USD-CAD Free Signal! Sell!

Hello,Traders!

USDCAD clear rejection from 3H horizontal supply with internal liquidity sweep and bearish shift in structure. Premium zone mitigation complete, expecting continuation toward discount imbalance and sell-side liquidity below.

--------------------

Stop Loss: 1.3639

Take Profit: 1.3577

Entry: 1.3613

Time Frame: 3H

--------------------

Sell!

Comment and subscribe to help us grow!

Check out other forecasts below too!

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

Forex

GBPCAD: Forecast & Trading Plan

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the GBPCAD pair price action which suggests a high likelihood of a coming move down.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

GBPUSD: Short Trade with Entry/SL/TP

GBPUSD

- Classic bearish formation

- Our team expects pullback

SUGGESTED TRADE:

Swing Trade

Short GBPUSD

Entry - 1.3648

Sl - 1.3683

Tp - 1.3591

Our Risk - 1%

Start protection of your profits from lower levels

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

CADJPY Will Explode! BUY!

My dear subscribers,

This is my opinion on the CADJPY next move:

The instrument tests an important psychological level 112.34

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 113.17

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

A downturn is imminent - 10 Year Treasury Note based analysisIn recent years, many of us acknowledge that the term "recession" has been appearing in news and social media outlets at an increasing rate. While it acts as great clickbait, most sources tend to avoid to avoid a more fundamentals data driven approach, but rather are preferential an opinionated viewpoint from which their viewers can relate. Here I propose a more decisive graphical proof of why I believe some sort of downturn is on the (medium term) horizon, using the 10 year US treasury bond as the foundation, and comparing its recent movements to other typical recession indicators at a long timeframe.

The top graph shows the US YoY interest rate divided by the US 10 year note. Bonds and the interest rate are very closely economically correlated, deviations in the ratio between these two factors provides a very strong indicator (historically) for recession territory. 7 out of 8 times where the white line around 1.2 has been crossed on the 3M chart, as shown by the bottom graph, unemployment is quick to follow with rapid and sharp increases (beginning from red vertical lines).

This white line acts as the point of no return for the economy medium term. The maximum threshold by which historically the balance of the economy tips in one direction, bursting bubbles in favor of what people call a recession, and eventual return to an equilibrium (stability). This was hit in December 2022. While its very hard to tell the exact point where the downturn begins after this point, its obvious (based off this chart alone) one is around the corner.

By no means is this solid proof of anything in the future, but a very simplified graphical comparison between the ratio of two major economic data trends and their historical impact on the rate unemployment. If these historic trends continue to remain strong (as they have done with 88% accuracy since 1971) we should expect a significant economic downturn on the medium term timeframe, between 3-18 months from now. This is not financial advice, derive what you will from this data, let this idea act only as a point of interest - however, I urge sensible and thoughtful investing/trading on medium/short term timeframes with a bias towards the downside and continues high volatility.

USDJPY The Target Is UP! BUY!

My dear subscribers,

My technical analysis for USDJPY is below:

The price is coiling around a solid key level - 152.81

Bias - Bullish

Technical Indicators: Pivot Points High anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 153.09

My Stop Loss - 152.66

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USD/JPY | Where to next? USDJPY continued last week's trend of dropping further in price until NFP came out on Wednesday, after a surge in price, it dropped again and then started to consolidate between the IFVG and the demand zone.

Currently USDJPY is being traded at 152.82, if it bounces back up from the Demand Zone, it can go a bit higher and retest the IFVG. If it goes through the IFVG, it can go all the way up to 154.65, however, if it fails to stabilize above 153.60, abort mission.

Targets: 153.00, 153.50, 154.00, 154.30 and 154.65.

NZD/USD | CPI aftermath! (READ THE CAPTION)As you can see in the 30m chart of NZDUSD, last night it had a dramatic fall in price just like the other Forex pairs, and then it continued to drop further and further to 0.6014. With the CPI news coming out, it went up to 0.6043 and then it dropped and went back up several times.

Now, it is being traded at 0.6037, just above the Feb 13th NDOG. If it stabilizes above 0.6040, I expect it to go higher. But if it fails to stabilize there, I expect another drop for AUDUSD.

If it stabilizes above 0.6040: 0.6048, 0.6056 and 0.6064.

If it fails: 0.6030, 0.6022 and 0.6014.

USDJPY: Bullish Push to 157.55?FX:USDJPY is eyeing a bullish reversal on the 4-hour chart , with price rebounding from support after forming lower highs in a downward trendline, converging with a potential entry zone that could ignite upside momentum if buyers break resistance amid recent volatility. This setup suggests a recovery opportunity post-downtrend, targeting higher levels with approximately 1:5.5 risk-reward .🔥

Entry between 152.25–152.85 for a long position. Target at 157.55 . Set a stop loss at a close below 152 , yielding a risk-reward ratio of approximately 1:5.5 . Monitor for confirmation via a bullish candle close above entry with rising volume, leveraging the pair's potential rebound near support.🌟

Fundamentally , USDJPY is trading around 152.8 in mid-February 2026, with key events next week potentially driving volatility. For the US Dollar, Monday February 16 at 08:25 AM ET features Fed Bowman Speech , which could strengthen USD if hawkish on rates. Tuesday February 17 at 08:15 AM ET brings ADP Employment Change Weekly, where strong hiring data may bolster USD amid labor resilience. For the Japanese Yen, Monday February 16 at 10:35 PM JST includes the 5-Year JGB Auction, with higher yields potentially weakening JPY if demand softens. Wednesday February 18 at 06:50 AM JST features Trade Balance (Jan), where a widening deficit could pressure JPY further. 💡

📝 Trade Setup

🎯 Entry (Long):

152.25 – 152.85

(Entry from current price is valid with proper risk & position sizing.)

🎯 Target:

• 157.55

❌ Stop Loss:

• Close below 152.00

⚖️ Risk-to-Reward:

• ~ 1:5.5

💡 Your view?

Is this the beginning of a broader USDJPY recovery toward 157.55, or will resistance cap the bounce and extend consolidation? 👇

GBPNZD Is Very Bearish! Sell!

Here is our detailed technical review for GBPNZD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 2.258.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 2.251 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

NZDCHF Will Go Lower! Short!

Please, check our technical outlook for NZDCHF.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 0.467.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 0.465 level.

P.S

Please, note that an oversold/overbought condition can last for a long time, and therefore being oversold/overbought doesn't mean a price rally will come soon, or at all.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN Will Fall! Short!

Here is our detailed technical review for BITCOIN.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is approaching a significant resistance area 68,030.86.

Due to the fact that we see a positive bearish reaction from the underlined area, I strongly believe that sellers will manage to push the price all the way down to 65,890.40 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

AUDNZD Will Go Lower From Resistance! Sell!

Take a look at our analysis for AUDNZD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 1.175.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 1.170 level.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

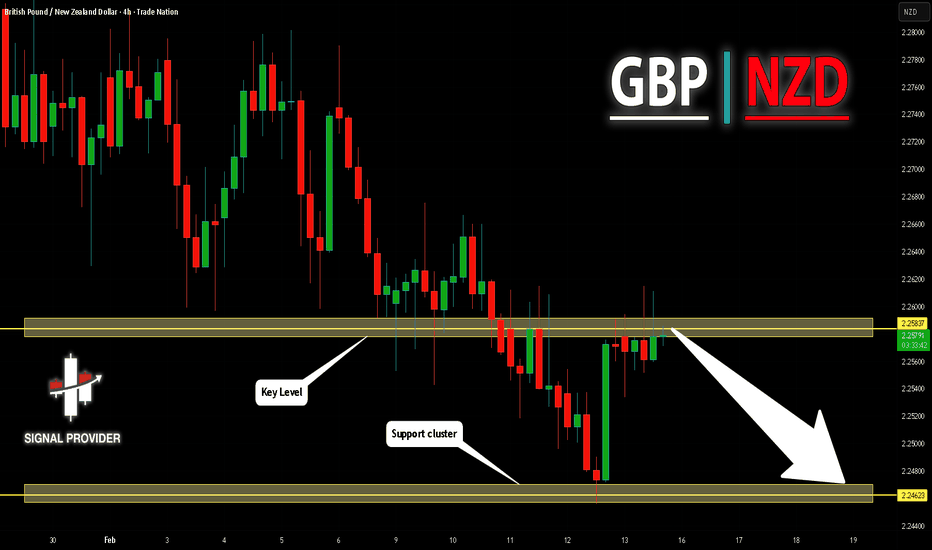

GBPNZD Will Go Down! Short!

Take a look at our analysis for GBPNZD.

Time Frame: 4h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The market is on a crucial zone of supply 2.258.

The above-mentioned technicals clearly indicate the dominance of sellers on the market. I recommend shorting the instrument, aiming at 2.246 level.

P.S

The term oversold refers to a condition where an asset has traded lower in price and has the potential for a price bounce.

Overbought refers to market scenarios where the instrument is traded considerably higher than its fair value. Overvaluation is caused by market sentiments when there is positive news.

Like and subscribe and comment my ideas if you enjoy them!

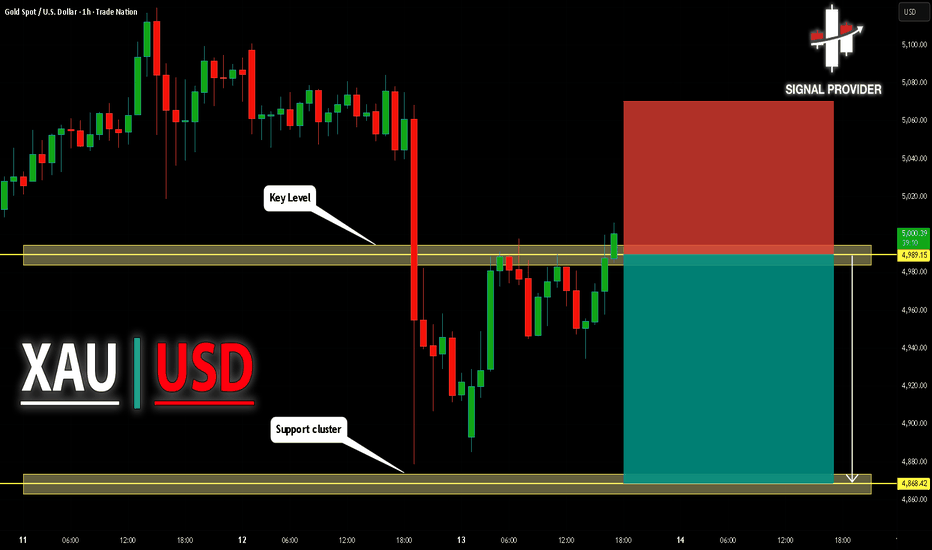

GOLD Will Move Lower! Sell!

Please, check our technical outlook for GOLD.

Time Frame: 1h

Current Trend: Bearish

Sentiment: Overbought (based on 7-period RSI)

Forecast: Bearish

The price is testing a key resistance 4,989.15.

Taking into consideration the current market trend & overbought RSI, chances will be high to see a bearish movement to the downside at least to 4,868.42 level.

P.S

We determine oversold/overbought condition with RSI indicator.

When it drops below 30 - the market is considered to be oversold.

When it bounces above 70 - the market is considered to be overbought.

Like and subscribe and comment my ideas if you enjoy them!

XAU/USD | Gold Facing Key $5000 Decision Level! (READ)By analyzing the #Gold chart on the 1-hour timeframe, we can see that last night price suddenly dropped more than $180 and entered the $4870 area. After that, Gold made a strong rebound and rallied back to $4999, where it reacted to the psychological $5000 resistance.

Today, after another pullback to $4935, CPI data pushed Gold higher again. Once more, price reached $4999 but faced a strong rejection from this key level and dropped to $4971. After several sharp moves in this zone, Gold is now trading around $4990.

Right now, the break or rejection of the psychological $5000 level will decide the next major move. Keep a close eye on price reaction around $5000. This analysis will be updated as soon as we see a clear move.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

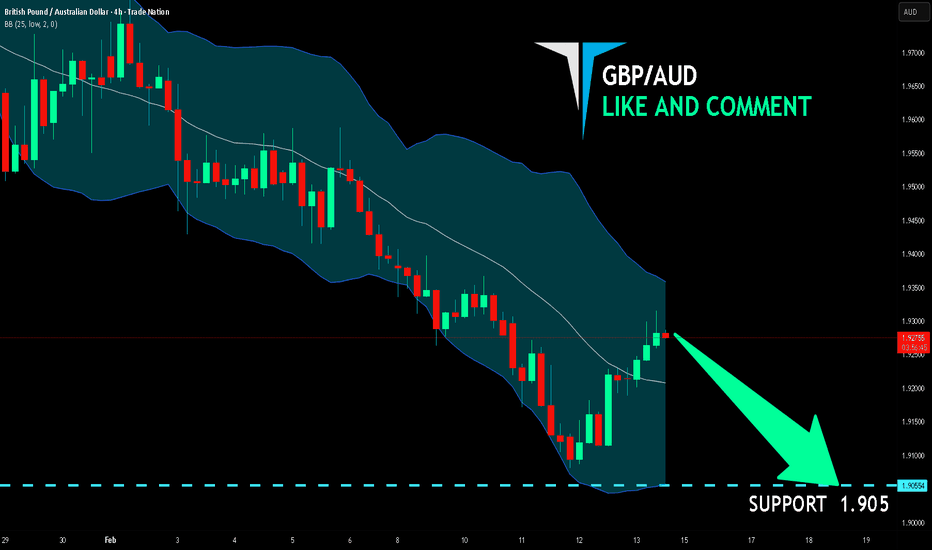

GBP/AUD BEST PLACE TO SELL FROM|SHORT

Hello, Friends!

GBP/AUD pair is in the downtrend because previous week’s candle is red, while the price is clearly rising on the 4H timeframe. And after the retest of the resistance line above I believe we will see a move down towards the target below at 1.905 because the pair is overbought due to its proximity to the upper BB band and a bearish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

XAUUSD (Gold) – 2H timeframe...XAUUSD (Gold) – 2H timeframe.

🔍 Structure

Price respected the ascending trendline

Fake breakout below → strong recovery

Back above short-term structure

Trying to push above minor resistance near 5,050

Bias right now: Bullish continuation

📈 Buy Targets

Current price around 4,990 – 5,000

🎯 TP1: 5,080 – 5,100

(previous resistance / intraday high)

🎯 TP2: 5,200

(clear structure resistance)

🎯 TP3: 5,300

(major resistance – matches my marked top target zone)

❌ Invalidation

2H close below 4,960

Clean break below trendline again

📌 My View

Fake breakdown + trendline support = liquidity grab

Upside toward 5,100 first, then continuation possible.

BITCOIN BEARS ARE STRONG HERE|SHORT

BITCOIN SIGNAL

Trade Direction: short

Entry Level: 67,399.39

Target Level: 66,211.07

Stop Loss: 68,187.15

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1h

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

EUR/USD | Will Price Hold or Fall ? Reaction After CPI Release!By analyzing the #EURUSD chart on the 1-hour timeframe, we can see that after the CPI release, the euro started to move higher and entered the 1.18780 to 1.18900 supply zone. The first reaction from this area was negative, and price pulled back to 1.18600. Right now, EURUSD is still trading close to this supply zone.

If price stabilizes below this resistance area, we can expect further downside. The next possible targets on the downside are 1.18500, 1.18330, and 1.18250.This analysis will be updated as price continues to react to key levels.

Please support me with your likes and comments to motivate me to share more analysis with you and share your opinion about the possible trend of this chart with me !

Best Regards , Arman Shaban

GBPUSD – 2H timeframe....GBPUSD – 2H timeframe.

I can see:

Head & Shoulders pattern

Neckline already breaking

Price below short-term structure

Inside / near Ichimoku cloud → momentum shifting bearish

📉 Bearish Setup (Primary Scenario)

Current price around 1.3625

🎯 Sell Targets:

TP1: 1.3560 (recent support)

TP2: 1.3500 (psychological + structure)

TP3: 1.3450 (measured move of H&S – matches my lower marked target)

📏 Measured Move Logic:

Head to neckline projected downward ≈ 150–180 pips → Gives target around 1.3450 area

❌ Invalidation

2H close above 1.3700

Strong break above right shoulder high

📌 My View

Neckline break + cloud resistance = downside likely

Best continuation below 1.3600

AUDJPY: Expecting Bullish Continuation! Here is Why:

The charts are full of distraction, disturbance and are a graveyard of fear and greed which shall not cloud our judgement on the current state of affairs in the AUDJPY pair price action which suggests a high likelihood of a coming move up.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

DXY H4 | Could We See A Bounce?The price is falling towards our buy entry level at 98.15, which is a pullback support that aligns with the 61.8% Fibonacci retracement.

Our stop loss is set at 95.40, which is a swing low support.

Our take profit is set at 96.84. whichis a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited fxcm.com Stratos Europe Ltd fxcm.com

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 69% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC fxcm.com Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to FXCM (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

Stratos Trading Pty. Limited fxcm.com

Trading FX/CFDs carries significant risks. FXCM AU (AFSL 309763), please read the Financial Services Guide, Product Disclosure Statement, Target Market Determination and Terms of Business at fxcm.com