Can Integration Save CVS or Sink It?CVS Health confronts a dangerous convergence of risks that threatens its vertically integrated business model. The company's Pharmacy Benefit Manager (PBM) subsidiary, Caremark, faces intensifying regulatory scrutiny as lawmakers target the opaque rebate structures and spread pricing mechanisms that underpin PBM profitability. Simultaneously, the explosive growth of high-cost GLP-1 weight-loss drugs has created unprecedented formulary pressure. CVS's decision to exclude Eli Lilly's Zepbound in favor of Novo Nordisk's Wegovy, based purely on price, backfired spectacularly. Lilly publicly pulled its employees from CVS's PBM plan and shifted to competitor Rightway Healthcare, signaling deep market skepticism about CVS's ability to balance cost control with clinical outcomes. This defection validates concerns that major employers are increasingly willing to abandon the "Big Three" PBMs for transparent alternatives.

The company's acquisition strategy has proven economically disastrous, with CVS recording a staggering $5.7 billion goodwill impairment charge on Oak Street Health in Q3 2025, effectively admitting the primary care assets were dramatically overvalued. This massive write-down undermines the core thesis that vertical integration of insurance (Aetna), PBM (Caremark), and care delivery creates synergistic value. Meanwhile, operational margins erode from multiple directions: $833 million in litigation charges from past business practices, declining generic dispensing rates as expensive branded GLP-1 drugs displace generics, and the structural reality that robust patent protection on GLP-1 drugs extending into the 2040s eliminates the PBM's traditional leverage of threatening generic competition.

CVS faces additional systemic vulnerabilities across geopolitical, technological, and scientific domains. The company's reliance on Active Pharmaceutical Ingredients sourced from China and India exposes it to supply chain disruptions, tariffs, and mandatory but expensive domestic manufacturing mandates. Its vast integrated infrastructure creates an attractive single point of failure for cyberattacks, heightened by the $20 billion technology investment to further interconnect all segments. Most critically, pharmaceutical manufacturers hold unprecedented leverage due to the extended patent exclusivity of breakthrough GLP-1 therapies, with no meaningful generic relief for 15-20 years, forcing CVS into a perpetual choice between excluding superior drugs and losing clients, or accepting coverage that severely erodes margins.

Until CVS demonstrates sustainable PBM client retention among major employers, successful integration of its healthcare delivery assets without further impairments, and a viable strategy to navigate the regulatory assault on traditional PBM economics, the investment profile remains fundamentally challenged. The Lilly defection represents more than a single client loss; it exposes structural fragility in a business model increasingly misaligned with market demands for transparency, clinical appropriateness, and technological innovation.

Loss

Simple XAUUSD Strategy That Just Made 100 Pips!Gold played out beautifully today with a clear 100-pip move to the downside. After testing resistance near 4240, price showed rejection with strong bearish candles, confirming exhaustion from buyers and giving a clear sell signal.

The structure shifted from higher lows to lower highs, signaling the start of a short-term correction. Once price broke below the intraday support zone, momentum carried it smoothly down toward 4145 — completing a perfect swing move.

No complex indicators were needed. Just clean market structure, rejection candle confirmation, and patience for entry. The dollar strength added extra pressure on gold, aligning with the technical view.

Key takeaway: follow structure, not emotion. A simple rejection and structure break can deliver more than any over-complicated setup. Consistency comes from clarity.

Trade closed around 4145 with a solid 100-pip gain. Now watching the 4140–4130 zone for possible reaction or bounce setup before the next move.

#XAUUSD #Gold #PriceAction #Breakout #SmartMoney #TechnicalAnalysis #DayTrading #Scalping #TradingView

Oct 2: SHORT TERM SELL (UPDATE)Oct 2: SHORT TERM SELL (UPDATE)

- ngl price action seems trash...

- all bullish targets but price is consolidating.

RESULT

SL HIT

CAUSES:

- OTE + S/R Flip acted as the bullish argument

- price nearly hit TP, but.. it is what it is?

- or maybe.. i already had bullish targets, and some bullish signals(divergence, etc).. so maybe instead of looking for a short entry, I waited for a bullish setup? For example, this fibonacci 0.7 + s/r flip line. it turned out to be effective.

LEARNING:

- if price seems wonky, consider the entry setups on both long and short directions.

Can Lilly Redefine Weight Loss Market Leadership?Eli Lilly is rapidly emerging as a dominant force in the burgeoning weight loss drug market, presenting a significant challenge to incumbent leader Novo Nordisk. Lilly has demonstrated remarkable commercial success despite its key therapy, Zepbound (tirzepatide), entering the market well after Novo Nordisk's Wegovy (semaglutide). Zepbound's substantial revenue in 2024 underscores its rapid adoption and strong competitive standing, leading market analysts to project Eli Lilly's obesity drug sales will surpass Novo Nordisk's within the next few years. This swift ascent highlights the impact of a highly effective product in a market with immense unmet demand.

The success of Eli Lilly's tirzepatide, the active ingredient in both Zepbound and the diabetes treatment Mounjaro, stems from its dual mechanism targeting GLP-1 and GIP receptors, offering potentially enhanced clinical benefits. The company's market position was further solidified by a recent U.S. federal court ruling that upheld the FDA's decision to remove tirzepatide from the drug shortage list. This legal victory effectively halts compounding pharmacies from producing unauthorized, cheaper versions of Zepbound and Mounjaro, thereby protecting Lilly's market exclusivity and ensuring the integrity of the supply chain for the approved product.

Looking ahead, Eli Lilly's pipeline includes the promising oral GLP-1 receptor agonist, orforglipron. Positive Phase 3 trial results indicate its potential as a convenient, non-injectable alternative with comparable efficacy to existing therapies. As a small molecule, orforglipron offers potential advantages in manufacturing scalability and cost, which could significantly expand access globally if approved. Eli Lilly is actively increasing its manufacturing capacity to meet anticipated demand for its incretin therapies, positioning itself to capitalize on the vast and growing global market for weight management solutions.

8 April Nifty50 important level trading zone #Nifty50

99% working trading plan

C1👉Gap up open 22318 above & 15m hold after positive trade target 22510, 22670,

C2👉Gap up open 22318 below 15 m not break upside after nigetive trade target 22142,

C3👉Gap down open 22142 above 15m hold after positive trade target 22318, 22510

C4👉Gap down open 22142 below 15 m not break upside after nigetive trade target 22078

C5💫big gapdown open 22070 above hold 1st positive trade view

C6💫big Gapup opening 22673 below nigetive trade view

📌For education purpose I'm not responsible your trade

More education following me

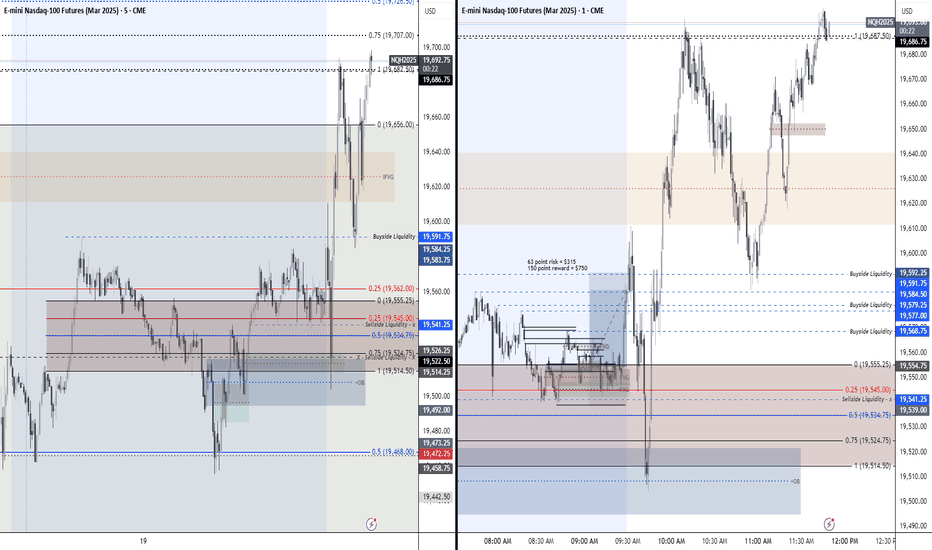

Review of my NQ Morning trade before FOMCThis is me going over the trade we took today that was a loss. Had we kept SL under the low of 19,541.25 we would've hit TP and caught our trade. We are done trading for today, just wanted to hop on here to share with you guys the result of the trade and outcome.

Give it a like ♥ and a 🚀 if you found this insightful.

Forex, Crypto and Futures Trading Risk Disclosure:

The National Futures Association (NFA) and Commodity Futures Trading Commission (CFTC), the regulatory agencies for the forex and futures markets in the United States, require that customers be informed about potential risks in trading these markets. If you do not fully understand the risks, please seek advice from an independent financial advisor before engaging in trading.

Trading forex and futures on margin carries a high level of risk and may not be suitable for all investors. The high degree of leverage can work against you as well as for you. Before deciding to trade, you should carefully consider your investment objectives, level of experience, and risk appetite.

There is a possibility of losing some or all of your initial investment, and therefore, you should not invest money that you cannot afford to lose. Be aware of the risks associated with leveraged trading and seek professional advice if necessary.

BDRipTrades Market Opinions (also applies to BDelCiel and Aligned & Wealthy LLC):

Any opinions, news, research, analysis, prices, or other information contained in my content (including live streams, videos, and posts) are provided as general market commentary only and do not constitute investment advice. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC will not accept liability for any loss or damage, including but not limited to, any loss of profit, which may arise directly or indirectly from the use of or reliance on such information.

Accuracy of Information: The content I provide is subject to change at any time without notice and is intended solely for educational and informational purposes. While I strive for accuracy, I do not guarantee the completeness or reliability of any information. I am not responsible for any losses incurred due to reliance on any information shared through my platforms.

Government-Required Risk Disclaimer and Disclosure Statement:

CFTC RULE 4.41 - HYPOTHETICAL OR SIMULATED PERFORMANCE RESULTS HAVE CERTAIN LIMITATIONS. UNLIKE AN ACTUAL PERFORMANCE RECORD, SIMULATED RESULTS DO NOT REPRESENT ACTUAL TRADING. ALSO, SINCE THE TRADES HAVE NOT BEEN EXECUTED, THE RESULTS MAY HAVE UNDER-OR-OVER COMPENSATED FOR THE IMPACT, IF ANY, OF CERTAIN MARKET FACTORS, SUCH AS LACK OF LIQUIDITY. SIMULATED TRADING PROGRAMS IN GENERAL ARE ALSO SUBJECT TO THE FACT THAT THEY ARE DESIGNED WITH THE BENEFIT OF HINDSIGHT. NO REPRESENTATION IS BEING MADE THAT ANY ACCOUNT WILL OR IS LIKELY TO ACHIEVE PROFIT OR LOSSES SIMILAR TO THOSE SHOWN.

Performance results discussed in my content are hypothetical and subject to limitations. There are frequently sharp differences between hypothetical performance results and the actual results subsequently achieved by any particular trading strategy. One of the limitations of hypothetical trading results is that they do not account for real-world financial risk.

Furthermore, past performance of any trading system or strategy does not guarantee future results.

General Trading Disclaimer:

Trading in futures, forex, and other leveraged products involves substantial risk and is not appropriate for all investors.

Do not trade with money you cannot afford to lose.

I do not provide buy/sell signals, financial advice, or investment recommendations.

Any decisions you make based on my content are solely your responsibility.

By engaging with my content, including live streams, videos, educational materials, and any communication through my platforms, you acknowledge and accept that all trading decisions you make are at your own risk. BDRipTrades, BDelCiel, and Aligned & Wealthy LLC cannot and will not be held responsible for any trading losses you may incur.

AR DAY TRADE!! (TALK ON BUSINESS OUTSIDE)BYBIT:ARUSDT.P

Yo I'm back with a mini-investment I'm going to go with this support zone the charts are at.. I've let it leak down at little to grab a bigger return. Otherwise, nothing else to report on.. ACTUALLY (yea I'm going to type on here like I'm talking because that's what I do) My wife and I have just purchased a commercial unit and are moving our detailing business into it this week! something exciting to look forward to and new adventures ahead!

Its not all about charts, We got business outside too.

HAWK - Full speed decline, what a piece of junkWhat a trajedy. Sorry if you're one of the unlucky ones who have lost money here. It just shows that technical analysis, a steady hand and an a total side-stepping of FOMO is critical when trading. This coin is trash and I'll give anyone who has lost any money a number of free signals and charts to support them in their journey back to the big city lights. So sad, but it's going to plump 0 where it'll most likely be delisted and sold for spare parts. Follow for more.

A 14% drop in $VKTX and I might still win. Here's why! NASDAQ:VKTX

A 14% drop in NASDAQ:VKTX and I might still win. Here's why!

In this video analysis update on my position in NASDAQ:VKTX , we will discuss why I didn't sell after the 14% pullback and why it's important not to sell based on price movement! Enjoy.

Have you ever sold a stock and right after it flew to the upside?

I LOST ON CELSIUS! HERE'S WHY!!!NASDAQ:CELH

In this video, I go over my losing trade on Celsius Holdings. It's important to talk about our wins and losses, as they all matter in the grand scheme of things. If you want to be a profitable trader, you need not lie to yourself.

Let me know what your last loss was and what you learned from it in the comments.

Lesson 4: Handling Losing Streaks – Embrace DisciplineWelcome to Lesson 4 of the Hercules Trading Psychology Course—Handling Losing Streaks: Embrace Discipline for Long-Term Success. Building on the essential traits of Initiative and Discipline covered in previous lessons, today we address a critical aspect of trading psychology: how to handle losing streaks. Whether you’re involved in forex, stocks, commodities, or cryptocurrencies, understanding and managing losing streaks with discipline is vital for achieving sustained profitability across all financial markets.

Understanding Losing Streaks

Losing streaks, defined as three or more consecutive losing trades, are an inevitable part of trading. They can significantly impact your trading account, erode your confidence, and disrupt your overall performance. However, it’s important to recognize that losing streaks are not a reflection of your trading abilities but rather a natural occurrence within the volatile environment of financial markets.

Why Changing Your Approach During Losing Streaks Is a Mistake

When faced with a losing streak, the temptation to alter your trading approach can be overwhelming. You might consider tweaking your strategy, increasing your trade sizes, or abandoning your trading plan altogether in an effort to recover losses quickly. However, these impulsive reactions often lead to more significant losses and hinder your long-term trading success.

At Hercules Trading, we advocate for steadfastness. If your trading system has been thoroughly tested and proven effective over time, the best course of action during a losing streak is not to change anything. Instead, maintain strict adherence to your established plan and trust in the process you have developed.

The Power of Discipline

Discipline in trading means sticking to your trading plan and executing your strategies consistently, regardless of market conditions or emotional states. Here’s how discipline can help you navigate losing streaks:

1. Maintain Consistency

Consistency is the cornerstone of successful trading. By following your trading plan meticulously, you minimize the influence of emotions and reduce the likelihood of making impulsive decisions.

For Swing Traders:

Stick to your long-term strategies. Resist the temptation to alter your plan based on daily market noise. For instance, if your plan dictates holding a position for two weeks, avoid the urge to exit prematurely due to minor market movements.

For Day Traders:

Follow your short-term strategies diligently. Adhere to your predefined entry and exit points, even when the market is volatile. This consistency helps in minimizing impulsive trades driven by emotional reactions.

2. Implement Robust Risk Management

Effective risk management is integral to discipline. It involves setting stop-loss orders, limiting the size of your trades, and ensuring that no single trade can significantly impact your overall portfolio.

For Swing Traders:

Diversify your investments across different financial instruments to mitigate risks. Implement strategies that protect your capital over the long term.

For Day Traders:

Use strict risk management techniques to handle the high-frequency nature of day trading. Limit your exposure per trade and use tools like trailing stops to protect your profits.

3. Control Your Emotions

Maintaining emotional equilibrium is essential for making rational trading decisions. Emotions like fear and greed can cloud your judgment and lead to poor trading choices.

For Swing Traders:

Develop patience and resilience to withstand market volatility. Avoid making decisions based on temporary market sentiments.

For Day Traders:

Stay calm during fast-paced trading sessions. Use techniques like deep breathing or short breaks to manage stress and maintain focus.

Strategies to Handle Losing Streaks with Discipline

1. Stick to Your Trading Plan

Your trading plan is your roadmap. It outlines your strategies, risk management techniques, and criteria for entering and exiting trades. During a losing streak, it’s crucial to adhere strictly to your plan without making any deviations based on emotions or short-term market fluctuations.

For Swing Traders:

Trust in your long-term analysis and remain patient, allowing your trades to develop as per your plan.

For Day Traders:

Adhere strictly to your trading rules, ensuring that each trade is executed based on your predefined criteria.

2. Avoid Overcompensating

Attempting to recover losses by increasing your trade sizes or making drastic changes to your strategy can lead to a downward spiral. Instead, focus on maintaining a balanced and disciplined approach.

For Swing Traders:

Maintain your long-term strategies even after experiencing losses. Overcompensating by increasing trade sizes or altering strategies can lead to further losses.

For Day Traders:

Follow your predefined trading rules without exception. Overcompensating by making larger trades to recover losses can result in significant account depletion.

3. Practice Mindfulness and Emotional Control

Techniques such as meditation or journaling can help you stay grounded and manage your emotions effectively. Maintaining emotional balance is crucial for making rational trading decisions.

For Swing Traders:

Incorporate mindfulness practices into your daily routine to maintain a calm and focused mindset, essential for long-term trading success.

For Day Traders:

Use short meditation sessions or deep breathing exercises during breaks to manage stress and maintain clarity during intense trading periods.

4. Keep a Trading Journal

Documenting each trade provides valuable insights and emphasizes the need for a solid system over mere gut instincts.

For Swing Traders:

Maintain a trading journal that records the rationale behind each long-term trade, the market conditions at the time, and the outcomes. This helps in identifying patterns and improving your strategies over time.

For Day Traders:

Keep detailed records of each intraday trade, including entry and exit points, the emotions you felt, and the results. Analyzing these records can help in refining your trading tactics and emotional control.

5. Seek Support and Engage with the Community

Engage with a community of traders or seek mentorship from experienced professionals. Sharing experiences and gaining insights can provide encouragement and reduce feelings of isolation.

For Swing Traders:

Join long-term investment forums or groups where you can discuss strategies and share experiences with like-minded traders.

For Day Traders:

Participate in day trading communities or mentorship programs that offer real-time support and feedback on your trading practices.

Why Changing Your Approach During Losing Streaks Is Counterproductive

Losing streaks are a part of the trading journey, and altering your approach every time you face a few losses can lead to inconsistency and undermine your trading system. A well-tested trading system is designed to navigate market fluctuations, and sticking to it during losing streaks reinforces the discipline required for long-term success.

For Swing Traders:

Allow your trades the necessary time to develop without interference. Overanalyzing or frequently adjusting your positions can lead to unnecessary losses and disrupt your long-term strategy.

For Day Traders:

Implement strict entry and exit times. This prevents you from getting caught up in the heat of the moment and helps maintain a disciplined trading routine.

Embrace the Long-Term Perspective

Success in trading is not about avoiding losses but about managing them with discipline and maintaining a long-term perspective. By adhering to your trading plan and maintaining emotional control, you position yourself to capitalize on profitable opportunities when they arise, ultimately leading to sustained profitability across all financial markets.

Action Steps:

Assess Your Current Discipline:

Reflect on how you handle losing streaks. Identify areas where you might be deviating from your trading plan and commit to maintaining discipline.

Reinforce Your Trading Plan:

Ensure your trading plan is comprehensive and includes strategies for managing losing streaks. Regularly review and update your plan as needed.

Implement Robust Risk Management:

Protect your capital by setting appropriate stop-loss orders, limiting trade sizes, and diversifying your portfolio across different financial instruments.

Maintain a Trading Journal:

Document every trade to gain insights into your trading behavior and identify patterns that need improvement.

Practice Emotional Control Techniques:

Incorporate mindfulness practices, meditation, or journaling into your daily routine to manage stress and maintain emotional equilibrium.

Engage with the Trading Community:

Join forums, attend webinars, or participate in trading groups to share experiences and gain support from fellow disciplined traders.

Trust in Your System:

Have confidence in your trading system. Understand that losing streaks are a part of the trading process and that sticking to your plan will yield long-term success.

Conclusion: Embrace Discipline to Overcome Losing Streaks

Discipline is more than just following a set of rules—it’s about cultivating a mindset that prioritizes consistency, reliability, and resilience. By embracing discipline, you empower yourself to navigate the complexities of all financial markets with confidence and determination.

In Lesson 4, we’ve explored the significance of handling losing streaks with discipline, the pitfalls of altering your approach during downturns, and strategies to maintain consistency and emotional control. These elements are essential for building a strong foundation and achieving consistent profitability across all financial markets, whether you’re a swing trader or a day trader.

Next Lesson: Patience – The Key to Long-Term Trading Success

Stay tuned for Lesson 5, where we’ll delve into Patience, another crucial trait that underpins consistent success in trading. Learn how to cultivate patience to make informed decisions, wait for optimal trading opportunities, and maintain a calm and focused mindset, regardless of market conditions.

Hercules Trading Psychology Course is designed to equip you with the mental tools necessary to thrive in all financial markets. By mastering traits like Initiative, Discipline, and Patience, you’ll build a resilient mindset that can withstand the challenges of trading and lead you to sustained profitability.

Here’s to your growth and success as a trader across all financial markets!

Bitcoin - The Marco MazeHistory doesn't necessarily have to repeat! I see a lot of history based derivation for the timelines and price as to when and how high or low bitcoin can sore. As exciting and adrenaline pumping as these ideas seem, the outcome will just be as good as any coin toss! The truth however is the "macro maze" above. I've taken sensible assumptions to derive on the timelines and humanly possibe price floors and ceilings! In this environment sensible assumptions can easily turn out to be the most major blunder, so as I always say, please do your own analysis!

How to read the chart? It's quite simple, red is resistance or sell, green is support or buy. The intersections are where Bitcoin's price would likely be attracted to. There is no saying with precision when and where it would be. Kinda of like the Schrödinger's cat, you will only know when it happens. Anyone who says otherwise has a 50/50 chance of being right. Now, are you a trader or a gambler? Stay safe, peace out!

Disclaimer: These are not trading signals. Trade at your own risk!

How to go through a LOSING STREAK better?

🍏1. Everything starts with preparation and true expectations. Losing streaks will happen from time to time, accept it if you want to be a good trader. Even the best traders on the planet have them. But it’s the reaction to them that separates good and bad traders.

Know your probability of losing streak, based on your own backtesting and accept them before they even happen. Keep longterm focus!

🍋2. Make sure you’re practicing process based trading, not outcome based. Before every trade, ask yourself if anyone in the whole worlds can say the outcome of any individual trade? The answer is obvious - no one can do it. So is it rational to build expectation of a specific market moves in this individual trade, or nearest several trades - that they are completely uncertain and you are working with random distribution of your edge.

🥥3. Once in a streak, remind yourself about your testing. See that over the past 200 or more trades, you were profitable, at least RR wise. These 5-6 losing trades you’re having now are just a very small part of a huge data collection you did before, and they are part of random distribution.

🍈4. In a losing streak, there’s usually an urge to trade more to earn the lost $ amount back. It’s a mistake, as overtrading will lead to only one outcome - even more loss in short or longterm perspective.

🍎5. In the past, I wanted to reach some state of unbreakable consistency, "once and for all", and when I thought I did it, I started to expect things to be easy from now on and not to struggle or put effort, cause now I'm fully consistent. And that was exact moment when everything fell apart.

The truth is, at least for me and for now, is that I need to make good decisions - mentally and technically - EVERY DAY and EVERY MOMENT, to actually prove I'm consistent. And consistency is dynamic, I'll continue to work on it, it's like gardening, when you need to put some effort everyday and it's never fixed or done, at least for me.

#LOS/USDT#LOS

The price is moving within a descending channel pattern on a 4-hour frame, which is a retracement pattern

We have a tendency to stabilize above the Moving Average 100

We have a downtrend on the RSI indicator that supports the rise and gives greater momentum and the price is based on it

Entry price is 0.0001125

The first target is 0.0002045

The second goal is 0.0002690

The third goal is 0.0003500

Learn How To Trade Tradingview's new BBTrend Indicator!

Introduction

In this analysis I want to take a closer look at Tradingview's newly released BBTrend indicator. It's an indicator on the widely popular Bollinger Bands. You can find more information about the indicator here: www.tradingview.com

Indicators are nice to use, but the most important question remains whether they are useful in trading or not?

I want to present you a very simple, but powerful trading strategy using this new indicator.

Indicators used

- BBTrend: determine the best reversal entries.

- 200-period EMA: assess whether we're trading bullish or bearish.

Strategy

Bullish: price should be above 5% of the 200-period EMA. Light-red BBTrend has to change in trend and become dark red.

Bearish: price should be below 5% of the 200-period EMA. Light-green BBTrend has to change in trend and become dark green.

Investment: risk 5% per stop loss. This means that you lose 5% of your balance if the stop is hit, but gain 15% once the profit target is hit.

Stop and profit targets

Stop-loss: place stop just above the most recent swing-high.

Take profit: 3x the stop-loss distance.

Results

Win-rate: 4/8, 50%

Profit: +42%

(1.15*1.15*0.95*0.95*0.95*1.15*1.15*0.95)

I'm aware of trading within existing trades, but for the sake of simplicity I use this easy profit calculation method.

Final remarks

This strategy works well in strongly trending markets due to the higher probability of the trend continuing the current direction. In periods of prolonged trading around the 200-period EMA it can get tricky to get a good trade in, hence we only trade once we're at least at 5% distance of the EMA.

This trend-following strategy can be used on every asset and on every time frame. Just make sure to be consistent.

Good luck!