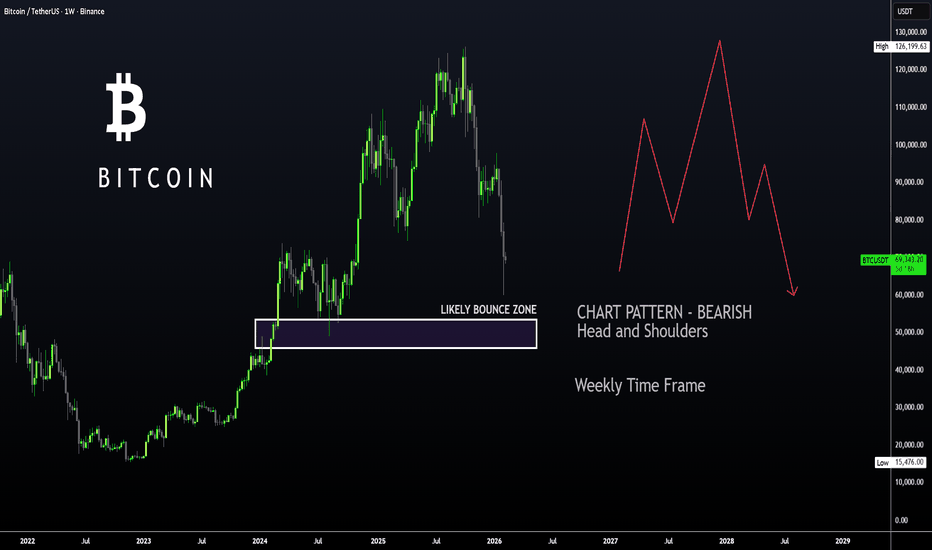

BTC Update - Only a FEW WILL SEE THIS !!Hello Bitcoin Watchers 📈

BT has made a bold and bearish pattern in the weekly, and it's a massive head and shoulders pattern:

And for the first time since May 2022 , the weekly moving averages has dropped to the lower band, the 200d moving averages:

This is when the heart of the bearish cycle starts, and we can easily see another -30% drop over the next few months.

BINANCE:BTCUSDT

Moving Averages

Booz Allen Hamilton Holding Corp | BAH | Long at $76.60Technical Analysis

Booz Allen Hamilton Holding Corp NYSE:BAH has officially dipped into my selected "crash" simple moving average zone. While the base of this zone is currently at $71, I am not super confident it will hold here. The "major crash" simple moving average area is currently between $51 and $60 and there is a good chance it will get there in the near-term. If so, it will be a much stronger entry point.

Insiders

$2.4 million purchased by insiders in the last 3 months at an average around $87.

Health & Fundamentals

P/E: 11.8x

Dividend: 2.98%

Debt-to-Equity: 4x (high)

Price-to-Free-Cash-Flow Ratio: 12x (undervalued)

Quick ratio / short-term debt: 1.8 (healthy)

Altman's Z Score / bankruptcy risk: 4.1 (healthy)

Action

While near-term weakness may drop the price of NYSE:BAH into the $50s, I would personally view it as even more of a deal. Thus, I am diving into a starter position at $76.60 ("crash" simple moving average zone) and plan to add significantly more in the $50s ("major crash" simple moving average zone).

Targets into 2029

$87.00 (+13.6%)

$105.00 (+37.1%)

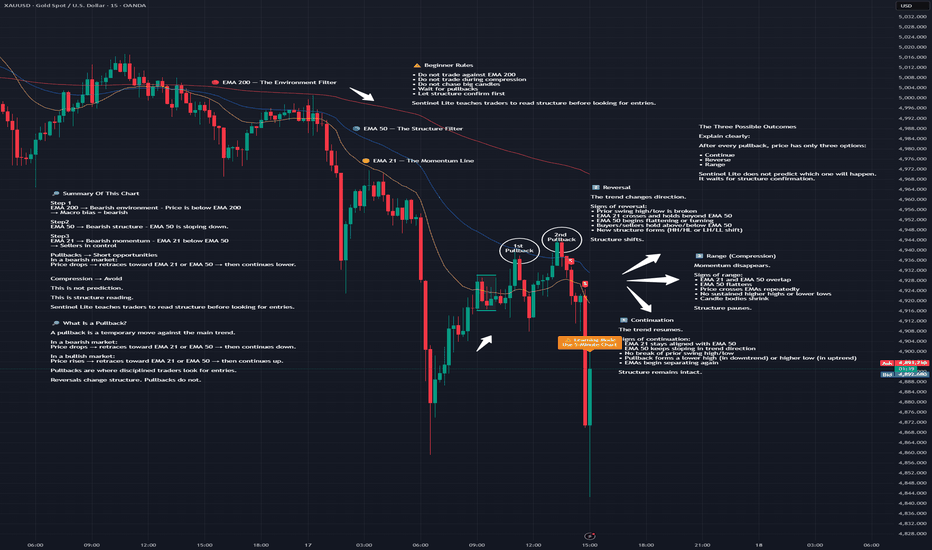

SENTINEL LITE — Beginner Walkthrough (15M Example)🛡️ SENTINEL LITE — Beginner Walkthrough (15M Example)

This chart shows how a beginner should read structure step by step.

We do not predict.

We read.

🧭 How To Read This Chart (In Order)

1️⃣ EMA 200 — The Environment Filter (Red Line)

Price is below EMA 200.

That tells us:

• Macro bias = Bearish

• We prefer sells

• We avoid aggressive longs

Never fight the EMA 200.

2️⃣ EMA 50 — The Structure Filter (Blue Line)

EMA 50 is sloping down.

That means:

• The market is trending down

• Structure is directional

• This is not sideways rotation

If EMA 50 is flat → expect chop.

3️⃣ EMA 21 — The Momentum Line (Yellow)

EMA 21 is below EMA 50.

That confirms:

• Short-term momentum = bearish

• Sellers are in control

When 200 + 50 + 21 align,

probability increases.

🔁 What Is A Pullback?

A pullback is a temporary move against the main trend.

In this bearish chart:

Price drops → retraces upward toward EMA 21 or EMA 50 → then continues down.

Pullbacks:

• Do NOT change structure

• Are where disciplined traders look for continuation

Reversals change structure.

Pullbacks do not.

🚫 Compression Warning

If EMA 21 and EMA 50 are tight and overlapping:

• That is compression

• That is low probability

• Do not force trades

Wait for separation.

📌 Summary Of This Chart

EMA 200 → Bearish environment

EMA 50 → Bearish structure

EMA 21 → Bearish momentum

Pullbacks → Short opportunities

Compression → Avoid

Sentinel Lite teaches structure reading before entries.

Discipline before execution.

⚠ Beginner Rules

• Do not trade against EMA 200

• Do not trade during compression

• Do not chase large candles

• Wait for pullbacks

• Let structure confirm first

#SentinelLite

#BeginnerTrading

#TradingEducation

#PullbackTrading

#EMA

#TrendTrading

#Gold

#XAUUSD

#Forex

#TechnicalAnalysis

#PriceAction

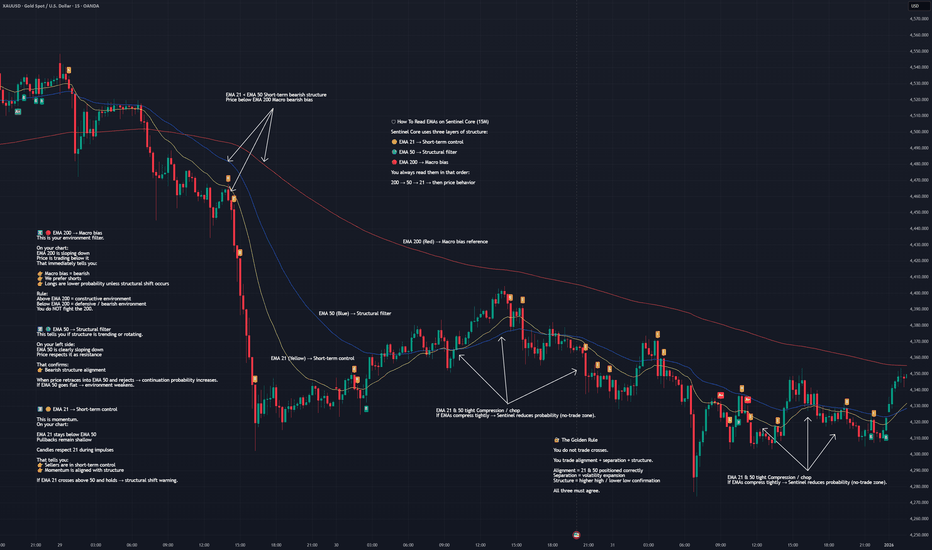

Sentinel Lite — Pullback vs Reversal vs Range (Live Example)SENTINEL LITE — Pullback vs Reversal vs Range (15M Live Example)

In my previous post, we reviewed a bearish structure and questioned whether the move was a reversal.

After observing the full sequence, structure confirmed continuation.

This is exactly how Sentinel Lite teaches traders to read markets:

Not by predicting.

By confirming.

🧠 After Every Pullback, Price Has Only 3 Outcomes

When price pulls back inside a trend, it can only do one of three things:

1️⃣ Continuation — The trend resumes.

Signs:

• EMA 21 remains aligned with EMA 50

• EMA 50 continues sloping in trend direction

• No break of prior swing high/low

• Pullback forms a lower high (downtrend) or higher low (uptrend)

• EMAs begin separating again

Structure remains intact.

2️⃣ Reversal — The trend changes direction.

Signs:

• Prior swing high/low is broken

• EMA 21 crosses and holds beyond EMA 50

• EMA 50 flattens or begins turning

• Buyers/sellers maintain control above/below EMA 50

• New HH/HL or LH/LL sequence forms

Structure shifts.

3️⃣ Range (Compression) — Momentum pauses.

Signs:

• EMA 21 and EMA 50 overlap

• EMA 50 flattens

• Price repeatedly crosses EMAs

• No sustained higher highs or lower lows

• Candle bodies shrink

Structure pauses.

Sentinel Lite does not predict which outcome will occur.

It waits for structure confirmation.

📉 What Happened on This 15M Chart

Environment

EMA 200 → Bearish

Price below EMA 200

Macro bias = short preference

Structure

EMA 50 sloping down

Directional environment

Momentum

EMA 21 below EMA 50

Sellers in control

Alignment = Bearish.

🔁 First Pullback

Price retraced toward EMA 21.

Checks:

• No break of prior swing high

• EMA 21 stayed below EMA 50

• EMA 50 remained bearish

Result → Continuation.

🔁 Second Pullback

This is where confusion usually happens.

Many beginners think:

“Maybe this is a reversal.”

But structure never shifted.

Checks:

• Did price break prior swing high? → No

• Did EMA 21 cross and hold above EMA 50? → No

• Did EMA 50 flatten or turn? → No

Then momentum expanded down again.

EMAs separated.

Result → Continuation confirmed.

Not reversal.

⚠️ Why It Could Have Ranged

Between pullbacks, EMAs began tightening slightly.

If:

• EMA 21 overlaps EMA 50

• EMA 50 flattens

• No break of structure

Then the market enters compression.

Trend → Pullback → Compression → Either continuation or reversal.

Never assume continuation automatically.

📌 The Real Lesson

The difference is not the candle.

It is:

• EMA alignment

• Structure integrity

• Swing break confirmation

A pullback is not automatically continuation.

It becomes continuation only if structure holds.

It becomes reversal only if structure shifts.

It becomes range if alignment disappears.

Sentinel Lite reads structure.

It does not guess.

Discipline before execution.

#SentinelLite

#MarketStructure

#Pullback

#TrendContinuation

#Reversal

#Range

#XAUUSD

#Gold

#TradingEducation

#EMA

#PriceAction

SENTINEL LITE — What Does The “S” Label Really Mean? (15M)🛡️ SENTINEL LITE — What Does The “S” Label Really Mean? (15M Live Example)

On this 15-minute chart, you can see multiple “S” labels printed by Sentinel Lite.

Many beginners see this and think:

“Sell immediately.”

But that is not how Sentinel Lite is designed to be used.

It does not predict.

It confirms structure alignment.

🧠 What Must Align For An “S” To Print?

For a valid sell condition, Sentinel Lite checks:

1️⃣ EMA 200 — Environment (Red)

• Price below EMA 200

• Macro bias = bearish

• We prefer shorts

2️⃣ EMA 50 — Structure (Blue)

• EMA 50 sloping down

• Market is directional, not ranging

3️⃣ EMA 21 — Momentum (Yellow)

• EMA 21 below EMA 50

• Short-term control = sellers

4️⃣ Pullback Into Structure

• Price retraces toward EMA 21 (sometimes EMA 50)

5️⃣ Momentum Expansion

• Strong bearish candle

• No compression between EMA 21 & 50

When these align →

The “S” label prints.

The label is the result of structure.

Not a signal in isolation.

🔍 What Happened In This Chart?

Notice the sequence:

• Downtrend established (200 / 50 / 21 aligned bearish)

• Price pulls back toward EMA 21

• Structure holds

• Momentum resumes down

The “S” appears at the moment structure confirms continuation.

This is not guessing.

This is alignment.

⚠️ Important: Not Every “S” Is Equal

If EMAs start compressing

If EMA 50 flattens

If price breaks prior swing high

Then probability weakens.

Sentinel Lite prints based on rules —

but YOU must grade context.

📌 The Real Teaching Point

Do not trade because you see an “S”.

Trade because:

• Environment agrees

• Structure agrees

• Momentum agrees

• Pullback confirms

• No compression

Structure first.

Label second.

Sentinel Lite is a structure confirmation tool.

Not a prediction machine.

#SentinelLite

#MarketStructure

#EMA

#PullbackTrading

#TrendContinuation

#XAUUSD

#Gold

#TradingEducation

#TechnicalAnalysis

#PriceAction

SENTINEL LITE - Beginner Introduction🛡 SENTINEL LITE — Beginner Introduction

Start Here Before Trading

If you are new to trading, this is where you begin.

Sentinel Lite is not a prediction tool.

It is a structure-reading framework.

Before placing a trade, you must first understand:

• Direction

• Structure

• Momentum

Sentinel Lite simplifies this into 3 EMAs.

🔴 EMA 200 — The Environment Filter

The red line defines the big picture.

Ask yourself:

Is price above or below the red line?

• Above → Constructive / bullish environment

• Below → Defensive / bearish environment

Beginner Rule:

Do not fight the EMA 200.

This defines macro bias.

🔵 EMA 50 — The Structural Filter

The blue line shows whether the market is trending or rotating.

If EMA 50 is clearly sloping:

→ Structure is directional.

If EMA 50 is flat:

→ Structure is mixed or choppy.

Repeated rejection from EMA 50 often signals continuation probability.

🟡 EMA 21 — The Momentum Line

The yellow line shows short-term control.

• EMA 21 above EMA 50 → Buyers in control

• EMA 21 below EMA 50 → Sellers in control

In strong trends:

Price respects EMA 21 during pullbacks.

In weak markets:

Price crosses it frequently.

How To Read Them (Always In This Order)

1️⃣ EMA 200 (Environment)

2️⃣ EMA 50 (Structure)

3️⃣ EMA 21 (Momentum)

4️⃣ Then price behavior

When all three align → probability increases.

When EMAs compress → probability decreases.

🚫 Beginner Rule

If EMAs are tight and overlapping:

This is compression.

This is chop.

This is low probability.

Do not force trades in compression.

What Sentinel Lite Teaches

• Trade with structure

• Avoid emotional entries

• Respect macro bias

• Wait for alignment

Trading is not about prediction.

It is about probability and discipline.

🛡 Sentinel Lite — Learning Mode

By Pips0mnian

#SentinelLite

#XAUUSD

#Gold

#EMA

#MovingAverages

#BeginnerTrading

#PriceAction

#IntradayTrading

#TrendTrading

#ForexEducation

#TradingView

#TechnicalAnalysis

Beginner Guide - How to Read EMAs on the Sentinel Core (15m)Sentinel Core uses three layers of structure:

🟡 EMA 21 → Short-term control

🔵 EMA 50 → Structural filter

🔴 EMA 200 → Macro bias

You always read them in that order:

200 → 50 → 21 → then price behavior

1️⃣ EMA 200 (Red) — Macro Bias

This is your environment filter.

On your chart:

EMA 200 is sloping down

Price is trading below it

That immediately tells you:

👉 Macro bias = bearish

👉 We prefer shorts

👉 Longs are lower probability unless structural shift occurs

Rule:

Above EMA 200 = constructive environment

Below EMA 200 = defensive / bearish environment

You do NOT fight the 200.

2️⃣ EMA 50 (Blue) — Structural Filter

This tells you if structure is trending or rotating.

On your left side:

EMA 50 is clearly sloping down

Price respects it as resistance

That confirms:

👉 Bearish structure alignment

When price retraces into EMA 50 and rejects → continuation probability increases.

If EMA 50 goes flat → environment weakens.

3️⃣ EMA 21 (Yellow) — Short-Term Control

This is momentum.

On your chart:

EMA 21 stays below EMA 50

Pullbacks remain shallow

Candles respect 21 during impulses

That tells you:

👉 Sellers are in short-term control

👉 Momentum is aligned with structure

If EMA 21 crosses above 50 and holds → structural shift warning.

🔎 What Happens in Compression?

See marked this well on your chart.

When:

EMA 21 & 50 compress tightly

Candles overlap

No clear higher high / lower low

Sentinel Core reduces probability.

That is a no-trade zone.

EMAs separating = expansion

EMAs compressing = chop

🧠 How To Read Your Chart Specifically

Early section:

Price below EMA 200

21 < 50

Clean downward slope

→ Bearish continuation phase

Mid section:

21 and 50 compress

Price rotates sideways

→ Reduced probability environment

Right section:

Still below 200

50 acting as resistance

→ Bearish bias remains intact

No structural shift occurred because:

Price never reclaimed 200

21 never sustainably held above 50

No bullish expansion sequence

So Sentinel Core would grade this as:

Defensive / Bearish Structure with rotational pauses.

🔐 The Golden Rule

You do not trade crosses.

You trade alignment + separation + structure.

Alignment = 21 & 50 positioned correctly

Separation = volatility expansion

Structure = higher high / lower low confirmation

All three must agree.

Sentinel Core does not predict.

It grades alignment.

Structure first.

Momentum second.

Execution last.

#XAUUSD #Gold #EMA #Scalping #Intraday #TrendStructure #SentinelCore #PriceAction

Mastercard: Heading for the Target ZoneFollowing a strong recovery, Mastercard faced notable selling pressure again. In the short term, we anticipate further declines within the framework of the turquoise wave C. We expect its low within our green Long Target Zone between $475.58 and $448.65. Simultaneously, this range should also capture the low of the broader magenta wave (4). We then expect a transition into the follow-up wave (5), which should initiate the next upward impulse. In parallel, we consider an alternative scenario with a 36% probability. In this scenario, a turquoise five-wave pattern might be unfolding, with wave alt.3 breaching the resistance at $589.67. In this case, the magenta wave alt.(4) would have concluded almost a year ago and our green Target Zone wouldn’t come into play.

AER - Ascending Channel & MACD Signal Point to Further UpsideAER - CURRENT PRICE : 150.43

AerCap Holdings N.V. (AER) is currently trading at all-time high levels, which reflects strong bullish momentum and continued demand from buyers. When a stock reaches new highs, it enters a price discovery phase with no historical resistance above, often signaling sustained upward strength.

Technically, price is moving within a well-defined ascending channel , forming higher highs and higher lows — a classic sign of a healthy uptrend. In addition, the stock is trading comfortably above the EMA 50, which is sloping upward, confirming that medium-term momentum remains firmly bullish and that pullbacks are being supported.

Momentum indicators are also turning positive. The MACD is showing a fresh bullish crossover, similar to previous instances highlighted on the chart (look at white circle) where a crossover was followed by a strong price rally. The histogram is turning positive again, suggesting that upside momentum is building at an early stage. If this setup follows the previous pattern, it could lead to another leg higher.

Overall, with price at all-time highs, a strong uptrend channel structure, trading above EMA 50, and an early bullish MACD signal, the technical outlook remains biased toward continued upside.

ENTRY PRICE : 148.00 - 150.43

FIRST TARGET : 163.00

SECOND TARGET : 173.00

SUPPORT : 137.55

Beginner Guide – How To Read This 15M Chart Using Sentinel Core🛡 How To Read This 15M Chart Using Sentinel Core

Step 1️⃣ — Start With EMA 200 (Macro Bias)

Look at the red line (EMA 200).

On this chart:

EMA 200 is sloping upward

Price is trading above it (right half of chart)

👉 Macro bias = constructive / bullish environment

We do NOT look for aggressive shorts in this condition.

Step 2️⃣ — Read EMA 21 & EMA 50 Alignment

Yellow = EMA 21 (short-term control)

Blue = EMA 50 (structure filter)

Left Side of Chart (Before Expansion)

EMA 21 crossing above EMA 50

Small pullbacks holding

No deep breakdown below EMA 200

This is Phase 3 beginning — structural shift.

Step 3️⃣ — Identify the Expansion Trigger

Mid-chart:

Strong bullish impulse candle

EMA 21 separates clearly from EMA 50

B signals begin aligning upside

Price accelerates

This is:

🔹 Phase 3 — Structural Shift Confirmed

Upgrade occurred because:

Higher low formed

EMA 21 > EMA 50

Momentum expansion

Clear EMA separation

This is where A+ prints.

Step 4️⃣ — Read the Continuation Phase

Right side of chart:

EMA 21 stays above EMA 50

Pullbacks are shallow

EMA 50 acts as dynamic support

Signals print mostly in trend direction

This is:

🔹 Phase 4 — Continuation / Constructive Pressure

Environment:

Constructive

Buy-side pressure

Higher probability pullback entries

What The Labels Mean On This Chart

🟢 A+

Full alignment

Momentum + structure

High probability

🔵 B

Strong but slightly less confirmation

Still aligned with structure

If signals appear against EMA alignment → probability drops.

How a Beginner Should Read This Chart

When opening a 15M chart:

Look at EMA 200 first

Check if EMA 21 is above or below EMA 50

Wait for separation (avoid compression)

Only take signals aligned with structure

Avoid signals inside overlap zones

Where Most Beginners Go Wrong

On this chart, the mistake would have been:

Shorting during bullish expansion

Taking early signals during small pullbacks

Trading before EMAs separated

Sentinel Core prevents that by grading alignment.

Institutional Summary

This session transitioned from structural rotation into constructive expansion.

Sentinel Core upgraded probability when:

• EMA 21 crossed above EMA 50

• Price held above EMA 200

• Momentum expanded

• Volatility increased

Continuation followed with controlled pullbacks and aligned signal flow.

Structure first.

Alignment second.

Execution third.

Sentinel Core does not predict.

It grades alignment.

🛡 Sentinel Core – 15M Framework

#XAUUSD #Gold #EMA #Scalping #Intraday #TrendStructure #SentinelCore #PriceAction

XAUUSD 15M - Compression to Structural ExpansionToday’s XAUUSD 15-minute session was graded using the Sentinel Core EMA Structure Script.

This chart demonstrates how Sentinel does not predict — it grades environment shifts.

🔻 Phase 1 – Defensive Alignment (Script: Bearish Grade)

Sentinel Core conditions:

• EMA 21 below EMA 50

• Price trading below EMA 200

• Consecutive lower lows

• B signals aligned with downside pressure

Environment: Defensive / Sell-side control

The script correctly graded continuation signals (B) inside bearish alignment.

Pullbacks showed no A+ confirmation because structure had not shifted.

Momentum existed — but alignment remained defensive.

⚠ Mid-Session – Compression Detected

Sentinel Core downgraded probability as:

• EMA 21 & 50 flattened

• Candles overlapped

• No clean higher high sequence

• Core score weakened

This is where discipline matters.

The script avoided high-grade signals.

No A+ prints inside chop.

Environment = Low probability.

No forcing trades.

🟢 Phase 2 – Structural Shift Confirmed

Sentinel Core upgraded the environment when:

• Higher low formed

• EMA 21 crossed above EMA 50

• Price reclaimed EMA 200

• Bullish impulse expanded volatility

Now:

• B signals aligned with upside structure

• A+ printed during strong alignment + momentum

Environment shifted:

Defensive → Constructive

This is the purpose of the framework.

🧠 What Sentinel Core Actually Does

• Grades structure via EMA alignment

• Filters continuation vs pullback

• Suppresses signals inside compression

• Highlights high-probability alignment (A+)

• Separates structure from emotion

It does not call tops or bottoms.

It measures alignment.

🎯 Current 15M Bias (Script-Based)

As long as:

• EMA 21 > EMA 50

• Price holds above EMA 200

• Higher low structure remains intact

Environment remains constructive.

Break below EMA 50 → Neutral.

Loss of EMA 200 → Defensive reset.

🛡 Sentinel Core Components

EMA 21 (Yellow) → Short-term control

EMA 50 (Blue) → Structure filter

EMA 200 (Red) → Macro bias reference

B = Base continuation signal

A+ = High-probability alignment signal

Structured Gold Trading (XAUUSD)

EMA-Based Framework

Session Discipline

Probability Alignment

🛡 Building the Sentinel execution model

Structure first.

Alignment second.

Execution third.

#XAUUSD #Gold #SentinelCore #EMA #Scalping #Intraday #PriceAction #TradingSystem #MultiTimeframe #TrendStructure

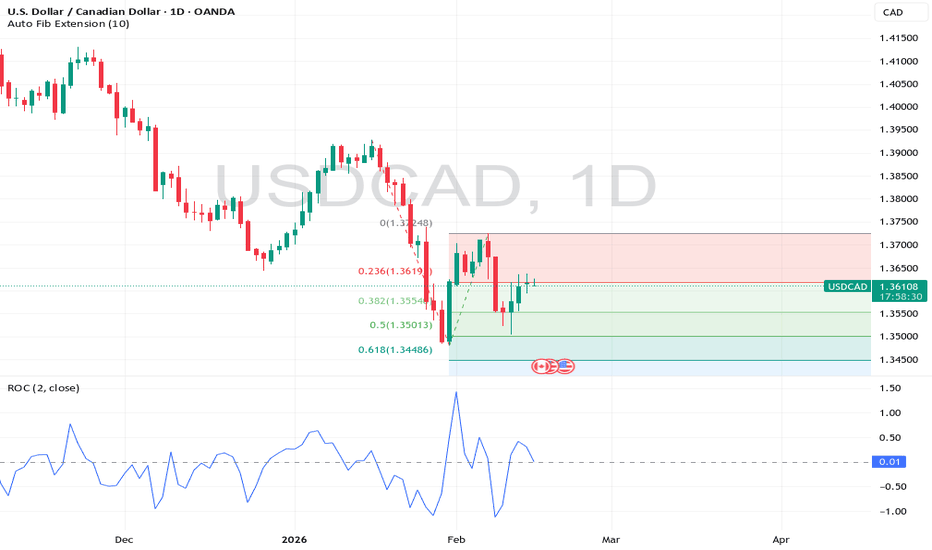

Why Market Research Is The #1 Tool-Part 2I wish i could tell you

this strongly with shouts and shouts!!

Technical analysis is very important

don't get me wrong

it is! you need to understand

the technical tools

but you also need market research

The price shows you the footprints

but you need to see who is making them

them footprints

Remember you need to be patient

make sure your market research

aligns with

the technical analysis tools

This is where the confidence comes

from..

Am going to tell you how

i use market research..

One time i wanted to buy

a pair of jeans

but the price was too high

I looked at the market research

and i realised that every time

The manufacturers decided to buy

more cotton

the prices of clothes including

jeans would be on sale!

Now this didn't mean i could

afford them at the sale price

but that was the indicator

i needed

or at-least it gave me a clue

that something is happening

Robert Kiyosaki

calls this Macro economics.

Market research tells

you macro economics

Weather the institutions

are buying or selling

the asset class that you

are interested in

because you want to buy or sell

when the big guys in the markets

are making moves

to avoid being chopped out

or margin called.

This is why market research is very

important and you have to pay for it

or at-least give it time

to understand it.

As you can see from this chart

the price is in between the Fibonacci

range of green

This tells you that them

insiders are watching

this currency pair like you and me are.

So who are these insiders?

Mostly commercial banks

and governments from

around the world

Rocket boost this content to learn more.

Disclaimer: Trading is risky

please only use a simulation trading account

Before you risk you hard earned capital.

Himadri Speciality Chemical Ltd | Daily Chart | Compression Himadri is currently trading inside a large symmetrical triangle after a prolonged corrective phase. Price is now approaching the apex zone, indicating that a decisive move is likely in the coming sessions.

This is a classic volatility contraction structure.Broader Structure Overview

Strong rally previously rejected from the ₹600–620 major supply zone

Since then, price has been forming:

Lower highs

Higher lows

This has resulted in a multi-month symmetrical triangle

Market is shifting from distribution → equilibrium → potential expansion phase

Pattern Breakdown

Pattern: Symmetrical Triangle

Timeframe: Daily

Nature: Neutral → Breakout-dependent

As price approaches the apex:

Volatility compresses

False moves increase

Breakout probability increases

Scenarios Ahead

✅ Bullish Breakout Scenario

Decisive close above descending trendline (~₹490–500)

Volume confirmation

Upside targets:

₹520 (intermediate supply)

₹590–600 (major supply)

⚠️ Range Continuation

More oscillation inside triangle

Time-based correction continues

❌ Bearish Breakdown

Close below ₹420

Structure invalidation

Opens downside toward previous swing lows

Educational purpose only. Not a buy/sell recommendation.

XAUUSD 15M – Structural Rotation & Alignment ShiftUsing the Sentinel Core EMA structure framework, this 15-minute session shows a clear transition from bearish alignment into structural recovery.

🔴 Phase 1 – Bearish Alignment

• EMA 21 below EMA 50

• Price below EMA 200

• Consecutive lower lows

• Environment: Defensive / Sell-side pressure

The downside impulse confirmed expansion in bearish momentum.

Pullbacks during this phase remained inside structure — no higher high formed.

Low probability for longs.

Structure was aligned. The environment was defensive.

⚠ Mid-Session Compression

• EMA 21 and EMA 50 compressing

• Overlapping candles

• No clean higher high sequence

• Momentum weakening

This was a chop zone.

When EMAs compress and structure stalls, probability drops.

No forcing trades inside compression.

Discipline > activity.

🟢 Phase 2 – Structural Shift

• Higher low formed

• EMA 21 crossed above EMA 50

• Strong bullish impulse candle

• Liquidity expansion during session

This marked a clear probability rotation.

The environment shifted from defensive to constructive.

Price reclaimed short-term control and began building higher lows.

🧠 What the Sentinel Labels Mean

B = Base continuation signal aligned with current structure

A+ = Higher probability signal (structure + momentum alignment)

EMA 21 (yellow) = Short-term control

EMA 50 (blue) = Structural filter

EMA 200 (red) = Macro bias reference

Sentinel Core does not predict reversals.

It grades the environment.

🎯 Current 15M Bias

As long as:

• EMA 21 holds above EMA 50

• Higher low sequence remains intact

Short-term structure remains constructive.

Failure below EMA 50 would shift the environment back toward neutral/defensive.

Structured Gold Trading (XAUUSD)

EMA-Based Framework

Session Discipline

Probability Alignment

🛡 Building the Sentinel execution model

Structure first. Alignment second. Execution third.

#XAUUSD #Gold #EMA #Intraday #Scalping #PriceAction #TrendFollowing #MultiTimeframe #TradingFramework

15M Structural Overview – Gold (XAUUSD)Using the Sentinel Core EMA Structure Framework, this session demonstrates a transition from bearish alignment into structural recovery.

Phase 1 – Bearish Alignment

EMA 21 below EMA 50

Price below EMA 200

Consecutive lower lows

Core environment: Defensive / Sell-side pressure

The downside impulse confirmed momentum expansion.

Pullbacks within this phase offered no strong bullish confirmation.

⚠ Mid-Session Compression

EMA 21 and 50 compressing

No confirmed higher high sequence

Overlapping candles (chop zone)

Reduced probability environment

This is where discipline matters — no forcing trades during compression.

🟢 Phase 2 – Structural Shift

Higher low formed

EMA 21 crossed above EMA 50

Strong bullish impulse

Liquidity expansion during session

This marked a probability shift from defensive to constructive structure.

Price reclaimed short-term control and began forming higher lows.

🧠 What The Labels Mean

B = Base continuation signal aligned with structure

A+ = Higher probability alignment (momentum + structure stacked)

EMA 21 (yellow) = Short-term momentum

EMA 50 (blue) = Structure filter

EMA 200 (red) = Macro bias reference

Sentinel Core does not predict — it grades structural alignment.

🎯 Current 15M Bias

As long as:

EMA 21 holds above EMA 50

Higher low sequence remains intact

Short-term bias remains constructive.

A sustained move below EMA 50 would shift conditions back toward neutral/defensive.

Structured Gold Trading (XAUUSD)

EMA Structure Framework

Session Discipline

Probability Alignment

🛡 Sentinel Execution Model

Structure first. Alignment second. Execution third.

#XAUUSD #Gold #EMA #Scalping #Intraday #TrendFollowing #MultiTimeframe