Bullish momentum to extend?GBP/USD is falling towards the support level, which is a pullback support that is slightly above the 50% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.3547

Why we like it:

There is a pullback support that is slightly above the 50% Fibonacci retracement.

Stop loss: 1.3458

Why we like it:

There is a pullback support lwvwl.

Take profit: 1.3714

Why we like it:

There is a pullback resistance.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Harmonic Patterns

Bullish continuation?EUR/USD is falling towards the support level, which is a pullback support that is slightly below the 38.2% Fibonacci retracement and could bounce from this level to our take profit.

Entry: 1.1806

Why we like it:

There is a pullback support that is slightly below the 38.2% Fibonacci retracement.

Stop loss: 1.1748

Why we like it:

There is a pullback support that aligns with the 50% Fibonaci retracement.

Take profit: 1.1908

Why we like it:

There is a pullback resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

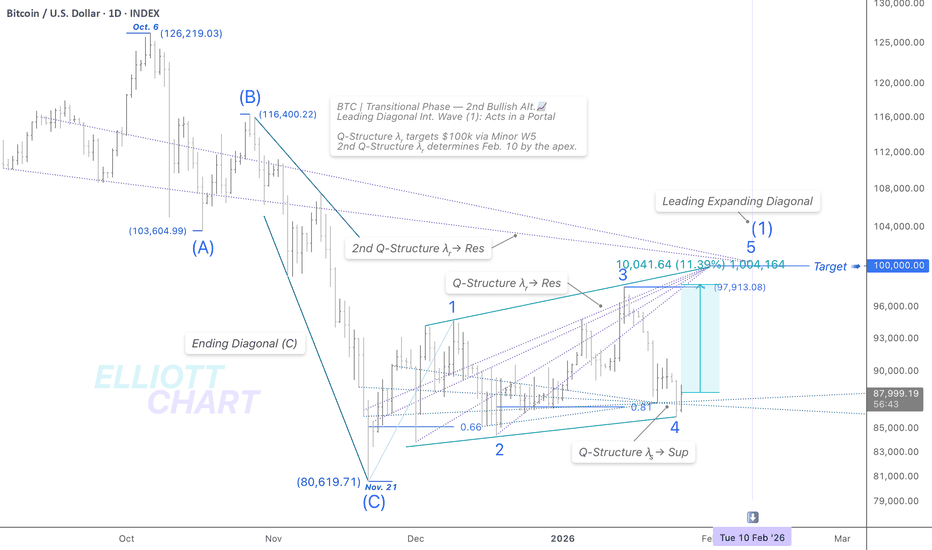

BTC | DailyCRYPTOCAP:BTC — Transitional Phase

Support Q-Structure λₛ held BTC as projected. (as noted on my last BTC's update on X)

Minor Wave 5 may now be underway; a ~11% further advance would confirm a Leading Diagonal as a transitional form in Intermediate Wave (1), signalling a Primary-degree trend reversal.

Newly generated Q-Structure λᵣ(2nd one) projects Feb. 10 as the transition-portal

peak of Int. LD (1).

🔖 This outlook is derived from insights within the Quantum Models framework. Within my methodology, Quantum Structures represent high-probability targets generated by the confluence of equivalence lines. These Q-Structures also serve as structural anchors, shaping the model's internal geometry and guiding the evolution of alternative paths as price action unfolds.

#BTC #Bitcoin #Crypto #CryptoCurrency #DigitalAsset #QuantModels #TrendAnalysis

Oscillating rebound trend

Core Support for Bullish Trends (Bullish Logic)

1.Strong Support Confirmed at $86,000: After a recent dip to $86,035, the price rebounded rapidly. This level, combined with the 200-day moving average, forms double support, and multiple tests have failed to break through it effectively, making it a short-term defense

against further declines. The technical outlook clearly indicates a need for oversold correction.

2.Whale Funds Accumulating Against the Trend: Over the past 9 days, whale wallets holding 10-10,000 BTC have collectively added 36,322 BTC, approximately $3.2 billion, to their low-level holdings. Sufficient support exists in the $87,000-$88,000 range, limiting further downside potential in the short term.

3.Marginal Inflow into ETFs: US spot Bitcoin ETFs saw a net inflow of $1.4 billion in a single week, a new high since the crash last October. BlackRock IBIT saw a net inflow of over $1 billion in a single week, indicating a recovery in institutional allocation intentions and providing financial support for the price rebound.

4.Technical indicators are signaling a recovery: The hourly RSI has turned upward from the oversold zone, and the MACD histogram is showing signs of a golden cross with the green bars continuing to shrink. The short-term technical rebound momentum is gradually accumulating, pushing the price closer to the resistance zone.

Bitcoin trading strategy

buy:87000-88000

tp:89000-90000

Bullish, target 5100Core Support for the Bulls: Three Underlying Logics Solidify the Foundation for Upside

1.Geopolitical Risk Aversion Escalates, Funds Frenziedly Flow into Gold: The US-EU Greenland sovereignty dispute has deteriorated, negotiations between Russia and Ukraine have stalled, the US-Iran standoff in the Persian Gulf has escalated, and news of Iran's full-scale mobilization for war continues to ferment, driving global risk aversion to its peak. The VIX fear index has risen, making gold, as a core safe-haven asset, the preferred choice for funds, with net inflows continuing to expand throughout the day, providing immediate momentum for gold prices.

2.The US Dollar Index Breaks Down, Removing All Pressure: The US dollar index has fallen below its 18-year long-term trend line, hitting a new low for the period. Furthermore, escalating US-EU trade frictions have further weakened the dollar's credibility, prompting European investors to accelerate their withdrawal from dollar assets and invest in gold. The negative correlation between the dollar and gold is extremely pronounced; a weak dollar significantly reduces the cost of holding gold, opening up upward potential.

3.Central Bank + ETF Dual-Way Gold Purchases Create Rigid Support at $5000: Global central banks are projected to purchase an average of 60 tons of gold per month in 2026. The People's Bank of China has increased its gold holdings for 14 consecutive months, and the SPDR Gold ETF recently added 6.87 tons to its holdings, bringing the total to 1086.53 tons. The $5000 level, a historical high for gold, has become a support level for both market sentiment and capital flows. With non-price-sensitive buying providing a floor, a deep correction is unlikely.

Gold trading strategies

buy:4990-5000

tp:5020-5040-5100

Insulet Corporation (PODD)Insulet Corporation (PODD): A Strong Buy Anchored by Platform Dominance, Strategic Execution, and Robust Financials

Insulet Corporation (PODD), a leader in innovative insulin delivery systems, is strategically positioned for sustained growth in the coming quarters. The company’s trajectory is being powered by the exceptional market adoption of its flagship Omnipod 5 platform, disciplined execution against long-term strategic priorities, and a rock-solid financial foundation. While macroeconomic headwinds and product concentration present inherent risks, the confluence of operational strength, market expansion, and upward earnings revisions makes PODD a compelling investment case, as reflected in its Zacks Rank #1 (Strong Buy).

Investment Thesis and Market Performance

Insulet’s focus on driving penetration, deepening its competitive moat, unlocking new market opportunities, and scaling profitably is yielding tangible results. This execution is mirrored in its stock performance, which has risen 10.6% over the past year, significantly outperforming its industry’s modest 1.5% growth. Although this trails the S&P 500’s 18.9% gain, it underscores the stock’s resilience and growth within its sector. With a market capitalization of $20.19 billion and an earnings yield of 1.7%—far superior to the industry average of 0.2%—the company demonstrates efficient value generation. Furthermore, PODD has a stellar track record of exceeding earnings expectations, delivering an average positive surprise of 17.8% over the last four quarters.

Core Growth Drivers: The Omnipod 5 Ecosystem and Strategic Execution

Omnipod 5: A Market Share Catalyst: Insulet’s Omnipod 5 is a transformative product, distinguished as the only FDA-cleared, fully disposable, pod-based Automated Insulin Delivery (AID) system. Its superior on-body wearability, simplicity, and broad accessibility continue to drive rapid adoption. The platform is a key growth engine internationally, where Q3 2025 revenues surpassed $200 million for the first time, fueled by the Omnipod 5 rollout. In the critical U.S. market, Omnipod revenues grew an impressive 25.6%, exceeding guidance, driven by strong demand across both Type 1 and, notably, Type 2 diabetes populations. The expansion into the Type 2 segment is a monumental opportunity, commercially opening the system to an estimated 5.5 million additional people in the U.S. alone.

Multi-Pronged Strategic Expansion: Insulet is executing a comprehensive growth strategy:

Commercial Investments: The company is ramping up demand generation through direct-to-consumer (DTC) campaigns and mass media to boost global brand awareness.

Platform Innovation: To maintain its technological edge, Insulet continues to enhance Omnipod 5 with key sensor integrations (Dexcom G6/G7, Abbott FreeStyle Libre 2 Plus) and has launched the Omnipod 5 App for iPhone. The pipeline is robust, with the STRIVE pivotal trial for a next-gen hybrid closed loop and the EVOLUTION 2 study for a fully closed loop in Type 2 diabetes underway.

Operational Scaling: Significant capacity investments at manufacturing facilities in Acton and Malaysia, coupled with the integration of AI and cloud-based tools, are designed to streamline service operations and support global scale.

Financial Resilience: Insulet’s balance sheet provides a substantial buffer. The company ended Q3 2025 with a strong liquidity position of $757.4 million in cash and cash equivalents against minimal current debt of $80 million. This financial health is a critical advantage in navigating economic uncertainty. Long-term debt stood at $935 million, showing a slight sequential decrease.

Acknowledged Risks and Challenges

Despite the strong outlook, investors must consider several risk factors:

Macroeconomic and Geopolitical Volatility: Global economic uncertainty can pressure demand, intensify competition, and lengthen sales cycles. Persistent supply chain disruptions and reliance on third-party suppliers, particularly in China, expose the company to risks from political instability, labor issues, and rising tariffs—the reinstatement of which is expected to increase product costs through 2025.

Product Concentration Risk: Insulet’s financial performance remains heavily dependent on the Omnipod System. Any material decline in market acceptance or adverse changes affecting its sales could significantly impact results. Additionally, international expansion introduces exposure to adverse currency fluctuations.

Earnings Estimate Momentum and Technical Perspective

The fundamental optimism is crystallizing in analyst projections. The Zacks Consensus Estimate for Insulet’s 2025 EPS has risen 6.3% over the past 30 days, a clear signal of strengthening confidence. Revenue estimates for 2025 stand at $2.69 billion, implying a substantial 30% year-over-year growth.

From a technical analysis standpoint, the chart reveals three defined Fibonacci retracement levels that could serve as crucial support zones during any market pullbacks, providing strategic reference points for entry or risk management:

Primary Support Zone: $240.22 - This level, corresponding to the 0.5 Fibonacci retracement, represents a key midline support and a likely area for consolidation and renewed buying interest.

Secondary Support Zone: $267.21 - Aligning with the 0.382 retracement, this zone indicates a shallower, healthier pullback within a strong uptrend if price holds above it.

Tertiary Support Zone: $213.22 - The 0.618 retracement level represents a deeper retracement support, often considered the last defense for a bull trend before a potential reversal.

Conclusion

Insulet Corporation (PODD) presents a compelling investment narrative centered on a dominant growth platform, meticulous strategic execution, and financial strength. The upward revision in earnings estimates and the stock’s Strong Buy Zacks Rank underscore the positive fundamental trajectory. While macroeconomic and concentration risks warrant monitoring, the company’s initiatives to expand its total addressable market, innovate its platform, and scale operations globally position it well for long-term value creation. For investors, the combination of strong fundamentals, positive estimate momentum, and clear technical support levels offers a structured framework for evaluating this high-potential medical technology leader.

Gold is about to experience a significant decline!!Gold looks like it has completed an impulsive Elliott 1–5 advance, with price now stalling near the top after wave (5). After a strong impulse, a corrective phase (ABC) becomes more likely.

Confluence for a pullback:

Wave (5) exhaustion after a clean 1–5 sequence

RSI topped

Gap / imbalance below, acting as a magnet for mean reversion

Fib retracement zones lining up with prior demand (key area to watch for a reaction)

As long as price fails to reclaim/hold above the recent top, odds favor a pullback into the fib/gap area before the next major move.

EURJPY 1📌 EURJPY – Sell Limit (Professional Analysis)

Entry: 185.000

Stop Loss: 186.200

Take Profit: 183.800

Market Structure & Bias

EURJPY is showing signs of short-term bearish pressure after an extended bullish move on the H4 timeframe. Price recently formed a sharp rejection from the highs, breaking short-term bullish structure and indicating potential distribution at premium levels. The current bias favors a corrective move to the downside.

Technical Confluence

The 185.000 level aligns with a previous intraday support turned resistance, acting as a sell-from-premium zone.

Strong bearish rejection and impulsive selling from the recent highs signal weakening bullish momentum.

Price is retracing into a supply zone, where sellers previously entered aggressively.

The overall move suggests a pullback into resistance before continuation lower.

Momentum has shifted bearish, increasing the probability of sellers defending this area.

Risk Management

The stop loss at 186.200 is placed above the recent swing high and supply zone, invalidating the setup if price regains bullish control.

The take profit at 183.800 targets a key support area, aligning with prior demand and offering a balanced risk-to-reward profile suitable for controlled downside continuation.

Trade Expectation

Price is expected to retrace into the 185.000 resistance zone, encounter selling pressure, and continue lower toward the 183.800 target. As long as price remains below the stop loss level, bearish continuation remains the primary expectation.

Disclaimer

This analysis is provided for educational purposes only and does not constitute financial advice. Always apply strict risk management and ensure the trade aligns with your individual trading plan and risk tolerance.

AeroVironment's High-Stakes Pivot Meets a Critical SetbackAeroVironment, Inc. (NASDAQ: AVAV), a leader in tactical unmanned aircraft systems (UAS) and a rising player in the defense space economy, is facing a pivotal and potentially precarious moment. The stock, which has been a standout performer buoyed by modern warfare trends and elevated defense spending, is now grappling with a significant project-specific setback that casts a shadow over its ambitious expansion and premium valuation.

The company, famously endorsed by CNBC's Jim Cramer who acknowledged liking the stock while cautioning about its "incredibly expensive" price, has ridden a powerful wave. Its portfolio of loitering munitions (often called "kamikaze drones") proved highly effective in the conflict in Ukraine, solidifying AeroVironment's reputation as a critical supplier for contemporary asymmetric warfare. This success catalyzed a strategic pivot beyond drones into the adjacent and high-growth arena of space and cyber systems, aiming to capture more of the Pentagon's budget focused on next-generation capabilities.

The Golden Promise and the BADGER Snag

Central to this expansion is the company's work on advanced satellite communication and management systems, such as the "Golden Dome" and the BADGER ground support system. The BADGER system, in particular, represents the frontier of military space tech—designed to manage constellations of small satellites with enhanced resilience to jamming and cyber attacks. Contracts in this domain with entities like the U.S. Space Force have fueled investor optimism, contributing to the stock's impressive ~70% gain over the past 12 months.

However, this week brought a sobering development. The U.S. government issued a work stop order on two BADGER systems, initiating a renegotiation of the contract due to newly identified required capabilities. The critical risk factor is the fixed-price nature of this development contract. Unlike cost-plus agreements where the government bears the burden of overruns, fixed-price contracts place the full financial risk of development delays and cost overruns squarely on the contractor. For AeroVironment, this means the potential for the BADGER program—a project that could be worth hundreds of millions or even billions in revenue—to become a major profitability drain if technical challenges prove more costly than anticipated. This news triggered a sell-off, reflecting investor fears of compressed margins and execution risk.

Valuation and Financials Under the Microscope

The setback arrives at a time when AeroVironment's valuation metrics were already stretching into high-risk territory. Even after the recent pullback, the company commands a market capitalization of approximately $15 billion. It trades at a price-to-sales (P/S) ratio of 8.6, a premium multiple that demands near-perfect execution and robust profit growth to justify.

Financially, the picture is mixed. The company has demonstrated spectacular top-line growth, increasing revenue by roughly 250% over the last five years. Yet, this growth has not consistently translated to the bottom line; AeroVironment has struggled to generate sustained operating profitability. As the company enters 2026, the core question for investors is whether it can transition from a high-growth, high-burn story to a profitable one. The BADGER contract renegotiation directly threatens that narrative, introducing the possibility of significant cost overruns that could extend its unprofitability and erode cash reserves.

Technical Perspective: Mapping the Risk Zones

From a technical analysis standpoint, the sharp rally and subsequent decline create defined Fibonacci retracement levels that chart watchers are monitoring for potential support. These levels, derived from the stock's previous major upswing, are:

0.5 (50%) Retracement: $259.43 - This represents a moderate pullback and a key level for the bullish trend to hold.

0.618 (61.8%) Retracement: $222.29 - The "golden ratio" retracement, a deeper but common pullback zone in strong trends.

0.786 (78.6%) Retracement: $169.41 - A deep retracement that would signal a severe weakening of the prior uptrend and could indicate a more fundamental re-rating of the stock.

These zones provide a roadmap for potential areas where selling pressure may abate, but a breach of the deeper levels would likely correlate with deteriorating fundamental news on the BADGER program or earnings.

Conclusion: A High-Risk Inflection Point

In summary, AeroVironment stands at a high-stakes inflection point. The company's strategic vision to dominate the nexus of drones, space, and cyber is compelling and aligns with clear Department of Defense priorities. However, the BADGER contract setback is a stark reminder of the execution risks inherent in developing cutting-edge, fixed-price military technology. Combined with a premium valuation and a historical lack of profitability, this introduces substantial uncertainty for 2026.

While the recent drawdown may attract value-oriented or speculative investors, the stock remains risky. The path forward depends heavily on the outcome of the government renegotiation, the company's ability to manage development costs, and its success in finally converting impressive revenue growth into durable profits. Until there is greater clarity on these fronts, particularly regarding the financial impact of the BADGER program, caution is warranted. Investors should view the defined Fibonacci support levels not as automatic buy signals, but as potential waypoints in a volatile re-assessment of the company's risk-reward profile.

Silver - Here comes the bullrun top!☠️Silver ( OANDA:XAGUSD ) creates its final top now:

🔎Analysis summary:

Silver still remains totally bullish. But Silver also remains totally overextended and the metal is also approaching the final resistance trendline. With all of this short term weakness, this might be the final top on Silver. Just please wait for bearish confirmation.

📝Levels to watch:

$100

SwingTraderPhil

SwingTrading.Simplified. | Investing.Simplified. | #LONGTERMVISION

The Trade Desk (NASDAQ: TTD)The Trade Desk (NASDAQ: TTD) finds itself navigating a period of pronounced turbulence, underscored by a sudden and concerning leadership shuffle at the highest financial level. In a press release issued early Monday, the advertising technology company announced the immediate departure of Chief Financial Officer Alex Kayyal. The company provided no reason for his exit, which comes after an exceptionally brief tenure—Kayyal had joined The Trade Desk's Board of Directors in February 2025 and was appointed CFO just over five months ago, in August 2025. This marks the company's second CFO transition in less than six months, following the departure of longtime CFO Laura Schenkein in mid-2024, raising significant questions about stability within the C-suite.

To manage the transition, The Trade Desk has appointed Tahnil Davis as Interim CFO. Davis, the company's current Chief Accounting Officer, brings 11 years of institutional knowledge to the role, a factor CEO Jeff Green highlighted in an attempt to reassure stakeholders. In the same announcement, management sought to preempt concerns about operational or financial health by explicitly reaffirming its previously issued fourth-quarter 2025 guidance. Despite this move, the market reacted negatively, with shares falling sharply on the news. The abrupt nature of the departure, particularly its timing after the close of Q4 but before the earnings report, inevitably fuels speculation about potential undisclosed issues, even as the company insists its financial trajectory remains on track.

This leadership volatility compounds the existing challenges facing The Trade Desk. The company, once a paragon of consistent execution with a 33-quarter streak of meeting or exceeding guidance, has been in a perceived turnaround phase since stumbling early in 2025. CEO Jeff Green attributed the initial miss to "a series of small execution missteps," but the competitive landscape has grown increasingly fierce. Well-capitalized giants like Amazon are expanding their presence in the adtech space, leading some investors to fear The Trade Desk is losing ground. This sentiment is reflected in the stock's precipitous decline, which has fallen roughly 75% since the start of 2025, evaporating a significant portion of its market capitalization.

The reaffirmed Q4 guidance itself reveals underlying business pressures. The forecast calls for revenue of at least $840 million, representing year-over-year growth of at least 13%. This figure confirms a continued deceleration from the 18% growth posted in Q3 and 19% in Q2. While management points to tough comparisons against a politically charged 2024 advertising cycle, the consistent slowdown is a headwind for a stock traditionally valued on high growth expectations. Furthermore, the decision to merely reaffirm—rather than raise—guidance may disappoint investors hoping for a positive surprise to catalyze a recovery.

Beyond growth and leadership, The Trade Desk contends with a valuation that remains elevated despite the steep share price decline. With a price-to-earnings ratio hovering around 40, the stock still prices in a significant growth premium. For the investment to justify its current multiple, The Trade Desk must demonstrate a reacceleration of revenue growth in 2026, successfully navigate the intensified competitive landscape, and restore confidence in its management stability. The repeated CFO changes undermine that confidence, suggesting potential internal discord or disagreements over financial strategy, even if the official guidance remains unchanged.

From an investment strategy perspective, some traders are identifying potential entry and exit points based on the stock's severe correction. A defined "buy zone" is noted around the $20 level, which would represent a further significant decline from current prices and could be seen as a deep-value or contrarian entry point for those believing in the company's long-term foundational strengths in the digital ad-buying platform market. The suggested "take profit" target is set at $60, a level that would represent a substantial recovery but still remain far below the stock's historical highs, acknowledging the changed market perception and growth profile.

In summary, The Trade Desk is at a critical juncture. The abrupt CFO departure is a glaring red flag that amplifies existing concerns about slowing growth, fierce competition, and a premium valuation. While the reaffirmation of guidance offers a sliver of operational stability, it does little to address the core issues of leadership continuity and growth reacceleration. Investors are left to ponder whether this is a temporary run of bad luck and execution errors, as management suggests, or the beginning of a more fundamental decline in the company's competitive edge and cultural stability. The upcoming Q4 earnings report and the subsequent search for a permanent CFO will be pivotal events in determining the answer.

Critical Metals Corp. (NASDAQ: CRML)Critical Metals Corp. (NASDAQ: CRML) has emerged as one of the market's standout performers, rallying significantly on the back of strategic international expansion news and heightened geopolitical focus on its core asset. The stock surged 11.7% on Friday to close at $20.62, marking a second consecutive day of substantial gains and cementing a remarkable one-month rally of over 123%.

The immediate catalyst for the recent surge was the company's announcement of a non-binding Memorandum of Understanding (MOU) with Tariq Abdel Hadi Abdullah Al-Qahtani & Brothers Company (TQB) in Saudi Arabia. The agreement outlines plans to establish one or more joint ventures for developing and operating a rare earth processing plant and refining facility within the Kingdom. This facility is strategically designed to process concentrate from Critical Metals' flagship Tanbreez Rare Earth Project in Greenland, in which the company holds a 42% ownership stake. This Saudi initiative represents a pivotal step in building a geographically diversified, integrated supply chain, moving raw material from Greenland to a U.S.-allied partner for processing, with the end goal of supplying finished products to the United States.

This expansion news builds upon and validates a series of prior strategic moves. The company has now entered into four separate non-binding term sheets for the offtake of rare earth concentrate from Tanbreez. Importantly, with this latest Saudi agreement, Critical Metals has secured potential offtake arrangements for 100% of the project's planned rare earth concentrate production, providing investors with significant visibility into future revenue streams. The specific focus of the Saudi joint venture is to supply the U.S. military-industrial sector, positioning CRML as a potential key strategic supplier to the American defense establishment.

The investment thesis for Critical Metals is inextricably linked to high-stakes geopolitics and the global scramble to secure critical mineral supply chains independent of China. Recent discussions and policy ambitions from the U.S. Trump administration regarding the potential acquisition of Greenland—a territory rich in critical minerals—have thrown a spotlight on the region and its resources. While such a geopolitical move is complex and faces international opposition, the mere discourse has underscored Greenland's strategic value and, by extension, the value of assets like the Tanbreez project. This political backdrop has catalyzed intense investor interest in CRML as a direct beneficiary of Western efforts to onshore or "ally-shore" supplies of materials vital for national security, advanced weapons systems, electric vehicles, and renewable energy technologies.

The Tanbreez project itself is notable for its mineralogy. The company highlights that approximately 27% of its total rare earth elements are heavy rare earths (HREEs), such as dysprosium and terbium. These are particularly scarce, high-value elements crucial for permanent magnets in high-performance motors and defense applications, giving the deposit an advantageous profile compared to many peers that are predominantly light rare earth-focused. The project has also received the necessary approvals to begin construction of its pilot-plant facility in Greenland.

From a technical analysis perspective, the stock's meteoric rise warrants a close look at its chart structure. Following the powerful uptrend, key Fibonacci retracement levels from the recent low to the recent high provide potential support zones at $16.68 (50% retracement), $13.03 (61.8% retracement), and $7.84 (78.6% retracement). These levels could become relevant during any market pullbacks or periods of consolidation. However, chart analysts also note the formation of a larger-scale double-top pattern dating back to February 2024. This long-term pattern typically indicates a major resistance level and can signal a potential reversal or significant pause in the uptrend if the price fails to break decisively above the previous highs.

In summary, Critical Metals Corp. is riding a powerful wave driven by a confluence of strategic partnerships, complete offtake coverage for its flagship project, and its central position in a geopolitical narrative focused on resource security. The company is transitioning from a development story to one with a clear pathway to production and sales, specifically targeting the strategic U.S. defense market. While the fundamental prospects appear brightened by these developments, investors must balance this optimism with the recognition that the company's agreements are still non-binding, its projects are in development stages, and the stock's technical picture shows signs of both extreme momentum and potential long-term resistance. The coming months will be critical as the company works to convert term sheets into binding agreements and advance construction in Greenland and Saudi Arabia.

TMC Options Swing — Institutional Call Flow Inside📈 TMC Weekly Trade

Direction: Bullish / Call

Instrument: TMC $8.00 Call

Expiry: Feb 6, 2026 (Friday)

Entry Zone: $0.38 – $0.46

🎯 Targets

Target 1: $0.58 (+25%) → scale 50%

Target 2: $0.74 (+60%+) → let runner ride

Risk:

Stop loss: $0.35 (-25%)

Hard exit: Closing below 50-DMA ($6.86) or failure to reclaim VWAP $8.58

Institutional call flow shows 30 unusual calls → bullish signal

Let remaining 50% ride with trailing stop 15% from peak

Monitor resistance cluster $9.00 – $10.05

JBLU Gamma Squeeze Potential — Weekly Trade📈 JBLU Weekly Trade

Direction: Speculative bullish / Call

Instrument: JBLU $5.50 Call

Expiry: Feb 6, 2026 (Friday)

Entry Zone: $0.11 – $0.12

🎯 Targets

Target 1: $0.14 (+25%) → scale 50%

Target 2: $0.19 (+60%+) → let runner ride

Risk: Stop loss: $0.085 (-25%)

Hard exit: JBLU below $5.00

Trade information:

Small size only — moderate conviction & earnings catalyst

Monitor earnings reaction closely

QS V4 ELITE: GOOGL Bullish Swing Trade📈 GOOGL Swing Trade (1–4 Weeks)

Instrument: GOOGL $330 Call

Expiry: Feb 20, 2026

Entry Zone: $3.50 – $4.50

🎯 Targets

Target 1 (scale 50%): $5.00 (+11–43%)

Target 2 (runner): $6.50 (+45–86%)

Risk:

Stop loss: $2.50 (-29% to -44%)

Hard exit: If GOOGL closes below 50-DMA ($312.71)

Enter on bullish confirmation above VWAP ($328.25) with volume

Use trailing stop 20% from peak profit for runner

Moderate position size due to low volatility/time decay

TSLA Set to Rip — Speculative Swing Call!📈 TSLA Swing Trade (1–4 Weeks)

Instrument: TSLA $445 Call

Expiry: Feb 20, 2026

Entry Zone: $8.50 – $10.50

🎯 Targets

Target 1 (scale 50%): $15.00 (+50%)

Risk: Stop loss: $6.00 (-40% from mid-entry)

Hard exit: Option premium hits stop or expiry

Trade Rules:

Enter after bullish candle above 50-DMA ($442.36) with volume

Avoid pre-earnings due to IV crush

Scale 50% at Target 1, move stop to breakeven

NVO Alert: Quick Downside Opportunity📉 NVO Weekly Trade (Speculative Bearish)

Direction: Short / Put

Instrument: NVO $62 Put

Expiry: Jan 30, 2026 (Friday)

Entry Zone: $1.65 – $1.72

🎯 Targets

Target 1: $2.06 (+25%) → scale 50%

Target 2: $2.64 (+60%+) → use trailing stop

Risk: Stop loss: $1.29

Hard exit: NVO above $64.16

Notes / Rules

Small position — speculative trade

Move stop to breakeven after Target 1

Monitor for short-term resistance around $64

Exit fast if price breaks above resistance

QS V4 ELITE: HIMS Bearish Continuation⚡ QS V4 ELITE: HIMS (WEEKLY)

Buy: HIMS $30.50 Put

Expiry: Jan 30, 2026 (Friday)

Entry: $0.80 – $0.90

⬢ KATY AI: MULTI-DAY VECTOR

Bias: Bearish | Probability: 63% | Projected Move: -2.0%

Katy AI predicts a measured decline to $30.07, signaling a bearish multi-day vector. While confidence is moderate (63%), this aligns with the stock's position well below its key moving averages ($35.06 50-DMA, $45.83 200-DMA), suggesting the path of least resistance is lower in the near term.

Tactical Observation: Price ($30.69) is trading just below the pivotal $30.70 level and above the daily VWAP ($29.87). A break below $30.50 could accelerate a move toward the $29.87 VWAP and the stronger $27.96 support. The lack of a clear gamma wall provides less friction for a down move.

⬢ OPTIONS FLOW INSIGHT

Options flow shows a balanced but active market with 47 unusual puts and 48 unusual calls. The chain reveals notable put volume at the $30.5 and $32.0 strikes, indicating institutional hedging or bearish positioning.

ACTION: BUY PUTS

| Execution Parameter | Institutional Target |

|:--------------------|:---------------------|

| INSTRUMENT | $30.50 PUT |

| EXPIRY | 2026-01-30 |

| ENTRY ZONE | $0.80 - $0.90 (PREMIUM PRICE) |

| TARGET 1 | $1.00 (+25%) |

| TARGET 2 | $1.44 (+60%+) |

| STOP LOSS | $0.68 (-25%) |

RISK GRADE: MODERATE

• THESIS ERROR: A daily close above the $31.00 resistance level and the VWAP ($29.87) would invalidate the immediate bearish structure and suggest a short squeeze.

• EXIT PROTOCOL: Scale 50% at Target 1; Move Stop to Breakeven. Use a trailing stop (e.g., based on the underlying stock breaking above its 5-minute 9 EMA) for Target 2.

QS V4 ELITE: SLV Mean-Reversion Short📉 SLV Weekly Trade

Direction: Bearish pullback

Buy: SLV $100 Put

Expiry: Jan 31, 2026

Entry: $6.40 – $6.60

🎯 Targets

Target 1: $8.00

Target 2: $10.40

🔴 Risk

Stop loss: $4.80

Hard exit: SLV above $106.70

⚠️ Trade Rules

Take 50% profit at +25%

Move stop to breakeven after Target 1

Use trailing stop for runner

Exit fast if price keeps making new highs

QS V4 ELITE: PLTR Speculative BouncePLTR Weekly Trade

Direction: Speculative bounce

Buy: PLTR $170 Call

Expiry: Jan 30, 2026 (Friday)

Entry: $2.75 – $2.95

🎯 Targets

Target 1: $3.50

Target 2: $4.50

🔴 Risk Stop loss: $2.10

Hard exit: PLTR below $165

Trade Rules: Small size only

Take profit fast if +25%

If price stalls near $170–172, be ready to exit