Harmonic Patterns

NASDAQ 100 INDEX: Trade on the Long-Side, Breakout Incoming.Hello There,

the NASDAQ 100 INDEX recently formed interesting formational structures which caught my attention. Following the underlying price-actions a trade signal on the long-side is generated. Important here is to wait for the breakout above the neckline of the inverse head-and-shoulder formation.

__________________________________________________________________________________

REASON: Inverse head-and-shoulder formation, structural MA-bullishness, strong volume spikes.

__________________________________________________________________________________

Trade on the Long-Side Potential

ENTRY: 25600 - 25700

MINIMUM TARGET: 26200

EXPECTED TARGET RANGE: 26300 - 26500

MINIMUM STOP LOSS: 25200

__________________________________________________________________________________

In this manner, thank you for watching and happy new year!

__________________________________________________________________________________

ONGC Swing Trade Setup📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

MAX FINANCIAL SERVICES LTD Swing Trade Setup📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

LTF Swing Trade Setup📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

SAMMAAN CAPITAL swing trade setup📊 Price Action & Trend Analysis

Analyzing market trends using price action, key support/resistance levels, and candlestick patterns to identify high-probability trade setups.

Always follow the trend and manage risk wisely!

Price Action Analysis Interprets Market Movements Using Patterns And Trends On Price Charts.

👉👉👉Follow us for Live Market Views/Trades/Analysis/News Updates.

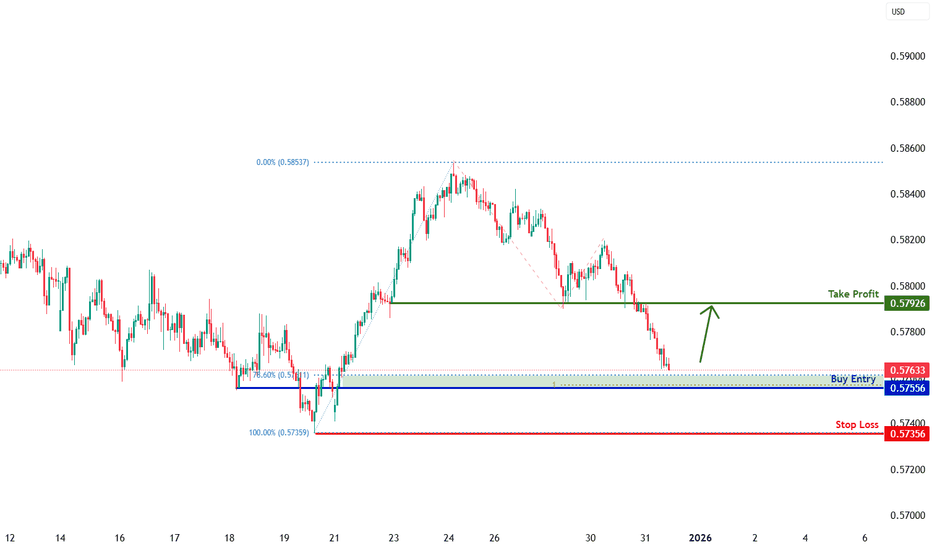

KIWI H1 | Could We See A Bullish Reversal?Based on the H1 chart analysis, we can see that the price is reacting off our buy entry level at 0.5755, which is a pullback support that is slightly below the 78.6% Fibonacci retracement and also aligns with the 100% Fibonacci projection.

Our stop loss is set at 0.5735, which is a swing low support.

Our take profit is set at 0.5792, which is a pullback resistance that aligns with the 50% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

AUDUSD H1 | Bearish DropBased on the H1 chart analysis, we could see the price rise to the sell entry level at 0.6697, which is a pullback resistance.

Our stop loss is set at 0.6716, which is a pullback resistance.

Our take profit is set at 0.6656, which is a pullback support that aligns with the 50% Fibonacci retracement

High Risk Investment Warning

Stratos Markets Limited (

USDCAD H1 | Bullish Bounce Off Pullback SupportBased on the h1 chart analysis, we could see the price fall to our by entry level at 1.3680, which is a pullback support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is set at 1.3659, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

Our take profit is set at 1.3736, which is a pullback resistance that is slightly below the 61.8% Fibonacci retracement.

High Risk Investment Warning

Stratos Markets Limited (

USDCHF H1 | Potential Bullish RiseBased on the H1 chart analysis, we can see that the price has bounced off our buy entry level at 156.31, which is a pullback support.

Our stop loss is set at 155.76, which is a pullback support.

Our take profit is set at 157.27, which is a pullback resistance that is slightly below the 161.8% Fibonacci extension.

High Risk Investment Warning

Stratos Markets Limited (

Breaking: Ekso Bionics Holdings, Inc. (EKSO) Spike 93% TodayEkso Bionics Holdings, Inc. (EKSO) shares shows a noteworthy uptick of over 90% in yesterdays trading session as the stock eyes a move to the $20 resistant.

Albeit market drawback the asset manage to pull the strings. a break above the 61.8% Fib level would solidify the bullish thesis on $EKSO.

In a recent news, EKSO Bionics Holdings, Inc. (Nasdaq: EKSO) (“EKSO”) announced today that Applied Digital and EKSO entered into a non-binding term sheet for a proposed business combination of Applied Digital’s cloud computing business, Applied Digital Cloud, with EKSO, which, once closed, will go forward as ChronoScale Corporation, an accelerated compute platform purpose-built to support artificial intelligence (“AI”) workloads (the “Proposed Transaction”).

As enterprise and AI-native demand for GPU-accelerated cloud infrastructure continues to grow rapidly, the Proposed Transaction is intended to create a focused platform designed to deliver high-performance compute at scale in a capacity-constrained market.

About EKSO

Ekso Bionics Holdings, Inc. designs, develops, sells, and rents exoskeleton products in the Americas, Germany, Europe, the Middle East, Africa, the Asia Pacific, and internationally. The company provides EksoNR, a wearable bionic suit and rehabilitation device that assists physical therapists and physicians to treat patients with acquired brain injury, stroke, and spinal cord injury; Ekso Indego Therapy, an adjustable and lower-limb powered exoskeleton.

XAUUSD Intraday OutlookXAUUSD Intraday Outlook (1H): Range Reclaim After the Dump, Eyes on 4,365 Then 4,485

Gold (XAUUSD) is trading back inside a large 1H range after a sharp selloff from the 4,52x supply. The key intraday read from the chart is simple: price is attempting to rebuild a base inside the green demand/range zone, and the next directional move will likely be defined by whether bulls can reclaim and hold above the 4,365 range ceiling.

With year-end liquidity often thinner, expect sharper wicks around the edges of the range. Trade the levels, not the noise.

Market Structure and Price Behavior (1H)

A strong impulsive drop broke the previous bullish sequence, creating a new short-term bearish leg.

Price then returned into the prior range/demand (large green box), showing acceptance rather than immediate continuation lower.

The recent low printed near the bottom of the range and snapped back quickly, suggesting buy-side defense is active.

Current bias is “range-to-reclaim”: bullish intraday as long as price holds above the lower band, but still capped until 4,365 is reclaimed.

Key Support and Resistance Levels (High Priority)

Support Zones

4,318–4,300: intraday decision area (current acceptance zone).

4,295: first support shelf; repeated reaction level.

4,270–4,265: range floor and main invalidation for longs (break and hold below shifts bias back to sell continuation).

4,240–4,216: deeper support if the floor fails (only relevant if 4,265 breaks clean).

Resistance Zones

4,355–4,365: range ceiling and the most important intraday trigger level.

4,405: mid resistance on the way up (often a pause/partial TP zone).

4,445: pre-supply reaction level.

4,475–4,485: major supply zone (green band above); primary upside target if 4,365 breaks and holds.

4,525–4,560: higher-timeframe supply zone (top green band); only in play if momentum is strong.

Fibonacci Map (Using the Selloff Swing High to Swing Low)

From the visible drop (high around 4,52x to low around 4,27x), the most useful retracement cluster for intraday is:

Fib 0.382: around 4,36x (lines up with range ceiling 4,365)

Fib 0.50: around 4,39x–4,40x (lines up with 4,405 region)

Fib 0.618: around 4,42x–4,43x (reaction zone before the 4,445–4,485 supply)

This confluence is why 4,365 is the key “go/no-go” level for bullish continuation.

EMA and RSI Read (How to Use Them Today)

EMA (Practical Use Intraday)

If price is below EMA50/EMA200 on 1H, rallies into 4,355–4,405 can still be sold unless price shows strong closes above the EMAs.

The clean bullish confirmation is: reclaim 4,365 + hold above EMA50, then use EMA20 as a dynamic support on pullbacks.

If price keeps closing back under EMA20 after touching 4,355–4,365, that is a sign the range top is still rejecting.

RSI (Confirmation, Not a Signal Alone)

RSI recovering back toward 50 supports the “base-build” idea.

Bullish continuation is favored if RSI holds above 50 during pullbacks after a 4,365 breakout.

Rejection setups are higher probability if RSI fails under 50 at the range top and prints bearish divergence near 4,365.

Intraday Trade Plans (Clear Conditions, Clean Invalidation)

Plan A: Buy the Dip Inside Demand (Best RR if You Get the Pullback)

Entry idea: 4,318–4,300 (or deeper 4,295 if a sweep happens)

Stop-loss: below 4,265 (range floor break)

Targets:

TP1: 4,355–4,365

TP2: 4,405

TP3: 4,445

Management: reduce risk into 4,355–4,365 because it is the major decision ceiling.

Plan B: Breakout Buy Above 4,365 (Momentum Confirmation)

Trigger: 1H close above 4,365 with follow-through, then a retest that holds (no immediate reclaim failure)

Stop-loss: below the retest swing low (or below 4,345 for tighter structure-based risk)

Targets:

TP1: 4,405

TP2: 4,445

TP3: 4,475–4,485 supply zone

Note: A breakout without a hold usually turns into a bull trap. Wait for acceptance.

Plan C: Sell Rejection at Range Top (If 4,365 Keeps Failing)

Trigger: rejection wicks + weak closes under 4,355, ideally with RSI failing under 50

Stop-loss: above rejection high (above 4,380 is a clean buffer)

Targets:

TP1: 4,318

TP2: 4,295

TP3: 4,270–4,265

Plan D: Sell at 4,485 Supply (If Price Reaches the Green Band)

Trigger: first touch reaction is common; confirm with 1H failure to close above supply

Stop-loss: above 4,505 (or above the supply high)

Targets:

TP1: 4,445

TP2: 4,405

TP3: 4,365

What to Watch During the Session

If price holds above 4,295 and keeps building higher lows, the market is preparing for a 4,365 break.

A clean reclaim and hold above 4,365 increases the probability of a push into 4,405 then 4,445.

The first major upside objective remains 4,475–4,485 supply; expect reaction there.

A breakdown and acceptance below 4,265 invalidates the bullish reclaim thesis and opens the door to 4,240–4,216.

Risk Note

This is a technical analysis view for trading and education, not financial advice. Intraday volatility can spike, especially around range edges and thin liquidity periods. Keep risk fixed per trade and avoid overtrading the middle of the range.

If you found these levels and trade plans useful, follow and save this idea to get more session-based XAUUSD strategies.

US30 short term sellsUS30 is reacting at a key confluence zone. Price has broken below the rising trendline and is now trading under a major resistance level. As long as this level holds, bearish continuation toward the lower liquidity zones remains likely. A reclaim and strong hold above resistance would shift bias back to the upside.

ONE/USDT at Edge: Bounce or Breakdown from Major Demand Zone?The ONE/USDT on the 1W (Weekly) timeframe shows a clear long-term bearish trend since the all-time high in 2021. Price has consistently formed lower highs and lower lows, confirming strong seller dominance over the past few years.

Currently, price is approaching a major historical demand zone, highlighted by the yellow block between 0.0024 – 0.0017, an area that previously triggered a strong bullish impulse.

---

Pattern & Price Structure

1. Long-Term Downtrend

Market structure remains bearish on a macro scale.

Every upward move has been a relief rally, failing to create a higher high.

2. Descending Structure Breakdown

Price has lost multiple minor supports, indicating progressive weakness.

Strong rejections from the mid-range supply area (around 0.01 – 0.02) accelerated the decline.

3. Major Historical Demand Zone

The 0.0024 – 0.0017 zone represents:

Previous accumulation area

Weekly historical support

Origin of a strong bullish move in the past

Price is now retesting this critical zone.

---

Key Levels

Major Resistance:

0.0050 – 0.0060

0.0090 – 0.0105

Major Support / Demand Zone:

0.0024 – 0.0017

Historical Extreme Low:

0.00118

---

Bullish Scenario

The bullish scenario is only valid if strong buying reactions appear inside the yellow zone:

Formation of:

Long lower wicks on weekly candles

Or a sideways accumulation base

No strong weekly close below 0.0017

Potential upside targets:

Short-term: 0.0050

Mid-term: 0.0090

Maximum relief rally: 0.015 – 0.02

➡️ This scenario represents a speculative bounce, not a confirmed trend reversal.

---

Bearish Scenario

The bearish scenario is confirmed if:

A strong weekly close below 0.0017

Failure of the historical demand zone

Increased selling pressure and breakdown momentum

Consequences:

Price may enter new low price discovery

No clear historical support below this level

High risk of continued downside

➡️ A breakdown here would signal market capitulation.

---

Conclusion

ONE/USDT is currently at a critical make-or-break technical level.

The 0.0024 – 0.0017 zone represents the last major weekly demand zone.

Aggressive buys are suitable only for high-risk traders

Conservative traders should wait for weekly confirmation

As long as price remains below key resistance levels, the primary trend stays bearish

---

#ONEUSDT #HarmonyONE #CryptoAnalysis #WeeklyChart #DemandZone #SupportResistance #BearishTrend #PotentialBounce #AltcoinAnalysis

USDCHF H1 | Bearish Reversal Off Pullback ResistanceThe price is rising towards our sell entry level at 0.7937, which is a pullback resistance that is slightly below the 78.6% Fibonacci retracement.

Our stop loss is set at 0.7958, which is a pullback resistance.

Our take profit is at 0.7906, which is a pullback support.

High Risk Investment Warning

Stratos Markets Limited (

GBPUSD H1 | Falling Towards 50% Fib SupportThe price is falling towards our buy entry level at 1.3442, which is a pullback support that aligns with the 50% Fibonacci retracement.

Our stop loss is set at 1.3422, which aligns with the 61.8% Fibonacci retracement.

Our take profit is set at 1.3500, which is a pullback resistance.

High Risk Investment Warning

Stratos Markets Limited (

Bullish bounce off for Bitcoin?The price has bounced off the pivot and could rise to the 1st resistance, which acts as a multi-swing high resistance.

Pivot: 87,847.82

1st Support: 86,753.29

1st Resistance: 90,258.97

Disclaimer:

The opinions given above constitute general market commentary and do not constitute the opinion or advice of IC Markets or any form of personal or investment advice.

Any opinions, news, research, analyses, prices, other information, or links to third-party sites contained on this website are provided on an "as-is" basis, are intended to be informative only, and are not advice, a recommendation, research, a record of our trading prices, an offer of, or solicitation for, a transaction in any financial instrument and thus should not be treated as such. The information provided does not involve any specific investment objectives, financial situation, or needs of any specific person who may receive it. Please be aware that past performance is not a reliable indicator of future performance and/or results. Past performance or forward-looking scenarios based upon the reasonable beliefs of the third-party provider are not a guarantee of future performance. Actual results may differ materially from those anticipated in forward-looking or past performance statements. IC Markets makes no representation or warranty and assumes no liability as to the accuracy or completeness of the information provided, nor any loss arising from any investment based on a recommendation, forecast, or any information supplied by any third party

GOLDGold after testing the 4H trendline, retrace towards fib 0.382 and then breaks its 4H trendline at 4302.093. The divergence is formed 4H and 1H and playing its role. I am of the opinion that trend line support is broken, price is retracing back from fib lvl 0.382 and trend is in bearish stance, there is probable chance of price to move downward to continue bearish trend till 4195 and if that breaks will see the price moving toward ABCD projection of 4150.

Buy again target 11 centsBuy again target 11 cents.Binance listing is coming. We can talk about much higher prices. The number in circulation is very small. I think it will reach a market value of close to $100 million during 2026, which would increase the price by almost 20 times. Good luck, follow me.