ETH Ascending Triangle: Long SetupEthereum is in an ascending structure, pulling back toward trendline support with clear resistance around 3,400 USD, offering a potential long setup with defined invalidation and targets.

Trade direction

- Long, buying the dip into the rising trendline / lower Bollinger area, aiming for another test of 3,400 resistance.

- Structure: Higher lows since November, forming an ascending triangle against the 3,400 horizontal cap.

Entry and invalidation

- Potential entry zone:

- $2,950–$3,050, near the blue trendline and mid-to-lower Bollinger band.

- Invalidation:

- Below $2,850, which would break the rising trendline and recent swing low structure.

Take‑profit levels

- TP1: $3,180–$3,200 (prior local resistance and Bollinger midline); consider taking partial profits and moving stop to breakeven.

- TP2: $3,400 major resistance; main target of the pattern.

Trade management

- If price closes a daily candle below the trendline and 2,850, treat the idea as invalid and stand aside.

Longsetup

XMR / USDT Approaching Key Support — 30% Bounce PossibleXMR / USDT is declining aggressively for a healthy retest of a key support zone. If price shows a strong reaction from this level, a clean bounce is expected, with a potential upside move of around 30%. Market conditions remain highly volatile, so proper risk management and confirmation are essential before entry.

Holding Profits by Structure vs. Taking Profits Too EarlyIn trading, many people enter correctly and catch the right trend,

yet in the end, their account still doesn’t grow.

The reason isn’t in the analysis.

It’s in how you exit the trade.

One side holds profits based on structure.

The other takes profits too early because… the heart starts racing.

1. Taking Profits Too Early — A Familiar Psychological Trap

Early profit-taking usually comes from fear:

Fear the price will reverse

Fear of losing current profits

Fear of “this is enough, better secure it”

Common signs:

Closing the trade at just +1R or +2R

Exiting as soon as a candle pulls back slightly

After exiting… price runs dozens of pips further

👉 The biggest problem with early exits is not whether the trade wins or loses,

but that you destroy your long-term expectancy.

You may win many trades,

but your R:R is always small,

and just 1–2 losing trades can wipe out all the effort.

2. Holding Profits by Structure

Holding profits by structure is not blind holding.

It’s based on market structure, not emotions.

For example, in an uptrend:

Price forms Higher Highs – Higher Lows

The structure is still intact

No clear reversal signals appear

➡️ There is no technical reason to exit

A structure-based trader will:

Trail the stop loss below structural lows

Let the market decide the exit

Accept pullbacks as long as structure holds

💡 Big profits don’t come from taking many trades,

but from a few trades held the right way.

3. One Critical Question Before You Exit

Before clicking the close button, ask yourself:

“Has the market structure really broken, or am I just scared by a candle?”

If the structure hasn’t broken,

closing the trade means you’re handing your own money back to the market.

4. Conclusion

Taking profits too early makes you feel safe in the short term

Holding by structure helps you survive and grow in the long run

New traders learn how to enter.

Progressing traders learn how to hold profits.

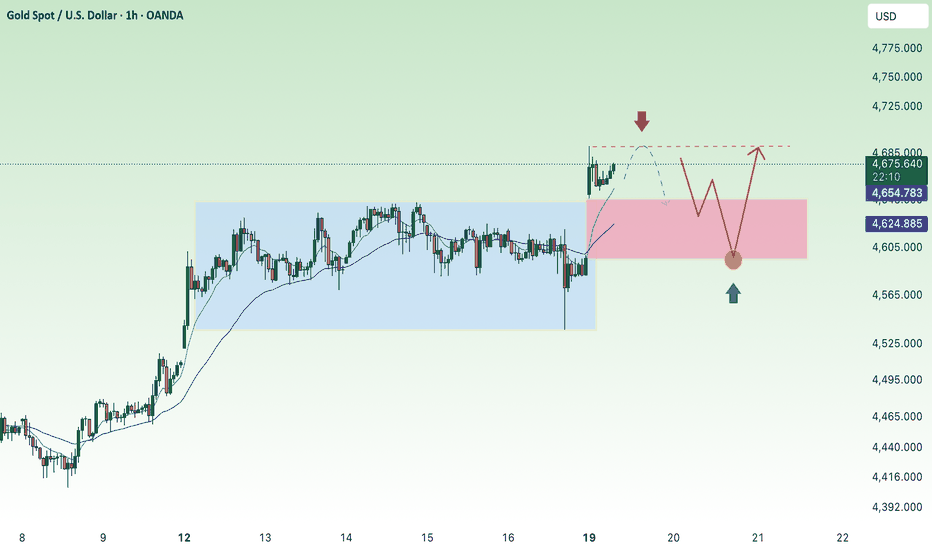

Sideways movement and waiting for a new ATH of 4724.⭐️GOLDEN INFORMATION:

Gold price (XAU/USD) edges higher to near $4,670 during the early Asian session on Tuesday. The precious metal is set to hit a fresh record high as traders flock to safe-haven assets amid a persistent geopolitical and economic outlook.

US President Donald Trump said on Saturday that he would impose new tariffs on goods from eight European countries that reject his plan to acquire Greenland. The countries affected include Denmark, Norway, Sweden, France, Germany, the Netherlands, Finland and the United Kingdom (UK).

⭐️Personal comments NOVA:

Gold prices are trading sideways, consolidating and recovering around 4680 in the Asian session, awaiting a breakout and further highs.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4724 - 4726 SL 4731

TP1: $4710

TP2: $4690

TP3: $4675

🔥BUY GOLD zone: 4617 - 4615 SL 4610

TP1: $4630

TP2: $4645

TP3: $4660

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

Structural Compression Phase🔎 Overview

This idea focuses on identifying potential bullish expansion after a multi-day price consolidation inside the EMA 100 High–Low Band.

The structure highlights range compression, swing-based trendline pressure, and rising volume during consolidation, which together can signal a market preparing for directional movement rather than random noise.

────────────────────────────

📘 Core Components

EMA 100 High–Low Band

• The EMA 100 High–Low Band represents fair value and balance.

• Price consolidating inside this band suggests indecision and energy buildup, not trend weakness.

Pivot High–Low Swings

• Pivot Highs and Pivot Lows are used to map internal market structure.

• Two swing-based trendlines are drawn:

• One connecting lower highs

• One connecting higher lows

This creates a structure squeeze within value.

────────────────────────────

🛠 Market Structure Concept

Consolidation & Compression

• Price has remained inside the EMA High–Low Band for multiple sessions.

• Swing highs are compressing downward while swing lows are compressing upward.

• This reflects decreasing volatility and controlled price action, often seen before expansion.

────────────────────────────

📐 Trendline Structure

• Upper trendline connects progressively lower swing highs.

• Lower trendline connects progressively higher swing lows.

• Both trendlines converge, indicating structural pressure.

This is not direction — it is preparation.

────────────────────────────

📊 Volume Behavior

• Volume is above average while price remains in consolidation.

• Rising participation without range expansion suggests absorption, not exhaustion.

• This behavior often precedes directional acceptance, not immediate rejection.

────────────────────────────

📈 Bullish Expansion Context (Structure-Based)

• A clean acceptance above the upper swing trendline

• Followed by price sustaining above recent structure highs

• While remaining supported outside the EMA High–Low Band

This sequence would indicate resolution of compression rather than a false breakout.

────────────────────────────

🧭 Validation, Devalidation & Projection Framework

Validation Line (Strength Confirmation)

• A candle close above the validation line confirms structural acceptance.

• This signals that the compression phase has resolved with strength, not noise.

Devalidation Line (Structure Failure)

• A candle close below the devalidation line invalidates the setup.

• This indicates failure of compression logic and negates the structural thesis.

Target Line (Maximum Structural Projection)

• Once validated, the target line represents the maximum expected structural expansion based on current compression range.

• This is a projection reference, not a prediction.

Devalidation as Protection

• After validation, the Devalidation level acts as a structure protection zone.

• A sustained close below this level signals loss of acceptance and invalidates continuation logic.

────────────────────────────

📝 Summary

• EMA 100 High–Low Band defines balance and value.

• Price consolidates inside the band for multiple sessions.

• Swing-based trendlines show structural compression.

• Volume expands during consolidation, indicating participation.

• Validation and devalidation lines define acceptance and failure zones.

• Target and revalidation levels provide structured projection and protection.

• The idea focuses on structure resolution, not prediction.

• Direction is assessed only after acceptance, not anticipation.

────────────────────────────

⚠️ Disclaimer

📘 For educational purposes only.

🙅 Not SEBI registered.

❌ Not a buy/sell recommendation.

🧠 Purely a learning resource.

📊 Not Financial Advice.

ETH possible longWe did break down from the bull flag pattern and that's fine. Price is currently accumulating below the resistance trend line. We will need to break above $3230 with high volume, for us to move upwards and take the high at around $3400

We have the expansion, and we are currently in the accumulation phase. It is important that we look out for manipulation.

Today is Monday and i am expecting high volume to relieve any fear of manipulation.

Tariff impact - gold breaks record high at 4690⭐️GOLDEN INFORMATION:

Gold (XAU/USD) catches aggressive bids at the start of a new week and jumps to the $4,700 neighborhood, or a fresh all-time peak, during the Asian session amid the global flight to safety. US President Donald Trump threatened to impose new tariffs on eight European countries that opposed his plan to acquire Greenland. The announcement drew criticism from European officials and raised concerns about a broader transatlantic trade dispute. This comes on top of heightened geopolitical risk and triggers a fresh wave of the global risk-aversion trade, prompting investors to seek refuge in the traditional safe-haven commodity.

⭐️Personal comments NOVA:

US and European tariff pressures were the main factor driving the sharp rise in gold prices, reaching 4690.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4690 - 4692 SL 4697

TP1: $4675

TP2: $4660

TP3: $4645

🔥BUY GOLD zone: 4597 - 4595 SL 4590

TP1: $4610

TP2: $4625

TP3: $4640

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

HP (HPQ) recent selloff shows potential longHello. This is a Macro analysis on HP Inc. (HPQ). I will discuss Technical developments indicating oversold conditions from its recent DECLINE in price. Aim of this is educational in purpose.

I will use price action, candlestick patterns, indicators and more to bring up the idea that there is potential trade opportunity here.

Firstly, I started this analysis at 1 Month timeframe. It was to capture the full picture of price history with Major Supports and Resistance areas.

1 Month is important in this case as major macro developments maybe occuring for HP

Price history for HP is that we wicked to a high of around $37.70 in Nov. 2024 and since then have been in a price DECLINE.

May 2024 was the start of HP to attempt to break above the MAJOR resistance zone of roughly $34.00 - $38.00.

But it failed and hence has been titled Major Resistance.

We also attempted in Dec. 2021 to June 2022 but failed which was the first attempt.

This current Decline in price however has me observing HP because its a Macro move of 2 + years. In my opinion im thinking potential bounce in Price can occur. We just need to determine whether that time is now.

There are 2 Major Support trendlines highlighted. We need to determine whether the Horizontal Support trendline is strong enough for price to bounce here or if we move back down to the uptrending Support trendline.

Note also The Major Resistance Horizontal trendline combined with the Major Support Horizontal trendline forms a Rectangle pattern, also known as Consolidation.

After its move from $20.00 to roughly $37.00 HP is consolidation and building market structure.

One way to look at it is to consider 2 buy zones. One now and another if price action touches the uptrending Major Support line at roughly $18.00.

Note also that this is 1 Month timeframe, and current monthly close is at the end of January so this current candle can still sell off. We need to assess and look for candle confirmations in the coming months.

We also need to analyze the lower timeframes to see if any significant signs are showing that could influence the macro picture.

Tune in for more evidence and analysis as HP continues this current move.

Gold prices have adjusted slightly around 4575.⭐️GOLDEN INFORMATION:

Gold (XAU/USD) loses ground after hitting a fresh record high of $4,643 in the previous session, trading around $4,600 per troy ounce on Thursday. The non-interest-bearing Gold lost ground as a stronger-than-expected United States (US) Producer Price Index (PPI) and Retail Sales, along with last week’s easing Unemployment Rate, reinforced the case for the US Federal Reserve (Fed) to keep interest rates on hold for the coming months.

Safe-haven Gold prices also weaken, partly reflecting easing geopolitical concerns. US President Donald Trump said reports indicated Iran’s crackdown-related killings were subsiding and that no large-scale executions were planned, though he did not rule out potential US military action, noting Washington would continue to monitor developments, according to Reuters.

⭐️Personal comments NOVA:

Gold prices are adjusting and consolidating around 4575, but still maintaining an upward trend.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4575 - 4573 SL 4568

TP1: $4588

TP2: $4602

TP3: $4615

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

XAUUSD: The Bullish Trend Remains IntactXAUUSD continues to trade within a primary bullish trend , and the current short-term pullbacks are merely a healthy pause before price extends higher.

From a fundamental perspective, recent U.S. economic data suggest that inflationary pressures are easing and consumer demand is no longer excessively strong, increasing expectations that the Federal Reserve may shift toward a more dovish stance . At the same time, geopolitical risks and a cautious market sentiment continue to support safe-haven demand, providing a solid short-term foundation for gold.

On the chart, the bullish structure remains clearly intact. Price is moving within a well-defined ascending channel , consistently forming higher lows. The 4,570 support zone below plays a critical role, acting as a confluence of the rising trendline and a key acceptance area. As long as this level holds, there are no signs of a trend breakdown.

On the upside, 4,720 stands out as a key psychological resistance . A shallow pullback into support followed by a renewed push higher would represent a healthy continuation scenario, allowing the market to build momentum before challenging this resistance once again. The fact that price is not facing aggressive selling pressure near the highs indicates that buyers remain firmly in control.

Chasing Buys at the Top? USDJPY Is Sending a Risk WarningUSDJPY is entering a technical corrective pullback after an extended and aggressive rally. While the broader macro backdrop previously remained unfavorable for the Japanese yen, the market is no longer reacting strongly to USD-bullish headlines as it did before.

From a news perspective, the Japanese yen is expected to stay under pressure amid speculation that Prime Minister Sanae Takaichi may call for an early election in February. A potential victory is widely seen as supportive of expansionary fiscal policies, which would add further downside pressure on JPY. However, the key point is that most of this narrative has already been priced in , and USDJPY has rallied sharply in anticipation of that outcome.

Turning to the chart, the technical picture is flashing early warning signs . Price is approaching the key psychological resistance zone at 159.50–159.60, while simultaneously testing a long-term ascending trendline. At this level, buying momentum is clearly fading, with visible rejection signals suggesting that bulls are losing control.

In this environment, chasing long positions near the highs carries elevated risk . A more prudent approach is to wait for weak pullbacks and prioritize SELL setups in line with the corrective structure, rather than getting trapped by outdated headlines. Markets do not move because of news titles — they move because of how price reacts after the news is released.

ZM LongChart looks wonderful. Textbook bearish to bullish reversal setup here. bottomed in 8/24, series of higher highs and higher lows since. Seen in the cup-like pattern forming.

I would play the coming bullish breakout - from the pennant pattern -with an aggressive long upon price action confirmation.

Fundamentals also look strong. Cheap valuation at 14 times forward (granted growth has slowed materially since COVID era). FCF/EV yield of 11+% and profit margins north of 30%. I don't see much downside risk. I see plenty of upside, especially if investor sentiment surrounding software mean reverts.

This is not financial advice. Good luck!

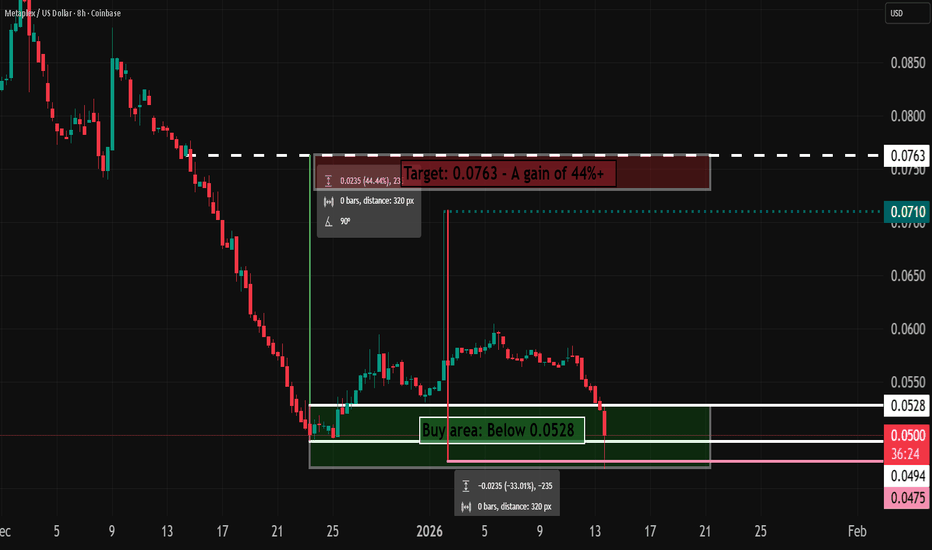

MPLX Due For A 44% RiseWhy do I believe in this trade?

Because, an important price was left behind and is likely to try a retest, the 4th dip on the weekly just occurred, price just formed a new all time low, and because price is down 30%+ from the last high, without a significant rise on the way down.

I am expecting price to rise 44% from 0.0528.

EUR/USD: When Every Pullback Becomes an Opportunity for SellersAs we move into mid-January 2026 , EUR/USD is clearly reflecting the internal contradiction within the European economic narrative : short-term bright spots exist, yet long-term structural risks remain a major headwind . When this macro backdrop is placed onto the current H4 chart, the bearish trend is being reinforced both fundamentally and technically.

From a news perspective , the market is not focusing on the improvement in quarterly growth. Instead, attention remains on negative structural factors: annual GDP growth slowing, energy costs still several times higher than in the US, and persistent competitiveness constraints. These elements are not strong enough to justify fresh EUR buying in the short term, while the USD continues to hold a relative advantage . As a result, capital flows are leaning toward defense rather than aggressively bottom-fishing the euro .

From a technical standpoint , the bearish structure is clearly visible on the H4 timeframe . Price remains below the Ichimoku cloud, repeatedly rejected at the descending trendline and the 1.1680–1.1700 resistance zone . Recent rebounds have been purely technical, failing to break the lower-high structure. This confirms that sellers remain firmly in control. Under the current scenario, EUR/USD may attempt a minor rebound into resistance, but is likely to resume its decline toward 1.1630, or even lower if selling pressure accelerates.

In summary, with fundamentals failing to support the euro and the chart maintaining a clear bearish structure , the most rational short-term approach remains selling in line with the trend, rather than anticipating a premature reversal.

OTTR Stock Confirmed Bullish/Going UPHello,

Ayrfolio trade ideas are based on weekly charts and momentum, so remember to be patient! No day trades here unless the stock soars up intraday. Today we’re covering:

COMPANY: Otter Tail Corporation

STOCK SYMBOL: OTTR

POSITION: Long

TP1 Risk-Reward Ratio: 1.67

TP2 Risk-Reward Ratio: 3.34

Stop Loss: must wait AFTER daily candle closes to exit trade (regular candle, NOT Heiken Ashi)

Ultimate Stop Loss: can exit IMMEDIATELY if price reaches this level during any trading hours

EXPLANATION: Weekly momentum increased and confirmed on Monday 8/18/25 at $85.97/share. Although the stop losses are listed on the chart, if momentum has been lost then we can exit before the price reaches the stop loss.

DISCLAIMER: Please do your own due diligence before making any decisions. I am not an investment advisor, and I do not personally trade these stocks. These posts are stock trade ideas that follow my same weekly momentum strategy. Past results are not indicative of future performance.

P.S. - Stocks can soar. YOU can soar. Soaring is possible!

-Ayrfolio

PINC Stock Going UP, Confirmed Monday 8/11/25Hello,

Ayrfolio trade ideas are based on weekly charts and momentum, so remember to be patient! No day trades here unless the stock soars up intraday. Today we’re covering:

COMPANY: Premier, Inc.

STOCK SYMBOL: PINC

POSITION: Long

TP1 Risk-Reward Ratio: 1.78

TP2 Risk-Reward Ratio: 3.57

Stop Loss: must wait AFTER daily candle closes to exit trade (regular candle, NOT Heiken Ashi)

Ultimate Stop Loss: can exit IMMEDIATELY if price reaches this level during any trading hours

EXPLANATION: Weekly momentum increased and confirmed on Monday 8/11/25 at $24.95/share. Although the stop losses are listed on the chart, if momentum has been lost then we can exit before the price reaches the stop loss.

DISCLAIMER: Please do your own due diligence before making any decisions.

P.S. - Stocks can soar. YOU can soar. Soaring is possible!

-Ayrfolio

FOMO When Gold Explodes: The Trap Most Traders Fall IntoIf you’ve ever chased a strong gold rally, entered a trade out of fear of “missing the move,” and then watched price reverse and stop you out minutes later — you’re not alone.

That’s FOMO (Fear of Missing Out), and it is one of the most dangerous psychological traps when trading XAUUSD.

How FOMO shows up when gold moves aggressively

Gold is a market known for speed, volatility, and expansion.

When price starts printing large bullish candles, the trader’s mind often reacts instinctively:

“Price is running, if I don’t enter now I’ll miss it”

“Everyone is buying, it must keep going”

“I’ll just enter quickly and use a tight stop”

The problem is simple: you’re reacting emotionally, not executing a plan.

In many cases, those strong impulsive moves you see are:

- The late-stage expansion of a trend

- A liquidity push designed to trigger late buy orders

- Or the area where institutions begin distributing positions

By the time FOMO kicks in, the best part of the move is often already over.

Why FOMO is especially dangerous in gold trading

Unlike many forex pairs, gold:

- Creates sharp spikes and deep pullbacks

- Frequently produces false breakouts around key levels

- Sweeps both sides before committing to the real direction

When you trade with FOMO:

- Stops are placed too tight

- Entries are made at expensive prices

- A normal technical pullback is enough to take you out

Price may still move in the direction you expected — just without you in the trade.

Signs you’re trading with FOMO (even if you don’t realize it)

Ask yourself:

- Did I enter because of my plan, or because price was moving too fast?

- Am I trading outside my pre-marked zones?

- Am I ignoring market structure because I’m afraid of missing out?

If the answer is yes, FOMO is likely driving your decision.

How to avoid the FOMO trap when gold is running

1. Trade levels, not candles

Large green candles are not signals. Zones are.

If price has already left your area, accept the missed opportunity.

2. Ask one key question: “Who is entering here?”

If you buy after a strong expansion, you’re often buying from traders who are taking profit.

3. Accept missing trades as part of the game

No professional trader catches every move.

Missing a trade is cheaper than forcing a loss.

4. Wait for reactions, not movement

The market always offers a second chance — pullbacks, consolidations, or clearer structure.

XAU/USD – The bullish momentum is firmly supportedAs we move into the new trading week, gold is once again demonstrating its role as a safe-haven asset, benefiting strongly from the current macroeconomic backdrop. The fact that gold prices surged nearly 2% and reached a record high during the Asian session is not merely a short-term reaction, but rather reflects a clear shift in monetary policy expectations and global risk sentiment.

From a fundamental perspective , the latest U.S. labor market data released at the end of last week acted as a key catalyst. Nonfarm payrolls increased by only 50,000 jobs , significantly below expectations, signaling a clear cooling in the U.S. labor market . This development has reinforced expectations that the Federal Reserve may soon enter a rate-cutting cycle this year, weakening the U.S. dollar and bond yields — an ideal environment for gold to remain well supported and continue to be repriced higher.

At the same time, heightened geopolitical risks have added another layer of support. Rising instability in the Middle East, particularly the prolonged unrest in Iran, alongside ongoing tensions between the U.S. and Venezuela, continues to drive demand for gold as a defensive hedge against uncertainty.

On the technical side, the structure of XAU/USD fully supports a bullish continuation scenario. The 4,550 zone is currently acting as immediate support , where buying interest consistently emerges on pullbacks. As long as this support remains intact, any retracement should be viewed as technical and corrective , offering opportunities for trend continuation rather than signaling reversal. To the upside, the psychological resistance at 4,650 stands as the next key target, where price may temporarily pause before potentially extending the rally further.

Wishing you successful and disciplined trading ahead!

Continued expectations for a new all-time high (ATH) for gold.⭐️GOLDEN INFORMATION:

Gold Price (XAU/USD) jumps to near $4,600 during the early Asian session on Tuesday. The precious metal extends the rally after retreating from a fresh record high of $4,630 in the previous session amid uncertainty and geopolitical risks. The US Consumer Price Index (CPI) inflation data for December will take center stage later on Tuesday.

Federal Reserve (Fed) Chair Jerome Powell said on Sunday that he’s under criminal investigation, sparking an independence crisis and triggering a flight to safety across global markets. Powell stated that the US Department of Justice had issued subpoenas to the central bank and threatened a criminal indictment related to his testimony before the Senate Banking Committee in June 2025 concerning a $2.5 billion renovation of the Fed's Washington, D.C., headquarters. Powell called the threats a "pretext" aimed at putting pressure on the Fed to cut interest rates.

⭐️Personal comments NOVA:

Gold prices continue to fluctuate upwards, consolidating around 4600 and awaiting the formation of a new all-time high (ATH): a potential 4679.

⭐️SET UP GOLD PRICE:

🔥SELL GOLD zone: 4678 - 4680 SL 4685

TP1: $4660

TP2: $4645

TP3: $4630

🔥BUY GOLD zone: 4547 - 4545 SL 4540

TP1: $4560

TP2: $4575

TP3: $4595

⭐️Technical analysis:

Based on technical indicators EMA 34, EMA89 and support resistance areas to set up a reasonable BUY order.

⭐️NOTE:

Note: Nova wishes traders to manage their capital well

- take the number of lots that match your capital

- Takeprofit equal to 4-6% of capital account

- Stoplose equal to 2-3% of capital account

CHESSUSDT 1DShort technical update 👇

On the daily timeframe, CHESS broke its bearish structure and completed a clean retest of the breakout level. The retest held, selling pressure is fading, and higher local lows are forming. The current structure suggests a recovery phase after a prolonged decline. The base scenario is a continuation to the upside with a move toward the MA200 as the next key mid-term target.