J-BNB

BNB/USDT 12h chart🔎 Current situation

• Price: 898.50 USDT (+7.03%) - outstanding candle.

• Trend: We see a strong growth impulse, confirmed by the reflection from the trend line (yellow).

• Support:

• 869.75 USDT (next short -term support).

• 838.37 USDT.

• 818.56 USDT (SMA #2).

• resistance:

• 921.99 USDT.

• 952.26 USDT (key level - potential target, can be tested).

⸻

📊 Indicators

• SMA (movable average):

• The price struck over SMA and lasts above-a pro-rectification signal.

• MacD:

• The MacD line pierces the signal line from the bottom → fresh buy signal.

• The histogram begins to grow green.

• RSI (Relative Strength Index):

• Currently ~ 60 → a lot of space for the purchase zone (70+).

• RSI directed up, confirms the momentum of bulls.

⸻

📈 Scenarios

1. Bycza (more likely short -term)

• If the price lasts above 869–870 USDT → attack on 922 USDT.

• Breaking 922 with a strong volume → Another target 950–960 USDT.

2. Bear (less likely now but possible)

• Rejection from 922 and descent below 870 USDT → withdrawal to 838 or even 818 USDT.

• Only the loss of 818 will negate the current upward trend.

⸻

📝 Summary

BNB currently looks very strong - a fresh growth impulse, breaking over medium, MacD gives a buy signal, RSI is not yet in the purchase zone.

➡️ If something negative on BTC or the wide market does not happen, then the 922 and 952 test is real in the short term.

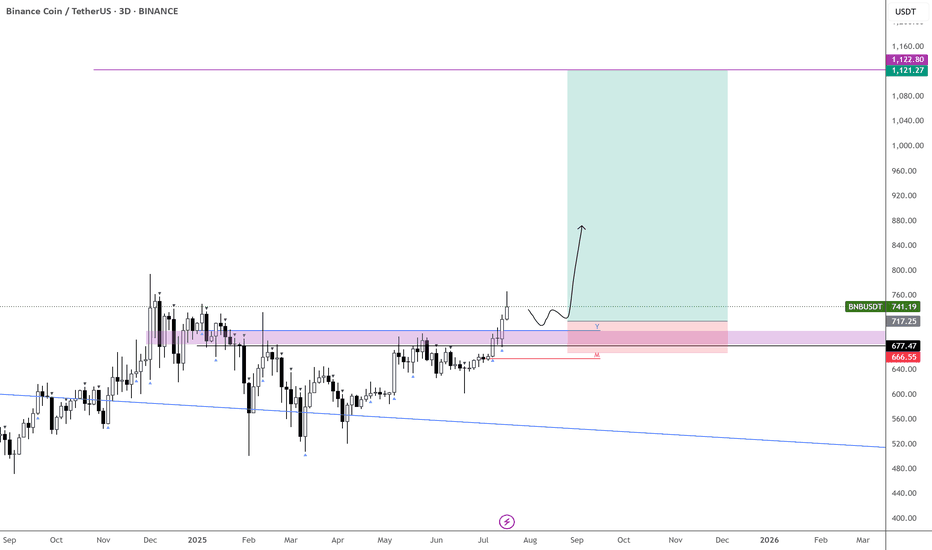

Binance Coin (BNBBTC) Reveals Altcoins Market True Bullish BiasA bullish wave is nullified by a correction. If a strong correction develops after a strong bullish wave, you can chart as if there was no bullish wave to start. That is, once support is found the chart (trading pair) in question is back to baseline and everything becomes possible such as a new bullish wave and cycle.

For example: Binance Coin vs Bitcoin (BNBBTC) produced a very strong bullish cycle ending November 2022. The ensuing correction, from November 2022 until December 2023 fully nullifies the previous bullish wave.

Here we can see BNBBTC established support 2023 December and in February 2025 produced a long-term higher low. That's it.

The bearish cycle ended. A bullish cycle is followed by a bearish cycle. A bearish cycle is followed by a bullish cycle.

Back in February 2021 BNBBTC moved weekly above EMA55. This move was followed by a more than 1,800% bullish wave. Just last week BNBBTC moved above EMA55, activating a new market run.

Summary

» We have the long-term higher low. December 2023 (higher) vs January 2021 (lower).

» We have local higher lows. July & February 2025 (higher) vs December 2023 (lower).

» We have the 672 days long accumulation (sideways) period. This is bullish. Between October 2023 and present day.

» We have a break and close above EMA55. This week starts green above EMA55 as confirmation of this resistance being conquered.

Conclusion · Altcoins Market True Bullish Bias

The altcoins market is bullish.

Will Bitcoin and the altcoins decouple? I don't know, but I can tell you the altcoins market is bullish and ready to grow...

Higher targets are possible than what is shown on the chart.

Namaste.

RAREUSDT — at Critical Accumulation Zone: Breakout or Breakdown?📊 Market Analysis

On the 4D timeframe, RARE/USDT is trading at a crucial pivot zone. The chart structure highlights:

1. Descending Triangle

Clear formation with lower highs pressing price down.

Strong horizontal support between $0.0415 – $0.065 (yellow box).

This pattern often signals bearish continuation, but if accumulation dominates, a bullish reversal can emerge.

2. Major Support Zone

Price has rejected breakdown multiple times in the $0.0415 – $0.050 region, showing active buyers.

This zone acts as the final defense before deeper downside risk.

3. Layered Resistances to the Upside

Key resistance levels if breakout occurs:

$0.0747 → $0.0949 → $0.1349 → $0.1715 → $0.2018 → $0.2208 → $0.2609 → $0.3476 (local high).

---

🚀 Bullish Scenario

For a bullish case, we need:

A confirmed breakout above the descending trendline (yellow).

Strong 4D candle close with volume.

Upside Targets if breakout holds:

🎯 TP1: $0.0747

🎯 TP2: $0.0949

🎯 TP3: $0.1349

🎯 Extended targets: $0.1715 – $0.20

📌 Note: Breakouts from descending triangles often trigger short squeezes → sharp upside moves possible.

---

🐻 Bearish Scenario

If sellers take control and support breaks:

A confirmed breakdown occurs if price closes 4D below $0.0415 with volume.

Downside targets:

🎯 Initial: $0.029 (psychological & historical support).

Lower levels possible if broader crypto sentiment turns bearish.

📌 Note: Descending triangle breakdowns tend to accelerate selling momentum.

---

📌 Pattern & Sentiment

The descending triangle shows sustained selling pressure, but repeated support tests suggest accumulation.

Overall crypto market sentiment (BTC & ETH) will heavily influence the outcome.

In short: RARE is waiting for a major trigger — either breakout or breakdown.

---

🧭 Trading Plan Recap

Bullish if breakout above trendline + close above $0.065–$0.0747 → targets $0.09 / $0.13.

Bearish if close below $0.0415 → target $0.029.

4D timeframe = stronger signals & less noise → better for swing setups.

---

> RARE/USDT 4D — Descending Triangle at Critical Support

RARE is consolidating inside a descending triangle, holding a key support zone at $0.0415 – $0.065.

• Bullish Case → breakout above trendline + volume → targets $0.0747 / $0.0949 / $0.1349 / $0.1715.

• Bearish Case → breakdown below $0.0415 → main target $0.029.

Market structure suggests both accumulation potential and breakdown risk. Wait for confirmation before entering a position.

#RARE #RAREUSDT #Crypto #TechnicalAnalysis #Altcoins #Breakout #SupportResistance #DescendingTriangle

Binance coin has dropped from $860 ┆ HolderStatOKX:BNBUSDT on the 6h chart shows a double top near 880, a sign of temporary weakness. However, the market is holding above the $800 critical level. Past triangle and sideways patterns hint at continued accumulation, with upside potential once 860 is cleared.

BNBUSD H4 | Potential bearish dropBNB/USD has rejected off the sell entry, which acts as a swing high resistance and could drop from this level to the downside.

Sell entry is at 856.99, which is a swing high resistance.

Stop loss is at 894.52, which aligns with the 127.2% Fibonacci extension.

Take profit is at 779.39, which is a pullback support that is slightly above the 78.6% Fibonacci retracement.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BNB/USDT 4H chart reviewKey levels:

• Resistance: 845.64 → 867.39 → 898.75

• Support: 819.84 → 788.98 → 765.21

• Current price: ~ 835 USDT

Structure:

• The upward trend is still in force (black rising trend line).

• After the summit around 867, the market made a correction to 819 and bounced.

• Now the price consolidates between 819 and 845, just above the trend line.

Scenarios:

1. Bullish (advantage of buyers)

• If the price stays over Trendline and 845, a possible attack on 867, and then to 898.

• Confirmation of increases will be closed with a 4h candle above 845.

2. Bearish (sellers' advantage)

• Support loss 819 = weakness signal.

• Further goals: 789 and 765 (key support).

• Trendline fracture will further strengthen the pressure of supply.

📊 Summary:

• As long as 819 and the trend line hold the advantage on the bull side.

• 845–867 is a strong resistance zone - here you have to be careful about the implementation of profits.

• Breaking below 819 will open the way to a deeper correction.

25R setup for BNBEveryone is talking about ETH right now, but don’t forget about this monster — BNB. BNB is about to break out after a successful retest of macro support. Where’s the end after the $850 breakout? Do you really want to bet against CZ? Stop-loss below support at $725.

Good luck — not financial advice.

LONG BNBMulti-Timeframe Bullish Confirmation: Weekly, daily, and 4h charts all show sustained uptrend, with price above key EMAs and strong momentum across time horizons.

Strong Institutional and Ecosystem Support: Recent news highlights large institutional acquisitions and expanding Binance ecosystem utility, affirming BNB’s foundational role in crypto infrastructure.

Clear Technical Targets: Fibonacci extensions and previous highs give a well-defined price objective, with $1,250 as the thesis target and technical resistance only modestly overhead.

Robust Risk Management: Stop loss placed at $626—safely below major technical supports and past swing lows—protects capital while allowing room for volatility.

Healthy Market Structure: No signs of euphoria or volume blow-off, just steady liquidity and rising relative volume, consistent with sustainable growth phases.

Positive Macro and Altcoin Context: Alts have very healthy momentum and inflation as well as risk assets are grinding higher.

Compelling Risk-Reward Profile: Thesis offers an asymmetric opportunity (~1.86 R/R), fitting for a patient multi-week/month position with clear upside and measured downside.

Binance Coin may drop to 805 points and break support levelHello traders, I want share with you my opinion about Binance Coin. The bullish momentum for BNB has been visibly accelerating, with the price transitioning from a steady upward channel into a steeper and more aggressive rising wedge formation. This change in character often suggests a late-stage trend that may be approaching exhaustion. The price action has been oscillating within this wedge, using the 820 level as a key support area for its most recent rebound. Currently, the asset is making another push towards the apex of the formation, approaching the final resistance line that has capped the highs. The primary working hypothesis is a short scenario, which is based on the typically bearish resolution of a rising wedge pattern. It is anticipated that the price will be rejected from the upper resistance line of the wedge, signaling the exhaustion of buying pressure. A confirmed rejection from this peak would likely trigger a sharp reversal, with enough momentum to cause a breakdown below the wedge's ascending support line and the critical horizontal support area around 820. This structural failure would validate the bearish thesis. Therefore, the tp for this anticipated reversal is logically placed at the 805 level, representing a prudent first target for the price to reach following a breakdown of the multi-week wedge structure. Please share this idea with your friends and click Boost 🚀

Disclaimer: As part of ThinkMarkets’ Influencer Program, I am sponsored to share and publish their charts in my analysis.

BNC — The Wall Street Backdoor to BNBMost U.S. investors can’t buy BNB (the world’s #3 cryptocurrency) directly in their brokerage accounts. Yet it powers one of the most-used blockchains in the world => it is deflationary, pays yield, and has outperformed Bitcoin over the last five years.

But there’s now a backdoor … and it trades on the NASDAQ.

📌 Meet CEA Industries ( NASDAQ:BNC )

BNC is the first publicly traded U.S. company to make BNB its core treasury asset; much like MicroStrategy did with Bitcoin, but with arguably even greater upside potential.

The company has already deployed over $500 million into BNB, backed by institutional names like 10X Capital and YZi Labs , positioning itself ahead of expected demand from ETFs, exchanges, and even sovereign funds.

For everyday investors, this could be the easiest way to get one-click exposure to BNB; before Wall Street catches on.

📊 Technical Analysis

After deploying over $500M into BNB 💰, BNC has skyrocketed by more than 880% 🚀.

Missed the initial rally? No problem. BNC had entered a markdown phase 📉, retracing to fill the previous gap — a classic textbook pattern 📚. Historically, once such gaps are filled, the stage is often set for the next big bullish impulse 📈.

That key moment has now arrived ✅ — price has broken above the $23 accumulation zone 🔓, confirming a decisive momentum shift from bearish (markdown) ➡️ bullish (markup).

With the markup phase underway, our targets are:

- Short-term: $50 — key resistance level & psychological milestone 🧠

- Medium-term: $82.30 — filling a major gap from earlier price action 📊

💡 Why This Matters

- BNB has outperformed Bitcoin over the last 5 years (25x vs 9x).

- Deflationary supply + staking yield potential.

- Global adoption despite regulatory headwinds.

- First-mover advantage => no other U.S. public company is building its treasury around BNB.

Bottom line?

This could be MicroStrategy 2.0 - but with a token that may have an even stronger growth story ahead.

➡️ Talk to your financial advisor and start your due diligence on CEA Industries (NASDAQ: BNC) before the institutions move in.

📚 Always follow your trading plan => including entry, risk management, and trade execution.

Good luck!

All Strategies Are Good, If Managed Properly.

~ Richard Nasr

BNB/USDT 1DTrend and market structure

• The price moves in an upward trend from the hole around 730 USDT, maintaining support on the trend line (orange line).

• Current price: ~ 840 USDT, close to important resistance at ~ 862 USDT.

• Another strong resistance is located at 940–950 USDT.

• The next support is 809 USDT (local horizontal level) and 758 USDT (earlier hole).

⸻

Medium walking (SMA)

• SMA #1 (red) is below the price - this is a growth signal.

• SMA #2 (green, long -term) is also below and inclined up - confirms the upward trend.

• SMA #5 (blue, very long) is far below - the market is still in the growth phase.

⸻

Indicators

• MacD - MacD line pierces the signal line from below, which is a buy signal. The histogram is slightly positive.

• RSI - ~ 66 points, grows towards the purchase zone (70). There is no extreme yet, but it is approaching - the risk of correction after breaking the resistance.

⸻

• (more likely with current dynamics): breaking the level of 862 USDT and continuation in the direction of 940 USDT. There are more profit realizations possible here.

• Bear: rejection from resistance and decrease in the direction of 809 USDT or even a trend line test and level 758 USDT.

BNB Price Stands Only 8% From ATH, Can It Reach This Week?BINANCE:BNBUSDT is currently the altcoin closest to its all-time high (ATH), trading just 8.25% from the $861 ATH . At $822, it remains poised for a potential breakout. The proximity to its ATH indicates strong market sentiment and potential for further upward movement in the near future.

The previous ATH was set about three weeks ago, and with broader market support, BNB could continue its bullish momentum. If the market conditions remain favorable, BINANCE:BNBUSDT may reach $861 and potentially break through it , surpassing the previous record high within this week.

However, if the broader market fails to maintain its rally, BINANCE:BNBUSDT may struggle to breach the $823 level . In such a scenario, a price drop could occur, pushing BNB down to $793 or potentially lower to $766 . Market conditions will be crucial in determining the direction of BNB’s price.

BNBUSD H4 | Bullish riseBNB/USD is falling towards the buy entry which is a pullback support and could rise to the take profit.

Buy entry is at 778.83, which is a pullback support.

Stop loss is at 743.04, which is a multi-swing low support.

Take profit is at 855.53, which is a swing high resistance.

High Risk Investment Warning

Trading Forex/CFDs on margin carries a high level of risk and may not be suitable for all investors. Leverage can work against you.

Stratos Markets Limited (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 65% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Europe Ltd (tradu.com ):

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 66% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Stratos Global LLC (tradu.com ):

Losses can exceed deposits.

Please be advised that the information presented on TradingView is provided to Tradu (‘Company’, ‘we’) by a third-party provider (‘TFA Global Pte Ltd’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by TFA Global Pte Ltd.

The speaker(s) is neither an employee, agent nor representative of Tradu and is therefore acting independently. The opinions given are their own, constitute general market commentary, and do not constitute the opinion or advice of Tradu or any form of personal or investment advice. Tradu neither endorses nor guarantees offerings of third-party speakers, nor is Tradu responsible for the content, veracity or opinions of third-party speakers, presenters or participants.

BnB is on the wayBnb usdt Daily analysis

Time frame 4hours

Target 900$

Close Target is upperside of the band

We hear a lot of news about major crypto companies collaborating, as well as corporate acquisitions and filling the coffers with valuable cryptocurrencies.

But there is no volume in the market.

We are not seeing the growth that we expect to hear after all this good news.😒

What is the reason?

The answer is one word.

👉Strategic patience. 👈

Wait, this is the beginning. The rockets are refueling for a long, long launch.🚀🚀🚀

Binance coinBnb usdt Daily analysis

Time frame daily

Risk rewards ratio >2.3 👈

Target 830$

Technical analysis 👇

Look at the chart carefully

Bnb is moving between two gray lines and down side of this is strong support line

Three parts of Correction is finished and price start the fist part of moving.

$BNB Is ready for $1k USDLow 700s before continuation?

This one’s been coiling up beautifully — still waiting on that strong move to hit.

OKX:CATUSDT and BINANCE:CAKEUSDT are part of the rotation I’m betting on.

BINANCE:BNBUSDT has one of the strongest consolidation structures among high caps — and it’s also one of the biggest laggards.

Looks like a setup worth the risk.

Binance coin is preparing for a breakthrough of 800 ┆ HolderStatBYBIT:BNBUSDT continues to respect the 780–800 inflection, where price briefly undercut and then reclaimed the level, confirming it as support. The prior, well‑defined wedge resolved higher after a broad multi‑month consolidation, and subsequent pullbacks have formed higher lows along the rising base trend line. As long as 760–780 holds, upside magnets sit at 825–840 and 860, with a stretch objective into 880–900 near the channel top. Momentum fades only on a decisive daily close beneath 750, which would re‑open 720; until then, the constructive trend remains intact.