TESLA What Next? SELL!

My dear subscribers,

This is my opinion on the TESLA next move:

The instrument tests an important psychological level 444.98

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 437.24

My Stop Loss - 449.86

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

Fx

GBPCHF Massive Short! SELL!

My dear friends,

My technical analysis for GBPCHFis below:

The market is trading on 1.0741 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 1.0731

Recommended Stop Loss - 1.0747

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NZDJPY Technical Analysis! BUY!

My dear subscribers,

My technical analysis for NZDJPY is below:

The price is coiling around a solid key level - 90.143

Bias - Bullish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear buy, giving a perfect indicators' convergence.

Goal - 90.455

About Used Indicators:

By the very nature of the supertrend indicator, it offers firm support and resistance levels for traders to enter and exit trades. Additionally, it also provides signals for setting stop losses

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SPY My Opinion! SELL!

My dear friends,

My technical analysis for SPY is below:

The market is trading on 694.02 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 687.59

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

US100 Set To Fall! SELL!

My dear friends,

US100 looks like it will make a good move, and here are the details:

The market is trading on 25760 pivot level.

Bias - Bearish

Technical Indicators: Supper Trend generates a clear short signal while Pivot Point HL is currently determining the overall Bearish trend of the market.

Goal - 25652

Recommended Stop Loss - 25821

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

NATGAS The Target Is UP! BUY!

My dear subscribers,

NATGAS looks like it will make a good move, and here are the details:

The market is trading on 3.141 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 3.304

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

SILVER Will Collapse! SELL!

My dear subscribers,

This is my opinion on the SILVER next move:

The instrument tests an important psychological level 7995.1

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 7807.8

My Stop Loss - 8100.3

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

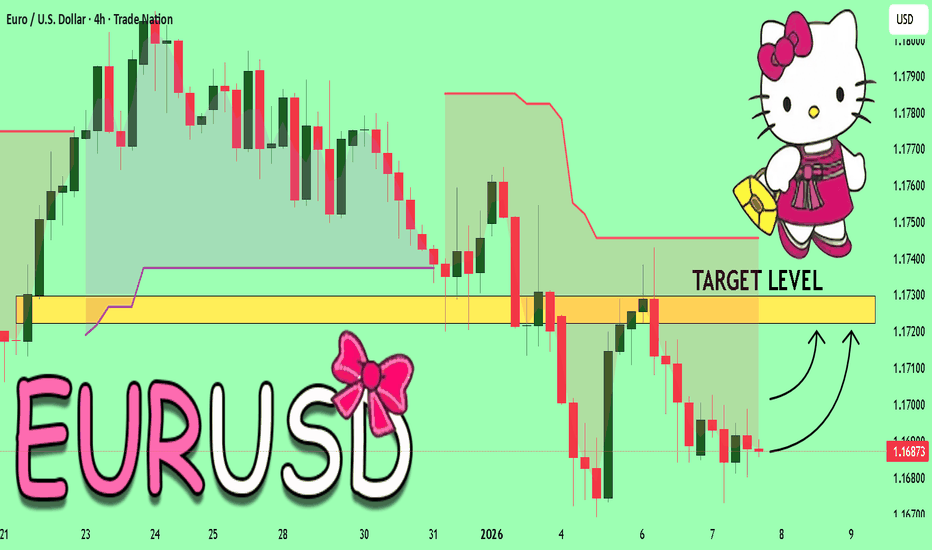

EURUSD Sellers In Panic! BUY!

My dear followers,

This is my opinion on the EURUSD next move:

The asset is approaching an important pivot point 1.1632

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1680

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDNZD Will Collapse! SELL!

My dear friends,

Please, find my technical outlook for AUDNZD below:

The price is coiling around a solid key level - 1.1667

Bias - Bearish

Technical Indicators: Pivot Points Low anticipates a potential price reversal.

Super trend shows a clear sell, giving a perfect indicators' convergence.

Goal - 1.1655

Safe Stop Loss - 1.1673

About Used Indicators:

The pivot point itself is simply the average of the high, low and closing prices from the previous trading day.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

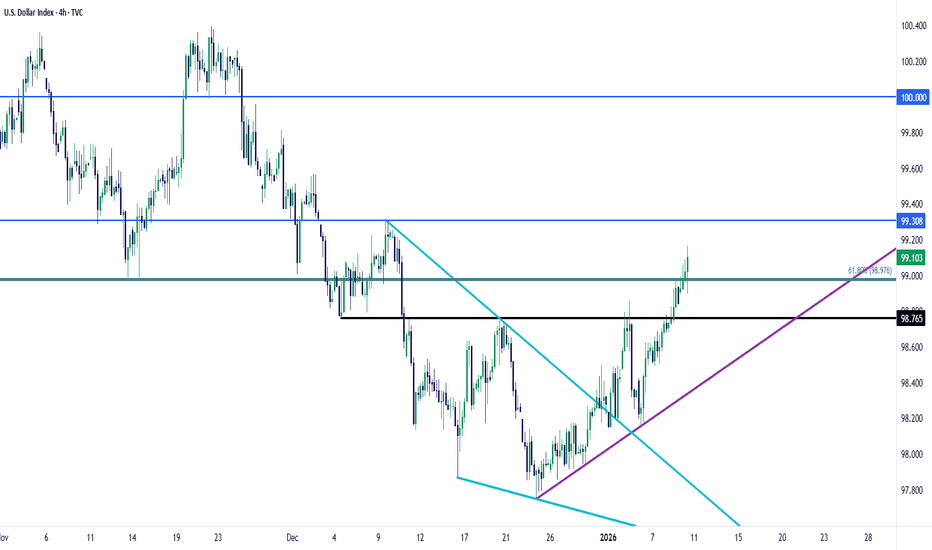

USD Triangle Break - What's NextThe NFP report from this morning is one of those items that could be construed either way. The headline number was below expected but the unemployment rate was a touch better at 4.4% v/s 4.5% expected.

Initially there was a bit of chaos in DXY, which is to be expected, but so far a big level has held and bulls are pushing up to fresh highs.

The support in question is the 98.98 level, which is the 61.8% Fibonacci retracement of the 2021-2022 major move. That price has so far been defended and now for the past couple weeks, USD bulls have been making a strong push. Next resistance is near at 99.30 and the 100-100.22 level was a brick wall in Q4, after having shown as support in late-2024 trade.

On the driver side of the matter, USD/JPY is at a fresh high and this is a point of concern if chasing either market, as getting closer to that 160.00 handle could bring threats of intervention from the MoF. This doesn't necessarily mean a top is in place or nearby, but it does highlight caution if chasing USD/JPY breakouts as bull traps after fresh highs have been a more regular type of thing in the pair. - js

EURUSD – 4HEURUSD continues to trade within a contracting structure, respecting both the descending resistance from the B–D highs and rising support from A–C. Price has rolled from the upper boundary and is now rotating lower toward the lower trendline support (E).

Momentum has weakened, with RSI drifting toward the lower range, suggesting downside pressure within the range, not a breakout yet. As long as price holds above the invalidation level (~1.1468), this remains consolidation rather than trend reversal.

A clean break below support would open continuation risk lower. Rejection at E keeps the range intact and sets up another rotation higher.

Key levels:

– Descending resistance (B–D)

– Rising support (A–C / E)

– Invalidation below 1.1468

AUDUSD Massive Long! BUY!

My dear friends,

Please, find my technical outlook for AUDUSD below:

The instrument tests an important psychological level 0.6675

Bias - Bullish

Technical Indicators: Supper Trend gives a precise Bullish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 0.6699

About Used Indicators:

Super-trend indicator is more useful in trending markets where there are clear uptrends and downtrends in price.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

CHFJPY The Target Is DOWN! SELL!

My dear friends,

My technical analysis for CHFJPY is below:

The market is trading on 197.00 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target - 196.69

Recommended Stop Loss - 197.19

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USD/CAD Comes Back to LifeComing into 2025 it seemed like USD bulls had full control of the FX market, but the Dollar set a high less than two weeks into the New Year and then weakness remained for pretty much the rest of the year. Of course, much of that weakness was confined the first-half of 2025, but another bearish run in December made it really easy to come into 2026 as a USD bear and so far in the New Year we've seen bullish price action in the DXY.

This puts a lot of focus into U.S. data with tomorrow's Non-farm Payrolls report and then inflation reports to be released thereafter, and what we're seeing now could simply be a degree of squaring up ahead of some big risk events, but in the USD/CAD pair, a strong sell-off has since led to a sizable rally with the pair continuing to show gains.

Notably, it was the oversold reading on the daily chart in late 2025 trade that led into the move and the question now is whether there's the making of a trend in here. Price is already testing a spot of resistance just inside of the 1.3900 handle and the 1.4000 level is a massive spot, if it does come into play. So chasing from here can be challenging, but, there's now bullish structure that can be worked with down to an upward-sloping trendline that's developed in the early stages of the rally.

I'm tracking supports at 1.3836, 1.3800 and then the zone from 1.3743-1.3750 as an 's3' of sorts. If sellers can elicit a closed body break below 's3' it's going to look like the rally is done for but, until that scenario, there's bullish potential for a re-test of the 1.4000 handle.

If 1.4000 trades before any of those supports come into play, then current resistance becomes the new 's1' area of support and that spans from 1.3889-1.3905. - js

EURCHF Massive Short! SELL!

My dear followers,

I analysed this chart on EURCHF and concluded the following:

The market is trading on 0.9312 pivot level.

Bias - Bearish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bearish continuation.

Target -0.9299

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GOLD Expected Growth! BUY!

My dear subscribers,

GOLD looks like it will make a good move, and here are the details:

The market is trading on 4426.8 pivot level.

Bias - Bullish

My Stop Loss - 4420.0

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 4441.8

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

BTCUSD Technical Analysis! BUY!

My dear subscribers,

BTCUSD looks like it will make a good move, and here are the details:

The market is trading on 87461 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 87892

About Used Indicators:

The average true range (ATR) plays an important role in 'Supertrend' as the indicator uses ATR to calculate its value. The ATR indicator signals the degree of price volatility.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURCHF Massive Long! BUY!

My dear friends,

My technical analysis for EURCHF is below:

The market is trading on 0.9283 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 0.9328

About Used Indicators:

A pivot point is a technical analysis indicator, or calculations, used to determine the overall trend of the market over different time frames.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

AUDJPY Under Pressure! SELL

My dear subscribers,

This is my opinion on the AUDJPY next move:

The instrument tests an important psychological level 105.33

Bias - Bearish

Technical Indicators: Supper Trend gives a precise Bearish signal, while Pivot Point HL predicts price changes and potential reversals in the market.

Target - 105.06

About Used Indicators:

On the subsequent day, trading above the pivot point is thought to indicate ongoing bullish sentiment, while trading below the pivot point indicates bearish sentiment.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

USD/CAD Forecast: Bearish Momentum Builds on Data ReturnThe Tide Turns

The USD/CAD exchange rate is losing bullish momentum. Trading near 1.3765, the pair struggles to find direction amidst a broader U.S. Dollar stall. A pivotal shift is underway as the holiday-induced lull ends. Domestic Canadian data is returning to the driver's seat. The market must now account for this potential decoupling from broad USD trends.

Macroeconomics: The Data Resurgence

The macroeconomic landscape is shifting focus back to Canada. The recent lack of domestic news forced the Loonie to follow the Greenback’s lead. This dynamic ends now. High-impact Canadian releases, including PMIs and trade figures, are imminent. Friday’s employment report stands as the critical catalyst. Recent data shows Canadian economic resilience. If upcoming numbers confirm this strength, the Canadian Dollar will likely outperform its U.S. counterpart.

Technical Analysis: Algorithmic Hesitation

Market technology and technical patterns signal exhaustion. Algorithmic trading models are struggling to push prices higher. The short-term setup appears neutral to mildly bearish. The rebound from December lows is officially losing steam. Intraday price action reveals significant hesitation rather than a clean bullish extension. The 1.3810 resistance level serves as a critical ceiling that defines the current upper bound.

Geostrategy and Industry Trends

Canada’s export-heavy economy remains sensitive to global trade currents. The upcoming trade figures will reveal the health of cross-border commerce. A strong trade surplus reinforces the Loonie’s geostrategic value. Conversely, U.S. economic strength appears priced in. The divergence between a resilient Canadian export sector and a stalling U.S. dollar rally creates a distinct market dynamic. Commodity-linked currencies like the CAD are poised to capitalize on any U.S. weakness.

Leadership and Monetary Policy

Central bank management drives long-term valuation. The Bank of Canada (BoC) and the Federal Reserve are entering a divergent phase. Previous better-than-expected Canadian data empowers the BoC to maintain a firm stance. In contrast, the Fed faces questions about the durability of U.S. growth. This policy divergence favors the CAD. Data will directly impact the forward guidance from Canadian policymakers.

Conclusion: A Drift Lower?

The path of least resistance currently points lower for the pair. If Canadian data reasserts itself and the broader U.S. dollar rally continues to fade, the exchange rate likely faces downward pressure. The focus remains on whether the pair can hold current support levels or if the bearish momentum will drive a deeper correction.

EURUSD Tests Key Support — Is This the Base for a Bullish ReversFX:EURUSD on the H1 timeframe has been in a corrective bearish phase following a prolonged distribution period at the highs, with price trending lower beneath declining moving averages. Momentum weakened sharply during the selloff, culminating in a strong downside extension that swept liquidity below prior lows before price began to stabilize.

Current price action shows FX:EURUSD reacting directly from a clearly defined support zone around the 1.1670 region. The sharp rejection from this area suggests the presence of responsive buyers stepping in after the liquidity sweep, creating conditions for a potential short-term base. While the broader intraday structure remains corrective, this reaction indicates that selling pressure is beginning to lose momentum.

If price can continue to hold above the support zone and build higher lows, a corrective rebound toward the 1.1710 region becomes the first area of interest. This level aligns with prior intraday structure and represents the initial objective where sellers may attempt to re-engage. Acceptance above this zone would improve the probability of further upside rotation.

A sustained move beyond 1.1750 would signal a deeper mean reversion within the range, opening the path toward the 1.1780 region where prior distribution occurred. Such a move would reflect a broader corrective recovery rather than an immediate trend reversal, but it would still offer constructive upside potential in the near term.

However, failure to hold the 1.1670 support would invalidate the recovery scenario and expose the pair to further downside continuation. In that case, price could extend lower as the market searches for deeper liquidity before any meaningful structural shift develops.

EURUSD On The Rise! BUY!

My dear friends,

EURUSD looks like it will make a good move, and here are the details:

The market is trading on 1.1688 pivot level.

Bias - Bullish

Technical Indicators: Supper Trend generates a clear long signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.1722

About Used Indicators:

Pivot points are a great way to identify areas of support and resistance, but they work best when combined with other kinds of technical analysis

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

GBPUSD Trading Opportunity! BUY!

My dear followers,

This is my opinion on the GBPUSD next move:

The asset is approaching an important pivot point 1.3470

Bias - Bullish

Safe Stop Loss - 1.3457

Technical Indicators: Supper Trend generates a clear (short (если short) long (если long)) signal while Pivot Point HL is currently determining the overall Bullish trend of the market.

Goal - 1.3498

About Used Indicators:

For more efficient signals, super-trend is used in combination with other indicators like Pivot Points.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK