EURUSD Bullish Recovery After Healthy Correction, Target 1.1870Hello traders! Here’s my technical outlook on EURUSD (4H) based on the current chart structure. EURUSD previously traded within a mixed structure that transitioned from a broader corrective phase into a clear bullish recovery. After forming a base near the rising higher-timeframe trend line, price began to print higher lows, signaling the gradual return of buyer control. This recovery phase was supported by a breakout above the descending triangle resistance line, which marked an important structural shift and confirmed the end of the prior bearish pressure. However, after reaching the upper Resistance / Seller Zone around 1.1870, bullish momentum slowed, and the market faced rejection from this key level. This rejection initiated a corrective pullback, which brought price back toward the former breakout area and the Support Level / Buyer Zone near 1.1780–1.1800. This zone is significant, as it represents previous resistance turned support and aligns with the rising triangle support line, making it a critical area for buyers to defend. Currently, EURUSD is stabilizing above this support zone, suggesting that the pullback is corrective rather than the start of a new bearish leg. As long as price holds above the Buyer Zone and continues to respect the rising support structure, the overall bias remains bullish. My primary scenario favors continuation to the upside after consolidation or a shallow pullback, with a potential move back toward the 1.1870 Resistance Level (TP1). This area stands as the first major upside target and a logical zone for partial profit-taking. If EURUSD manages to break above the 1.1870 resistance with strong acceptance, this would confirm bullish continuation and open the door for further upside expansion. On the other hand, a decisive breakdown and acceptance below the Buyer Zone and rising support line would invalidate the bullish scenario and signal a deeper correction. Until such confirmation appears, EURUSD remains positioned for a bullish continuation within the current market structure. Always manage your risk and trade with confirmation. Please share this idea with your friends and click Boost 🚀

LONG

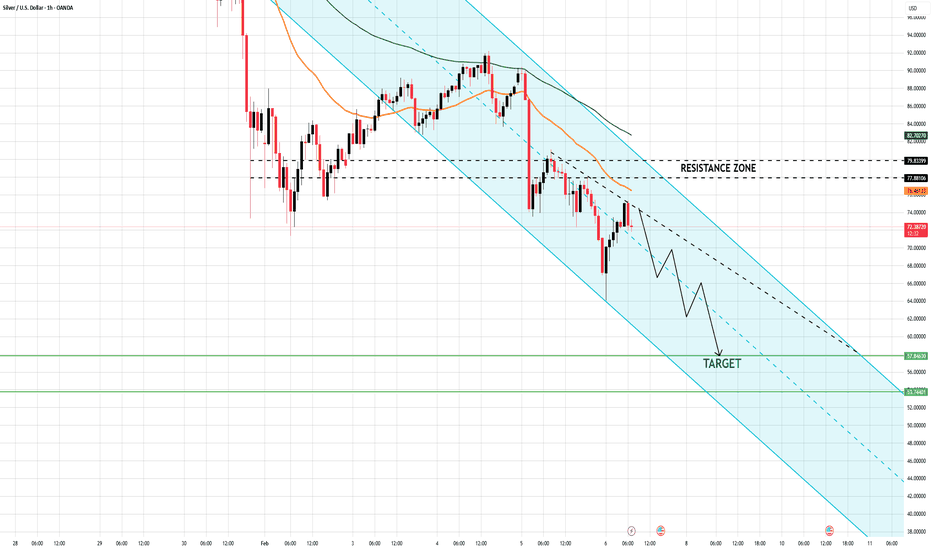

Silver Is Bouncing — But the Bearish ChannelSilver (XAGUSD) on the H1 timeframe remains firmly inside a well-defined descending channel, confirming that the broader structure is still bearish. The recent rebound is corrective, not impulsive price is reacting from short-term demand but continues to print lower highs beneath channel resistance.

Price is currently trading below the EMA cluster, with the EMA acting as dynamic resistance. Each bullish attempt has been capped near the descending trendline + resistance zone, reinforcing the idea that sellers are still in control. There is no structural break, no higher high, and no acceptance above resistance key requirements for a trend reversal that are still missing.

As long as price stays inside this channel, the path of least resistance remains to the downside. A rejection from the current resistance area opens room for continuation toward the lower channel boundary, with downside targets aligned near the highlighted green levels. Bulls only regain control if price breaks and holds above the channel resistance with follow-through.

Bias: Bearish continuation

Strategy mindset: Sell rallies, not bottoms

Invalidation: Clean breakout and acceptance above channel resistance

Trade what the chart confirms not what you hope will happen.

Gold Holds Demand - Long Scenario After Correction Toward $5,180Hello traders! Here’s my technical outlook on XAUUSD (1H) based on the current chart structure. Gold initially traded within a well-defined range, indicating a period of accumulation and market balance. This consolidation eventually resolved to the upside, leading to a strong impulsive move and confirming bullish intent. Following the breakout, price respected a clean ascending channel, forming higher highs and higher lows. Multiple bullish breakouts along the structure confirmed sustained buyer control. However, after reaching the Resistance / Seller Zone around 5,180–5,200, bullish momentum weakened, and price faced strong rejection, resulting in a sharp corrective drop. This pullback drove price into a major Buyer Zone around 4,880–4,925, which aligns with a key horizontal support level and a previous breakout area. Price briefly dipped below this zone but quickly reclaimed it, forming a fake breakdown — a strong sign of seller exhaustion and buyer defense at demand. Currently, XAUUSD is stabilizing above the Buyer Zone, suggesting the correction may be complete. As long as price holds above this demand area, the structure favors a long scenario on pullbacks rather than continuation to the downside. A healthy retracement and consolidation within or just above the Buyer Zone could provide a favorable long opportunity. Bullish confirmation from this area increases the probability of a continuation move toward the 5,180 Resistance / Seller Zone (TP1). This level represents the first major upside target and an area where partial profits can be considered. If bullish momentum strengthens and price breaks above the Seller Zone with acceptance, the move could extend further toward higher resistance levels, confirming trend continuation. The long scenario remains valid as long as price holds above the Buyer Zone and avoids acceptance below support. A decisive breakdown and acceptance below the Buyer Zone would invalidate the long bias and shift focus back toward bearish continuation. Until that happens, Gold remains positioned for a bullish recovery from demand within the broader market structure. Please share this idea with your friends and click Boost 🚀

WDC — Long Setup (Trend Continuation)The trend structure remains strong, with ADX ~46 confirming robust directional strength. Price trades well above both the SMA200 and SMA50 and remains positioned above the 1-hour VWAP, indicating a favorable continuation environment.

Momentum supports the upside case (1h RSI 60; positive 4h MACD histogram). The entry zone at 282 –286 aligns with current technical structure and defined risk parameters (stop: 234.54, approx. R 1:2.5). Upside targets are 296 (conservative) and 404 (primary).

Order flow is currently normal, indicating no clear institutional absorption; monitor this closely for any shift toward absorption or churn, which could materially affect trade management in this particular setup.

Overall summary: Technical strength + supportive sentiment justify a buy, with disciplined risk control at 234.54 (SL) and ongoing monitoring of volume profile and news flow.

EURUSD Breakout and Potential Retrace!Hey Traders, in today's trading session we are monitoring EURUSD for a buying opportunity around 1.18000 zone, EURUSD was trading in a downtrend and successfully managed to break it out. Currently is in a correction phase in which it is approaching the retrace area at 1.18000 support and resistance area.

Trade safe, Joe.

Hate to crash the bear party, but Bitcoin is primed to explode.Bitcoin is following the same growth pattern Apple did as it established its massive uptrend. Many investors are bearish, calling for low targets like $50K or even $30K—but most don’t realize Bitcoin is likely to rally all the way to a new all-time high.

The trend is your friend, and Bitcoin is in a monstrous uptrend. Don’t fight it. Work with it.

As always, stay profitable.

— Dalin Anderson

Support bounce on UPST?OptionsMastery:

🔉Sound on!🔉

📣Make sure to watch fullscreen!📣

Thank you as always for watching my videos. I hope that you learned something very educational! Please feel free to like, share, and comment on this post. Remember only risk what you are willing to lose. Trading is very risky but it can change your life!

ETHUSD Is Going Up! Long!

Please, check our technical outlook for ETHUSD.

Time Frame: 1D

Current Trend: Bullish

Sentiment: Oversold (based on 7-period RSI)

Forecast: Bullish

The market is approaching a key horizontal level 2,050.77.

Considering the today's price action, probabilities will be high to see a movement to 2,817.29.

P.S

Overbought describes a period of time where there has been a significant and consistent upward move in price over a period of time without much pullback.

Like and subscribe and comment my ideas if you enjoy them!

BITCOIN BUYERS WILL DOMINATE THE MARKET|LONG

BITCOI SIGNAL

Trade Direction: long

Entry Level: 69,967.58

Target Level: 85,412.99

Stop Loss: 59,642.66

RISK PROFILE

Risk level: medium

Suggested risk: 1%

Timeframe: 1D

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBP/AUD BULLISH BIAS RIGHT NOW| LONG

Hello, Friends!

The BB lower band is nearby so GBP-AUD is in the oversold territory. Thus, despite the downtrend on the 1W timeframe I think that we will see a bullish reaction from the support line below and a move up towards the target at around 1.950.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

GBPCHF Expected Growth! BUY!

My dear followers,

I analysed this chart on GBPCHF and concluded the following:

The market is trading on 1.0565 pivot level.

Bias - Bullish

Technical Indicators: Both Super Trend & Pivot HL indicate a highly probable Bullish continuation.

Target - 1.0602

About Used Indicators:

A super-trend indicator is plotted on either above or below the closing price to signal a buy or sell. The indicator changes color, based on whether or not you should be buying. If the super-trend indicator moves below the closing price, the indicator turns green, and it signals an entry point or points to buy.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

———————————

WISH YOU ALL LUCK

EURUSD: Buyers Defend 1.1780 - Upside in Focus 1.1870Hello everyone, here is my breakdown of the current EURUSD setup.

Market Analysis

EURUSD was previously trading within a well-defined downward channel, where price consistently respected the descending resistance and support boundaries, forming a series of lower highs and lower lows. This structure confirmed sustained bearish control and orderly downside continuation. During this phase, several bearish pushes developed smoothly within the channel, highlighting strong seller dominance. After breaking the channel, EURUSD continued higher and successfully reclaimed the Support Zone around 1.1780, which acted as a key decision level. The breakout and subsequent hold above this zone confirmed a change from bearish structure into a bullish recovery phase. Price then accelerated toward the 1.1870 Resistance Zone, where supply became active again, resulting in consolidation and multiple breakout attempts.

Currently, price is trading above the rising trend line, while also forming a descending corrective structure beneath the triangle resistance line. Despite the pullback, the market continues to respect higher lows, suggesting that the recent decline is corrective rather than impulsively bearish. The ability of EURUSD to hold above the support zone keeps the bullish structure intact.

My Scenario & Strategy

My primary scenario favors a long continuation as long as EURUSD holds above the 1.1780 Support Zone and respects the rising trend line. The current consolidation appears to be a corrective pause within a broader bullish structure. A successful break and acceptance above the triangle resistance and the 1.1870 Resistance Zone would likely trigger renewed upside momentum. If buyers manage to reclaim and hold above resistance, the next bullish leg could extend higher, following the direction of the dominant trend.

However, a decisive breakdown below the support zone and trend line would weaken the bullish scenario and signal a potential deeper correction or range formation. For now, structure favors buyers, with pullbacks viewed as opportunities for continuation rather than trend reversal. EURUSD remains at a key technical decision area, and price reaction around support will be critical for the next move.

That’s the setup I’m tracking. Thank you for your attention, and always manage your risk.

GBP/USD BULLS WILL DOMINATE THE MARKET|LONG

Hello, Friends!

GBP/USD pair is in the uptrend because previous week’s candle is green, while the price is clearly falling on the 4H timeframe. And after the retest of the support line below I believe we will see a move up towards the target above at 1.374 because the pair is oversold due to its proximity to the lower BB band and a bullish correction is likely.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

✅LIKE AND COMMENT MY IDEAS✅

Silver Is Compressing Below Trendline — Breakdown Risk Silver remains in a clearly bearish structure on the H1 timeframe. Price is capped below a descending trendline after a sharp impulsive selloff from the prior range high. The bounce from the support area is weak and overlapping, showing corrective behavior rather than genuine accumulation. Each rally is being sold into, confirming that sellers are still in control.

The market is currently compressing between the descending trendline and a well-defined support zone. This type of structure often precedes expansion, and given the broader downside momentum, the probability still favors a bearish resolution. The highlighted support has already been tested multiple times, which increases the risk of failure rather than strengthening it.

A clean breakdown below the support zone would likely trigger continuation toward lower liquidity levels, aligning with the projected bearish path. Only a decisive reclaim above the descending trendline and sustained acceptance would invalidate this setup. Until then, upside moves should be treated as corrective pullbacks within a larger downtrend trade the structure, not the bounce.

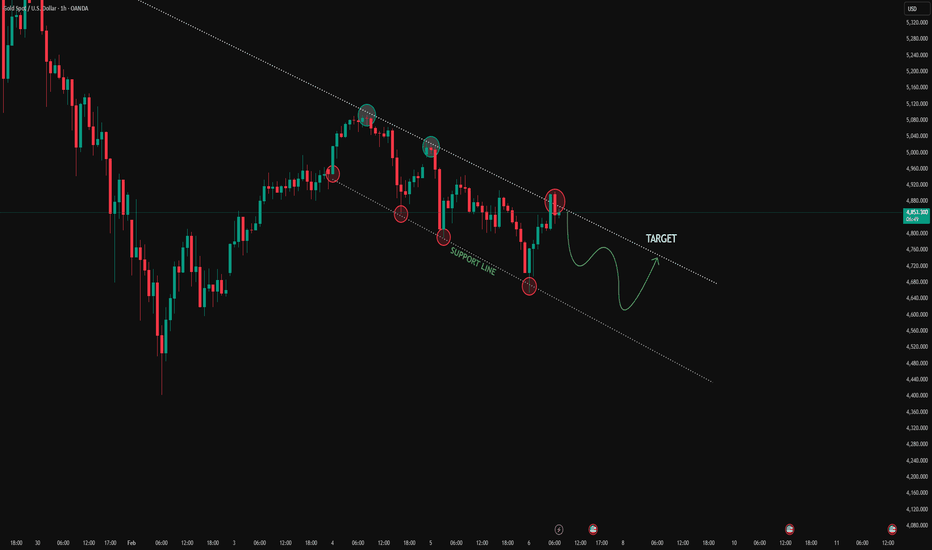

Gold Is Bouncing Inside a Bearish Channel — Relief Rally or TrapGold remains structurally bearish on the 1H timeframe, trading inside a clearly defined descending channel. Recent price action shows repeated rejections from the channel resistance, confirming that sellers are still defending lower highs. The current bounce is coming from the channel support line, where price has reacted multiple times in the past, making a short-term rebound technically reasonable.

However, this upside move should be viewed as corrective, not impulsive. There is no clean break above the descending channel or a confirmed shift in market structure yet. As long as price stays below the channel top and fails to hold above prior swing highs, bullish momentum remains limited and vulnerable to renewed selling pressure.

The key decision area lies at the channel resistance ahead. A rejection there would reinforce the bearish continuation narrative, while only a decisive breakout and hold above the channel would invalidate the downtrend. Until then, this is a market to trade reactions and levels not to assume a trend reversal.

Silver Is Trapped Between Supply and DemandOn the H1 timeframe, Silver is currently trading inside a well-defined range, bounded by a clear resistance zone above and a strong support zone below. The prior sell-off into support was impulsive, signaling liquidation rather than a gradual trend change. However, the sharp reaction from the support zone shows that buyers are actively defending this area, preventing further downside expansion.

From a price action standpoint, the recovery off support has been constructive but overlapping. Price failed to reclaim the resistance zone and was rejected again near the EMA cluster, confirming that sellers remain active at higher levels. This behavior suggests range rotation rather than a new impulsive trend the market is oscillating between supply and demand, not trending.

The primary scenario is continued rotation within the range. As long as the support zone holds, price may attempt another push higher toward resistance. A clean breakout and acceptance above the resistance zone would be required to shift the structure bullish and open the door for trend continuation.

The alternative scenario activates if price breaks below the support zone with strong momentum and acceptance. Such a move would invalidate the range structure and likely lead to a deeper bearish continuation toward lower demand levels.

In summary, Silver is in a decision phase. Buyers are defending support, but sellers are still firmly in control at resistance. Until one side clearly wins, patience is key and trades should respect the range boundaries rather than anticipate a breakout.

Silver Is Breaking Down From a Rising StructureOn the M45 timeframe, Silver has transitioned from a prior rising channel into a clear descending corrective structure. The recent sell-off from the upper resistance zone was impulsive, breaking internal structure and pushing price decisively below the EMA. This behavior signals a shift in short-term control from buyers to sellers.

From a structural perspective, price is now trading inside a descending channel, with lower highs forming beneath a clearly defined resistance trendline. The bounce from the recent low lacks momentum and is unfolding with overlapping candles, which strongly suggests a corrective pullback rather than the start of a new bullish leg. Sellers continue to defend the resistance zone and dynamic EMA area effectively.

Price action further confirms this bias. Each recovery attempt has been capped below resistance, and the market is failing to reclaim prior support levels. As long as price remains below the resistance zone and inside the descending channel, the path of least resistance remains to the downside.

The primary scenario favors continuation lower. A rejection from the current resistance area would likely lead to another leg down toward the lower boundary of the channel and potentially deeper demand levels below.

he alternative scenario only becomes valid if Silver can break above the descending channel and reclaim the resistance zone with acceptance. Without that confirmation, upside moves should be treated as corrective rallies within a bearish structure.

In summary, Silver is no longer rotating bullishly it is transitioning into a bearish phase. The structure favors selling rallies until proven otherwise.

Respect the channel. Let price confirm. Trade what you see not what you hope.

Silver Is Reacting From Major Support On the H1 timeframe, Silver is currently trading inside a broad consolidation structure after a sharp bearish impulse. The prior sell-off was aggressive and impulsive, confirming strong supply entering the market from the higher resistance zone. However, price has now reached a well-defined major support zone around the 72–74 area, where selling pressure has clearly stalled.

The reaction from this support zone is constructive. Buyers stepped in decisively, producing a sharp bounce rather than continued acceptance below support. This behavior suggests that the move into support was likely a liquidity sweep rather than the start of a fresh bearish expansion. Still, it’s important to note that this rebound is occurring within a broader range, not a confirmed bullish trend. From a structural perspective, the upside is capped by a clear supply zone overhead. As long as price remains below this supply and fails to reclaim the resistance zone with acceptance, the current move should be viewed as a corrective recovery. The projected upside path toward supply is reasonable if support continues to hold, but it remains a rotation within the range rather than trend continuation. The alternative scenario comes into play if price loses the support zone with strong momentum and acceptance. A clean breakdown below this level would invalidate the recovery thesis and reopen the downside toward lower demand levels.

In summary, Silver is stabilizing after a strong sell-off, with buyers defending a key support zone. However, the market has not yet done enough to confirm a bullish reversal. Until supply is reclaimed, rallies should be treated as corrective moves within a larger range.

GBPCAD: Bullish Continuation is Highly Probable! Here is Why:

Our strategy, polished by years of trial and error has helped us identify what seems to be a great trading opportunity and we are here to share it with you as the time is ripe for us to buy GBPCAD.

Disclosure: I am part of Trade Nation's Influencer program and receive a monthly fee for using their TradingView charts in my analysis.

❤️ Please, support our work with like & comment! ❤️

This Still Looks Like a Corrective Range, Not a Breakout SetupOn the H1 timeframe, Gold remains capped well below the ATH / All-Time-High resistance zone, which continues to define the broader upside limit. After the impulsive sell-off from the highs, price transitioned into a recovery phase but has since evolved into a sideways-to-lower corrective structure rather than a renewed bullish expansion.

From a structural perspective, price is currently forming lower highs beneath a descending trendline, while repeatedly testing a clearly defined support zone below. This behavior signals balance and compression, not accumulation. The EMA has flattened and price is oscillating around it, reinforcing the idea that the market is in a corrective range rather than trending with strength.

Price action further supports this view. Each attempt to push higher has been met with selling pressure before any meaningful follow-through can develop. At the same time, the support zone continues to attract buyers, preventing immediate breakdown. This back-and-forth suggests distribution within a range, where both sides are active but neither has taken control yet.

The primary scenario favors continued range rotation or a gradual downside resolution. If price fails to break above the descending trendline and loses acceptance above support, a clean breakdown below the support zone would likely trigger a deeper bearish leg toward the next lower demand area.

The alternative scenario only becomes valid if Gold can break above the descending trendline and reclaim it with acceptance. Such a move would signal that sellers are losing control and could open the door for a broader recovery toward higher resistance levels. Until that happens, upside moves should be treated as corrective.

In summary, Gold is not preparing for a breakout yet. The market remains below ATH resistance and stuck in a corrective range, where patience and confirmation are essential.

Trade the range. Respect ATH resistance. Let structure decide.

Silver Is Reacting From Channel SupportOn the M45 timeframe, Silver remains inside a well-defined ascending channel, confirming that the broader structure is still bullish despite recent volatility. The sharp sell-off into the lower boundary of the channel pushed price directly into a clearly defined support zone, where selling pressure stalled quickly. This behavior suggests a liquidity sweep rather than the start of a bearish expansion.

From a price action perspective, the reaction off support was decisive. Buyers stepped in aggressively, rejecting lower prices and defending the channel base. Importantly, this reaction occurred after price was rejected from the upper resistance zone, indicating a normal rotational move within a healthy channel rather than structural failure. The market is rotating, not breaking.

As long as price continues to hold above the support zone and the lower channel boundary, the preferred scenario is a recovery move back toward the mid-range and prior resistance area. A controlled push higher, followed by shallow pullbacks, would support the idea of continuation toward the marked TP zone. This would remain a textbook bullish rotation inside an ascending channel.

The alternative scenario comes into play only if price fails to hold the support zone and breaks decisively below the channel with acceptance. In that case, the bullish structure would be compromised, opening the door for a deeper corrective phase. Until that happens, downside moves should be treated as corrective rather than trend-changing.

In summary, Silver is respecting its broader bullish structure. The current move appears to be a high-quality reaction from support within an ascending channel, favoring patience and confirmation over emotional chasing.

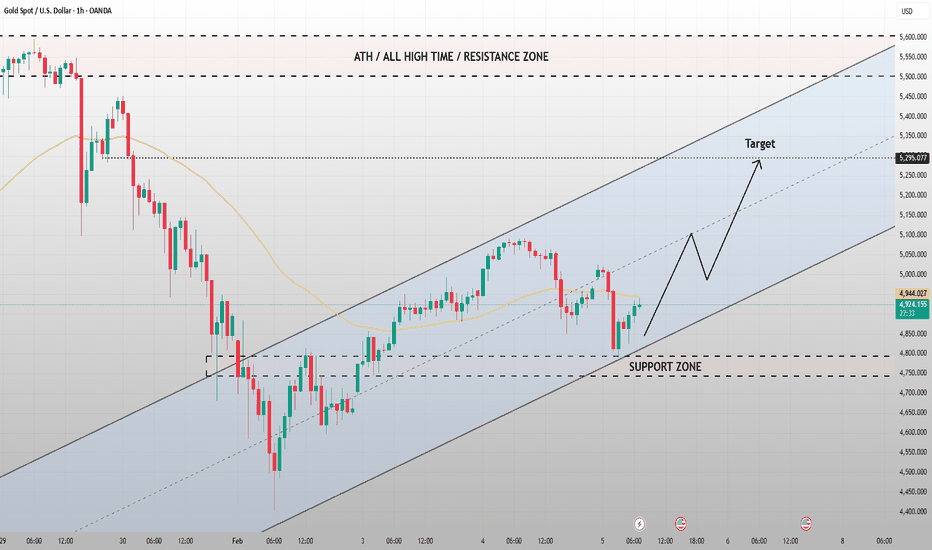

Gold Is Bouncing From Support — But ATH Ceiling Controls GameGold on the H1 timeframe remains in a corrective recovery phase after the sharp selloff from the all-time-high resistance zone. Price is now trading inside a well-defined ascending channel, with recent pullbacks being absorbed cleanly above the highlighted support zone around 4,750–4,800. This behavior suggests stabilization and controlled buying, not panic covering. As long as this support holds, the short-term structure favors continuation within the channel rather than a breakdown.

From a structural perspective, the current advance is still countertrend relative to the prior impulse down, meaning upside moves should be treated as rotations inside the channel, not a confirmed bullish breakout yet. The EMA acts as dynamic balance, and price is oscillating around it — typical of a corrective market seeking equilibrium. The projected path shows a measured push toward the mid-to-upper channel, where liquidity and prior reactions align near 5,140–5,300.

Key invalidation is clear: a decisive loss of the support zone and channel base would negate the bullish rotation and reopen downside risk. On the flip side, a clean break and hold above the channel midline increases the probability of a test toward the upper channel and the ATH supply zone. Until that happens, the correct mindset remains neutral and reactive. Let structure lead trade confirmation, not anticipation.