Gold Breaks Through Three Pillars of Traditional LogicGold Breaks Through Three Pillars of Traditional Logic

The current strong performance of gold prices has transcended the traditional logic of safe-haven or inflation hedging, evolving into a "repricing" of the global monetary and credit system.

Below is my macroeconomic analysis of recent gold price movements, representing only my personal views.

Our current holdings are approximately $5080.

The stop-loss is set around $5050.

Our short-term intraday target price: $5150-$5200 range.

Core intraday trading strategy: As long as the gold price remains above $5050-$5060, we will adopt a buy-on-dips strategy, with holding periods that may be indefinite or short-term. We will adjust the overall strategy according to the trading rhythm.

As always, our trading strategies will be released in real-time on our channel. We will continue to provide a free advanced signal channel, consistently offering high-probability trading signals. Thank you for your attention and participation. If you have any questions, please leave a message, and I will answer them one by one.

Macroeconomic Analysis:

1. Structural De-dollarization and Credit Restructuring

Many central banks continue to purchase large amounts of gold to diversify reserve risks. This price-insensitive demand provides solid support for gold prices. Market concerns about the credibility of the US dollar and US fiscal policy have transformed gold from a "safe-haven asset" into a "non-sovereign credit asset."

2. Geopolitical and Policy Uncertainty. Policy volatility during the US election year, the Trump administration's tariff policies, and geopolitical stances (such as actions against Venezuela and Greenland) have exacerbated global uncertainty. Recent geopolitical tensions, particularly with Iran, have also stimulated safe-haven demand.

3. "Crowded Trade" by Central Banks and Capital.

Major central banks globally have been net buyers of gold for several consecutive months (approximately 60 tons per month). Simultaneously, private investors (such as ETFs and institutional investors) have also significantly increased their gold holdings. These factors combine to create a virtuous cycle, pushing up gold prices. The rising gold prices themselves attract more trend-following funds, thus creating a self-reinforcing upward cycle.

As shown in the chart: Technical Analysis

Key Resistance and Support Levels Analysis

Core Resistance Zone: $5400 - $6000

Many institutions believe $5400 is the next important target.

More optimistic forecasts (such as those from Bank of America and Jefferies) suggest that if a historic bull market cycle repeats itself, gold prices could challenge $6000 or even $6600 by 2026.

Core Support Zone: $5000 - $4850

The recently broken psychological level of $5000-$5100 has become a key support zone for both bulls and bears.

If gold prices experience a deep correction, I believe $4850 (the previous high) will be a stronger support level.

Besides technical corrections, we also need to be wary of low-probability, high-impact events.

Potential Black Swan Events:

1: A large-scale oil supply shock triggered by the Iranian crisis.

A surge in oil prices could trigger stagflation (high inflation + economic recession) panic, making gold, as the ultimate safe-haven asset and inflation hedge, a hot commodity.

If this happens, it should be seen as a significant buying opportunity, but it's important to note that the initial widespread decline across various assets could lead to a liquidity shock.

2: Escalation of conflict between Russia and NATO.

This would disrupt the global geopolitical landscape, and extreme risk aversion would rapidly push up gold prices. This is also a significant buying opportunity, but market volatility will become extreme and unpredictable, requiring extremely strict position management and stop-loss strategies.

3: A major breakthrough in China's technology sector.

This could trigger a plunge in US tech stocks, leading to global market turmoil. In the short term, liquidity shortages (investors selling off all assets to cash out) could put pressure on gold prices; however, in the medium to long term, this will reinforce the logic of de-dollarization and asset diversification, which is beneficial for gold.

Harmonic Patterns

Nat Gas: At The Moon - $6.. Now Next Stop $7?! NYMEX:NG1! NYMEX:NGG2026 Well it's been 4 days since my last post,

In my previous post I put forward a target of $6 for the prompt month NG contract . Now that we've blown through that target with a strong weekend open, the next question is where do we go from these historic Winter 2026 highs?? Many NG bears, would argue everything is already priced in, and there's no more gas left in the tank. However, if you look back a year from now, you'll realize we're finally at the bullish levels that were the BASE CASE for what we thought the supply & demand picture would like for 2026. This means we are finally at the expected value that markets had anticipated, 12 months ago, not that we are OVERVALUED.

Now BEARS are supposed be hibernating during the winter, but for some the recent historic rally has caused them to come out of hibernation. Well... there's a reason bears try to sleep through the winter.... it's because you don't chase penny's... when there's dollars to be made!! Right now you should only be taking tactical & quick shorts. This rally still has room to run, and you don't want to step in front of this Bull Train!!

From my charts & fundamental insights, I believe our next target for a session close will be $6.55 then $6.99, and that the February 2026 contract will expire above $6.

Looking at the charts for the front month, you can clearly see an upward directional channel that's now been established. The 30 minute ichi cloud has been providing upward support for NG. The 30min ichi wave targets are lower than the 1hour ichi cloud, and at first if you're looking at the lower time frame, it might seem that the near term movement is to the downside, below the lower upward channel support line & the next wave targets take us lower.

Howeverrrrrrr, if you look at the 1hour ichi, you can clearly see a support cloud above the upward channels bottom support. The next wave targets on the hourly seem to imply, that we can reach $6.55 to $6.65, and if those targets are smashed through next resistance is at $6.99 at the top of the upward channel.

The one hope for Bears, that may lead to consolidation & accumulation at or below the $6 level, before another move higher past $6.30 : "..analysts said potential reductions in LNG exports and pipeline deliveries to Mexico could help offset some of the tightening.

“Another potential wrinkle is how much LNG exports may decline as a result of Fern,” said Pat Rau, NGI’s senior vice president of research and analysis. “Back during Winter Storm Uri, LNG exports fell as well. That meant the overall supply/demand picture wasn’t just lost supply, there was some curtailed demand to help balance things a bit.””-NGI

Now, taking the above quote into consideration... I know you must be skeptical of a continuation of this breakout, but please refer to my previous post of why this rally had legs to begin with to take out the $6 level. But to reach the $7 level, I'll provide a few more quotes below, of why this historic Winter Freeze will keep the bull train going strong down the tracks.

A few fundamental insights on why the cold weather in the U.S. has been an ignition switch for NG prices for the weekend open, quotes provided from industry news source Natural Gas Intelligence:

“I think this storm has all the elements to make it a major risk on the level of Elliott and Uri,” said NGI’s Dan Spangler, senior director of analytics. “There’s going to be widespread cold in nearly all major producing areas, so there will definitely be a freeze-off impact.”

"Wood Mackenzie said Friday that average U.S. natural gas production month-to-date is down to 109.2 Bcf/d, “reflecting the impact of supply-related outages.” The consultancy’s freeze-off projections for the final two weeks of January jumped 9.5 Bcf on Thursday to 138.8 Bcf. That would be an all-time high if realized, breaking the 118.7 Bcf record set in February 2021 when Uri hit.”

"When Uri struck in mid-February 2021, LNG feed gas flows slowed to a trickle. Deliveries fell 87% to 1.3 Bcf/d from above 10 Bcf/d at the start of the month, Wood Mackenzie data show."

“Prices still took off back then, of course,” Rau said, “but the impact may have been even worse if LNG hadn’t served as a demand destruction vehicle to help counter some of the lost production.”

"Even so, Fern may not stress the Texas power grid to the same degree as Uri, according to RBN Energy LLC analyst John Abeln.

The expected zone of extreme cold during Fern “does not extend as far south across Texas” as it did during Uri, Abeln said, and the storm is forecast to move through the state much more quickly. Temperatures in Dallas are expected to rise above freezing by Tuesday, compared with a much longer stretch below freezing during Uri.

“The sustained deep freeze that exhausted storage and led to equipment failures is likely to be much less severe this time around,” Abeln said.

If deep snow materializes, frigid temperatures linger and production freeze-offs mount, February natural gas “could rally to the $7.500 area” in a highly bullish scenario, Yawger added.

Exceptional storage withdrawals are in the cards as well, with most analysts now looking for a pull far north of 300 Bcf for the last week of the month.

“The chatter around the natural gas space is a storage draw of over 350 Bcf or greater,” Yawger said. “There have only ever been four draws of 300 Bcf or greater in the history” of federal storage data.

Gold: Extended Its Strong Uptrend TodayGold extended its strong uptrend today, gapping up and surging in the Asian session then consolidating at highs. It broke through the key psychological level of 5000 and hit a new all-time high, with the bullish trend dominating the market. However, the risk of a pullback is rising amid overbought conditions. The primary trading approach is to buy the dips on corrections with strict control over chasing highs.

Short-term (Intraday Core)

Support levels:

5030 (strong support, the lower edge of intraday consolidation and key defensive level for pullbacks);

5000 (critical psychological support, a break below this integer level will trigger short-term selling pressure).

Resistance levels:5110 (critical psychological resistance, a breakout will further open up upside momentum).

Medium-term (Swing Reference)

Support level: 4960 (bull-bear pivot support, the level of the previous consolidation platform, a break below may trigger a deep pullback in gold prices).

Resistance level: 5150 (trend resistance, the extension of the all-time high, with no significant technical resistance above this level).

Trading Strategy:

Buy 5040 - 5050

SL 5030

TP 5080 - 5090 - 5100

Sell 5100 - 5090

SL 5110

TP 5070 - 5060 - 5050

NVA Long: Breakout From Descending Wedge With 80%+ Upside📌 Nova Minerals (#NVA) — Long Idea | Premium Channel

This long position was opened today in our premium channel, and the setup is still attractive for entry.

📊 FUNDAMENTAL ANALYSIS

🟢 Nova Minerals is a gold exploration and development company with key assets in Alaska (the Estelle Gold Project), one of the most prospective and geopolitically safe regions for gold mining.

🟢 The company continues to actively expand its resource base, increasing confirmed reserves, which enhances its investment appeal amid expectations of higher gold prices.

🟢 Gold traditionally benefits from macroeconomic uncertainty, inflation risks, and weakening confidence in fiat currencies — creating a supportive backdrop for the junior mining sector.

🔴 The main risks remain the lack of stable profitability at this stage and high volatility typical of early-stage development companies.

🛠 TECHNICAL ANALYSIS

📈 LONG

▪️ Price has broken out of a descending wedge and is holding above the upper trendline.

▪️ Price is confidently trading above the 50 EMA, with attempts to consolidate above a key resistance level.

▪️ The 200 EMA acts as a strong long-term support, keeping the broader structure bullish.

▪️ RSI is trending higher, remains in bullish territory, and is not overbought.

▪️ MACD has turned upward and shows strengthening bullish momentum.

▪️ Volume confirms renewed buying interest after consolidation.

↗️ TRADE SETUP

🎯 T1: $14.37

🎯 T2: $18.53

📊 Upside potential: approximately 80%+ if momentum continues toward the upper range and a breakout to new local highs.

💼 Portfolio

#active_management

⚠️ This idea is not investment advice and reflects the author’s personal opinion. Each investor is responsible for their own trading decisions.

GOLD XAUUSD GOLD 5096-5100 was a complete reaction as predicted on friday.

KEY DEMAND FLOOR 4965-4960

KEY DEMAND FLOOR 4847-4840.

OR FOLLOW THE STRUCTURE.

STRUCTURE NEVER LIES.

am watching 4500-4496 zone a strong demand floor

Geopolitical Tensions

US President Donald Trump's insistence on acquiring Greenland, including threats of force and tariffs on opposing European nations, has sparked US-Europe friction. French President Macron's rebukes and potential suspension of US-EU trade deals have weakened the dollar, boosting gold's appeal to foreign buyers.

Economic Factors

A softer US dollar makes gold cheaper globally, while expectations of steady Federal Reserve rates—despite labor improvements—favor non-yielding assets like gold. Central banks in China and India continue aggressive gold buying, adding structural support.

Future Outlook

Prices may climb toward $5,000-5024k AND extend into 5070k zone if tensions persist and the dollar stays weak, though stronger US data could cap gains.

the dollar index is holding daily support at 97.935$ and during newyork today buy candle kept yesterday demand floor and we are seeing GOLD price into systematic correction from 4890-4880 zone .if they insist on daily buy floor then we will be watching 4900 which is a pathway to 5000-524k and more advanced buying based on the trendangle strategy.

WHAT IS GOLD ???

Gold (Au) is a chemical element and dense, malleable transition metal prized for its lustrous yellow hue, exceptional conductivity, and resistance to corrosion.

History as Store of Value

Gold has served as a store of value for over 6,000 years, from ancient Egyptian tombs (c. 4000 BCE) symbolizing immortality to Lydian coins (600 BCE) enabling standardized trade across empires like Rome (aureus) and Byzantium (solidus, stable 700+ years). The 19th-century gold standard anchored global currencies until 20th-century abandonments, yet gold retains purchasing power

Tier 1 Status Clarification

Gold classifies as a Tier 1 asset under Basel III banking rules , with 0% risk weighting for physical bullion, equivalent to cash for capital reserves, enhancing bank balance sheets amid fiat volatility. This elevates it from prior Tier 3 status, affirming its role as "money again.

HOW DOES THE DOLLAR INDEX AFFECT THE PRICE ACTION AND DIRECTIONAL BIAS ??

The US Dollar Index (DXY) exhibits a strong inverse relationship with global gold prices, where a stronger dollar typically depresses gold values and a weaker dollar boosts them.

Core Mechanism

Gold trades in US dollars worldwide, so dollar strength raises gold's cost for non-US buyers, curbing demand and lowering prices. A weaker dollar reduces this barrier, making gold cheaper and spurring purchases from international investors.

Correlation Strength

Historical data shows a negative correlation coefficient of -0.40 to -0.80, meaning 40-80% of gold's movements often align inversely with DXY changes. Interest rate differentials amplify this: Fed hikes strengthen the dollar and hurt non-yielding gold, while cuts weaken it and favor gold.

Influencing Factors

Geopolitical risks or inflation can override the link temporarily, but dollar dynamics remain the primary driver in most cycles. For instance, recent dollar weakness from de-dollarization trends has fueled gold rallies.

the brics nation are busing buying GOLD.this is the year of GOLD as the new money backed by physical GOLD ,this is why all BRICS CENTRAL BANKS are stocking the yellow bullion.

#GOLD #XAUUSD

I am now Long PUTS IN SLV and Silver 2027 lateThe wave structure is now complete as into the cycle high and fib relationship The US$ is about to Bottom in wave B low we should then see a huge rally in DXY and a sharp decline in all metals and the sp 500 is in wave c up in wave 5 of the diagonal 5th wave all coming into the 5 spirals due 2/9 event best of trades WAVETIMER

CRDO in BUY ZONEMy trading plan is very simple.

I buy or sell when at either of these events happen:

* Price tags the top or bottom of parallel channel zones

* Money flow volume spikes beyond it's Bollinger Bands

So...

Here's why I'm picking this symbol to do the thing.

Price in buying zone at bottom top of channels

Money flow momentum is spiked negative and at bottom of Bollinger Band

Entry at $136.25

Target is upper channel around $164, but may close at moving averages around $150

Set your own stop. Mine is set at $133.

[LOI] - BTR - BTR

Key Points

Purpose : Bitlayer is a Layer 2 network built on Bitcoin, designed to enable scalable DeFi applications while maintaining Bitcoin's security through BitVM technology. It aims to unlock Bitcoin's capital for broader use in smart contracts and decentralized finance.

Problem Solved: Bitcoin's native limitations in scalability, programmability, and transaction throughput hinder complex DeFi; Bitlayer addresses this by providing Turing-complete contracts via an optimistic validation scheme, allowing high-throughput execution without compromising Bitcoin's consensus.

Bullish Case for Demand : With Bitcoin's ecosystem gaining traction in 2026 amid BTCFi narratives, Bitlayer's EVM compatibility, yield-generating assets like YBTC, and upcoming enhancements could drive adoption; its low market cap (~$30M) suggests high growth potential but also volatility, making it risky to short as pumps (e.g., recent 46%+ daily gains) indicate strong speculative interest.

Partnerships : Key collaborations include mining pools (Antpool, F2Pool, SpiderPool) controlling ~40% of Bitcoin hashrate, DeFi platforms like Kamino Finance and Orca for YBTC integration on Solana, infrastructure ties with AWS and Chainlink, and ecosystem links with Sui, Base, Arbitrum, and Cardano.

Current Market Cap : Approximately $30.6 million, with a circulating supply of 261.6 million BTR out of 1 billion total; this low cap amplifies upside potential in a bullish BTC L2 market but heightens risk.

Recent Announcements : January 2026 funding surge of $29 million to enhance BTC and multi-chain integrations; anticipated mainnet upgrade in February 2026; USDC token contract update; outlook for further growth including Bitcoin event participation.

Notes on how I personally use my charts/NFA:

Each level L1-L3 and TP1-TP3 (Or S1-S3) has a deployment percentage. The idea is to flag these levels so I can buy 11% at L1 , 28% at L2 and if L3 deploy 61% of assigned dry powder. The same in reverse goes for TP. TP1: 61%, TP2:28% and TP3:11%. If chart pivots between TP's, in-between or in Between Sell levels these percentages are still respected. I like to use the trading range to accumulate by using this tactic.

Just my personal way of using this. This is not intended or made to constitute any financial advice.

This is not intended or made to constitute any financial advice.

NOT INVESTMENT ADVICE

I am not a financial advisor.

The Content in this TradingView Idea is for informational purposes only, you should not construe any such information or other material as legal, tax, investment, financial, or other advice. Nothing contained within this idea constitutes a solicitation, recommendation, endorsement, or offer to buy or sell any securities or other financial instruments in this or in in any other jurisdiction in which such solicitation or offer would be unlawful under the securities laws of such jurisdiction.

All Content on this idea post is information of a general nature and does not address the circumstances of any particular individual or entity. Nothing in the idea/post constitutes professional and/or financial advice, nor does any information on the idea/post constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. You alone assume the sole responsibility of evaluating the merits and risks associated with the use of any information or other Content on the idea/post before making any decisions based on such information.

Sir. Galahad - QUANT

Disclaimer

The information and publications are not meant to be, and do not constitute, financial, investment, trading, or other types of advice or recommendations supplied or endorsed by.

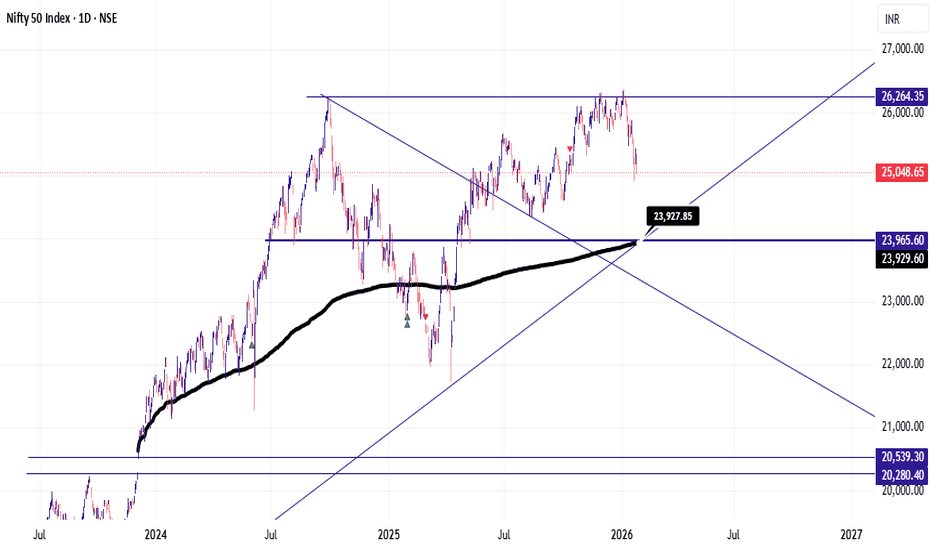

Nifty 50 Analysis Target For Bearish Momentum Stop Here Sure 👍

Here is the **Nifty 50 Components list (in English only):**

---

## ✅ Nifty 50 Companies List

### **Banking & Financial Services**

* HDFC Bank

* ICICI Bank

* State Bank of India

* Axis Bank

* Kotak Mahindra Bank

* Bajaj Finance

* Bajaj Finserv

* Shriram Finance

### **Information Technology (IT)**

* Tata Consultancy Services (TCS)

* Infosys

* HCL Technologies

* Wipro

* Tech Mahindra

### **Oil, Gas & Power**

* Reliance Industries

* ONGC

* NTPC

* Power Grid Corporation of India

### **FMCG (Fast Moving Consumer Goods)**

* Hindustan Unilever (HUL)

* ITC

* Nestlé India

* Britannia Industries

### **Automobile**

* Maruti Suzuki India

* Tata Motors

* Mahindra & Mahindra

* Hero MotoCorp

* Bajaj Auto

* Eicher Motors

### **Metals & Mining**

* Tata Steel

* JSW Steel

* Hindalco Industries

* Coal India

### **Pharmaceuticals & Healthcare**

* Sun Pharmaceutical Industries

* Dr. Reddy’s Laboratories

* Cipla

* Divi’s Laboratories

* Apollo Hospitals

### **Cement & Infrastructure**

* UltraTech Cement

* Grasim Industries

* Larsen & Toubro (L&T)

### **Telecom**

* Bharti Airtel

### **Others**

* Adani Enterprises

* Adani Ports & SEZ

* Asian Paints

* UPL

---

⚠️ *Note:*

Nifty 50 constituents are reviewed **twice a year (March & September)** by NSE, so the list may change slightly over time.

If you want, I can also provide:

* Nifty 50 sector weightage

* Latest updated list in table format

* Nifty 50 historical returns

* Best stocks for long-term investment

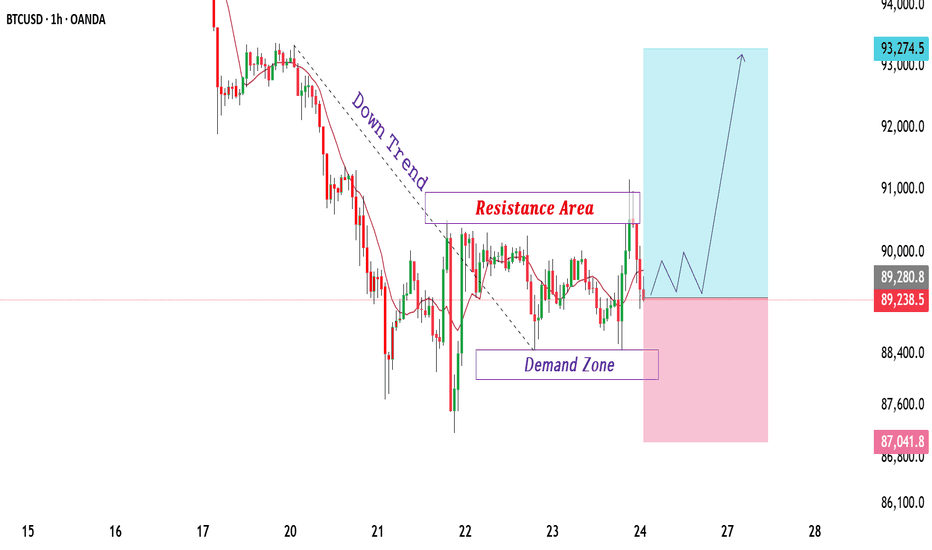

BTCUSD Consolidates Between Demand and Resistance Price Zones.BTCUSD is trading within a corrective phase after a strong bearish impulse, clearly showing a short-term downward structure. Price action continues to respect the descending trend, with lower highs and controlled pullbacks, indicating that selling pressure is still active. The marked resistance area around the recent highs represents a key supply region where price previously reacted and faced rejection. This zone remains important, as repeated failures above it suggest sellers are defending this level and limiting upside momentum.

On the lower side, a well-defined demand zone is visible near the recent swing lows. This area is supported by multiple price reactions and a short period of consolidation, highlighting the presence of buyers absorbing selling pressure. The demand zone acts as a critical support region and a potential buy interest area if price shows stability and positive reaction within this range. As long as price holds above this demand, a temporary recovery or sideways movement remains possible.

Current market behaviour suggests consolidation between demand and resistance, reflecting a balance between buyers and sellers after the sharp decline. Volatility is expected near both zones, where price may react strongly. Acceptance above resistance would weaken the bearish structure and shift focus toward higher levels, while a sustained move below demand would confirm continuation of downside momentum. Overall, the market remains cautious, with a bearish bias in the short term while price stays below resistance, and key reactions expected around the highlighted demand and resistance areas.

Disclaimer: This analysis is for educational purposes only. It is not financial advice. Trading involves risk and uncertainty.

EURUSD LONG 4 HOURSİn the position entered based on the bat pattern , i believe the long position should be maintained , and the target is the potential D point of the newly forming crab pattern .

Entry Level = 1.15130

Stop Level = 1.1450

(To protect against the possibility of the pattern failing , we can move the stop level to point a of the first pattern)

Tp = 1.18617

"Not financial or trading advice -simply sharing my perspective"

Gold's safe-haven properties have been activated to the extreme.Bullish Core Support: Four-Fold Logic Resonance, Maximum Momentum

1.Massive Capital Inflows, ETF and Central Bank Support: The world's largest gold ETF (SPDR) significantly increased its holdings by 6.87 tons from the previous day, reaching 1086.53 tons, a new high in over two years. It also recorded a net inflow of over $500 million during the day, setting a new record for single-day capital inflow, indicating strong institutional bullish sentiment. Central bank gold purchases continue to increase, with the People's Bank of China increasing its holdings for 16 consecutive months, adding 35 tons in January. The average monthly gold purchase by central banks globally remains at a high level of 60-70 tons, creating rigid support and absorbing marginal supply from the market.

2.Escalating US-Europe Geopolitical Conflicts, Extreme Risk Aversion: Trump officially announced a 10% tariff on goods from eight countries, including Denmark, Germany, and France, starting February 1st. The EU is preparing retaliatory countermeasures. Pension funds in Denmark and other countries are accelerating the sale of US bonds and shifting to gold. Geopolitical risks have evolved from a temporary event to a constant support factor. The VIX index surged to 20.09, maximizing the safe-haven attribute of gold.

3.US Dollar Index Hits Three-Month Low, Valuation Pressure Completely Removed: The US dollar index continued to weaken during the day, falling to a low of 97.48, a new three-month low. It is currently trading at 97.207, down 0.45% for the day and a cumulative decline of 1.5% since the beginning of the year, establishing a weak trend. The negative correlation between the dollar and gold is evident; dollar depreciation significantly reduces the cost of holding gold, opening up ample room for a surge in gold prices.

4.Strong Institutional Bullish Consensus, Strong Trend Momentum: Goldman Sachs raised its gold price target to $5400 by the end of 2026, and UBS suggested that it could reach $5400 in extreme scenarios. The market has a high degree of consensus on the upward shift of the gold price center. Gold prices surged by $38.94 in just one hour today, a 0.77% increase. Both domestic and international markets showed strong upward momentum, with London gold and COMEX gold futures rising simultaneously. The daily and hourly charts show a complete bullish pattern, indicating that the trend is likely to continue.

Gold trading strategies

buy:5060-5070

tp:5080-5090-5120

BTC/USDT – Short-Term Relief Rally (Weekly Timeframe)hi traders

Don't get too excited but...

This technical analysis evaluates the weekly price action of Bitcoin (BTC), identifying a high-probability reversal setup based on momentum exhaustion at a key structural support level.

1. Technical Setup: Bullish RSI Divergence

The primary catalyst for this trading idea is the Bullish Divergence between the price action and the Relative Strength Index (RSI) on the weekly timeframe.

Price Action: Bitcoin has recently undergone a healthy correction, pulling back to a significant horizontal support zone between $84,000 and $88,000. While the price made a series of lower lows (or equal lows) in this range, the bearish pressure appears to be waning.

RSI Indicator: During this same period, the RSI (14) has formed a clear higher low.

Significance: A bullish divergence on a high timeframe like the weekly chart is a powerful indicator of "selling exhaustion." It suggests that while the price is testing lows, the underlying momentum is actually shifting to the upside, often preceding a trend reversal or a significant relief rally.

2. Chart Structure: Support & Resistance

Support Validation: The level near $87,937 is acting as a strong psychological and technical floor. The presence of several weekly wicks in this area confirms that buyers are stepping in to defend this zone.

Immediate Resistance: The first major hurdle for the bulls is the recent consolidation peak near $96,000 - $98,000. This area served as local resistance throughout late 2025.

3. Trading Execution Plan

Based on the "short-term rally" thesis indicated on the chart:

Entry Zone: $87,500 - $89,000 (Current market price/support retest).

Target (Short-Term): ~$98,000. This aligns with the flag marked on the chart and represents a return to the upper boundary of the current range.

Stop-Loss: A weekly close below the major support at $84,000 would invalidate the bullish divergence thesis.

4. Market Context

Bitcoin is currently in a phase of high-level consolidation. This weekly bullish divergence suggests that the most aggressive portion of the recent sell-off is over. A successful bounce from this $88k floor would validate the broader macro bull trend and potentially set the stage for an attempt at the six-figure mark ($100,000+) later in the quarter.

Conclusion

The Weekly Bullish Divergence on BTC/USDT provides a high-conviction setup for a short-term rally. With the price successfully defending the $88k support and momentum shifting upward, the path of least resistance points toward a retest of the $98,000 level in the coming weeks.

DXY DOLLAR INDEXThe DXY, or U.S. Dollar Index, measures the value of the U.S. dollar against a basket of six major foreign currencies. A rising DXY signals dollar strength, while a falling index indicates weakness.

DXY Composition

The index weights currencies as follows: euro (57.6%), Japanese yen (13.6%), British pound (11.9%), Canadian dollar (9.1%), Swedish krona (4.2%), and Swiss franc (3.6%). Created in 1973 by the Federal Reserve, it uses a geometric average formula to track dollar performance relative to these trade partners.

Impact on Gold

DXY and gold prices show a strong inverse correlation, often 73-95% negative. When DXY rises, a stronger dollar makes gold pricier for foreign buyers, reducing demand and pushing prices down; a falling DXY has the opposite effect.

Impact on Forex

DXY directly influences USD pairs like EUR/USD and GBP/USD, where a higher index weakens these pairs as the dollar strengthens. It also affects USD/JPY positively and serves as a gauge for overall market risk sentiment and Fed policy effects.

#DXY #DOLLAR

ASTRUSDT Forming Falling WedgeASTRUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range after the recent decline, suggesting that selling pressure is steadily weakening while buyers are quietly stepping in to regain control. With consistent volume confirming accumulation at these lower levels, the setup is pointing toward a potential bullish breakout in the near term. If the price breaks decisively above the wedge resistance, the projected move could deliver an impressive gain of around 90% to 100% from the breakout point.

This falling wedge pattern is typically seen at the end of downtrends or during corrective phases, and it serves as a strong sign that market sentiment may be shifting from bearish to bullish. Traders closely watching ASTRUSDT are observing a similar strengthening momentum as it approaches its own breakout zone. The healthy trading volume supporting the pattern adds real confidence, showing that market participants are getting positioned early in anticipation of a reversal.

The growing interest in ASTRUSDT is fueled by increasing belief in the project’s long-term fundamentals combined with this attractive technical structure. A confirmed breakout backed by sustained volume could trigger the start of a fresh bullish leg. Traders might view this as a compelling setup for medium-term gains, especially once the wedge pattern fully resolves and buying pressure starts to accelerate.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!

ZKCUSDT Forming Falling WedgeZKCUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range after the earlier decline, suggesting that selling pressure is steadily weakening while buyers are quietly stepping in to regain control. With consistent volume confirming accumulation at these lower levels, the setup is building toward a potential bullish breakout in the near term. If the price breaks decisively above the wedge resistance, the projected move could deliver an impressive gain of around 90% to 100% from the breakout point.

This falling wedge pattern is typically seen at the end of downtrends or during corrective phases, and it serves as a strong sign that market sentiment may be shifting from bearish to bullish. Traders closely watching ZKCUSDT are seeing a similar strengthening momentum as it approaches its own breakout zone. The solid trading volume supporting the pattern adds real confidence, showing that market participants are getting positioned early in anticipation of a reversal.

The growing interest in ZKCUSDT is driven by increasing optimism about the project’s long-term fundamentals combined with this attractive technical picture. A confirmed breakout backed by sustained volume could mark the beginning of a fresh bullish leg. Traders might view this as a high-quality setup for medium-term gains, especially once the wedge pattern fully completes and buying momentum starts to accelerate.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!