August 24, Forex Outlook: What Can Traders Expect This Week?Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDJPY

USDCAD

EURGBP

EURJPY

GBPCHF

NZDCHF

USDCHF

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

Highprobability

August 11, Forex Outlook: What to Expect from This Weeks TradingWelcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

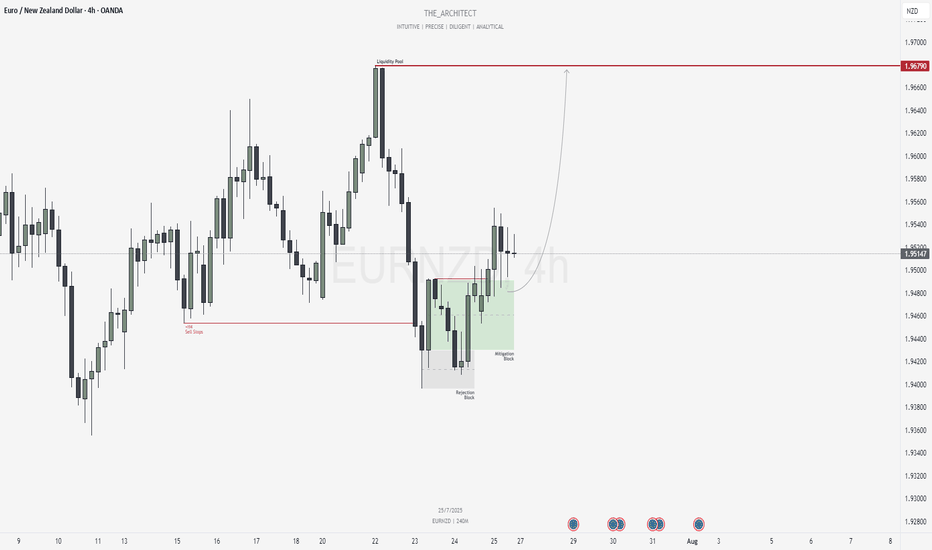

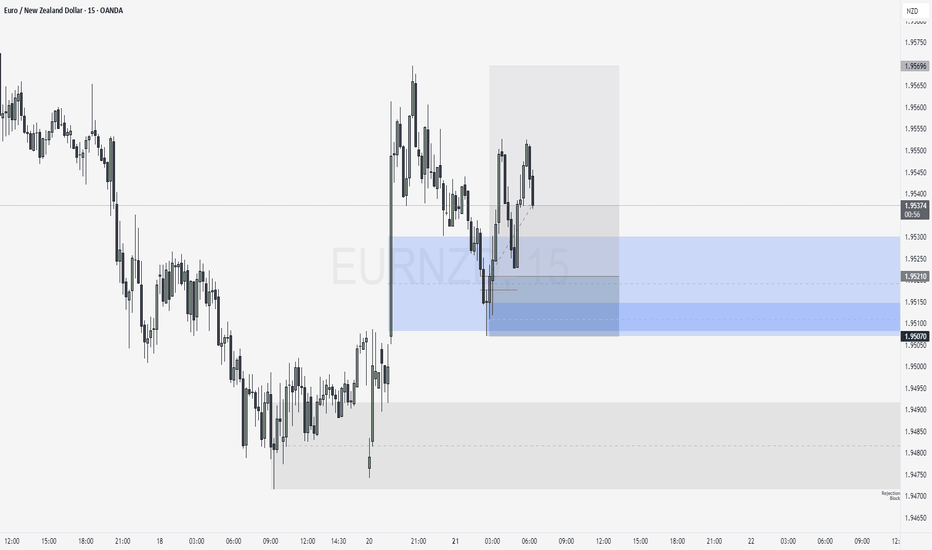

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

August 3, Forex Outlook: High-Reward Setups You Need to See Now!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDCAD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

July 29, Forex Outlook : High-Reward Setups You Shouldn’t Miss!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

USDJPY

AUDJPY

CADJPY

EURGBP

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

Weekly Trade Outlook | Lessons in Discipline, Risk & PerspectiveGreetings Traders,

In today’s video, I’ll be walking you through my end-of-week trade outlook, breaking down every setup I took throughout the week. This session is designed to offer insight into how I apply risk management, trading rules, and maintain psychological discipline in real-time market conditions.

Whether you're struggling with emotional trading, inconsistency, or overtrading, this video will give you a fresh perspective on how structure, faith, and discipline can shape a sustainable trading approach.

Remember: respect your trading rules, pray over them daily, and ask God for the strength to remain disciplined—so you don’t become your own worst enemy in the market.

Let’s grow together,

The Architect 🏛️📈

July 21, Forex Outlook : Don’t Miss These High-Reward Setups!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Pairs to focus on this Week:

EURUSD

USDJPY

AUDJPY

CADJPY

EURJPY

GBPCHF

USDCHF

NZDCHF

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

July 13, Forex Outlook : This Week’s Blueprint to Profit!Welcome back, traders!

In today’s video, we’ll be conducting a Forex Weekly Outlook, analyzing multiple currency pairs from a top-down perspective—starting from the higher timeframes and working our way down to the lower timeframes.

Currency Pairs:

EURUSD

USDCAD

AUDUSD

EURGBP

EURJPY

GBPCHF

USDCHF

NZDCHF

NZDUSD

EURNZD

Our focus will be on identifying high-probability price action scenarios using clear market structure, institutional order flow, and key confirmation levels. This detailed breakdown is designed to give you a strategic edge and help you navigate this week’s trading opportunities with confidence.

📊 What to Expect in This Video:

1. Higher timeframe trend analysis

2. Key zones of interest and potential setups

3. High-precision confirmations on lower timeframes

4. Institutional insight into where price is likely to go next

Stay tuned, take notes, and be sure to like, comment, and subscribe so you don’t miss future trading insights!

Have a great week ahead, God bless you!

The Architect 🏛️📉

CADJPY Multi-Timeframe Price Analysis: Trade SetupIn this video, we analyse the CADJPY across multiple timeframes (4H, 1H, and 15M) to identify a high-probability long trade setup based on structural price action, momentum shifts, and Fibonacci retracement levels.

🔍 4H Analysis (Momentum High Formed)

The CADJPY has shown a strong bullish recovery on the 4-hour chart, forming a Momentum High — a key signal that often precedes price movement. According to the principle "Momentum Precedes Price," we anticipate a corrective pullback to form a Higher Low (HL). This HL is expected to become a decision point for buyers looking to join the uptrend.

⏱ 1H Analysis (Confirmation of Structure)

On the 1-hour timeframe, price has formed a Higher Market Low (ML), confirming the structural HL observed on the 4H chart. Price has now entered the Fibonacci Buy Zone, providing a high-probability entry area for bullish trades.

📉 15M Analysis (Failure Setup & Entry Trigger)

The 15-minute chart shows a Failure to Make a Lower Low (LL). While a higher low is a positive sign, confirmation comes only after a break above the last Lower High (LH) that failed to produce a new low. We’re watching for a break above 104.128 to confirm this failure setup and trigger our long entry.

🎯 Trade Setup

✅ Entry: Long above 104.128

🛑 Stop Loss: Below London session low at 103.74 ± 5 pips

🎯 Targets:

T1: 106.92

T2: 108.64

💬 Wishing you a successful trading week! Don’t forget to like, comment, and follow for more technical analysis and trade ideas.

AAPL, NVDA, MSFT & XPS: High-Probability Trade Setups This WeekWeekly Trade Radar & Market Outlook

This week, my focus is on AAPL, NVDA, MSFT, and XPS. There could be a potential retest of the 200 SMA with AAPL and MSFT, offering opportunities for well-structured trades. NVDA looks weak and has already tested the 200 SMA, making it a candidate for further downside potential or a short-term bounce. Additionally, Chinese developments in AI chip production remain a factor that could influence price action, particularly with NVDA. Staying aware of these key levels and macro developments is crucial for trade execution.

📚 Trading Plan: Ichimoku & 200 SMA Monthly Options Strategy**

📌 Strategy Objective

This strategy aims to capitalize on **high-probability trend-following setups** by using the **Ichimoku Cloud and 200 SMA** for confirmation while trading **monthly options contracts** to minimize time decay risks.

📀 Trading Rules

✅ 1. Entry Timing Rules (Your 3 Golden Rules)**

🚫 **No trading on Mondays** (Avoid weekend gaps & false breakouts).

🚫 **No trading on Fridays** (Avoid weekend time decay & volatility).

⏳ **No trades before the first 15-minute candle closes** (Avoid market noise).

📊 Setup & Trade Criteria

🔹 2. Trend Confirmation Using Ichimoku & 200 SMA

Bullish (Call Trade) Criteria:

✅ **Price is above the 200 SMA** (bullish bias).

✅ **Price is above the Ichimoku Cloud** (strong uptrend).

✅ **Tenkan-sen is above Kijun-sen** (momentum confirmation).

✅ **Chikou Span is above price from 26 candles ago** (historical trend alignment).

✅ **Future Cloud is green** (trend continuation signal).

Bearish (Put Trade) Criteria:

✅ **Price is below the 200 SMA** (bearish bias).

✅ **Price is below the Ichimoku Cloud** (strong downtrend).

✅ **Tenkan-sen is below Kijun-sen** (momentum confirmation).

✅ **Chikou Span is below price from 26 candles ago** (historical trend alignment).

✅ **Future Cloud is red** (trend continuation signal).

🔹 3. Entry Triggers (After First 15-Min Candle Closes)**

**Bullish (Call Trade) Entry:**

- Price pulls back to **Kijun-sen** and holds support, then starts to bounce.

- OR price **breaks above the Ichimoku Cloud** and holds.

- ✅ Enter **Call contract (monthly expiration)**.

**Bearish (Put Trade) Entry:**

- Price pulls back to **Kijun-sen**, rejects resistance, and starts falling.

- OR price **breaks below the Ichimoku Cloud** and holds.

- ✅ Enter **Put contract (monthly expiration)**.

🔹 4. Selecting the Right Option Contract

✅ Monthly expiration contract (third Friday of the month).

✅ 30-60 days to expiry (avoid rapid theta decay).

✅ Strike Price:

- **ATM (At-The-Money) or slightly ITM (In-The-Money)**.

- Delta between **0.55 – 0.70** for balance between premium & movement.

✅ Liquidity Criteria:

- **Open Interest > 1,000** for easy fills.

- **Tight bid-ask spread** (<$0.10 on liquid stocks).

🎯 Risk Management & Trade Management**

🔹 5. Stop Loss & Take Profit Rules**

Stop Loss (SL):

🔴 For Calls: Below the Kijun-sen or most recent swing low.

🔴 For Puts: Above the Kijun-sen or most recent swing high.

Take Profit (TP):

✅ First Target: At the opposite edge of the Ichimoku Cloud.

✅ Second Target: Key support/resistance level based on price action.

✅ If profit reaches 70-80% max potential, close early** to avoid theta decay.

---

🔹 6. Trade Adjustments**

🔄 Rolling:If trade is profitable near expiry but hasn’t hit full target, roll to next monthly contract.

🔄 Cutting Losses: Exit early if price **closes inside the Ichimoku Cloud** (loss of trend strength).

📊 Trade Example: Bullish Call Play**

- Stock:** AAPL

- Current Price:** $190

- Bias: Price is above 200 SMA and Ichimoku Cloud

- Entry Trigger:** Price pulls back to Kijun-sen and bounces

- Option Contract:

- Expiry: **Next monthly contract (e.g., July 19 expiration)**

- Strike: **$190 ATM Call**

- Delta: **0.60**

- Bid/Ask Spread: **$2.00 / $2.05**

- Entry Price: $2.05

- Stop Loss: Below Kijun-sen (~$187)

- Take Profit:

- First TP at $195 (Cloud resistance)

- Final TP at $200 key resistance

🔹 7. Why This Strategy Works?**

✅ **Avoids weak setups by following strict entry rules**.

✅ **Uses monthly contracts to avoid rapid time decay**.

✅ **Combines trend-following confirmation from Ichimoku & 200 SMA**.

✅ **Ensures liquidity & better risk management with ATM/ITM options**.

📀 Final Notes

🔹 Only trade **Tuesday to Thursday** to avoid low-probability days.

🔹 Wait for **first 15-minute candle to close** before entering.

🔹 Stick to **monthly contracts** for better theta control.

🔹 **Follow trend confirmation rules strictly**—no guessing.

Turning a Small Trading Account into a Side Hustle for Financial Freedom

Imagine having a skill that allows you to generate income from anywhere, with nothing more than your phone, iPad, or laptop. No need for an expensive setup, no need for hours glued to a screen, and no need to risk everything on a single trade. This is the power of trading options with a small account—starting with as little as $500 and scaling up over time to create financial security, eliminate debt, and build leverage for larger investments.

Weekly Trade Radar & Market Outlook

This week, my focus is on AAPL, NVDA, MSFT, and XPS. There could be a potential retest of the 200 SMA with AAPL and MSFT, offering opportunities for well-structured trades. NVDA looks weak and has already tested the 200 SMA, making it a candidate for further downside potential or a short-term bounce. Additionally, Chinese developments in AI chip production remain a factor that could influence price action, particularly with NVDA. Staying aware of these key levels and macro developments is crucial for trade execution.

Trading Method: Ichimoku Cloud & 200 SMA Strategy

For trade setups, I rely on a combination of the Ichimoku Cloud and the 200 SMA to confirm entries and exits. This system provides a structured approach to trading by identifying trend direction, support and resistance levels, and potential breakouts.

Identify the Trend – The 200 SMA serves as the key trend indicator. If price is above, we look for long opportunities; if below, short setups take priority.

Ichimoku Confirmation – Price action should align with the cloud structure:

Bullish trades: Price above the cloud with strong momentum.

Bearish trades: Price below the cloud with confirmation of weakness.

Entry Timing – Trades are entered after the first 15-minute candle closes to avoid early market volatility. No trades on Mondays or Fridays to maintain consistency and avoid false breakouts.

Monthly Options Contracts – Focusing on monthly expirations allows for strategic entries with enough time for price movements to develop.

Risk Management – Stop losses are set just below key Ichimoku or 200 SMA levels, ensuring a disciplined risk-reward ratio.

How This Can Work as a Side Hustle

Many people look for side hustles to supplement their income, but most involve long hours, additional expenses, or require significant effort to scale. Trading options, however, offers:

✅ Minimal time commitment – With the right plan, you spend less than an hour per day analyzing and placing trades.

✅ Low startup cost – Start with as little as $500 and build from there.

✅ No physical inventory or overhead – You don’t need to buy and store products.

✅ Scalability – As your account grows, you can increase contract size and compound gains.

✅ Financial freedom potential – The profits from consistent, disciplined trading can be used to pay off debt, invest, or build long-term wealth.

The Power of Leverage: Using Trading to Build Wealth

The ultimate goal of trading isn’t just to make a little extra cash—it’s to create financial leverage. Here’s how smart traders use small account growth to create lasting financial success:

1️⃣ Get Out of Debt – Use profits to pay off credit cards, student loans, or other financial burdens. Imagine the freedom of being debt-free.

2️⃣ Reinvest in Larger Opportunities – Once your small account grows, you can scale up your trades, fund larger investments, or even start a business.

3️⃣ Build a Safety Net – Having extra cash flow from trading can serve as an emergency fund, helping you navigate life’s unexpected challenges.

4️⃣ Create a Path to Full-Time Trading – For those who love the process, this side hustle can evolve into a primary source of income over time.

It’s About Discipline, Not Just Trading

The key to successful trading isn’t the market—it’s you.

Many traders fail because they lack the discipline to follow a system. This approach isn’t just about making money; it’s about becoming the kind of person who can execute a plan without emotion, without impulsiveness, and without shortcuts.

Success in trading mirrors success in life: patience, discipline, and consistency always win.

Getting Started – No Excuses

You don’t need a fancy setup. You don’t need to be a finance expert. You just need a phone, iPad, or laptop, a brokerage account (I use Robinhood for its simplicity), and a commitment to mastering a system that works.

If you’re looking for a low-stress, high-reward way to build financial security, trading options with a small account might be the perfect opportunity. It’s time to take control of your future—one trade at a time.

Quarter Theory: Intraday Trading Mastery - Part 2 ExamplesGreetings Traders!

In today's video, we'll continue our deep dive into Quarter Theory Intraday Trading Mastery—a model rooted in the algorithmic nature of price delivery within the markets. We’ll explore the concept of draw on liquidity through premium and discount price delivery, equipping you to identify optimal trading sessions and execute high-probability trades, all while aligning with market bias.

This video is part of our ongoing High Probability Trading Zones playlist on YouTube. If you haven't watched the previous videos, I highly recommend doing so. They provide essential insights into identifying and acting on market bias, which Quarter Theory enhances further.

I highly recommend you watch ICT2022 Mentorship model on YouTube, it will really help you in your trading journey, the link to the mentorship is provided below.

I’ll attach the links to those videos in the description below.

Quarter Theory: Intraday Trading Mastery - Part 1 Intro:

Premium Discount Price Delivery in Institutional Trading:

ICT 2022 Mentorship: www.youtube.com

High Probability Trading Zones: www.youtube.com

Best Regards,

The_Architect

Quarter Theory: Intraday Trading Mastery - Part 1 IntroGreetings Traders!

In today’s video, we’ll be introducing Quarter Theory Intraday Trading Mastery, a model grounded in the algorithmic nature of price delivery within the markets. We’ll explore candle anatomy and learn how to predict candle behavior on lower timeframes to capitalize on intraday trading opportunities. This model will also help us identify the optimal trading sessions and execute trades with high probability, all while effectively acting on market bias.

This video will focus primarily on the foundational content, with practical examples to follow in the next video. In the meantime, I encourage you to practice these concepts on your own to deepen your understanding.

This video is part of our ongoing High Probability Trading Zones playlist on YouTube. If you haven’t watched the previous videos in the series, I highly recommend checking them out. They provide crucial insights into identifying market bias, which Quarter Theory will help you act on effectively.

I’ll attach the links to those videos in the description below.

Premium Discount Price Delivery in Institutional Trading:

Mastering Institutional Order-Flow Price Delivery:

Quarter Theory Mastering Algorithmic Price Movements:

Mastering High Probability Trading Across All Assets:

Best Regards,

The_Architect

Mastering High Probability Trading Across All AssetsGreetings Traders!

Welcome back to today’s video! In this session, we're revisiting the critical concept of draw on liquidity. I'll guide you on how to take advantage of it with extreme market precision, focusing on when to trade, when to avoid the market, and how to increase your chances of high-probability trade outcomes.

If you're looking to enhance your trading strategy and make smarter decisions, this video is for you. Let's dive in and start mastering these concepts!

Refer to these videos as well:

Premium Discount Price Delivery in Institutional Trading:

Mastering Institutional Order-Flow Price Delivery

Quarter Theory Mastering Algorithmic Price Movements:

Best Regards,

The_Architect

Quarter Theory: Mastering Algorithmic Price Movements!Greetings Traders, and welcome back!

In today's video, we’ll dive deep into Quarter Theory—a powerful concept that can take your trading to the next level. We’ll break it down step-by-step, explain how it works, and show you how to implement it into your strategy.

Quarter Theory is all about studying the algorithmic price delivery within the markets. It’s grounded in Time and Price Theory, which suggests that significant market moves often occur at specific price levels and times. This foundational idea will help us predict price movements more effectively.

If you haven’t already, be sure to check out the previous videos in the High Probability Trading Zones playlist for the key concepts you’ll need to fully grasp today’s content. For those watching on TradingView, links to previous videos will be included to help you catch up.

Mastering Institutional Order Flow & Price Delivery:

Premium & Discount Price Delivery in Institutional Trading:

We’re kicking off a weekly series on Quarter Theory, with the goal of helping you build a robust trading model by the end. Stay tuned!

Best Regards,

The_Architect

High Probability Trading Environments Part 2: Liquidity RunsIn this educational video, we'll explore the distinction between High Resistance Liquidity Runs and Low Resistance Liquidity Runs, crucial for identifying High Probability Trading Environments. Our analysis will focus on NAS100USD, providing insights into potential trading opportunities for the week ahead.

By understanding these concepts, you'll gain valuable insights into positioning yourself effectively in the market. Be sure to watch to gain a comprehensive understanding of the key confluences that contribute to successful trading strategies.

Understanding Trend Analysis, SMT and ICT Concepts

Mastering High Probability Trading Environments Part 1

Kind Regards,

The_Architect

Mastering High Probability Trading EnvironmentsIn this educational video, we'll delve into High Probability Trading Environments and introduce a simple yet effective concept to confirm their presence . Understanding these environments will empower you to confidently navigate the market with consistency and success.

For a comprehensive understanding, I recommend watching my previous video on Understanding Trend Analysis, SMT, and ICT Concepts below.

If you have any questions, feel free to leave them in the comments section.

Happy trading!

The_Architect

The final shooting star for the AUDAUDUSD presented a shooting star at a key area of confluence on Wednesday. Price failed to break this confirmed evening star. Thus creating a volatile indecision bearish engulfing at the high. I will short upon a retest of the high or the presentation of a reversal candlestick on the back of the trendline if broken. Price is still pushing for its highest point. ADX is still very bullish for now.

ABB INDIA LTD Looks good for positional trade.Aim for 5-8%. It can be easily achievable in 1-3 days.

My belief is to choose high winning probability trade with a risk-reward ratio going from 1:1 to 1:2.

The reason for booking profit of only 5-8% is because the market direction is not sure at this point. So better to aim for 1:1 risk-reward and rotate your money in better opportunities.

Take trade if all conditions meet at the end of the day 3:15-3:30 PM.

If you have any questions or suggestions, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

HAL Looks good for positional trade.Aim for 5-8%. It can be easily achievable in 1-3 days.

My belief is to choose high winning probability trade with a risk-reward ratio going from 1:1 to 1:2.

The reason for booking profit of only 5-8% is because the market direction is not sure at this point. So better to aim for 1:1 risk-reward and rotate your money in better opportunities.

Take trade if all conditions meet at the end of the day 3:15-3:30 PM.

If you have any questions or suggestions, please leave a comment below.

I will personally reply to every single comment!

If you enjoyed this analysis, I would definitely appreciate it, if you smash that like button and maybe consider following my channel.

LONDON SESSION:11-23 REVIEW +45RR POTENTIAL BUT POOR EXECUTIONToday's London session was a bit of a fumble. I am still working on psychology and being confident in my analysis. My overall analysis was correct but executing my trades and accepting losses has been a struggle. If I placed limit orders on all my ideas today the optimum outcome would have been +45RR-including the exception of the EU 1:13RR trade loss due to spread. If we do not count that trade today's recap would still be a +32RR day. For me that is 8k and 16% gain. More stats: 44% strike rate,4 wins and 5 losses, average RR =12.5RR per winning trade.

All in all I am working on execution because the potential P/L looks great to me.