Crypto Total Market Cap (Excl. Top 10)Crypto Total Market Cap (Excl. Top 10)

Price still moving inside a long-term descending wedge on the weekly timeframe.

Currently sitting near major lower trendline support (~7.3%) — key reaction zone.

Momentum remains weak, but downside looks limited while support holds.

A solid bounce from this zone → could start a relief rally toward 9–12% dominance (altcoins outside top 10 gain strength).

Breakdown below wedge support → continuation of weak altcoin participation.

Overall: At critical support — bounce zone, not breakout yet.

Marketprofile

Not Every Trade Will Happen — Discipline Comes FirstSometimes the market gives us a setup… but the conditions we need never appear.

Price may reach a zone that looks promising, show a small reaction, and then move away.

For me, that first touch is information, not a trade.

I wait for confirmation — absorption, commitment, and proper structure on lower timeframes.

This approach means:

-watching price move without me,

-missing what might look like a “perfect” trade,

-staying flat while others are active.

And that’s okay.

Activity is not the same as progress.

By waiting for confirmation, I trade less — but with intention.

Risk stays defined, decisions remain clean, and outcomes become repeatable.

Not trading is not hesitation.

It’s discipline.

And discipline is part of the system.

>If you want to see how I analyze setups in real time and share my thought process on each move, hit follow and join the journey.

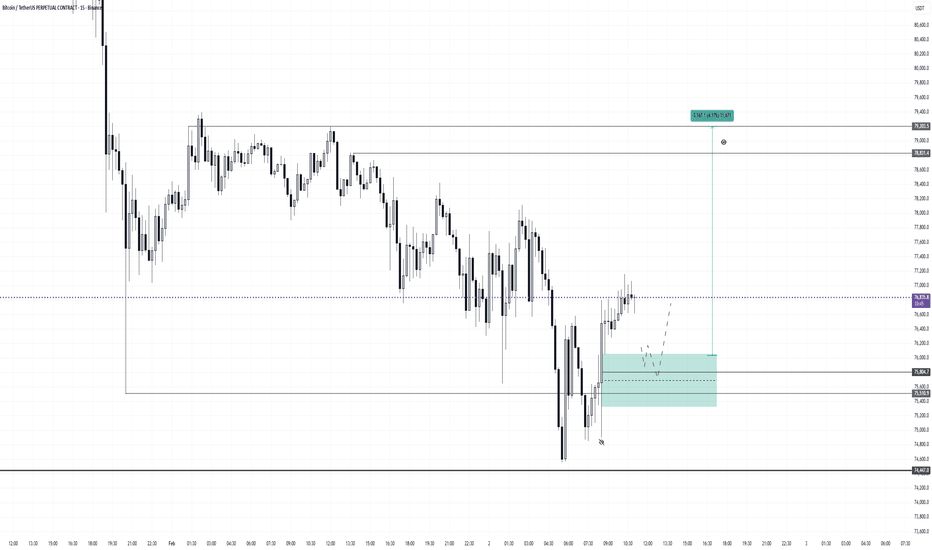

BTCUSD — Intraday Long (Expectation)I’m considering long exposure within the 75,400–76,000 range.

Context:

Daily composite support

Local sell-side absorption

Buyer stimulation visible after sell lock-in

Ideally, I want to see a controlled bullish impulse from the zone to confirm acceptance.

Targets:

78,800

79,200

Invalidation:

Sustained acceptance below 74,900.

No confirmation — no trade.

Risk will be kept minimal and strictly managed.

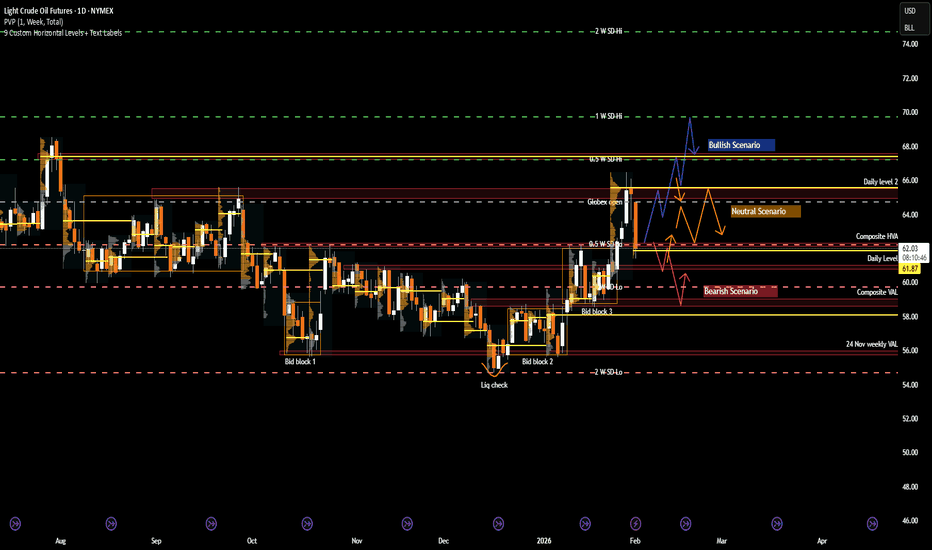

CL: Crude Oil at a Crossroads as Geopolitics Meet Key LevelsRecent Sentiment and Key Headlines Driving Crude

Crude oil sentiment over recent weeks has been shaped by a renewed mix of geopolitical risk and shifting expectations around global supply discipline. Headlines tied to Venezuela and Iran have been particularly influential, adding a layer of risk premium back into the market after a prolonged period of bearish positioning.

In Iran, renewed domestic unrest has been a notable catalyst. Protests that emerged in late December were initially sparked by economic pressures, including currency weakness, elevated inflation, and deteriorating living standards. As demonstrations spread across several major cities, concerns shifted from purely domestic stability toward potential implications for energy production and exports. While Iranian crude flows have not seen immediate disruption, the market has reacted to the increased uncertainty around enforcement of sanctions, internal security priorities, and the broader risk of escalation in an already fragile region.

Venezuela remains another key variable. Ongoing questions around sanctions compliance, export licenses, and the sustainability of recent production gains have kept traders cautious about assuming incremental supply will remain consistent. Any tightening of enforcement or breakdown in negotiations could quickly alter expectations, particularly given the market’s sensitivity to marginal barrel availability.

Beyond geopolitics, crude continues to trade against a mixed macro backdrop. Global growth expectations remain uneven, with slowing industrial activity in some economies offset by resilient consumption elsewhere. At the same time, OPEC plus communication has reinforced a willingness to manage supply if downside pressure accelerates. Together, these factors have kept sentiment reactive and highly responsive to both headlines and technically defined levels rather than driven by a clear fundamental trend.

What the market has done

• In November 2025, the market was in a grind trend down to bid block 1, where there was a liquidity check and buyers responded by holding the 56 level.

• Since December, the market has been in a block step trend up due to improving risk sentiment, renewed geopolitical premium, and reduced willingness by sellers to press below established value.

• In the past week, the market imbalanced out of bid block 3 above the 62.4 area (the composite HVA) and rotated higher toward the 65 area at daily level 2. This move coincided with a noticeable rise in geopolitical risk premium in oil markets as tensions between the U.S. and Iran escalated. Markets were responding to reports that the U.S. was considering possible military action if Iran did not negotiate a settlement on key issues, which was interpreted by traders as increasing the chance of supply disruption in the Persian Gulf. This elevated risk pricing helped push crude higher into the 65 area as participants priced in the possibility that instability could affect exports or shipping routes through the Strait of Hormuz. During the same period, there were also reports that Iran had announced live-fire exercises in the Strait of Hormuz, a key oil chokepoint, reinforcing those risk premiums even though no actual supply disruption occurred. The combination of geopolitical headlines and elevated risk appetite drove sellers to defend higher levels only after the initial breakout, leading the market back down toward 62.5 where responsive orders re-entered.

• Sellers responded by pushing price back down toward the 62.5 area, which corresponds with the weekly 0.5 SD low, signaling responsive selling rather than initiative downside continuation. This pullback was supported by an easing of the geopolitical risk premium that had driven the prior breakout. Over the weekend, no U.S. strike on Iran actually took place, and comments from U.S. leadership over the weekend suggested that Iran and Washington were “seriously talking” about negotiations rather than immediate military action. These remarks reduced the acute fear of an imminent strike that had been pushing oil toward multi-month highs late last week. As a result, the risk premium priced into crude unwound somewhat when markets reopened, and prices retraced back toward the 62.5 area as traders reassessed the likelihood of a near-term supply disruption.

What to expect in the coming weeks

The 62.5 area, which marks the level where the market imbalanced out of bid block 3 last week, remains the key level to monitor.

Bullish Scenario

• If the market holds above the 62.5 area, expect a rotation back up toward the 66 area (daily level 2), where sellers are likely to respond initially.

• If sellers fail to regain control at 66, the market could extend higher toward the 67.5 area, which aligns with the 28 Jul 2025 VPOC and the weekly 0.5 SD high.

• Acceptance above that zone would open the door for a test of the 70 area, corresponding with the weekly 1.0 SD high and a more pronounced shift in medium term structure.

Neutral Scenario

• If buyers defend the 62.5 area but sellers respond firmly at 66, expect a two-way auction to develop.

• In this case, price is likely to re- establish value and work through the repair of the previous week’s LVA, favoring rotational trade rather than trend continuation.

Bearish Scenario

• If buyers fail to defend the 62.5 area, expect a move back down into bid block 3 toward 59.7, which aligns with the weekly 1.0 SD low.

• Further downside could test the 59 area, defined by the bid block 3 low and the CVAL, where buyers are expected to respond and attempt to stabilize price.

Conclusion

Crude oil is currently balancing well defined technical structure against an evolving geopolitical backdrop. Risk premiums re-entered the market as unrest in Iran, U.S. rhetoric around a potential strike, and Iran’s live firing exercises near the Strait of Hormuz raised concerns about supply disruption, even though no strike ultimately materialized. The absence of escalation over the weekend led to some unwinding of that premium, reinforcing the recent pullback as responsive rather than initiative selling. At the same time, Venezuela remains a moderating variable, with questions around sanctions enforcement and incremental supply limiting follow through on both extremes.

From a technical perspective, price remains anchored around the 62.5 area, which continues to act as the primary pivot for directional intent. Acceptance above this level would favor renewed upside rotation toward higher distribution targets, while failure to hold would suggest a return into lower value and corrective trade. As geopolitical headlines continue to ebb and flow, traders should remain focused on how price responds at key levels.

If you found this analysis helpful, consider sharing your own levels or scenarios and join the discussion below

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

C - Composite

w - Weekly

m - Monthly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

NG: Natural Gas Surge as the Polar Vortex Tests the Upper Range Market Overview and Key Drivers

Natural gas futures are among the most seasonally sensitive products in the commodity markets, with prices largely driven by predictable demand cycles and unpredictable weather shocks. Demand typically begins to build in late summer, with prices often finding seasonal lows between July and August before rallying into September and October as the market prices in winter heating demand. Volatility generally accelerates from November through February, when cold weather events, storage draws, and forecast revisions can rapidly shift sentiment. As winter demand fades, prices often soften into March and April, followed by a weaker period in May and June as heating demand subsides and storage injections resume.

Beyond seasonality, traders closely monitor weekly EIA storage reports, temperature forecasts measured through heating degree days, production trends, and LNG export flows. Short term price discovery is frequently driven by changes in weather models, while medium term direction is shaped by whether storage levels and production trends confirm or contradict seasonal expectations.

Natural gas does not maintain a consistent correlation with other energy products, as pricing is driven more by regional supply and demand than global macro flows. That said, broader risk sentiment and energy sector positioning can still influence short term price behavior. Volatility remains elevated, especially during winter, when forecast changes can reprice the market quickly.

Over the past week, natural gas prices reacted sharply to weather driven headlines. A polar vortex warning across large parts of the United States triggered a surge in short term demand expectations, leading to an aggressive upside move. This rally pushed price into the upper portion of the broader multi-year range.

What the market has done

• The market remains within a larger multi-year range, with clearly defined weekly resistance in the 5.8 to 6.0 area and weekly support near the 3.2 area.

• Since the end of winter in 2025, price has respected a block step trend down, consistently rotating lower after each failed rally attempt.

• The market began its seasonal rally in September, driven by expectations of increased winter heating demand and tightening balances.

• Sellers responded aggressively at the start of December at offer block 2, auctioning price lower and pushing the market back toward the 3.2 weekly support area.

• In the past week, a polar vortex weather warning across the United States triggered a sharp upside spike, driving price toward the 5.6 area, aligning with offer block 1 near the top of the multi-year range and directly into the March 2025 mVAH.

What to expect in the coming weeks

The key level to monitor remains the 5.0 area, which aligns with daily level 1, the March mVAL, and the April mVAH. This zone is likely to act as the primary decision point for both buyers and sellers as the winter season progresses.

Bullish scenario

• If the market holds above the previous week’s close at 5.278, continued momentum could carry price higher toward the 6.0 area.

• The 6.0 level aligns with weekly resistance and the upper boundary of the multi year range.

• Sellers are expected to respond aggressively in this area, potentially leading to rotational or rejection based price action rather than sustained breakout behavior.

Neutral scenario

• Price may balance between the 5.0 area and the 5.75 zone for the remainder of the winter season.

• This range represents a region of prior acceptance, with 5.75 aligning with weekly resistance and the March 2025 mVAH.

• In this scenario, traders should expect two sided trade and rotational behavior rather than directional continuation.

Bearish scenario

• If buyers fail to hold price above the 5.0 area, long liquidation could accelerate.

• A downside move could target the SOC, repairing single prints left behind during the recent weather driven rally.

• Buyers are expected to respond near the 4.47 and 4.25 area, which aligns with the December 2025 VPOC and daily level 2.

Conclusion

Natural gas remains a headline driven market where technical structure and macro fundamentals must be evaluated together. While seasonal demand and extreme weather events continue to support volatility, the broader market remains constrained within a well defined multi year range. From a technical perspective, acceptance or rejection around the 5.0 area will likely dictate whether price continues higher toward weekly resistance or rotates lower to repair unfinished auctions. Fundamentally, traders should remain alert to shifts in weather forecasts, storage trends, and production data, as these factors can quickly invalidate technical setups. As winter unfolds, traders will need to respect the speed of rotations and the market’s tendency to punish late positioning near range extremes.

If you found this analysis helpful, consider sharing your own levels or scenarios and join the discussion.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

C - Composite

w - Weekly

m - Monthly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

ES (S&P 500 E-mini) – January 26 Day Session OutlookES (S&P 500 E-mini) – January 26 Day Session Outlook

Timeframe: 15m

Current Price Area: ~6946

Market Context

ES is trading inside a balanced range after a sharp downside liquidation and recovery. Price is currently rotating around high-volume acceptance near 6945–6950, with clear resistance stacked above 6958–6965 and responsive buyers previously defending 6925–6932.

This is a range-to-range auction day unless we see strong initiative volume outside value.

🔹 Key Levels

Resistance / Supply: 6958 – 6965

Acceptance / Pivot: 6945 – 6950 (POC-like behavior)

Support / Demand: 6930 – 6925

Range Low (failure area): 6915 – 6908

📊 Trade Plan – Day Session

9:30 AM – 12:00 PM (Opening Rotation)

Primary Expectation: Responsive trade off extremes, rotation through value.

Trade Idea 1 – Short from Upper Range

Entry: 6958 – 6965

Target: 6946 → 6935

Stop Loss: 6972

Logic: Prior rejection + heavy volume node → sellers defend value high

Alternate Long (Only if Acceptance Holds)

Entry: 6930 – 6935

Target: 6948 → 6955

Stop Loss: 6922

Logic: Buyers defend prior demand and rotate back to POC

12:00 PM – 4:00 PM (Afternoon Continuation / Fade)

Primary Expectation: Either continuation to range extremes or late-day fade.

Trade Idea 2 – Afternoon Long (If Hold Above Value)

Entry: 6940 – 6946

Target: 6958 → 6968

Stop Loss: 6932

Logic: Holding above value = bullish acceptance into close

Failure Scenario – Breakdown Short

Entry: Acceptance below 6928

Target: 6915 → 6905

Stop Loss: 6940

Logic: Loss of demand → liquidation toward prior lows

This is not financial advice. For educational purposes only.

GoldContext: The 5,000 Sentinel & The Structural Void

Related Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Weekly Recap (Jan 19 – Jan 23, 2026)

1. Market Context (Extreme Vertical Initiative)

The auction was a display of Vertical Initiative driven by geopolitical shocks.

• The Structure: MGC sliced through 4,700 and 4,800 with minimal horizontal development, leaving a Thin Profile with Single Print sequences.

• The Behavior: Pure Price Discovery . Friday ended with a Buying Tail , closing at 4,979.7 , confirming OTF buyers remained aggressive into the close.

2. Inventory & Nuance (Safe-Haven Structural Gaps)

• Inventory: Stretched Long . The lack of TPO density below current prices suggests a fragile structure.

• Structural Anomalies: Rapid moves left behind Low Volume Nodes (LVNs) . These are magnets for future Mean-Reversion if the safe-haven bid cools.

Week Ahead Analysis (Jan 26 – Jan 30, 2026)

1. Developing Profile (The 5,000 Battlefield)

• The Magnet: 5,000 is the primary sentinel. Acceptance above triggers a shift into uncharted distributions.

• The Pivot: 4,980 is the floor. Acceptance below suggests a Look Above and Fail .

2. Fundamental Catalyst (The FOMC Gauntlet)

• The Fed (Jan 28): Main event. FOMC rhetoric will decide if the auction continues its vertical search or rotates to find balance.

Daytrade Plan (Jan 26, 2026)

• Bias: Bullish Initiative above 4,980.

• Scenario A: Acceptance with Volume above 5,000 targets 5,050+.

• Scenario B: Rejection at 5,000 targets rotation to the 4,900 HVN .

• Invalidation: Value migration below 4,830 kills the immediate bull case.

Talk to you for the next update.

PL: Platinum at an Inflection PointWhy Platinum Is Moving

Platinum is a unique metal that sits at the intersection of precious and industrial markets. Unlike gold, which is primarily viewed as a monetary or store of value asset, platinum derives a larger share of its demand from industrial uses. Silver sits between the two, with meaningful industrial demand alongside its role as a monetary metal. These include catalytic converters, chemical processing, hydrogen related technologies, and jewelry. Because of this dual role, platinum tends to be more sensitive to shifts in global growth expectations than gold, while still reacting to macro forces such as inflation, real rates, and currency trends.

From a correlation standpoint, platinum often trades in sympathy with gold and silver during periods of broad commodity strength, but the relationship is not constant. Gold typically leads during risk off environments, while platinum performs best when growth expectations improve and industrial demand increases. In recent months, platinum has begun to decouple from gold, showing relative strength as investors price in tighter physical supply and improving demand narratives. Silver has also participated in this move, but platinum’s advance has been more structurally driven rather than purely momentum based.

Recent sentiment has shifted materially since December 2025. After spending years trapped in a large consolidation range, platinum finally attracted sustained institutional interest. Supply constraints from major producing regions, rising costs of extraction, and renewed interest in platinum as a substitute metal in industrial applications have all contributed to the move higher. The breakout since December 2025 reflects a repricing of long term value rather than a short term speculative spike, which helps explain the persistence of the trend despite periods of volatility.

What the Market has done

• The market has been on a bullish uptrend since markets broke out of a multi year consolidation and accumulation range that lasted from December 2021 to June 2025.

• Markets formed two clear accumulation ranges during the advance, suggesting strong two way trade before higher prices were accepted.

• At the start of December 2025, market compressed against daily level 1, forming bid block 1 as buyers continued to absorb supply.

• Buyers initiated higher from this compression and pushed price to new ATHs in the spot market.

• Sellers responded aggressively at the end of December 2025, resulting in a volatile two way whipsaw and expanded range.

• Over the past two weeks, market volatility has contracted and the overall range has narrowed as the market works to establish a new value area at higher prices.

What to expect in the coming week

Key reference levels remain 2500, which marks the CVAH, and 2330, defined by the 5 Jan wVAH and the 12 Jan wVAL. These levels frame the current auction and provide clarity for upcoming scenarios.

Neutral scenario

• Continued two way balanced rotation between 2500 and 2330 would suggest acceptance of higher prices.

• This behavior would indicate responsive participation from both buyers and sellers rather than initiative control.

• Value may continue to build above prior ranges, reinforcing the broader bullish structure without requiring immediate continuation.

Bearish scenario

• If buyers are unable to defend the 2330 area, the auction is likely to rotate lower in search of demand.

• A move toward 2136.9, which aligns with the 5 Jan wVPOC, would be the first downside repair target.

• Continued acceptance below that level could expose the 2069 area, where the CLVN remains untested.

Bullish scenario

• If the market is able to break and accept above 2500, buyers may regain initiative control.

• Acceptance above the CVAH would signal strength and continuation of price discovery.

• This scenario increases the probability of a move toward new ATHs, particularly if value begins to migrate higher.

Conclusion

Platinum’s breakout is occurring against a backdrop of tightening supply, improving industrial demand expectations, and a broader commodity bid as inflation and growth dynamics remain in focus. While the structural shift higher is notable, history offers an important reminder. The last time platinum entered a parabolic phase in 2008, the move was followed by a 67% drawdown that erased four years of gains in just four months. As price continues to build value at higher levels, respecting both macro drivers and auction behavior will be critical in navigating the weeks ahead.

If you found this analysis useful, feel free to give a boost, comment, or share your own levels and scenarios below.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

C - Composite

w - Weekly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

MGC Context: Intra-Period Development & BCOM Absorption AnalysisRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Developing Profile Period)

We are observing the development of the Current Profile Period above the previous session’s value.

• The Structure: Auction is exhibiting Initiative Activity above the Value Area High (VAH) . OTF participants are finding value at higher levels despite BCOM rebalancing.

• The Behavior: No "Look Above and Fail" yet; the market is Building Value at elevated levels, shifting the perception of "fair price."

2. Inventory & Nuance (BCOM Money Flow & Acceptance)

• Mechanical Pressure: Tracking ~$1.4 billion in mechanical sell-side flow in the current profile.

• Absorption Signature: Market is Accepting Price above the 4,600 pivot . High-volume nodes near the range top confirm buyers are absorbing the robot selling.

• Inventory: Long-Stretched inventory. Lack of an Excess Tail at highs suggests the upside auction is incomplete.

3. Fundamental Catalyst (CPI Decision Point)

• Upcoming Profile Impact: US CPI Data (20:30 WIB) will dictate the next Directional Move .

• Scenario A: Weak CPI targets a Trend Day profile toward the next Distribution above ATH.

• Scenario B: Hot CPI triggers Range Extension to the downside, testing the Friday POC at 4,480 .

Plan & Execution

• Bias: Bullish Initiative .

• The Play: Monitoring for Acceptance with Volume above the 4,612 Initial Balance High .

• Invalidation: Failure to maintain trade above the 4,580 High Volume Node signals BCOM flow has gained control.

Talk to you for the next update.

Note :

BCOM = Bloomberg Commodity Index

ZB: 30 Year Treasuries Face a Defining Data Week The Long Bond and the Shifting Inflation Narrative

The ZB thirty year Treasury futures contract represents the long end of the United States Treasury yield curve and is primarily driven by expectations around inflation, growth, fiscal policy, and long term interest rate risk. Because of its long duration, ZB is the most sensitive Treasury product to changes in inflation expectations and shifts in term premium. When markets become concerned about persistent inflation or increased Treasury issuance, ZB tends to underperform. When growth risks rise or inflation pressures ease, ZB often attracts defensive demand.

Within the Treasury complex, ZB sits at the far end of the curve, while ZT two year, ZF five year, and ZN ten year futures reflect progressively shorter duration exposures. ZT is most reactive to Federal Reserve policy expectations, ZN tends to balance policy and growth considerations, and ZB expresses longer term confidence or concern about economic stability and inflation control. Over the past few months, sentiment in ZB has improved as inflation has moderated from prior highs and recession risks have remained present but not fully realized. The narrative since late spring has centered on easing tariff fears, slower but resilient growth, and a market that is gradually reassessing how restrictive policy needs to remain over the long run.

This week, macro data will be a major driver. CPI on January 13th, followed by PPI and retail sales on January 14th, will shape near term direction. A miss in CPI or PPI, particularly on core measures, would likely support ZB as it reinforces the idea that long term inflation pressures are cooling, allowing yields to drift lower. A beat in inflation or strong retail sales would pressure ZB lower, as it would revive concerns that growth and pricing power remain too firm for comfort at the long end of the curve.

What the Market has done

• Since bottoming out at the 109'14 area in May 2025 after tariff fears were alleviated, bids have stepped up and the market has steadily reclaimed the April Trump liberation tariff selloff.

• In September 2025, buyers were able to overcome sellers at 116’00, which was daily level 2 and a four month resistance level where sellers had previously defended.

• Subsequently, buyers were able to defend this level until the end of November, when bids slipped and sellers were able to offer prices down through the September 5, 2025 low value area and single print at 115'20 to 114'20.

• Since December, the market has been consolidating sideways within this zone, filling in and repairing the LVA as balance has developed.

What to expect in the coming week

The key level to watch is 115'25 to 116'00, which represents the previous week’s close, the current consolidation block high, and the over-under zone of daily level 2.

Neutral scenario

• Expect the market to continue consolidating in a tight range, potentially between 115'25 and 115'05, as participants wait for clarity from CPI on January 13th and PPI and retail sales on January 14th.

• In this scenario, rotational and mean reverting behavior should dominate, with responsive buyers and sellers active at range extremes.

Bearish scenario

• If the market is unable to accept above 116'00, expect a rotation back down through the consolidation block toward 114'18, which aligns with the range low and weekly one standard deviation low.

• This bearish scenario is likely to be very choppy and difficult to trade, as the market remains in balance within the broader 116 to 114'20 range.

Bullish scenario

• If the market is able to accept above 116'00, price could move up through offer block 1 toward 117'00, which represents the high of offer block 1 and the weekly one standard deviation high.

• In our opinion, this is the cleaner trade opportunity, as the market would be imbalancing out of the current balanced and composite value area, opening the door for directional follow through.

Conclusion

ZB sits at a critical decision point, balancing between a well repaired value area below and a clearly defined acceptance zone above. With CPI scheduled for January 13th, followed by PPI and retail sales on January 14th, the market is likely to remain patient until these releases provide clarity on inflation persistence and demand strength. A softer inflation print or weaker consumption data would support acceptance higher and reinforce the bullish imbalance scenario, while firmer data could keep ZB capped and pressure price back through the current consolidation. In our opinion, traders should focus on how price responds at 116'00 and 115'25 following the releases, as acceptance or rejection at these levels will likely define the next directional opportunity.

If you found this analysis useful, feel free to give a boost, comment, or share your own levels and scenarios below.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

w - Weekly

VAH - Value Area High

VAL - Value Area Low

VPOC - Volume Point of Control

LVN - Low Value Node

HVN - High Value Node

LVA - Low Value Area

SP - Single print

MGC Context: NY Open Absorption & The 4,600 Line in the SandRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Vertical Initiative vs. Extreme Absorption)

The auction is a textbook case of Vertical Initiative colliding with massive mechanical Absorption .

• The Structure: Gold hit a historic ATH of 4,612.7 today. Price is currently hugging 4,600 . This initiative is fueled by the Fed Independence Crisis after the DOJ served subpoenas to Chair Powell.

• The Behavior: Massive volume at highs indicates a "Transfer of Ownership" from BCOM index sellers to aggressive safe-haven buyers.

2. Inventory & Nuance (BCOM vs. The Fed Bid)

• Mechanical Flow: We are in the peak of BCOM rebalancing (Jan 9–15), which mechanically unloads ~$7 billion (2.4m oz) of gold.

• Absorption Signature: Holding 4,600 against this supply dump is a signal of extreme strength. A weak market would have flushed 2.5–3.0% by now.

• Inventory: Ultra-Long but absorbed. OTF buyers are providing liquidity for every ounce the index robots sell.

3. Fundamental Catalyst (The 24-Hour Outlook)

• Today (Monday): Watching 4,580–4,600 . Acceptance above 4,600 post-mid-day signals the safe-haven bid has exhausted the BCOM sellers.

• Tuesday (Jan 13): US CPI Data . A hot print could break the absorption and launch MGC toward 4,700 .

Plan & Execution

• Bias: Ultra-Bullish Initiative .

• The Play: Watch for a "Look Below and Fail" at 4,580 . If 4,600 holds into the close, target is 4,660 .

• Invalidation: A close below 4,518 implies BCOM selling has finally overwhelmed the buyers.

Talk to you for the next update.

Gold Context: Structural Resilience & The Inflation GauntletRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Weekly Recap & Setup)

The second week of 2026 closed with a powerful display of Responsive Buying . After a healthy mid-week pullback, Gold (MGC) caught a bid and finished the week strong near 4518 .

• Structure: The Friday close created a solid base above previous value. We have successfully reclaimed the 4500 psychological level .

• The Nuance: Trading above 4500 shifts the auction to Initiative . The ATH is now the primary magnet.

2. Inventory & Nuance (Support Clusters)

• The 4500 Pivot: Line in the sand. Trade above confirms dip buyers are in control.

• Friday POC (4480): If 4500 fails, we test the Friday POC at 4480 . This is the "fairest price" from the Friday auction.

• GEX Profile: Sustained trade above 4500 could trigger a Gamma Squeeze toward 4550 .

3. Fundamental Catalyst (The Inflation Gauntlet)

The week of Jan 12–16 is packed with high-impact data.

• Tuesday, Jan 13: US CPI (20:30 WIB). Expect Headline 2.7%. High MoM = USD Tsunami.

• Wednesday, Jan 14: US PPI & Retail Sales . Weak sales = Gold rocket.

• Fed Speak: Multiple officials (Bostic, Kashkari, Williams) speaking. Clues for the Jan 28 meeting are critical.

Plan & Execution

• Bias: Bullish Initiative above 4500.

• Scenario A (ATH Run): Acceptance above 4500 targets 4550 and ATH.

• Scenario B (Rotation): Failure at 4500 targets 4480 . Look for Responsive Buying there.

• Invalidation: Sustained trade below 4420 kills the bull case for now.

Talk to you for the next update.

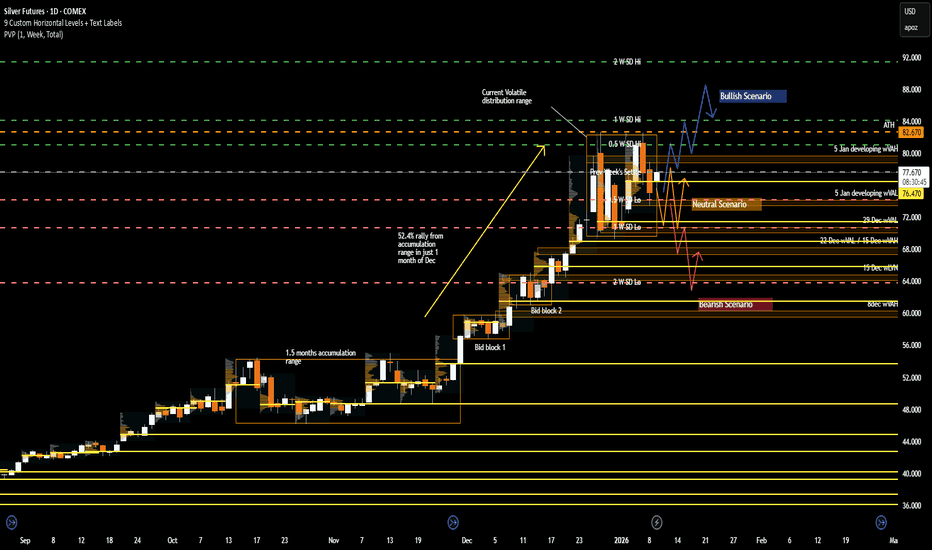

Silver Futures Breakdown: From Trend Expansion to DistributionWhy Silver Is Moving: Economic Cycle, Correlation, and Sentiment

Silver futures (SI), represent one of the most dynamic markets within the precious metals complex. Silver occupies a unique position because it functions as both a monetary metal and an industrial input. This dual role makes it sensitive not only to inflation expectations, real interest rates, and currency movements, but also to manufacturing demand, energy transition themes, and broader economic growth expectations. Silver is closely correlated with Gold futures, or GC, due to their shared role as hard assets and hedges against currency debasement. However, silver often exhibits higher beta behavior than gold, meaning it tends to lag initially and then accelerate more aggressively once capital rotates into the metals complex.

From an economic cycle perspective, silver typically performs best during late cycle and early easing environments. These are periods when growth concerns rise, central banks signal accommodative policy, and investors seek both inflation protection and upside convexity.

Sentiment toward silver has shifted meaningfully over the past several months. The recent bull uptrend has been driven by a combination of persistent inflation pressures, expectations for lower real rates, strong industrial demand tied to electrification, and increasing speculative participation. Over the past month specifically, silver prices have been influenced by renewed weakness in the US dollar, falling real yields, and a broader rotation into commodities. The general sentiment remains constructive, with market participants viewing pullbacks as opportunities rather than trend reversals.

What the Market has done

• The market consolidated between the 46.325 and 54.285 area from October through the end of November 2025, forming a well defined balanced region.

• Buyers initiated out of this range causing an imbalance to the upside.

• The market trended higher throughout most of December, displaying persistent initiative buying that resulted in new all time highs at 82.670.

• Over the past two weeks, volatility has expanded, with more pronounced two way rotations.

• This activity has led to the development of a distribution range bounded by 82.32 on the upside and 69.640 on the downside.

What to expect in the coming week

The key levels to watch are the current range high and range low at 82.32 and 69.64. These boundaries define the active distribution and will be critical in determining the next move of the market.

Neutral scenario

• Given the increase in volatility following the strong bullish December run, the market may continue to rotate in two directions as participants work to establish value.

• Price could remain contained within the recent distribution range as both buyers and sellers test conviction at the edges.

Bullish scenario

• If bids are able to step up and hold the 73.96 area, which aligns with the developing weekly value area low, buyers may regain control.

• A sustained buyer response from this level could lead to a rotation back toward the all time highs.

• Acceptance above the 79.22 area, which aligns with the developing weekly value area high, would signal strength and open the door for a move toward 84, corresponding with the weekly one standard deviation high.

• Continued acceptance and momentum could extend the move toward 88, which aligns with the weekly two standard deviation high.

Bearish scenario

• If sellers are able to step down offers and buyers are unable to hold the 75.75 area, which aligns with the developing weekly value area low, the market may rotate lower to 70.58, which aligns with the distribution range low and the December 29 weekly value area low.

• Failure of buyers to defend 70.58, would expose further downside move to the 67.755 level, which aligns with the December 15 weekly value area high.

• Continued acceptance below 67.755 would open the door to a move toward the 64 area, where bid block 2 high is located and responsive buyers may attempt to defend

Conclusion

Silver remains in a confirmed higher time frame uptrend, supported by strong initiative buying since the December breakout and sustained acceptance above prior value. The recent increase in volatility reflects a transition from directional expansion into distribution rather than structural weakness. As long as price continues to hold above the lower boundary of the current range at 69.64, the broader bullish structure remains intact, with upside potential defined by acceptance above 79.22 and a retest of the 82.32 to 82.67 all time high region. A failure to hold the lower range would mark a shift in market condition and open the door to deeper rotations toward lower weekly references.

If you found this breakdown useful, feel free to give a boost, comment, or share your own levels and scenarios below.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Acronyms:

wVAH - Weekly Value Area High

wVAL - Weekly Value Area Low

wVPOC - Weekly Volume Point of Control

wLVN - Weekly Low Value Node

wHVN - Weekly High Value Node

Gold Context: Structural Repair & The NFP CatalystRelated Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Correcting the Narrative)

You are correct to point out the terminology: the anomaly above us is a Poor High .

• The Structure: A Poor High (located near the 4500/4505 zone) indicates that the previous auction did not reach a natural conclusion. Buying simply dried up rather than being met by aggressive responsive selling.

• The Behavior: This creates "unfinished business." The market has a high statistical probability of eventually returning to this level to "repair" the high by creating a proper excess tail.

2. Inventory & Nuance (The Support Floor)

• The Base: While the Poor High acts as a magnet above, the market is currently leaning on the Put Support / 4430-4440 band .

• The Tension: We are caught in a classic "squeeze." The structure wants to go up to fix the high, but the short-term inventory is waiting for permission from the macro data.

• Gamma Influence: The Gamma Wall 0DTE sits right at that Poor High area, creating a "boss level" resistance that likely requires an external shock (like a weak NFP) to break through.

3. Fundamental Catalyst (Next 24 Hours)

• Today (Friday Jan 9):

• Non-Farm Payrolls (NFP): The decider for the "Structural Repair."

• Bullish Case: If NFP comes in weak (<50k), the dollar drops, and the auction initiates a move to repair that Poor High at 4505.

• Bearish Case: If NFP is hot (>80k), the repair is postponed. We likely flush lower to find deeper value before the Poor High magnet pulls us back next week.

Plan & Execution

• Bias: Neutral-to-Bullish (Targeting structural repair).

• Observation: The goal is the 4505 Poor High. I am looking for a "Floor hold" at 4430 during the NFP print to confirm the rotation toward the high.

• Risk: Be wary of the BCOM Rebalancing next week, which adds a layer of passive selling pressure.

Talk to you for the next update.

Gold Context: Asian Session Slide & The Test of Long-Term Put Gold Context: Asian Session Slide & The Test of Long-Term Put Support

Related Tickers: COMEX_MINI:MGCG2026, COMEX:GC1!, CAPITALCOM:DXY

Analysis

1. Market Context (Asian Session Slide)

The auction has continued its downward drift during the Asian session, trending toward the two-day low area .

• Structure: Price is currently testing the HVL 0DTE and GEX 3 levels around 4440-4445 . After failing to reclaim the POC yesterday, the market is searching for a base.

• The Shift: We are transitioning from a liquidation phase to a potential Range Bound environment as we hit heavy structural support.

2. Inventory & Nuance (Support Clusters)

• Put Support Defense: We are currently trading on long-term Put support . The confluence of 0DTE Put Support and HVL 0DTE just below yesterday's low is acting as a "sticky" floor.

• The Magnet: If this floor holds, the auction's natural magnet is the POC (~4465-4475) as shorts take profits at the range extremes.

• Inventory: Inventory is likely short-heavy after the slide from 4480. A failure to break 4440 could trigger a "Short Squeeze" rotation back to value.

3. The Catalyst (Upcoming News - Next 24 Hours)

• Today (Thursday Jan 8):

• 08:30 AM EST (20:30 WIB): Initial Jobless Claims. This will confirm if the labor market cooling is real. A "high" number is "good" for Gold.

• Friday (Jan 9):

• Non-Farm Payrolls (NFP). The focal point of the week.

Plan & Execution

• Bias: Neutral / Defensive Buy . We are at the bottom of the bracket; selling here is low-odds.

• The Play: Look for Responsive Buying at 4440-4445. Target a rotation back to the POC (4465) .

• Invalidation: A sustained trade and close below the 1D Min / GEX 6 (~4410) would imply a deeper bearish correction.

Talk to you for the next update.

Gold Context: Defending the Floor & The 0DTE Battle**Related Tickers:** `COMEX_MINI:MGCG2026`, `COMEX:GC1!`, `CAPITALCOM:DXY`

### Analysis

**1. Market Context (Liquidation Break)**

The auction has shifted from "Balance" to **Imbalance** (Short-term Bearish).

* **The Move:** The failure to hold the POC (4480) triggered a liquidation of weak longs. We have now rotated down to the bottom of the bracket.

* **Current Location:** We are trading **below** Yesterday’s Value Area Low (VAL ~4473). In strict auction terms, price is being "accepted" lower. However, we have slammed directly into a major structural "Floor" at the Put Support.

**2. Inventory & Nuance (The Line in the Sand)**

* **The Defense:** The **4455-4459** zone is effectively the "Put Wall." Market Makers who sold puts here are defending this level to avoid being forced to short futures.

* **Sticky Price:** We are seeing a cluster of Gamma Exposure (GEX 2 & GEX 8) here. This creates a "sticky" environment where price often stalls or bounces as dealers adjust inventory.

* **Inventory:** Shorts are likely **stretched**. The rapid move from 4488 down to 4459 likely has late shorts chasing. If 4455 holds, these late shorts could be squeezed.

**3. The Structural Risk (The Air Pocket)**

* **The Cliff:** If **4450** gives way, the Dealer Put Support evaporates.

* **The Drop:** Below 4450, the volume profile is thin. The next major high-volume node/GEX structure is the **4400-4410** area.

### Plan & Execution

* **Bias:** Defensive. We are looking for a **Responsive Buy** (The Save) against 4455 or an **Initiative Sell** (The Flush) below 4450.

* **Scenario A (The Save):** We must reclaim **4473** (Yesterday's VAL) to confirm the breakdown was a trap. Target return to POC (4480).

* **Scenario B (The Flush):** A sustained break below **4450** targets **4410**.

Talk to you for the next update.

RTY: Small Caps Stuck Between Growth Optimism & Macro OutlookRTY Overview and Recent Macro Backdrop

RTY, or Russell 2000 futures, track the performance of the Russell 2000 Index, which represents approximately two thousand U.S. small cap companies. These constituents are drawn from the lower end of the Russell 3000 Index and typically reflect firms with smaller market capitalizations, greater domestic revenue exposure, and higher sensitivity to economic conditions than their large cap peers. The primary deciding factor for inclusion in RTY versus the S&P 500 is market capitalization. The Russell 2000 consists of the smallest two thousand companies within the Russell 3000, while the S&P 500 is a committee selected index composed of roughly five hundred large cap companies that must meet additional criteria such as profitability, liquidity, sector balance, and sustained earnings. Although market cap thresholds shift annually, Russell 2000 constituents generally fall well below the market cap range of S&P 500 companies and are reconstituted mechanically each year based on size rankings.

As the market settles into the new year, RTY has been trading within a more nuanced macro environment shaped by early year repositioning and reassessment of economic expectations. Price action over the past month has been increasingly influenced by evolving views on monetary policy, credit conditions, and the durability of U.S. growth. While recent inflation data has shown signs of moderation, it has remained uneven, keeping rate cut expectations fluid rather than fully priced in. This has limited sustained directional momentum in small caps, as higher borrowing costs continue to pressure balance sheets and earnings visibility. At the same time, resilient employment data and stable consumer demand have helped contain downside risk, allowing buyers to engage at value rather than chase extension. The result has been a rotational and range bound market structure, reflecting cautious positioning and a wait and see approach, with RTY acting as a battleground between early year growth optimism and ongoing policy and financing constraints.

What the Market has done

• Market reversed higher and entered an uptrend after concerns surrounding Trump’s liberation day tariffs eased in April 2025.

• In July 2025, the market consolidated and formed bid block 1, which buyers used as a base to drive price higher toward the 2585 area, a key daily resistance established in 2021 and the 2024 yearly high.

• Sellers responded at the 2585 area and offered prices back down toward the 2440 area, aligning with daily support and the 24 Nov weekly HVN.

• Buyers attempted to defend the 2440 area but failed, resulting in a downside auction to the 2320 area, corresponding to the bid block 1 high.

• Buyers defended and initiated at the 2320 area, bidding prices back up to the 2585 area, where sellers remained active.

• Markets have since rotated between the 2585 and 2490 areas.

What to expect in the coming week

The key level to monitor is the 48650 area, which aligns with the previous week’s VPOC and the 15 December weekly Value Area High

Bullish scenario

• If the market is able to hold above the previous week’s settlement, an initial move toward the 2555 area is expected, which aligns with the 22 Dec weekly VAL, the 3 Dec weekly VAH, and the 0.5 weekly SD high.

• If price is able to accept above the 2555 area, continuation toward the 2585 area becomes likely.

• Sellers are expected to respond around the 2585 area based on prior failed auctions and higher timeframe resistance.

• If sellers fail to gain control, the market could extend higher toward the 2620 area, which marks the 8 Dec weekly high.

Neutral scenario

• In the absence of a major news or data catalyst, the market may continue to auction two ways

• A rotational consolidation between the 2490 and 2555 areas would signal continued balance and acceptance of value within this range.

Bearish scenario

• If buyers are unable to defend and hold the 2490 area, expect a move down toward the 2460 area, which aligns with the 1 weekly SD high.

• Continued selling pressure could cause markets to auction prices further down to the 2440 area, which remains a key daily support and the 24 Nov weekly HVN.

Conclusion

In conclusion, RTY remains in a balanced yet highly responsive state, with higher timeframe reference levels clearly defended and defended by both buyers and sellers. The 2490 area is the line in the sand for the coming week, and traders should remain flexible and responsive to acceptance or rejection around this zone. As always, patience and execution around key levels will matter more than prediction.

If you found this breakdown useful, feel free to give a boost, comment, or share your own levels and scenarios below.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

BTCUSD | Intraday Long — Range Re-Expansion ContextContext

An abnormal sell-off during the Asian session positioned price for a re-expansion above the 88,000 level.

As a result, today’s focus shifts toward a long-biased intraday context.

Plan

I am monitoring the 87,300 – 87,500 zone for potential long consideration, only if confirmation factors are present.

Targets

-88,450

-89,000

Risk

Position risk is reduced relative to standard sizing.

This is a context-driven idea, not a blind entry.

Invalidation

The long scenario will be invalidated in the event of an aggressive move and firm acceptance below 87,100.

YM at All-Time Highs: Key Levels for Continuation or RotationUnderstanding YM and the Current Market Environment

The Dow Jones Industrial Average futures contract, commonly referred to as YM, represents a price weighted index composed of 30 large, established U.S. companies across industrials, financials, healthcare, and consumer sectors. Unlike the S&P 500, which is market capitalization weighted and broader in scope, the Dow tends to reflect performance in more mature, cyclical, and value oriented companies. Because of this composition, YM often behaves differently from the S&P 500 during periods of rotation between growth and value or when interest rate and macro expectations shift.

Over the past month, YM has generally tracked the bullish tone seen in the broader equity indices, though with its own internal rhythm. While the S&P 500 has continued to be driven by mega cap technology and growth names, YM strength has largely come from financials, industrials, and defensive value stocks. Recent price action suggests a market that remains constructive but increasingly selective, with participants sensitive to valuation, positioning, and year end flows. Overall sentiment remains cautiously bullish, though signs of short term exhaustion have appeared near the highs

What the Market has done

• Since the start of December, buyers have consistently stepped up bids, establishing higher value and maintaining control of the broader auction.

• During the second week of December, buyers defended the 1 December weekly High Value Node, which provided a clear structural base. This defense allowed prices to rotate higher and ultimately make new all time highs.

• In the third week of December, profit taking emerged from buyers near the highs. The market was unable to accept at all time highs and began auctioning lower.

• Price rotated back down toward the 1 December weekly High Value Node, where buyers once again responded and bid price higher, pushing the market back toward all time highs into last week.

• This behavior reflects a market that remains supported structurally but is increasingly two sided near extremes.

What to expect in the coming week

The key level to monitor is the 48650 area, which aligns with the previous week’s VPOC and the 15 December weekly Value Area High

Bullish scenario

• Buyers could initiate from the previous week’s close at 48998 and attempt to push price higher toward new all time highs.

• Alternatively, price may retrace back toward the 48650 area, where buyers are expected to respond and defend the level.

• A successful defense at 48650 could lead to a rotation back up toward 49294, the current all time high.

• Continued buying pressure could extend the move toward 49430, the weekly 0.5 standard deviation high.

• Profit taking may emerge near 49430, potentially causing the market to rotate lower in the short term.

• If buyers are able to maintain acceptance above this area, continuation toward 49838, the weekly 1 standard deviation high, becomes possible.

Neutral scenario

• If the market makes new all time highs but fails to accept above the 48998 previous close, sellers may respond.

• Seller response is likely near the 49420 area, which aligns with the weekly 0.5 standard deviation high.

• A failure to accept higher prices could result in a rotation back down toward the 48650 area.

• Buyers are expected to respond again near 48650, supporting price and slowing downside momentum.

• A two way auction may develop as the market works to establish higher value.

Bearish scenario

• If buyers fail to defend the 48650 level, this would indicate a breakdown in short term market structure.

• A failure at this level would likely lead the price to move lower through the 15 December weekly value area.

• The market could then auction down toward the 48170 area, which aligns with the 15 December weekly Value Area Low and the weekly 1 standard deviation low.

Conclusion

YM remains in a structurally bullish environment, but recent price action suggests a market transitioning from directional strength to balance near the highs. How price behaves around 48650 will likely determine whether buyers can continue pressing higher or whether the market needs additional time to rotate and build value. As always, context, acceptance, and response at key levels will be critical.

If you found this analysis useful, feel free to like, comment, or share your own view on YM below. Please give this a boost so that more traders in the community can participate. Thank you.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.

Regime Detection: The AI Trader's Secret Weapon

Your Strategy Didn’t "Stop Working" - The Market Regime Changed

Every trader knows the feeling:

Same signals

Same rules

Suddenly, completely different results

Most people call this "my edge stopped working".

Often, the truth is simpler: the regime changed, but your strategy didn’t.

---

What We Really Mean by "Regimes"

Regimes are just labels for how the market is behaving:

Trending vs ranging

High volatility vs low volatility

Risk‑on vs risk‑off

AI and systematic tools see this in the data:

ATR, realized volatility, and correlation spikes

Trend strength from measures like ADX

Clustered patterns in returns and volume

You feel it as:

"Breakouts keep failing now"

"Mean‑reversion is getting steamrolled"

"Options premium isn't decaying like it used to"

Same observation, different language.

---

Why Regime Awareness Is Mandatory in the AI Era

When you use AI or algo systems, you're often:

Running the same rules from last month

On today's data

If the rules were built in one regime and deployed in another, results will diverge.

AI can help by:

Classifying days/weeks into regime buckets

Tracking how each strategy performs in each bucket

Alerting you when the regime label flips

But you still have to decide how your playbook changes when the label changes.

---

A Simple Regime → Strategy Mapping

You don’t need complex ML to get started. Even a basic map helps:

Trending + Normal Vol → Trend‑following systems sized normally

Trending + High Vol → Same systems, reduced size, wider risk buffers

Ranging + Low Vol → Mean‑reversion and carry trades

Choppy + High Vol → Trade less, focus on defense, maybe only scalp

AI can refine the labels; your job is to define what each label means for you

BTCUSDT — Intraday Short Continuation | Range Pressure RemainsContext

Following the previous short execution from the seller’s zone 88,600 – 88,200, price delivered a clean downside move and reacted from 86,400.

However, despite this reaction, there is no clear evidence of sustained buyer strength at the moment.

Expectation

Within the current intraday structure, continuation toward the 86,000 area remains a valid and logical scenario.

Price is still trading under prior supply, and upside acceptance has not been established.

Risk Management

This is a continuation idea, not a late entry chase.

Risk should be reduced relative to standard position sizing and execution considered only with confirmation.

Invalidation

The intraday short bias will be invalidated only in the case of an aggressive move and firm acceptance above 88,600.

Gold Is Executing the Next Wyckoff LegGOLD (XAUUSD) – 30M STRUCTURE UPDATE

Price is confirming Wyckoff Phase C → D, with a clean breakout from Phase B.

Structure shows impulsive markup followed by controlled pullbacks — classic continuation behavior.

Price holds above EMA 34 & EMA 89, confirming trend strength and acceptance at higher levels.

The move labeled (1) → (2) → (3) reflects a healthy bullish sequence, not exhaustion.

Near-Term Path

Base case: Short consolidation / shallow pullback → continuation toward (5).

Invalidation: Only if price loses the EMA cluster and falls back into the prior range.

Bottom line:

Gold is not topping it is advancing in phases.

Patience favors continuation, not counter-trend trades.

ES Weekly Outlook: Can the Santa Rally Carry ES Back to All TimeMacro Backdrop and Sentiment Over the Past Month

Over the past month, the macro narrative for ES has been defined by a gradual shift from momentum driven optimism to a more cautious and selective risk environment. Coming out of October, equities were supported by easing financial conditions, strong earnings from mega cap technology, and continued enthusiasm around productivity gains tied to AI investment. That optimism pushed ES to fresh all time highs by the end of October.

As November progressed, sentiment became more balanced. Market participants began to reassess forward growth expectations, the path of monetary policy, and the sustainability of stretched valuations. Rather than a sharp risk off move, the tape transitioned into a rotational regime where participants became increasingly responsive around well defined value areas.

This shift has resulted in slower tempo, overlapping value, and greater sensitivity to technical references rather than headline driven trend continuation. The market has increasingly rewarded patience, context, and execution around key levels as opposed to chasing momentum.

What the Market has done

• From the all time highs made at the end of October, the market rotated lower toward the 6605 area, which aligned with daily support. Responsive buyers entered aggressively at this level and successfully defended the level.

• Following the responsive buying, price auctioned higher toward the 6975 area, which aligned with daily resistance and the 5 November weekly value area high, where sellers responded and capped further upside.

• During the past week, the market broke below the first two weeks of December’s range and the composite value area, signaling a short term loss of acceptance at higher prices.

• Price then auctioned lower toward the 6780 area, which aligned with the 24 November weekly VPOC, where buyers once again responded and defended the level.

• Responsive buying from 6780 drove the price back higher toward the 6885 area, which sits near the 12 December weekly settlement and the two week composite value area low, reinforcing the broader balanced structure.

What to expect in the coming week

The key reference to frame the coming week is the previous week’s settlement at 6888.50.

Bullish scenario

• If the market can accept above 6888.50, expect an auction higher toward the 6970 area, which aligns with daily resistance, the 5 November weekly value area high, and the weekly 0.5 standard deviation high.

• Sellers are expected to respond in the 6970 area and attempt to rotate price back down

• If sellers fail to defend this area, continuation higher toward 7012 becomes likely, which aligns with all time highs and the weekly 1 standard deviation high.

Bearish scenario

• If the market is unable to accept above 6888.50, expect a move lower toward the 6827 area, which aligns with the previous week’s value area low and the weekly 0.5 standard deviation low.

• Buyers are expected to respond at 6827 to bid prices back up through value.

• If buyers fail to hold 6827, expect a continuation lower toward the 6780 area, which aligns with the previous week’s low, the 24 November weekly VPOC, and the weekly 1 standard deviation low.

Neutral scenario

• If the market is unable to extend meaningfully beyond 6970 on the upside or 6827 on the downside, expect the market to remain balanced and rotational.

• In this scenario, value is likely to continue shifting modestly higher as the market awaits the next catalyst.

Conclusion

ES remains in a broader balance regime where responsive trade dominates and initiative activity has struggled to sustain follow through. Until the market can show clear acceptance above resistance or below support, patience and level based execution remain critical. The previous week’s settlement at 6888.50 will act as the primary decision point this week that helps determine whether the market seeks higher prices, deeper balance, or continued two way trade. If seasonal Santa rally dynamics come into play, they may act as the catalyst that allows the market to regain initiative strength and auction back toward all time highs.

What is your take on ES? We would love to hear your view on it. Please give us your comments and give this a boost so that more traders in the community can participate. Thank you.

Disclaimer: This is not financial advice. Analysis is for educational purposes only; trade your own plan and manage risk.