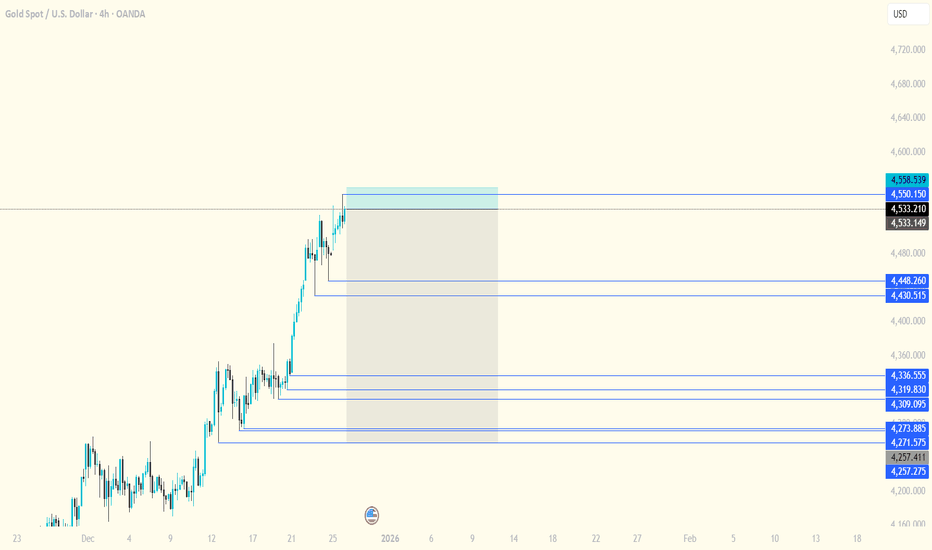

XAUUSD-Buyers in Control but Resistance in PlayGold remains in a bullish structure, respecting an ascending trendline with multiple CHOCH → BOS confirmations, showing strong buyer control. Price has now reached a key premium supply / resistance zone where momentum is slowing and consolidation is forming.

The current reaction at resistance suggests short-term exhaustion, with a likely pullback toward the nearest support first. A deeper retracement could target the lower support zone, while bullish continuation is only favoured if price breaks and holds above the marked resistance high.

Harmonic Patterns

btcusd bitcoin bounce to 100k then down all year long to 50kBear Market Phase (Throughout 2026):

Bitcoin is expected to enter a prolonged bear market lasting the entire year of 2026, resulting in a significant decline to around $50,000 or potentially even lower by Christmas 2026.

Dead Cat Bounces: Multiple short-term recoveries (dead cat bounces) are anticipated during this period.

The next one is projected around mid-February 2026, coinciding with the start of Chinese New Year, potentially pushing the price up to approximately $100,000 temporarily.

As of simlirat to late 2022 the next lower high, occurring sometime in April or May 2026.

Consolidation and Decline will follow and Bitcoin is expected to trade in a choppy range between $80,000 and $60,000 for much of the year, culminating in a final capitulation event a sharp downward candle that drives the price down to $50,000 by the end of 2026.

Next Bull Cycle a major 10x bull run is to begin 2027 potentially reaching $500,000 by mid-2029, following the next Bitcoin halving event in 2028.

Bulls in Full Control, but Reversal Risks Rise Near Record Highs- Gold continues to dominate the market after surging to a fresh all-time high at $4536.74, reinforcing strong bullish control despite a modest intraday pullback toward the $4515–$4525 zone. With no overhead resistance in sight, upside momentum remains intact, but the speed and vertical nature of the rally increase the risk of a short-term reversal, particularly if profit-taking accelerates into the close.

- In this environment, the concept of a “dip” has fundamentally changed: the key 50% retracement level of the current swing now sits near $4350.27, almost $200 below recent highs, reflecting the expanding volatility typical of a parabolic market.

- A critical technical level to monitor is $4479.41, any daily close below this price would confirm a bearish daily reversal top, potentially triggering a 2–3 day corrective move toward value areas.

- Fundamentally, gold remains supported as strong U.S. economic growth and persistent inflation expectations keep demand underpinned, while mixed Treasury yields and a weakening U.S. dollar add further tailwinds. The dollar’s vulnerability below the 97.814 support level could accelerate downside pressure toward 96.218, a move that would likely fuel another leg higher in gold. Until a confirmed reversal materialises, the broader trend favors continued strength, with any pullbacks viewed as strategic buying opportunities.

Bitcoin: Downtrend Structure and Key Acceptance ZoneBitcoin remains in a short-term downtrend, with a clear sequence of lower highs and lower lows. This trend is highlighted by the descending channel.

The latest move within this structure is corrective, forming a compression/triangle that has already reached resistance. While a trend break is possible, current price behavior still favors continuation rather than reversal.

From a volume profile perspective, the 82,000–71,000 range represents a low-activity zone where price barely traded in the past. Such areas typically act as zones where the market seeks to build acceptance and accumulation.

For this reason, the higher-probability outcome remains another impulsive leg to the downside.

The key level is 82,000, which marks the origin of the last impulse within the corrective structure of the downtrend (FRL context). A sustained acceptance below this level would confirm continuation.

Until then, downside remains conditional, not confirmed.

Canadian Dollar vs. US Dollar. The Spring is CompressingIn previous posts, we have already begun to look at the key drivers of the US outperformance over the past decade.

The US market dominance has been largely driven by the rapid rise of tech giants (such as Apple, Microsoft, Amazon and Alphabet), which have benefited from strong profit growth, global market reach and significant investor inflows.

Unsatisfactory International Performance

Markets outside the US have faced headwinds including multiple stifling sanctions and tariffs, slowing economic growth, political uncertainty (especially in Europe), a stronger US dollar and the declining influence of high-growth tech sectors.

The Valuation Gap. By 2025, US equities will be considered relatively expensive compared to their international peers, which may offer more attractive valuations in the future.

Recent Shifts (2025 Trend)

Since early 2025, international equities have begun to outperform the S&P 500, and European and Asian equities have regained investor interest. Global market currencies are also widely dominated by the US dollar.

Factors include optimism around the following three big themes.

DE-DOLLARIZATION. DE-AMERICANIZATION. DIVERSIFICATION.

De-dollarization is the process by which countries reduce their reliance on the US dollar (USD) as the world's dominant reserve currency, medium of exchange, and unit of account in international trade and finance. This trend implies a shift away from the central role of the US dollar in global economic transactions to alternative currencies, assets, or financial systems.

Historical context and significance of the US dollar

The US dollar became the world's primary reserve currency after World War II, as enshrined in the Bretton Woods Agreement of 1944. This system pegged other currencies to the dollar, which was convertible into gold, making the dollar the backbone of international finance. The United States became the world's leading economic power, and the dollar replaced the British pound sterling as the dominant currency for global trade and reserves.

The dollar has been the most widely held reserve currency for decades. As of the end of 2024, it still accounts for about 57% of global foreign exchange reserves, far more than the euro (20%) and the Japanese yen (6%). However, this share has fallen from over 70% in 2001, signaling a gradual shift and prompting discussions about de-dollarization.

How De-Dollarization Works

Countries looking to reduce their reliance on the dollar are pursuing several strategies:

Diversifying reserves: Central banks are holding fewer U.S. dollars and increasing their holdings of other currencies, such as the euro, yen, British pound, or new alternatives such as the Chinese yuan. While the yuan's share remains small (about 2.2%), it has grown, especially among countries like Russia.

Using alternative currencies in trade: Countries are entering into bilateral or regional agreements to conduct trade in their own currencies rather than using the dollar as an intermediary. For example, China has introduced yuan-denominated oil futures (the "petroyuan") to challenge the petrodollar system.

Increasing gold reserves: Many countries, including China, Russia and India, have significantly increased their purchases of gold as a safer reserve asset, reducing their dollar holdings.

Developing alternative financial systems: Some countries and blocs, such as BRICS, are working to develop alternatives to the US-dominated SWIFT payment system to avoid the risk of sanctions and gain true economic and political independence.

Reasons for de-dollarization

The move towards de-dollarization is driven by geopolitical and economic factors:

Backlash against US economic hegemony: The US often uses dollar dominance to impose sanctions and exert political pressure, encouraging countries to seek financial sovereignty.

Rise of new economic powers: Emerging economies like China and groups like the BRICS are seeking to reduce their vulnerability to U.S. influence and promote regional integration and alternative financial infrastructures.

Geopolitical tensions: Conflicts like the war in Ukraine have intensified efforts by countries like Russia to remove the dollar from their reserves to avoid sanctions.

Implications and outlook

While the dollar remains dominant, a more de-dollarized world is already changing global economic power. The U.S. may lose some advantages, such as lower borrowing costs and geopolitical influence. For the U.S. economy, de-dollarization could lead to a weaker currency, higher interest rates, and reduced foreign investment, although some effects, such as inflation from a weaker dollar, could belimited .

For other countries, de-dollarization could mean greater economic independence and less exposure to U.S. policy risks. However, no currency currently matches the dollar’s liquidity, stability, and global recognition, so a full transition is unlikely in the near future .

Summary

De-dollarization is a complex, ongoing process that reflects a gradual shift away from the global dominance of the U.S. dollar. It involves diversifying reserves, using alternative currencies and assets, and creating new financial systems to reduce dependence on the dollar.

Driven by geopolitical tensions and the rise of emerging economic powers, de-dollarization challenges the entrenched role of the dollar but is unlikely to completely replace it anytime soon.

Instead, it is leading to a more multipolar monetary system in international finance, increasing demand for alternative investments to the U.S.

Technical task

The main technical chart is presented in a quarterly breakdown, reflecting the dynamics of the Canadian dollar against the US dollar

CADUSD in the long term.

With the continued positive momentum of the relative strength indicator RSI(14), flat support near the level of 0.70 and a decreasing resistance level (descending top/ flat bottom) in case of a breakout represent the possibility of price growth to 0.80, with the prospect of parity in the currency pair and strengthening of the Canadian dollar to all-time highs, in the horizon of the next five years.

--

Best wishes,

Your Beloved @PandorraResearch Team 😎

BITCOIN: Major Wyckoff Distribution Ongoing, Look for the Signs.Hello There,

the bitcoin price in the recent weeks has been very volatile, increasing crucial bearish price actions. Following these dynamics, I have spotted important signs that reveal in what state the bitcoin price currently is. These signs are important hints on where the price action is likely to move within the upcoming times. Also fundamentally, these dynamics are supported by major events and underlying market sentiments.

When analyzing the bitcoin dynamic, I am also looking at historical developments and how the price action moved. Therefore, a smart trader can spot these patterns over time and position oneself appropriately in the market. Connecting the dots to the current state of the market, I have spotted a crucial underlying pattern, which is called Wyckoff distribution. This type of pattern is an almost sure sign that the market is undergoing a trend-changing bearish reversal.

Considering the volatile price action here, bitcoin just dumped massively since testing the $123,000 level. From there on, massive bearish developments pushed the price below the $85,000 mark. This is also an important sentiment for the market. Because below the $100,000 price level is now a huge resistance. With round numbers always being massive resistance levels.

This crucial resistance of $100,000 was also confirmed since the Preliminary Supply (PSY) and Buying Climax (BC) the bitcoin price formed earlier. As this resistance was confirmed several times, there is a high likelihood that it will hold in the near future as well. With further inflection points such as the major descending resistance, the major upper resistance angle is formed.

As Wyckoff distributions move in several stages till a much more pronounced bearish move pushes the price far below established supports, bitcoin is already in the later stages of this distribution cycle. With rising short open interest, this will give fuel to unfold a main bearish price action towards lower levels. The Wyckoff distribution for Bitcoin consists of the following completed, ongoing, and upcoming parts/phases.

Phase A:

The bitcoin prior uptrend has stopped, which was a hint towards a reversal likely to happen.

Preliminary Supply (PSY): First evidence of supply entered the market with bitcoin short volume increasing.

Buying Climax (BC): An abnormal move into bullish spheres, which can’t go on forever, signals that the trend is likely to reverse.

Secondary Test (ST): This is very crucial for Bitcoin in this dynamic, as Bitcoin did not establish substantially higher highs; the price was rejected from the local levels. Marking the phase B in the distribution with clear signs of weak hands pushed out of the market.

Phase B

UT in Phase B: The upthrust above previous resistance levels marks a last try for Bitcoin to form significant higher highs. This did not happen, and Bitcoin pulled back again into the range. It is the most critical bearish sign here.

Phase C

In the next phase, C, several Last Points of Supply (LPSY) will be expected. We see a lot of bearish pressure in the market as whales throw their bitcoin into the market. Bearish volume increases. Short increases. All these bearish signs support the last points of supply. A final push below the support is determined by a Sign of Weakness (SOW), which shows that the market is likely to continue in the bearish direction.

In any case, the bearishness of this whole constellation should not be underestimated. As it is unlikely that this level holds and Bitcoin has the ability to continue to form new highs, a major bear market is likely to enter. Once the Wyckoff distribution pattern is completed, the bear market will unfold in its full determination.

Therefore, thank you very much for watching.

Bearish continuation off pullback resistance?EUR/GBP has rejected the resistance level, which is a pullback resistance slightly below the 38.2% Fibonacci retracement, and could drop from this level to our take-profit.

Entry: 0.8731

Why we like it:

There is a pullback resistance level which is slightly below the 38.2% Fibonacci retracement.

Stop loss: 0.8747

Why we like it:

There is a pullback resistance level that lines up with the 50% Fibonacci retracement.

Take profit: 0.8690

Why we like it:

There is an overlap support level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Zumiez (ZUMZ): A Strong Buy on Robust Earnings Revision TrendsZumiez (ZUMZ): A Strong Buy on Robust Earnings Revision Trends and Momentum

Zumiez Inc. (NASDAQ: ZUMZ), a leading specialty retailer of apparel, footwear, and accessories rooted in youth and action sports culture, is emerging as a compelling investment opportunity. The company’s stock has demonstrated significant strength recently, rallying approximately 33.6% over the past four weeks. This momentum is well-supported by a fundamentally improving outlook, primarily driven by a pronounced upward trend in analysts' earnings estimates. Such revisions are among the most powerful catalysts for stock price appreciation, and Zumiez currently exemplifies this dynamic.

The Power of Earnings Estimate Revisions

A cornerstone of equity analysis is the strong, empirically demonstrated correlation between trends in earnings estimate revisions and near-term stock price movements. When analysts collectively raise their forecasts, it often signals improving business fundamentals, greater visibility into profitability, or successful execution of a turnaround strategy—all of which the market eventually rewards.

Zumiez is currently at the center of such positive revision activity. The company has witnessed substantial increases in consensus earnings estimates for both the upcoming quarter and the full fiscal year, with a notable consensus among covering analysts. There have been no downward revisions, indicating a clear and unified bullish sentiment regarding the company's near-term trajectory.

Quantifying the Upward Estimate Revisions

The magnitude of the estimate increases is significant and highlights a dramatic turnaround in profitability expectations:

For the Current Quarter: The Zacks Consensus Estimate now stands at $1.03 per share, representing a substantial year-over-year increase of +32.1%. Over the critical last 30-day period, this consensus estimate has been revised upward by 5.48%, driven by three separate analysts raising their forecasts.

For the Current Fiscal Year: The outlook is even more striking. The full-year consensus estimate of $0.73 per share implies an astounding year-over-year growth of +911.1%. This estimate has surged 52.38% higher over the past month, propelled by two positive revisions against a complete absence of negative adjustments.

This revision trend paints a picture of a company experiencing a powerful earnings inflection point, moving from a period of challenged profitability to one of robust and accelerating earnings power.

The Zacks Rank #1 (Strong Buy) Endorsement

As a direct result of this highly favorable and unanimous estimate revision activity, Zumiez has been awarded a Zacks Rank #1 (Strong Buy). The Zacks Rank system is a quantitative, model-driven stock rating tool that rigorously categorizes stocks based on the power and direction of earnings estimate revisions. Its track record is exceptional: since 2008, stocks ranked #1 have generated an average annual return of +25%, significantly outperforming the broader market.

This ranking places Zumiez in an elite category of stocks that research shows have the highest probability of delivering market-beating returns in the months ahead. Investors seeking to leverage the power of earnings momentum would find a Zacks Rank #1 stock like Zumiez a prime candidate for portfolio inclusion.

Strategic and Fundamental Context

While the earnings revision data provides a powerful quantitative signal, it is likely rooted in improving fundamental drivers. These may include:

Successful inventory management and a more favorable product mix.

Effective cost control measures flowing through to the bottom line.

Strategic initiatives to enhance digital sales and optimize the omnichannel experience.

A potential stabilization or improvement in the discretionary spending environment for its core youth demographic.

The combination of a strong price momentum trend and accelerating fundamental improvements creates a potent setup for continued stock price strength.

Price Target and Investment Conclusion

Given the powerful confluence of a high Zacks Rank, explosive earnings growth projections, and confirmed price momentum, Zumiez presents a structured investment opportunity. Based on this analysis, a take-profit target of $24 is identified. This target reflects a logical extension of the current uptrend, calibrated to both the stock's recent breakout momentum and the substantially higher earnings base supporting its valuation.

Bottom Line

Zumiez is more than just a recent momentum play. It is a company where analyst optimism is concretely and aggressively rising, a phenomenon that historically serves as a reliable precursor to further stock gains. The prestigious Zacks Rank #1 (Strong Buy) provides a data-backed seal of approval on this trend. For investors looking to capitalize on a clear earnings recovery story with demonstrated price strength, adding Zumiez to one’s portfolio offers a strategic opportunity to participate in its ongoing positive re-rating. The current window, characterized by rising estimates and strong momentum, may be an advantageous time to establish or add to a position.

Potential bearish drop?NZD/USD has rejected the resistance level, which serves as a pullback resistance that aligns with the 50% Fibonacci retracement, and could potentially drop from this level to our take-profit target.

Entry: 0.5834

Why we like it:

There is a pullback resistance level which aligns with the 50% Fibonacci retracement.

Stop loss: 0.5849

Why we like it:

There is a swing high resistance level.

Take profit: 0.5804

Why we lik eit:

There is a pullback support level that is slightly below the 38.2% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Heading towards 61.8% Fib resistance?USD/JPY is rising towards the pivot point of 156.92, which is a pullback resistance that aligns with the 61.8% Fibonacci retracement and could reverse from this level to our take profit.

Entry: 156.92

Why we like it:

There is a pullback resistance level that aligns with the 61.8% Fibonacci retracement.

Stop loss: 157.48

Why we like it:

There is a pullback resistance level

Take profit: 156.03

Why we like it:

There is an overlap support level

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Bearish drop off?EUR/USD is reacting off the resistance level which is a pullback resistance and could drop from this levle to our take profit.

Entry: 1.1775

Why we like it:

There is a pullback resistance level

Stop loss: 1.1791

Why we like it:

There is a multi-swing high resistance level.

Take profit: 1.1747

Why we like it:

There is an overlap support that lines up with the 61.8% Fibonacci retracement.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.

Root, Inc. (NASDAQ:ROOT)Root, Inc. (NASDAQ:ROOT): A Detailed Look at Q3 Performance, Market Reaction, and Long-Term Positioning

Root, Inc. (NASDAQ:ROOT), a technology-driven auto insurer that utilizes mobile apps and data science to price policies based on individual driving behavior, delivered what can be considered one of the strongest third-quarter performances within the property & casualty insurance segment. The company reported revenues of $387.8 million, marking a substantial 26.9% year-over-year increase and surpassing analysts' expectations by a notable 4.5%. The quarter was characterized by impressive execution, with beats on both earnings per share (EPS) estimates and a solid outperformance on net premiums earned estimates.

A Paradoxical Market Reaction

Despite this robust operational showing, the market's response was decidedly negative. Following the earnings release, the stock declined by approximately 8.5%, trading around $81.94. This disconnect between strong fundamentals and weak price action highlights the complex sentiment surrounding disruptive, growth-oriented insurance tech companies. The bearish reaction may reflect broader sector concerns, valuation pressures, or market impatience with the timeline to sustained, high-margin profitability.

This skepticism was echoed by financial commentator Jim Cramer. When asked about Root, Cramer advised looking elsewhere, cautioning that the stock is "expensive" based on doubts about the durability of its earnings, and pointed to competitor Lemonade (NASDAQ:LMND) as a point of comparison. Cramer's remarks underscore the high expectations and intense scrutiny facing companies in this innovative but competitive space.

The Core Investment Thesis: Data as a Moat

Root's fundamental proposition remains compelling. The company is transforming the traditional insurance model through its data-driven, mobile-first approach. By leveraging telematics to analyze actual driving behavior—processing over 32 billion miles of driving data—Root aims to more accurately assess risk and reward safe drivers, creating a powerful feedback loop for customer acquisition and retention.

This proprietary technology underpins a high-margin, recurring revenue business model. Key metrics demonstrate significant traction:

Policies in force grew from $220 million in 2022 to $415 million in 2024, reflecting a compound annual growth rate (CAGR) of approximately 37%.

The company has successfully expanded its product suite into renters and homeowners insurance, a strategic move designed to increase customer lifetime value and cross-selling opportunities.

Financial discipline is improving markedly, with the net margin rising from -150% in 2021 to 3% in 2024, and the generation of positive free cash flow of $195 million in 2024.

Strategic Positioning and Financial Health

Root operates in a massive U.S. auto insurance market estimated at $300 billion, benefiting from secular trends toward personalized, digital-first solutions. Its asset-light model and digital platform contribute to lower operational costs and efficient claims processing. Management alignment is strong, with insiders owning 11.6% of shares and compensation tied to performance metrics.

Analytically, Root scores 16.5 out of 22 on the "Compounder Score," qualifying it as a high-conviction business with a compelling growth and profitability narrative. The thesis emphasizes Root's development of a durable competitive advantage through scalable AI and machine learning models. While risks around pricing power, regulation, and competition persist, the company projects a revenue CAGR of 14.5% through 2027 and maintains a strong balance sheet.

Technical Perspective and Price Pathways

From a chart analysis standpoint, the recent decline places the stock in a cautious technical position. A major support level is identified near $40.00, which would represent a critical zone for the longer-term bullish structure.

For investors and traders anticipating a recovery and continuation of the growth story, Fibonacci extension levels derived from prior price movements suggest several key upside targets:

First Take-Profit Target (0.236 Fibonacci level): $94.76

Second Take-Profit Target (0.382 Fibonacci level): $111.27

Third Take-Profit Target (0.5 Fibonacci level): $124.61

These levels provide a structured framework for assessing potential resistance areas on a rebound.

Conclusion: A Story of Execution Versus Expectation

In summary, Root, Inc. presents a fascinating case of a company executing strongly on its operational and growth metrics—evidenced by an outstanding Q3—while facing a skeptical market preoccupied with valuation and the long path to dominating a traditional industry. The core investment thesis, centered on a transformative data advantage and improving financials, remains intact. However, the stock's journey will likely be volatile, as it must continually prove that its technology-led model can consistently translate into superior underwriting profits and shareholder value in a challenging macroeconomic and competitive landscape. The juxtaposition of its solid fundamentals against its weak recent price action and noted technical supports and resistances defines the current investment dilemma surrounding ROOT.

JPMorgan Maintains Neutral Rating on Enact (ACT)JPMorgan Maintains Neutral Rating on Enact (ACT) with Slight Target Adjustment Post-Q3 Earnings

On November 7, JPMorgan analyst Richard Shane reaffirmed a Neutral rating on Enact Holdings, Inc. (NASDAQ: ACT) while modestly reducing his price target to $39 from $40. This adjustment followed the company’s third-quarter 2025 financial update, as reported by The Fly.

Third-Quarter 2025 Financial Overview

Enact reported total revenue of $311.4 million, a slight increase from the $309.5 million recorded in the same quarter last year. Premiums for the quarter came in at $244.6 million, compared to $249 million in Q3 2024. The company’s liquidity position remained stable, with $339 million in cash and cash equivalents and an additional $311 million in invested assets as of September 30. Management noted that the combined liquidity pool was essentially unchanged from the previous quarter, as share repurchases and regular dividend payments largely offset the capital contributions from its EMICO subsidiary.

Key Operational Metrics Show Steady Growth

New insurance written during the quarter reached $14 billion, representing a 6% increase from Q2 2025 and a 3% year-over-year rise. The product mix remained heavily weighted toward monthly premium policies, which accounted for 97% of the volume, while purchase originations made up 93%. Primary insurance in force grew marginally to $272 billion, up from $270 billion in the prior quarter and $268 billion a year earlier. During the quarter, Enact continued its commitment to shareholder returns, distributing $31 million in dividends.

Industry Context: Property & Casualty Insurance in Q3

Enact operates within the broader Property & Casualty (P&C) insurance sector, which is known for its cyclicality. The industry tends to perform well during "hard markets," characterized by rising premium rates that outpace claims and cost inflation. Conversely, profitability can compress during "soft markets." External factors such as interest rates—which influence investment yields—and long-term challenges like increasing catastrophe losses due to climate change and rising litigation costs ("social inflation") also shape sector performance.

Among the 33 P&C insurance stocks tracked, the group reported a strong collective quarter, with revenues exceeding consensus estimates by 3.8% on average. Following their earnings releases, these stocks have remained resilient, posting an average gain of 4.6%.

Enact’s Position and Market Performance

As a leading U.S. private mortgage insurer, Enact plays a vital role in the housing ecosystem by enabling lenders to offer mortgages with lower down payments—thereby expanding access to homeownership—while assuming default risk on behalf of lenders. The company’s Q3 revenue of $311.5 million was essentially flat compared to the prior year and aligned with analyst expectations. Although it was a relatively slower quarter with only a narrow beat on earnings per share estimates, the stock has responded positively, rising 8.3% since the earnings release to trade around $38.90.

Technical Perspective and Price Levels

From a technical standpoint, Enact’s share price is currently situated below the revised JPMorgan target of $39. Key support zones to monitor are located near $35, $34, and $31, which could serve as potential areas of buyer interest should any near-term pullbacks occur. On the upside, a take-profit target around $42 remains a relevant resistance level for traders and investors looking for continued upward momentum.

In summary, while JPMorgan’s slight target trim reflects a cautious near-term outlook, Enact’s stable operational performance, disciplined capital management, and strategic role in the mortgage market continue to support a steady investment case within the Neutral rating framework.

GBPJPYWelcome to my channel.

This analysis is presented strictly for educational and informational purposes, focusing on price delivery, market structure, and liquidity behaviour as observed on the higher timeframe. No financial advice, trade recommendations, or performance claims are being made.

🔍 Market Structure Context

Price has recently delivered a clear bullish displacement, breaking prior internal structure with strong momentum. This impulsive move signals institutional participation, not retail noise. Such expansion phases typically occur after liquidity has been efficiently collected below recent lows.

Following the expansion, price is now operating in premium territory, suggesting that upside continuation or a corrective retracement is dependent on how price reacts around key institutional levels.

🧠 Demand & Imbalance Consideration

The highlighted demand zone represents the origin of the displacement — an area where buy-side imbalance previously entered the market with authority. From an institutional perspective, this zone is not a “buy signal,” but rather a reference point where price may rebalance if efficiency is sought.

Markets do not move in straight lines. If price revisits this zone, the reaction (or lack thereof) will provide critical information about order flow strength and continuation probability.

⚖️ Risk & Expectation Management

This chart does not predict the future. It outlines probabilities, not certainties.

Price may:

Continue expanding higher if demand remains unmitigated

Retrace into discounted levels to rebalance inefficiencies

Consolidate while institutions redistribute positions

Every scenario remains valid until price invalidates it.

If you value objective analysis, rule-based frameworks, and professional market commentary, you’re welcome to follow and engage.

Let price do the talking

#GBPNZD:+1000 PIPS Two Take Profit Swing Buy Analysis The price is currently consolidating, indicating no clear move. We’re looking for a safe entry point here. There are two potential targets for setting your take profit. We anticipate a strong price reversal on this pair and significant volume in the coming weeks.

Good luck! Show us some support by liking and commenting on the ideas.

Team Setupsfx_

GOLD BUY BIAS📈 Bullish Continuation Structure – Price Action Read

Price previously delivered a strong bullish impulse, confirming buy-side control. The following pullbacks have been shallow and corrective, with price forming higher lows rather than showing signs of distribution.

This type of compression typically precedes trend continuation, not reversal.

The rising structural base highlights areas where buyers repeatedly defended price, while sellers failed to produce a meaningful break in structure.

Below current price sits a key demand zone aligned with the bullish leg. A controlled pullback into this area followed by bullish reaction would support continuation toward resting liquidity above prior highs.

❌ Invalidation: A decisive close below the demand zone or a clear break of structure would negate this bias.

📌 Bias remains bullish while structure holds.

STORJUSDT Forming Falling WedgeSTORJUSDT is forming a clear falling wedge pattern, a classic bullish reversal signal that often indicates an upcoming breakout. The price has been consolidating within a narrowing range, suggesting that selling pressure is weakening while buyers are beginning to regain control. With consistent volume confirming accumulation at lower levels, the setup hints at a potential bullish breakout soon. The projected move could lead to an impressive gain of around 90% to 100% once the price breaks above the wedge resistance.

This falling wedge pattern is typically seen at the end of downtrends or corrective phases, and it represents a potential shift in market sentiment from bearish to bullish. Traders closely watching STORJUSDT are noting the strengthening momentum as it nears a breakout zone. The good trading volume adds confidence to this pattern, showing that market participants are positioning early in anticipation of a reversal.

Investors’ growing interest in STORJUSDT reflects rising confidence in the project’s long-term fundamentals and current technical strength. If the breakout confirms with sustained volume, this could mark the start of a fresh bullish leg. Traders might find this a valuable setup for medium-term gains, especially as the wedge pattern completes and buying momentum accelerates.

✅ Show your support by hitting the like button and

✅ Leaving a comment below! (What is your opinion about this Coin?)

Your feedback and engagement keep me inspired to share more insightful market analysis with you!