A Triangle Appears In Bloody WatersOANDA:EURGBP seems to have found itself Consolidated into a Rising Triangle with Higher Lows into Equal Highs.

Last time price was at these levels a Harmonic pattern, the Bullish Shark, formed and we seen price make quite a rise!

Now triangle patterns are statistically known to fail 1/3 of the time but with price forming a Rising Triangle, we must assume that price could very well be looking to head back up from such an area of Support.

If price is able to Close above the Resistance of the pattern, this could generate Long Opportunities!

Fundamentally, EUR will be dealing with CPI and GDP news events tomorrow (Friday) ranging from Midnight - 4 AM. GBP will have M4 Money Supply, Mortgage Approvals and Lending releasing @ 3:30 AM.

Be Vigilant!

GDP

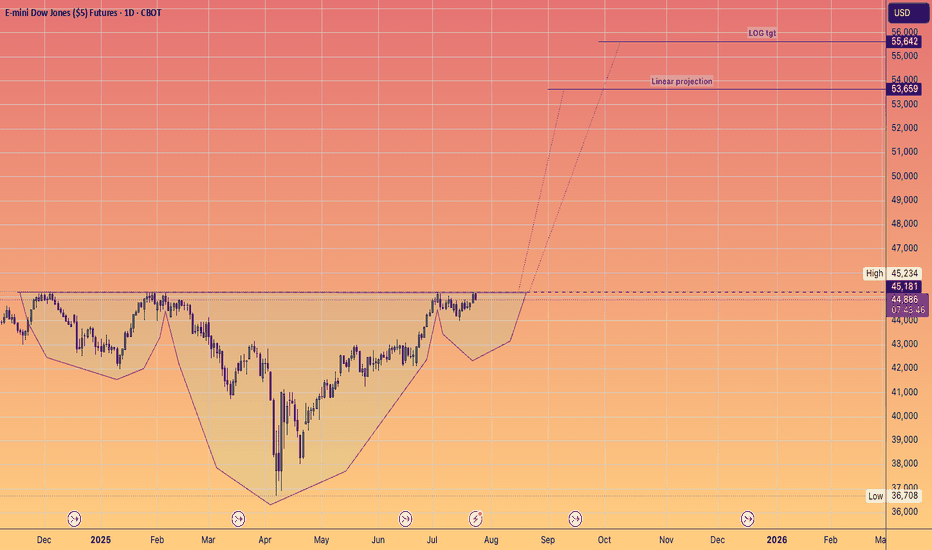

$SPY & $SPX — Market-Moving Headlines Thursday Jan 22, 2026🔮 AMEX:SPY & SP:SPX — Market-Moving Headlines Thursday Jan 22, 2026

🌍 Market-Moving Themes

🧠 Relief Rally Test

Markets face a reality check as growth and labor data hit after tariff-driven volatility

💻 Intel Earnings Focus

Intel reports after the close with AI server demand and data center share in focus

🏦 Consumer Credit Scrutiny

Capital One earnings test credit quality amid political pressure on card rates

⚡ Energy Infrastructure Spillover

Kinder Morgan earnings strength lifts attention on pipelines tied to AI power demand

🎮 High-Beta Aftershocks

Meme and media names remain volatile following insider buying and deal reactions

📊 Key U.S. Economic Data Thursday Jan 22 ET

8:30 AM

- Initial Jobless Claims Jan 17: 208K

- GDP Q3 first revision: 4.3%

10:00 AM

- Personal Income Nov delayed: 0.4%

- Personal Spending Nov delayed: 0.5%

- PCE Index Nov delayed: 0.2%

- Core PCE Index Nov delayed: 0.2%

- Core PCE YoY

⚠️ Disclaimer: For informational purposes only. Not financial advice.

📌 #SPY #SPX #Macro #GDP #PCE #Jobs #Earnings #AI #Energy #Markets #Stocks #Options

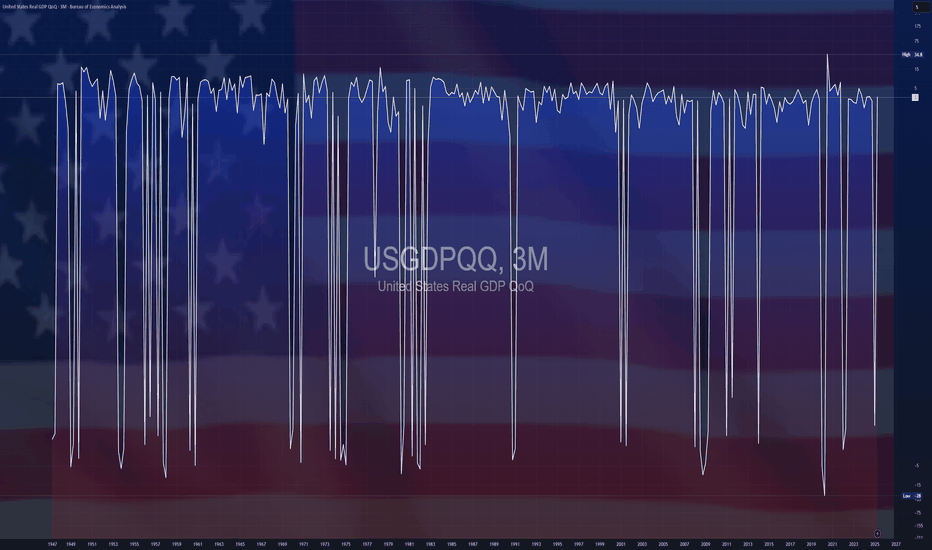

Velocity Of Money Rolling Over Again!The Real Interpretation

This chart is telling one story:

Money supply growth has massively outpaced real output for decades.

It lines up perfectly with:

Falling real productivity

Stagnant wages

Declining borrower quality

Rising debt-to-GDP

Asset inflation decoupling from fundamentals

The economy shifting from productive borrowing → consumption and asset speculation

You don't fix this with “policy choices.”

You fix it with real wealth creation, which requires creditworthy borrowers — not printing.

Forward-Looking View

Unless:

Productivity rises

Real output accelerates

Borrowers gain real income strength

Capital flows into productive sectors instead of financial games…this ratio won’t materially rise.

That means:

Every new dollar is buying less GDP

Long-term growth potential is fading

More money chasing fewer productive opportunities

More fragility in the credit system

It’s a classic late-cycle fiat symptom.

Here are questions to ask:

If “money creation” creates growth, why is GDP-per-dollar collapsing?

Why did 40 years of money expansion not produce proportional GDP?

If borrowers create loans, where are the new productive borrowers?

Why did QE cause asset inflation but no sustainable GDP boost?

If the system is “fine,” why does each new dollar buy less real output?

Perma Bulls, MMTers, Politicians etc.. can’t answer those without admitting the private-sector engine is weakening.

The less productive output per $ while the markets keep rising & rising will only produce less and less profit per share over time. No matter how much lipstick they put on that pig. Eventually, the economy & markets will CRASH! They always correct themselves in the end.

Perma Bulls have no exit strategy and will go down with the boat!

MMTers will want Gov to borrow and spend EVEN MORE! despite the empirical self-evident fact that print and play doesn't work!

Politicians will borrow and spend even more, claiming they will "STIMULATE THE ECONOMY"

I got all that from just one chart? NO! The entire spectrum of data.

Here is one

THANK YOU for getting me to 5,000 followers! 🙏🔥

Let’s keep climbing.

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in truth, not hype.

GDP Growth Illusion From Tariffs CAUTION!GDP Growth Can Rise When Imports Collapse

GDP is defined as:

GDP = C + I + G + (X − M)

Example:

C + I + G = 110

(X − M) = −10

GDP = 100

Now assume imports collapse while everything else stays the same:

C + I + G = 110 (unchanged)

(X − M) improves from −10 to −5

GDP = 105

That appears as a +5% GDP growth, despite no new production having occurred.

A drop in imports mechanically boosts GDP by improving (X − M). GDP rises on paper—even if the economy is actually weakening due to collapsing demand.

Translation:

GDP can look stronger because activity fell, not because value was created.

This important to understand bc it also influences the velocity of Money. Giving the illusion that it is increasing when it's not. See my previous post.

One more point I want to make for you.

👉GDP accounting does NOT force consumption (C) to fall when imports fall.

👉 But in the real economy, consumption of those specific goods can fall if tariffs remove availability or raise prices.

👉 Job loss created as a result will also drop (C); the effects are not noticeable at first in GDP.

🚨DON'T MAKE THE MISTAKE OF THINKING THIS IS REAL GROWTH AND GO OUT AND BET THE FARM TRADING/INVESTING!

This is not POLITICAL! This is COUNTING!

If you enjoy the work:

👉 Drop a solid comment

Let’s push it to 6,000 and keep building a community grounded in raw truth, not hype.

4 Biggest trading opportunities this week This week presents several key events traders should keep a close eye on:

Korean inflation – Monday 6pm

The last reading for SK CPI came in at +2.4% year‑on‑year in October 2025, above the 2.1% expected by economists. Another surprise uptick might reinforce expectations of a rate pause (or even a re‑tightening), which could boost KRW.

Euro inflation – Tuesday 5am

Inflation data out of the eurozone will shape expectations for the European Central Bank (ECB). If inflation remains sticky or rises, it could bolster ECB hawkishness, strengthening EUR and European bond yields.

Australian GDP Growth – Tuesday 7.30am

Australia’s GDP report will offer a snapshot of the local economic picture. A strong GDP print could support the Australian dollar and lift demand for commodity‑linked assets, given Australia’s status as a major commodity exporter.

US PCE – Friday 10am

The upcoming release of the Personal Consumption Expenditures Price Index (PCE) matters because the Fed views it as its preferred inflation gauge. A hotter‑than‑expected PCE could reaffirm caution on rate cuts and lift USD, bond yields, and potentially weigh on risk assets.

Weekly Trading Opportunities | October 21–25 • Monday: China GDP data

China’s third-quarter GDP report will be closely watched as growth is expected to slow to 4.8% year-on-year from 5.2% in Q2.

Slowing growth in China could reduce demand and prices for commodities. A surprise upside could support commodity prices.

• Tuesday: Coca-Cola and Netflix earnings.

Earnings season continues with Coca-Cola, Netflix, and others including Tesla, IBM, and Intel.

Strong results could offset soft U.S. data and help reignite the risk-on environment.

• Wednesday: U.K. inflation data and Tesla earnings

U.K. inflation is expected to edge back toward 4%. A softer reading could boost U.K. equities and pressure the pound.

• Thursday: Intel earnings

• Friday: U.S. CPI report

With the U.S. government shutdown entering its fourth week, the CPI release remains the week’s key data point. A hotter print could lift the dollar.

SNB holds interest rates, US GDP revised higher, Swissy slips The Swiss franc is sharply lower on Thursday. In the North American session, USD/CHF is trading at 0.8013, up 0.78% on the day.

The Swiss National Bank held its benchmark rate at zero earlier today. The decision was widely expected. The Swiss franc has fallen sharply today but that is more likely due to the surprising strong US GDP release, rather than the SNB rate cut.

The SNB statement noted that inflation had remained virtually the same in the second quarter and the inflation outlook called for little change. However, members expressed concern about the slowdown in global economic growth and the uncertainty over US tariffs.

The statement said that the Swiss economy had been affected by the US tariffs, dampening the export sector. In particular, the machinery and watchmaking industries had been hit, but the impact on the services sector had been limited.

Switzerland has been hit with massive tariffs of 39% on Swiss goods, and the statement warned that the economic outllook for the country remains "uncertain".

Third-estimate GDP climbed to 3.8% in the second quarter, a strong improvement from the 3.3% gain in the second estimate. This was above the consensus of 3.3%. The gain was driven by stronger consumer spending and a sharp decline in US imports.

The tariffs continue to create uncertainty and could dampen consumer spending as the price of imports rise. There are concerns that GDP will fall significantly in the second half of the year.

The Federal Reserve signaled at last week's meeting that it planned to cut rates twice more before the end of the year, but today's strong GDP data lowers the pressure on the Fed to ease policy. The markets have priced in an October rate cut at 88%, according to CME's FedWatch.

GBPUSD at make or break level ahead of a split BOEThe BOE faces a pivotal moment as it prepares to announce its latest interest rate decision.

With MPC members split between hawkish concerns about stubborn inflation and dovish worries over a weakening job market, expectations are swirling about the path forward.

Will the BOE signal a pause after this cut, or will inflation surprises force a more cautious, hawkish stance going into the end of the year?

Traders are watching for clues in the updated forecasts, as even a minor shift could spark major volatility in GBP/USD.

If the BOE sounds hawkish—maybe they raise their inflation forecasts, or the vote split shows strong resistance to further cuts, or they signal a pause in easing—then GBPUSD might have found a bottom for now.

On the flip side, if the BOE puts more emphasis on economic risks, reduces its GDP outlook, or if the vote split shows a strong push for even bigger cuts, then the pound could come under pressure.

On the charts, Cable is clinging to 1.3375, with a potential developing head and shoulders pattern threatening a deeper move lower if the neckline breaks.

Will the upcoming BOE decision be the make-or-break catalyst for the pound?

This content is not directed to residents of the EU or UK. Any opinions, news, research, analyses, prices or other information contained on this website is provided as general market commentary and does not constitute investment advice. ThinkMarkets will not accept liability for any loss or damage including, without limitation, to any loss of profit which may arise directly or indirectly from use of or reliance on such information.

British GDP slows to 0%, pound edges lowerThe British pound is slightly lower on Friday. In the North American session, GBP/USD is trading at 1.3541, down 0.22% on the day.

UK GDP slowed in July, posting zero growth month-to month. This was down from the 0.4% gain in June and matched the market estimate. Services and construction were higher but were offset by a decrease in manufacturing. In the three months to July, GDP eased to 0.2%, down from 0.3% and below the market estimate of 0.2%.

The UK economy has been losing steam - after a strong gain of 0.7% in the first quarter, GDP eased to 0.3% in Q2 and all signs point to negative growth in the second half of 2025.

The weakening economy supports the case for the Bank of England to lower rates, but rising inflation is making it harder for the BoE to ease policy. In July, consumer inflation rose to 3.8%, higher than expected. The BoE has projected that inflation will rise to a peak of 4% in September, double the BoE's target of 2%.

The BoE meets on September 18 and is expected to hold rates, after cutting rates in August to 4.0%. At that meeting, the nine-member monetary policy committee voted 5-4 to lower rates. Governor Bailey has said that the BoE will take a "gradual and careful" approach to rate cuts. The November 6 meeting will be very significant, coming just ahead of the government's budget.

There was a lot of attention paid to Thursday's US CPI report, as inflation rose to 2.9% y/y, up from 2.7% and in line with expectations. Overshadowed by the CPI release was unemployment claims which jumped to 267 thousand in the first week of September, up sharply from 236 thousand in the prior release and well above the market estimate of 235 thousand. This was the highest number of claims since October 2021 and is another sign of a deteriorating labour market.

GBPUSD has pushed below support at 1.3563 and is testing support at 1.3543. Below, there is support at 1.3524

There is resistance at 1.3582 and 1.3602

Australian confidence data slips, Aussie rally continuesThe Australian dollar continues to propel higher. In the European session, AUD/USD is trading at 0.6618, up 0.40% on the day. The Aussie has shot up 1.5% since Thursday and is trading at six-week highs.

Australia's consumer and business confidence have taken a hit, pointing to pessimism over the economic outlook. The Westpac Consumer Sentiment Index fell 3.1% m/m in September, after a strong 5.7% gain in August. Westpac said that the index is back in "cautiously pessimistic" territory.

Consumers remain uneasy over high interest rates, as the Reserve Bank has been slow to lower rates. The Westpac survey found that consumers are more concerned about unemployment and less likely to purchase a major household item.

The NAB Business Confidence Index also headed lower, falling in August to 4 points, down from 8 in July. This marked a three-month low. Still, business conditions showed improvement and forward orders moved higher.

The Reserve Bank of Australia is coming off a quarter-point rate cut and meets next on September 30. The money markets don't expect a cut in September, as GDP rose in Q2 to 1.8% from 1.4% and core inflation jumped to 2.7% in July, up from 2.1%. A stronger economy and higher inflation will make it more difficult for the RBA to lower rates.

We could see a rate cut in November and further easing early in the new year. Much will depend on the direction of inflation, the strength of the labor market, and the health of the Chinese economy.

In the US, the Federal Reserve is poised to deliver a rate hike next week for the first time since December 2024. The weak nonfarm payrolls report has raised the likelihood of a half-point cut to 12%, with a quarter-point cut priced in at 88%, according to CME's FedWatch.

Japan's GDP sparkles, yen pushes higherThe Japanese yen is in positive territory on Monday. In the European sesssion, USD/JPY is trading at 147.87, down 0.35% on the day.

The week has started on a positive note in Japan, as GDP for the second quarter was revised sharply higher to 2.2% y/y, up from the initial reading of 1.0% and above the Q1 gain of 0.3%.

This was the fastest pace of growth since Q3 2024, as private consumption was higher, in part due to government subsidies for rice and energy. Exports were higher as firms rushed to ship to the US before the blanket 15% tariffs kicked in. On a quarterly basis, GDP expanded 0.5%, up from the initial reading of 0.3%.

The increase in exports could be short-lived, as the US tariffs are making Japanese exports more expensive. Tariffs concerns could delay the Bank of Japan from raising interest rates, and third-quarter GDP will help gauge the effect of the tariffs on Japan's economy.

The political uncertainty in Japan is another factor which supports the BoJ staying on the sidelines. Prime Minister Shigeru Ishiba has resigned after a disastrous election in which Ishiba's coalition lost its majority in the lower house of parliament. It remains unclear who will replace Ishiba, with a leadership vote expected in October.

US nonfarm payrolls disappointed with a marginal gain of 22 thousand, well below the upwardly revised gain of 79 thousand in July and the market estimate of 75 thousand. The unemployment rate edged up to 4.3% from 4.2%, the highest level since December 2021.

The money markets responded to the weak nonfarm payrolls report by fully pricing in a rate cut at next week's meeting, with a 90% probability of a quarter-point cut and a 10% chance of a half-point cut, according to CME's FedWatch. Prior to the jobs release, there was a 0% chance of a half-point cut.

USD/JPY is testing support at 147.60. Next, there is support at 146.62

There is resistance at 148.37 and 149.35

Euro gains ground, US GDP revised higher, German CPI nextThe euro has posted gains on Thursday. In the North America session, EUR/USD is trading at 1.1670, up 0.27% on the day.

US GDP (second-estimate) surprised on the upside, with a gain of 3.3%. This was revised higher from 3.0% in the preliminary estimate and was an impressive turnaround from the 0.5% decline in the first quarter.

After the release of the first-estimate GDP, President Trump called on Federal Reserve Chair Powell to lower interest rates, and it wouldn't be surprising if Trump again uses the strong GDP report to attack Powell.US GDP (second-estimate) surprised on the upside, with a gain of 3.3%. This was revised higher from 3.0% in the preliminary estimate and was an impressive turnaround from the 0.5% decline in the first quarter.

After the release of the first-estimate GDP, President Trump called on Federal Reserve Chair Powell to lower interest rates, and it wouldn't be surprising if Trump again uses the strong GDP report to attack Powell.

The US labor market has been softening and the July nonfarm payrolls fell to just 73 thousand. Still, unemployment claims have been steady and today's release showed that claims dropped to 229 thousand, down from a revised 234 thousand last week and just below the market estimate of 230 thousand.

Germany releases CPI report on Friday, with a market estimate of 0% m/m for August. This would mark the second flat reading in three months, an indication that inflation is under control. Annually, CPI is expected to nudge up to 2.1% from 2.0%.

Eurozone inflation will be released next week. Headline CPI is currently at 2.0% and core CPI is at 2.3%, with little change expected in the August release.

The European Central Bank took a pause in July after seven straight rate cuts. The ECB meets on September 11 and with inflation largely contained and around the ECB's 2% target, the Bank is not feeling pressure to continue lowering rates.

July 30 2025 USDJPY Buy Limit ActivatedGood day, folks!

Another trade today! This is a continuation trade before the USD fundamental news. I've got some useful schematics on my chart for trading continuation momentum patterns with positive confluence in your fundamentals. You can see a swing structure BOS with validity of an internal structure: another BOS. I waited for the price to tap again into that valid order block, which also had validity of internal structure - BOS. The risk-reward (RR) is 1:4. Check the chart for detailed annotations.

I hope you find value in this trade today. Until next time!

#proptrader

#wyckoff

#supplyanddemand

#riskmanagement

$USGDPQQ -U.S Economic Growth Outpaces Forecasts (Q2/2025)ECONOMICS:USGDPQQ 3%

Q2/2025

source: U.S. Bureau of Economic Analysis

- The US economy grew at an annualized rate of 3% in Q2 2025,

sharply rebounding from a 0.5% contraction in Q1 and exceeding market expectations of 2.4% growth, largely driven by a decline in imports and a solid increase in consumer spending.

However, the gains were partly offset by weaker investment and lower exports.

Interesting few days ahead... USD pairs approaching key levelsDXY is finishing a HTF consolidation and is approaching medium-term key areas. Other USD pairs are also in areas where they could aggressively turn around. EURUSD just finished a H4 3-touch continuation flag and is starting to stall on the 3rd touch, suggesting indecision in the markets.

Considering the news events in the next 3 days, starting today with USD advanced GDP data, we could see volatility kicking in on these key levels. We do need a catalyst to push price into a larger directional move, and we are prime positioned for the next leg. Technically, a breakout in both directions would make sense in these areas. Time to set alarms and be vigilant but not jump into trades too early, considering NFP on Friday as well.

*** **** ****

📈 Simplified Trading Rules:

> Follow a Valid Sequence

> Wait for Continuation

> Confirm Entry (valid candlestick pattern)

> Know When to Exit (SL placement)

Remember, technical analysis is subjective; develop your own approach. I use this format primarily to hold myself accountable and to share my personal market views.

The pairs I publish here are usually discussed in detail in my Weekly Forex Forecast (WFF) and are now showing further developments worth mentioning.

⚠ Ensure you have your own risk management in place and always stick to your trading plan.

*** **** ****

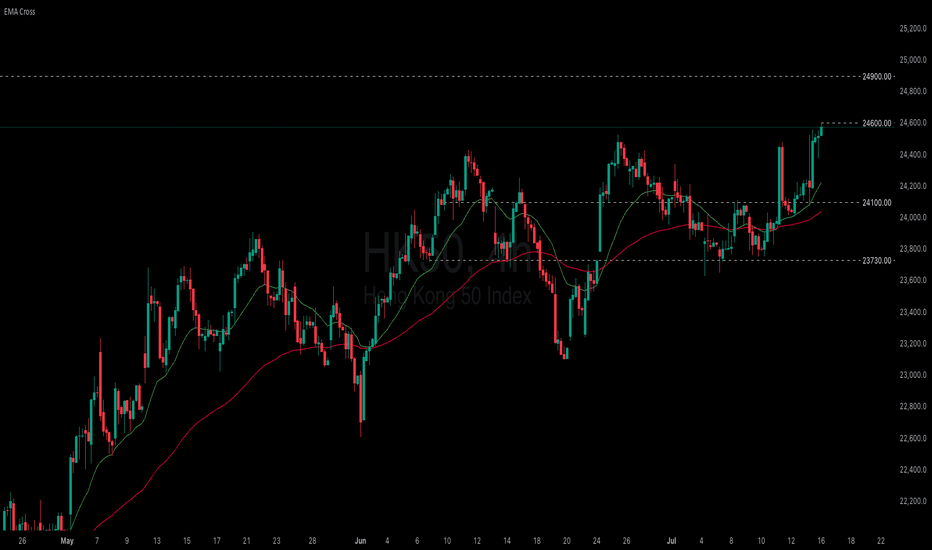

Will China's strong growth and ongoing stimulus lift the HK50?

Despite US-China trade tensions and weak domestic demand, China’s GDP growth has surpassed its 5% target for the first half of the year. According to the National Bureau of Statistics, Q2 GDP grew 5.2% YoY, with authorities noting that stimulus measures aimed at boosting consumption had some effect. Reflecting this momentum, Morgan Stanley raised its 2024 China growth forecast from 4.2% to 4.5%, while Deutsche Bank revised its outlook to 4.7%, a 0.2 percentage point increase.

HK50 maintained its steady uptrend, marking a new 4-month high. Both EMAs widen the gap, indicating the potential continuation of bullish momentum. If HK50 breaches above the recent high at 24600, the index could gain upward momentum toward the next resistance at 24900. Conversely, if HK50 breaks below the support at 24100, the index may retreat to 23730.

New Zealand GDP expected to contract, New Zealand dollar recoverThe New Zealand dollar has posted gains on Wednesday. In the North American session, NZD/USD is trading at 0.6042, up 0.45% on the day. The New Zealand dollar sustained sharp losses a day earlier, declining 0.75%.

The New Zealand economy is in recession and the markets are bracing for a contraction in first-quarter GDP of 0.8%. The economy declined in Q4 2024 by 1.1%.

A weak GDP report would put pressure on the Reserve Bank of New Zealand to reduce interest rates at the next meeting on July 9. The Reserve Bank has been aggressive and lowered rates for a sixth straight time in May to 3.25%, for a total of 225 basis points.

Is the resilient US consumer showing cracks?

US retail sales slumped in May, falling 0.9% m/m. This was well below the revised -0.1% reading in April and worse than the market estimate of -0.7%. Annually, retail sales fell to 3.3%, down sharply from a revised 5.0%.

The monthly retail sales is particularly concerning because it marked a second straight decline. The pre-tariff spike in consumer spending has fizzled as the tariffs have taken effect. Consumers are wary that the tariffs will boost inflation and dampen consumer spending power and concerns about hiring have risen, prompting consumers to batten down the hatches in anticipation of tougher times ahead.

If additional key US data heads lower, this will increase pressure on the Federal Reserve to lower interest rates. The markets have priced in a hold at Wednesday's meeting at practically 100%, with little chance of a rate cut before September.

NZD/USD is testing resistance at 0.6035. Above, there is resistance at 0.6060

0.5990 and 0.5965 and providing support

US & Global Market Breakdown | Profits, Losses & Bearish TradesIn this video, I break down the current state of the US and global economy, and why I believe we’re heading into a bearish phase.

📉 Fundamentals:

I cover the key macroeconomic factors influencing the markets — including Trump’s proposed new tariffs, slowing GDP growth, and ongoing supply chain constraints. These all point toward increasing pressure on the global economy.

📊 Technical Analysis:

I go over the major indexes and highlight their recent behavior. We’ve seen reactions from resistance levels, contraction patterns forming, and a significant volume dry-up — followed by today’s spike in volume, which occurred right at resistance. These are potential signs that the market may be shifting toward a bearish trend.

That said, we could still just be witnessing a deeper pullback within a longer-term uptrend. Markets are unpredictable, and no one knows for sure — which is why it’s important to always do your due diligence.

💰 I also review the profits and losses I’ve taken on recent bullish trades, and why I’ve now positioned myself in select short opportunities based on what I’m seeing.

If I’m sharing this, it’s because I’m personally investing my capital based on my conviction — so always use your own judgment and risk management when making decisions.

If you found value in the breakdown, leave a like, comment, and subscribe for more timely updates.

Are you shorting the bounce or waiting for confirmation?Japan’s Q1 GDP came in worse than expected: -0.2% QoQ (-0.7% annualized). Weak consumption, soft exports, and a fading external boost despite a weak yen isn't a great combo for Asia’s largest export economy.

The Nikkei 225 reacted immediately, and the H4 chart is starting to reflect deeper structural pressure.

🔍 Technical Outlook:

- Price reversed from the high of 38,745.

- Price is testing the 50 SMA and could enter the Ichimoku cloud.

- The cloud is signalling a twist, which could be a sign of momentum fading and the trend weakening or reversing.

📊 Projection:

If the price closes below the 50 SMA and breaks through the cloud, further downside could be expected, with the target levels at

- 36,800 (last consolidation zone), and

- 35,570 (38.2% fibonacci retracement level and 200 SMA).

Alternatively, if the bulls defend the cloud, we could see the price climb to the resistance level of 40,500

This is a classic macro meets technicals moment. A weak data print is lining up against the possibility of a technical rollover.

$GBGDPQQ -UK GDP Growth Above Expectations (Q1/2025)ECONOMICS:GBGDPQQ

Q1/2025

source: Office for National Statistics

- The British economy expanded 0.7% on quarter in Q1 2025, compared to 0.1% in Q4 and forecasts of 0.6%, preliminary figures showed. It is the strongest growth rate in 3 quarters, with the largest contribution coming from the services sector, gross fixed capital formation and net trade. Year-on-year, the GDP expanded 1.3%.