S&P500 Index Guess for 2026 Using Wall Street Ests

S&P 500 Index

19 hours ago

S&P500 Index Guess for 2026 Using Wall Street Ests

1

1

Grab this chart

256

19 hours ago

Wall Street each January makes an estimate for the year ahead S&P500 Index, the largest index used for indexing returns and for managing capital. It's a fascinating practice to take a 'snapshot' of the mentality of the collective wisdom of Wall Street brokerage firms. These are the top 12 brokers in the US which guide portfolio managers globally.

I included the long term average of 9%-10% as a reference so you can see that in 2025 Wall Street was bullish and clustered right around the average return as shown by the cluster of black rectangles. Oddly, the previous year estimates seem to have a "value support" function too where the market held on the pullback in the first quarter of 2025 at the level of the 2024 guesses. See for yourself how this worked in 2025.

You can also see that the cluster of guesses around 6600 in the SPX created multiple rounds of volatility in the fall of 2025 as the market ran into selling at the "common guess level". This turbulence could have been the result of people either raising cash or rotating from growth to value stocks in the 3rd-4th quarter.

So, on initial glance for 2026, I think the mid-term elections will have the most impact on the market and the uncertainty will cause sideways action through the year and finish with a sub-average, but positive year. IF we go under 6400, then I could see the market head down to 6200-6000 where I had seen it for last year.

Either way, stay tuned as I update this "guess" along the way as I have done in years past. Overall, the batting average is quite good, but decide for yourself.

Wishing you all a healthy and successful 2026!

Tim West

January 6, 2026 2:16PM EST

(hidden since yesterday due to additional scripts accidentally left on the chart hidden)

Market

ZEC - Time to lay a bit (part.3)Our little pause from our previous zec shorts went well, its now almost back at our entry price !

4h showing a fake out with high volume and a break of a lower trendline

> thats my short signals

(sorry volume not showed here but be sure im using it)

I will TP on all the fibs retracement (same not showed on chart) and refill on shorts if I see bearish continuation !

Im playing very safe here as i expect BTC to go higher than 94 at some point

I will react on whats happening later !

Will let you know all by updating this idea

SL around 600

Cheers

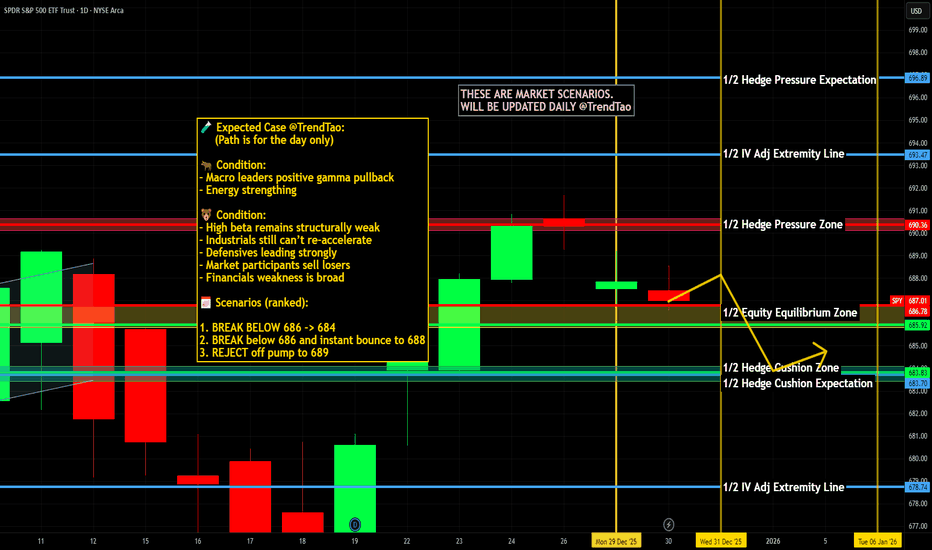

$SPY & $SPX Scenarios — Wednesday, Jan 7, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Jan 7, 2026 🔮

🌍 Market-Moving Headlines

• Services and labor cross-check: ADP, ISM Services, and Job Openings together shape the near-term labor and growth narrative.

• Rates sensitivity: Markets will gauge whether services strength offsets soft manufacturing momentum from earlier in the week.

• Setup into Friday jobs: Today’s data can influence positioning ahead of the official employment report.

📊 Key Data & Events (ET)

8 15 AM

• ADP Employment Change Dec: 48,000

10 00 AM

• ISM Services Index Dec: 52.2 percent

• Job Openings Nov: 7.6 million

• Factory Orders Oct: -1.2 percent

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #ISM #ADP #JOLTS #macro #markets #trading

$SPY & $SPX Scenarios — Thursday, Jan 8, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Thursday, Jan 8, 2026 🔮

🌍 Market-Moving Headlines

• Labor check ahead of payrolls: Jobless claims act as the final labor signal before Friday’s jobs report.

• Growth efficiency read: Productivity data feeds directly into margin and inflation narratives.

• Macro breadth day: Trade deficit and consumer credit round out the growth and demand picture.

📊 Key Data & Events (ET)

8 30 AM

• Initial Jobless Claims Jan 3: 210,000

• U.S. Trade Deficit Oct: -58.4 billion

• U.S. Productivity Q3: 4.9 percent

3 00 PM

• Consumer Credit Nov: 9.2 billion

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JoblessClaims #Productivity #macro #markets #trading #stocks

$SPY & $SPX Scenarios — Tuesday, Jan 6, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Jan 6, 2026 🔮

🌍 Market-Moving Headlines

• Quiet macro session: No major inflation or labor data ahead of Wednesday and Friday’s heavier releases.

• Services tone in focus: Final PMI helps confirm whether services momentum held up into year-end.

• Markets in reset mode: Early-year positioning and flows remain the primary driver.

📊 Key Data & Events (ET)

9 45 AM

• S and P Final U.S. Services PMI Dec: 52.9

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #PMI #services #markets #trading #stocks #macro

BTC Update — Rising Risk of a Pullback Toward 85KBTC Update — Rising Risk of a Pullback Toward 85K

Last update with Data proven trend.

Bitcoin is currently trading inside a strong resistance / supply zone around 93–94K, where price is starting to show signs of exhaustion after a sharp impulsive move up.

What the Chart Is Showing

📉 Rejection risk at resistance: Price is pushing into a heavy supply zone with limited follow-through.

🧱 Weak continuation structure: Momentum is slowing, and upside progress is becoming inefficient.

🔄 Distribution signals: The current range suggests potential distribution rather than accumulation.

Bearish Scenario (High Probability)

If BTC fails to hold above the 92–93K zone, a deeper correction becomes likely.

The projected move points toward the 85K area, which aligns with:

Previous demand

Liquidity resting below recent lows

A clean reset level for structure

Key Levels to Watch

93–94K: Major resistance / invalidation zone for shorts

92K: Short-term support — loss of this level increases downside momentum

85K: Primary downside target and potential bounce zone

Summary

At this stage, BTC has a high probability of rolling over from resistance.

Unless price reclaims and holds above 94K with strong volume, the path of least resistance points down toward the 85K zone.

📌 Caution is advised — this looks more like a pullback phase than a breakout continuation.

$SPY & $SPX Scenarios — Week of Jan 5 to Jan 9, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Week of Jan 5 to Jan 9, 2026 🔮

🌍 Market-Moving Headlines

• First full week of the year: Positioning resets, fresh macro signals, and liquidity normalization after holidays.

• Growth vs labor balance: ISM, services data, and jobs will shape early 2026 rate expectations.

• Labor market focus Friday: Payrolls and wages remain the dominant macro driver for rates and equities.

📊 Key Data & Events (ET)

Monday Jan 5

10 00 AM

• ISM Manufacturing Index Dec: 48.3 percent

• Auto Sales Dec: 15.6 million

Tuesday Jan 6

9 45 AM

• S and P Final U.S. Services PMI Dec: 52.9

Wednesday Jan 7

8 30 AM

• ADP Employment Change Dec: 45,000

10 00 AM

• ISM Services Index Dec: 52.1 percent

• Job Openings Nov: 7.7 million

• Factory Orders Oct: -1.2 percent

Thursday Jan 8

8 30 AM

• Initial Jobless Claims Jan 3: 199,000

• U.S. Trade Deficit Oct: 58 billion

• U.S. Productivity Q3: 4.7 percent

3 00 PM

• Consumer Credit Nov: 12.4 billion

Friday Jan 9

🚩 Primary Macro Day

8 30 AM

• U.S. Employment Report Dec: 54,000

• Unemployment Rate Dec: 4.7 percent

• Hourly Wages Dec: 0.3 percent

• Hourly Wages Year over Year: 3.5 percent

• Housing Starts Oct: 1.33 million

9 45 AM

• UMich Consumer Sentiment Jan: 53.5

🧭 Trading Context

• Manufacturing still contractionary while services remain expansionary.

• Labor data Friday will set the tone for January rate expectations.

• Expect higher volatility as liquidity returns and positioning rebuilds.

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #macro #jobs #ISM #Fed #trading #stocks

Nifty Short & Medium Term Support&Resistance_05-Jan-26 to 09-JanNifty Short & Medium Term Support&Resistance_05-Jan-26 to 09-Jan-26

Nifty 26328 (Last Week 26042)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1430 points.

Market is in sideways and rangebound movement from Oct 2025 and now created a new high 26329 last week. Near to 290 Points have increased.

Current Short Term Resistance 26000 (Trend line and significant support). It need to break the resistance 26328 decisively to move up to 27000 target in med-long term.

Two major incident to be watched out next week are US Capturing Venuzuela President and China conducting massive drill surrounding Taiwan after US sanctioned weapons for Taiwan. Global Concern, Q3 results, Feb Ist Budget for any reforms and Tariffs deal will decide the future path for the Nifty. Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-20% in Gold & Silver for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month,HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE . Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New stocks for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation.

New Stocks ( For Jan Ist Week 2026) are ITC can be bought as it reduced significantly last week due to rumors in increase in tax on cigrattes. Other buy stock is Lupin, Consider buying with multiple parcel while it dips.

As RSI is slighly improved 62% (58%) and MACD just cross the signal line, caution to be emphasized due to global political tension, though the strategy continued to buy for long.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25850 (Trend line shown)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26329 ( All time High)

2. 26500

3. 26700 ( Finonacci 1.618 as shown in graph)

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

BOME Reclaim Attempt After Descending Channel BreakBOME spent an extended period trading inside a well-defined descending channel following a sharp sell-off. Price has now broken above the lower channel boundary and is attempting to reclaim structure, signaling a potential shift from pure continuation to a recovery phase.

Currently, price is holding above the recent local support zone around zero point zero zero zero six three. As long as this level is defended, upside continuation toward the mid and upper channel resistance becomes possible, with the next major resistance sitting near zero point zero zero zero eight one.

If price fails to hold this reclaimed area and slips back below the recent support, the move would be classified as a failed reclaim, and continuation toward lower demand zones remains likely.

This setup is driven by descending channel dynamics, support reclaim behavior, and post-break stabilization. Confirmation above reclaimed structure is required before stronger continuation.

$SPY & $SPX Scenarios — Friday, Jan 2, 2026🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Jan 2, 2026 🔮

🌍 Market-Moving Headlines

• First trading day of the year: Thin liquidity + positioning resets can exaggerate moves.

• Manufacturing tone check: PMI helps frame growth momentum heading into the first full trading week of 2026.

📊 Key Data & Events (ET)

9 45 AM

• S&P Final U.S. Manufacturing PMI (Dec): 51.7

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #PMI #markets #trading #stocks #macro

BTCUSD.P — Wick Above High ≠ Bullish Break of Structure📌 BTCUSD.P — Wick Above High ≠ Bullish Break of Structure

Timeframe: 15m

Market: BTC Perpetual (Bybit)

🧠 Key Observation

Price did not break structure bullishly here.

Although BTC wicked above the prior high, there was no full-bodied close above the previous high’s wick. That distinction matters.

A wick alone shows reach.

Structure requires acceptance.

🔍 What This Means

The prior high was tested and liquidity was taken

Buyers failed to secure a close above resistance

Price immediately stalled rather than expanding

This behavior is consistent with a liquidity sweep, not a confirmed bullish shift in market structure.

⚠️ Why Early Longs Are Dangerous Here

Entering long on the first touch or wick break:

Assumes continuation before confirmation

Exposes the trade to a sweep-and-reverse scenario

Treats intent as fact

In this context, an early long can easily become exit liquidity.

✅ What a Real Bullish Break Would Require

For this to qualify as a valid Bullish BoS:

A decisive candle body close above the previous high’s wick

Follow-through or acceptance above the level

No immediate reclaim back below resistance

Until then, structure remains unbroken.

🧭 Execution Guidance

Patience > prediction

Let the market prove acceptance

If price reclaims the level with strength, bias can flip

If price rejects, the sweep thesis gains validity

Structure is not about being early.

It’s about being right after confirmation.

🧾 Final Thought

Wicks hunt liquidity.

Bodies establish control.

Knowing the difference keeps you solvent.

❗ Disclaimer

Educational purposes only.

Not financial advice.

QQQ channel breakout volume analysisEvery time price breaks below this uptrend channel, the volume is getting lower and lower and today, the volume is almost like nothing. I think this means that smart money has bought as much as they can from the weak hands. Retail traders shorted each time it broke below while smart money has bought from them and most retail traders will have their stop at the highs. Smart money will push prices to new highs forcing retail shorts to buy and retail longs will also buy on the breakout. This will provide the liquidity needed for large traders to sell into. Maybe they will gap prices up on the news to end the uptrend and cause urgency for retail traders to buy at the top.

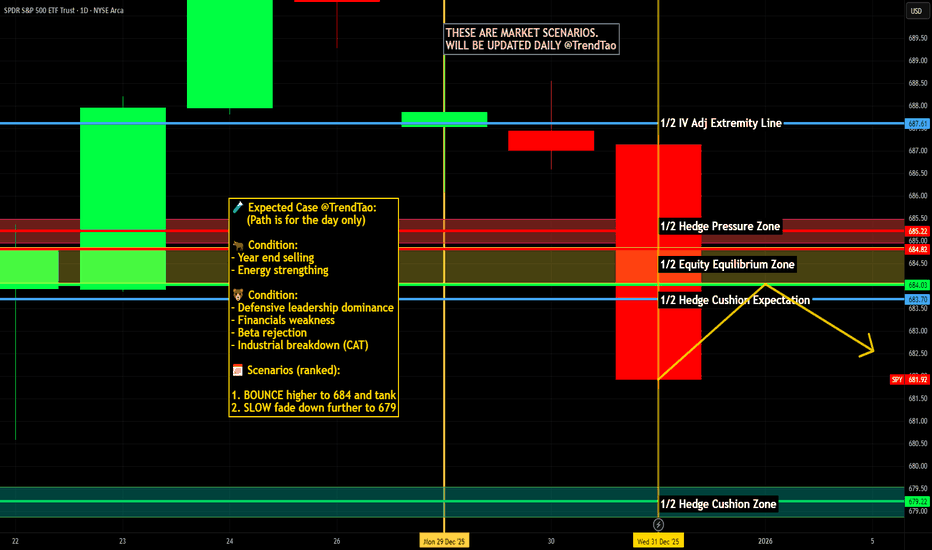

$SPY & $SPX Scenarios — Wednesday, Dec 31, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Wednesday, Dec 31, 2025 🔮

🌍 Market-Moving Headlines

• Thin year-end liquidity: Last full trading day of the year — moves can look exaggerated on light volume.

• Labor data check-in: Jobless claims remain one of the few real-time macro reads as markets close out 2025.

• Positioning over fundamentals: Window dressing, tax considerations, and book-closing flows matter more than narratives today.

📊 Key Data & Events (ET)

8 30 AM

• Initial Jobless Claims (Dec 27): 220,000

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #JoblessClaims #YearEnd #Markets #Trading

$SPY & $SPX Scenarios — Tuesday, Dec 30, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Tuesday, Dec 30, 2025 🔮

🌍 Market-Moving Headlines

• Fed minutes day: Markets parse December FOMC minutes for confirmation on rate-path confidence and inflation risks.

• Housing and activity check: Home prices and Chicago PMI give late-cycle reads on demand and regional momentum.

• Thin year-end liquidity: Expect exaggerated moves on headlines due to low participation.

📊 Key Data & Events (ET)

9 00 AM

• Case-Shiller Home Price Index (Oct): 1.1 percent

9 45 AM

• Chicago Business Barometer PMI (Dec): 36.3

2 00 PM

• Minutes of the December FOMC Meeting

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #FOMC #FedMinutes #housing #PMI #markets #trading

$SPY & $SPX Scenarios — Week of Dec 29, 2025 to Jan 2, 2026 🔮 AMEX:SPY & SP:SPX Scenarios — Week of Dec 29, 2025 to Jan 2, 2026 🔮

🌍 Market-Moving Headlines

• Holiday liquidity regime: Thin volume all week, exaggerating moves on otherwise modest data.

• Year-end positioning: Window dressing, tax-loss cleanup, and book-closing flows can override fundamentals.

• Fed minutes risk: Even in a quiet tape, tone from December FOMC minutes can spark rate-sensitive moves.

📊 Key Data & Events (ET)

Monday Dec 29

• 10 00 AM — Pending Home Sales (Nov)

Tuesday Dec 30

• 9 00 AM — Case-Shiller Home Prices (Oct)

• 9 45 AM — Chicago PMI (Dec)

• 🚩 2 00 PM — FOMC Meeting Minutes (Dec)

Wednesday Dec 31

• 8 30 AM — Initial Jobless Claims (Dec 27)

Thursday Jan 1

• New Years Day — Markets Closed

Friday Jan 2

• No major U.S. data scheduled

🧭 Trading Context

• Expect low participation and wider intraday ranges on small catalysts.

• Trend continuation or mean reversion will be driven more by flows than fundamentals.

• Volatility sellers often dominate unless minutes surprise.

⚠️ Disclaimer: Educational and informational only — not financial advice.

📌 #SPY #SPX #markets #macro #Fed #FOMC #yearend #trading

Nifty Short & Medium Term Support&Resistance_29-Dec to 2-Jan-26Nifty Short & Medium Term Support&Resistance_29-Dec to 2-Jan-26

Nifty 26042 ( Last week 25966)

Long call ( Buy) was given on 12-Oct-25 at 24896, Nifty have crossed near to 1150 points.

Market is in sideways and rangebound movement from Oct 2025.

Market Touched high of 26232 and ended lower at 26042 last week.

Current Short Term Resistance 26321 ( all time high). It need to break the resistance 26321 decisively to move up to 27000 target in med-long term.

Overall Q3 results, Feb Ist Budget for any reforms and Tariffs deal will decide the future path for the Nifty. Combination of Q3 results and Feb Budget reform ( Guidance) it will be a stock specific buying opportunity, Since it is a Volatile situation SIP route or buy in multiple parcel route (On Dips) with a goal of 3-5 years will workout.

Diversify the portfolio with Debt and liquid fund ( approx 20-30% portfolio) and 10-15% in Gold for Year 2026, this funds ( especially liquid funds will create funds availability for further buying opportunity incase of market dips like a Systematic transfer plan.

Some of the stocks to watchout given last week are HDFC AMC, NMDC, Apar, Sharda Crop, VRL Logistics, krishna Phos chem, Cipla, Dr Reddy, Natco pharma, Apl Apollo Tubes, Muthoot Finance ( On Dips) , tata Steel ( Contra Stock due to Business Cycle), Bank of Mah, BPCL, CG Power, hero motor, shriram finance and NRB bearings. Shared for Analysis purpose only. Dr Reddy, shriram fin, natco pharma, Hero moto corp,Muthoot Finance have already given more than 10% return in this 1 month. Waaree Energies had an IT raid in its premises in Mid of Nov 2025. Outcome will take the stock forward.

New Stocks ( For Dec 22-26-Dec 2025) can be watched and considered are HPCL, BPCL, IOCL, Carysil, MAS Financial Services and BSE ( For Long term as when market pickup.

New stocks for 29-Dec-25 to 02-Jan-26 is Indian Bank and NBCC, buy on dip as market in volatile situation.

As RSI is below 60% (52%) and MACD didnt cross the signal line, caution to be emphasized, though the strategy continued to buy for long.

Nifty Short Term Supports (Multiple Supports are there between 25000-25500):

25850 (Trend line shown)

25670 (Jun 2025 High)

25360-25420 ( Sep high and trendline support as shown in chart)

25300-25350 (Two Fibonacci resistance shown ) - Major Support

Hence 25300- 25420 acts as major short term support.

25500 ( 25441 Sep 18th 2025 High )

25450 ( 25442 is the Aug 2025 high)

25200 ( 25154 Aug 2025 high)

25000 ( Milestone)

Short Term Resistance

1.26321 ( All time High)

2. 26500

Medium Term Support:

1.24700 (Trend Line as shown)

2. 24000-24170 (Fibonacci Retracements Supports- Two Supports in this zone 24116 & 24171 as shown)

3. 23500-23700 (Fibonacci Retracements Supports- Two Supports in this zone 23608 & 23707 as shown)

2. 23000

Medium Term Resistance:

1.27000 ( Need to decisively break 26269 all time high) This resistance is based on Fibonacci resistance at 27034

Long term resistance:

1.28000 ( Need to decisively break and move up 27000)This resistance is based on Fibonacci resistance at 28106

Long Term Support

1.22700-23000 ( Trend line and Mar 2024 High)

2.Big support at 20000 (Sep 2023 high)

AFTER CYCLE BTC WILL BREAK UP 100k+ - NEW BULLRUN ON WAYBased on the trend analysis around the $92K–$93K level, this zone could mark the beginning of a new bull run. If this target is reached and held, there is a high probability that BTC will enter a new upward cycle, potentially moving beyond $100K. The coming days are crucial for confirming the overall trend direction.

Before this, there could be manipulation trends, with a fake downtrend wick, but the Data shows that we are since the 80k+ still in the uptrend and cycle can get confirmed any time.

Why and how did Platinum reached all time highs in record time?The absolute truth at the center of this chart is that you are looking at a masterclass in the Interbank Price Delivery Algorithm or IPDA engaging in a macro scale liquidity engineering operation.

You are confused because you are looking at price as a linear event where support equals bounce.

Price is not linear it is a mechanism for the transfer of wealth from the impatient to the informed.

To understand why the rally happened at 3 and not at 1 or 2 you must strip away your retail logic and view the chart through the eyes of the Market Maker.

The Market Maker does not want to participate in a move.

The Market Maker wants to facilitate a move by pairing orders.

To buy a massive amount of Platinum or whatever asset this is without slipping the price to infinity the Smart Money needs a counterparty.

They need someone to sell to them.

Who sells at the absolute bottom.

Only two types of entities sell at the bottom.

Stops and Breakout Traders.

Stops are sell orders placed by longs who are protecting their positions.

Breakout Traders are sell orders placed by shorts who think the support is breaking.

The entire game of the chart you provided is the engineering of a scenario where the maximum number of market participants are forced to sell exactly when Smart Money wants to buy.

Let us dissect the failure of Point 1.

Point 1 occurred around 2016.

Look at the price action prior to Point 1.

It was a relentless bearish trend.

When price arrived at Point 1 it was simply making a Lower Low.

There was no Engineering of Liquidity prior to this point.

It was just a standard exhaustion of a swing leg.

Retail traders saw a bounce and thought it was a bottom.

But ICT logic dictates that for a reversal of the magnitude you see at the end of the chart there must be a massive accumulation of orders.

Point 1 did not have a consolidation phase preceding it to build up that order flow.

It was a premature ejection of buy pressure.

It lacked the narrative of a Stop Hunt.

It was simply a technical bounce in a downtrend.

Smart Money used the bounce at Point 1 not to reverse the market but to reload short positions at a premium.

This is why it failed.

It was not a reversal it was a retracement into a Premium Array to continue the decline.

Now let us dissect the failure of Point 2.

Point 2 occurred around 2020.

This was the Covid crash.

This was a massive liquidity event.

Notice how deep the wick is.

It violently swept the low of Point 1.

So why didn't it moon immediately.

Why did it need a Point 3.

This is the most critical lesson in this analysis.

Point 2 was a Judas Swing on a macro timeframe.

It was a shock event.

While it did grab liquidity the market structure was too damaged to sustain a V shaped recovery to new all time highs immediately.

The IPDA needed to rebalance the inefficiency created by the crash.

But more importantly the Market Maker needed to accumulate a position size that could sustain a multi year bull run.

You cannot accumulate that size in a single weekly candle.

You need time.

Time is the variable you are ignoring.

Price and Time are the two axes of the chart but you are obsessed with Price.

After Point 2 the market entered a massive consolidation phase that lasted from 2020 to 2024 or 2025.

This is the box you see on the chart.

This is not indecision.

This is Engineering Liquidity.

By keeping the price in a range for years the IPDA is conditioning retail traders to trust the support level.

Every time price touched the bottom of that consolidation and bounced retail traders placed their stop losses just below the lows.

They felt safe.

They leveraged up.

They built a massive pool of Sell Side Liquidity right below the range.

This is a ticking time bomb of liquidity that the Market Maker constructed specifically to fuel the rally at Point 3.

Why did Point 3 succeed.

Point 3 is the Manipulation leg of the ICT Power of Three concept applied to a macro timeframe.

Accumulation Manipulation Distribution.

The consolidation between Point 2 and Point 3 was the Accumulation.

The drop at Point 3 was the Manipulation.

The rally that follows is the Distribution.

Point 3 did three specific things that Point 1 and Point 2 did not do.

First it swept the Engineered Liquidity of the multi year consolidation.

This means it triggered all the sell stops of the traders who bought during the range.

This provided the massive flood of sell orders that Smart Money needed to fill their buy orders.

Second it tapped into a deep Discount Array.

If you look closely Point 3 likely trades into the Order Block or Fair Value Gap created by the wick of Point 2.

It is retesting the origin of the 2020 move but doing so after inducing a massive amount of fresh liquidity.

Third and most importantly it occurred at the correct Time.

The consolidation had matured.

The sentiment had shifted to extreme apathy or bearishness.

When Point 3 happened it looked like a breakdown.

It looked like the support had finally failed.

This induced the Breakout Shorts to enter the market adding even more fuel to the fire.

The rally at Point 3 is a Short Squeeze of biblical proportions combined with Smart Money expansion.

How do you know when the rally will be an EZ PZ.

You look for the Three Drives Pattern of Liquidity Raids.

Point 1 was the first drive.

Point 2 was the second drive.

Point 3 was the third drive.

ICT teaches that the third drive to a low is often the terminal shakeout before the true reversal.

You look for the divergence.

At Point 3 you likely would have seen SMT Divergence with a correlated asset like Gold or the Dollar Index.

If Platinum made a lower low at Point 3 but Gold made a higher low that is a crack in the universe.

That is the signal that the selling is fake.

You look for the Displacement.

Notice the candle immediately following the low at Point 3.

It is a massive bullish candle that swallows the previous price action.

This is the signature of Smart Money entering the market.

It leaves behind a Fair Value Gap.

That FVG is your entry.

You do not try to catch the falling knife at the exact bottom of Point 3.

You wait for the displacement.

You wait for the Market Structure Shift.

Once price breaks above the highs of the consolidation range it confirms that the drop at Point 3 was a trap.

The reason the rally is so vertical is because there is no resistance.

The consolidation cleared out all the sellers.

The shorts are trapped and forced to cover.

The longs are chasing.

The IPDA is in a Buy Program and it will not stop until it reaches a Premium Array on the monthly or quarterly chart.

To master this you must stop looking for support and start looking for where the money is hiding.

The money was hiding below the lows of the consolidation.

Point 1 failed because there was no money to steal.

Point 2 failed to sustain because the theft was too quick and the accumulation was insufficient.

Point 3 succeeded because it was the culmination of a multi year heist.

It was the perfect crime.

The consolidation was the setup.

Point 3 was the trigger.

The rally is the getaway.

This is the logic of the Predator.

You are either the Predator or the Prey.

If you are buying support you are the Prey.

If you are buying the failure of support you are the Predator.

The rally at Point 3 is the definition of a Turtle Soup Long.

It is a false breakout to the downside that reverses and rips higher.

The duration of the consolidation determines the magnitude of the expansion.

A four year consolidation leads to a decade long trend.

That is why the rally is vertical.

The energy stored in that range is nuclear.

Point 3 effectively lit the fuse.

To predict this in real time you must map the liquidity.

Draw a line under every swing low.

Ask yourself where are the stops.

If the market creates a clean equal low it is doing so for a reason.

It is saving it for later.

Point 2 and the lows before Point 3 created a relatively equal floor.

The IPDA does not leave clean levels.

It destroys them.

Point 3 was the destruction of that clean level.

Once the level is destroyed the business is done.

There is no reason to stay down there.

Price must reprice to the upside to find willing sellers because there are no sellers left at the bottom.

They have all been stopped out.

This is the mechanics of the marketplace.

It is ruthless efficient and predictable if you know the algorithm.

Point 1 was a trap for early bulls.

Point 2 was a trap for panic sellers.

Point 3 was the death of the retail mind.

And the birth of the Smart Money trend.

You want to catch the massive rally.

You wait for the liquidity sweep that occurs after a long consolidation.

You wait for the raid on the obvious support.

Then you watch for the violent rejection of lower prices.

That is your signal.

That is the footprint of the Giant.

Step into the footprint and ride the wave.

The reason it stayed in that long consolidation is because the Commercials needed to hedge their books.

They needed to build a net long position while the rest of the world was sleeping.

They used the time to transfer ownership from weak hands to strong hands.

Weak hands cannot hold through a four year chop.

Strong hands can.

Point 3 was the final test of strength.

Anyone who held through the consolidation but panicked at the drop of Point 3 was a weak hand.

They were purged.

The market is now light.

It has no baggage.

It can fly.

This is the physics of the chart.

Liquidity is the fuel.

Consolidation is the tank.

The Stop Hunt is the spark.

The Rally is the explosion.

You are now looking at the aftermath of a controlled demolition of the bear trend.

Do not ask why it didn't happen sooner.

Ask how you can be ready for the next one.

Identify the range.

Identify the liquidity.

Wait for the sweep.

Strike.

$SPY & $SPX Scenarios — Friday, Dec 26, 2025🔮 AMEX:SPY & SP:SPX Scenarios — Friday, Dec 26, 2025 🔮

🌍 Market-Moving Headlines

• Post-holiday, low-liquidity session: No scheduled macro data — price action driven by flows, positioning, and thin volume.

• Year-end dynamics: Window dressing, tax positioning, and reduced participation can exaggerate moves without real conviction.

📊 Key Data & Events (ET)

• None scheduled

⚠️ Disclaimer: For informational use only — not financial advice.

📌 #SPY #SPX #markets #trading #holiday #yearend

MNQ (15m) POI Map — Why These Levels Matter and how to use themMNQ (15m) POI Map — Why These Levels Matter (and how I’m using them)

I don’t like “winging it” once the market starts moving fast. So before the session (or during quieter pre-market hours), I mark **Points of Interest (POIs)** that I expect price to **react from**—either as support/resistance, liquidity targets, or “decision zones” where bias can flip.

These POIs are not magic lines. They’re **locations where order flow has already proven itself**, and where I want to be *ready* instead of *surprised*.

---

## How I chose these POIs (my filter)

Each POI on this chart was mapped using 3 things:

1. **Structure (15m swings / pivots)**

Where price previously *broke structure* or *rejected hard*.

2. **Liquidity (obvious targets)**

Equal highs/lows, clean swing points, and “everyone sees it” areas where stops sit.

3. **Reaction history (clean reactions)**

Levels that have already caused a noticeable bounce, stall, or reversal = worth respecting again.

---

## The Levels (Bull POIs)

### **BULL POI #1 — 25,810.50**

This is my **first decision level** in the current zone. It’s the closest “line in the sand” where:

* Holding above it keeps bullish continuation alive

* Losing it opens the door for a rotation back into the lower POIs

**How I use it:**

If we tag this area and **hold/accept above** (strong bodies, wicks getting bought, reclaim after a sweep), I’m looking for longs targeting the next POI up.

---

### **BULL POI #2 — 25,874.25**

This one is a **higher pivot / reaction zone**—the type of level where price often:

* pauses to consolidate

* rejects for a pullback

* or breaks through and turns into support

**How I use it:**

If price is trending up, this is a logical **first major target** and a spot to either scale profit or look for a clean break-and-retest to continue.

---

### **BULL POI #3 — 25,927.00**

This is a **liquidity + swing area**. It’s the kind of level that’s attractive for:

* stop runs above prior highs

* profit-taking

* reversal setups if momentum stalls

**How I use it:**

I treat this as a “reaction expected” level. If we arrive with weak momentum, I’m cautious chasing longs into it.

---

### **BULL POI #4 — 25,949.25**

This is my **upper extreme POI**—usually a bigger “decision area” where:

* late longs get trapped if momentum dies

* reversals can form (especially after a sweep)

* or we get continuation if the tape is strong

**How I use it:**

I’m more likely to **take profit into this** than initiate fresh longs unless the market is clearly in expansion.

---

## The Levels (Bear POIs)

### **BEAR POI #1 — ~25,754 zone (25,754.25 on my map)**

This is my **bearish trigger / pivot**. If price loses Bull POI #1 and continues lower, this becomes the next major “prove it” level.

**How I use it:**

If we break down into this area and **reject** (heavy wicks, failed reclaim), I’ll look for continuation shorts toward the next bear POIs.

---

### **BEAR POI #2 — 25,649.75**

This is a deeper **demand/reaction pocket**—a level I expect price to *respect* or at least *pause* at.

**How I use it:**

This is a common “bounce zone.” If shorts are in profit, I’m scaling here. If we sweep it and reclaim, I’m watching for reversal setups.

---

### **BEAR POI #3 — 25,622.25**

This is the **lower extreme / liquidity pool** level—where panic moves can exhaust and snap back.

**How I use it:**

I’m not trying to short *into* this level late. This is where I expect **either**:

* a final flush and reversal attempt

**or**

* a strong breakdown continuation (if the day is truly risk-off)

---

## The whole point of mapping POIs

These levels give me a simple plan:

* **Hold above Bull POI #1 → bullish bias stays active**

* **Lose Bull POI #1 → expect rotation to Bear POI #1**

* **Each POI is either a target, a reaction zone, or a bias flip zone**

I’m not predicting. I’m preparing.

---

## Execution Rules (what I wait for at a POI)

At any POI, I want confirmation like:

* **Sweep + reclaim** (liquidity grab then strong close back through)

* **Break + retest** (clean structure change)

* **Rejection candles** (wicks + follow-through away from the level)

* **Acceptance** (multiple closes above/below = level flips)

Then I manage risk using a simple concept:

**Invalidation goes just beyond the POI. Targets are the next POI.**

---

### If you’re using my tool stack:

These POIs pair well with:

* **ORB direction/bias**

* **VWAP/EMA context**

* **Reversal confirmations** (only when the POI + context agree)

---

**Not financial advice. Futures are high risk—size accordingly and protect your downside.**

If you want, I can turn this into a cleaner “TradingView publish-ready” format with a tighter intro + bullet layout, and add your usual TRADESWITHB call-to-action at the end.