Mastering Divergence in Technical AnalysisIn technical analysis, a divergence (also called a “momentum divergence” or “price/indicator disagreement”) is one of the most powerful early warning signals available to traders. In simple terms, divergence occurs when price and a momentum indicator (such as RSI, MACD, or Awesome Oscillator etc.) move in opposite directions.

This disagreement often signals that the current trend is losing strength and that a pause, pullback, or full reversal may be approaching.

1. What Is Divergence?

Normally, in a healthy trend:

In an uptrend, price makes higher highs and momentum indicators also make higher highs.

In a downtrend, price makes lower lows and momentum indicators also make lower lows.

A divergence appears when this alignment breaks.

Typical example with RSI or MACD:

Price makes a higher high,

But the indicator makes a lower high.

This tells us that, although price has pushed to a new extreme, the underlying momentum is weaker. Smart money may be taking profits, and the late participants are driving the final leg of the move.

2. Types of Divergence

There are two main families of divergence:

Regular (classic) divergence – often associated with potential trend reversals.

Hidden divergence – often associated with trend continuation after a correction.

Within each family, we have bullish and bearish versions.

2.1 Regular Bullish Divergence – Potential Trend Reversal Up

This suggests that sellers are still pushing price to new lows, but momentum is no longer confirming the strength of this selling pressure. The downtrend is weakening and a bullish reversal may develop.

Context where it’s most powerful:

After a prolonged downtrend.

At or near a higher-timeframe support level (daily/weekly support, major demand zone, trendline, or Fibonacci confluence).

2.2 Regular Bearish Divergence – Potential Trend Reversal Down

This signals that buyers are still able to push price higher, but each new high is supported by less momentum. The uptrend is aging, and a bearish reversal or deeper correction becomes more likely.

Context where it’s most powerful:

After a strong, extended uptrend.

Around major resistance levels, supply zones, or upper trendlines.

2.3 Hidden Bullish Divergence – Trend Continuation Up

Here, price structure still shows an uptrend (higher lows), but the indicator has overshot to the downside. This often appears during pullbacks within an uptrend, suggesting that the correction is driven more by short-term emotion than by real structural weakness.

Interpretation:

Hidden bullish divergence indicates trend continuation. Bulls remain in control, and the pullback may provide an opportunity to join the uptrend at a better price.

2.4 Hidden Bearish Divergence – Trend Continuation Down

Price structure still favors the bears (lower highs), but the indicator has spiked higher, often due to a sharp counter-trend rally. This suggests that the bounce is corrective rather than the start of a new uptrend.

Interpretation:

Hidden bearish divergence favors continuation of the downtrend and often appears before the next impulsive bearish leg.

3. Which Indicators to Use?

Divergence can be spotted on many oscillators, but the most commonly used are:

RSI (Relative Strength Index) – very popular for spotting overbought/oversold zones and divergences.

MACD (and its histogram) – useful for trend and momentum, especially on higher timeframes.

Stochastic Oscillator – often used in range-bound environments.

Awesome Oscillator, CCI, etc. – alternative momentum tools, depending on your preference.

The concept is the same: price and indicator should generally confirm each other. If not, you have a divergence.

4. Timeframes and Reliability

Divergences can be found on all timeframes, but their reliability increases with higher timeframes:

On M5–M15, divergences are frequent but often short-lived. Better for scalpers.

On H1–H4, signals have more weight and can lead to multi-session moves.

On Daily/Weekly, divergences can mark major tops and bottoms, but they may take longer to play out.

A good practice is to:

Identify major divergences on higher timeframes (H4, Daily).

Refine entries on lower timeframes (M15, M30, H1) using structure and price action.

5. How to Trade Divergences (Practical Framework)

Divergence by itself is not a complete trading system. It is a signal of potential imbalance, which should be combined with:

Key levels (support, resistance, supply/demand zones).

Trend structure (higher highs/lows or lower highs/lows).

Price action confirmations (reversal candles, break of structure, etc.).

Risk management (position sizing, stop loss, invalidation level).

6. Common Mistakes When Using Divergences

- Trading every divergence blindly.

Not every divergence leads to a big reversal. Many will result in only minor pullbacks.

- Ignoring the trend.

Regular divergences against a strong trend can fail multiple times before a real top or bottom forms. Hidden divergences are often more reliable in trending markets.

- Forcing divergences where they don’t exist.

Only connect clear, obvious swing highs and lows on both price and indicator. If you have to “stretch” the lines, the signal is probably weak.

- No risk management.

A divergence is just a probability edge, not a guarantee. Always define invalidation and manage position size accordingly.

7. Best Practices

Combine divergence with market structure (trendlines, channels, higher highs/lows).

Use higher-timeframe context and drop to lower timeframes for refined entries.

Pay attention to confluence:

Divergence + key level + candlestick signal is stronger than any single factor.

Keep a trading journal of divergence setups, including screenshots from your charts. Over time, you will see which conditions work best for your style.

Divergences are not magic, but they are one of the cleanest ways to see when price and momentum disagree. Used correctly, they can:

Help you avoid entering late in a trend,

Alert you to potential reversals before they are obvious to the crowd, and

Provide high-probability continuation entries via hidden divergences within strong trends.

Hidden Bullish RSI Divergence

KML - Daily TF, Technical AnalysisKML after the 10/1 split share price dropped from PKR 146.77 to 14.67 and then it continued its price drop due to profit booking. Historically, this SCRIP retraces to 50% Fib level before starting its next run for HH.

At present, the price after retracing to 50% Fib level is almost maintaining 38~42% for the last 2 weeks consolidation. It may take even 1 to 2 weeks for once again going upwards but you never know it may go up even in one day as hidden bullish divergence has been observed on RSI. KVO is below zero level but its signal line (blue) is almost parallel to Klinger oscillator (green), suggesting slow transition but both lines are very close as well, therefore, any good news or bad news will give its immediate results.

For trade consider buying at levels mentioned on the chart.

ABCD harmonic pattern has been plotted to arrive to the TP-4.

Hidden Bullish Divergence on Bigger tf.IMAGE

Closed at 21.94 (27-05-2025)

Hidden Bullish Divergence on Bigger tf.

Monthly Closing above 20.70 will be a

positive sign.

Upside Targets can be around 26 - 26.50

On the flip side, 20.50 - 20.68 is a Good

Support zone and then around 19.

Should not break 17.30, otherwise we may

witness nd Reversal.

XRPUSD Double BottomHi all, looking on the weekly, this might be a larger run ahead of us.

The weekly shows a Double Bottom, With Hidden Bullish Divergence.

Should reach $4.5 according to the larger cup size, maybe $5.

The divergence makes it more probable to break out.

Not financial advice, just my next move.

Happy & safe trading.

Hidden Bullish Divergence will play?as mentioned during market

timings, 36.50 was important to

sustain. It could not and hit the

Lower Lock at 36.03

Next Support is around 34.50 - 34.62

Now it is Important to Sustain 36.50 - 36.70

on Weekly basis.

Monthly Support is around 35.

One +ve sign: Hidden bullish divergence has

also appeared.

Played exactly the same as predicted last week. KSE100 Closed at 114113.94 (02-05-2025)

Played exactly the same as predicted last week.

Now seems like Hidden Bullish Divergence is appearing.

Important Supports :

S1 around 113100 - 113400

S2 around 110500 - 110800

Important Resistances :

R1 around 114630 - 115120

R2 around 117000 - 117500

Tue 15th Apr 2025 GBP/CAD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/CAD Buy. Enjoy the day all. Cheers. Jim

XRP Continues to Mirror BTC's Macro Pirce-Action; Only Slower.XRP since it was listed on Poloniex back in 2014 seems to have mirrored the overall price action of BTC over the years but at a much slower pace.

It would appear that BTC makes the move first then XRP takes about 65% longer to make a move of equal significance.

We can see that BTC had a Major Pump in 2013 and that from there it traded within a range until 2017 before rising 5,424%

XRP's story appears to be the same but with the small twist that it is still trading within it's Multi-Year-Range that it's found itself trading within after a huge 2017 rise.

2022 will be coming to and end soon and it will soon be that XRP has traded 6 Years within this range and just like BTC in the past it appears to be holding on to a trendline, if XRP goes like how BTC went, then we should expect XRP to be nearing or even above the top of the range Several Months after it's first test of the trendline which would point us to February 2023.

If XRP's Multi-Year-Range Breakout lives up to BTC's, I would expect to see an approximate 5,400% pump from XRP's Range Highs which would take it up to the seemingly insane and "unreachable" target of $120.94

We even have some added Monthly MACD Hidden Bullish Divergence to back XRP up.

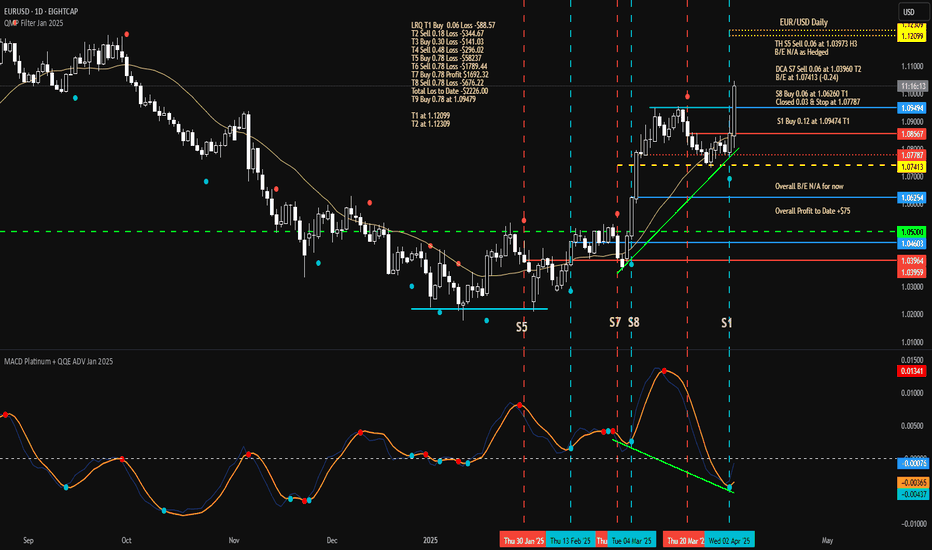

Fri 4th Apr 2025 AUD/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a AUD/USD Buy. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 NZD/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a NZD/USD Buy. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 EUR/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a EUR/USD Buy. Enjoy the day all. Cheers. Jim

Thu 3rd Apr 2025 GBP/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a GBP/USD Buy. Enjoy the day all. Cheers. Jim

Bullish Divergence on Monthly TF.Bullish Divergence on Monthly TF.

Weekly Support seems to be around 30.

& Important Resistance is around 32-33.

Though a re-testing of breakout done. but

Important to Sustain 24.90

As of now, Stock is in sideways movement;

& it will be Bullish once it will cross 36.

A positive point is that there are multiple

bullish / hidden bullish divergences on

different time frames.

Hidden Bullish Divergence appeared.Hidden Bullish Divergence appeared.

Breaking Out a long Consolidation Box around

145 - 149.

164 - 169 is a Strong Resistance zone.

If this Level is Sustained, we may witness

200+

However, if 135 - 136 is broken, more Selling

Pressure will be witness & it may drag the price

towards 113 - 115.

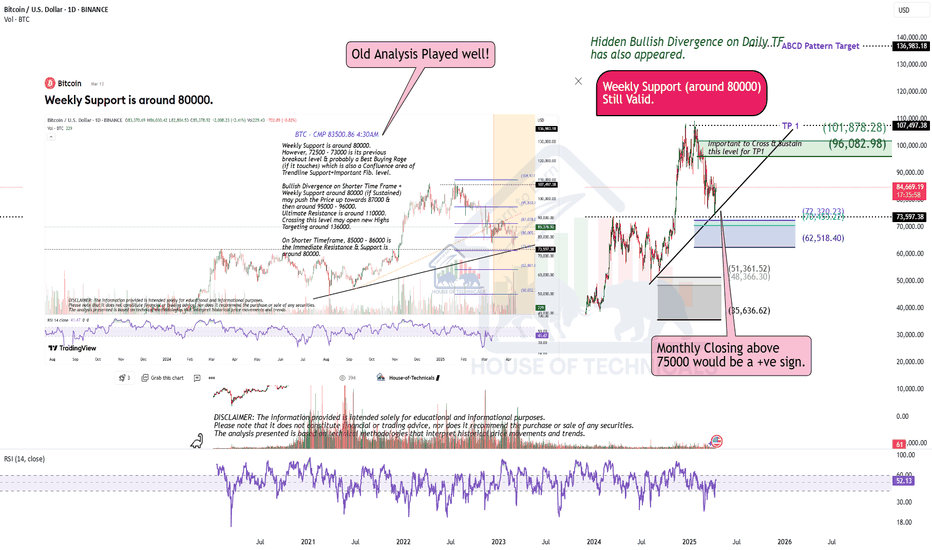

Tue 18th Mar 2025 BTC/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a BTC/USD Buy. Enjoy the day all. Cheers. Jim

Wed 5th Mar 2025 XAG/USD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a XAG/USD Buy. Enjoy the day all. Cheers. Jim

Fri 28th Feb 2025 USD/SGD Daily Forex Chart Buy SetupGood morning fellow traders. On my Daily Forex charts using the High Probability & Divergence trading methods from my books, I have identified a new trade setup this morning. As usual, you can read my notes on the chart for my thoughts on this setup. The trade being a USD/SGD Buy. Enjoy the day all. Cheers. Jim

Bitcoin - preparing for a Mega bullish waveThe weekly chart is bullish for Bitcoin.

It shows a hidden bullish divergence on RSI, indicating that the price trend is likely to continue upward.

Additionally, the chart highlights a double bottom pattern on HTF.

Bitcoin maintaining support at 0.786 Fibonacci will give it the momentum needed to create a new high.

A new all-time high (ATH) for Bitcoin is expected in the coming weeks.

Best regards Ceciliones🎯