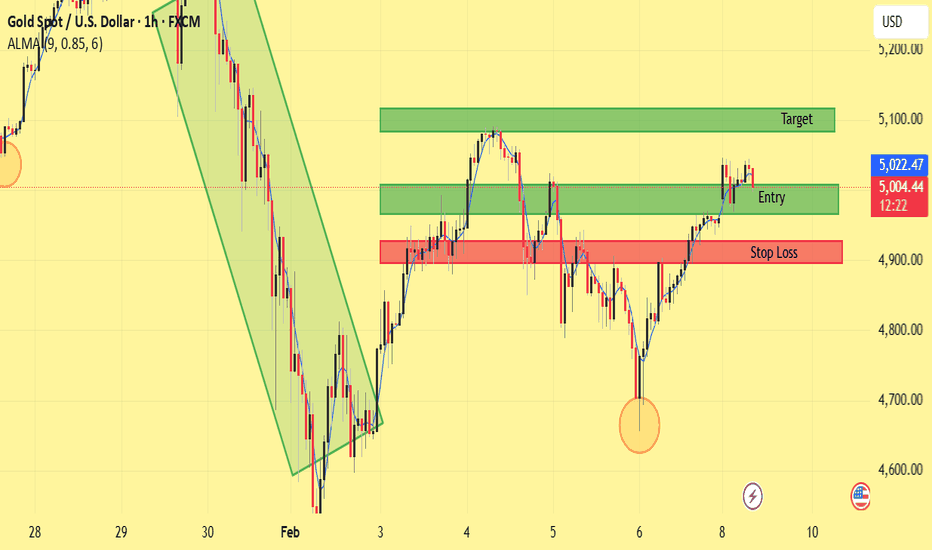

XAUUSD (Gold) – 1H Chart Analysis & Trade IdeaGold has completed a strong corrective phase after the sharp bearish impulse and is now showing signs of trend reversal and bullish continuation. Price respected the recent swing low (marked with the circle), forming a higher low, which confirms improving market structure.

After the rebound, price pushed above the short-term moving average and successfully retested a key demand zone, which now acts as support. This area aligns with previous consolidation, increasing the probability of bullish continuation.

Trade Idea

Entry: Buy from the highlighted green support / entry zone

Stop Loss: Below the red support zone (below recent higher low)

Target: Upper green resistance zone (prior supply area)

Technical Confluence

Higher low formation (bullish structure shift)

Strong rejection from demand zone

Moving average support holding

Previous resistance turned support

Favorable risk-to-reward setup

Conclusion

As long as price holds above the stop-loss zone, the bullish bias remains valid. A sustained move toward the marked target zone is expected. A break below support would invalidate this setup.

This analysis is for educational purposes only. Always manage risk properly.

If you want, I can also:

Rewrite this in short TradingView post style

Translate it into German, French, Spanish, Italian, Turkish, or Polish

Create a title-only version for quick posting

Forex

SILVER (XAGUSD) – 1H CHART PATTERN)...SILVER (XAGUSD) – 1H CHART PATTERN).

Bias: Bullish

(Descending trendline breakout + higher lows)

Buy Zone:

🔹 80.00 – 78.70

Targets:

🎯 TP1: 84.00 – 85.00

🎯 TP2: 92.00 – 96.00

🎯 TP3 (Main Target): 118.00 – 120.00 🚀

Stop Loss:

❌ Below 76.50

Notes:

Strong rejection from demand zone

Trendline breakout confirmed

Price holding above Ichimoku cloud = bullish continuation

Book partial profit at TP1, move SL to breakeven

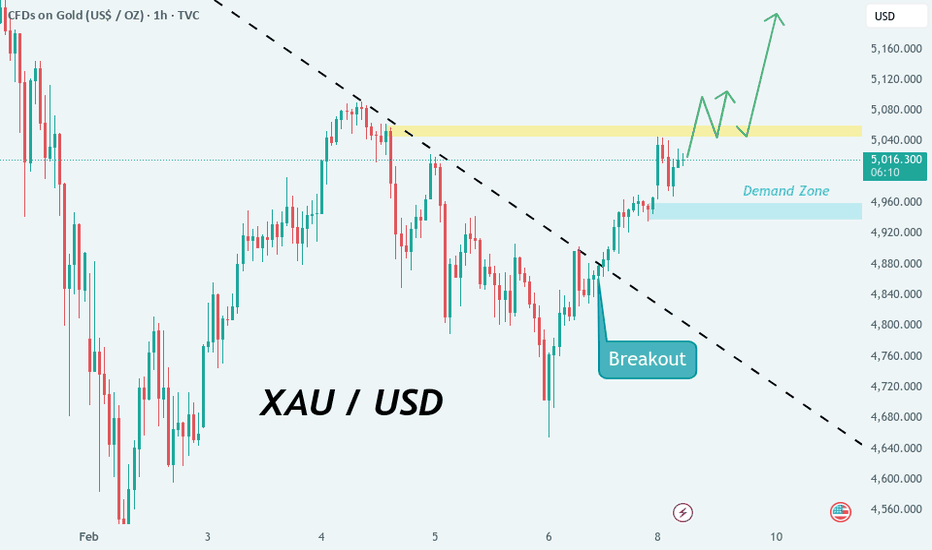

XAUUSD (Gold) – 30M Price Action & Key LevelsGold is trading within a corrective phase after breaking below the ascending channel. Price is currently reacting from a well-defined support zone, while the overall structure suggests bullish continuation if this support holds. A sustained move above the resistance zone may confirm strength and open the path toward the marked upside target.

Trend: Overall bullish structure, short-term correction completed

Support Zone: 4,850 – 4,870 (strong demand, price reacting upward)

Resistance Zone: 5,000 – 5,030 (key supply area)

Breakout Level: Above 5,030 (bullish confirmation)

Target 1: 5,060 – 5,080

Target 2: 5,160 – 5,170 (final upside target)

Invalidation: Daily/30M close below 4,840

Bullish as long as price holds above support; breakout above resistance may trigger strong upside momentum.

This analysis follows TradingView chart rules using price action, trend structure, and key support/resistance zones. For educational purposes only.

BTCUSD – (1H chart)...BTCUSD – (1H chart).

Bias: Bullish (trendline breakout + consolidation above support)

Buy Zone:

🔹 70,200 – 69,800

Targets:

🎯 TP1: 71,500

🎯 TP2: 73,000

🎯 TP3 (Main Target): 75,000 – 75,500

Invalidation / SL:

❌ Below 69,200 (daily close)

Notes:

Price has broken the descending trendline and is holding above the demand zone.

A clean hold above 70K increases probability toward 75K.

Partial profits recommended at TP1 & TP2, trail stop after TP1.

XAUUSD Liquidity Harvest Before Expansion Toward 511Gold is approaching a key liquidity zone after a strong intraday recovery. Price has tapped into the lower demand area and is now moving toward the equal highs where buy-side liquidity rests. The chart shows a clear liquidity probe followed by a potential liquidity harvest above the dotted resistance.

If price sweeps the highs near 5020–5030, it can trigger stop orders and fuel the next expansion move toward the higher supply zone around 5090–5118.

This setup reflects classic smart money behavior:

liquidity grab ➝ displacement ➝ continuation.

Plan:

Wait for the liquidity sweep and bullish confirmation for continuation entries.

Targets: 5090 → 5118

Invalidation: Below the demand zone.

Trade with confirmation and proper risk management.

SOLUSD (2H) chart pattern...SOLUSD (2H) chart pattern.

Market Structure

Strong overall downtrend (lower highs + lower lows).

Price is below the descending trendline.

Current price is consolidating inside a supply / resistance zone (red box).

Ichimoku cloud is above price → bearish pressure intact.

Bias = SELL continuation unless trendline is broken strongly.

🎯 Sell Targets (Primary Scenario) 🔴

Target 1 (TP1)

➡ 82.0 – 80.0

Recent demand

First liquidity pool

Target 2 (TP2)

➡ 75.5 – 74.0

Previous strong rejection area

Matches my marked TARGET POINT

Extended Target (If momentum is strong)

➡ 70.0 – 68.0

❌ Invalidation

A clean 2H close above 92.5–94.0

Break & hold above trendline + cloud = bearish idea fails

📌 Trade Plan Idea

Sell zone: 90.0 – 92.0

SL: Above 95.0

TPs: 82 → 75 → 70

Summary

✅ Trend intact

✅ Supply respected

⚠️ Wait for rejection candle for safest entry

XAUUSD (2H) (chart pattern)...XAUUSD (2H) (chart pattern).

Current Structure

Price bounced strongly from demand (blue arrow).

Market broke the descending trendline → bullish shift.

Now trading inside / just above the red supply zone (key decision area).

🎯 Bullish Targets (Primary Bias) 📈

Target 1 (TP1)

➡ 5,300 – 5,320

First marked TARGET POINT

Previous structure + liquidity resting here

Good partial profit zone

Target 2 (TP2)

➡ 5,480 – 5,520

Upper major resistance

Matches my top projected arrow

Strong sell reaction expected here

❌ Invalidation / Risk

If price closes back below 4,950–4,900, bullish idea weakens.

Below 4,850, structure turns bearish again.

📌 Trading Plan Idea

Buy on pullback near 5,000–4,980

SL: Below 4,880

TPs: 5,300 → 5,500

Bias Summary

✅ Trendline break

✅ Higher low formed

⚠️ Watch reaction inside red zone

Gold (XAU/USD) using a combination of key technical levelsThis chart analysis is focused on trading Gold (XAU/USD) using a combination of key technical levels and a specific entry, stop loss, and target strategy. Let’s break down the key components and ideas from the chart:

1. Price Structure and Trend:

The chart shows an overall sideways movement or consolidation pattern, with price moving within a certain range. It appears to be in a pullback after a prior upward move, with a possible bullish reversal expected from this point.

The purple curved line suggests the trader expects the price to rebound and move upwards, based on the price pattern and technical analysis.

2. Entry Point:

The entry point is marked at approximately 4,964.30, where the price is expected to start moving up. This level is significant because the price appears to be at a support zone (highlighted in green), and traders are looking for a buy position at this point, anticipating a breakout or reversal to the upside.

3. Target Level:

The target is identified around 5,080.00 (blue zone), where the trader expects the price to go if the trend continues upwards. This level is set with the idea of capturing potential profits if the price reaches or exceeds it.

The target area is likely determined based on resistance or past price highs, where the price has previously struggled to push higher.

4. Stop Loss:

The stop loss is placed around 4,840.00 (red zone). The stop loss is designed to limit potential losses if the price moves in the opposite direction of the trade (downwards).

The stop loss level appears to be just below a key support zone, ensuring that if the price falls below this level, it would signal that the bearish trend may continue, invalidating the trade idea.

5. Risk/Reward Setup:

The setup shows a favorable risk/reward ratio. The price has a chance to move up to the target (5,080.00) while limiting potential losses if the price falls to the stop loss (4,840.00).

If the trade is successful, the potential profit could significantly outweigh the potential loss, which is ideal for risk management.

6. Technical Indicators and Price Action:

The price action suggests that the market may be forming a double bottom pattern or similar reversal pattern near the entry point, signaling a potential shift to an uptrend.

The chart has a bullish bias, as indicated by the trader's setup for a long position and the price potentially breaking above resistance levels.

7. Conclusion/Trade Idea:

Buy near 4,964.30 (Entry Point) if the price shows signs of reversal or breaking through resistance.

Set a stop loss around 4,840.00 to manage risk.

The target is set at 5,080.00, expecting the price to reach this level if the bullish trend continues.

This setup relies on the idea that the market is in a bullish reversal phase, and the trader aims to profit from an upward movement.

This trading strategy focuses on technical analysis (support, resistance, price action) and aims to capitalize on the reversal after a pullback. The trader is positioning for a possible breakout and looking to manage risk using a well-placed stop loss.

ADAUSDT (2H CHART PATTERN) (Bullish)...ADAUSDT (2H CHART PATTERN) (Bullish).

Buy / holding zone:

0.268 – 0.275

Target 1 (near resistance):

0.300 – 0.305

(first supply zone / MY lower target)

Target 2 (main target):

0.330 – 0.335

(major resistance / trend continuation target)

Extended target (only with strong market momentum):

0.350 – 0.360

🛑 Invalidation / Stop idea

Below 0.255 A clean close below this level puts price back under cloud → bullish idea weak.

Bias summary

Above 0.265 → Buy on dips

Break & hold above 0.305 → Fast move toward 0.33+

Below 0.255 → Reassess

EURAUD Signal : H2 / H4 : Big Long !!!

Hello Traders! 👋

What are your thoughts on EURAUD ?

This correction could offer a buy-the-dip opportunity, with potential for a move back toward the recent highs.

EURAUD H2 / H4

Market price : 1.6840

Buy limit : 1.6800 - 1.6700

Tp1 : 1.7000

Tp2 : 1.7200

Tp3 : 1.7450

Tp4 : 1.7800

Sl : 1.6550 ( 200 pip )

Don’t forget to like and share your thoughts in the comments! ❤️

Remember this is a position that was found by me and it is a personal idea not a financial advice, you are responsible for your loss and gain.

EURUSD Lower Timeframe Bearish ContinuationQuick Summary

EURUSD continues to trade bearish on lower timeframes and The move appears to be part of a daily timeframe correction, Price may retrace higher toward 1.19035

This level aligns with an H4 supply correction zone

After that continuation lower is expected to fill the liquidity void left uncorrected from the previous month

Full Analysis

EURUSD remains in a bearish phase on the lower timeframes

This downside movement is developing as a corrective leg within the daily structure

A temporary pullback to the upside is possible and Price may rise toward the 1.19035 level

This area represents a supply correction zone on the 4 hour chart

If price reacts from this zone the expectation is for bearish continuation

The main objective of this move is to fill the liquidity void that was left without correction during the previous month

As long as lower timeframe structure stays bearish any upside movement should be treated as corrective

XRPUSD – 2H chart pattern)...XRPUSD – 2H chart pattern).

What I see

Strong downtrend earlier, now trendline breakout

Price is holding above Ichimoku cloud support

Current structure = base → accumulation → upside continuation

This supports the bullish targets me marked.

🎯 XRP Targets (Bullish)

Buy / holding zone:

1.42 – 1.48

Target 1 (nearest resistance):

1.65 – 1.70

(previous supply zone + my first blue box)

Target 2 (main target):

1.90 – 1.95

(major resistance + trend continuation)

Extended target (only if market momentum stays strong):

2.05 – 2.10

🛑 Invalidation / Stop idea

Below 1.34 – 1.32 If price goes back under cloud and closes there, bullish bias weakens.

Bias summary

Above 1.40 → Buy on dips

Break & hold above 1.70 → Expect fast move toward 1.90+

Below 1.32 → Reassess

ETHUSD – 2H (Chart pattern)...ETHUSD – 2H (Chart pattern).

What the chart is saying

Overall downtrend (descending trendline).

Price has broken above the trendline and is now holding above Ichimoku support (yellow cloud).

This looks like a trend reversal / pullback-buy structure, not a continuation sell.

Key levels I see

Current zone (buy area):

2,050 – 2,090

(inside the cloud + above broken trendline → good base)

🎯 Targets (Bullish continuation)

Target 1 (safe / partial):

2,300 – 2,350

Target 2 (main):

2,450 – 2,500

Target 3 (extended, only if momentum stays strong):

2,800 – 2,900

These match my marked “target points” on the right side of the chart.

🛑 Invalidation / Stop idea

Below 1,980 – 1,950 If price goes back under the cloud and holds there, bullish idea is weak.

Bias summary

Above 2,050 → Buy on dips

Below 1,950 → Avoid longs / reassess

XAUUSD Breakout Confirmed — Is Gold Preparing for a Major Rally?📊 Market Structure

Gold has successfully broken above a descending trendline, signaling a potential shift in short-term market structure from bearish to bullish.

After the breakout, price formed strong higher lows — suggesting buyers are stepping in with momentum.

---

🧠 What I’m Watching

Price is now approaching a key resistance zone near 5,040.

A clean break and hold above this level could open the door for the next bullish expansion.

As long as gold remains supported above the demand zone, the path of least resistance appears to be upward.

---

🔑 Key Levels

Demand Zone: 4,920 – 4,960

Resistance: 5,040

✅ Bullish Bias: While price holds above demand

❌ Invalidation: Sustained move below 4,920 may weaken bullish momentum

---

🚀 Trade Idea

Breakout + structure shift often leads to continuation phases.

If buyers maintain control, gold could begin its next leg higher in the coming sessions.

---

⚠️ Risk Note

This analysis is for educational purposes only. Always use proper risk management.

---

Do you see gold breaking this resistance — or forming a rejection?

Bullish or bearish from here? Comment below!

USDCHF H4 | Heading Towards 61.8% Fib ResistanceBased on the H4 chart analysis, we could see the price rise to our sell entry level at 0.7863, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 0.7960, which is an overlap resistance that is slightly above the 78.6% Fibonacci retracement.

Our take profit is set at 0.7693, whichis a pullback support.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

GBPUSD H4 | Bearish Reversal Off Pullback ResistanceThe price is rising towards our buy entry level at 1.3652, which is a pullback resistance that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 1.3753, which is a pullback resistance that is slightly above the 61.8% Fibonacci retracement.

Our take profit is set at 1.3550, which is an overlap support level.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

EURUSD H1 | Bullish ReversalThe price is falling towards our buy entry level at 1.1798, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.1775, which is a multi-swing low support.

Our take profit is set at 1.1860, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com

Falling towards key support?Kiwi (NZD/USD) is falling towards the pivot, which has been identified as an overlap support that aligns with the 61.8% Fibonacci retracement and could bounce to the 1st resistance, which is a multi-swing high resistance.

Pivot: 0.5854

1st Support: 0.5710

1st Resistance: 0.6098

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bearish reversal setup?Loonie (USD/CAD) has rejected off the pivot and could drop to the 1st support.

Pivot: 1.3723

1st Support: 1.3484

1st Resistance: 1.3926

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Heading towards pullback resistance?Swissie (USD/CHF) is rising towards the pivot, which has been identified as a pullback resistance and could reverse to the 1st support, which is a pullback support.

Pivot: 0.7855

1st Support: 0.7611

1st Resistance: 0.7892

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

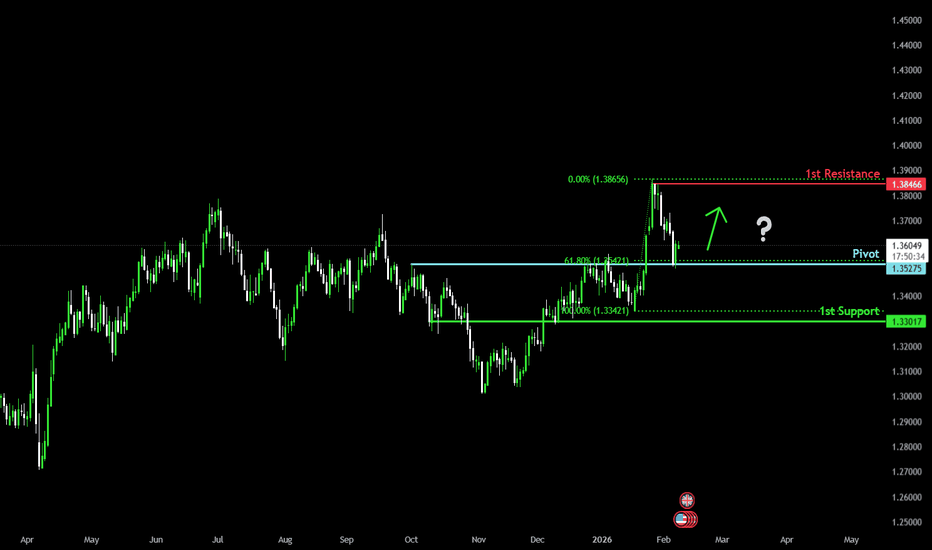

Bullish bounce off 61.8% Fib support?Cable (GBP/USD) has bounced off the pivot and could rise to the 1st resistance.

Pivot: 1.3527

1st Support: 1.3301

1st Resistance: 1.3846

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

Bullish bounce off?Fiber (EUR/USD) has bounced off the pivot, which acts as a pullback support that aligns with the 61.8% Fibonacci retracement and could potentially rise to the 1st resistance, which has been identified as a swing high resistance.

Pivot: 1.1791

1st Support: 1.1550

1st Resistance: 1.2080

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party