Market Re-cap and structure of the dayMarket Type: Breakout → Trend Day Up

Bias: Bullish once PDH reclaimed

Result: + $128 | 4W / 1L

Key Levels I respected

PDH: 25,844.75

NY AM High: ~25,880

POI ladder acted as clean targets + reaction zones (POI4/5/6 area)

What price did today (simple)

Early AM was choppy / ORB filters blocked some entries (good… no forced trades).

Once price reclaimed PDH, it confirmed buyers.

Breakout pushed into NY AM High, then we got continuation candles = the edge window.

Later in the day, entries started showing “too late / low volume” → that’s the sign momentum is extended and risk increases.

My best trades / why they worked

✅ Took longs after PDH reclaim + strength candles

✅ Used POIs as targets, not hope

✅ Stayed with the trend during the best time window

The mistake (and the lesson)

❌ One late trade = reduced edge (post push / extension / “too late” conditions)

Rule reminder: If the system is warning “too late,” either size down or shut it down.

What I’m focused on next session

Wait for PDH reclaim + pullback continuation

Don’t chase after big candles

Trade the clean window, protect the green

US NAS 100

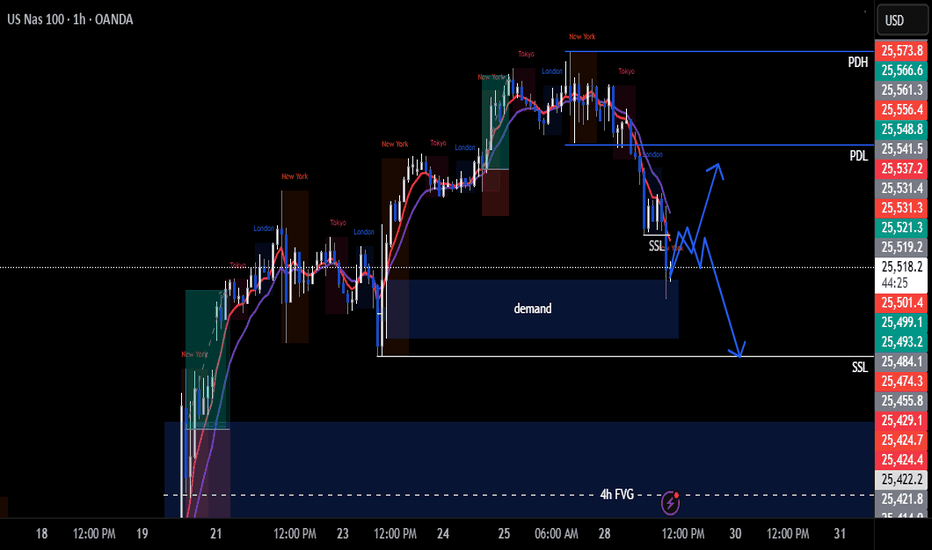

NAS100 Trade Set Up Jan 7 2026Price swept PDH during Asia and came down to fill a 4h bullish FVG and now is sweeping London highs, so i will wait to see if price can test the 4h bearish FVG to then look for 1m-5m IFVG/CISD to take sells to London lows but if price can stay bullish above the 1h IFVG i will look for buys to PDH

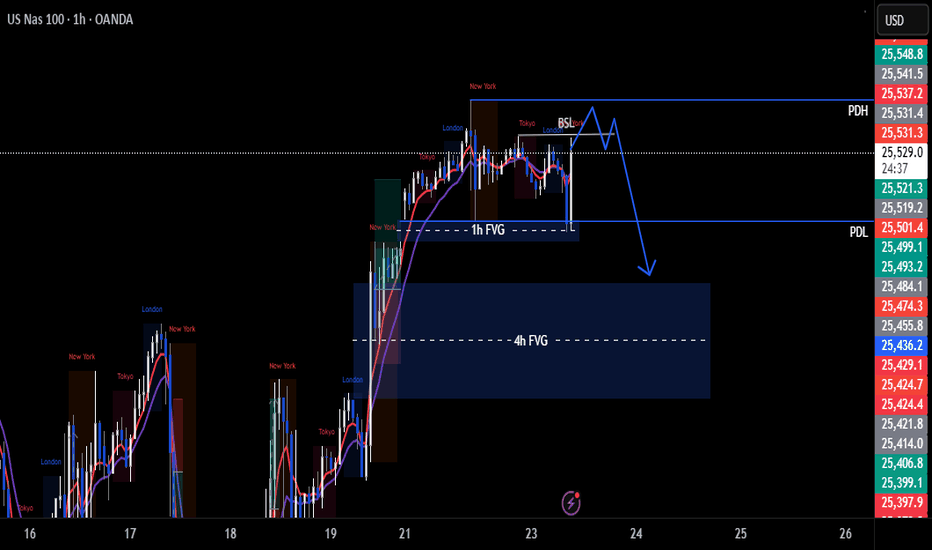

MNQ – NY Open Game Plan Fundamentals stay bullish, but MNQ being MNQ… it already showed its teeth.

Double top printed, neckline broke, and now I’m expecting a sharp pullback, not a meltdown.

MNQ loves to move fast and fake people out, so I’ve got two buy zones and zero interest in guessing:

🟦 Buy Zone 1

First reaction area. If MNQ snaps in and gives me a clean setup, I’ll take the shot.

🟦 Buy Zone 2

Deeper pullback zone. If MNQ overreacts like it always does, I’m ready to try again with confirmation.

This thing doesn’t reward patience… until it suddenly does.

NY open should bring speed, volatility, and probably a few traps ⚠️

I’m waiting for price to hit my zones and show its hand.

Fast market, slow decisions.

Bearish Supply Zone On NASAQTwo Supply Zones, one in the extreme at the External high, and the other in the Internal High.

Could get a reaction from the internal high and continue to plough through to the extreme zone, or we could get a confirmation signal from that zone and continue with the bearish trend.

How Overconfidence Destroys Profitable TradersHow Overconfidence Destroys Profitable Traders

Understanding Overconfidence in Trading

Welcome everyone to another article.

One of the most dangerous stages a trader can walk into is not fear… but overconfidence. (EGO)

Overconfidence in trading is essentially ego.

However, there is still an important difference:

- Confidence is a real belief built on proof, statistics, and discipline.

- Overconfidence is an inflated belief in your ability beyond the proof. This is driven by ego.

Many traders do not fail because they do not know enough.

They fail because at some point, they believe they know enough or know “everything.”

What Overconfidence appears as in Trading:

A trader builds a system. ( yay! )

They go on a clean winning streak maybe 10, 12, even 15 profitable trades in a row.

At this point, the trader begins to think and assume:

“ I’ve cracked the code. ”

- Risk gets increased .

- Position sizes get bigger .

- Rules start to bend .

Confidence continues grow until it crosses a dangerous path where belief is no longer supported by data, statistics and proof.

Reality eventually steps in.

You will never again feel as confident as you did during your first major winning streak when it looked like the market finally made sense and success was “ figured out. ”

That feeling is exactly what traps traders.

Overconfidence WILL break Risk Management

Overconfidence destroys a trader by slowly dismantling their risk management, their system, their discipline, their psychology and their consistency.

It rarely happens all at once.

First:

- “ I’ll just risk a little more this time. ”

- “ This setup looks perfect. ”

- “ I’m on a winning streak. ”

Over time, the trader begins to:

• Ignore position sizing rules ( Too many LOTS or contracts )

• Move stop losses (Increases risk)

• Add to losing trades ( Does not accept the original loss )

• Trade larger to “maximize opportunity” (Stick to what you can afford to lose )

The trader thinks and believes the system will continue to work, because it worked before.

But markets do not reward belief, they reward discipline. (I have mentioned this many times in my previous posts.)

Once risk management breaks, even a profitable system becomes dangerous and can lead to zero profits, or even down to negatives.

Overconfidence Blocks Positive criticism and continuous Learning

There is no such thing and there will never be a 100% perfecto trading system/strategy.

Losses are part of the game.

Overconfident traders struggle when reality does not meet their expectations.

Instead of adapting to the market by adjusting their strategy they:

- Resist feedback (Or consider any feedback as hate/negative criticism)

- Ignore changing market conditions (Consolidation, flat lining, barcoding etc)

- Refuse to admit the system is underperforming (Bad performance & results)

- Believe the problem can’t be them (“It’s not the system, it’s the computer!”)

But Why…?

Well because… their mind keeps rewinding the dopamine high from when everything worked perfectly and the win rate was 99%

They only remember the wins, and “ GREEN ” $$$ %%% not the probability.

The exact moment a trader believes they “can’t be wrong,” learning comes to a halt.

And in trading, when learning stops, losses accelerate, revenge trading increase, risk management collapses, and consistency becomes scrambled.

Overconfidence changes Traders into > Gamblers

Overconfidence does not just cause losses it can also change behavior.

Frustration from unexpected losses turns into:

- Anger

- Impatience

- Forced trades

- Revenge trading

Rules get ignored.

Emotions take control.

The trader may still look like a trader, but they are acting like a gambler.

The most dangerous part?

They still believe they are right…

Example: How Overconfidence Destroyed a Profitable Trader

Let’s look at Bobby.

Bobby was a profitable trader. A very successful one in his 4th year of trading.

He discovered what he believed was a 99% win-rate system.

The first month was incredible.

The second month was just as good. Cash flowing in, heaps of green.

By the third month, losses started to appear.

Instead of falling back, taking a breather and reassessing , Bobby doubled down.

Continuing to trade the same system despite clear signs of underperformance.

He was no longer focusing on perfect executions and setups, he was chasing the high.

Losses turned into frustration .

Frustration turned into anger .

Anger turned into impatience .

Soon Bobby was:

• Forcing trades

• Revenge trading

• Ignoring risk management

Bobby refused to take responsibility.

“It was my internet.”

“My computer lagged.”

“My family distraccted me.”

The excuses piled up, but the account kept shrinking.

Bobby did not fail because of the system.

Bobby failed because ego stopped him from adapting to the market and adjusting his system.

Markets Will Always Humble Ego

Markets will humble traders in ways they never expect.

No matter how experienced you are, there is always something else to learn.

Trading is not a destination, it is a constant process of adaptation towards the market. Traders who believe they “know everything” will always be reminded by the market that They. Do. Not.

Overconfidence doesn’t end trading careers immediately.

But it slowly erodes them trade by trade turning it into mental torture.

Final Thoughts

Confidence is necessary to trade.. But Ego is fatal!

The very moment a trader believes they have cracked the code is often the moment their decline begins.

Stay humble.

Respect risk.

Let statistics, not emotion, guide your decisions.

Because in trading, the market doesn’t punish ignorance it punishes ego.

NASDAQ doesn’t move randomly. It hunts liquidity.CAPITALCOM:US100 Price is currently trading inside a broken OG zone, after a clear distribution phase from the premium area.

Market structure remains bearish, with lower highs and weak upside reactions.

Short-term outlook (15M)

• Price failed to hold above the broken OG zone

• No strong bullish displacement or acceptance above resistance

• Liquidity is still resting below current price

• Expectation: continuation to the downside to sweep short-term liquidity

Mid-term outlook (1H)

• Overall structure remains bearish

• Previous OG zone acting as resistance

• Unfilled liquidity remains below the range lows

• As long as price stays below the broken zone, shorts remain valid

My expectation

I expect price to take the liquidity below and deliver a minimum 50-point drop from the current levels.

Any pullback into the broken OG zone can be considered a sell opportunity, as long as structure does not shift.

Nasdaq 100 Index - Analysis & ProjectionBased on the current upward trajectory and the alignment of moving averages, the Nasdaq 100 Index is likely to continue its bullish trend in the near term, potentially testing the 26,000 level by mid-January 2026 if momentum persists. However, a pullback could occur if the RSI approaches overbought territory (above 70), possibly around the 25,800 resistance level. Long-term, the index may aim for 27,000 by mid-2026, assuming sustained economic growth and favorable market conditions, though external factors like interest rate changes or geopolitical events could introduce volatility.

NAS100 H4 | Falling Towards Key SupportBased on the H4 chart analysis, we could see the fall to our buy entry level at 25,330.99, which is an overlap support that aligns with the 38.2% Fibonacci retracement.

Our stop loss is at 25,096.06, which is a pullback suport that aligns with the 61.8% Fibonacci retracement.

Our take profit is at 25,813.89, which acts as a swing high resistance.

High Risk Investment Warning

Stratos Markets Limited (

TSM Swing Trade Playbook | Bullish Structure + Demand Zone📌 Asset Overview

TSM – Taiwan Semiconductor Manufacturing Company (NYSE)

Market: US Equities

Style: Swing Trade Playbook

📈 Market Bias

Bullish Plan Confirmed

Price action shows sustained demand, higher-timeframe trend strength, and accumulation behavior consistent with institutional participation.

Momentum remains constructive as buyers continue defending key demand zones.

🎯 Entry Plan – Layered Accumulation Strategy

This setup uses a layered limit-order approach (accumulation style), allowing flexible participation across price zones rather than chasing a single entry.

Buy-Limit Layers (Example):

• 295.00

• 290.00

• 285.00

• 280.00

👉 You may increase or adjust layers based on personal risk rules and position sizing.

👉 This approach helps smooth entries during volatility and pullbacks.

🛑 Risk Management

Stop-Loss Zone: 270.00

Risk control is essential. This level invalidates the bullish structure if broken decisively.

Each trader should adapt risk rules based on account size and strategy discipline.

🎯 Profit Objective

Target Zone: 330.00

This area aligns with:

• Prior resistance zone

• Overbought risk on momentum indicators

• Potential supply reaction (profit-taking zone)

Partial exits are encouraged when price approaches resistance.

🧠 Technical Confluence

✔ Higher-timeframe bullish structure

✔ Demand zone holding

✔ Accumulation-style price behavior

✔ Trend continuation bias intact

🌍 Fundamental & Macro Considerations (Non-Speculative)

Key Structural Drivers:

• TSM is a global leader in advanced semiconductor manufacturing

• Strong positioning in AI, data centers, and high-performance computing supply chains

• Long-term contracts and diversified client base support revenue visibility

Macro Factors to Monitor:

• Global semiconductor demand cycles

• US dollar strength (USD sensitivity)

• Technology sector risk sentiment

• Interest-rate expectations impacting growth stocks

Upcoming macro data and policy signals may influence volatility — manage exposure accordingly.

🔗 Related Instruments to Watch (Correlation Watchlist)

• NASDAQ:SOXX – Semiconductor ETF (sector health confirmation)

• NASDAQ:SMH – Chipmakers ETF (institutional flow proxy)

• NASDAQ:NVDA – AI demand sentiment leader

• NASDAQ:AMD – Peer momentum correlation

• NASDAQ:QQQ – Tech risk-on / risk-off behavior

👉 Strength in these instruments often confirms continuation in TSM

👉 Weakness may signal caution or delayed expansion

⚠️ Notes for Traders

Risk management > entry precision.

Adapt position size, layering depth, and exits to your own trading plan.

✨ “If you find value in my analysis, a 👍 and 🚀 boost is much appreciated — it helps me share more setups with the community!”

Disclaimer: This is a thief-style trading strategy shared just for fun and educational purposes. Always trade responsibly and manage risk independently.

Bullish rise?US30 has bounced off the support level, which is an overlap support and could rise from this level to our take profit.

Entry: 25,425.09

Why we like it:

There is an overlap support level.

Stop loss: 25,270.20

Why we like it:

There is a pullback support level.

Take profit: 25,855.87

Why we like it:

There is an overlap resistance level.

Enjoying your TradingView experience? Review us!

Please be advised that the information presented on TradingView is provided to Vantage (‘Vantage Global Limited’, ‘we’) by a third-party provider (‘Everest Fortune Group’). Please be reminded that you are solely responsible for the trading decisions on your account. There is a very high degree of risk involved in trading. Any information and/or content is intended entirely for research, educational and informational purposes only and does not constitute investment or consultation advice or investment strategy. The information is not tailored to the investment needs of any specific person and therefore does not involve a consideration of any of the investment objectives, financial situation or needs of any viewer that may receive it. Kindly also note that past performance is not a reliable indicator of future results. Actual results may differ materially from those anticipated in forward-looking or past performance statements. We assume no liability as to the accuracy or completeness of any of the information and/or content provided herein and the Company cannot be held responsible for any omission, mistake nor for any loss or damage including without limitation to any loss of profit which may arise from reliance on any information supplied by Everest Fortune Group.