Research Shows That Trading Harmonic Pattern Could Improve IQ. Hey everyone, in this video, I broke down a fantastic trading setup on the EUR/USD pair using harmonic patterns. I love trading harmonics because it constantly challenges your IQ and makes you a smarter, more analytical trader.

I focused on my three-step framework that I apply to any pair:

Key Level: First, I identified a crucial order block on the higher time frame (weekly). This is our potential reversal zone.

Harmonic Pattern: Next, I moved to the 4-hour and daily charts to find a harmonic pattern aligned with that key level. I found a beautiful bearish Butterfly pattern. It's crucial to match the pattern with the trend—since the overall structure was bullish, we looked for an extension pattern (like the Butterfly) into the key level, not a retracement pattern.

Liquidity Sweep & Entry: The final step was confirming the setup. We waited for a liquidity sweep (a break of the Previous Daily High - PDH) and then a close below a key bullish candle. Entry is on the retest of that break, with a stop loss placed just above the key level.

I showed how the Fibonacci measurements (the 1.272 and 2.0 extensions) converged perfectly in the Potential Reversal Zone (PRZ), making it a high-probability trade. We also discussed profit targets and how to manage the trade by moving stop losses to maximize profits.

This exact same process is what I've used successfully on pairs like GBP/JPY, USD/JPY, and indices like the German 40. It's a structured, repeatable method that filters out market noise.

If you have any questions, drop them in the comments below! Don't forget to like, subscribe, and watch out for more videos like this.

Happy trading!

Harmonic Patterns

Volume Profile Explained with Application BTC Forecast09/09/2025Price isn’t held up by your tweets — it’s held up by volume. And volume says lower.

By walking through the profile step by step, I explain how:

The thick high-volume nodes act as magnets for price.

The thin low-volume zones provide little support and often get filled quickly.

Bitcoin’s current setup suggests price is more likely to retrace lower to retest the areas where most of the trading volume occurred.

If you’ve ever wondered how to connect the dots between the volume profile and the order book, or why market structure points down when everyone else says up

Boom and Crash Strategy on tradingview – Smart Money ConceptTrading Boom and Crash indices can be exciting, but also very challenging. These synthetic assets are designed with volatility in mind. Boom creates sudden upward spikes, while Crash produces sharp downward spikes. For most traders, these spikes feel random, but when you understand market structure and timing, they actually make sense.

In this post, I want to share a detailed Boom and Crash trading strategy based on smart money concepts (SMC). This is not about chasing every spike or relying on heavy indicators. Instead, it’s about learning how the market moves, spotting liquidity traps, and waiting for the right confirmations before entering.

Why Boom and Crash Are Different

Unlike forex pairs or crypto assets, Boom and Crash follow an internal synthetic engine created by Deriv. This means:

They run 24/7 without downtime.

There are no external fundamentals moving them — only programmed volatility.

Spikes are built into their behavior.

Because of this, traditional technical analysis alone often leads to frustration. Many traders try to scalp spikes randomly and end up losing accounts. What works better is combining price action with smart money concepts to create rules for when and where to trade.

Core Elements of the Strategy

Here’s the step-by-step structure of the strategy explained in my video:

1. Liquidity Grab

Markets often move to take out stop-loss clusters before reversing. On Boom and Crash, this is even clearer — you’ll see price sweep recent highs or lows with a sudden spike. That’s your signal that the market is preparing to move the other way.

2. Supply and Demand Zones

Instead of chasing every candle, mark out zones where price previously moved aggressively. These are institutional footprints. When price comes back to test these zones, you prepare for entries.

3. Fractal Confirmation

Don’t enter immediately when price touches your zone. Wait for confirmation — such as a smaller structure break, rejection wick, or micro liquidity grab. This reduces false entries.

4. 1-Minute and 5-Minute Setups

The Boom and Crash 1-minute strategy is for scalpers who want quick profits, but I recommend checking the 5-minute chart for context. Using both keeps you aligned with short-term opportunities while respecting the bigger picture.

5. Best Times to Trade

Timing matters. Even though Boom and Crash are open 24/7, volatility has cycles. Trading during low-volume windows (when fewer spikes are engineered) often produces smoother moves and cleaner setups.

Example Setup

Imagine Boom 1000 is consolidating near a previous high. Suddenly, it spikes above that high, grabbing liquidity. Instead of buying the spike, you mark the supply zone left behind. When price returns to test that zone, you wait for confirmation (a break of structure on the 1-minute chart). That’s your entry for a short, riding the move down safely.

This method works because you’re trading with the market’s intention, not against it.

Risk Management

No strategy works without discipline. For Boom and Crash especially, lot size and stop loss make the difference between growing an account and blowing one.

Risk no more than 2% per trade.

Always set a stop loss, even if it’s mental.

Take profits at clear liquidity pools instead of holding forever.

Remember, consistency matters more than catching every big spike.

Why This Strategy Works

The beauty of this strategy is that it simplifies trading Boom and Crash. Instead of chasing random spikes, you’re reading the “story” of the market: where liquidity is, where institutions are positioned, and when the reversal is most likely.

It also gives confidence. Many traders hesitate to enter because Boom and Crash look unpredictable. With this method, you have rules:

Wait for liquidity grab.

Mark supply/demand.

Confirm with structure.

Enter with controlled risk.

My Journey With Boom & Crash

When I first started with Boom and Crash, I made the same mistakes most traders do. I tried scalping every spike, opening too many positions, and hoping luck would carry me. Accounts got blown faster than they were funded.

It wasn’t until I studied price action and smart money concepts that things changed. I realized Boom and Crash don’t need dozens of indicators. They just need patience, timing, and a structured plan.

This strategy is the result of testing, failing, refining, and testing again. Now it’s the backbone of how I approach synthetic indices.

Key Takeaways

Don’t chase every spike — let the market grab liquidity first.

Focus on supply and demand zones for cleaner entries.

Use 1-minute for scalps, 5-minute for context.

Trade during stable sessions for less noise.

Protect your account with strict risk management.

Final Thoughts

Boom and Crash can either be a trader’s nightmare or a powerful opportunity. It all depends on how you approach them. With a structured strategy based on smart money concepts, you don’t have to guess — you simply wait for the market to show its hand.

If you’re serious about trading these indices, I encourage you to watch the full video breakdown. It walks through chart examples, entry setups, and risk management in detail.

How Institutions Trade with Smart Money ConceptMost traders lose because they don’t understand how the big players (banks & institutions) actually move the markets.

Institutions don’t rely on RSI, MACD, or retail indicators — they move billions with Smart Money Concept (SMC), targeting retail stop losses and fueling big moves.

In this video, I break down:

✅ Market Structure – how institutions decide direction

✅ Liquidity Grabs – stop hunts that trap retail traders

✅ Order Blocks & Fair Value Gaps – where banks enter positions

✅ Step-by-step Institutional Playbook you can follow

💡 Key Idea:

Institutions create the moves retail traders chase. By following market structure, liquidity pools, and order blocks, you can trade WITH the smart money — not against it.

📊 Example Inside the Video:

Real chart breakdown (XAUUSD & EURUSD)

Spotting liquidity pools (equal highs/lows)

Entry after market structure shift

Risk-to-reward setup like institutions

If you want to stop trading like retail and start trading like the banks, this is for you.

📌 Hashtags (for reach):

#SmartMoneyConcept #ForexTrading #FrankFx #LiquidityGrab #OrderBlock #SMCStrategy #TradingView

Liquidity Grab Strategy | Smart Money ConceptHave you ever had your stop loss hunted before price moved in your direction?

That’s called a Liquidity Grab — one of the most powerful setups in Smart Money Concept (SMC).

In this video, I break down:

What Liquidity Grab really means 📊

How institutions use stop hunts to fuel big moves 🏦

Step-by-step guide to trade liquidity grabs profitably

Real chart example on XAUUSD with 1:5 Risk-Reward setup 💰

📌 Why Watch This Video?

Stop chasing false breakouts 🚫

Learn to spot liquidity pools (double tops/bottoms) ✅

Understand confirmation entries after the grab 🎯

Trade with Smart Money, not against it ⚡

🔗 Watch Full Video Here: Liquidity Grab Strategy | Smart Money Concept

📈 Chart Highlight (From Video)

Equal highs formed → liquidity pool created

Price spiked above → retail stops hunted

Market reversed with momentum → clean entry after structure shift

This is exactly how institutions move the market. Knowing this gives you the edge most retail traders miss.

⚡ Key Takeaway

Liquidity Grabs are not manipulation against you — they’re opportunities.

Flip the script: enter with institutions, not against them.

📌 Tags

#SmartMoneyConcept #LiquidityGrab #ForexTrading #XAUUSD #SMC #SupplyAndDemand

Smart Money Concepts LuxAlgo: Trade Like InstitutionsMost traders lose money because they buy and sell randomly. Smart Money Concepts (SMC) changes that by focusing on how big institutions actually move the market — using order blocks, liquidity grabs, supply & demand, and fair value gaps.

Now, imagine combining SMC with LuxAlgo’s Smart Money Concepts indicator on TradingView. This tool automatically marks out order blocks, liquidity levels, and imbalances, making it much easier to spot high-probability setups.

🔹 Key Points Covered in My Video

What Smart Money Concepts really mean

How LuxAlgo highlights order blocks, liquidity sweeps & FVGs

Step-by-step trade confirmation using SMC + LuxAlgo

Real chart examples for forex, gold, and indices

If you’re tired of trading blind and want to understand the market like institutions do, this video is for you.

👉 Watch the full video here

🔔 Don’t forget to subscribe to my channel FrankFx for more trading tutorials and SMC strategies.

#SmartMoneyConcepts #LuxAlgo #Forex #XAUUSD #OrderBlocks #Liquidity #FairValueGap #FrankFx

Exploring Supply and Demand in Financial MarketsIn this video, I discuss the concept of supply and demand and its relevance in today’s markets. Price behavior is often shaped by areas where buying and selling pressures are concentrated, and recognizing these dynamics can provide valuable insights into market movement.

📌 Key Highlights

The role of supply and demand in market structure

How institutional activity shapes price zones

Practical examples from recent charts

Why these concepts remain central to market analysis

This video is designed for traders and investors who want a deeper understanding of how markets respond to imbalances between buyers and sellers.

🔖 Hashtags for Reach

#SupplyAndDemand #MarketAnalysis #TradingView #Forex #Investing #FinancialMarkets #PriceAction

TRADING RECAP ON AUDJPY AND EURUSDHey, my people, I have made a quick video on the trades I took from last week, and I hope that I have shared some lessons that would be useful for you all to take on board and I hope that by the end of this video, you will have clarity on what the trade probability would look like.

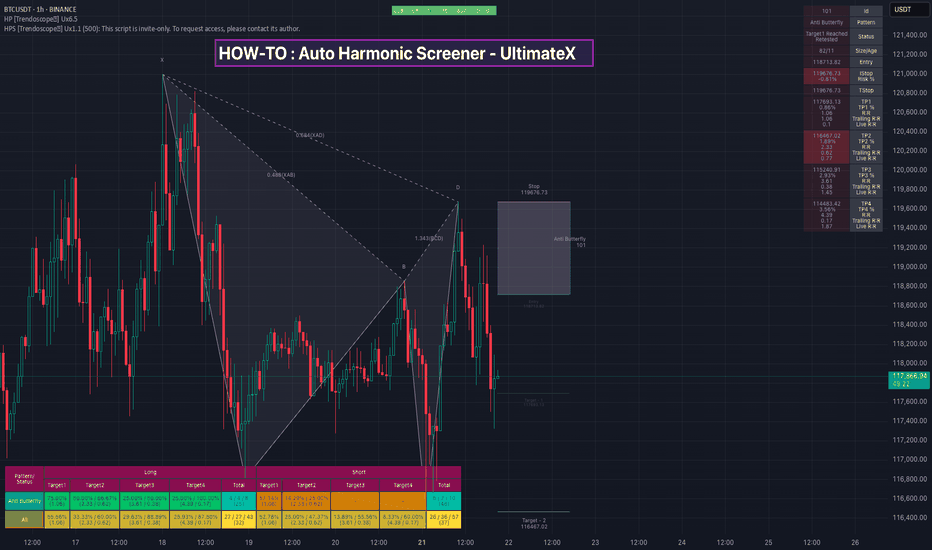

HOW-TO: Auto Harmonic Screener - UltimateXHello Everyone,

In this video, we have discussed on how to use our new Auto Harmonic Screener - UltimateX. We have covered the following topics.

Difference between Auto Harmonic Screener - UltimateX (Current script) and Auto Harmonic Pattern - UltimateX and how to use both the scripts together

Difference between Auto Harmonic Screener - UltimateX (Current script) and the existing screener Auto Harmonic Pattern - Screener which is built on request.security calls. We have discussed how the limitations of old script and how using the new script with Pine screener utility will help overcome those problems.

We have gone through the indicator settings (which are almost similar to that of Auto Harmonic Pattern UltimateX

Short demo on how to use the script with Pine Screener

Also check our existing video on How to use the new Pine Screener Utility.

Learn how to trade EOD / FOD Professional StrategyEOD /FOD is an acronym for End of Day buy or sell short entry that holds overnight and the First of Day sell the ETF or stock at Market Open. This is a strategy for experienced to Elite aka Semi-Professional Traders. Beginners need to hone skills and practice in a simulator.

Professional Traders use this strategy all the time. They rarely intraday trade aka "day trading" unless they are Sell Side Institution floor traders who do intraday trading all daylong.

EOD /FOD is a very simple, easy to learn strategy for when Buy Side Giant Dark Pools have accumulated OR have Supported the Market and the Dark Pools foot print of a rectangle that is narrow with consistent highs and lows.

TWAP Dark Pool orders trigger at a low price or lower and usually move price minimally. When in Support the Market mode. The run up is a long white candle.

TWAPs are automated Time Weighted At Average Price. These orders ping at a specific time and buy in accumulation mode. If the stock price suddenly moves up beyond the high range of the TWAP, then the orders pause or halt.

Then pro traders do nudges and runs are instigated by either Gap Ups by HFTs, OR smaller funds VWAP ORDERS, or MEME's or other large groups of retail traders all trading and entering orders in sync or as close to sync as possible to create a flood of small lots that do move price upward OR downward rapidly.

Using the EOD /FOD requires understanding of how the Dark Pools, Pro Traders and other groups react to price and what, where and when orders are automated.

When ever you see a platform trend pattern such as we have on the QQQ yesterday at close and early this morning, then the entry would have been in the last 5 minutes of yesterday's market.

Using The Zig-Zag Indicator To Gain Clarity On Your Price ChartIn my experience, learning how to read a price chart, specifically understanding the ebbs and flows of a trend, is the biggest hurdle that newer traders face. At least on the technical side of things.

Something that helped me shorten that learning curve at the beginning of my trading career was the "Zig-Zag" indicator. Now, I didn't use it as part of a strategy or anything like that. Rather, it was a tool that helped train my eyes to read extensions and retracements in the markets both at a beginner and advanced level.

If you're someone that is struggling, hopefully it can do the same for you.

Please remember to support by hitting that like button and if you thought this video was helpful please share so other traders can benefit as well.

Akil

US30 Trading Strategy That’s Been Proven to WorkThis strategy is backtested over trades and works best during the New York session (9:30 AM - 12 PM EST).

Here’s how it works:

Step 1: Identify Key Levels

These are the support & resistance areas where institutions place big orders.

Look for previous highs, lows,

Step 2: Wait for a Liquidity Grab

Banks love to trick retail traders by creating fake breakouts.

We wait for price to break a key level, trap traders, then reverse.

Step 3: Enter on Confirmation

Once we see a liquidity grab, we wait for a strong rejection candle (pin bar, engulfing, etc.).

Entry is placed at the close of the confirmation candle.

Step 4: Set Stop Loss & Take Profit

Stop loss: Just beyond the liquidity grab.

Take profit: At least 2x the stop loss distance for a 1:2 risk-reward ratio.

How to Predict Market Highs - Lows with Gann Astro Trading.How to Predict Market Highs & Lows with Gann Time & Price Theory

Gann Planetary Time Cycles | The Only Proven Way to Predict Market Reversals With 95% Accuracy.

In this in-depth Video, we explore Gann Astro Trading and uncover how Gann’s time and price square techniques can help predict major market reversals. By understanding Gann’s planetary cycles, you’ll learn how planetary movements influence price action and how traders can use this knowledge for precise entry and exit points.

🔹 What You Will Learn in This Video:

✅ How Gann used planetary cycles to forecast market trends

✅ The connection between time and price and how they square for reversals

✅ Identifying market turning points using planetary trend lines

✅ The significance of planetary longitudes and key angles (e.g., 135°, 180°) in trading

✅ Using major planetary pairs (e.g., Mars-Uranus, Saturn-Sun) to find support & resistance

✅ How traders subconsciously react to planetary movements and price levels

✅ The importance of using long-term charts for accurate forecasting

✅ Finding a universal price conversion for a stock, forex pair, or commodity

📈 Why Gann’s Astro Techniques Work:

Gann believed that financial markets move in harmony with planetary cycles. By applying his time cycles and planetary movements, traders can decode price action and anticipate future highs and lows.

Gann Astro Trading | The Secret to Predicting Market Reversals with Planetary Cycles

Gann Astro trading is a highly advanced market forecasting method that combines W.D. Gann’s time and price principles with planetary cycles, astrology, and mathematical timing techniques to predict market movements with unmatched precision. Gann believed that markets are not random but move in cyclical patterns influenced by celestial forces, planetary transits, and natural laws. By decoding these cycles, traders can anticipate highs, lows, reversals, and trend shifts before they happen, gaining a significant edge in forex, stocks, and crypto trading.

This strategy goes beyond conventional technical analysis by integrating astro-financial patterns, Gann angles, the Square of Nine, and harmonic time cycles to identify the exact moments when time and price align. When this happens, explosive market moves occur, creating high-probability trade setups with minimal risk. Whether you are a day trader or a long-term investor, mastering Gann Astro trading can help you forecast major market turning points, trade with confidence, and maximize profits while minimizing uncertainty.

Traders who apply Gann’s planetary time cycles understand how astro-trading indicators, retrogrades, conjunctions, and planetary aspects influence market behavior. Learning this powerful yet hidden method allows you to see what most traders miss, making it one of the most profitable and accurate trading techniques available today.

Understanding ICT’s Framework for Price Delivery | Smart Money 📊 In this video, we break down ICT’s framework for price delivery, explaining how smart money moves price efficiently through liquidity pools and imbalance zones. We cover:

✅ Market structure & liquidity

✅ How price seeks inefficiencies (FVGs & Imbalances)

✅ The role of algorithmic price delivery

✅ How to anticipate price movement using ICT concepts

🔔 Subscribe for more ICT-based analysis!

#ICTTrading #SmartMoneyConcepts #ForexTrading #PriceDelivery

#ICT #Forex #SmartMoneyConcepts #PriceAction #MarketStructure #OrderFlow #Liquidity #TraderMindset #5minwithfriday

"Gann’s Secrets: Time Cycles, Square of 9 & Market Reversals"Gann’s Trading Secrets | Gann Time Cycles, Gann Square of 9, and Predicting Market Reversals

📌 Topics Covered in This Video:

- The Power of Gann 90 in Market Cycles

- Gann Time Cycles & Gann Market Timing

- Gann Fibonacci levels & Gann Price Levels

- Gann Fan & The Billion-Dollar Trade

- Gann Square of 9 & Price Movements

- The 90-Year Gann Market Cycle & Financial Crises

- How to Use Gann’s Methods in Modern Trading

📌 Why You Should Watch This Video:

- Learn how to forecast market tops and bottoms using W.D. Gann’s techniques.

- Understand how Gann time cycles and Gann price action align in market movements.

- See real-world examples of how Gann’s methods predicted historical market crashes and reversals.

- Discover how major traders, including George Soros, unknowingly used Gann's principles to execute billion-dollar trades.

📌 Timestamps: Gann’s Trading Secrets | Gann Time Cycles, Square of 9, and Predicting Market Reversals

00:00 ▶️ Introduction

00:43 ▶️ W.D.Gann

01:35 ▶️ His Contribution to Technical Analysis

02:19 ▶️ Core Principals

04:13 ▶️ Price and Market Cycles

04:52 ▶️ What is Swing Chart?

06:32 ▶️ Gann Square of 9

07:12 ▶️ Gann's Relentless Study of Markets

07:37 ▶️ The Role of Astrology in Market Cycle

08:13 ▶️ Key Natural Market Turning Points

09:12 ▶️ Gann's 50% Rule

09:58 ▶️ The Three Key factors in Gann Trading

10:13 ▶️ The Price

14:07 ▶️ Gann Fan

14:43 ▶️ The Core Concept of Time-Price Balance

19:02 ▶️ The Role of Geometry in Gann's Work

19:41 ▶️ The Power of the Number 3

24:37 ▶️ The 90-Time Cycle in the Market

27:40 ▶️ Famous Trader George Soros

29:52 ▶️ Historical Economic Depression

30:35 ▶️ 2019 as a Key Time Cycle

31:10 ▶️ Economic Conditions

Pattern Identification ExerciseHere I run through an exercise I first started carrying out around 4 years ago. It is a brilliant tool to help train yours eyes to spot patterns within the market, log the data across multiple different instruments and find specific characteristics with that instrument.

The importance behind carrying out an exercise like this is training your lens to spot these in the live markets, and also stacking your confidence so when you see these develop you are able to approach them in the best way possible.

Any questions just drop them below 👇

Gann Reversals: 144-225 Time Cycle & Fibonacci StrategyMastering Gann Market Reversals The 144 - 225 Time & Gann Price Cycle + Fibonacci Trading Strategy.

We dive deep into a powerful trading strategy that combines Gann’s 144-225 time and price cycles with Fibonacci retracement levels to predict market reversals with high accuracy. We explore how to identify key turning points, confirm entries using price action, and develop a well-planned exit strategy to maximize profits.

Whether you're a beginner or an experienced trader, this method will provide you with a structured approach to understanding price movements and timing your trades more effectively. Apply these principles to your trading routine and start seeing improvements in your decision-making and trade execution.

Learn how to master Gann market reversals using the 144-225 time cycle and Gann price synchronization, combined with Fibonacci trading strategies. This powerful approach helps traders identify key turning points, align time and price for precision entries, and enhance market predictions with Fibonacci confluence.

ACCUMULATION MANIPLUTION DISTRIBUTION EXPLAINED SMCHere i explained how you can use accumulation manipulation distribution trade . As a smart money concept trader you need to under when price is ranging and when is manipulating so you can take advantage of distribution. Using this can maximize your profit and reduce loss.