XAGUSD Bullish Breakout: Trend Continuation Toward 124.00This is a 30-minute XAGUSD (Silver vs USD) chart showing a bullish breakout within a well-defined uptrend.

Overall trend: Price is moving inside a rising channel, respecting an ascending trendline that has acted as dynamic support.

Ichimoku Cloud:

Price is above the cloud, confirming bullish market structure.

The cloud is rising and expanding, signaling strong underlying momentum and trend stability.

Key resistance & breakout:

A horizontal resistance zone capped price multiple times.

Silver has now broken and held above this level, confirming a bullish breakout.

Price action: Post-breakout consolidation shows higher lows, indicating acceptance above resistance rather than a false break.

Support confluence: The breakout level aligns closely with the rising trendline and the top of the Ichimoku cloud, strengthening the bullish bias.

Target projection: An upside target is marked near 124.00, consistent with trend continuation and prior structure extension.

Overall, the chart favors trend continuation to the upside, as long as price remains above the breakout zone and ascending trendline.

GOLD-SILVER

Stop!Loss|Market View: USDJPY🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDJPY currency pair☝️

Potential trade setup:

🔔Entry level: 153.102

💰TP: 151.009

⛔️SL: 154.358

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: The USD remains susceptible to selling due primarily to geopolitical risks, and yesterday's Federal Reserve results were perceived by the market as unfavorable for the American currency. This trend will likely persist until the end of the week, but special attention should be paid to today's and especially tomorrow's US session. Profit-taking is likely before the weekend.

Thanks for your support 🚀

Profits for all ✅

#EURJPY , Gonna be sweet with us ?📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #EURJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Not a Quality Setup , if it Moves Perfectly will take it , if not .... just let it go

🚀 Trading Plan:

• Need Valid momentum Structure over the POI

• LTF ENTRY NEEDED

• Just and Only for QuickScalp

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

SPY/QQQ Plan Your Trade For 1-28: Breaking(Up/Down)Today’s pattern is a Breaking(Up/Down) pattern.

This pattern suggests the SPY/QQQ will attempt to break away from yesterday’s price range. Normally, these Breaking patterns resolve as a moderately aggressive move away from the previous candle’s body range. Thus, my expectations are for the SPY/QQQ to attempt to move higher into the “new high” territory as we continue to work through the Flag Apex volatility phase.

Overall, I believe this move higher will stall out in early February and move downward as my Predictive Modeling has suggested. For many weeks, the Predictive Modeling tool has shown the markets will move into a potential breakdown phase in early/min February.

At this time, I believe the markets are pushing higher into a “false high” pattern that could translate into a larger breakdown phase moving through Q1:2026 and into Q2:2026. Time will tell.

As you know, I’ve moved my trades mostly to CASH and am currently sitting on about 70-80% CASH in my account. Yes, I still have some trades active and I have begun to setup 35+ day Shorts/Puts related to my expectation the markets may move downward in early February – but I’m not going to chase this move any further right now.

The one trade I believe I may make by the end of this week is to put on 1-3 longer-term Gold/Silver Calls. I believe this move in metals is unprecedented and I believe a small active position is almost essential. If you don’t play this once in a lifetime move efficiently, you can’t materialize the gains.

Right now, the hardest part of my trading is NOT wanting to get overly excited about these big runs in Metals and the potential for NatGas. I have to keep telling myself to be patient and wait for the right setups. Trust my analysis and trust my instinct.

There will always be another day to trade in the future.

At this point, I think the smartest move is to sit back and watch for a few days. This big move higher in Gold/Silver could be “the rally to the peak of Leg #2” – just like I predicted. One thing I’ve learned is not to chase moves when you believe they are over or nearly done.

Sure, you can leave a small runner position on if you want. Just be prepared for that position to turn into a loss if the markets suddenly turn against your trade.

NatGas rolled to the March contract. That is why we are seeing a big price gap on the NG chart. UNG is holding up well and I believe this storm will continue to increase demand into February – possibly into March. So, I plan on trying to take advantage of any price weakness in UNG.

If today goes as planned, it should be a day of mostly sitting and watching the markets. I don’t plan on being overly aggressive with my trades today.

Get some.

BTCUSD: continuation of the fall🛠 Technical Analysis: BTC is trading below the 90K psychological zone after the recent pullback, with price compressing near the MA cluster (dynamic resistance). The rising support line and the 88,335 area act as the key “trigger” zone: a clean breakdown can open the way for a deeper correction. Nearest resistance is 92,193 . Key downside support/target zone is 80,820.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: 88335.83

🎯 Take Profit: 80820.02

🔴 Stop Loss: 92193.50

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

CRITICAL JUNCTIONThe larger trend is down.

Shorter term trend is up.

There are 3 cases to be made here.

I currently don't see any reason for the green case, but perhaps the yellow. Gold and silver are signaling for the red case.

Strong Dollar Camp

- Scott Bessent's comments were helpful "strong dollar policy".

- Long Term Yields are rising. If they are relatively higher than their peers and confidence in the U.S. returns, it could be massively bullish.

Neutral Camp

Jerome Powell essentially walked away today, and said the rest is up to the next guy.... Did nothing to defend the dollar, or weaken it further. Stable Mable.

Weak Dollar Camp

- Trump weakens the dollar "who needs allies".

- Congress just wants to keep printing more to spend, they're only arguing about what to spend it on...

GBPUSD: consolidation at 1.37🛠 Technical Analysis: On the H1 chart, GBPUSD remains bullish after a strong impulse move and is now compressing beneath the marked resistance zone around 1.37000. Price is holding inside a rising structure, with the steep trend channel still intact and suggesting continuation if buyers defend the pullbacks. The moving averages are angled higher and sit below price, reinforcing the upward bias. A clean push above the resistance area opens the way toward the next upside target, while a drop back below the consolidation base would signal a deeper retracement into the nearest support zone.

———————————————

❗️ Trade Parameters (BUY)

———————————————

➡️ Entry Point: 1.36872

🎯 Take Profit: 1.37532

🔴 Stop Loss: 1.36438

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

XAUUSD: false breakout setup🛠 Technical Analysis: On the 4-hour timeframe, XAUUSD remains in a strong uptrend, but the price is currently squeezing below a clearly defined resistance band in the 5080-5100 region. A probable breakout above this zone could potentially form a "false breakout," trapping buyers before a corrective move begins. The key trigger is the rising trendline support: a confirmed break below it would confirm a bearish correction scenario. The price is still above the 50/100/200 SMA, but a loss of the trendline + SMA50 area will likely accelerate the downward momentum. The next important demand zone is near 4900. A sustained hold above the resistance zone (and especially above the 5184 area) would invalidate the sell signal and maintain the bullish trend.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed false breakout at 5,080–5,100 followed by a break below the rising trend support (approx. 5,050–5,070)

🎯 Take Profit: Support near 4,900

🔴 Stop Loss: 5,184

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

#GBPJPY , Another Short ??📊 Morning Market Brief | London Session Prep

🔎 Instrument Focus: #GBPJPY

⚠️ Risk Environment: High

📈 Technical Overview:

Maybe , We can have GJ again but this time would be so Risky.

🚀 Trading Plan:

• Check Momentum around Entry point . if it be high momentum , SKIP IT

• LTF ENTRY NEEDED

🧠 Stay updated with real time news and macro events, visit 👉 @News_Ash_TheTrader_Bot

#Ash_TheTrader #Forex #EURUSD #MarketInsight #PriceAction #TradingPlan #RiskManagement #LondonSession #Scalping #Futures #NQ #Gold

$TSLA Earnings Surprise? Sub $400 perhapsWell... Hope everyone has been good since I've last seen everyone. I'm doing alright, thanks for asking. Had my first profitable year trading options and it feels fantastic. With that said, lets start the new year with a bang! I've got this bar pattern here, a direct bearish match. Invalidation with a close above the gap at $475. Any close below the gap fill will be considered bearish into Earnings where the pattern matches up for a mean drop sub $400 by the end of the first week of February. I'll be looking forward to catching this $70 move if possible.

Gold near $5,000 — this is where bull markets turn parabolic🚨 As we are closing in 5,000 USD in gold prices, the bull market is entering its parabolic stage. Let’s review the current bull market stats + historic bull markets in more detail. Let’s go.

________________________________________

✅ Executive Summary — Top 10 Key Takeaways

1.🟡 Gold just printed a new ATH: $4,887.82/oz (Jan 21, 2026) and is hovering around $4,885.

2.🧠 From the 2016 low (~$1,080) to today: ~+352% (≈ 4.5×).

3.🎯 $5,000 is the magnet level: Reuters notes traders are watching/holding for the $5,000 psychological threshold.

4.🏦 This cycle’s signature: central banks remain the anchor buyer — 1,045t added in 2024 (3rd straight 1,000t+ year).

5.💧 ETFs are back: physically backed gold ETFs saw record-setting demand bursts

6.🧨 The 2026 catalyst (right now): fresh safe-haven demand tied to elevated geopolitical/trade stress.

7.🧱 Structure matters: the multi-year base/breakout thesis (2024) has evolved into an “ATH staircase” into 2026.

8.🥈 Silver is also in a historic move: it hit an all-time high around $95.87

9.📊 Relative performance: S&P 500 finished 2025 up ~16.39%, while gold’s 2025 run was widely described as exceptional

10.🔥 Upside framing is now mainstream: some strategists explicitly model paths to $7,500/oz in 2026

________________________________________

🔥 What’s Different About This Bull Market 2026

•🏦 Central-bank dominance is the backbone

•💸 ETF flows returned in size, adding a powerful Western liquidity bid.

•📉 Rates/real-yield expectations still matter, but now gold also trades as a trust/sovereign-risk hedge during political and trade shocks.

________________________________________

🏆 Historic Gold Bull Markets — Timeline & Stats

1) 1968–1980 “Super Bull”

•Start/End: ~$35 → $850

•Gain: ~2,330%

•Drivers: End of Bretton Woods, oil shocks, double-digit inflation, geopolitics

•Drawdown: ~–45% before the final blow-off run

2) 1999–2011/12

•Start/Peak: ~$252 → ~$1,920

•Gain: ~650%

•Drivers: Commodities supercycle, EM demand, USD weakness, GFC safe-haven bid

3) 2016/2018–Present The “CB-Led” Cycle

•Cycle low (key anchor): ~$1,080 (2016)

•Latest / ATH: ~$4,885 spot; ATH $4,887.82 (Jan 21, 2026)

•Gain since 2016 low: ~+352%

•Primary drivers:

o🏦 Central banks: 1,045t added in 2024 (3rd straight 1,000t+ year)

o💧 ETF inflows: major re-acceleration, including record Q3 2025

o🌍 Geopolitics/trade shocks: renewed safe-haven urgency into Jan 2026

________________________________________

📊 At-A-Glance Comparison

Metric 1968–80 Super Bull 1999–2012 2016–2026 Current

🚀 Total Gain ~2,330% ~650% ~+352% (from ~$1,080)

⏲️ Duration 12 yrs 13 yrs ~10 yrs (ongoing)

💔 Max Drawdown ~–45% ~–30% ~–20%ish (not a deep secular washout so far)

🏦 Main Buyer Retail/Europe Funds/EM Central banks + ETFs/investors

🏛️ Pattern Secular parabolic Cyclical ramps Breakout → staircase ATHs → $5k magnet

________________________________________

📈 Top 10 Stats of the Current Bull Jan 2026 Edition

1.🟡 Price / ATH: $4,885 spot; ATH $4,887.82

2.🧮 Bull-cycle gain (2016 low): ~+352% from ~$1,080

3.🧲 Next magnet: $5,000 psychological level

4.🏦 Central banks: +1,045t in 2024 (3rd straight 1,000t+ year)

5.💧 ETF surge: Q3 2025 logged the strongest quarter on record (WGC)

6.🌍 2026 impulse: safe-haven bid tied to geopolitical/trade escalation

7.🥈 Silver confirmation: record ~$95.87 (Jan 20, 2026)

8.🧱 Demand pulse: WGC-linked commentary highlighted record-strong quarterly demand in 2025 (investment + CBs)

9.📊 Equity comparison anchor: S&P 500 2025: +16.39% (gold’s run continued to new records in Jan 2026)

10.🎯 Street framing: credible scenario work explicitly targets $5,000/oz as a 2026 outcome case

________________________________________

🎯 Strategy Ideas 2026+

Core simple + durable

•🧱 Hold/add on pullbacks via allocated physical, high-liquidity ETFs, and quality royalty/producer names.

•⚖️ Size it like insurance: you want enough to matter, not enough to force emotional selling.

Satellite torque, optional

•🥈 Silver (higher beta) + select miners only if you accept volatility (silver just proved it can go vertical).

Risk management

•🧯 Define your trim rules before the chart goes vertical:

otrim a slice into euphoric spikes, keep the core

oavoid leverage if you can’t stomach violent swings

________________________________________

🧪 Reality Check — What Could Cool This Bull?

•💵 Sustained USD strength + higher real yields

•🏦 Meaningful slowdown in official-sector buying

•📉 Big reversal in safe-haven demand if geopolitical/trade risk de-escalates fast

________________________________________

🔚 Updated Key Takeaways

•🏦 Central banks + ETFs are the twin pillars of this cycle.

•🟡 Gold is printing fresh records into Jan 2026 and $5,000 is the next psychological battleground.

•🧠 From $1,080 (2016) to ~$4,885, we’re up ~+352% — and the tape is behaving like a late-stage trend.

Breakdown after Jan 14 Volatility Event - Get some.This video highlights the continued price action I suggested would take place after the Jan 14 volatility event.

Honestly, watching the markets open tonight, moving in the direction of my trades (metals, SPY/QQQ/TECS/XLK/others). I could not be happier.

Additionally, Nat Gas is starting to make a big move higher. I've been positioning into this move for more than 30 days. Now, the dual Polar Vortex may setup driving very cold temps into the US/UK.

Sometimes, you have to trust the ADL predictive modeling and play those bigger moves for profits.

I just wanted to share this success and to ask you if you were able to follow my research and GET SOME as well.

We could see a big breakdown over the next 24 hours on news or social issues in the US/UK.

Get some.

Jan 14 Major Volatility Event Update - Thank youI wanted to give everyone an update related to my thinking.

I'm not expecting this Jan 14 volatility event to be more than a 3-5% pullback event. I know that may seem huge for some of you, but it really is not that big.

What I really do expect is this event changes how the markets develop forward objectives for Q1 and Q2 2026.

I've tried to explain my actions and expectations in this video for all of you to review.

Remember, I'm just a trader like all of you. I use my tools and research to try to make the best decisions.

Overall, as I've learned, it is all about protecting capital and positioning for the best opportunities. If you are wrong, you take your lumps, learn, and try to do better next time. If you are right, you try to replicate that winning process.

As I mentioned before. Last year, I had a great year trading. I'm not going to go into details - but I'm very happy.

I'm looking to do even better this year.

As I continue to share more videos, remember one thing (please), I'm just sharing my thoughts. if you don't like my content - go find someone else you trust.

This is all about trying to make the best decisions.

Get some.

USDCHF: post-NFP setup🛠 Technical Analysis: On the H4 chart, USDCHF is rebounding into a key resistance cluster around 0.7990–0.8000, where price meets the prior supply zone and the MA area (SMA200 ~0.7976). The structure still carries a broader bearish tone (global bearish signal), and the current rally looks like a retest rather than a clean trend reversal. It expected that a potential liquidity sweep (renewal of the local high) followed by a reversal — a confirmed close back below 0.79900 would be the trigger for continuation lower. If the rejection is validated, the downside path opens toward the marked support at 0.78787.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell after a sweep higher and a confirmed H4 close back below 0.79900 (approx. 0.79809 – 0.79900)

🎯 Take Profit: 0.78787

🔴 Stop Loss: 0.80488

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

MAJOR VOLATILITY EVENT ON JAN 14 : GET READYI've created this message to alert all of you to a massive volatility event that should take place on January 14, 2026.

My predictive modeling system suggests the SPY/QQQ/DIA will react to some type of massive volatility event on Jan 14. I don't know what will cause the event, but it looks like the SPY/QQQ/DIA may move 3-5% or more and remain in an elevated-volatility period for more than 5-10 days (through the end of January).

I suggest traders take Monday/Tuesday (Jan 12-13) to balance their portfolios/trades and try to position ahead of this massive volatility event.

If you have trades that could be wiped out over the next 5-10 days because of an event like this, make efforts to preserve your capital ASAP.

If you have longer-term trades, expiring after Feb 15 or so, you may be OK holding them if they are LONGS/CALLS. But I believe this volatility event could be something HUGE. So, all of you need to make efforts to protect your account/capital - even if I'm wrong.

I've created this video to explain WHY it is so important for traders to understand what may happen on Jan 14. And the only reason I know this event is likely to happen is because of my predictive modeling tools.

Either way, this is a warning for all of you. The markets will likely move into a massive volatility event on or near Jan 14.. Get ready.

This could be HUGE.

Get some

Gold and Silver Breakout After Jobs ShockFriday’s US jobs report acted as a macro trigger

Not noise

A regime signal

Payrolls printed well below expectations

Labor momentum is cooling faster than policy expected

Markets reacted immediately

✓ Gold pushed into the $4,490 zone

✓ Silver surged toward $79

✓ Weekly momentum confirmed across both metals

Why This Matters

Weak employment data accelerates the path toward rate cuts

That shifts the balance

✓ Real yields fall

✓ Dollar pressure increases

✓ Non yielding assets gain relative strength

This environment historically favors precious metals

Why This Move Has Follow Through

✓ The rate hiking cycle is already over

✓ Inflation has stabilized enough to allow easing

✓ Geopolitical risk remains elevated

✓ Central bank gold accumulation continues

This is structural demand meeting cyclical tailwinds

Silver Is Leading

Silver out performance signals risk appetite within the metals complex

✓ Dual demand from industry and capital flows

✓ Elevated gold silver ratio compressing

✓ Smaller market size amplifies momentum

Historically silver leads during expansionary phases of metals bull cycles

Technical Structure

Gold

✓ Holding breakout above recent consolidation

✓ Prior resistance now acting as support

Silver

✓ Clean expansion from multi week base

✓ Strong acceptance above breakout zone

This is trend continuation behavior not exhaustion

Positioning Insight

Pullbacks into prior breakout zones remain constructive

Invalidation only occurs on sustained acceptance back below support

RB Trading

Educational content only

Risk management required

Stop!Loss|Market View: USDCHF🙌 Stop!Loss team welcomes you❗️

In this post, we're going to talk about the near-term outlook for the USDCHF currency pair☝️

Potential trade setup:

🔔Entry level: 0.79758

💰TP: 0.78838

⛔️SL: 0.80276

"Market View" - a brief analysis of trading instruments, covering the most important aspects of the FOREX market.

👇 In the comments 👇 you can type the trading instrument you'd like to analyze, and we'll talk about it in our next posts.

💬 Description: At the end of this week, at least until tomorrow's non-farm data release, we should expect further strengthening of the USD across all major currencies. However, the technical situation for USDCHF is different from the others, growth is also expected there, but the area around 0.79 will likely be tested before a more global strengthening of the USD. Targets around 0.78 are also being considered. The most reliable entry point for this could be a false breakout near the 0.8 resistance level.

Thanks for your support 🚀

Profits for all ✅

Venezuela: The "Blue Gold" Heist (It’s Not Just Oil)If you rode the Western Digital ( NASDAQ:WDC ) trade with me, you saw what happens when the market realizes AI needs Space. We caught the bottom on WDC because the infrastructure trade was obvious. (See related idea: The Vault of the AI Era)

But the "Supercycle" doesn't stop at Storage. It goes deeper. From Bytes (Software) ➡️ to Atoms (Raw Materials).

1. The "Blue Gold" Thesis 🇺🇸🇻🇪 Everyone is debating the oil politics of the US & Venezuela. They are missing the Tech Angle. Venezuela sits on the Orinoco Mining Arc, home to massive reserves of Coltan ("Blue Gold") and Rare Earths.

The Reality Check: You cannot build an NVDA GPU, a WDC hard drive, or a TSLA robot without these minerals. Coltan is the "blood" of the electronics industry.

The Pivot: The US "Reconstruction" effort isn't just charity. It is a strategic move to secure the physical supply chain of the AI era. They are breaking the monopoly on critical tech inputs.

2. The "Hard Asset" Rotation 🔄 Smart Money is rotating from "Overvalued Tech" to "Undervalued Resources."

Silver ( NASDAQ:XAG ): The ultimate "Hybrid." It wins twice—once on inflation (Venezuela spending), and again on the massive industrial demand for the AI grid. (See my "Curse Broken" analysis)

Gold ( TVC:XAU ): The Liquidity Sponge. If they print money to rebuild, Gold goes up. Simple math.

3. The Chart: The REMX Breakout 📉 I marked up the Weekly Chart of the Rare Earth ETF ( AMEX:REMX ) because the geometry is too clean to ignore.

The Wedge: We just broke out of a multi-year Falling Wedge (Blue Channel). In my experience, this is the "Terminator" of bear markets.

The Floor: We are bouncing perfectly off the Green Support Zone ($50-$60). The "Peak Fear" is in.

The Trade: While Tech is at All-Time Highs, the inputs for Tech are at multi-year lows. That is the opportunity.

REMX 1D:

👇 The "Physical AI" Watchlist: We are playing the Supply Chain, not the noise.

The Brains: NASDAQ:NVDA (Compute)

The Vault: NASDAQ:WDC (Storage Infrastructure)

The Atoms: AMEX:REMX , NYSE:MP (Rare Earths)

The Hedge: TVC:SILVER , TVC:GOLD , $

The Question: We all own the Chips ( NASDAQ:NVDA ). But be honest—do you own a single ounce of what the chips are actually made of?

Disclaimer: Just sharing my read on the macro supply chain. Not financial advice.

XAUUSD: short-term opportunities🛠 Technical Analysis: On the H4 chart, Gold (XAUUSD) remains in a broader uptrend, but the latest swing shows a rejection from the rising resistance line, followed by a sharp pullback and consolidation. Price is now rotating back toward the key horizontal support zone around 4,350–4,365, where another test could trigger a bearish continuation move. The SMA50 and SMA100 are acting as dynamic “decision” levels, while the SMA200 aligns closely with the first downside objective. A confirmed breakdown below the 4,350 area opens the path toward 4,246.67, with the marked medium-term support area near 3,900 as an extended target.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Sell on a confirmed breakdown 4,350–4,365 support zone (approx. 4,365.78)

🎯 Take Profit: 4,246.67 (the first target), medium-term extension toward the support area near 3,900

🔴 Stop Loss: 4,484.90

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

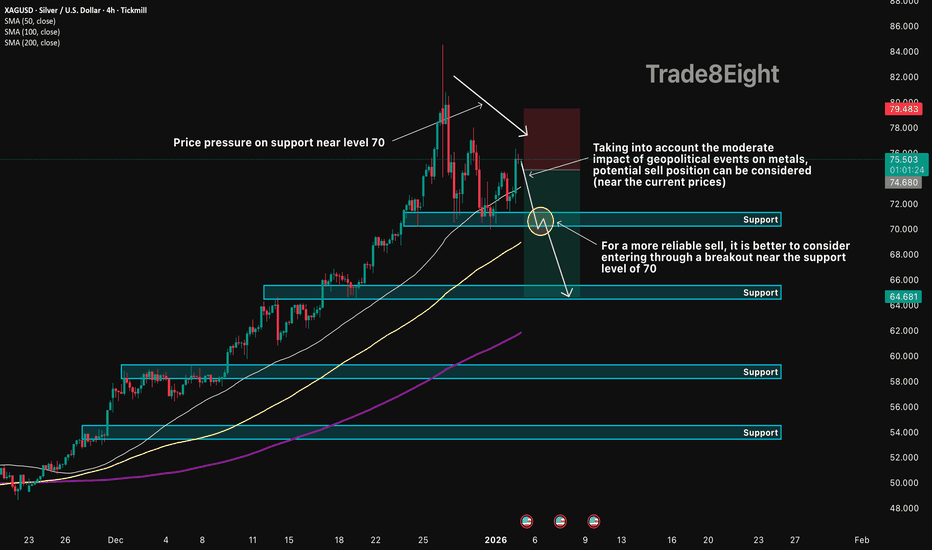

XAGUSD: pressure on $70 support🛠 Technical Analysis: On the 4-hour (H4) timeframe, Silver (XAGUSD) is showing a structural shift toward a corrective phase. Despite the broader uptrend, the price is currently exerting "pressure on the support in the 70 area".

While the long-term trend remains bullish, the "moderate influence of geopolitical events on metals" is currently favoring a pullback. For a "more reliable sell," the strategy recommends waiting for a confirmed breakdown of the 70.00 support zone, which would signal a move toward deeper liquidity levels.

———————————————

❗️ Trade Parameters (SELL)

———————————————

➡️ Entry Point: Current market price ($75.498) or on a break of 70.00

🎯 Take Profit: 64.681 (Support)

🔴 Stop Loss: 79.483

⚠️ Disclaimer: This is a potential trade idea based on current analysis; market conditions and price direction are subject to change based on news factors and volatility.

GOLD: The "Reconstruction" Supercycle (Cup & Handle Breakout)The headlines are focused on the "Oil" aspect of the US-Venezuela news. They are missing the bigger picture. Rebuilding a nation requires massive capital expenditure. Whether it's printed or borrowed, it adds liquidity to the system.

The Thesis: The "Silent Takeover" Phase 2 As we discussed in my previous idea ( Gold: The Silent Takeover) , Smart Money has been rotating out of fiat/tech and into Hard Assets for months. The "Venezuela Reconstruction" is just the latest catalyst in a broader Capital Rotation Supercycle.

1. THE STRUCTURE:

Textbook Continuation 📉 I marked up the Daily Chart (attached) to show the pure geometry of this move.

The Pattern: We have formed a massive Cup & Handle continuation pattern (the purple curve). This is one of the most reliable bullish structures in technical analysis.

The Breakout: Price has broken above the key $4,380 Resistance (Red Line) and is now holding it as support.

The Channel: We are strictly respecting the Blue Ascending Channel. As long as we stay inside this blue zone, the trend is mathematically up.

2. THE CATALYST:

Inflationary Geopolitics 🌍 Why is Gold pushing ATHs while the Dollar is strong? Because the market is pricing in the cost of the US intervention in Venezuela.

Reconstruction = Spending: The US administration has pledged to "invest billions" to rebuild Venezuela's energy grid.

The Hedge: Institutional capital uses Gold to hedge against the currency debasement required to fund these geopolitical moves.

3. THE TARGET:

The "TP" Zone 🎯 The technical measured move of this Cup & Handle aligns perfectly with the "TP" circle marked on the chart. If this channel holds, we are looking at a structural target in the $4,800 - $5,000 region as the Supercycle accelerates.

👇 The "Hard Asset" Rotation List:

If this Supercycle is real, it's not just Gold. Check my previous analysis on Silver (The 1980 Curse Broken) to see how the whole sector is moving together.

TVC:GOLD , TVC:SILVER , CAPITALCOM:COPPER