Market Maker Model on NQThe algorithm is currently engineering a Market Maker Buy Model to reprice towards the Buy Side Liquidity resting at 25900. The present action within the Sunday Open and Monday session is the final accumulation phase at the Weekly Bias Level before the primary expansion leg targets the premium Volume Imbalance.

Entry: 25325.00 (68 points lower)

Stop loss: 25125.00 (200 points from entry)

Take profit: 25925.00 (600 points from entry)

Risk to reward ratio: 3.00R

The absolute truth at the center of this chart is that the algorithm has transitioned from a rebalancing phase into a high probability expansion state targeting the external range liquidity.

You are witnessing a fractal expansion where the Monthly and Weekly order flow is unilaterally bullish and seeking new all time highs.

The Draw on Liquidity for the Month is the parabolic projection target at 26750 which acts as the ultimate magnetic draw for the institutional order flow.

The Draw on Liquidity for the Week is the distinct cluster of Buy Side Liquidity resting above the relative equal highs at 25900.

The Draw on Liquidity for the Day is the internal Volume Imbalance and Void residing between 25600 and 25700 which must be filled before the higher timeframe expansion can complete.

The market has spent the previous sessions consolidating around the 25300 level which is functioning as the dynamic fulcrum for this move.

This consolidation is not indecision it is the engineering of liquidity to fuel the next leg higher.

The entry logic is predicated on the mitigation of the Bullish Order Block and Breaker structure formed around the 25300 region.

The algorithm has successfully displaced above this level and is now holding it as a floor.

We are looking for a subtle retracement or a stop hunt into this 25300 to 25325 pocket during the London or New York Killzone.

This price point represents the equilibrium of the local range and the launchpad for the attack on the highs.

Buying here aligns with the institutional intent to defend the trend and forces you to act when the retail mind is fearful of a reversal.

The temporal window for this entry is the opening range of the week where the initial balance is established before the true expansion begins.

The invalidation of this thesis occurs if the algorithm achieves a daily close below the 25125 swing low.

Such a move would violate the immediate bullish market structure and suggest that the consolidation at 25300 was distribution rather than accumulation.

It would indicate that the algorithm is seeking a deeper discount potentially targeting the 24200 level before any resumption of the uptrend.

If price trades heavy through 25125 with displacement the probability of the bullish expansion collapses and we enter a defensive posture.

Until that structural damage occurs every tick lower is an inducement to trap shorts.

Target 1: 25600.00 | Type: Internal BSL / Void Fill | Probability: 90% | ETA: Monday Tuesday

Target 2: 25925.00 | Type: External BSL / Swing Highs | Probability: 75% | ETA: Mid Week Expansion

Target 3: 26750.00 | Type: Monthly Projection / Discovery | Probability: 60% | ETA: End of Month

A 25% probability exists for the antithetical reality: a Complex Correction.

In this scenario the rejection from the 26000 region was significant enough to warrant a return to the mean of the larger range.

The current holding of 25300 is a trap to induce early longs before a violent flush to the 24500 Order Block.

This reality is confirmed if price breaches the Omega Point at 25100.

Mmxm

Gold LongsFollowing last weeks bias. Looking for REQH target.

Want to pair longs with a weekly profile. Ideally Monday or Tuesday creates the low of week. Will look to get onside with longs once theres a clear intraweek reversal. Trade the continuation higher. A close below 3320 is invalidation. Expecting previous week low to be protected and expansion to the upside

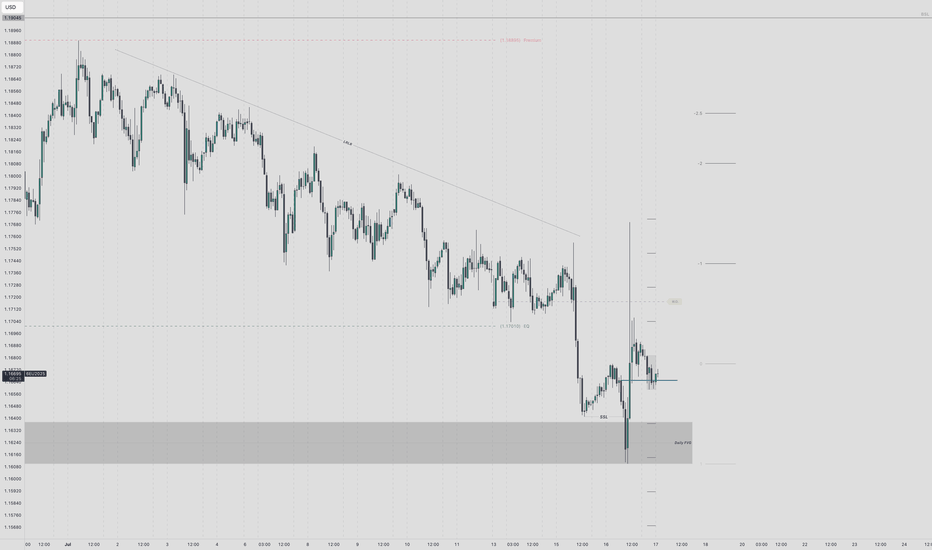

Euro LongsI've been waiting for euro to reach discount of its daily range and deliver into a daily BISI.

Mon - Wed trade lower into key arrays. Intraweek reversal confirmed with 4h and 1h CISD. Paired with Pound SMT at the daily lows.

LRLR built up from last weeks pullback. That bsl looks too obvious to me.

Entering off 1h cisd at 1.16650. Stop at Wednesday low. Targeting manipulation leg STD levels and relative equal highs at 1.19045

If the weekly draw on liquidity is to the upside, this intraweek reversal will hold. I know im wrong on direction if Wednesday low doesnt hold. The framework and logic line up with what I look for. Midweek Reversal daily profile. Thursday continuation in play.

To fade all time highs or not?Not trying to fade ATH run but the SSL in this daily range looks too obvious to me. Super premium.

Price was in a consolidation July 7th - 14th. Took external range high today. I really could see shorts playing out if theres a intraweek reversal confirmed after purging the ERH.

Would need to see 1h CISD confirm intraweek reversal to the downside then trade the daily continuation lower targeting 22,779, 22,578 & EQ of the range at 22,370. Also, the daily BISI that needs sellside delivery.

CPI scheduled this week. PPI following.

Gold LongsSolid daily structure for Gold heading into the holiday weekend. Bullish going into next week if price closes bullish on the week.

Daily discount SSL swept and closed back inside the range on Monday. Daily OB confirmed on Tuesday. FVG created and inversion fvg confirmed on Wednesday.

Anticipating Thursday to possibly pull back and offer a prime continuation to the upside. I'd like to see the inversion be respected. Price can wick into the BISI but I don't want to see price close below the BISI. That's a red flag.

Targeting Equal Highs.

Copper LongsBullish Bias for copper. Looking for daily BPR target, then possibly relative equal highs.

Ideally would like to pair a bullish weekly profile with longs. If the week opens lower first and delivers to a key level, thats favoring longs. So looking for Monday, Tuesday or Wednesday to create the low of the week.

I see a daily MMBM in play. Price expanded off the breaker block. If bsl is the dol, price should expand hard of EQ of the range.

Gold LongsBullish weekly bias for Gold.

Classic Expansion Weekly profile in play. Price opened lower first, Im treating this as the possible manipulation for the week. Tuesday swept key ssl and closed back inside the range.

Drop to a 4h and OB is confirmed. 1h CISD aligned with 4h. Execution off 4h OB with stop at OB Low / Tuesday low. If BSL is the draw, I would like to see Tuesday low be protected.

LRLR is first low hanging fruit objective. 3420 roughly, with equal highs at 3476 being final target.

OIL Bullish BiasCurrently sitting on my hands but closely watching oil, especially after Iran & Israel

Consolidation Protocol active. Need to see external range taken. I will not trade inside this range. Favoring longs.

Think accumulation, manipulation, distribution. Right now its in the accumulation phase. Manipulation phase is next. Preferably sweeping external low first then distribution higher to bsl.

Relative equal highs / LRLR at 114.29 first long term target.

Final target are the inefficiencies at 130 - 150.

$XAUUSD IdeaWhen analyzing gold, we observe a monthly chart with a bullish structure. However, the monthly candle left a low without an apparent wick, which may indicate a region to be liquidated in the future.

On the weekly chart, the asset confirmed a break in structure, reinforcing the continuation of the bullish movement. On the daily timeframe, we identify a possible CRT formation, suggesting that the price might correct to seek liquidity in a discounted region before resuming its bullish trend.

Based on this analysis, our main Draw on Liquidity are the PDL and the CRT low, which coincide with an FVG in the discounted zone. This could be the region where the price finds support to continue its upward movement.

On the 1H chart, we identify a formed range and are focusing on a key level in the premium region. On the 15M timeframe, we observe an order pairing that aligns with the 1H key level, making it a potential reaction point for a sell-off. This could be the ideal area to look for short trades. For stronger confirmation, it would be ideal to see an SMT with silver during this mitigation.

It is important to note that this is only an initial projection. The true confirmation that the price will hold in this FVG will depend on the market’s reaction upon reaching this zone.

$DXY IdeaFor the DXY, on the monthly chart, we remain in a consolidation bias, as the price is trapped within a range formed by two FVGs. However, when analyzing the yearly candles, we notice a macro bearish bias, since the 2025 candle has swept the 2024 high and is now targeting the annual lows.

Since we trade intraday, it is essential to analyze other timeframes to confirm a trading bias. On the weekly chart, we observe that last week's candle swept the previous week's low and closed within the range, indicating a potential correction. This makes sense, as the DXY has extended significantly in recent weeks and is currently discounted, which may lead the price to a premium zone before resuming its downtrend, in line with our macro bias.

Additionally, based on the economic calendar, there is a possibility that the weekly low will be formed on Monday, which could create an opportunity for a counter-trend trade at the beginning of the week. However, this type of trade carries high risk, requiring caution and confirmation before entry.

For this week, we are looking for bullish opportunities up to equilibrium or until the price shows resistance to continue rising. However, this initial outlook will only be confirmed as price action develops throughout the week.

It is also important to note that this will be a challenging week, due to a lack of significant news events and a Federal Reserve speech on interest rates, which could significantly impact the market and increase volatility.

$MSTR Time to Buy?Hello Friends,

For those of you looking to capitalize on Microstrategy NASDAQ:MSTR you may want to add to your position, or start accumulating for the first time.

After an impressive move to the upside, we can now feel confident to look for entries after that retracement.

Keeping with the Bullish narrative of CRYPTOCAP:BTC we can assume NASDAQ:MSTR will once again see another projection higher back to its ATH (All Time High) of $543.

ETHUSDT | Midweek AnalysisAt the beginning of the week, the price failed to take higher timeframe buyside liquidity and made a run to the low of the previous week.

Market Maker buy model framework.

I would expect the price to reach target 1, perhaps tomorrow with the PPI.

Next week we have Federal Funds Rate, so we could also see some consolidation the day before.The analysis is valid until then.

EURNZD: Buy Opportunity

Well, as you can see, the price hit the daily bullish FVG in deep discount and cleared the sell-side liquidity. Here in the hourly chart, we know the market structure shifted and we are bullish now.

Now we are on the buy side of the curve so we expect the price to stay above the key level and respect the bullish PD Arrays, like Order block and FVG that you can see on the chart.

We need LTF confirmation for entry.

💌It is my honor to share your comments with me💌

🔎 DYOR

🗓️06/06/2024

💡Wait for the update!